Paper Menu >>

Journal Menu >>

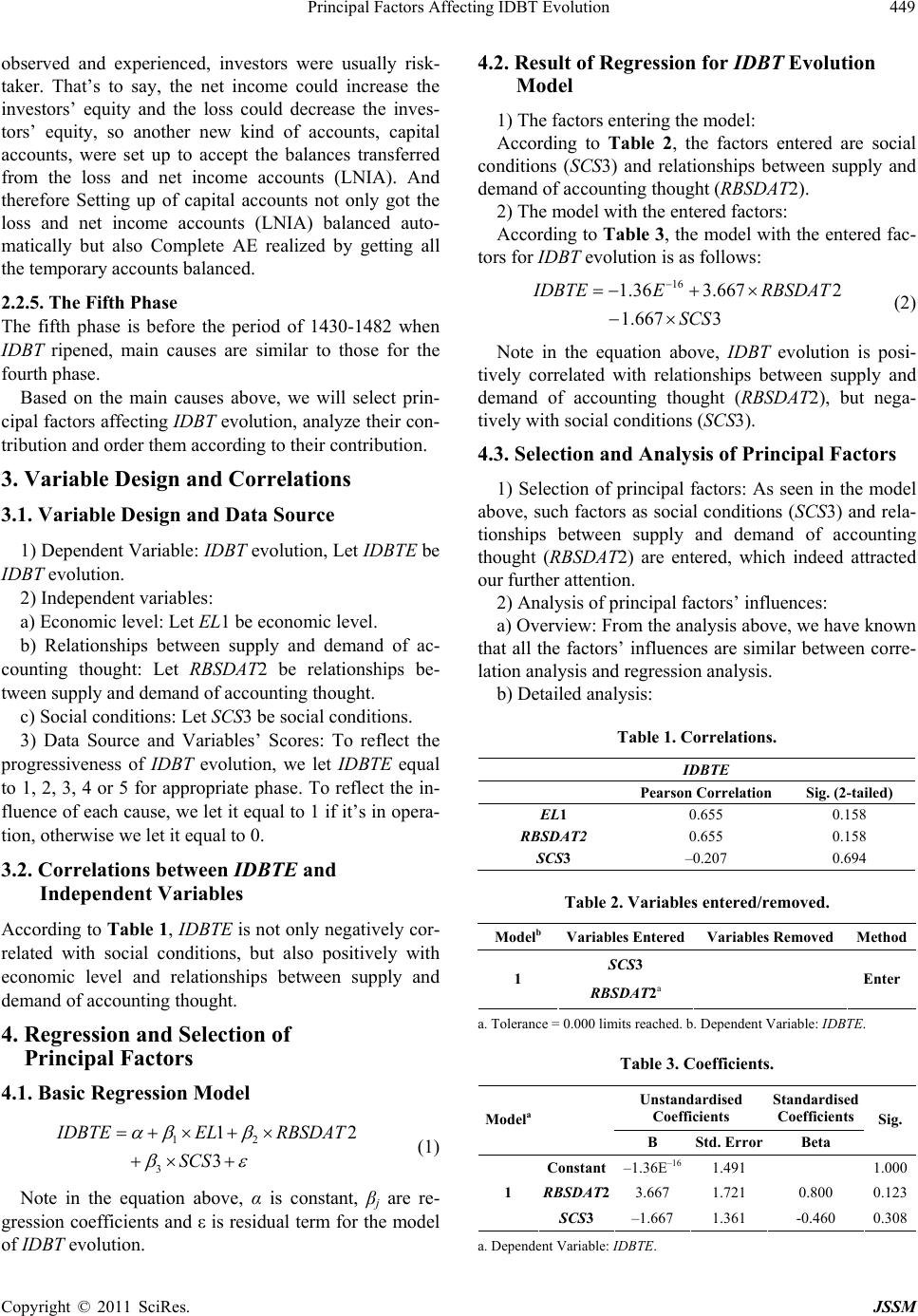

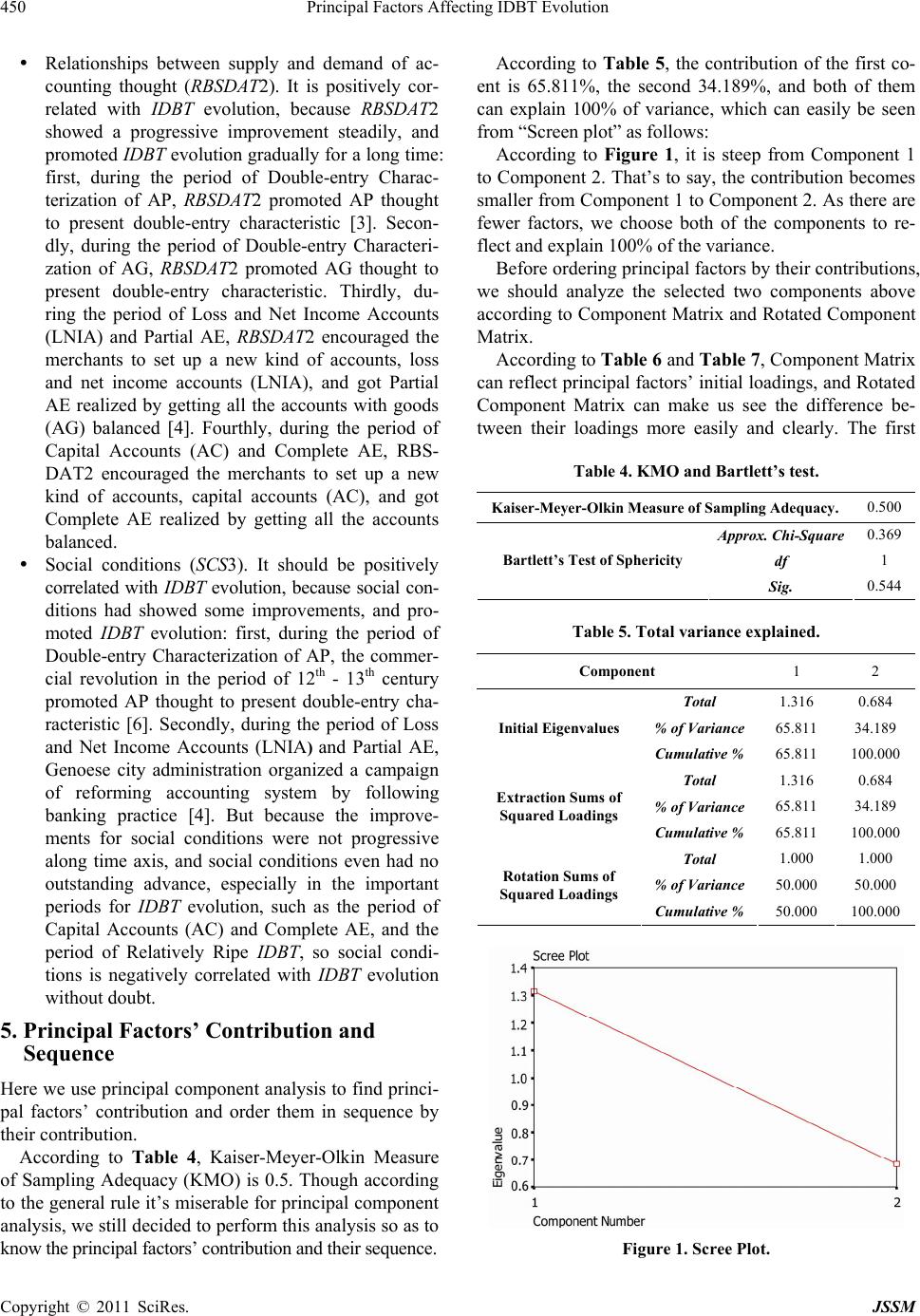

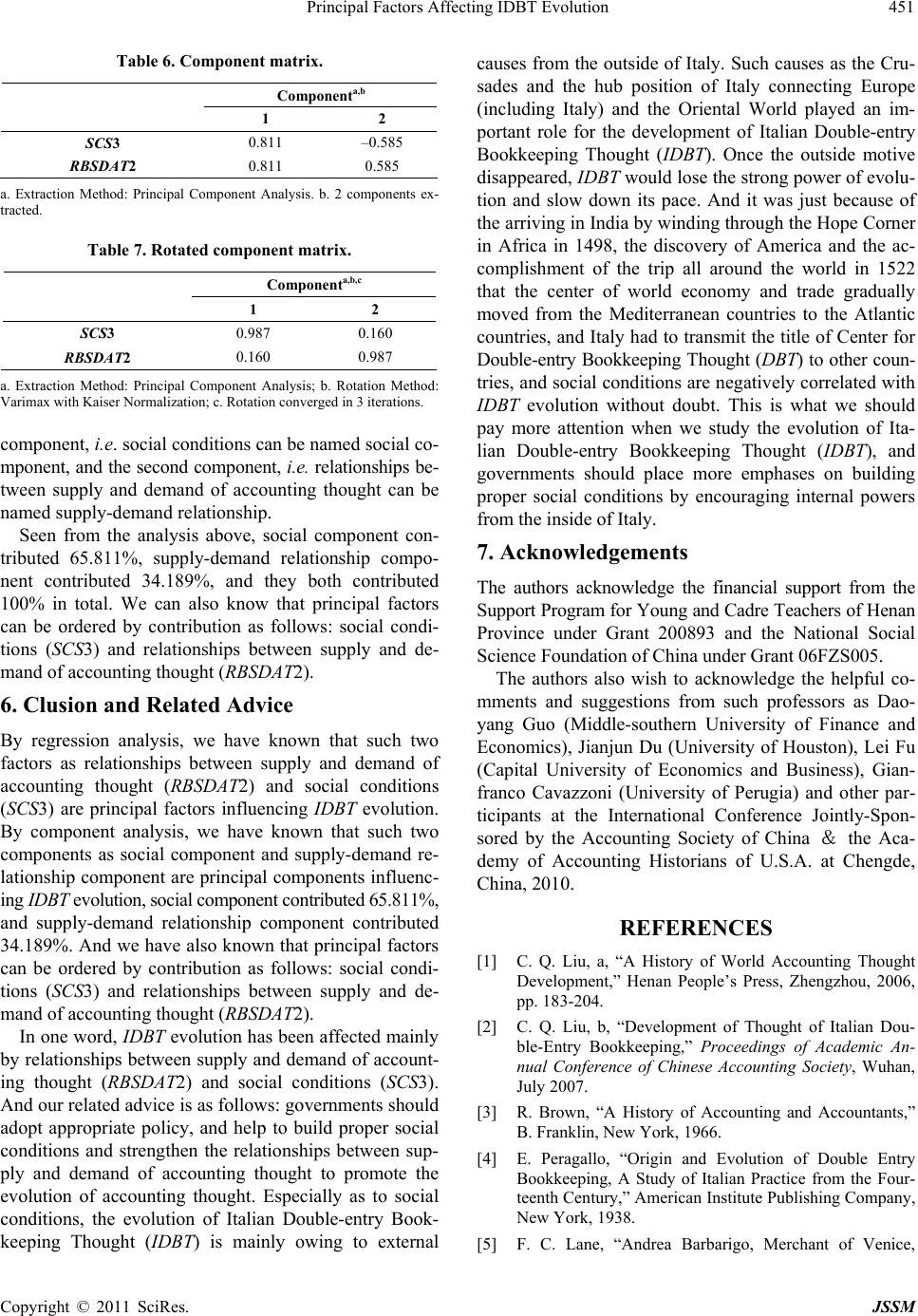

Journal of Service Science and Management, 2011, 4, 445-452 doi:10.4236/jssm.2011.44050 Published Online December 2011 (http://www.SciRP.org/journal/jssm) Copyright © 2011 SciRes. JSSM 445 Principal Factors Affecting IDBT Evolution Changqing Liu1, Haili Yuan2 1Department of Accounting, Zhengzhou Institute of Aeronautical Industry Management, Zhengzhou, China; 2School of Mathematics and Statistics, University of Wuhan, Wuhan, China. E-mail: liuevergreen@zzia.edu.cn Received October 9th, 2011; revised November 16th, 2011; accepted November 28th, 2011. ABSTRACT Studies on Italian Double-entry Bookkeeping Thought (IDBT) evolution are seldom found in such aspects as accounts with persons (AP), accounts with goods (AG), and accounts equilibria (AE), etc., so we studied IDBT evolution in the aspects stated above and the principal factors for IDBT evolution, including their selection, contribution and sequence in this thesis. By our analysis, IDBT evolved in such aspects as accounts with persons (AP), accounts with goods (AG), loss and net income accounts (LNIA), capital accounts (AC) and accounts equilibria (AE), etc., and ripened in the pe- riod of 1430-1482. Principal factors affecting IDBT evolution can be ordered by contribution as follows: social condi- tions (SCS3) and relationships between supply and demand of accounting thought (RBSDAT2). And our related advice is as follows: governments should adopt appropriate policy, and help to build proper social conditions and strengthen the relationships between supply and demand of accounting thought to promote the evolution of accounting thought. Especially as to social conditions, IDBT evolution is mainly owing to external causes from the outside of Italy. Once the outside motive disappeared, IDBT would lose the strong power of evolution and slow down its pace. So governments should place more emphases on building proper social conditions by encouraging internal powers from the inside of Italy. Keywords: IDBT Evolution, Principal Factors, Contribution, Sequence 1. Introduction The world is composed of many different kinds of eco- nomic transactions among people, which have promoted and are promoting social and economic development greatly. The economic transactions above cannot exist and develop without such kinds of flow at least as substance flow, information flow, money flow, etc., which can all be represented by value flow in essence. One of the important methods to record and reflect the flowing movement of value (or value flow) is double- entry bookkeeping (DB), in which the economic transact- tions must be recorded in Receipt and Pay entries in two related journals or ledgers (i.e. in two different directions) simultaneously and the amount in two directions should be equal, so it’s important to study the evolution of dou- ble-entry bookkeeping and its thought. According to my study, the evolution of double-entry bookkeeping and its thought should be studied in such aspects as accounts with persons (AP), accounts with goods (AG), and ac- counts equilibria (AE), etc., which constitutes the main points of double-entry bookkeeping, but studies on Ital- ian Double-entry Bookkeeping Thought (IDBT) evolu- tion are seldom found in this way. Therefore I have stu- died Italian Double-entry Bookkeeping Thought (IDBT) evolution in this way [1,2], and was invited to attend Academic Annual Conference of Chinese Accounting So- ciety and International Conferences Jointly-Sponsored by ASC & AAH from 2005 to 2010. Encouraged by this, I managed to study the principal factors affecting IDBT evolution in this study and try to give appropriate advice. According to our purpose of study, we will study prin- cipal factors affecting IDBT evolution, including their selection, sequence and contribution, so the other part of this thesis can be structured as follows: first, IDBT evo- lution, secondly main causes of IDBT evolution, thirdly variable design and correlations, fourthly regression and selection of principal factors, fifthly principal factors’ con- tribution and their sequence, and sixthly conclusion and related advice. 