Paper Menu >>

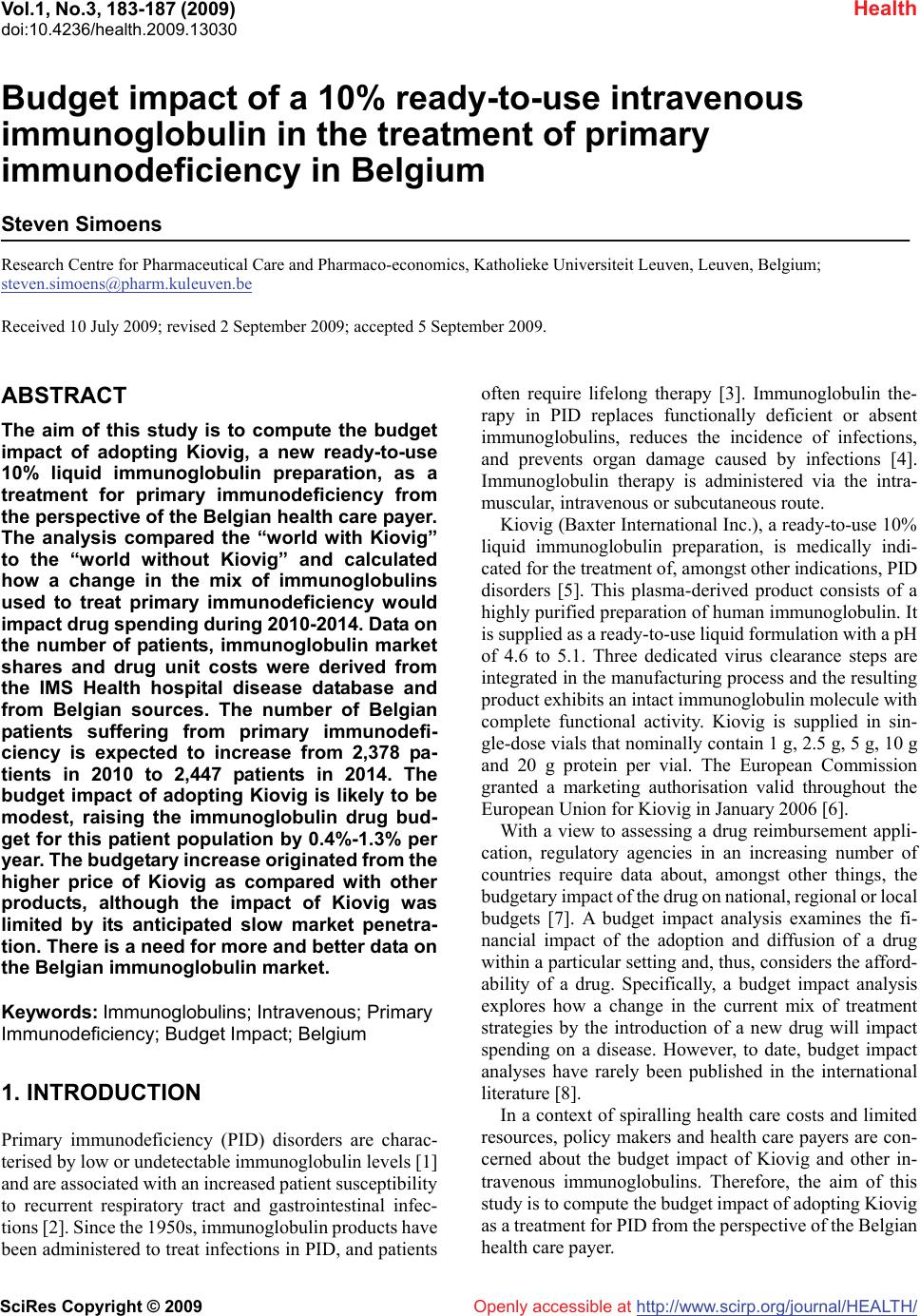

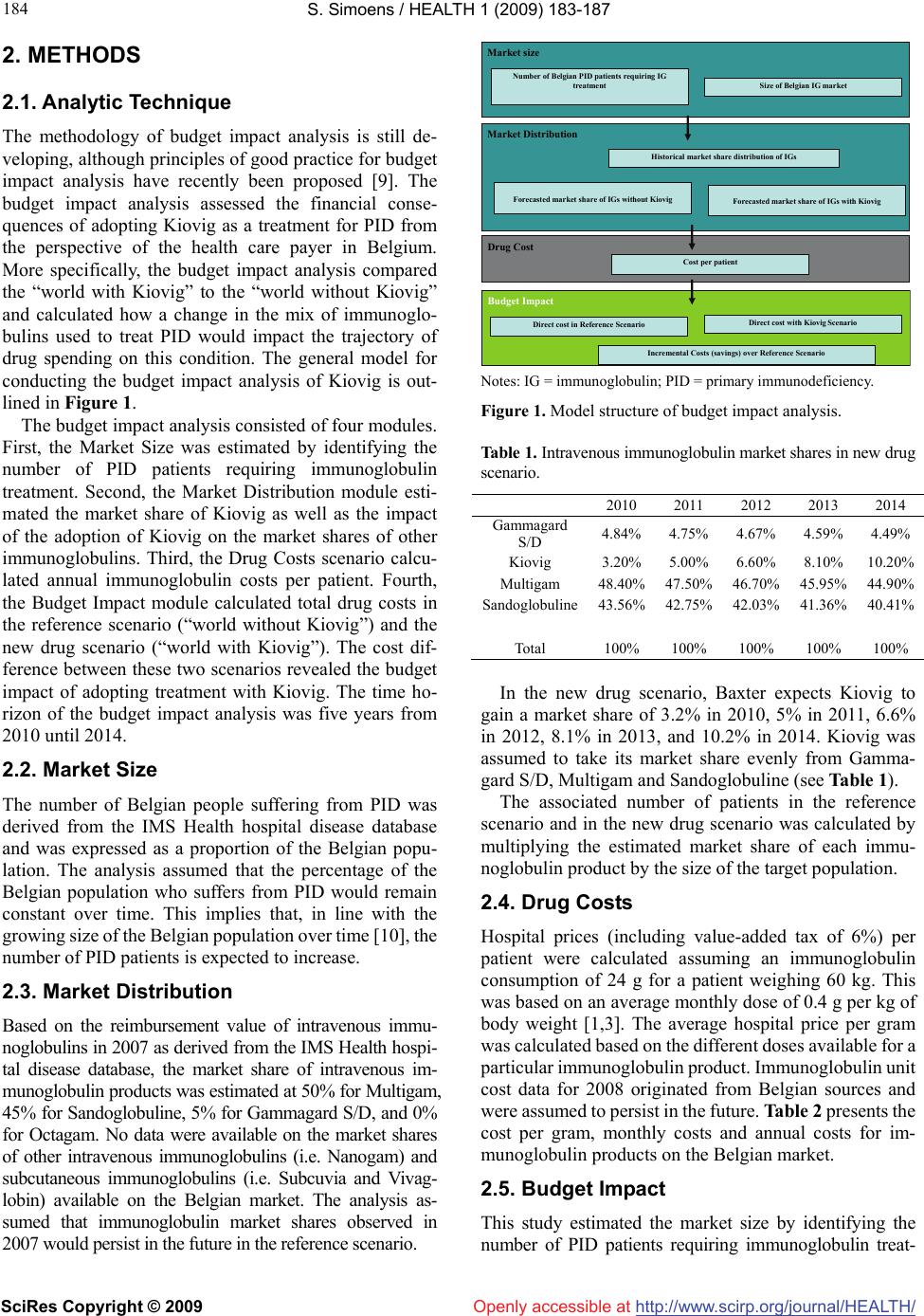

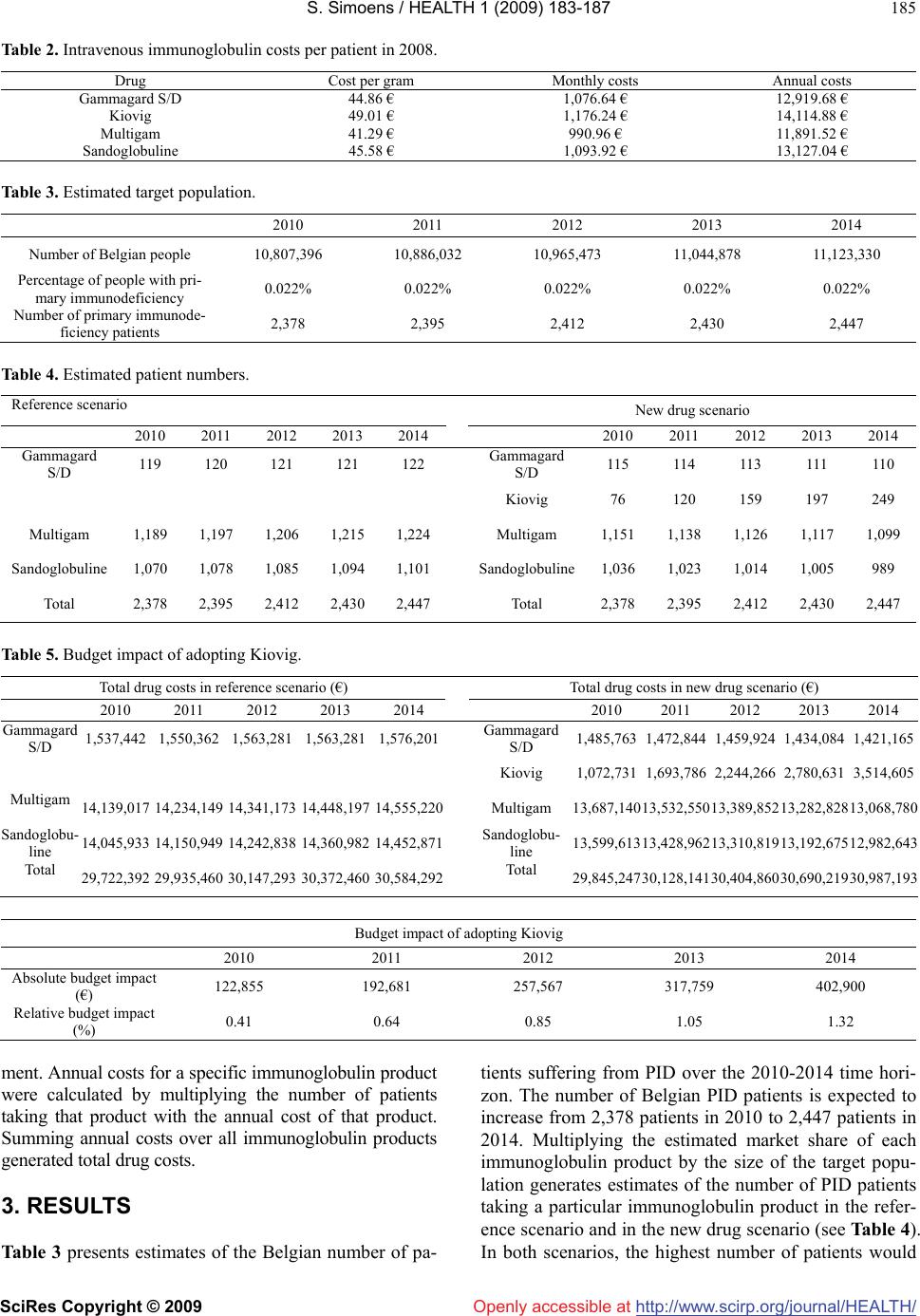

Journal Menu >>

Vol.1, No.3, 183-187 (2009) doi:10.4236/health.2009.13030 SciRes Copyright © 2009 Openly accessible at http://www.scirp.org/journal/HEALTH/ Health Budget impact of a 10% ready-to-use intravenous immunoglobulin in the treatment of primary immunodeficiency in Belgium Steven Simoens Research Centre for Pharmaceutical Care and Pharmaco-economics, Katholieke Universiteit Leuven, Leuven, Belgium; steven.simoens@pharm.kuleuven.be Received 10 July 2009; revised 2 September 2009; accepted 5 September 2009. ABSTRACT The aim of this study is to compute the budget impact of adopting Kiovig, a new ready-to-use 10% liquid immunoglobulin preparation, as a treatment for primary immunodeficiency from the perspective of the Belgian health care payer. The analysis compared the “world with Kiovig” to the “world without Kiovig” and calculated how a change in the mix of immunoglobulins used to treat primary immunodeficiency would impact drug spending during 2010-2014. Data on the number of patients, immunoglobulin market shares and drug unit costs were derived from the IMS Health hospital disease database and from Belgian sources. The number of Belgian patients suffering from primary immunodefi- ciency is expected to increase from 2,378 pa- tients in 2010 to 2,447 patients in 2014. The budget impact of adopting Kiovig is likely to be modest, raising the immunoglobulin drug bud- get for this patient population by 0.4%-1.3% per year. The budgetary increase originated from the higher price of Kiovig as compared with other products, although the impact of Kiovig was limited by its anticipated slow market penetra- tion. There is a need for more and better data on the Belgian immunoglobulin market. Keywords: Immunoglobulins; Intravenous; Primary Immunodeficiency; Budget Impact; Belgium 1. INTRODUCTION Primary immunodeficiency (PID) disorders are charac- terised by low or undetectable immunoglobulin levels [1] and are associated with an increased patient susceptibility to recurrent respiratory tract and gastrointestinal infec- tions [2]. Since the 1950s, immunoglobulin products have been administered to treat infections in PID, and patients often require lifelong therapy [3]. Immunoglobulin the- rapy in PID replaces functionally deficient or absent immunoglobulins, reduces the incidence of infections, and prevents organ damage caused by infections [4]. Immunoglobulin therapy is administered via the