American Journal of Industrial and Business Management

Vol. 3 No. 5 (2013) , Article ID: 36374 , 11 pages DOI:10.4236/ajibm.2013.35059

Critical Evaluation of the Policy Environmental for Mineral Resources Sector in Pakistan

![]()

1School of Public Administration, China University of Geosciences, Wuhan, China; 2School of Resources China, University of Geosciences, Wuhan, China; 3Schools of Environmental Studies, China University of Geosciences, Wuhan, China.

Email: *tayyabsohail@yahoo.com, dlhuang1030@163.com, earlplanner@hotmail.com, malikma_2012@yahoo.com

Copyright © 2013 Muhammad Tayyab Sohail et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received June 15th, 2013; revised July 15th, 2013; accepted August 5th, 2013

Keywords: Minerals Resources; Pakistan; Policy; Joint Venture Agreement; Industry

ABSTRACT

Despite Pakistan’s abundant mineral resources and two successive mineral policies, the sector’s contribution to GDP remains small. Evaluation of the policies and administration framework for management of the sector reveals that among the factors plaguing are; inadequate monitoring and evaluation, lack of community base resources management programmes, insufficient tax compliance, political instability, weather related problems and insecurity within mineral rich areas. However, there is still room for improved technical and economic analysis of the sector as well as tremendous opportunities for Joint Venture Agreement (JVA) with other emerging economies and international private partners. New discoveries of precious metals and rare earth minerals and an expansion of technical information on reserves provide sufficient grounds for modification of the current policy and subsequent expansion of the industry. There is still time to realize the national development benefits from the sector.

1. Introduction

The mining sector in Pakistan contributes less than one percent to the national GDP at the end of financial year 2011/2012 [1]. This is a relatively low percentage contribution given the evidences supporting the presence of significant large amounts of multiple mineral deposits and industrial minerals. There is indeed potential for this contribution to be increased in the region of ten to fifteen percentages over the next ten years. This can allow for a greater contribution of the sector to the country’s socioeconomic development.

In 1995, the government formulated, through a broadbased stakeholder’s consultation process, and launched the National Mineral Policy (NMP-1) [2]. The policy was aimed at (inter alia) enhancing the investment and operational environment of the mining sector to attract local and foreign direct investments (FDIs). The revised NMP of 2012 (NMP-2) is geared at identifying and learning from the challenges of the first plan by focusing on five thematic areas: 1) increasing contribution to GDP; 2) international competitiveness and partnership; 3) coordination between state and provincial institutions; 4) sustainable development; and 5) Encouraging small scale local mining. After two sector policies and various changes to the manner in which the industry operates, there seems to be no positive turn around in the sector, let alone any indication that its future is on a path of sustainability. Apart from the minimal contribution to GDP, the sector also is plagued by issues relating to local and ethnic conflicts, which continue to disrupt operations and ward off potential investors as well as problems associated with natural hazards inter alia. The government of Pakistan is now at a crossroads, where the industry is concerned. Bold and innovative changes are needed driven by the better governance and management support as well as effective plans derived from good policies. This paper argues that the first place to start is to undertake a critical evaluation of the policy environment in which the industry operates. This should be followed by an identification of the flaws and strengths in this environment and relevant recommendations for the future. Accordingly, attention is brought to the institutional framework and the policy environment that impacts the development and operation of the mineral sector.