2. IDBT Evolution and Its Main Causes IDBT evolved in such aspects as accounts with persons (AP), accounts with goods (AG), loss and net income ac- counts (LNIA), capital accounts (AC) and accounts equi- libria (AE), etc., and ripened in the period of 1430-1482.  Principal Factors Affecting IDBT Evolution 446 2.1. IDBT Evolution 2.1.1. D ou ble-Entry Charac te rization o f A P AP thought presented double-entry characteristic in 1211 as presented in the Florentine Bank Ledger. Banking played a leading role in IDBT evolution. Then Florentine banks usually set up an account for each client and named the account with the client’s name, so this kind of accounts is called accounts with persons (AP). Banking gave AP the characteristic of double-entry in 1211 as presented in the Florentine Bank Ledger. According to the Floren tin e Bank Ledger now stored in Bibliotheca Mediceo Laurenziana di Firenze, Floren- tine banks then not only set up journals but also entry books. Journals were often used as memorandums and references by which to classify and enter items in appro- priate accounts, etc. Entry books were similar to the le- dgers used today and set up as AP [3], which were the important account books of Florentine Banks. In entry books, an account was set up for each client and named with the client’s name, and the folios of the ledger were divided into upper and lower sections on each page. The upper section, called the debit side today, was use to re- cord what he must give us, i.e., what the banks should get from the clients. The lower section, called the credit side today, was use to record what he shall have from us, i.e., what the banks must give the clients, or what the clients should get from the banks. As to each transaction, the banks chose to transfer the amount of transactions from the credit side of the account of one client to the debit side of the account of the other client, or from the debit side of the account of one client to the credit side of the account of the other client, to settle accounts between or among clients. That is to say, transactions involved must be recorded in debit and credit entries in two related ac- counts simultaneously. In other words, one entry in debit, another in credit, and the amount in two directions should be equal. So it’s the transference carried out by Florentine banks between or among clients that made AP present dou- ble-entry characteristic so that both the increases and de- creases of debts (or credits) and the relationships bet- ween debtors and creditors could be recorded and re- flected more clearly. But the debit side and credit side of an account were still placed in upper section and lower section respectively so the relationships between them were not reflected directly, and the thought of AG did not present double-entry characteristic yet, etc. 2.1.2. D ou ble-Entry Charac te rization o f A G AG thought presented double-entry characteristic in the period of 1296-1305 as presented in the Florentine Rin- erio and Baldo Fini’s Merchant Ledger. According to this Merchant Ledger, Rinerio and Baldo Fini set up such accounts as journals, ledgers and general ledgers, which not only included AP but also AG. To record and reflect the increases and decreases of goods and other related items, AG were further classified into such accounts as quilts and clothes, woolen, boots and hats, and miscellaneous accounts, etc. Such accounts abo- ve were recorded in the similar way as used in AP above, i.e., in double-entry. So it is Rinerio and Baldo Fini’s treating AG the simi- lar way as AP that made AG present double-entry char- acteristic, which helped to record and manage goods and other related items effectively and efficiently, including their costs and expenses. But the debit side and credit side of an account were still placed in upper section and lower section respectively so the relationships between them were not reflected directly, the net income or net loss of the operations could not be measured and re- flected clearly, and the accounts, including AG, did not get balanced automatically yet, etc. 2.1.3. Loss and Net Income Accounts (LNIA) and Partial AE Partial