intra- muscular, intravenous or subcutaneous route. Kiovig (Baxter International Inc.), a ready-to-use 10% liquid immunoglobulin preparation, is medically indi- cated for the treatment of, amongst other indications, PID disorders [5]. This plasma-derived product consists of a highly purified preparation of human immunoglobulin. It is supplied as a ready-to-use liquid formulation with a pH of 4.6 to 5.1. Three dedicated virus clearance steps are integrated in the manufacturing process and the resulting product exhibits an intact immunoglobulin molecule with complete functional activity. Kiovig is supplied in sin- gle-dose vials that nominally contain 1 g, 2.5 g, 5 g, 10 g and 20 g protein per vial. The European Commission granted a marketing authorisation valid throughout the European Union for Kiovig in January 2006 [6]. With a view to assessing a drug reimbursement appli- cation, regulatory agencies in an increasing number of countries require data about, amongst other things, the budgetary impact of the drug on national, regional or local budgets [7]. A budget impact analysis examines the fi- nancial impact of the adoption and diffusion of a drug within a particular setting and, thus, considers the afford- ability of a drug. Specifically, a budget impact analysis explores how a change in the current mix of treatment strategies by the introduction of a new drug will impact spending on a disease. However, to date, budget impact analyses have rarely been published in the international literature [8]. In a context of spiralling health care costs and limited resources, policy makers and health care payers are con- cerned about the budget impact of Kiovig and other in- travenous immunoglobulins. Therefore, the aim of this study is to compute the budget impact of adopting Kiovig as a treatment for PID from the perspective of the Belgian health care payer.  S. Simoens / HEALTH 1 (2009) 183-187 SciRes Copyright © 2009 http://www.scirp.org/journal/HEALTH/ 184 Openly accessible at 2. METHODS 2.1. Analytic Technique The methodology of budget impact analysis is still de- veloping, although principles of good practice for budget impact analysis have recently been proposed [9]. The budget impact analysis assessed the financial conse- quences of adopting Kiovig as a treatment for PID from the perspective of the health care payer in Belgium. More specifically, the budget impact analysis compared the “world with Kiovig” to the “world without Kiovig” and calculated how a change in the mix of immunoglo- bulins used to treat PID would impact the trajectory of drug