2. Location and Physical Geography

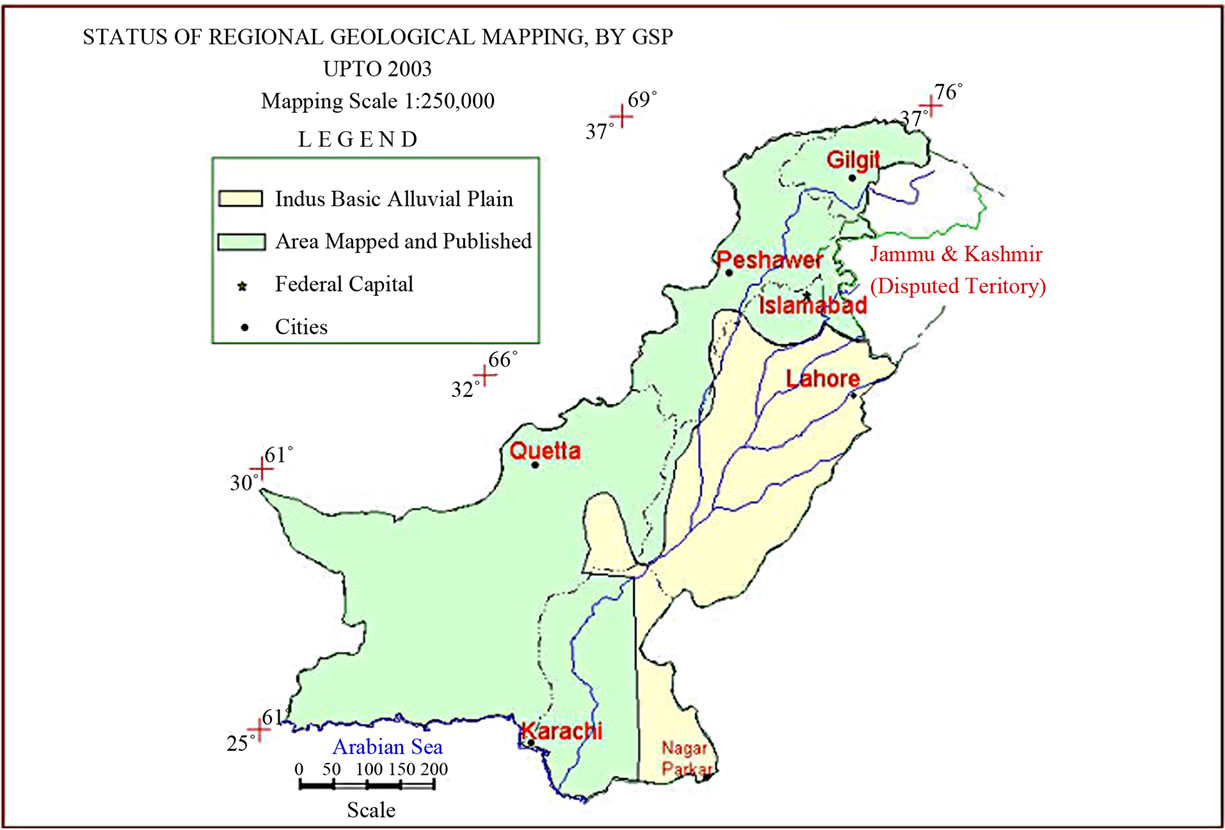

Pakistan has a landmass of 796,096 km2, making it the eight largest countries in Asia, and a population of over 187 million with a growth rate of 1.6%/annum [3] making it the sixth most populous country in the world. Located at the crossroads of the strategically important regions of South Asia, Central Asia and Western Asia, Pakistan has a 1046-kilometre (650 mi) coastline along the Arabian Sea and the Gulf of Oman in the south and is bordered by India to the east, Afghanistan to the west and north, Iran to the southwest and China in the far northeast (Figure 1) and the geographical mapping location of Pakistan by the geology survey of Pakistan (Figure 2).

3. Minerals Resource of Pakistan

Understanding the mineral resources of Pakistan must begin with an appreciation with its physical geology and hydrology, which are intimately linked to its location, mentioned earlier. The occurrences of mineral resources are synonymous with the physical geological processes associated with the location of the country and the climate which affects the ecological processes associated with mineral formation.

Geology: Pakistan’s complex geological structure (Figure 3) can be divided into three parts:

1) The Eastern Seismic slope belt: This slope is underlain by a thick pile of sedimentary rocks which overlie the northern ward protruding shield rocks from the Indian peninsula. This belt is rich in hydrocarbons and most of the productive oils and gas.

2) The western Mobile belt: This belt indicates variegated geological environment where sedimentary and magnetic rocks are associated with the continental shelf and island arc. This belt hosts metallogenic provinces, e.g. the shelf carbonates zone, the rakish-chaghai island arc and Muslim Bagh-Waziristan ophiolite complexes.

3) The Northern Collisional belt: This belt consists of two Himalayan sutures with ophiolites, calc-alkaline kohistan/Ladakh island arc.

Soils: The soils (Figures 2 and 3) of Pakistan have evolved to represent dissimilar characteristics from the parent material and by their mode of formation. The river-laid sediments have developed into alluvial soils. The desert sand has turned into distinct soils. The mountains and plateaus produced residual soils with patches of alluvial, loess and others.

Hydrology: The Indus River and its tributaries drain form a network of hydrological basins that are responsi-

Figure 1. Political map of Pakistan’s regional and international location.

Figure 2. Geology of Pakistan (Source: GSP, 2003).

Figure 3. Map showing the distribution of soil types in Pakistan (Source: Soil Survey of Pakistan).

ble for the hydrological processes in Pakistan. Groundwater accounts for over 40% of the irrigation needs of the region, while water from the Indus River provides potable water to approximately 130 million people, power generation and fills the gap in irrigation demand.