AE (i.e. not all accounts balanced) thought pre- sented in Genoese Public Ledger in 1340 by setting up of loss and net income accounts (LNIA). To check if the entries of accounts were right, people tried to balance the accounts. When AP were settled, no matter either debts were paid or loans were returned, the entries in AP opposite to their balance sides could make AP balanced automatically, but AG were different, only settling AG could not make AG balanced automatically. So as a result of people’s pursuing solution, Partial AE thought presented in Genoese Public Ledger in 1340 by setting up of loss and net income accounts (LNIA). According to this Public Ledger, Genoese city admini- stration then set up such accounts as journals, ledgers and general ledgers, and the general ledgers included such accounts as: 1) AP including Financial officials, Tax- collecting officials and attesters, etc.; 2) AG including Peppers and Fabrics and Silks, etc.; and 3) loss and net income accounts (LNIA); etc.. Especially, loss and net income accounts (LNIA) could not only accept the credit balances transferred from the accounts with goods (AG) but also help to measure the net income or net loss of the operations [4]. In this way, AG got balanced and Partial AE was realized. So it is setting up of loss and net income accounts that made Partial AE realized by getting some of the accounts balanced, including AP and AG. Meanwhile the debit side and credit side of an account were placed in left sec- tion and right section respectively so the relationships between them were reflected more directly, but some of the accounts, especially the loss and net income accounts Copyright © 2011 SciRes. JSSM  Principal Factors Affecting IDBT Evolution447 could not get balanced yet, etc.. 2.1.4. Capital Accounts (AC) and Complete AE Complete AE (i.e. all the temporary accounts balanced) thought presented in Venitian Donaldo Soranzo’s Mer- chant Ledger in the period of 1406-1434 by setting up of capital accounts. According to this Merchant Ledger, Venitian Donaldo Soranzo set up a complete set of accounts, not only in- cluding accounts with persons (AP), accounts with goods (AG) and loss and net income accounts (LNIA) but also capital accounts (AC), etc. Next we will show how Venitian Donaldo Soranzo got all the accounts balanced. The first step is to close all the temporary accounts. At the end of every accounting pe- riod, accountants first summarized debit and credit amo- unts and calculated the balances of the ledger accounts, then transferred these balances into loss and net income accounts (LNIA) to calculate net income or net loss whi- ch was further transferred into capital accounts (AC), so capital accounts (AC) not only accepted the balances transferred from the loss and net income accounts (LNIA) but also got all the temporary accounts balanced auto- matically. The next step is to get all the accounts balanced by preparing trial balance. Accountants first posted all the balances of the accounts into the trial balance, summa- rized debit amounts and credit amounts respectively, and proved the equality of debits and credits in the trial bal- ance. If the amount of debits equaled to that of credits, it not only meant all the accounts got balanced but also all the entries were right. Otherwise something must be wrong with the entries, accountants must check them until the errors were found and corrected to ensure the amount of debits equaled to that of credits. So it is setting up of capital accounts (AC) and trial balance that made Complete AE realized by getting all of the accounts balanced. Meanwhile all the accounts were entered in double-entry, and especially the preparing of trial balance made a preparation for Balance Sheet, but IDBT was not mature yet with preparing of Balance Sheet being immature as one of the examples, etc.. 2.1.5. Relati vely Ripe IDBT IDBT as a whole ripened in the period of 1430-1482 as presented in Andrea Barbarigo’s Merchant Ledger. As the commerce developed, IDBT kept on evolving and ripened relatively in the period of 1430-1482 with a relatively advanced version as presented in Andrea Bar- barigo’s Merchant Ledger [5]. According to this Merchant Ledger, the