spending on this condition. The general model for conducting the budget impact analysis of Kiovig is out- lined in Figure 1. The budget impact analysis consisted of four modules. First, the Market Size was estimated by identifying the number of PID patients requiring immunoglobulin treatment. Second, the Market Distribution module esti- mated the market share of Kiovig as well as the impact of the adoption of Kiovig on the market shares of other immunoglobulins. Third, the Drug Costs scenario calcu- lated annual immunoglobulin costs per patient. Fourth, the Budget Impact module calculated total drug costs in the reference scenario (“world without Kiovig”) and the new drug scenario (“world with Kiovig”). The cost dif- ference between these two scenarios revealed the budget impact of adopting treatment with Kiovig. The time ho- rizon of the budget impact analysis was five years from 2010 until 2014. 2.2. Market Size The number of Belgian people suffering from PID was derived from the IMS Health hospital disease database and was expressed as a proportion of the Belgian popu- lation. The analysis assumed that the percentage of the Belgian population who suffers from PID would remain constant over time. This implies that, in line with the growing size of the Belgian population over time [10], the number of PID patients is expected to increase. 2.3. Market Distribution Based on the reimbursement value of intravenous immu- noglobulins in 2007 as derived from the IMS Health hospi- tal disease database, the market share of intravenous im- munoglobulin products was estimated at 50% for Multigam, 45% for Sandoglobuline, 5% for Gammagard S/D, and 0% for Octagam. No data were available on the market shares of other intravenous immunoglobulins (i.e. Nanogam) and subcutaneous immunoglobulins (i.e. Subcuvia and Vivag- lobin) available on the Belgian market. The analysis as- sumed that immunoglobulin market shares observed in 2007 would persist in the future in the reference scenario. Market size Market Distribution Historical market share distribution of IGs Forecasted market share of IGs without Kiovig Forecasted market share of IGs with Kiovig Drug Cost Cost per patient Budget Impact Direct cost in Reference Scenario Direct cost with Kiovig Scenario Number of Belgian PID patients requiring IG treatment Size of Belgian IG market Incremental Costs (savings) over Reference Scenario Notes: IG = immunoglobulin; PID = primary immunodeficiency. Figure 1. Model structure of budget impact analysis. Table 1. Intravenous immunoglobulin market shares in new drug scenario. 