4. Distribution of Mineral Resources

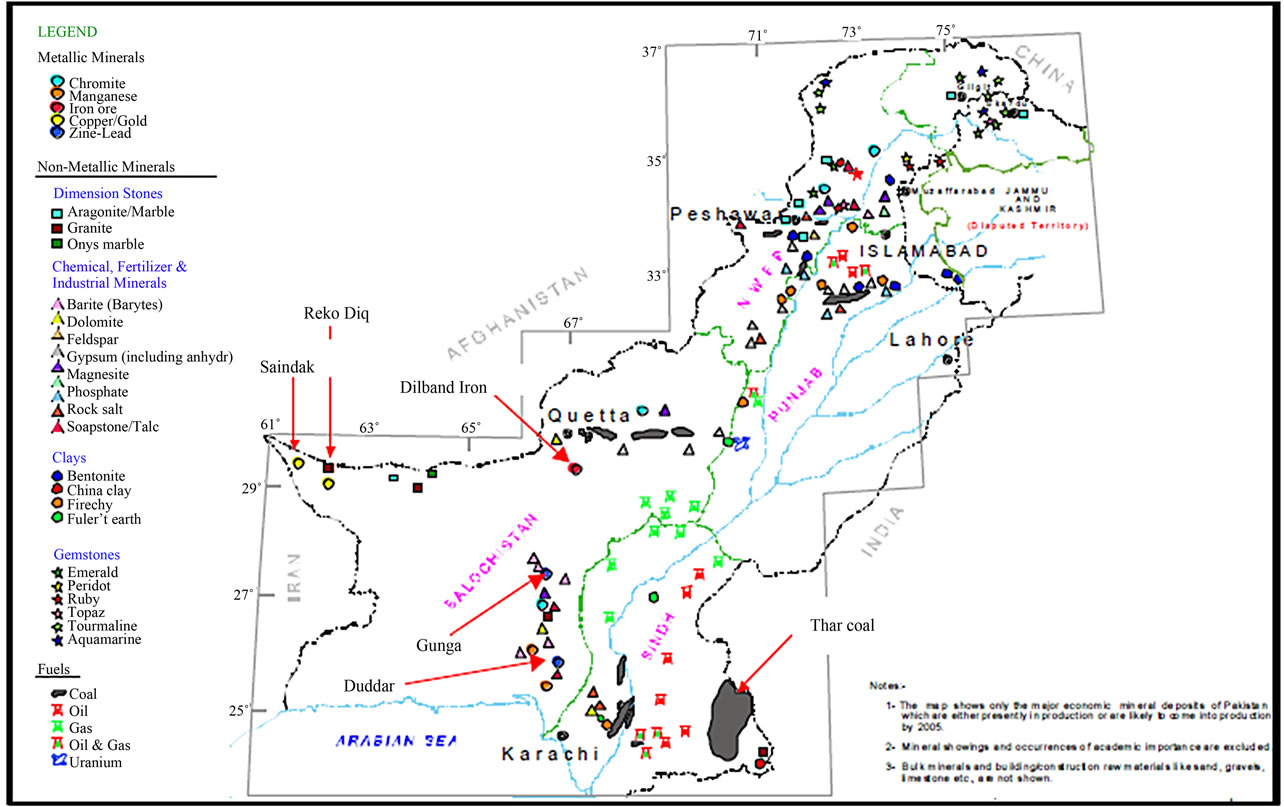

Pakistan has several minerals deposits including coal, copper, gold, chromite, salt, bauxite and others (Figures 4 to 6 and Table 1). A variety of precious and semi-precious minerals are also mined, these include peridot, aquamarine, topaz, ruby, emerald, rare-earth minerals bastnaesite and xenotime, sphene, tourmaline (Figures 4-6), and many varieties and types of quartz [4] The mineral industry has grown since independence from exploiting only 5 minerals to the current 52. Since independence, majority of minerals mined were discovered by the GSP [5].

Among the approximately 200 mineral rich countries in the world; Pakistan has the second largest salt mines and coal reserves, fifth largest copper and gold reserves and world’s second largest coal deposits of 185 billion tons. It has more than 436.2 million to 618 billion barrels of crude oil and 31.3 TCF of proven gas reserves. The current oil production is 65,997 barrels/day while gas production is 4 BCF/day. Additionally, there is resource potential of 27 billion Barrels of Oil and 282 TCF of gas reserves which has not been explored due to lack of vision and flawed policies [6].