main charac- teristics of relatively ripe IDBT could be summarized as follows: 1) Book system: Account books were organized as a system of three primary books, i.e., journals, ledgers and general ledgers, etc.. When a transaction occurred, it was immediately recorded in the journal, and the entries in journals were usually chronological and detailed reco- rding of business transactions in order of date. After the transactions were entered in journals, the debit changes and credit changes in the individual accounts of journals were entered into the debit side and credit side of ledgers respectively. Then the entries of ledgers were summa- rized and copied to general ledgers further. So journals, ledgers and general ledgers, etc., formed into an inter-re- lated system. 2) Account system: The accounts in the general ledger and other books could be classified as accounts with persons (AP), accounts with goods (AG), loss and net income accounts (LNIA), capital accounts (AC) and ba- lances account, etc., which were united as a system and could meet the need of bookkeeping very well. 3) Recording method: The entries were recorded in the accounts based on the double-entry bookkeeping. With Per meaning debit side, A meaning credit side, and the a- mount in the two sides being equal, the entries in 1430 accounts give us clear evidence of double-entry book- keeping [4]. 4) Complete AE: The balances of loss and net income accounts (LNIA) in both 1430 and 1432 were posted into loss and net income accounts (LNIA) in 1434, then the balance of which was posted into capital accounts, and finally the balances of which were posted into balances account, so all the accounts were got balanced. 5) Balance Sheet and Income Statement: According to Andrea Barbarigo’s Merchant Ledger in the period of 1456-1482, Balances account was prepared in 1482 and the yearly profit was also calculated irregularly. To make it clear, we can briefly analyze it as follows. The first is that all the balances on the debit sides and credit sides of accounts were reflected and totaled in the balances ac- count, which was used to examine the accuracy of record keeping. If the record keeping was correct, the total amount in the two sides must be equal. So balances ac- count could be treated as both trial balance and balance sheet. The second is that the yearly profit was calculated mainly by means of loss and net income accounts (LNIA), which divided expenses (or cost) into more subsidiary items, so that profit could be determined by the formula of revenue subtracting expenses more easily. 2.2. Main Causes for IDBT Evolution 2.2.1. The First Phase The first phase is before 1211 when AP thought presen- ted double-entry characteristic, main causes are stated as follows: 1) Economic level (EL): There are two factors we Copyright © 2011 SciRes. JSSM  Principal Factors Affecting IDBT Evolution 448 should consider. The first is that the medieval military expeditions of recovering Jerusalem from the Muslims by Europeans greatly promoted the development of com- merce. From 1096 to 1291, this kind of armed forces had invaded and plundered the countries to the east of the Mediterranean for at least 8 times, which brought back silks, spices and other goods to Europe (including Italy) from the Oriental World, and encouraged European peo- ple to produce appropriate goods to exchange for what they need from the Oriental World. The second is the hub position of Italy that joined most important parts of the world as a whole, especially joined Europe (including Italy) with the Oriental World together, which stimulated not only the trade between Europe (including Italy) and the Oriental World but also the development of Italian economy. 2) Relationships between supply and demand of ac- counting thought (RBSDAT): From the late part of the 12th century to the beginning of the 13th century in Italy, as industry and commerce developed rapidly, more and more capitals were needed, and more and more entrepre- neurs became clients of banks, which were very deman- ding for banking. To facilitate the procedures and take fewer risks, the banks preferred to transfer the amount of transactions from creditors (or debtors) to debtors (or cre- ditors) as middlemen rather than record the amount of transactions as agents of creditors (or debtors), which cau- sed AP thought to present double-entry characteristic [3]. 