Modern Economy

Vol. 4 No. 5 (2013) , Article ID: 32392 , 8 pages DOI:10.4236/me.2013.45044

Capacity Choice in a Price-Setting Mixed Duopoly with Network Effects*

College of Economics, Nihon University, Tokyo, Japan

Email: yasuhiko.r.nakamura@gmail.com

Copyright © 2013 Yasuhiko Nakamura. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received March 10, 2013; revised April 10, 2013; accepted May 10, 2013

Keywords: Mixed Duopoly; Price Competition; Network Effects; Capacity Choice

ABSTRACT

This paper explores the capacity choice for a public firm that is a welfare-maximizer and for a private firm that is a pure-profit-maximizer in the context of a price-setting mixed duopoly with a simple mechanism of network effects where the surplus that a firm’s client gets increases with the number of other clients of that firm. In this paper, we show that the public firm chooses over-capacity irrespective of the strength of network effects and the demand parameter, and that the difference between the output level and capacity level of the private firm strictly depends on the values of both the strength of network effects and the demand parameter. More precisely, the private firm chooses over-capacity when the strength of network effects is high relative to the demand parameter, while it chooses under-capacity otherwise.

1. Introduction

This paper investigates the capacity choice issue for a public firm that is a welfare-maximizer and for a private firm which is a pure-profit-maximizer in the context of a price-setting mixed duopoly with network effects where the surplus that a firm’s client gets increases along with the number of other clients of that firm1. The purpose of this paper is particularly to show that the difference between the output level and the capacity level of the private firm strictly depends on both the strength of network effects and the demand parameter2.

Nishimori and Ogawa [19] is a seminal paper that considered the capacity choice problems in the context of a mixed duopolistic market using the approach à la Horiba and Tsutsui [20], and they showed that in a quantitysetting game with homogeneous goods, the public firm chooses under-capacity while the private firm chooses over-capacity, which is different from the result found in the existing literature on private oligopolistic markets3. Ogawa [21] and Barcena-Ruiz and Garzon [22] extended the model introduced in Nishimori and Ogawa [19] to quantity-setting and price-setting mixed markets with differentiated goods, respectively, and found that the difference between the output and capacity levels of the public firm and that of the private firm strictly depend on the relation between the goods produced by them, that is, whether the goods are substitutable or complimentary4. Subsequently, from the viewpoints of both a quantitysetting and a price-setting mixed duopoly with differentiated goods, Tomaru et al. [23] analyzed the influence of the separation between ownership and management in the fashion ofFershtman and Judd [24], Sklivas [25], and Vickers [26] on the difference between the output levels and capacity levels of both the public firm and the private firm and the changes therein before and after the privatization of the public firm5. Most recently, Nakamura and Saito [28] and Nakamura and Saito [29] investigated the capacity choice of a public firm that is a welfaremaximizer and a private firm that is a relative-profitmaximizer in the context of quantity-setting and pricesetting mixed duopolies, respectively; their most important contribution in these two papers is to show that even though the relation between the goods produced by the two firms is restricted to being substitutable, the difference between the output level and capacity level of the private firm can change in accordance with the degree of importance of its relative performance6.

In the context of a price-setting mixed duopoly, this paper checks the robustness of the result on the differences between the output and capacity levels of both the public firm and the private firm against introducing the strength of the network effects such that the necessity to build market share is stronger. For tractability, we concentrate on the simple mechanism of network effects as studied in Katz and Shapiro [35] and applied in Hoernig [36]. In this paper, we show that under the assumption wherein there exist network effects, a public firm chooses over-capacity irrespective of both the strength of network effects and the demand parameter, whereas a private firm chooses over-capacity when the strength of network effects is high relative to the demand parameter and it chooses under-capacity otherwise. The intuition behind the former result on the difference between the output level and the capacity level of the public firm is almost the same as that presented in Bárcena-Ruiz and Garzón [22]7. The public firm has a strong incentive to increase mixed duopolistic market competition to increase of consumer surplus since its objective function is social welfare. Then, in the model of this paper, by taking into consideration the fact that the price level of the private firm is negatively associated with the capacity level of the public firm for any strength of network effects and demand parameter, the public firm makes the private firm behave aggressively in the market by increasing its capacity level. As a consequence, the public firm chooses overcapacity for arbitrary values of both the strength of network effects and the demand parameter.

In contrast, in this paper, we show that the difference between the output level and capacity level of the private firm strictly depends on both the strength of network effects and the demand parameter. In particular when the strength of network effects is high relative to the demand parameter, we obtain the result that the private firm chooses over-capacity, which is strikingly different from the result obtained in Bárcena-Ruiz and Garzón [22] without network effects. This result is explained by means of the following two effects induced by such network effects. First, as the strength of network effects increases, the private firm has less incentive to strategically set a lower level of its capacity in order to reduce market competition by raising the price level of the public firm. Second, as the strength of network effects increases, the strategic substitutability between the capacity levels of both the public firm and the private firm becomes weaker, and thus in the case wherein the strength of network effects is sufficiently high, the private firm tends to not decrease its capacity level. Consequently, when the strength of network effects is high relative to the demand parameter, the difference between the output level and capacity level of the private firm is negative. Therefore, in the context of a price-setting mixed duopoly, in addition to the relation between the goods produced by both firms and the degree of importance of the private firm’s relative performance, the strength of network effects also plays an important role as a determinant of the difference between the output level and capacity level of the private firm.