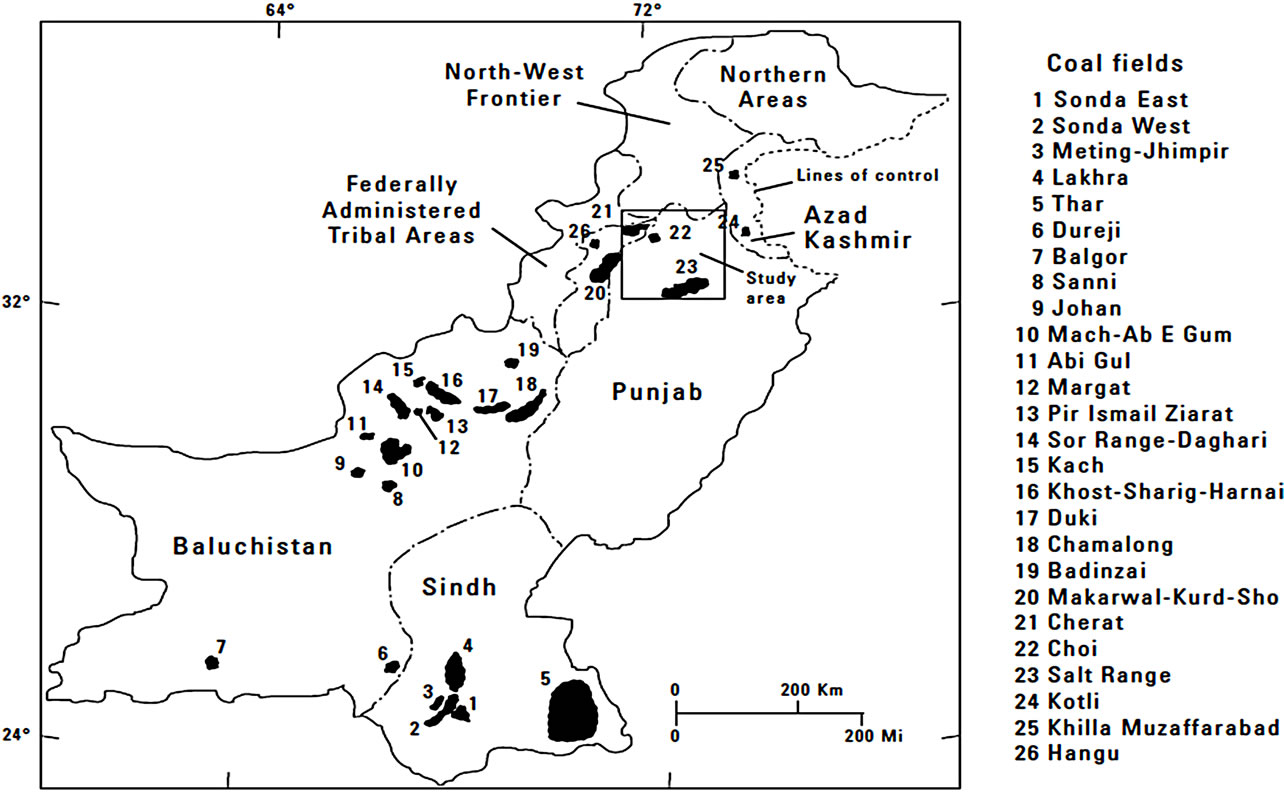

Baluchistan is the richest mineral resources province in Pakistan, but majority of coal deposits are in Thar (Figure 5). Of the fifty two mineral exploited in the country, twenty are from the Balochistan region (Table 1). Khyber Pakhtoonkhwa is rich in gems and most of the mineral gems found in Pakistan exist here. Apart from oil, gas and some mineral used for nuclear energy production, which comes directly under federal control mines, other mineral deposits are controlled by the Provincial government. Currently, approximately 52 minerals are mined and processed in Pakistan [7]. Coal is found in very large quantities in Thar, Chamalang, Quetta and other sites. Salt has been mined in the region since 320 BC. The Khewra Salt Mines, in an underground area of about 110 km2 (42 sq mi), are among the world’s oldest and largest. These mines produce ~220 million tonnes of rock salt deposits. The current production from the mine is 325,000 tons of salt per annum.

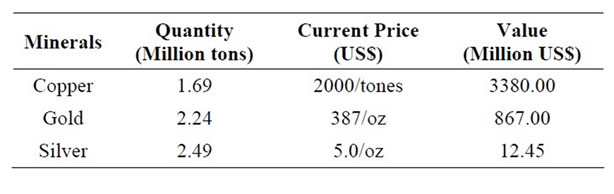

In Reko Diq, Baluchistan, deposits of copper and gold are present (Table 1). There are also copper deposits in Daht-e-Kuhn, Nokundi, and in the Chaghi district. Iron ore is found in various regions of Pakistan including Nokundi, Chinot, Harripur and other Northern Areas and

Figure 4. Major mineral resources of Pakistan (Source: Geological Survey Pakistan, 2003)

Figure 5. Distribution of Coal mines in Pakistan (adapted from Warwick and Wardlaw, 2003)

Figure 6. Map of distribution of major minerals in Pakistan (the map shows location of Pet: Petroleum, U: Uranium, NG: Natural Gas, Sr.: Stontium and Talc-Mkneral-composed of hydrate and magnesium silicate) source Compare Infobase limited, 2007.

Table 1. Estimated Recoverable Quantities of Metals and Values in Baluchistan (Source: 2009 GSP and MOPNR).

also in Kalabagh (less than 42% quality) where the largest deposits are found. The eastern shield slope zone has considerable amount of limestone, gypsum, rock salt dolomite, glass sand, celestial, coals, Cis-Indus salt range and newly explored huge reserve in Sindh, which are being utilized for energy generation. Similarly, moderate quantities of gold and copper are found in Chagai, in the Island Arc area where the Geological Survey of Pakistan (GSP) has identified at least 12 porphyry type deposits containing appreciable quantities of gold along with copper and silver [8].

One of the areas of significant mineral deposits is the Federally Administered Tribal Areas (FATA). This is a semi-autonomous tribal region in the northwest of present-day Pakistan, laying between Afghanistan to the west and north, and the provinces of Khyber Pakhtunkhwa and Balochistan to the east and south, respectively. The FATA comprises seven agencies (tribal districts) and six frontier regions. The territory is almost exclusively inhabited by Pashtun tribes, who also live in the neighboring Khyber Pakhtunkhwa and Afghanistan and are Muslims by faith. The territory is governed through the Frontier Crimes Regulations. Over the last decade there has been moderate increase in mineral production in FATA, with an average 35% annually since 2004 [9]. This equated to revenue of approximately Rs31.5 million or USD3.2 million. Simultaneously, mineral production within FATA during that same period grew by almost 219%. To date nineteen different minerals deposits, including copper, manganese, chromite, iron ore, lead, barite, soapstone, coal, gypsum, limestone, marble, dolomite, feldspar, quartz, silica sand, bentonite, marl, emerald and graphite have been identified in tribal areas within the FATA region, which are still to be exploited. Limestone, chromite and quartz are also in large quantities, as well as small quantities of coal with annual production of 5,705,190 tons in 2004-2005. however these have a low market value both locally and internationally. So far no copper has been extracted in FATA but large deposits exist in North and South Waziristan agencies. For instance, in the Shinkai area of North Waziristan an estimated 27 million tons of copper reserves exist. Unfortunately, the proposed plan of copper enrichment in FATA and establishment of a prototype plant at Shinkai are still to materialize. Table 2 shows a summary of some copper, gold and silver deposits and reserves in Pakistan.

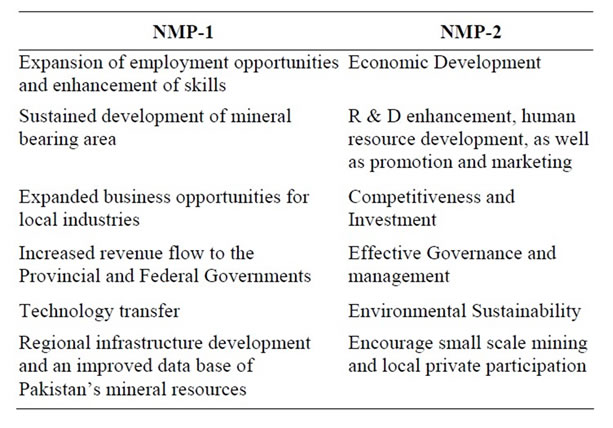

Table 2. Comparative policy concerns of NMP-2 and NMP-1.

