Journal of Service Science and Management, 2011, 4, 440-444 doi:10.4236/jssm.2011.44049 Published Online December 2011 (http://www.SciRP.org/journal/jssm) Copyright © 2011 SciRes. JSSM Dynamic Pricing of Perishable Products under Consumer Factor* Yanming Ge, Jianxin Zhang 1College of IT, Shanghai Ocean University, Shanghai, China. E-mail: {ymge, jxzhang}@shou.edu.cn Received September 5th, 2011; revised October 16th, 2011; accepted November 10th, 2011. ABSTRACT With effect of consumer factor considered, a model for dynamic pricing of perishable products is proposed. By this model, we obtained a property of the value function: marginal value is a decreasing function of the capacity and an increasing function of the consumer factor. Basing on this property, we proposed the following pricing strategy: ac- cording to the regions that the perishable products are sold, we adopt the appropriate consumer factor and then use the routine pricing strategy. This strategy not only maximizes the retailer’s revenue but also improves its service level. Lastly, a constructive example is discussed. Keywords: Revenue Management, Dynamic Pricing, Perishable Product, Bellman Equation 1. Introduction Since the adoption of reform and opening-up policy, China residents’ consumptive level has been dramatically increasing as a whole. In the meanwhile, owin g to the di- fference of history and culture, the consumptive level in different regions differs greatly. Furthermore, this trend is still upwards. Although some rules and regulations were drawn up by Chinese government in order to ex- pand domestic demand, the status quo is not changed but aggravated. Under these circumstances the retailers should take what kind of price strategies to maximize their own revenues and respond to the call of the government (in other word: improve the service level). I will discuss this problem in this paper. There are many perishable products in reality, such as: meats, drugs, fashionable dress. Usually, perishability is classified into two categories [1]: fixed lifetime and ran- dom lifetime. In this paper we will restrict attention only to the former category. The papers related to optimal pricing for perishable product are abundant. Gallego and van Ryzin [2] constru- cted a continuous-time, time-homogeneous stochastic mo- del to analyze some properties of optimal price, give an exact solution in the exp onential demand case, and prove the asymptotic optimality of the deterministic policy. Bitran and Mondschein [3] analyzed a discrete-time pri- cing model and tested in on apparel retail data. Zhao and Zheng [4] discussed the continuous-time model with a time-varying demand function and provided results on the monotonicity of optimal prices over time. Das Var- mand and Vettas [5] analyzed the problem of selling a finite supply over an infinite horizon with discounted revenues, where the discounting provides an incentive to sell items sooner rather than later. Feng and Gallego [6] discussed an interesting stochastic model of dynamic pricing where demand is Markovian and may depend on the current inventory level. Zhang and Cooper [7] model a pricing control problem. They acknowledge the com- plexity of the dynamic program, construct heuristics, and test performance using a numerical study. Dong et al. [8] examine both the initial inventory and subsequent dy- namic pricing decisions with a multinomial logit model of consumer choice. Their work focuses on horizontally differentiated products, uses numerical experiments to demonstrate the value of dynamic pricing, and illustrates the value of their approach in determining near-optimal initial inventories. The main method used in papers [2,6,7,9] is the dy- namic programming. There the terminal functions of op- timality equation are usually equal to zero despite how many produc ts are left if the salv ag e v alue is no t co nsid e- red. We will use the same method with different terminal *This paper is supported by program of Shanghai Ocean University (No B-8515-10-0001) and Public welfare industry special funds research rojects of The Ministry of Science and Technology of the P.R.C. (No. 200905014-06).  