Paper Menu >>

Journal Menu >>

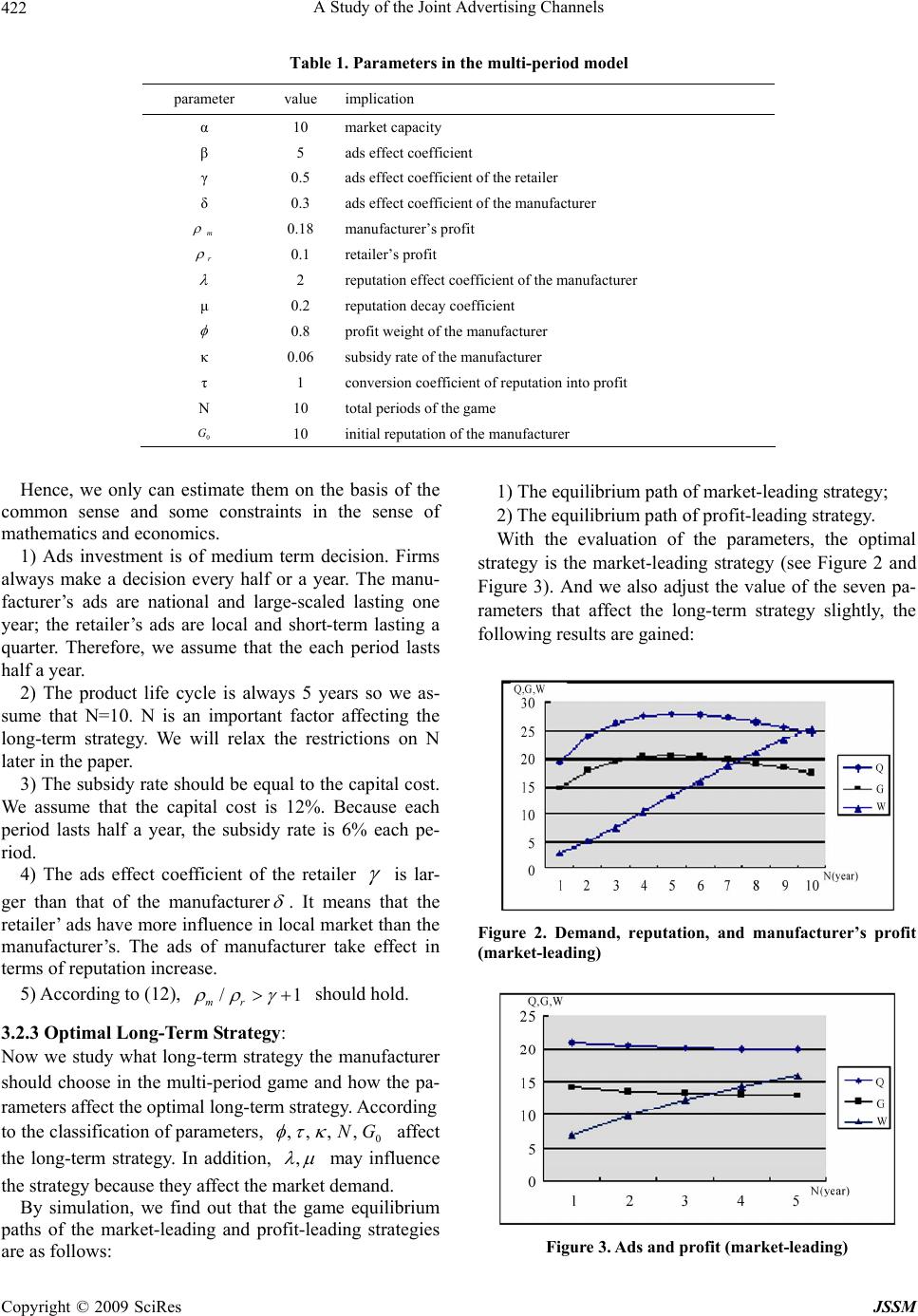

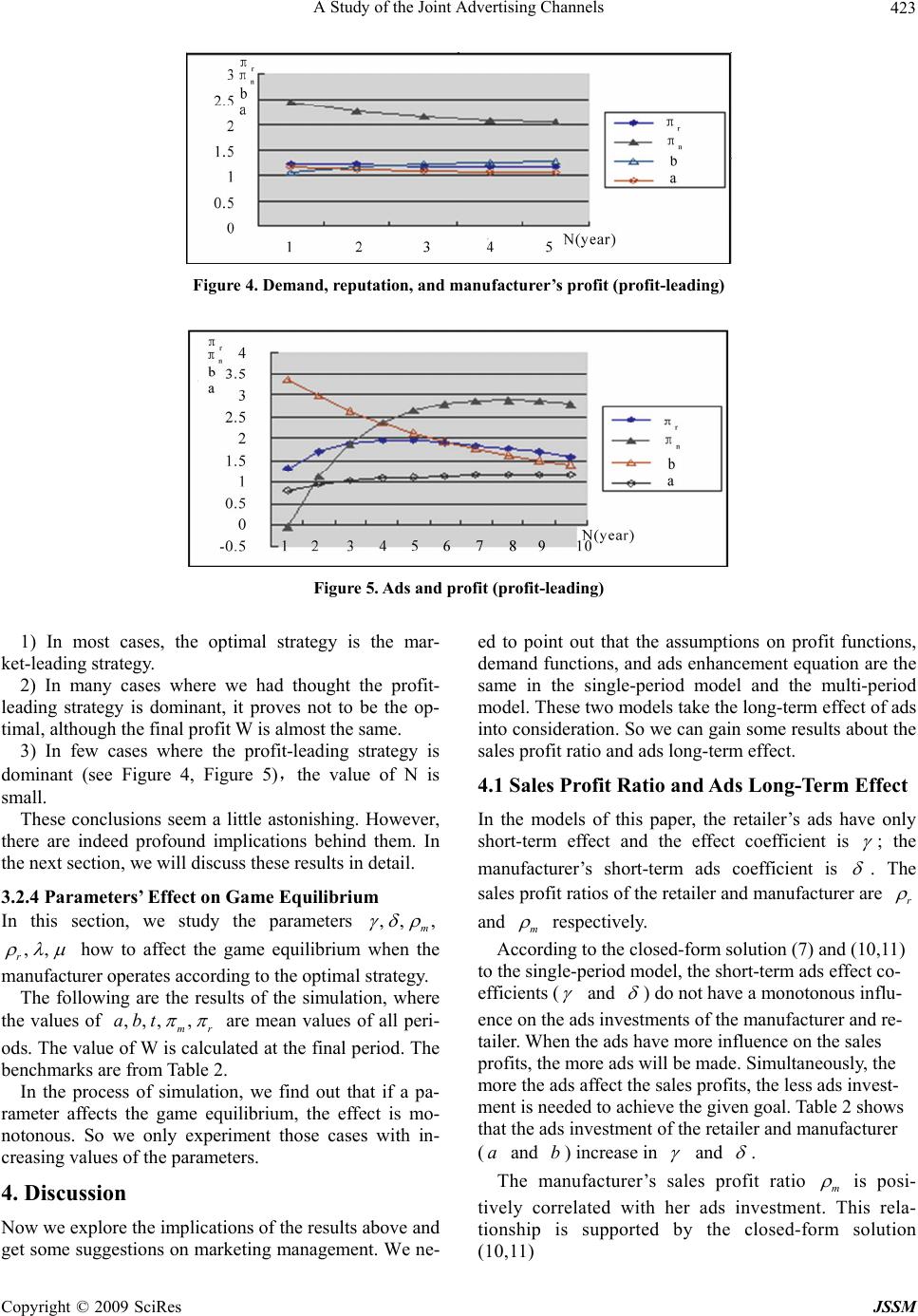

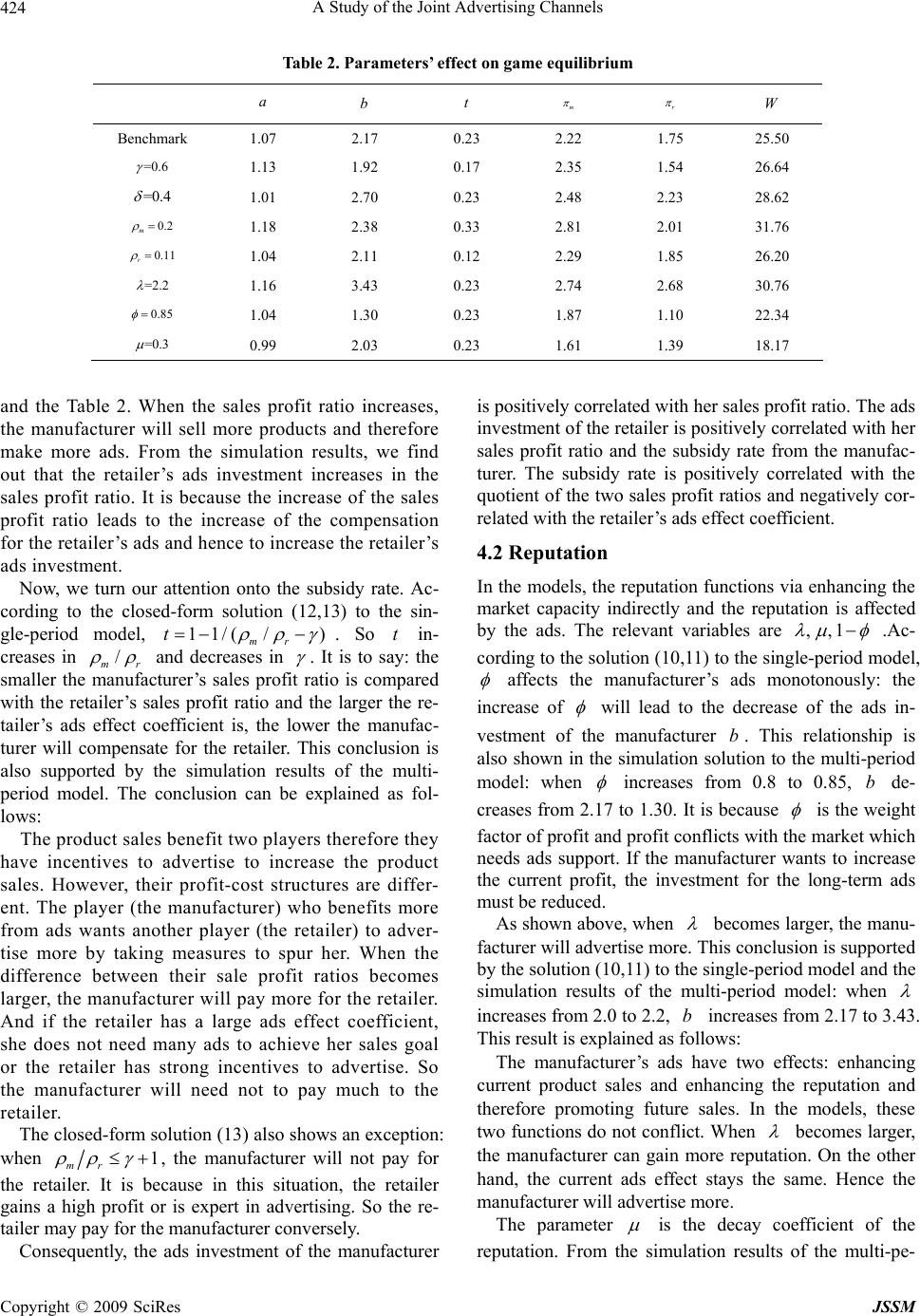

J. Service Science & Management, 2009, 2: 418-426 doi:10.4236/jssm.2009.24050 Published Online December 2009 (www.SciRP.org/journal/jssm) Copyright © 2009 SciRes JSSM A Study of the Joint Advertising Channels Ming LEI, Shuguang SUN, Dan YANG Department of Management Science and Information System, Guanghua School of Management, Peking University, Beijing, China. Email: leiming@gsm.pku.edu.cn, sunshuguang@gsm.pku.edu.cn, yangdan@gsm.pku.edu.cn Received July 22, 2009; revised September 1, 2009; accepted October 11, 2009. ABSTRACT The study of joint advertising channels decision-making is a very difficult issue. It mainly focuses on ads investment game between a manufacturer and a retailer in a vertical supply chain. With the rise of the game theory, scholars have been starting to investigate this issue in the frame of game theory in recent years. The paper improves the existing mod- els and introduces single-period and multi-period modified models. The paper obtains the closed-form solutions to the single-period model and the simulation results of the multi-period model. We also examine the implications of these results and obtain some insights into the real practice. Keywords: Joint Advertising Channel, Game Theory, Simulation Method 1. Introduction The cooperative advertising has been an important and interesting issue in the channel management literature. The paper adopts the frame of the two-level supply chain: the upstream firm (a manufacturer) and the downstream firm (a retailer). When pushing a new product into mar- ket, both the manufacturer and the retailer need to adver- tise. Meanwhile, the manufacturer will provide the re- tailer some incentives. In this paper, we investigate how much the manufacturer and the retailer invest on the ads respectively and how much the manufacturer should pay for the retailer as a subsidy. Actually, the study of the cooperative advertising has a long history. However, prior to the application of game theory, the papers had been viewing this question as a pricing problem, not a game. The examples of such kind are Jeuland and Shugan, Moorthy, Ingene and Parry [1–3]. Currently, more and more scholars adopt the frame of game theory to study the cooperative advertising. All these studies differ from each other by the hypothesis on forms of the ads expense and subsidy rate and by the game type. As for the form of the ads expense and subsidy rate, Dant and Berger assumed that the manufacturer provided the retailer a constant subsidy for per product sold [4]. Doraiswamy et al. also adopted such an assumption [5]. Under this hypothesis, the manufacturer charges a lower wholesale price. Bergen and John proposed that the manufacturer and retailer share the ads cost together [6]. Under this assumption, the manufacture compensates the retailer for the ads cost. However, they thought that the retailer chooses the total amount of ads. It is somewhat unreasonable because the manufacturer usually hold the leading position nowadays. In the study of Steffen, Simon and Georges, ads are divided into two different types: long and national, short and local. And it is also assumed that the manufacturer and retailer have the right to make ads of these two kinds. The manufacturer com- pensates the retailer for the ads costs via two constant subsidy rates, respectively [7]. But this assumption is a little complicated because the retailer is declined to make the ads of the first kind. Bergen and John distinguished between national ads and local ads [6]. Zhimin Huang and Susan distinguished between ads made by the manu- facturer and ads made by the retailer. And they also as- sumed that the retailer is compensated for her ads in- vestment [8]. Most papers adopt the complete information static or dynamic game models. For example, Zhimin Huang and Susan used Cournot and Stackelberg model, while other papers only adopted Stackelberg model where the manu- facturer acts as the leader. Although the static game model is simple to deal with, the cooperative advertising has a