There is no doubt that Pakistan has a wide variety and distribution of minerals. This fact alone supports the formulation of an effective mineral policy and relevant supporting plan for its implementation. The sector is a critical feature in the ongoing industrialization and economic development process of the country. The GSP calculated the percentage distribution of coal use in Pakistan per industry to be 23.1% Coke manufacturing, 65.4% Brick Kiln production and the remaining 11.5% to power generation. Similarly, percentage share of fuel in commercial energy composition is distributed as 1% nuclear, 30% oil, 11% Coal, 17% Hydro and 41% gas. These statistics were published in the Energy Yearbook, 2007 [10].

5. Critical Review of Minerals Resources Policy and Development

With constitutional backing, the Federal and Provincial Governments jointly had responsible for the formulation of the first National Mineral Policy in 1995 (NMP-1). The policy was duly implemented by the provinces which also simultaneously provided the appropriate institutional and regulatory framework, while the Federal Government assumed a supervisory role. This policy has since been replaced by the NMP-2, with the same basic institutional and management structure as the first. Instead of regurgitating the content of the policies the review and assessment will focus on the main policy directions in the context of their overall aim (Table 2), which is to increase the mineral sector’s contribution to the economic development of Pakistan. The main challenges that NMP-1 and 2 seeks to address revolve around the broad themes presented in Table 2. Similarly, a comparative analysis of both successive mineral policies for 1995 and 2012 reveals serious information and strategic deficiency. Structurally, both documents occupied the approximate same volume of pages with less information in the NMP-2. The current policy fails to identify the major challenges facing the sector and well as associating the appropriate policy response to these challenges. Each of these focus area will be assessed forthwith.

5.1. Economic Development

Countries that have demonstrated the long-term ability to “manipulate” their mineral resources, not only adding value to them, but substantively integrating the benefits into their socio-economic development are better off than those who have not. The focus of this policy objective is to increase the economic contribution of the sector to Pakistan’s economy through, mainly a facilitation of private investments and Joint Venture Partnerships in the mineral sector. The JVP agreement is perhaps one of the most important developments in the global mineral industry today. This alternative policy focus needs more substantive consideration, in particularly as it relates to enhancing the sector’s competitiveness and attracting potential local and foreign investment. The only portion of the policy dedicated to this states that “A license/lease may be granted jointly to two or more persons with respect to an area where such an application is made jointly and the liability of the applicants under the license/lease in such a case will be joint and several” (NMP-2).

The formulating of a Joint Venture Agreement for Mineral Exploration can be a tedious legal task, requiring many hours of pother debate to achieve consensus and agreement. This can be especially true within the governance structure of the sector in Pakistan. Many countries now publish investor’s guides to mineral exploration to enhance the sector’s JVP potentials and thus its competitiveness. These guides are not only to educated potential investors in their mineral industry about the prospects of mining and exploration, but to also ensure that investors align themselves with national development priorities in consideration of their mineral exploration investment plans.

The mineral sector contributes on average ~0.5% to GDP annually, which is likely to increase considerably with the development and commercial exploitation of Saindak & Reco Diq copper deposits, Duddar Zinc lead, Thar coal and Gemstone deposits. The sectors contribution to economic development is regularly revised down due to the impacts of inclement weather conditions, such as the torrential rains in Sindh Province during August 2011, which compelled the government to revise its GDP growth target [11]. However, GDP data for the mining and or mineral sector are not specific, but are truncated with figures for the production and manufacturing sectors generally. For example, the mining and quarrying sector recorded positive growth of 4.4% for 2011-2012 against the negative growth of 1.3% in 2009-2010 [12]. These figures are also included within those for large scale manufacturing which posted a growth of 1.05 percent as compared to growth of 0.98 percent during the first nine months of the fiscal year 2011-2012. With this sort of double accounting, it is difficult to track real actions within the industry. This is also compounded by the fact that the large scale manufacturing industry includes other sector’s contribution, such as: pharmaceutical, paper and board, wood product, food beverages and tobacco, nonmetallic mineral products, leather product and textile. This is one major challenge in monitoring target for the industry in order to determine if policy objectives to this end are been met. The World Bank’s 2011 Economic Update Report for Pakistan, had no information on the specific mineral industry and failed to mention any mineral (even coal) in its analysis [13]. Since the WB and by extension the IMF are important international partners in the country’s economic development, this is a worrying trend.