Dynamic Pricing of Perishable Products under Consumer Factor441 functions in this paper. In addition to obtaining the ma- ximum revenue, our aim is to control the service level, and it is directly reflected by the number of unsold prod- uct at terminal time. Therefore the terminal function de- fined in this paper adopts the following strategy: if the number of unsold product is more than a given number, some “penalty” will be implemented, and the poorer the region that the stores link is, the more “penalty” is im- plemented. The degree of “penalty” is negatively corre- lated to a parameter, called consumer factor, which is a function that positively correlated to the consumption levels of the regions. Using this terminal function, the optimality equation and some properties relating to re- gion factors are obtained: marginal value is a decreasing function of the capacity and an increasing function of the consumer factor. Basing on these properties, the strategy, which not only maximizes the retailer’s revenue but also improves its service level, is given. The remainder of the paper is organized as follows. In Section 2, we describe a dynamic pricing model. In Sec- tion 3, we investigate some properties of the expected value function. In Section 4, we present a numerical ex- periment to illustrate properties of the model. Conclud ing this study, we give our conclusions in Section 5. 2. Proposed Model 2.1. Preliminaries Consider a firm that sells (discrete) items of a kind of perishable product in Tperiods. Here we assume there is only one customer per period and the customer in periodt, where , has a willingness to pay ; that is, a random variable with distribution 1, 2,t ,T t v ,t tvPv v Therefore, if the firm offers a price in period , it will sell exactly one unit if (with probability p pt t v 1, tp). Letting ,1dtp ,Ftp denote the demand rate, we can define an inverse-de- mand functi o n 1 ,1 t ptdFdt and revenue-rate function is ,,rtd dptd. The inventory and demand in this case are both as- sumed to be discrete. On the other hand, let ,, td rtd d , and assume it is strictly decreasing in the demand . Equivalently, it is strictly increasing in the price . d p Letting denote the optimal expected revenue t Vn to go, if there is items of products unsold, and called value functio n . n Letting 1T Vn express the expected revenue at the end of selling season (terminal time), and called terminal function, which will be defined in the following subsec- tion. 2.2. Definition of Terminal Function In traditional revenue management, if salvage cost does not consider, the expected revenue at terminal time is defined as zero usually. It is rational because the selling is stop at terminal time. However, if the region that is poor, the consumption level is very low, some products are unsold. Neither sellers nor potential customers want to see this situation. Here we adopt a strategy to control the number of un- sold product, if it is more than a given number, some “penalty” will be implemented. Firstly, let a parameter for 01 corresponding to the region that the seller links, which is called consumer factor and posi- tively correlated to the consumption level of this region, such as: if the regions are Shanghai or Beijing, is 1, and is 0.3 if they are Xining or Guiyan (they are two cities in China). Secondly, we define a fun ction related to the consumer factor, if the ratio of unsold product is less than the region factor, the value of this function is zero, otherwise is decreasing to the number of unsold product. This is just the terminal function we want to define. For convenience, in this paper it is defined as hnAn M where is a positive constant and expresses the maximum integer number less than . Obviously, when 1 , the terminal function is zero, this is just the “tra- ditional” terminal function. 