3) Social conditions (SCS): As commerce developed, more and more cities came into existence from the period of the 9th - 10th century on, and became the center of in- dustry and commerce. It is because of the commercial revolution in the period of the 12th - 13th century that tens of cities, especially those in the northern Italy such as Florence, etc. became the economy center of Italy and even of Europe, which in turn promoted commerce and AP thought to develop. 2.2.2. The Second Phase The second phase is before the period of 1296-1305 when AG thought presented double-entry characteristic, main causes are stated as follows: 1) Economic level (EL): From 1230, many banks, es- pecially those in Florence of Italy, set up agency bran- ches in western Europe to collect duties for the Roman Pope and do business of great amount with the Monarchs there frequently, and therefore from the late 13th century on, the Florence Banking became the pillar of European financial markets. 2) Relationships between supply and demand of ac- counting thought (RBSDAT): As commerce developed more and more rapidly, facing such great difficulties as larger and larger amounts of transactions, more and more varieties of goods, and higher and higher turnover ratios of goods, etc., Florence merchants realized that only the accounts with persons (AP) could not meet the demand of reflecting not only the purchases and sales of goods but also the increases and decreases of cost (or expenses) of goods, and therefore AG thought presented itself on the stage with double-entry characteristic. 2.2.3. The Third Phase The third phase is before 1340 when Partial AE thought presented itself by setting up of loss and net income ac- counts (LNIA), main causes are stated as follows: 1) Economic level (EL): At that time, Genoa was one of the important hubs promoting the trade between Eu- rope (including Italy) and the Oriental World only next to Venice. 2) Relationships between supply and demand of ac- counting thought (RBSDAT): In the middle part of the 14th century when capitalism developed rapidly, profit- making became a more and more important aim for mer- chants, they were very eager to get purchases price as low as possible and sales price as high as possible, so the amount of credits was usually more than that of debits in the accounts with goods (AG). That’s to say, the ac- counts with goods (AG) could not get balanced automa- tically and usually had credit balances. How to solve this problem encouraged the merchants to set up a new kind of accounts, loss and net income accounts (LNIA), to not only accept the credit balances transferred from the ac- counts with goods (AG) but also help to measure the net income or net loss of the operations, and therefore setting up of loss and net income accounts (LNIA) got Partial AE realized by getting all the accounts with goods (AG) balanced (but LNIA not balanced). 3) Social conditions (SCS): In the beginning of the 14th century, the double-entry bookkeeping for Italian Bank- ing was very good. In 1327, Genoese city administration organized a campaign of reforming accounting system by following banking practice [4]. 2.2.4. The Fourth Phase The fourth phase is before the period of 1406-1434 when Complete AE thought presented itself by setting up of capital accounts, main causes are stated as follows: 1) Economic level (EL): From the 12th - 15th century, Venice dominated the world trade, especially that be- tween Europe (including Italy) and the Oriental World, which not only strengthened the hub position of Italy but also kept on providing engines for Italian economy. 