5.2. Competitiveness and Investment

The competition in the global mineral industry has never been fiercer as it is today. The increasing importance and impact of new players such as; China, India and Brazil and the resurgence of Russia, Australia and Canada, are adding dynamism to all facets of the market. These players are unreserved and relentless to securing their place in the global industry. Pakistan should therefore align itself with best practices of its neighbours (China and India). Moreover, the traditional players and leading in innovation and forging new partnerships with the emerging players. The policy’s aim in this regard is to improve Pakistan mineral industry’s competitive for scarce and mobile international capital for investment in the sector through a stable and enabling environment. This stable enabling environment is proving a herculean task for the successive governments since NMP-1. The reappearance of this policy objective in NMP-2 is questionable to its success in NMP-1. Political and social stability are key factors in attracting international investors to boost competition. Contrary to the economic potential of its mineral resources, Pakistan is depending on foreign aid (World Times, 2011) and is classified as a Lower Middle Income Country by the World Bank, with debt to GDP ratio of 187.1 as of 2011. Additionally, the country faces significant economic, governance and security challenges to achieve durable development outcomes. The persistence of conflict in the border areas and security challenges throughout the country is a reality that affects all aspects of life in Pakistan and impedes development. A range of governance and business environment indicators suggest that deep improvements in governance are needed to unleash Pakistan’s growth potential. The World Bank (2010) ranks Pakistan at 85 with a trade facilitation, as indication of the ease of doing business. The rank represents the country’s overall business climate based on seven indicators. The low to moderate ranking of Pakistan in these two categories hinders its economic growth, compromising potential benefits from its vast mineral resources wealth. The global nature of the mineral industry negates an overly national focus, as is the case with NMP-2. The policy should reflect the global awareness of the national government towards the industry, and its willingness to be flexible with national standards to accommodate global technologies etc.

5.3. Effective Governance and Management

The World Bank [14] (CFAA, 2003) and GoP has embarked upon an extensive reform program to improve governance, reduce debt, increase public investment, increase revenues, and decrease unwarranted expenditures. Achieving these reforms require: improvements in the effectiveness and productivity of public spending, not only through a better allocation of resources and a more careful choice of policies and priorities but also through better implementation, more efficient delivery of services, and improved controls over financial flows. These reforms are also to be realised at the sectoral levels. Within the mineral sector, the objective is to ensure smooth operational and effective coordination between Federal and Provincial institutions in the implementation of regulatory and legislative regime.

The NMP-2 does not fall short on delineating the portfolio responsibilities of the Federal and Provincial government and their associated agencies (NMP-2). This focus is noteworthy. However, for the industry to find and maintain a niche within the global market the Federal Government must take the lead role through the Ministry of Foreign Affairs (Foreign Affairs Division) and the Ministry of Planning and Development through the Planning and Development Division. Especially, at the international level, investors are more willing to negotiate and dialogue with national (federal) agents than those at the provincial levels. Moreover many of the conflicts at the provincial level, that affect the operations of the sector at that level, for example those within the FATA, GiligitBiltistan, AJK and ICT are constitutionally addressed at the Federal level. These and other constitutional conflicts need to be resolved in the interest of better government and management of the sector.

In addition to the federal and provincial government, there are numerous private institutions also involved in the management of the sector. The PMDC, created in 1974 to expand and help mineral development activities, is an autonomous body connected to the Ministry of Petroleum and Natural Resources (MPNR). The Corporation operates four coal mines, four salt mines/quarries and a silica sand quarry producing ~10% of the coal and 45% of the total salt production in the country. Its annual turnover during the year 2003-2004 was Rs.584.864 million [15]. NMP-2 shows the government exercising more flexibility and amicability with private companies and investors. This was all part of the aim of securing much needed FDI into the industry along with technical assistance and advances in research and development.

Mineral Investment Facilitation Authorities (MIFAs) are to be established at both level federal and provisional level. At the provisional level it will provide Provincial Mining Concession Rules, while at the federal level MIFA-F will be reconstituted by the MPNR. There will be Mineral Investment Facilitation Board (MIFB) under the MPNR not only context of fiscal policies but also in international contacts with donor agencies and negotiation of mineral agreements to promote the mining sector. Other important concerns under the governance challenge are related to; Regulatory Framework, Fiscal Framework, Legal Framework and Institutions and Research & Development. The concerns are range from licensing and environmental protection.

5.4. Environmental Sustainability

Apart from satisfying its local environmental laws, the main objective of NMP-2 is to ensure the exploration for, and development and production of, Pakistan’s mineral resources in an environmentally sustainable manner. Pakistan is signatory to fifteen Multilateral Environmental Agreements (MEAs)/conventions/protocols and has ratified all of them. Consequently, it is mandatory for the state to ensure the implementation of the agreements that have been endorsed. The international environmental instruments (conventions/protocols) may be divided into five broad categories:

1) Biodiversity-related Conventions;

2) Atmosphere/Climate Change (UNFCCC);

3) Land Convention/Environmental Cooperation Conventions;

4) Chemicals and Hazardous Wastes Conventions;

5) Regional Seas Conventions and related Agreements.

These legislations should form the basis for establishing environmental standards, for the sector. These should also form an important part of an investor’s guide to JVP. The NMP-2 needs to be broadened to include this important consideration, especially if it intends to expand globally and attract international interests and multinational financing from WB and IMF etc. The relevant ministry should make it mandatory for all Licenses for mineral exploration be automatically accompanied by an Environmental Impact Assessment (EIA).

5.5. Local Involvement and Community Development

This focus encourages small scale mining and local private participation in the development of the sector. This shows an appreciation of the correlation between mineral exploration and the community development. Other important aspects involve people participation, resources assessment and social and physical infrastructure. Strategies on community based resource development in mineral exploration are some of the most important aspects in preserving the social side of the sector. This is often achieved by the implementation of regular Social Impact Assessment (SIA) study to determine the possible and potential impacts on the community of mineral exploration projects. Too often the economic and financial gains from mineral exploration highlighted and placed at the centre of planning and policy making. This is evident in the aim of increasing the sectors contribution to GDP.

