Modern Economy

Vol.07 No.03(2016), Article ID:64884,7 pages

10.4236/me.2016.73033

Linder Hypothesis and Trade of Quality Differentiated Good: A Case of Cosmetic Industry of China

Le Duc Niem

Department of Economics, Tay Nguyen University, Buon Ma Thuot City, Vietnam

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 22 February 2016; accepted 20 March 2016; published 23 March 2016

ABSTRACT

In this paper, we tested if country similarity positively affects the index of vertical intra-industry trade share (VIIT), given that the lower developed country is bigger in size. By using the trade data of the cosmetic industry in China, we found that VIIT was higher when China traded with a country similar in size or similar in level of economic development. This finding suggested that perhaps recent papers failed to derive any support for Linder Hypothesis because their model settings did not take the asymmetric impact of relative country size into account.

Keywords:

Linder Hypothesis, Country Similarity, and Intra-Industry Trade

1. Introduction

Intra-industry trade (IIT) was discovered in the beginning of the 1960’s but until Grubel and Lloyd’s work [1] , systematic investigation on this topic just began. Krugman [2] and Lancaster [3] are widely and typically known with seminal papers on IIT determinants. They promoted a theoretical framework associating intra-industry trade resulted from economies of scale in production and varieties of horizontally differentiated products. However, there are many arguments against this theory. Torstensson [4] provides evidence of Sweden’s specialization in quality connecting closely with countries that are at different levels of per capita income. Schott [5] finds that US imports exhibit a wide variance in unit values within product categories.

Linder [6] suggested a hypothesis that countries with similar demand structures would trade more with one another. The “so called” Linder Hypothesis has been the focus of many empirical researches for decades. However, few empirical studies provide consistent evidence supporting this hypothesis (Schott [5] , Hummels and Klenow [7] ). Hallak [8] showed that aggregation across sectors induced a systematic bias against finding support for this hypothesis, and argued that the Linder hypothesis should be formulated at the sector level, where inter-sectoral determinants of trade can be controlled for.

In this paper, the impact of country similarity on trade was tested with a control of relative country size as proposed by a theoretical model of Kim and Niem [9] . China was selected to ensure the relative country size in the econometric model (defined as the ratio of trading partner’s population to Chinese population) being less than 1. In addition, cosmetic industry was chosen, because cosmetic products are often highly quality-differen- tiated so as to suit the model of vertical intra-industry trade.

2. Theoretical Model

Kim and Niem [9] considered a 2 × 2 × 2 model: two countries, two firms, and two varieties of goods. One country is called Home, and the other is referred to as Foreign. Home is a low-income country, and Foreign is a high-income country. Each country is assumed to have only one firm. The level of technology measured by product quality produced in Home is lower compared with the one in Foreign. For these reasons, this model assumes trade between developing and developed countries. The game is over two stages. In the first stage, each firm chooses the quality level of their goods such that the foreign firm’s goods are higher in terms of quality compared with the Home firm’s goods. In the second stage, the firms compete simultaneously in price.

The findings of Kim and Niem [9] model are summarized in Figure 1 and Table 1.

In the above table, vertical intra-industry trade index is denoted IIT. The relative country size k is defined by the ratio of foreign population divided by Home’s while economic development similarity h is measured by Home income divided by Foreign’s. It is worth noting that if the country size of Home is bigger than Foreign’s, an increase in k carries the meaning that the two countries are similar in terms of population. Similarly, an increase in h means the two countries are similar in terms of economic development.

The above findings suggest that if Home is the bigger country, the Linder Hypothesis can be evidenced. For this reason, we selected China as a developing country while its trading partners serving as a developed one.

3. Econometric Model

3.1. Trade Measurements

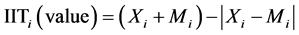

In this paper, the formula of Grubel-Lloyd index (GL-index) will be used to measure IIT. The total trade in an industry is called volume of trade or the sum of export value and import value (X + M). The total trade consists of two components: intra-industry trade (IIT) and inter-industry trade. Inter-industry trade is defined by the absolute difference between export value and import value and intra-industry trade is defined by the difference between total trade and inter-industry trade.

Thus,  where

where  and

and  are the export value and import value of industry i. The GL-index is defined as the share of IIT in the total trade in an industry and expressed as:

are the export value and import value of industry i. The GL-index is defined as the share of IIT in the total trade in an industry and expressed as:

(1)

(1)

Figure 1. Preference similarity, relative country size, and the IIT index.

Table 1. Effects of preference similarity and relative country size on the IIT index.

The export  and import

and import  are calculated at four digit level of the SITC classification by the summings-up of exports or imports of all good items within the industry.

are calculated at four digit level of the SITC classification by the summings-up of exports or imports of all good items within the industry.

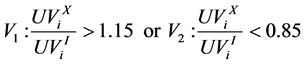

3.2. Vertical and Horizontal Intra-Industry Trade

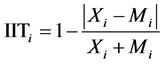

To decompose total IIT into vertical IIT (VIIT) and horizontal IIT (HIIT), unit value is popularly used as an indirect way to measure quality level of goods in most of empirical studies. Up to now, unit value seems to be the best means to evaluate good quality in trade data (Abd-El-Rahman [10] ; Greenaway, Hine and Milner [11] ).