2010 2011 2012 2013 2014 Gammagard S/D 4.84% 4.75% 4.67% 4.59% 4.49% Kiovig 3.20% 5.00% 6.60% 8.10%10.20% Multigam 48.40%47.50% 46.70% 45.95% 44.90% Sandoglobuline 43.56%42.75% 42.03% 41.36%40.41% Total 100% 100% 100% 100% 100% In the new drug scenario, Baxter expects Kiovig to gain a market share of 3.2% in 2010, 5% in 2011, 6.6% in 2012, 8.1% in 2013, and 10.2% in 2014. Kiovig was assumed to take its market share evenly from Gamma- gard S/D, Multigam and Sandoglobuline (see Table 1). The associated number of patients in the reference scenario and in the new drug scenario was calculated by multiplying the estimated market share of each immu- noglobulin product by the size of the target population. 2.4. Drug Costs Hospital prices (including value-added tax of 6%) per patient were calculated assuming an immunoglobulin consumption of 24 g for a patient weighing 60 kg. This was based on an average monthly dose of 0.4 g per kg of body weight [1,3]. The average hospital price per gram was calculated based on the different doses available for a particular immunoglobulin product. Immunoglobulin unit cost data for 2008 originated from Belgian sources and were assumed to persist in the future. Table 2 presents the cost per gram, monthly costs and annual costs for im- munoglobulin products on the Belgian market. 2.5. Budget Impact This study estimated the market size by identifying the number of PID patients requiring immunoglobulin treat-  S. Simoens / HEALTH 1 (2009) 183-187 SciRes Copyright © 2009 http://www.scirp.org/journal/HEALTH/Openly accessible at 185 Table 2. Intravenous immunoglobulin costs per patient in 2008. Drug Cost per gram Monthly costs Annual costs Gammagard S/D 44.86 € 1,076.64 € 12,919.68 € Kiovig 49.01 € 1,176.24 € 14,114.88 € Multigam 41.29 € 990.96 € 11,891.52 € Sandoglobuline 45.58 € 1,093.92 € 13,127.04 € Table 3. Estimated target population. 2010 2011 2012 2013 2014 Number of Belgian people 10,807,396 10,886,032 10,965,473 11,044,878 11,123,330 Percentage of people with pri- mary immunodeficiency 0.022% 0.022% 0.022% 0.022% 0.022% Number of primary immunode- ficiency patients 2,378 2,395 2,412 2,430 2,447 Table 4. Estimated patient numbers. Reference scenario New drug scenario 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 Gammagard S/D 119 120 121 121 122 Gammagard S/D 115 114 113 111 110 Kiovig 76 120 159 197 249 Multigam 1,189 1,197 1,206 1,215 1,224 Multigam 1,151 1,138 1,126 1,117 1,099 Sandoglobuline 1,070 1,078 1,085 1,094 1,101 Sandoglobuline1,036 1,023 1,014 1,005 989 Total 2,378 2,395 2,412 