long-term effect therefore a multi-period game is necessary [8]. The paper employs the dynamic programming method to study the multi-period dynamics model. Unfortunately, there are many limitations on the application of such method so few papers have adopted the multi-period dy- namics model. Steffen distinguished the “long- term and national” ads from the “short-term and local” ads. This  A Study of the Joint Advertising Channels419 paper assumed that the ads of the first kind have a long-term effect: the ads affect the manufacturer’s repu- tation and the market demand later. To solve the model, the paper adopted some simplified function forms there- fore made the demand equation unconvincing [7].To obtain a better understanding of cooperative advertising in the frame of game theory, the paper provides a sin- gle-period and multi-period models, on the basis of Huang and Susan, and Steffen. We get a closed-form solution to the single-period model and simulate the multi-period model. In the end, the paper explains the results from economics perspective. 2. Modeling 2.1 Single-Period Model On the basis of Huang and Susan, and Steffen, the paper introduces a game theory model of the joint ads [7,8]. This model is a Stackelberg model with the manufacturer as the leader. 2.1.1 Players There are two players: the manufacturer and the retailer. The players are rational persons with complete informa- tion. The decision variables of the manufacturer are the ads investment () and subsidy rate (). The decision variable of the retailer is her ads investment (). bt a The subsidy the manufacturer compensates for the re- tailer is . Therefore, the profit functions are: mm Qtab (1) 1 rr Qt a (2) where and stand for the manufacturer and the retailer respectively, mr stands for the profit ratio sub- tracting the ads cost, and is the sales volume. Q 2.1.2 Relationship between Market Demand and Ads Investment On the basis of Huang and Susan, and Steffen, we as- sume that the demand function satisfies: ,Qaba bG (3) where is the reputation of the manufacturer, and are the ads investments of the manufacturer and re- tailer respectively, is the subsidy rate, and G q ,, a t, are all positive constants. In addition, we assume that the reputation of the manufacturer satisfies the following dynamics equation: GbG (4) These two equations are explained as follows: 1) The demand function implies that the market de- mand is affected by two factors: the reputation and cur- rent ads investment. The maximum value of the current market demand is and can be affected by the reputation [7,8]. It is widely assumed that the marginal revenue of the ads decreases, so the paper does not adopt the linear function. 2) In the reputation dynamics equation, the paper adopts the form of exponential decay. The model of such kind is generally used in depicting decay trend [9–11]. 2.1.3 Payoffs It is reasonable to propose that the objective of the re- tailer is to maximize her current profits. Although the reputation of the manufacturer has a long-term effect, the retailer cannot gain profits brought by the long-term ef- fect. Admittedly, to enhance the manufacturer’s reputa- tion will increase the long-term sale volume therefore benefit the retailer indirectly. However, the profit gained by the manufacturer far overweighs that gained by the retailer. Meanwhile, the manufacturer can take several measures to grab away these indirect profits gained by the retailer [12]. For example, the manufacturer can change retailers or increase the commission. So the pay- off of the retailer is r . The objective of the manufacturer is to maximize the payoff: Max: 1m wG (5) where is a positive constant, adjusting the units of the two terms in (5). The manufacturer is concerned about both the current profits and the reputation. The manufac- turer can benefit from the current product sales and the enhancement of reputation: the enhancement of reputa- tion can increase the product sales in future. So the manufacturer wants to maximize and G simulta- neously [13]. However, these two goals conflict because to increase means to advertise more therefore to re- duce current profits. The paper introduces a weight factor G to reconcile the conflict. And is exogenous in the paper. It is somewhat unreasonable. In the second model later in the paper, we discuss how the manufac- turer selects the most proper . 