2) Relationships between supply and demand of ac- counting thought (RBSDAT): As stated above, the loss and net income accounts (LNIA) could not get balanced automatically, which encouraged the merchants and in- vestors to manage to find a new solution. As what they Copyright © 2011 SciRes. JSSM  Principal Factors Affecting IDBT Evolution449 observed and experienced, investors were usually risk- taker. That’s to say, the net income could increase the investors’ equity and the loss could decrease the inves- tors’ equity, so another new kind of accounts, capital accounts, were set up to accept the balances transferred from the loss and net income accounts (LNIA). And therefore Setting up of capital accounts not only got the loss and net income accounts (LNIA) balanced auto- matically but also Complete AE realized by getting all the temporary accounts balanced. 2.2.5. The Fifth Phase The fifth phase is before the period of 1430-1482 when IDBT ripened, main causes are similar to those for the fourth phase. Based on the main causes above, we will select prin- cipal factors affecting IDBT evolution, analyze their con- tribution and order them according to their contribution. 3. Variable Design and Correlations 3.1. Variable Design and Data Source 1) Dependent Variable: IDBT evolution, Let IDBTE be IDBT evolution. 2) Independent variables: a) Economic level: Let EL1 be economic level. b) Relationships between supply and demand of ac- counting thought: Let RBSDAT2 be relationships be- tween supply and demand of accounting thought. c) Social conditions: Let SCS3 be social conditions. 3) Data Source and Variables’ Scores: To reflect the progressiveness of IDBT evolution, we let IDBTE equal to 1, 2, 3, 4 or 5 for appropriate phase. To reflect the in- fluence of each cause, we let it equal to 1 if it’s in opera- tion, otherwise we let it equal to 0. 3.2. Correlations between IDBTE and Independent Variables According to Table 1, IDBTE is not only negatively cor- related with social conditions, but also positively with economic level and relationships between supply and demand of accounting thought. 4. Regression and Selection of Principal Factors 4.1. Basic Regression Model 12 3 12 3 I DBTEEL RBSDAT SCS (1) Note in the equation above, α is constant, βj are re- gression coefficients and ε is residual term for the model of IDBT evolution. 4.2. Result of Regression for IDBT Evolution Model 1) The factors entering the model: According to Table 2, the factors entered are social conditions (SCS3) and relationships between supply and demand of accounting thought (RBSDAT2). 2) The model with the entered factors: According to Table 3, the model with the entered fac- tors for IDBT evolution is as follows: 16 1.36 3.6672 1.667 3 I DBTE ERBSDAT SCS (2) Note in the equation above, IDBT evolution is posi- tively correlated with relationships between supply and demand of accounting thought (RBSDAT2), but nega- tively with social conditions (SCS3). 4.3. Selection and Analysis of Principal Factors 1) Selection of principal factors: As seen in the model above, such factors as social conditions (SCS3) and rela- tionships between supply and demand of accounting thought (RBSDAT2) are entered, which indeed attracted our further attention. 2) Analysis of principal factors’ influences: a) Overview: From the analysis above, we have known that all the factors’ influences are similar between corre- lation analysis and regression analysis. b) Detailed analysis: Table 1. Correlations. IDBTE Pearson Correlation Sig. (2-tailed) EL1 0.655 0.158 RBSDAT2 0.655 0.158 SCS3 –0.207 0.694 Table 2. Variables entered/removed. Modelb Variables EnteredVariables RemovedMethod SCS3 1 RBSDAT2a Enter a. Tolerance = 0.000 limits reached. b. Dependent Variable: IDBTE. Table 3. Coefficients. Unstandardised Coefficients Standardised Coefficients Modela B Std. Error Beta Sig. Constant –1.36E–16 1.491 1.000 RBSDAT23.667 1.721 0.800 0.123 1 SCS3 –1.667 1.361 -0.460 0.308 a. Dependent Variable: IDBTE. Copyright © 2011 SciRes. JSSM  Principal Factors Affecting IDBT Evolution 450 Relationships between supply and demand of ac- counting thought (RBSDAT2). It is positively cor- related with IDBT evolution, because RBSDAT2 showed a progressive improvement steadily, and promoted IDBT evolution gradually for a long time: first, during the period of Double-entry Charac- terization of AP, RBSDAT2 promoted AP thought to present double-entry characteristic [3]. Secon- dly, during the period of Double-entry Characteri- zation of AG, RBSDAT2 promoted AG thought to present double-entry characteristic. Thirdly, du- ring the period of Loss and Net Income