The remainder of this paper is organized as follows. In Section 2, we formulate a price-setting mixed duopolistic model with capacity choice of both the public firm and the private firm and with network effects. In Section 3, we consider the difference between the output and capacity levels of both firms. Section 4 concludes with several remarks. Each firm’s equilibrium price level is relegated to the Appendix8.

2. Model

We formulate a price-setting competition model in a mixed duopoly with the capacity choice of both the public firm and the private firm and with an additional term that reflects network effects in the fashion of Katz and Shapiro [35] and Hoernig [36]9.

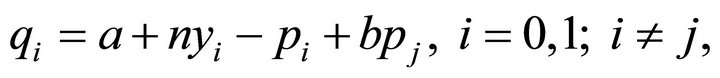

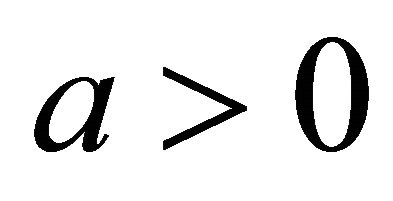

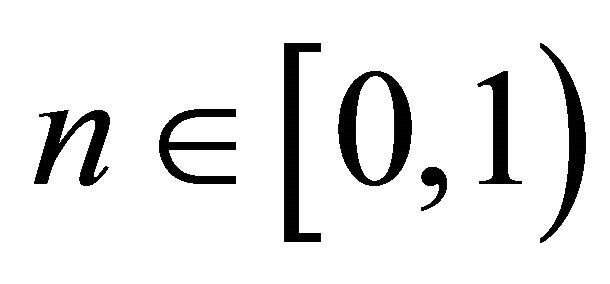

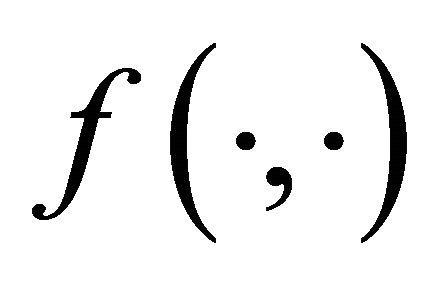

We assume that firm 0 is a public firm that is a welfare-maximizer whereas firm 1 is a private firm that is a pure-profit-maximizer. Similar to Hoernig [36], firm i faces a linear demand of the following form:

where  and

and  are demand parameters.

are demand parameters.  indicates the strength of network effects, and

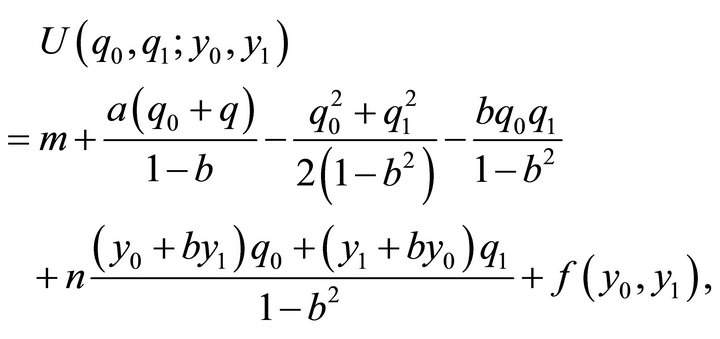

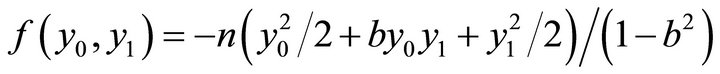

indicates the strength of network effects, and  is consumers’ expectation on firm i’s equilibrium market share. As explained in Hoernig [36], the above demand system can be derived from the following quasilinear concave utility function of a representative consumer:

is consumers’ expectation on firm i’s equilibrium market share. As explained in Hoernig [36], the above demand system can be derived from the following quasilinear concave utility function of a representative consumer:

where m denotes the income of the representative consumer and  represents some symmetric function of expectations. In this paper, as in Hoernig [36], we suppose that

represents some symmetric function of expectations. In this paper, as in Hoernig [36], we suppose that

10.

10.

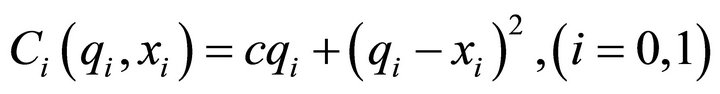

We suppose that both firms adopt identical technologies represented by cost function , where

, where  is the capacity level of firm

is the capacity level of firm . Following Vives [37], Ogawa [21], Bárcena-Ruiz and Garzón [22], Tomaru et al. [23], Nakamura and Saito [28], and Nakamura and Saito [29], we assume that the cost function is given by

. Following Vives [37], Ogawa [21], Bárcena-Ruiz and Garzón [22], Tomaru et al. [23], Nakamura and Saito [28], and Nakamura and Saito [29], we assume that the cost function is given by  11. This cost function implies that if each firm’s output level equals its capacity level,