In this paper, trade flows are classified as VIIT when the spread in the unit value of exports to the unit value of imports is less than 15% at the four-digit SITC (Standard Industrial Trade Classification) level. If relative unit values are outside this range, products are considered as vertically differentiated.

(2)

(2)

Following the above methodology, the unit value index (UV) is calculated for exports and imports of the cosmetic industry of China at the four-digit level of the SITC. Horizontal and vertical IIT are defined based on the ratio between unit value of exports  and the unit value of imports

and the unit value of imports . More specifically, horizontal IIT is calculated by following formula:

. More specifically, horizontal IIT is calculated by following formula:

(3)

(3)

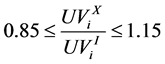

When the unit value index (UV) was outside the +/−15% range, vertical IIT is defined for this industry. The vertical IIT is further broken down into two dependent shares of V1 and V2 using the following condition:

(4)

(4)

Formula (4) implies that V1 is the exports and imports of goods such that the exported goods have higher quality compared with the imported goods. Similarly, V2 is trade flows of goods such that exported goods have lower quality than that of imported goods.

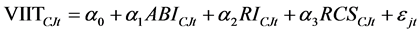

3.3. Econometric Models

(5)

(5)

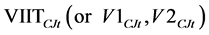

where:

: Vertical IIT between China and J country in year t;

: Vertical IIT between China and J country in year t;

Based on the findings derived from Kim and Niem [9] , we expect the signs of our regression coefficients as follows:

・

・

・

3.4. Data

Because China is a large country in terms of population, we consider China as the low-income country as in part II of this paper. The trading partners of China under consideration need to be high-income and relatively small in population. Based on the availability of trade data, we derived 14 representative countries (or autonomous zones) including Korea, Canada, Australia, France, England, Singapore, Italy, Spain, Netherlands, Hong Kong, Taiwan, Japan, USA, and Germany to be considered as trading partners of China.

The official trade statistics of OECD is the main source for trade data (from 1994 to 2004) to calculate trade indices. Other variables are obtained on internet at ERS (Economic Research Service1) for per-capita income by countries and IDB (International Data Base2).

4. Findings and Discussions

As showed in Figure 2, vertical IIT captures the main share of total IIT in the cosmetic industry of China but it tends to decrease from 1994 to 2004. An interesting fact is that the share of low-quality export is increasing while that of high-quality export tends to decrease over time. This phenomenon can be explained by the export-oriented strategy of China that stimulates firms to produce cheap goods for exportation.

Actually, we do not have a complete theoretical model for all determinants of intra-industry trade. In addition, the countries under consideration are selected based on the availability of trade data. To cope with this fact, we split our study into two parts. The former involves tests of IIT determinants with roughly calculated data and the later regards “fixed effect model” with transformed data.

4.1. Regression with OLS

In this section, we assume that cross-sectional heterogeneity is not high and that the econometric model presented in this paper well includes all relevant independent variables of VIIT. This assumption is relatively strong and we will relax it later in the next analysis.

In order to investigate relationships between trade dependent and explanatory variables, we refer to the regression analysis 1. In this setting, vertical IIT, V1, and V2 are, one by one, put in the regression model as explained variable. The explanatory variables include average per-capita income used as a proxy for level of development of China and its trading partner (ABI), relative per-capita income as a proxy for economic development similarity (RI), and relative population as relative country size (RCS).

As in Table 2, the sign of RCS coefficients derived from the regressions with VIIT and V2 as a dependent variable are both positive as we predicted. In other words, it is significant that VIIT is higher when China trades with a similar-sized country. However, we cannot find any strong relationship between relative country sizes (RCS), average income (ABI), or relative income (RI) and V1. Thus, V1 is not significantly explained by those independent variables in our model3. This implies that the intra-industry trade with export of high quality goods may behave differently from those of low quality goods. This gives an implication for future empirical studies

Figure 2. Intra-industry trade in cosmetic industry of China.

Table 2. OLS regression.

Note: “*” significant at the 0.1 level; “**” significant at the 0.05 level and “***” significant at the 0.01 level.

that trade data should be decomposed into V1 and V2 as they may have different natures. The regression outcomes also show that the level of regional development (represented by ABI) has positive impact on VIIT and V2. Both of these findings support Linder Hypothesis. Finally, we do not have enough confidence to conclude that relative income (RI) does not significantly determine VIIT and V2. This relationship would be clearer when we use a fixed effect model.

4.2. Fixed Effect Model

Now we consider a case when cross-sectional heterogeneity is significant and the econometric model may not include relevant variables. Because our model has such a large number of countries, the use of dummy variables will consume a lot of degree of freedom. Thus, it is better if we cope with this problem by transforming our data.

The transformation is as follows:

Table 3. Fixed effect model.