There are mounting evidences of large corporations making large profits from mineral exploration projects, yet the communities in which they operate are poverty stricken and suffer from general blightedness. Planners and community development practitioners should be specifically trained to ensure that communities are not disenfranchised from exploration of their resources base. Similarly, they should be equipped with the requisite skills to identify alternative economic bases, when mining operations are discontinued. Communities must be protected against the negative aspect of resource dependency and the resources curse [16].

One very important consideration in the focus local involvement and community development is the issue of minerals and production facilities in indigenous and tribal areas. Many such areas still exists in Pakistan. There must be special consideration to the rights and delicacy of such cultures and customs during pre-mining and postmining operations. At the federal level the Ministry of Minorities through the minorities Affairs Division must assume the lead role in the local involvement within the industry.

6. Summary of Policy Issues

The current NMP-2 should be considered nothing more than the embryonic steps in formulating a more comprehensive policy and associated implementation plan for the mineral sector of Pakistan. The comparison table in Table 2 shows that the documents are merely gnawing away at the surface of only some of the most important issues to be resolved in the sector. Additionally, other larger constitutional and national security concerns are necessary preconditions for the formulation and implementation of an effective mineral policy and plan. Still more important issues relating to the; investor’s confidence building, informal mining and the black market for minerals, vulnerability of the sector to hazards, formulating an effective FVP policy, developing measurable environmental and social standards for the industry in all its phases, engaging community participation (inclusive diversity and distributive justice), reversing negative perceptions relating to political and civil unrest, considerations for indigenous groups and cultures, clear management guidelines for provincial and federal governments and most importantly a clear accounting and economic monitoring framework to track the contribution of the sector to national GDP. These are some of the most Salient concerns that the current policy has failed to address in any substantive manner.

The country will continue to lose substantial revenues from the industry, if these issues are not strategically planned for in a proper legislative manner. The aim of the government, to align the industry to global standards bears no evidence in the wording and foci of the current policy. Moreover, there is nothing in the policy that can be substantively or procedurally, explicitly identified as a factor to increase the GDP contribution from the sector. Streamlining Pakistan’s mineral resources industry to its economic development needs a more comprehensive and wide-reaching policy direction. Inter-linkages with other sectors, such as agriculture, industrial, energy and environment etc, are indispensable for the national economic aim and objectives to be realised. Inter-policy linkages are proven methods of achieving national objectives and sector aims simultaneously. Others players in the global mineral resources industry have more experience and technical expertise and more assets in research and development than does Pakistan. The government should continue to align support strategies to align the local sector interests to participate in global sector.

6.1. Mineral Resources and Development of Pakistan

Pakistan’s endowment in mineral wealth, a relatively large labour force of 58.41 million and a mineral/manufacturing industry accounting for approximately 20.1% of employment, should be a receipt for high growth and socioeconomic development. For this turn around to occur, there needs to be significant modification of not only the policy and legislative environment that governs the industry, but also significant changes in the structure of management and trade policies. Pakistan is the sixth most populous country in the world having a large share of “young population” i.e. 63% below 25 years of age (UNDP 07) Successive failed to moderately successful policies have caused unemployment to mount to 15%. This translates to a significant number of the labour trained and skilled force/pool not having an opportunity to contribute to economic development.

There is a strong positive correlation between economic growth and natural mineral resources wealth. Neither [17]

Dollar nor Kraay (2002), or other recent studies, have investigated whether a country’s export structure affects its poverty conditions. If a state’s dependence on mineral exports tends to increase its poverty rates, it could help explain why many mineral-rich countries have persistently high poverty rates; it would also inform policy interventions in the sector. If it does not, it would support Dollar and Kraay, and encourage policymakers to focus their efforts elsewhere. Many recent studies imply that mineral wealth, or more specifically, a state’s dependence on mineral wealth will hurt the poor. Six different mechanisms could bring this about; four mechanisms are economic and two are political. First, the volatility of minerals prices may hurt the poor, who are normally the first to feel the negative effects of market anomalies. For at least the last century, the international prices for primary commodities have been more volatile than the prices for manufactured goods [18]. Since 1970, this volatility has grown worse [19]. Economies that are more dependent on minerals exports are hence more likely to face economic shocks. Export volatility appears to pose greater problems for the poor, since the poor are less able to guard against negative shocks [20]. Even though debate amongst researches and intellects [21] within the sector wades on, there is no denying that with the correct mixture of legislation, policy, management and efficient implementation and monitoring strategies, this correlation can work in favour of national development.

6.2. Human Resource Development

In order to improve the technical and intellectual resource based of the sector, a strong, educated and productive workforce is necessary. The Technical Education & Vocational Training Authority (TEVTA) is trying to achieve this goal, but there is still a demand for more professionals and engineers in the mining sector. The government needs to make more scholarships and training programs opportunities available. In the short term, the hiring of highly skills foreign professionals is always a viable option for the industry. These should operate alongside local experts as a means of technological transfer for long term sustainability of the sector. Investments should be made to increase the number of facilities for technical education and training and the government should foster collaboration among the local, private and public sectors.

6.3. Quantitative Data on Mining and Quarrying

Census of Mining and Quarrying is one of the regular activities of Energy & Mining Section. The first census was conducted in 1962-1963 and so far 23 reports have been completed which covers the data for all minerals at National and Provincial levels. The last census was conducted in 2005-2006. Monthly mineral production data in respect of four provinces is received from provincial Directorate of Mines and Mineral Development, PMDC and Directorate General of Petroleum Concessions, MPNR. This monthly data is then aggregated to form the annual figure. Thereafter, monthly and annual mineral production data in respect of 45 selected mineral items is also published and supplied to various National and International agencies.