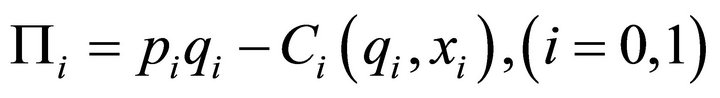

11. This cost function implies that if each firm’s output level equals its capacity level,  , then the long-run average cost is minimized. The profit of firm i is given by

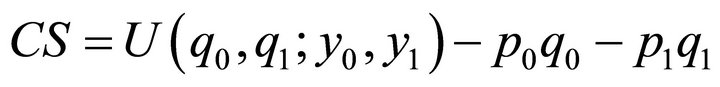

, then the long-run average cost is minimized. The profit of firm i is given by . Consumer surplus as the representative consumer utility is represented as follows:

. Consumer surplus as the representative consumer utility is represented as follows: , whereas producer surplus is given by the sum of the profits of both firms 0 and 1,

, whereas producer surplus is given by the sum of the profits of both firms 0 and 1, . Finally, we suppose that social welfare in this paper is equal to the sum of consumer surplus and producer surplus.

. Finally, we suppose that social welfare in this paper is equal to the sum of consumer surplus and producer surplus.

We investigate the game with the following two stages: In the first stage, firms 0 and 1 simultaneously set their capacity levels. In the second stage, after both the firms observe each other’s capacity level, they engage in a price-setting competition. In the fashion of Hoernig [36], we consider the subgame perfect Nash equilibrium presented in Katz and Shapiro [35] as our equilibrium concept. Thus, in the equilibrium, we derive the subgame perfect Nash equilibrium under the additional “rational expectations” assumption:  and

and .

.

3. Equilibrium Analysis

We solve the game by backward induction from the second stage to obtain the “rational expectations” subgame perfect Nash equilibrium. In the second stage, firm 0 maximizes social welfare W with respect to , whereas firm 1 maximizes its pure profit

, whereas firm 1 maximizes its pure profit  with respect to

with respect to . The best-response functions of both the firms in the second stage are given as follows:

. The best-response functions of both the firms in the second stage are given as follows:

(1)

(2)

(2)

From Equations (1) and (2), we find that for any strength of network effects,  is increasing in

is increasing in , and thus the price levels of both firms 0 and 1 are strategic complements

, and thus the price levels of both firms 0 and 1 are strategic complements .

.

Furthermore, we obtain the rational expectations Nash equilibrium of the price-setting stage by substituting the two conditions  and

and  into the best-response functions of both firms 0 and 1. Then, we obtain

into the best-response functions of both firms 0 and 1. Then, we obtain

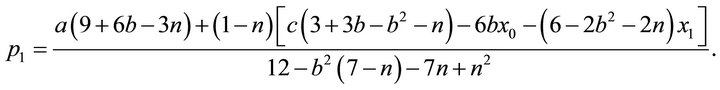

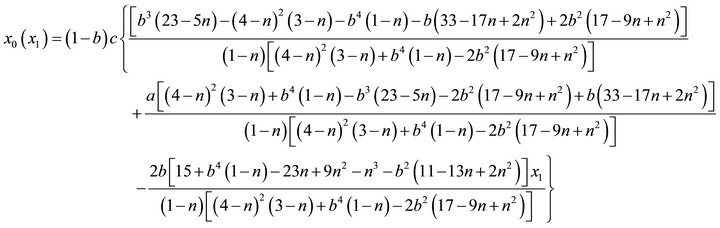

(3)

(3)

(4)

(4)

In the first stage, both firms 0 and 1 know that their capacity choices affect their price levels in the second stage. Given Equations (3) and (4), firms 0 and 1 simultaneously and independently set their capacity levels with respect to social welfare and own relative profit, respectively. Thus, by solving the first-order conditions of firms 0 and 1 in the first stage, we have

(5)

(5)

(6)

(6)

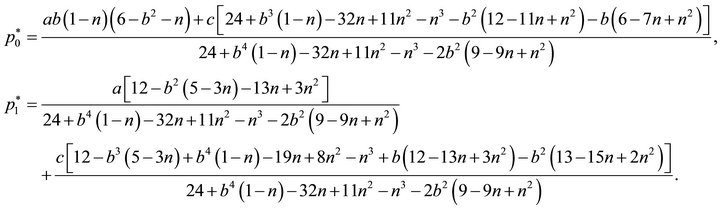

yielding

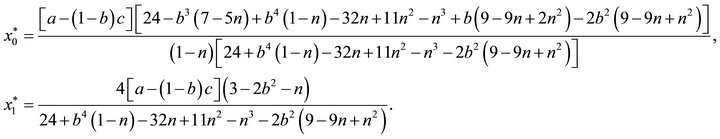

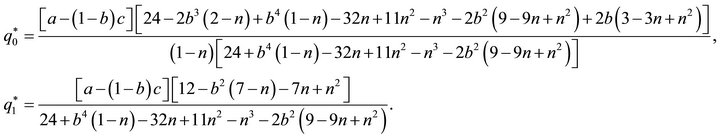

Note that superscript * is used to represent the subgame perfect equilibrium market outcomes with consumers’ rational expectations. Thus, the output levels of both the firms in the equilibrium are given as follows12:

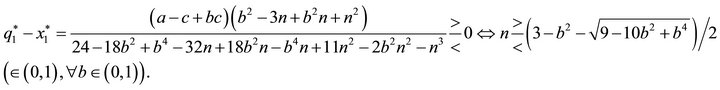

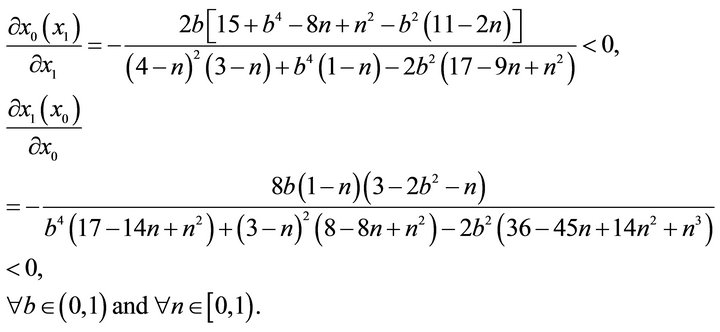

Hence, from easy calculations, we obtain the following results on the difference between the output and capacity levels of both firms 0 and 1:

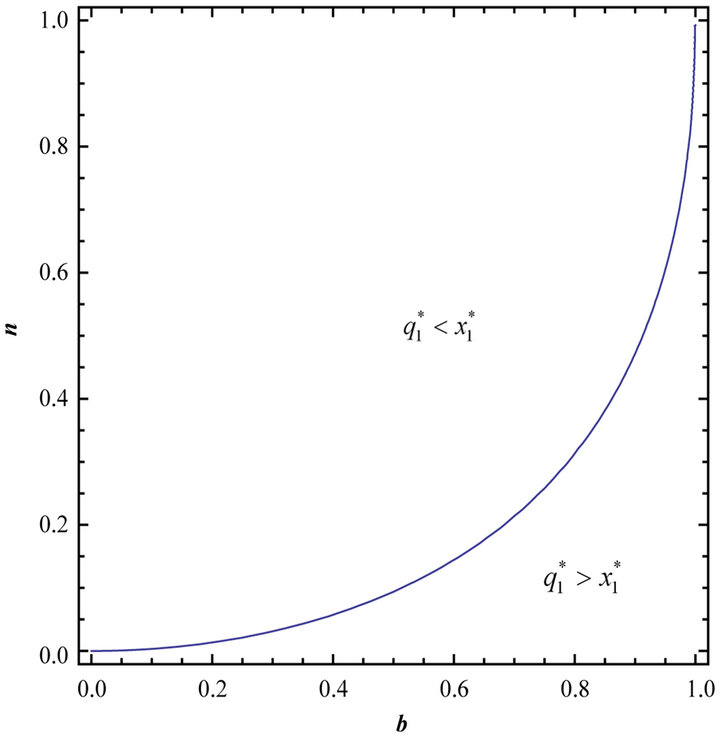

Thus, we recognize that the public firm chooses overcapacity irrespective of the strength of network effects, n, and the demand parameter, b. In contrast, we find that the difference between the private firm’s output level and capacity level strictly depends on both n and b. By summing the above two facts, we obtain the next proposition on the differences between the output levels and capacity levels of both firms 0 and 1.

Proposition 1. Public firm 0 chooses over-capacity,  , for any value of the demand parameter

, for any value of the demand parameter  and any strength of network effects

and any strength of network effects . In contrast, the difference between private firm 1’s output and capacity levels strictly depends on both n and b. More precisely, firm 1 chooses over-capacity

. In contrast, the difference between private firm 1’s output and capacity levels strictly depends on both n and b. More precisely, firm 1 chooses over-capacity  if n is high relative to b, whereas it selects under-capacity,

if n is high relative to b, whereas it selects under-capacity,  , otherwise. Moreover, the area in the

, otherwise. Moreover, the area in the  -plane where in firm 1 selects under-capacity becomes wider as b increases.

-plane where in firm 1 selects under-capacity becomes wider as b increases.

Proposition 1 gives the result that irrespective of both n and b, public firm 0 chooses over-capacity, which corresponds to the case of substitutable goods presented in Bárcena-Ruiz and Garzón [22] wherein n = 0 was investigated. Thus, the intuition behind this result is the same as that given in Bárcena-Ruiz and Garzón [22]. For arbitrary values of both the strength of network effects n and the demand parameter b, from Equaiton (4), we find that the capacity level of firm 0,  , is negatively associated with the price level of firm 1,

, is negatively associated with the price level of firm 1, . Since firm 0 takes consumer surplus into account, it has a strong incentive to make private firm 1 behave aggressively in the mixed duopolistic market. Thus, firm 0 sets a relatively high capacity level in order to decrease the price level of firm 1, and consequently firm 0 chooses over-capacity for any values of

. Since firm 0 takes consumer surplus into account, it has a strong incentive to make private firm 1 behave aggressively in the mixed duopolistic market. Thus, firm 0 sets a relatively high capacity level in order to decrease the price level of firm 1, and consequently firm 0 chooses over-capacity for any values of  and

and .