2,430 2,447 Total 2,378 2,395 2,412 2,430 2,447 Table 5. Budget impact of adopting Kiovig. Total drug costs in reference scenario (€) Total drug costs in new drug scenario (€) 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 Gammagard S/D 1,537,442 1,550,362 1,563,281 1,563,281 1,576,201Gammagard S/D 1,485,763 1,472,844 1,459,924 1,434,084 1,421,165 Kiovig 1,072,7311,693,786 2,244,266 2,780,6313,514,605 Multigam 14,139,017 14,234,149 14,341,173 14,448,197 14,555,220Multigam 13,687,14013,532,550 13,389,852 13,282,828 13,068,780 Sandoglobu- line 14,045,933 14,150,949 14,242,838 14,360,982 14,452,871Sandoglobu- line 13,599,613 13,428,962 13,310,819 13,192,67512,982,643 Total 29,722,392 29,935,460 30,147,293 30,372,460 30,584,292Total 29,845,247 30,128,141 30,404,860 30,690,21930,987,193 Budget impact of adopting Kiovig 2010 2011 2012 2013 2014 Absolute budget impact (€) 122,855 192,681 257,567 317,759 402,900 Relative budget impact (%) 0.41 0.64 0.85 1.05 1.32 ment. Annual costs for a specific immunoglobulin product were calculated by multiplying the number of patients taking that product with the annual cost of that product. Summing annual costs over all immunoglobulin products generated total drug costs. 3. RESULTS Table 3 presents estimates of the Belgian number of pa- tients suffering from PID over the 2010-2014 time hori- zon. The number of Belgian PID patients is expected to increase from 2,378 patients in 2010 to 2,447 patients in 2014. Multiplying the estimated market share of each immunoglobulin product by the size of the target popu- lation generates estimates of the number of PID patients taking a particular immunoglobulin product in the refer- ence scenario and in the new drug scenario (see Table 4). In both scenarios, the highest number of patients would  S. Simoens / HEALTH 1 (2009) 183-187 SciRes Copyright © 2009 http://www.scirp.org/journal/HEALTH/Openly accessible at 186 be expected to take Multigam, followed by patients tak- ing Sandoglobuline and patients taking Gammagard S/D. In the new drug scenario, the number of patients treated with Kiovig is expected to increase from 76 patients in 2010 to 249 patients in 2014. Table 5 shows total drug costs in the reference sce- nario (“world without Kiovig”) and the new drug sce- nario (“world with Kiovig”), respectively. In the refer- ence scenario, total drug costs are expected to increase from 29.7 million € in 2010 to 30.6 million € in 2014. In the new drug scenario, total drug costs would rise from 29.8 million € in 2010 to 31 million € in 2014. The esti- mated budget