Pakistan Bureau of Statistics has been computing annual series of Quantum Indices of Mining Production based on weights derived from census value added of mining sector, which was designed to measure changes in physical out-put of mining indices. Three series of mining indices have so far been computed by taking 1975-1976, 1980-1981 and 1999-2000 as base using the same Laspayer’s formula. The work on the development of indices with the base 2005-2006 is in progress. The sector needs continuous accurate and up-to-date data and information in order to inform decision making and sector evaluation exercises. GSP should undertake periodic to regular mapping, ore assessment, and other related spatial exercises within the industry. Similarly, there should be a continuous search for new areas of exploration. There are opportunities in this area for JVP development.

7. Conclusion and Recommendations

Pakistan mineral resources sector suffers from being perpetually undeveloped, if urgent policy and legislative tools are not formulated and implemented in a strategic manner to align sector interests with national interests. Reasons such as political stability, weather related problems, security and lack of vision are but some of the many drawbacks plaguing the sector. Attempts to rectify these through two successive mineral policies reflect a timid approach to inject intellectual and technical resources in an industry that has the potential to radically transform the economic, social and physical fortunes of Pakistan, while simultaneously respecting ecological sensitivities. The opportunity still exists for the formulation and implementation of an effective and comprehensive policy document that will reflect the true potential of the industry. JVPs are contemporary strategies to attract FDI as well as to align the industry with global standards and bring it to a global competitive edge.

8. Acknowledgements

I would like to say thanks to earl bailey for his valuable partnership in co-authoring this paper and Prof Huang Delin for his expert and professional supervision. We express gratitude to our families and friends for their unending support. Tayyab Sohail would also like to make special mention of the support of his parents and sisters (Rukhsana and Aysha).

REFERENCES

- “National Mineral Policy 2 (MPNR-2),” Ministry of Petroleum and Natural Resources Islamabad Pakistan, 2012. http://www.mpnr.gov.pk/gop/index.php?q=aHR0cDovLzE5Mi4xNjguNzAuMTM2L21wbnIvcG9saWNpZXNEZXRhaWxzLmFzcHg%3D

- “National Mineral Policy 1 (MPNR-1),” Ministry of Petroleum and Natural Resources Islamabad Pakistan, 1995.

- “United Nation Development Program (UNDP, 2007, 2008),” Human Development Report, 5 May 2013. http://www.mbendi.com/indy/ming/iron/as/pk/p0005.htm

- All Pakistan Commercial Exporter Association, “All Pakistan Commercial Exporters Association of Rough & Unpolished Precious and Semi Precious Stones,” Recognized by Ministry of Commerce Government of Pakistan, 2012. http://www.gems.com.pk/index.asp

- “Geological Survey of Pakistan (GSP-2003),” Ministry of Petroleum and Natural Resources, 2009.

- I. Sodhar, “Pakistan Rich in Natural Resources but Poor in Their Management,” World Times Monthely, 1 September 2011. http://jworldtimes.com/Article/92011_Pakistan_Rich_in_Natural_Resources_But_Poor_in_their_Management

- MBendi Information Service, “Iron Ore Mining in Pakistan,” 2012. http://www.mbendi.com/indy/ming/iron/as/pk/p0005.htm

- Khan, et al., “Minerals of Baluchistan Pakistan,” 1996.

- R. Khan, “Miderals Development in FATA,” FATA Research centre (FRC), 2003. http://frc.com.pk/articles/miderals-development-in-fata/

- “Pakistan Energy Yearbook,” Pakistan Bureau of Statistics Government of Pakistan, 2007. http://www.pbs.gov.pk/content/pakistan-statistical-year-book-2007

- “Pakistan Bureau of Statistics,” Government of Pakistan, 2010. http://www.pbs.gov.pk/

- “Pakistan Economic Survey (PES-2011-12),” Economic Adviser’s Wing, Finance Division, Government of Pakistan, Islamabad, 2011.

- World Bank, “Pakistan Economic Update: Poverty Reduction, Economic Management, Finance and Private Sector Development,” SAR, 2011.

- “CFAA World Report, Country Financial Accountability Assessment Guidelines to Staff,” 2003. http://www1.worldbank.org/publicsector/pe/CFAAGuidelines.pdf

- PMDC: Official Government Website. http://www.pmdc.gov.pk/

- B. Shaffer and T. Ziyadov, “Beyond the Resource Curse,” University of Pennsylvania Press, Philadelphia, 2012.

- D. Dollar and K. Aart, “Growth Is Good for the Poor,” Journal of Economic Growth, Vol. 7, 2002, pp. 195-225. doi:10.1023/A:1020139631000

- E. R. Grilli and M. C. Yang, “Primary Commodity Prices, Manufactured Goods Prices, and the Terms of Trade of Developing Countries: What the Long Run Shows,” The World Bank Economic Review, Vol. 2, No. 1, 1988, pp. 1-47. doi:10.1093/wber/2.1.1

- C. Reinhart and P. Wickham, “Commodity Prices: Cyclical Weakness or Secular Decline?” IMF Staff Papers 41, 2 June 1994, pp. 175-213.

- S. Sinha and M. Lipton, “Damaging Fluctuations, Risk, and Poverty: A Review, Background Paper for the World Development Report 2000/2001,” 1999.

- S. Hussain, “Natural Resource Abundance and Economic Growth in Pakistan,” Euro Journals, No. 15, 2009. http://www.eurojournals.com/EJEFAS.htm

NOTES

*Corresponding author.