“*” significant at the 0.1 level; “**” significant at the 0.05 level and “***” significant at the 0.01 level.

・ Calculate means of all variables;

・ Calculate the deviation from the means.

We carried out the second regression analysis with the below econometric model. It is noteworthy that intercept constant is restrained to zero.

It is worth noting that Δ is simply the mathematic operator.

Based on Table 3, some findings are derived as follows: First, the signs of independent variables (when regressions do not have a multi-collinearity problem and when determinants are significantly tested) are the same as theoretical predictions. Particularly, the main regression with VIIT as a dependent variable shows that ABI, RI, and RCS significantly increase VIIT. This finding strongly supports Linder Hypothesis. Second, the findings in the regression 1 are reconfirmed with higher level of confidence when the fixed effect model is used. Third, we find that the relative economic development (RI) is strongly determining V1 while it is weakly explaining V2. This implies that the trade with exports of high quality goods is positive to the development similarity between trading countries. However, we do not have enough confidence to make the same conclusion for the trade with exports of low quality goods.

5. Conclusion

The main goal of this paper is to provide an initial check of Linder Hypothesis with a control of relative country size as proposed by Kim and Niem [9] . Generally, the empirical tests support the hypothesis. First, the signs of determinants are corresponding with the theoretical prediction. In details, relative country size, relative income and average income are asserted to have a positive impact on VIIT. Recall that an increase in the relative country size carries the meaning that trading countries are more similar in size and an increase relative income means trading countries are more similar in level of development, thus VIIT is higher when we trade with a country of a similar size or a similar level of development. Furthermore, the finding confirms that VIIT increases as development levels of both countries are higher. These findings suggested that some previous papers failed to derive any support for Linder Hypothesis because their model settings did not take the asymmetric impact of relative country size into consideration. Second, the behaviors of V1 and V2 are somehow different. This phenomenon shows that a decomposition of VIIT into V1 and V2 is needed for empirical studies because the determinants of V1 may differ from those of V2. It also implies a certain determinant may have opposite impact on V1 compared with that on V2.

Acknowledgements

The author would like to thank the Vietnam National Foundation for Science and Technology Development (NAFOSTED) for supporting this research under grant number II1.1-2012.17.

Cite this paper

LeDuc Niem, (2016) Linder Hypothesis and Trade of Quality Differentiated Good: A Case of Cosmetic Industry of China. Modern Economy,07,307-313. doi: 10.4236/me.2016.73033

References

- 1. Grubel, H.G. and Lloyd, D.J. (1975) Intra-Industry Trade, the Theory and Measurement of International Trade in Differentiated Products. Macmillan, London.

- 2. Krugman, P. (1979) Increasing Returns, Monopolistic Competition, and International Trade. Journal of International Economics, 9, 469-479.

http://dx.doi.org/10.1016/0022-1996(79)90017-5 - 3. Lancaster, K. (1980) Intra-Industry Trade under Perfect Mono-Polistic Competition. Journal of International Economics, 10, 151-175.

http://dx.doi.org/10.1016/0022-1996(80)90052-5 - 4. Torstensson, J. (1991) Quality Differences and Factor Proportions in International Trade: An Empirical Test of the Swedish Case. Weltwirtschaftliches Archiv, 127, 183-194.

http://dx.doi.org/10.1007/bf02707318 - 5. Schott, P.K. (2004) Across-Product versus Within-Product Specialization in International Trade. Quarterly Journal of Economics, 119, 647-678.

http://dx.doi.org/10.1162/0033553041382201U - 6. Linder, S. (1961) An Essay on Trade and Transformation. Wiley, New York.

- 7. Hummels, D. and Klenow, P.J. (2005) The Variety and Quality of a Nation’s Exports. The American Economic Review, 95, 704-724.

http://dx.doi.org/10.1257/0002828054201396 - 8. Hallak, J.C. (2010) A Product-Quality View of the Linder Hypothesis. The Review of Economics and Statistics, 92, 238-265.

http://dx.doi.org/10.1162/REST_a_00001 - 9. Kim, T.G. and Niem, L.D. (2011) Product Quality, Preference Diversity and Intra-Industry Trade. The Manchester School, 79, 1126-1138.

http://dx.doi.org/10.1111/j.1467-9957.2010.02210.x - 10. Abd-El-Rahman, K. (1991) Firms’ Competitive and National Comparative Advantages as Joint Determinants of Trade Composition. Weltwirtschaftliches Archiv, 127, 83-97.

http://dx.doi.org/10.1007/bf02707312 - 11. Greenaway, D., Hine, R.C. and Milner, C.R. (1994) Country-Specific Factors and the Pattern of Horizontal and Vertical Intra-Industry Trade in the UK. Review of World Economics, 130, 77-100.

http://dx.doi.org/10.1007/bf02706010

NOTES

2http://www.census.gov/ipc/www/idb/country.php

3Please note that regression 2.1 has a serious problem of multi-collinearity thus results in 2.2 and 2.3 are considered.