impact of treatment with Kiovig is the difference in total drug costs between the new drug sce- nario and the reference scenario. Table 5 demonstrates that the absolute budget impact of adopting treatment with Kiovig increases from 0.1 million € in 2010 to 0.4 million € in 2014. Overall, treatment with Kiovig raises the 2010-2014 budget by 1.3 million € (or 0.86% of the reference drug budget). 4. DISCUSSIONS The budget impact analysis compared the “world with Kiovig” to the “world without Kiovig”. The analysis took into account the market size, immunoglobulin market shares and unit costs with a view to estimating the budget impact of Kiovig. The findings showed that, from the perspective of the Belgian health care payer, the budget impact of adopting Kiovig in the treatment of PID is likely to be limited. The adoption of Kiovig would raise the immunoglobulin drug budget by 0.4%-1.3% per year. The budgetary in- crease originated from the higher price of Kiovig as com- pared with other intravenous immunoglobulins, although the impact of Kiovig was limited by the slow market penetration of Kiovig as predicted by Baxter. The analysis used conservative estimates of the market share of Kiovig over time given that similar products are expected to enter the market in the future. The budget impact analysis was based on a number of assumptions in the absence of data. First, the analysis focused on some, but not all intravenous immunoglobulin therapies available on the Belgian market and did not include subcutaneous immunoglobulin therapies. Second, the immunoglobulin market evolves so that, even though the most recent market share data relating to 2007 were used, the data may no longer reflect the current market situation. Third, the assumption was made that a patient would require an immunoglobulin consumption of 24 g per month. This is in line with estimates used by the Belgian Commission for Drug Reimbursement [11]. In light of these assumptions, the findings give an idea of the order of magnitude of the budget impact of Kiovig, but do not represent the exact budget impact. These shortcom- ings highlight the need for more and better data on the Belgian immunoglobulin market size and the market distribution. It should be noted that the budget impact is only one of the factors informing the decision whether to reimburse Kiovig. Other factors that are taken into account in Bel- gium are the therapeutic value, price, importance in medical practice in terms of therapeutic and social needs, and cost-effectiveness. Kiovig has a favourable