Accounts (LNIA) and Partial AE, RBSDAT2 encouraged the merchants to set up a new kind of accounts, loss and net income accounts (LNIA), and got Partial AE realized by getting all the accounts with goods (AG) balanced [4]. Fourthly, during the period of Capital Accounts (AC) and Complete AE, RBS- DAT2 encouraged the merchants to set up a new kind of accounts, capital accounts (AC), and got Complete AE realized by getting all the accounts balanced. Social conditions (SCS3). It should be positively correlated with IDBT evolution, because social con- ditions had showed some improvements, and pro- moted IDBT evolution: first, during the period of Double-entry Characterization of AP, the commer- cial revolution in the period of 12th - 13th century promoted AP thought to present double-entry cha- racteristic [6]. Secondly, during the period of Loss and Net Income Accounts (LNIA) and Partial AE, Genoese city administration organized a campaign of reforming accounting system by following banking practice [4]. But because the improve- ments for social conditions were not progressive along time axis, and social conditions even had no outstanding advance, especially in the important periods for IDBT evolution, such as the period of Capital Accounts (AC) and Complete AE, and the period of Relatively Ripe IDBT, so social condi- tions is negatively correlated with IDBT evolution without doubt. 5. Principal Factors’ Contribution and Sequence Here we use principal component analysis to find princi- pal factors’ contribution and order them in sequence by their contribution. According to Table 4, Kaiser-Meyer-Olkin Measure of Sampling Adequacy (KMO) is 0.5. Though according to the general rule it’s miserable for principal component analysis, we still decided to perform this analysis so as to know the principal factors’ contribution and their sequence. According to Table 5, the contribution of the first co- ent is 65.811%, the second 34.189%, and both of them can explain 100% of variance, which can easily be seen from “Screen plot” as follows: According to Figure 1, it is steep from Component 1 to Component 2. That’s to say, the contribution becomes smaller from Component 1 to Component 2. As there are fewer factors, we choose both of the components to re- flect and explain 100% of the variance. Before ordering principal factors by their contributions, we should analyze the selected two components above according to Component Matrix and Rotated Component Matrix. According to Table 6 and Table 7 , Component Matrix can reflect principal factors’ initial loadings, and Rotated Component Matrix can make us see the difference be- tween their loadings more easily and clearly. The first Table 4. KMO and Bartlett’s test. Kaiser-Meyer-Olkin Measure of Sampling Adequacy.0.500 Approx. Chi-Square0.369 df 1 Bartlett’s Test of Sphericity Sig. 0.544 Table 5. Total variance explained. Component 1 2 Total 1.316 0.684 % of Variance 65.811 34.189 Initial Eigenvalues Cumulative % 65.811 100.000 Total 1.316 0.684 % of Variance 65.811 34.189 Extraction Sums of Squared Loadings Cumulative % 65.811 100.000 Total 1.000 1.000 % of Variance 50.000 50.000 Rotation Sums of Squared Loadings Cumulative % 50.000 100.000 Figure 1. Scree Plot. Copyright © 2011 SciRes. JSSM  Principal Factors Affecting IDBT Evolution451 Table 6. Component matrix. Componenta,b 1 2 SCS3 0.811 –0.585 RBSDAT2 0.811 0.585 a. Extraction Method: Principal Component Analysis. b. 2 components ex- tracted. Table 7. Rotated component matrix. Componenta,b,c 1 2 SCS3 0.987 0.160 RBSDAT2 0.160 0.987 a. Extraction Method: Principal Component Analysis; b. Rotation Method: Varimax with Kaiser Normalization; c. Rotation converged in 3 iterations. component, i.e. social conditions can be named social co- mponent, and the second component, i.e. relationships be- tween supply and demand of accounting thought can be named supply-demand relationship. Seen from the analysis above, social component con- tributed 65.811%, supply-demand relationship compo- nent contributed 34.189%, and they both contributed 100% in total. We can also know that principal factors can be ordered by contribution as follows: social condi- tions (SCS3) and relationships between supply and de- mand of accounting thought (RBSDAT2). 