.

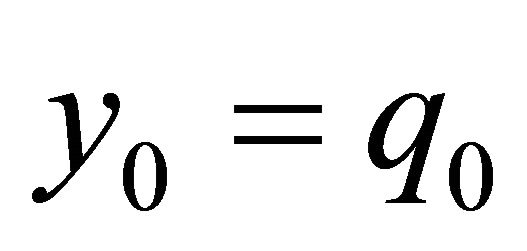

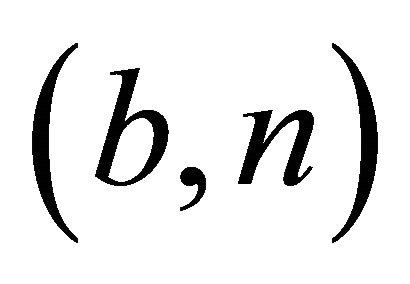

In contrast, in Proposition 1, it is stated that the difference between the output level and capacity level of firm 1 strictly depends on both the strength of network effects n and the demand parameter b. In Figure 1, the difference between the output level and capacity level of private firm 1 is described when the values of the demand parameter b and the strength of network effects n change. In particular, we obtain the surprising result that if n is high relative to b, private firm 1 chooses overcapacity, which is strikingly different from that in Bárcena-Ruiz and Garzón [22], whereas firm 1 chooses undercapacity, otherwise. The intuition behind the latter result is the same as that presented in Bárcena-Ruiz and Garzón [22]. Firm 1 has an incentive to reduce the market competition, and thus, an incentive to raise the price level of the opponent firm. From Equaiton (3), the capacity level of firm 1 is negatively associated with the price level of firm 0, and this negative relation is sufficiently strong when b is high relative to n. Thus, firm 1 sets a relatively low capacity level to raise the price level of firm 1 if b is high comparative to n. As a consequence, private firm 1 chooses under-capacity when the demand parameter b is high relative to the strength of network effects n. The intuition behind the former result that private firm 1 chooses over-capacity if the strength of network effects n is high relative to the demand parameter b is given as follows. When n is high relative to b, from Equation (3), we recognize that firm 1 is less likely to have an incentive to strategically set a lower capacity level in order to raise the price level of firm 0. In addition, although we find that from Equations (5) and (6), the capacity levels of both firms 0 and 1 are strategic substitutes in the first stage, this strategic substitutability is weak if the strength of network effects n is high relative to the demand parameter b.13 Thus, when the strength of network effects n is low relative to the demand parameter b, the capacity level of private firm 1 becomes comparatively low owing to a downward spiral induced by the relatively strong strategic substitutability between them, implying the result that firm 1 chooses under-capacity. In reverse, when the strength of network effects n is high relative to the demand parameter b, firm 1 is less likely to set a lower capacity level compared to the case wherein n is low relative to b. Consequently, we obtain the surprising result that private firm 1 can choose over-capacity when the strength of network effects n is high relative to the demand parameter b.

Finally, Proposition 1 provides that given the strength of network effects n, as the demand parameter b increases, firm 1 strategically tends to choose under-capacity. The intuition behind this result is given as follows. In general, firm 1 attempts to raise the price level of firm 1 by setting a relatively low capacity level, since it has a strong incentive to decrease the market competition. From Equation (3), on the basis of this incentive of firm 1, it chooses a lower capacity level when b is sufficiently high. Therefore, as b increases, it is likely that the area in the  -plane wherein the difference between firm 1’s output and capacity levels is positive, becomes wider.

-plane wherein the difference between firm 1’s output and capacity levels is positive, becomes wider.

4. Conclusions

This paper explored capacity choice for a public firm that is a welfare-maximizer and a private firm that is a pureprofit-maximizer in the context of a price-setting mixed duopoly with network effects. With regard to network effects, we consider the situation wherein consumers’ expectation on each firm’s equilibrium market share is directly reflected in the demand for its product. More precisely, in the model of this paper, the degree of consumers' expectation on each firm’s equilibrium market share that is reflected in the demand for its product implies the strength of network effects. Then, we derived the subgame perfect Nash equilibrium with consumers’ rational expectations such that each firm’s output level is equal to its capacity level, which was introduced in Katz and Shapiro [35] and applied in Hoernig [36].

Figure 1. Difference between firm 1’s output and capacity levels in the equilibrium.

Although Barcena-Ruiz and Garzon [22] investigated capacity choice for a public firm and a private firm in the context of a price-setting mixed duopoly without network effects, the public firm chooses over-capacity whereas the private firm chooses under-capacity, if the relation between the goods produced by them is restricted to be substitutable, in this paper, we specifically obtained a strikingly different result on the difference between the private firms’s output level and capacity level from that in Bárcena-Ruiz and Garzón [22]. In particular, we found that the private firm chooses over-capacity when the strength of network effects is high relative to the demand parameter. This result never occurs without such network effects. The intuition behind this result is given by the following two phenomena related to the strength of network effects. First, as the strength of network effects increases, compared to in the case wherein such network effects are not considered, the private firm has less incentive to set a lower capacity level in order to reduce the market competition by increasing the price level of the public firm. Second, in the stage wherein the capacity levels of both the public firm and the private firm are set, that is, in the first stage of the model in this paper, as the strength of network effects increases, the strategic substitutability between them becomes weaker relative to the case wherein the network effects are not taken into account. The above two facts yield the comparatively high capacity level of the private firm, implying that it chooses over-capacity when the strength of network effects is high relative to the demand parameter.