pharmacokinetic, safety and effectiveness profile in the treatment of PID patients. Three prospective, open-label, multi-centre studies 160001 [12], 160101 [13] and 160002 [14] have demonstrated that Kiovig attains the required minimum trough levels and pharmacokinetic parameters in PID patients. The Euro- pean Public Assessment Report of Kiovig reveals no special risk for humans based on the exploration of safety pharmacology and toxicity [15]. The outcome measures of incidence of infections, antimicrobial use and the number of days off school or work were similar to those of other intravenous immunoglobulins. In Belgium, Kiovig tends to be more expensive than other intravenous immunoglobulins, amounting to an increase in the hospital price per gram (excluding VAT of 6%) of 0%-18% as compared with Gammagard S/D, 5%-27% as compared with Multigam, -4% to 21% as compared with Nanogam, and 8%-28% as compared with Octagam in 2008. In addition to Kiovig, other intravenous immu- noglobulins are available on the Belgian market, in- cluding Gammagard S/D, Multigam, Nanogam, Octa- gam and Sandoglobuline. Furthermore, Subcuvia and Vivaglobin are available for subcutaneous administra- tion. As compared with other immunoglobulins, Kiovig benefits from: a manufacturing process consisting of three dedicated virus reduction steps; a formulation containing no sucrose or sodium and containing more than 98% immunoglobulin G; a ready-to-use liquid presentation obviating the need for reconstitution; the ability to store at room temperature; a faster infusion speed and lower infusion volume; and the potential for home-based administration [4,5]. To date, the cost-effectiveness of Kiovig as compared with other intravenous immunoglobulins is unknown. The previous sections point to a similar effectiveness and higher price of Kiovig as compared with other products. To determine the cost-effectiveness of Kiovig, there is a need for an economic evaluation alongside a head-to- head clinical trial comparing Kiovig with other intrave- nous immunoglobulins. 5. ACKNOWLEDGEMENTS Financial support for this research project was received from Baxter. The author has no conflicts of interest that are relevant to the content of this manuscript.  