2.2 Multi-Period Model In this multi-period model, there are still two parties: the manufacturer and the retailer and they are rational person with complete information. And similar to the single- period model, this model is a Stackelberg model with the manufacturer as the leader. The hypothesis of the market demand, profit functions, reputation dynamic equation is the same with that of the single-period model. The only difference is that we need a footnote n to denote the nth period. For example, the reputation dynamics equation is Copyright © 2009 SciRes JSSM  A Study of the Joint Advertising Channels 420 1nn Gb G or 1 1 nn n Gb G The goal of the retailer is still to maximize its profit at each period, i.e.() rn . However, the goal of the manu- facturer changes a little, for the long-term profit is in the consideration of the manufacturer. 2.2.1 Goal of the Manufacturer We suppose that the goal of the manufacturer is 11 0 Max: 11 NNn Nm n WG n (6) where stands for the nth period, kmeans the dis- counting rate, N is the total periods, stands for the long-term interests, is the current profits at the end of Nth period [13,14]. n N G mn 11 0 1 NNn n is the weight factor adjusting the units of the two terms in (6). Differ- ent from the single-period model, we do not introduce n for nth period. Instead, the paper adopts an overall weight factor for the model. The manufacturer needs to choose n for each period. 2.2.2 Hypothesis of the Long-Term Strategies To make the model solvable, the paper introduces two hypotheses. Hypothesis 1: Let be the weight factor for each period. And the N-period decision-making question can be converted into a question selecting the optimal ω-path. What we need to do is just to solve the single-period op- timization problem with the weight factor in each period. All these single-period solution under ω-path consist the set . So another statement of this hypothe- sis is that if there is a solution sequence to question (6), the solution sequence must lie in the set . This hypothesis is reasonable because it is naturally accepted that there exists a weight factor to adjust the long-term and short-term interests. Actually, this is our hypothesis in the first model. And this hypothesis is tenable in the management practice: if the long-term in- terests conflicted with the short-term interests, the man- gers would allocate resources between them based on a weight factor. The role of the hypothesis 1 is to convert a compli- cated multi-period optimization question into a route choice and single-period optimization questions. It is difficult to employ the dynamics programming method to solve the multi-period optimization question mathemati- cally. That is why there are few papers that adopted the multi-period game theory model to deal with the coop- erative ads question. It is true that some papers did adopt dynamics programming, but these papers made many unreasonable assumptions. In contrast, this paper does not sacrifice the reasonability for the simplification. We just confine the solution to the question into some forms. Fortunately, the hypothesis is reasonable from manage- ment practice perspective. Hypothesis 2: the optimal ω-path is monotonous and convergent to . This hypothesis is to restrict the types of the optimal ω-path making the question solvable. It is reasonable to assume that the optimal ω-path is convergent to : and are two measures weighing the long-term and short-term interests. At the end of the multi-period game, the short-term measures should approximate the long- term measures. And when N=1, must be equal to . Why do we assume that the optimal ω-path is mo- notonous? In the real practice, how to choose de- pends on the strategy of the firm. means that the firm how to balance the market against profits. Generally speaking, there are three types of the strategies: 1) Market-leading strategy: in prophase, the goal of the firm is to sacrifice profits for expending market. So in prophase. In anaphase, Increases and ap- proximates to . 