Finally, similar to Nakamura and Saito [28] and Nakamura and Saito [29], we found that even though the area of the demand parameter corresponds to the case wherein the relation between the products by both the public firm and the private firm is substitutable, the difference between the output level and capacity level of the private firm changes in accordance with the exogenous variables in the model. Therefore, similar to Nakamura and Saito [28] and Nakamura and Saito [29], this paper discloses that the simple dichotomy between price and quantity as each firm’s strategic variable and that between substitutable goods and complementary goods are not enough to explain the difference between the output level and capacity level of the private firm.

REFERENCES

- W. Merrill and N. Schneider, “Government Firms in Oligopoly Industries: A Short-Run Analysis,” Quarterly Journal of Economics, Vol. 80, No. 3, 1989, pp. 400-412. doi:10.2307/1880727

- G. DeFraja and F. Delbono, “Alternative Strategies of a Public Enterprise in Oligopoly,” Oxford Economic Papers, Vol. 41, No. 2, 1989, pp. 302-311.

- I. Ishibashi and T. Matsumura, “R&D Competition between Public and Private Sectors,” European Economic Review, Vol. 50, No. 6, 2006, pp. 1347-1366. doi:10.1016/j.euroecorev.2005.04.002

- A. Nishimori and H. Ogawa, “Public Monopoly, Mixed Oligo Poly and Productive Efficiency,” Australian Economic Papers, Vol. 41, No. 2, 2002, pp. 185-190. doi:10.1111/1467-8454.00158

- J. Poyago-Theotoky, “R&D Competition in a Mixed Duopoly under Uncertainty and Easy Imitation,” Journal of Comparative Economics, Vol. 26, No. 3, 1998, pp. 415- 428. doi:10.1006/jcec.1998.1541

- S. Mujumdar and D. Pal, “Effects of Indirect Taxation in a Mixed Oligopoly,” Economics Letters, Vol. 58, No. 2, 1998, pp. 199-204. doi:10.1016/S0165-1765(97)00264-4

- J. C. Bárcena-Ruiz and M. B. Garzón, “Economic Integration and Privatization under Diseconomies of Scale,” European Journal of Political Economy, Vol. 21, No. 1, 2005, pp. 247-267. doi:10.1016/j.ejpoleco.2004.02.008

- J. C. Bárcena-Ruiz and M. B. Garzón, “International Trade and Strategic Privatization,” Review of Development Economics, Vol. 9, No. 4, 2005, pp. 502-513. doi:10.1111/j.1467-9361.2005.00290.x

- G. Corneo and O. Jeanne, “Oligopole Mixte Dans un Marché Commun,” Annales d’Economie et de Statistique, No. 33, 1994, pp. 73-90.

- K. Fjell and D. Pal, “A Mixed Oligopoly in the Presence of Foreign Private Firms,” Canadian Journal of Economics, Vol. 29, No. 3, 1996, pp. 737-743. doi:10.2307/136260

- D. Pal and M. D. White, “Mixed Oligopoly, Privatization, and Strategic Trade Policy,” Southern Economic Journal, Vol. 65, No. 2, 1998, pp. 264-281. doi:10.2307/1060667

- N. Matsushima and T. Matsumura, “Mixed Oligopoly, Foreign Firms, and Location Choice,” Regional Science and Urban Economics, Vol. 36, No. 6, 2006, pp. 753-772. doi:10.1016/j.regsciurbeco.2006.03.005

- J. C. Bárcena-Ruiz and M. B. Garzón, “Mixed Duopoly, Merger and Multiproduct Firms,” Journal of Economics, Vol. 80, No. 1, 2003, pp. 27-42. doi:10.1007/s00712-002-0605-2

- J. Méndez-Naya, “Merger Profitability in Mixed Oligopoly,” Journal of Economics, Vol. 94, No. 2, 2008, pp. 167-176. doi:10.1007/s00712-008-0001-7

- S. Ohori, “Optimal Environmental Tax and Level of Privatization in an International Duopoly,” Journal of Regulatory Economics, Vol. 29, No. 2, 2006, pp. 225-233. doi:10.1007/s11149-006-6037-0

- J. C. Bárcena-Ruiz and M. B. Garzón, “Mixed Oligopoly and Environmental Policy,” Spanish Economic Review, Vol. 8, No. 2, 2006, pp. 139-160. doi:10.1007/s10108-006-9006-y

- L. F. S. Wang, Y.-C. Wang and T.-L. Chen, “Trade Liberalization and Environmental Tax in Differentiated Oligopoly with Consumption Externalities,” Economics Bulletin, Vol. 17, No. 9, 2007, pp. 1-9.