2.3. Optimality Equation In order to find the optimal policy, here we give out the optimality equation of this prob lem, that is the following Bellman Equation: 11 0 max , tt d Vnrtd dVnVn t (1) with boundary conditions 1T Vnhn and 00 t V for all , where t ttt Vn Vn 1Vn is the ex- pected marginal value of capacity. Under the monotonic assumption of , td * , necessary and sufficient condition for the optimal rate are d 1 ,t tdV n (2) Different values of reflect different regional con- dition and thus, lead to distinct control policies. There- fore, for clarity, the consumer factor parameter will ap- Copyright © 2011 SciRes. JSSM  Dynamic Pricing of Perishable Products under Consumer Factor 442 pear as a parameter in various notations. For example, , t Vn denotes the value function with the consumer factor equals to . 3. Properties of the Value Function From Section 2, we are aware that the differences of the value functio n, which represent the marginal revenues of remaining capacity, play a critical role in making optimal decisions. In this section, we explore the structural pro- perties of the value function in Theorem 1, and another property relating to consumer factor in Theorem 2. Theorem 1. ,1 , tt Vn Vn . Proof: The proof is by indu ction on . t First, when , from the definition of terminal function, we have 1tT ,1 ,1 11 11 0 tt Vn Vn MnnMn nMnM other n It is true obviously in this case. Assume it is true for period , and consider period . Let denote the optimal solutio n to Bellman equa- tion (1) for inventory level 1t ni t* i d . From Bellman equa- tion we have 11 ** 221 ** 111 ** 111 ** 001 ,2 ,1 ,2 ,1 ,, ,, ,, ,, tt tt t t t t Vn Vn Vn Vn rtdd Vn rtdd Vn rtdd Vn rtdd Vn 2 1 1 1 1 1 1 1 (3) From the optimality of , the following inequalities hold: * 1 d ** 111 ** 221 ,, ,, t t rtdd Vn rtdd Vn and ** 111 ** 001 ,, ,, t t rtdd Vn rtdd Vn Substituting into (3), rearranging and canceling terms yields * 21 1 * 01 1 ,2 ,1 1,2, ,1 , tt tt tt Vn Vn dV nV n dV nV n By induction 11 ,2 ,1 tt Vn Vn 0 11 ,1 , tt Vn Vn 0 And since values at most one, and . Therefore this conclusion is true. d* 2 1d0 * 00d This conclusion has intuitive implications for the op- timal price. Note that equation (2) and Assumption ( , td is strictly increasing in the price) together p imply that higher marginal values correspond to higher optimal prices. Hence the more capacity remaining at any given point in time, the lower the optimal price. Theorem 2. If 01 , then ,, tt VnVn Proof: The proof is by indu ction on . t First, when1tT , from the definition of terminal function, if 1MM , we have ,1 ,1 01 1 1 11 tt Vn Vn Mn M An MMnM AMnM MnMn M Therefore, it is true in this case. If 1MM , the conclusion can be proved similarly. Assume it is true for period and consider period . Let 1t t* i d denote the optimal solution to Bellman equa- tion (1) for inventory level and consumer factor is ni . From Bellman equation we have 11 ** 111 ** 001 ** 111 ** 001 ,1 ,1 ,1 ,1 ,, ,, ,, ,, tt tt t t t t Vn Vn Vn Vn rtdd Vn rtdd Vn rtddVn rtdd Vn 1 1 (4) From the optimality of * 1 d and * 0 d , the following inequalities hold: ** 111 ** 111 ,, ,, t t rtdd Vn rtdd Vn 1 1 and ** 001 ** 001 ,, ,, t t rtdd Vn rtdd Vn Substituting into (4), rearranging and canceling terms yields Copyright © 2011 SciRes. JSSM  Dynamic Pricing of Perishable Products under Consumer Factor443 Figure 1. The curves for expected marginal value relating to consumer factor . * 11 1 * 01 1 ,1 ,1 1,1, ,, tt tt tt Vn Vn dVnVn dV nV n 1 0 By induction, 11 ,1,1 0 tt Vn Vn and 11 ,, tt VnV n * and since d values at most one, and . Therefore, this conclusion is true. 1 10d * 00d This conclusion is just that we want to achieve. When the time and capacity is fixed, ,, tt Vn Vn means the lower the region’s consumption level is, the lower price are adopted. This not only reduces the num- ber of unsold products but also improves the service level. 