2) Profit-leading strategy: contrary to the market- leading strategy, the profit-leading strategy seeks profits in prophase. So at this stage, and decreases and approximates to in anaphase. 3) Equalitarian strategy: the firm has no preference towards profits or market. During the whole process, . Obviously, the hypothesis is justified under these three strategies. 3. Analysis of the Models 3.1 Analysis of the Single-Period Model For this model, we can get the closed-form solution. We substitute (3) into (2) and then get the first order condi- tion of the retailer: 110 r r dGb at da Therefore, 1 1 1 rG atb (7) Next, we substitute (7) into (1) and get: (1) (1) 1( 1)(1) 1 1 mm Gtb tt bb (8) where 10 m dwdb d , Copyright © 2009 SciRes JSSM  A Study of the Joint Advertising Channels421 10 m dwdb d . The first order condition for the manufacturer is: 10 m dwdb d (9) So, 11 1 * mr b G , when 1 (10) , when 1 (11) * b *1 mr mr t , when 1 m r (12) , when 1 m r (13) *0t We notice that when 1 is large enough ( 1 ), the manufacturer will increase the ads investment as much as possible. 1 is the marginal value of the reputation and is marginal reputation per ads. 1 means it is more profitable for the manufacturer to increase the ads investment. There- fore, the manufacturer will spare no effort to produce. (12,13) demonstrate that the manufacturer will not com- pensate for the retailer as an incentive, until the marginal profit of the manufacturer is large and the marginal profit of the retailer is small (1 mr ), for the manufac- turer benefits more from ads than the retailer does. 3.2 Analysis of the Multi-Period Model As discussed above, the retailer holds the same behaviors as in the single-period model. As for the manufacturer, under the hypothesis 1, the N-period optimization prob- lem is converted into a problem selecting the optimal ω-path and a series of single-period problems. And these single-period questions are almost the same with that in the first model. The only difference is that the parameter is , rather than . Hence, the key part of the analysis of the multi-period model is how to select the optimal ω-path. We will use the simulation method to solve this problem [13]. 3.2.1. Selecti ng the Optimal ω-Path Selecting the optimal ω-path is a part of the decision of the manufacturer. In the real practice, the manufacturer will calculate the profit W of the final period and then compares the profits of the all possible paths to select one to maximize W. Now, we use computer programs to select the optimal ω-path. According to the hypothesis 2, the process of selection is divided into two steps: Step 1: given the origin of the path, we try various ap- proaching methods. Step 2: select another origin, and repeat step 1. As Figure 1 demonstrates, we experiment five differ- ent paths given two origins. They correspond to the three types of strategy respectively: the two paths above the horizontal line correspond to the profit-leading strategy; the two paths below the horizontal line correspond to the market-leading strategy; the horizontal line corresponds to the equalitarian strategy. The arrows mean changing the origins. Also as shown in Figure 1, we adopt two ap- proximating methods: linear approximation and expo- nential approximation [13]. To be specific, the exponen- tial approximation employs the function: 1 1 *1 x ee e , 1 n xN Of course, these two approximation methods fail to cover all possibilities. However, we just want to find an approximate solution, not the precise solution. And the approximate solution is accurate enough for the real practice. If greater accuracy is needed, we can try more approximation functions and the origins. 