- T.-L. Chen and L. F. S. Wang, “Trade Liberalization and Transboundary Pollution in an International Mixed Duopoly,” Environmental Economics and Policy Studies, Vol. 12, No. 4, 2010, pp. 187-200. doi:10.1007/s10018-010-0170-9

- A. Nishimori and H. Ogawa, “Do Firms Always Choose Excess Capacity?” Economics Bulletin, Vol. 12, No. 2, 2004, pp. 1-7.

- Y. Horiba and S. Tsutsui, “International Duopoly, Tariff Policies and the Case of Free Trade,” Japanese Economic Review, Vol. 51, No. 2, 2000, pp. 207-220. doi:10.1111/1468-5876.00147

- H. Ogawa, “Capacity Choice in the Mixed Duopoly with Product Differentiation,” Economics Bulletin, Vol. 12, No. 8, 2006, pp. 1-6.

- J. C. Bárcena-Ruiz and M. B. Garzón, “Capacity Choice in a Mixed Duopoly under Price Competition,” Economics Bulletin, Vol. 12, No. 26, 2007, pp. 1-7.

- Y. Tomaru, Y. Nakamura and M. Saito, “Capacity Choice in a Mixed Duopoly with Managerial Delegation,” Economics Bulletin, Vol. 29, No. 3, 2009, pp. 1904-1924.

- C. Fershtman and K. Judd, “Equilibrium Incentives in Oligopoly,” American Economic Review, Vol. 77, No. 5, 1987, pp. 927-940.

- S. D. Sklivas, “The Strategic Choice of Management Incentives,” RAND Journal of Economics, Vol. 18, No. 3, 1987, pp. 452-458. doi:10.2307/2555609

- J. Vickers, “Delegation and the Theory of the Firm,” Economic Journal, Vol. 95, 1985, pp. 138-147. doi:10.2307/2232877

- Y. Tomaru, Y. Nakamura and M. Saito, “Strategic Managerial Delegation in a Mixed Duopoly with Capacity Choice: Partial Delegation or Full Delegation,” Manchester School, Vol. 79, No. 4, 2011, pp. 811-838. doi:10.1111/j.1467-9957.2010.02179.x

- Y. Nakamura and M. Saito, “Capacity Choice in a Mixed Duopoly: The Relative Performance Approach,” Theoretical Economics Letters, Vol. 3, No. 2, 2013, pp. pp. 124-133.

- Y. Nakamura and M. Saito, “Capacity Choice in a Price- Setting Mixed Duopoly: The Relative Performance Approach,” Modern Economy, Vol. 4, No. 4, 2013, pp. pp. 273-280.

- Y. Lu and S. Poddar, “Mixed Oligopoly and the Choice of Capacity,” Research in Economics, Vol. 59, No. 4, 2005, pp. 365-374. doi:10.1016/j.rie.2005.09.004

- Y. Lu and S. Poddar, “The Choice of Capacity in Mixed Duopoly under Demand Uncertainty,” Manchester School, Vol. 74, No. 3, 2006, pp. 266-272. doi:10.1111/j.1467-9957.2006.00492.x

- Y. Lu and S. Poddar, “Endogenous Timing in a Mixed Duopoly and Private Duopoly—‘Capacity-then-Quantity’ Game,” Australian Economic Papers, Vol. 48, No. 2, 2009, pp. 138-150. doi:10.1111/j.1467-8454.2009.00369.x

- J. C. Bárcena-Ruiz and M. B. Garzón, “Endogenous Timing in a Mixed Duopoly with Capacity Choice,” Manchester School, Vol. 78, No. 2, 2010, pp. 93-109. doi:10.1111/j.1467-9957.2009.02137.x

- J. H. Hamilton and S. M. Slutsky, “Endogenous Timing in Duopoly Games: Stackelberg or Cournot Equilibria,” Games and Economic Behavior, Vol. 2, No. 1, 1990, pp. 29-46. doi:10.1016/0899-8256(90)90012-J

- M. Katz and C. Shapiro, “Network Externalities, Competition, and Compatibility,” American Economic Review, Vol. 75, No. 3, 1985, pp. 424-440.

- S. Hoernig, “Strategic Delegation under Price Competition and Network Effects,” Economics Letters, Vol. 117, No. 2, 2012, pp. 487-489. doi:10.1016/j.econlet.2012.06.045

- X. Vives, “Commitment, Flexibility, and Market Outcomes,” International Journal of Industrial Organization, Vol. 4, No. 2, 1986, pp. 217-229. doi:10.1016/0167-7187(86)90032-9

Appendix

Each Firm’s Equilibrium Price level

NOTES

*We thank the financial support by KAKENHI (23730226). All remaining errors are our own.