S. Simoens / HEALTH 1 (2009) 183-187 SciRes Copyright © 2009 http://www.scirp.org/journal/HEALTH/ 187 187 Openly accessible at REFERENCES [1] Ho, S. Membe, K. Cimon K, et al., (2008) Subcutaneous versus intravenous immunoglobulin for primary immu- nodeficiencies: Systematic review and economic evalua- tion. Ottawa: Canadian Agency for Drugs and Technolo- gies in Health. [2] A. Gardulf, (2007) Immunoglobulin treatment for primary antibody deficiencies: Advantages of the subcutaneous route. BioDrugs, 21(2), 105-116. [3] B. Hogy, H. O. Keinecke, M. Borte, (2005) Pharma- coeconomic evaluation of immunoglobulin treatment in patients with antibody deficiencies from the perspective of the German statutory health insurance. European Journal of Health Economics, 6(1), 24-29. [4] C. G. M. Kallenberg, M. Laseur, (2007) Cost considera- tions in choosing an intravenous immunoglobulin prepa- ration. European Journal of Hospital Pharmacy Practice, 13(2), 6-7. [5] J. Bjorkander, J. Nikoskelainen, H. Leibl, et al., (2006) Prospective open-label study of pharmacokinetics, effi- cacy and safety of a new 10% liquid intravenous immu- noglobulin in patients with hypo- or agammaglobulinemia. Vox Sanguinis, 90(4), 286-293. [6] European Medicines Agency, (2006) European Public Assessment Report (EPAR): Kiovig. London: European Medicines Agency. [7] J. Cohen, E. Stolk, M. Niezen, (2007) The increasingly complex fourth hurdle for pharmaceuticals. Pharma- coeconomics, 25, 727-734. [8] J. A. Mauskopf, S. Earnshaw, C. D. Mullins, (2005) Budget impact analysis: review of the state of the art. Expert Review of Pharmacoeconomics and Outcomes Research, 5, 65-79. [9] J. A. Mauskopf, S. D. Sullivan, L. Annemans, et al., (2007) Principles of good practice for budget impact analysis: report of the ISPOR task force on good research practices- budget impact analysis. Value in Health, 10, 336-347. [10] National Statistics of Belgium, (2009) Population statis- tics. Available from: http://www.statbel.fgov.be, Accessed 5th May 2009. [11] Commission for Drug Reimbursement, (2006) Evaluation report day 60 Kiovig. Brussels: Commission for Drug Reimbursement. [12] Prospective open-label study of pharmacokinetics, effi- cacy and safety of immune globulin intravenous (human), 10% TVR solution in patients with hypo- or agammag- lobulinemia. Final study report, study no. 160001. [13] A clinical investigation to assess the safety and efficacy of immune globulin intravenous (human), 10% in subjects with primary immunodeficiency disorders. Interim study report, study no. 160101. [14] Prospective open-label study of the efficacy and safety of immune globulin intravenous (human), 10% TVR solu- tion in adult subjects with chronic idiopathic thrombocy- topenic purpura. Final study report, study no. 160002. [15] European Medicines Agency, (2006) European Public Assessment Report (EPAR): Kiovig. London: European Medicines Agency. |