3.2.2 Parameters Valuating There are thirteen parameters: ,,,,, ,,, mr 0 ,, ,,NG . Their meanings and values in the simu- lation are demonstrated in the following Table 1. These parameters can be divided into three groups: Demand and profit: ,,,, , mr , Market indicator: Long-term strategy: 0 ,, ,,NG It is true that to get the best evaluation, we need to adopt the data in the real economy. However, there are too many limitations for us to do so. Another difficulty is that several parameters always change in the real practice, for example, , but in the paper, they are viewed as constants. Figure 1. Various approaching methods Copyright © 2009 SciRes JSSM  A Study of the Joint Advertising Channels Copyright © 2009 SciRes JSSM 422 Table 1. Parameters in the multi-period model parameter value implication α 10 market capacity β 5 ads effect coefficient γ 0.5 ads effect coefficient of the retailer δ 0.3 ads effect coefficient of the manufacturer m 0.18 manufacturer’s profit r 0.1 retailer’s profit 2 reputation effect coefficient of the manufacturer μ 0.2 reputation decay coefficient 0.8 profit weight of the manufacturer κ 0.06 subsidy rate of the manufacturer τ 1 conversion coefficient of reputation into profit N 10 total periods of the game 0 G 10 initial reputation of the manufacturer Hence, we only can estimate them on the basis of the common sense and some constraints in the sense of mathematics and economics. 1) The equilibrium path of market-leading strategy; 2) The equilibrium path of profit-leading strategy. With the evaluation of the parameters, the optimal strategy is the market-leading strategy (see Figure 2 and Figure 3). And we also adjust the value of the seven pa- rameters that affect the long-term strategy slightly, the following results are gained: 1) Ads investment is of medium term decision. Firms always make a decision every half or a year. The manu- facturer’s ads are national and large-scaled lasting one year; the retailer’s ads are local and short-term lasting a quarter. Therefore, we assume that the each period lasts half a year. 2) The product life cycle is always 5 years so we as- sume that N=10. N is an important factor affecting the long-term strategy. We will relax the restrictions on N later in the paper. 3) The subsidy rate should be equal to the capital cost. We assume that the capital cost is 12%. Because each period lasts half a year, the subsidy rate is 6% each pe- riod. 4) The ads effect coefficient of the retailer is lar- ger than that of the manufactuerr . It means that the retailer’ ads have more influence in local market than the manufacturer’s. The ads of manufacturer take effect in terms of reputation increase. Figure 2. Demand, reputation, and manufacturer’s profit (market-leading) 5) According to (12), / mr 1 should hold. 3.2.3 Optimal Long-Term Strategy: Now we study what long-term strategy the manufacturer should choose in the multi-period game and how the pa- rameters affect the optimal long-term strategy. According to the classification of parameters, 0 ,, ,,NG , affect the long-term strategy. In addition, may influence the strategy because they affect the market demand. By simulation, we find out that the game equilibrium paths of the market-leading and profit-leading strategies are as follows: Figure 3. Ads and profit (market-leading)  A Study of the Joint Advertising Channels423 Figure 4. Demand, reputation, and manufacturer’s profit (profit-leading) Figure 5. Ads and profit (profit-leading) 1) In most cases, the optimal strategy is the mar- ket-leading strategy. 2) In many cases where we had thought the profit- leading strategy is dominant, it proves not to be the op- timal, although the final profit W is almost the same. 3) In few cases where the profit-leading strategy is dominant (see Figure 4, Figure 5),the value of N is small. These conclusions seem a little astonishing. However, there are indeed profound implications behind them. In the next section, we will discuss these results in detail. 3.2.4 Parameters’ Effect on Game Equilibrium In this section, we study the parameters ,, , m ,, r how to affect the game equilibrium when the manufacturer operates according to the optimal strategy. The following are the results of the simulation, where the values of ,,, , mr abt are mean values of all peri- ods. The value of W is calculated at the final period. The benchmarks are from Table 2. In the process of simulation, we find out that if a pa- rameter affects the game equilibrium, the effect is mo- notonous. So we only experiment those cases with in- creasing values of the parameters. 