1The literature on mixed oligopoly can be traced back to the paper of Merrill and Schneider [1] and DeFraja and Delbono [2]. Since Merrill and Schneider [1] and DeFraja and Delbono [2], many researchers have been tackling several topics in the context of mixed oligopoly, focusing on the privatization of the public firm and the optimal policy of the government from a viewpoint of social welfare, and recently, the literature on mixed oligopoly has become richer and more diverse. For example, Ishibashi and Matsumura [3], Nishimori and Ogawa [4], and Poyago-Theotoky [5] investigated the R&D competition between the public and private firms. Mujumdar and Pal [6] considered the tax effects on the market outcomes in a mixed oligopolistic market. Bárcena-Ruiz and Garzón [7] and Bárcena-Ruiz and Garzón [8] explored the policy interaction between the market integration and the privatization policy. Corneo and Jeanne [9], Fjell and Pal [10], Pal and White [11], and Matsushima and Matsumura [12] investigated the international mixed oligopolistic competition. Bárcena-Ruiz and Garzón [13] and Méndez-Naya [14] discussed a merger problem between the public firm and the private firm. Ohori [15], Bárcena-Ruiz and Garzón [16], Wang et al. [17], and Chen and Wang [18] analyzed the environmental policies in the mixed oligopoly.

2The area of the demand parameter considered in this paper corresponds to that wherein the goods produced by both the public firm and the private firm are substitutable.

3As the examples of the capacity choices for the public firms, recently, the local public firms are likely to set their optimal capacity levels through their aggressive construction investments in the mixed oligopolistic markets including the industries of water-supply, sewerage, and hospitals in Japan. Moreover, although there exists the M&A of SEAT, a Spanish publicly-owned automobile enterprise, with Volkswagen in 1986 as one of the most famous examples of the mergers between the public firm and the private firm, then, Volkswagen faced some sort of optimal capacity choice problem since it decided to conduct the managements of both the brands after such a merger.

4More concretely, in a quantity-setting mixed duopoly, Ogawa [21] showed that a private firm chooses over-capacity irrespective of the relation between the products, whereas a public firm chooses undercapacity if the products are substitutes and under-capacity if they are complements. In a price-setting mixed duopoly, Bárcena-Ruiz and Garzón [22] found that the private firm chooses under-capacity irrespective of the relation between the products, whereas the public firm chooses over-capacity when the products are substitutes and undercapacity when they are complements.

5Furthermore, in the context of a quantity-setting mixed duopoly, by introducing the following two alternatives as each firm’s delegation type to its manager: 1) partial delegation-delegating only the quantity setting; and 2) full delegation-delegating the determination of both the output level and the capacity level, Tomaru et al. [27] investigated the difference between each firm’s output level and capacity level, given its delegation type. They derived the equilibrium delegation type of each firm under the endogenous decision by its owner.

6Note that Nakamura and Saito [28] which considered the quantitysetting mixed duopoly with the degree of importance of the private firm’s relative performance showed that the difference between the output and capacity levels of the public firm also changes in accordance with the degree of importance of the private firm’s relative performance, even though the area of the demand parameter corresponds to the case wherein the relation between the products by both the public firm and the private firm is substitutable. In addition, another strand of the capacity choice problems in a mixed oligopoly, comprising Lu and Poddar [30], Lu and Poddar [31], Lu and Poddar [32], and Bárcena-Ruiz and Garzón [33], too focused on several kinds of economic factors. Lu and Poddar [30] and Lu and Poddar [31] explored the effects of a change in competition style to sequential-move competition and of the introduction of demand uncertainty, respectively, on the capacity choice of both the public firm and the private firm. Furthermore, Lu and Poddar [32] and Bárcena-Ruiz and Garzón [33] investigated a game with endogenous timing of the sequential choice of the capacity levels and output levels of both the public firm and the private firm on the basis of an observable delay game presented in Hamilton and Slutsky [34].

7In addition, in the economic environment wherein the private firm maximizes its relative profit in a price-setting mixed duopoly, Nakamura and Saito [29] also gave the intuition similar to that presented here against the result that the public firm always chooses over-capacity.

8The equilibrium market outcomes including each firm’s profit, consumer surplus, and social welfare are available upon request.

9In the model which is employed in this paper, the parameters are a, b, c, and n. The economic meanings of such parameters are given in the following body of this paper.

10This assumption on the form of  implies that the representative consumer's utility is the highest with respect to the consumption vector of the goods produced by both the public firm and the private firm,

implies that the representative consumer's utility is the highest with respect to the consumption vector of the goods produced by both the public firm and the private firm,  , when expectations are correct.

, when expectations are correct.

11We assume that  in order to ensure the nonnegativity of all equilibrium outcomes.

in order to ensure the nonnegativity of all equilibrium outcomes.

12The equilibrium price levels of both firms 0 and 1 are given in the Appendix.

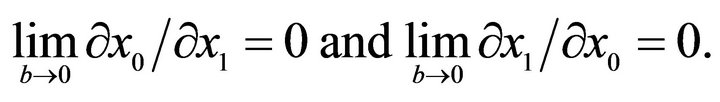

13From easy calculations, by differentiating Equations (5) and (6) with respect to  and

and![]() , respectively, we get

, respectively, we get

Thus, we find that the capacity levels of both firms 0 and 1 are strategic substitutes in the first stage. Furthermore, we obtain the following result:

Consequently, although in the first stage, the capacity levels of both firms 0 and 1 are strategic substitutes, we find that this strategic substitutability is sufficiently weak, in particular when the strength of network effects n is high relative to the demand parameter b, since the capacity levels of both firms are set to become more independent and irrelevant with respect to each other as b decreases, given n.