6. Clusion and Related Advice By regression analysis, we have known that such two factors as relationships between supply and demand of accounting thought (RBSDAT2) and social conditions (SCS3) are principal factors influencing IDBT evolution. By component analysis, we have known that such two components as social component and supply-demand re- lationship component are principal components influenc- ing IDBT evolution, social component contributed 65.811%, and supply-demand relationship component contributed 34.189%. And we have also known that principal factors can be ordered by contribution as follows: social condi- tions (SCS3) and relationships between supply and de- mand of accounting thought (RBSDAT2). In one word, IDBT evolution has been affected mainly by relationships between supply and demand of account- ing thought (RBSDAT2) and social conditions (SCS3). And our related advice is as follows: governments should adopt appropriate policy, and help to build proper social conditions and strengthen the relationships between sup- ply and demand of accounting thought to promote the evolution of accounting thought. Especially as to social conditions, the evolution of Italian Double-entry Book- keeping Thought (IDBT) is mainly owing to external causes from the outside of Italy. Such causes as the Cru- sades and the hub position of Italy connecting Europe (including Italy) and the Oriental World played an im- portant role for the development of Italian Double-entry Bookkeeping Thought (IDBT). Once the outside motive disappeared, IDBT would lose the strong power of evolu- tion and slow down its pace. And it was just because of the arriving in India by winding through the Hope Corner in Africa in 1498, the discovery of America and the ac- complishment of the trip all around the world in 1522 that the center of world economy and trade gradually moved from the Mediterranean countries to the Atlantic countries, and Italy had to transmit the title of Center for Double-entry Bookkeeping Thought (DBT) to other coun- tries, and social conditions are negatively correlated with IDBT evolution without doubt. This is what we should pay more attention when we study the evolution of Ita- lian Double-entry Bookkeeping Thought (IDBT), and governments should place more emphases on building proper social conditions by encouraging internal powers from the inside of Italy. 7. Acknowledgements The authors acknowledge the financial support from the Support Program for Young and Cadre Teachers of Henan Province under Grant 200893 and the National Social Science Foundation of China under Grant 06FZS005. The authors also wish to acknowledge the helpful co- mments and suggestions from such professors as Dao- yang Guo (Middle-southern University of Finance and Economics), Jianjun Du (University of Houston), Lei Fu (Capital University of Economics and Business), Gian- franco Cavazzoni (University of Perugia) and other par- ticipants at the International Conference Jointly-Spon- sored by the Accounting Society of China & the Aca- demy of Accounting Historians of U.S.A. at Chengde, China, 2010. REFERENCES [1] C. Q. Liu, a, “A History of World Accounting Thought Development,” Henan People’s Press, Zhengzhou, 2006, pp. 183-204. [2] C. Q. Liu, b, “Development of Thought of Italian Dou- ble-Entry Bookkeeping,” Proceedings of Academic An- nual Conference of Chinese Accounting Society, Wuhan, July 2007. [3] R. Brown, “A History of Accounting and Accountants,” B. Franklin, New York, 1966. [4] E. Peragallo, “Origin and Evolution of Double Entry Bookkeeping, A Study of Italian Practice from the Four- teenth Century,” American Institute Publishing Company, New York, 1938. [5] F. C. Lane, “Andrea Barbarigo, Merchant of Venice, Copyright © 2011 SciRes. JSSM  Principal Factors Affecting IDBT Evolution Copyright © 2011 SciRes. JSSM 452 1418-1449,” Studies in Historical and Political Science, No. 1, 1944, pp. 153-181. [6] G. T. Mills, “Early Accounting in Northern Italy: The Role of Commercial Development and the Printing Press in the Expansion of Double-entry from Genoa, Florence and Venice,” The Accounting Historians Journal, No. 1, 1994, pp. 82-96. |