4. Discussion Now we explore the implications of the results above and get some suggestions on marketing management. We ne- ed to point out that the assumptions on profit functions, demand functions, and ads enhancement equation are the same in the single-period model and the multi-period model. These two models take the long-term effect of ads into consideration. So we can gain some results about the sales profit ratio and ads long-term effect. 4.1 Sales Profit Ratio and Ads Long-Term Effect In the models of this paper, the retailer’s ads have only short-term effect and the effect coefficient is ; the manufacturer’s short-term ads coefficient is . The sales profit ratios of the retailer and manufacturer are r and m respectively. According to the closed-form solution (7) and (10,11) to the single-period model, the short-term ads effect co- efficients ( and ) do not have a monotonous influ- ence on the ads investments of the manufacturer and re- tailer. When the ads have more influence on the sales profits, the more ads will be made. Simultaneously, the more the ads affect the sales profits, the less ads invest- ment is needed to achieve the given goal. Table 2 shows that the ads investment of the retailer and manufacturer (a and ) increase in b and . The manufacturer’s sales profit ratio m is posi- tively correlated with her ads investment. This rela- tionship is supported by the closed-form solution (10,11) Copyright © 2009 SciRes JSSM  A Study of the Joint Advertising Channels 424 Table 2. Parameters’ effect on game equilibrium a b t m r W Benchmark 1.07 2.17 0.23 2.22 1.75 25.50 =0.6 1.13 1.92 0.17 2.35 1.54 26.64 =0.4 1.01 2.70 0.23 2.48 2.23 28.62 0.2 m 1.18 2.38 0.33 2.81 2.01 31.76 0.11 r 1.04 2.11 0.12 2.29 1.85 26.20 =2.2 1.16 3.43 0.23 2.74 2.68 30.76 0.85 1.04 1.30 0.23 1.87 1.10 22.34 =0.3 0.99 2.03 0.23 1.61 1.39 18.17 and the Table 2. When the sales profit ratio increases, the manufacturer will sell more products and therefore make more ads. From the simulation results, we find out that the retailer’s ads investment increases in the sales profit ratio. It is because the increase of the sales profit ratio leads to the increase of the compensation for the retailer’s ads and hence to increase the retailer’s ads investment. Now, we turn our attention onto the subsidy rate. Ac- cording to the closed-form solution (12,13) to the sin- gle-period model, 11/( /) mr t . So in- creases in r t / m and decreases in . It is to say: the smaller the manufacturer’s sales profit ratio is compared with the retailer’s sales profit ratio and the larger the re- tailer’s ads effect coefficient is, the lower the manufac- turer will compensate for the retailer. This conclusion is also supported by the simulation results of the multi- period model. The conclusion can be explained as fol- lows: The product sales benefit two players therefore they have incentives to advertise to increase the product sales. However, their profit-cost structures are differ- ent. The player (the manufacturer) who benefits more from ads wants another player (the retailer) to adver- tise more by taking measures to spur her. When the difference between their sale profit ratios becomes larger, the manufacturer will pay more for the retailer. And if the retailer has a large ads effect coefficient, she does not need many ads to achieve her sales goal or the retailer has strong incentives to advertise. So the manufacturer will need not to pay much to the retailer. The closed-form solution (13) also shows an exception: when 1 mr , the manufacturer will not pay for the retailer. It is because in this situation, the retailer gains a high profit or is expert in advertising. So the re- tailer may pay for the manufacturer conversely. Consequently, the ads investment of the manufacturer is positively correlated with her sales profit ratio. The ads investment of the retailer is positively correlated with her sales profit ratio and the subsidy rate from the manufac- turer. The subsidy rate is positively correlated with the quotient of the two sales profit ratios and negatively cor- related with the retailer’s ads effect coefficient. 