4. Numerical Results We present a numerical experiment in this section to show how the proposed model works in the constructive example. The results enhance the readers to understand the theoretical conclusions from the practical applica- tions. In this example, Let , , 100M10000T ,1.1 dtp e , and 1 . Using the approximate numerical methods of the ordi- nary differential equations, we derive the following re- sults. Figure 1 draws curves for and 00.1, ,Vn 00.9,Vn of . From these curves, it’s clear that along with the increase of , the marginal value is decrease when ti- me and consumer factor are fixed, this is just the con- clusion of theorem 1. At the same time, we can observe that the curve of nn 00.9,Vn locates over the curve of 00.1,Vn, this is just the conclusion of Theorem 2. 5. Conclusions This paper presents a dynamic programming model for a kind of perishable product, in which the consumer factor is considered. This model retains the desirable property in the traditional dynamic pricing models which do not consider the consumer factors: the monotone property of the marginal values. Therefore, this model d oes not incur any additional difficulty for its implementation. Meanwhile, the influence of the consumer factor to the marginal values is corroborated strictly. This property guarantee that we can increase the service levels by con- trolling the consumer factor rationally. Nevertheless, there are rooms to continue work on this issue. The solution procedure is not at a high satisfaction level of efficiency, especially when the capacities of the product are large. Effective heuristics are desired in re- sponse to prompt on-line enquires and transactions . 6. Acknowledgements The authors thank anonymous referees and associate edi- tor for many constructive suggestion s that greatly impro- ved the manuscript. REFERENCES [1] S. Nahmias, “Perishable Inventory Theory: A Review,” Operations Research, Vol. 30, No. 4, 1980, pp. 680-708. doi:10.1287/opre.30.4.680 [2] G. Gallego and G. Van Ryzin, “Optimal Dynamic Pricing of Inventories with Stochastic Demand over Finite Hori- zons,” Management Science, Vol. 40, No. 8, 1994, pp. 999-1018. doi:10.1287/mnsc.40.8.999 [3] Britan and V. S. Mondschiin, “Periodic Pricing of Sea- sonal Products in Retailing,” Management Science, Vol. 43, No. 1, 1997, pp. 64-79. [4] W. Zhao and Y. S. Zheng, “Optimal Dynamic Pricing for Perishable Assets with Non-Homogeneous Demand,” Management Science, Vol. 46, No. 3, 2000, pp. 375-388. [5] G. Das Varma and N. Vettas, “Optimal Dynamic Pricing with Inventories,” Economics Letters, Vol. 72, 2001, pp. 335-340. doi:10.1016/S0165-1765(01)00439-6 [6] Y. Feng and G. Gallego, “Perishable Asset Revenue Man- agement with Markovian Time Dependent Demand In- tensities,” Management Science, Vol. 46, No. 7, 2000, pp. 941-956. doi:10.1287/mnsc.46.7.941.12035 [7] D. Zhang and W. L. Cooper, “Pricing Substitutable Flights in Airline Revenue Management,” European Journal of Operations Research, Vol. 197, No. 3, 2009, pp. 848-861. doi:10.1016/j.ejor.2006.10.067 [8] L. Dong, P. Kouvelis and Z. Tian, “Dynamic pricing and inventory control of substitute products”, Manufacturing Service Operations Management, Vol. 11, No. 2, 2009, Copyright © 2011 SciRes. JSSM  Dynamic Pricing of Perishable Products under Consumer Factor Copyright © 2011 SciRes. JSSM 444 pp. 317-339. doi:10.1287/msom.1080.0221 [9] Y. Akcay, H. P. Natarajan and S. H. Xu, “Joint Dynamic Pricing of Multiple Perishable Products Under Consumer Choice,” Management Science, Vol. 56, No. 8, 2010, pp. 1345-1361. doi:10.1287/mnsc.1100.1178

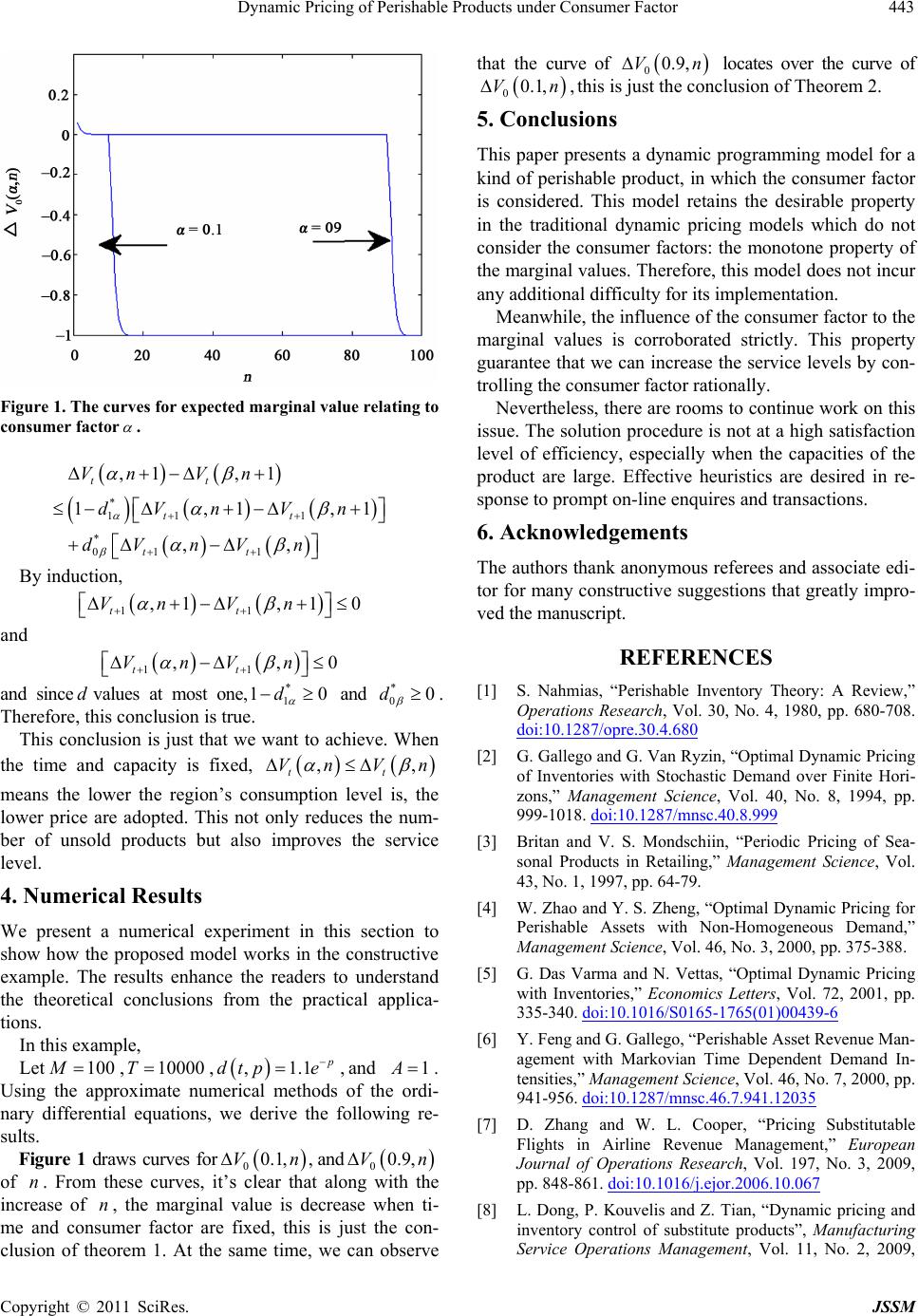

|