4.2 Reputation In the models, the reputation functions via enhancing the market capacity indirectly and the reputation is affected by the ads. The relevant variables are ,,1 .Ac- cording to the solution (10,11) to the single-period model, affects the manufacturer’s ads monotonously: the increase of will lead to the decrease of the ads in- vestment of the manufacturer b. This relationship is also shown in the simulation solution to the multi-period model: when increases from 0.8 to 0.85, de- creases from 2.17 to 1.30. It is because b is the weight factor of profit and profit conflicts with the market which needs ads support. If the manufacturer wants to increase the current profit, the investment for the long-term ads must be reduced. As shown above, when becomes larger, the manu- facturer will advertise more. This conclusion is supported by the solution (10,11) to the single-period model and the simulation results of the multi-period model: when increases from 2.0 to 2.2, increases from 2.17 to 3.43. This result is explained as follows: b The manufacturer’s ads have two effects: enhancing current product sales and enhancing the reputation and therefore promoting future sales. In the models, these two functions do not conflict. When becomes larger, the manufacturer can gain more reputation. On the other hand, the current ads effect stays the same. Hence the manufacturer will advertise more. The parameter is the decay coefficient of the reputation. From the simulation results of the multi-pe- Copyright © 2009 SciRes JSSM  A Study of the Joint Advertising Channels425 riod model, it is found out that when increases, the average profits of the manufacturer and retailer decrease. It is because the market increases slower or decays faster in this situation. According to (11), when 1 , the manufac- turer will advertise as much as possible. Why does it happen? (1 ) is the marginal profit of the reputation and is the marginal reputation of the ads, so 1 is the marginal value of the ads. Meanwhile, is the marginal value of profit. The inequality 1 means that ads can bring the manufac- turer more value than current profits do. 4.3 Long-Term Game Strategy The long-term game strategy is a concept that the paper introduces to explain the simulation results of the multi-period model. This concept is employed to deter- mine the weight factor of profit each period. Generally speaking, there are several variables to af- fect the long-term strategy: 0 ,NG,,, N . However, it seems that only the variable affects it according to the simulation results. Actually, the market-leading strategy is called the market penetration strategy and profit-leading strategy is called market skimming strat- egy. According to the marketing theory, if a firm plans to develop in long term, the market penetration is optimal. The firm should sacrifice profit in prophase to increase the market share, or else, the firm adopts the policy of “high price and high profit” in prophase and then with- draws from the market. Of course, there are no meta- phase or anaphase plans in this situation. That is why the optimal long-term strategy is always the market-leading strategy in the multi-period model when is large. There is no market withdrawal me- chanism in the models. So when the game duration is long, the manufacturer has to adopt the market-leading strategy. This analysis justifies assumptions and the simulation method in models. N 5. Conclusions In this paper, we explore the interactions of ads invest- ments between the manufacturer and retailer. Two types of game theory are employed to achieve our goal. In the first model: single-period model, we get a closed-form solution while in the multi-period model, we have to re- sort to the simulation methods to get some numerical solutions. The paper provides some interesting conclu- sions. The manufacturer’s reputation has influence on the market demand and it is affected by the long-term ads investment only by the ads investment of the manufac- turer, while the increase of the reputation is beneficial to the retailer too. At the same time, the manufacture must pay for the retailer to spur her ads investment. In such a context, the interaction between these two firms is com- plex. The main results of the paper are: 1) The manufacturer’s ads investment is positively correlated with her sales profit ratio and the retailer’s ads investment is positively correlated with her sales profit ratio and the subsidy rate from the manufacturer. 2) The smaller the manufacturer’s sales profit ratio is compared to the retailer’s sales profit ratio and the larger the retailer’s ads effect coefficient is, the lower the manufacturer will compensate for the retailer. 3) The increase of the manufacturer’s profit weight and will lead to the decrease of the ads investment of the manufacturer, while as reputation effect coefficient be- comes larger, the manufacturer will advertise more. 4) When the game duration is long, the manufacturer will adopt the market-leading strategy. 6. Future Study 6.1 Improving the Models In this paper, we adopt the simulation method that im- poses little limitation on modeling. We can introduce more complicated models: 1) there are more than two players; 2) the assumptions on the long-term ads effect are a little simple: attributing all long-term effect factors to the manufacturer’s reputation. The future work can take other factors into consideration; 3) the future re- searches can introduce the information asymmetry into models. For example, the manufacturer does not know the sales profit ratio and the ads effect coefficient of the retailer, or the retailer knows little about the product quality and after service of the manufacturer. 6.2 Applying the Models and Simulation into Specific Situations The simulation relies heavily on the valuation of the pa- rameters. If we can get data from the firms in real prac- tice and then simulate on the basis of the data, the results will be more convincing. The implications of these new results will bring us several new findings. REFERENCES [1] A. P. Jeuland, and S. M. Shugan, “Managing channel pro- fits,” Marketing Science, Vol. 2, No. 3, pp. 239–272, 1983. [2] K. S. Moorthy, “Managing channel profits: Comment,” Marketing Science, Vol. 6, No. 4, pp. 375–379, 1987. [3] C. A. Ingene and M. E. Parry, “Channel coordination when retailers compete,” Marketing Science, Vol. 14, No. 4, pp. 360–377, 1995. [4] R. P. Dant and P. D. Berger, “Modeling cooperative ad- Copyright © 2009 SciRes JSSM  A Study of the Joint Advertising Channels Copyright © 2009 SciRes JSSM 426 vertising decisions in franchising,” Journal of the Opera- tional Research Society, Vol. 49, No. 9, pp. 1120–1136, 1996. [5] K. Doraiswamy, T. W. McGuire, and R. Staelin, “An analysis of alternative advertising strategies in a competi- tive franchise framework,” Proceedings of Educator's Conference of American Marketing Association, pp. 463– 467, 1979. [6] M. Bergen and G. John, “Understanding cooperative ad- vertising participation rates in conventional channels,” Journal of Marketing Research, Vol. 34, No. 3, pp. 357– 369, 1997. [7] S. Jørgensen, S. P. Sigue, and G. Zaccour, “Dynamic cooperative advertising in a channel,” Journal of Retailing, Vol. 76, No. 1, pp. 71–91, 2000. [8] Z. Huang and S. X. Li, “Co-op advertising models in manufacturer-retailer supply chains: A game theory ap- proach,” European Journal of Operational Research, Vol. 135, No. 3, pp. 527–544, 2001. [9] Deal and R. Kenneth, “Optimizing advertising expendi- tures in a dynamic duopoly,” Operations Research, Vol. 27, No. 4, pp. 682–692, 1979. [10] Chintagunta, K. Pradeep and D. Jain, “A dynamic model of channel member strategies for marketing expenditures,” Marketing Science, Vol. 11, No. 2, pp. 168–188, 1992. [11] Chintagunta and K. Pradeep, “Investigating the sensitivity of equilibrium profits to advertising dynamics and com- petitive effects”, Management Science, Vol. 39, No. 9, pp. 1146–1162, 1993. [12] K. C. Sen, “Advertising fees in the franchised channel,” Journal of Marketing Channels, Vol. 4, No. 1, pp. 83–101, 1995. [13] S. P. Wang, K. L. Judd and C. Gung, “Solving a savings allocation problem by numerical dynamic programming with shape-preserving interpolation,” Computers & Op- erations Research, Vol. 27, pp. 399–408, 2000. [14] L. Tesfatsion, “Introduction to the special issue on agent- based computational economics,” Journal of Economic Dynamics and Control, Vol. 25, No. 3–4, pp. 281–293, 2001. |