Modern Economy

Vol.3 No.7(2012), Article ID:25098,7 pages DOI:10.4236/me.2012.37111

Research on China’s Regional Differences of Crowding-In or Crowding-Out Effect of FDI on Domestic Investment

Economic & Finance School, Xi’an Jiaotong University, Xi’an, China

Email: jamesxuy0528@gmail.com

Received October 4, 2012; revised November 9, 2012; accepted November 18, 2012

Keywords: Foreign Investment; Domestic Investment; Crowding-In and Crowding-Out; Regional Differences

ABSTRACT

Since the reform and opening up, FDI has made a significant contribution to China’s economic development; however, the crowding-out phenomenon appears inevitably in some districts and industries where FDI enters intensively. Confronted with the new environment of foreign capital use after the international financial crisis, our country has begun to adjust investment attraction work from the policy level and needs to specify the work the next step according to every region’s situation. Based on this background, this paper examined how foreign investment impact domestic investment over the 30 years, especially contrasted regional differences of crowding-in or crowding-out effect of FDI on domestic investment in eastern, central and western China, then made further analysis of the causes, in order to supply the policy makers and investors with effective references.

1. Introduction

Since the implementation of opening up policy, China, with integration to the world economy, has been seeing a rapid economic development. And the contribution by FDI can not be ignored. By the end of 2011, China’s total actual use of foreign investment amounted to 135.583 billion US dollars. A big concern is that such huge foreign capital will affect the use of domestic funds, thereby affecting the competitiveness of domestic enterprises. Some people hold that the imbalance of FDI between different regions of China has a great impact on the economic development of the regions, and also resulted in the different situations of domestic capital in different regions. The role played by FDI is expected to be an experienced horse which knows the way, absolutely not a buffalo which robs feed or space in capital markets.

Currently, the stage of economic development and the development environment faced by China has already changed. “Enterprise Income Tax Law of the People’s Republic of China” implemented since January 1st, 2008 sets the income tax rate of domestic and foreign enterprises at 25%, which marked that the “super national treatment” enjoyed by foreign investment will be gradually disappearing and the foreign investment policy adjustment is on the right track. This adjustment, however, is bound to affect the further foreign investment attraction, especially with the shadow of global financial crisis still over our head; therefore, the effective use of foreign capital still has a long way to go. Under the situation of imbalanced economic development and foreign capital utilization between regions, this paper studies how FDI affects domestic investment. On the one hand, it can make recommendations to the host country’s policy adjustment; on the other hand, it can be reference to investment decisions of multinational corporations.

2. Literature Review

As to the crowding-in and crowding-out effect of FDI, three main conclusions which are proposed in “World Investment Report 1999” on United Nations Conference on Trade and Development are as follows. Firstly, the funding sources of multinational companies matter a lot. If funds are raised outside the host country, the total amount of investment will be increased; if the funds are raised in the host country, the interest rate will be increased with the increased demand of capital in capital market of host country. The financing costs’ rise will result in the crowding out of domestic investment. Secondly, too large scale of foreign investment will cause the rise of exchange rate to some extent, which is not conducive to the host country’s trade exports, thus crowds out the domestic enterprises’ investment on export products. Thirdly, if multinational companies bring newborn products or services, the local industry can be stimulated by the forward and backward linkages, and the domestic investment can be increased, otherwise, domestic investment will be crowded out [1]. These conclusions are authoritative and can provide references for other studies.

Many scholars made analysis of the crowding-in and crowding-out effect of foreign investment on domestic investment of host countries, however, the researches based on developing countries are less well established. One typical study is from Agosin and Machado (2005). They made an empirical analysis of 12 countries’ panel data from 1971 to 2000. Conclusions are arrived at as follows. FDI has crowding-in effect in Asian and African countries and has crowding-out effect in Latin American countries [2]. The studies abroad of FDI’s effect on China are mostly from Chinese scholars. Tang Sumei (2005) collected quarterly data from 1988 to 2003, and made empirical analysis of China’s FDI, GDP and domestic investment with Error Correction Model (ECM). The results showed that there is no evidence to support that FDI has crowding-out effect on domestic investment in China [3].

Studies by local scholars in China are closer to the actual situation. Zhang Qianxiao (2004) expanded the neoclassical model, made an empirical analysis of FDI’s effect on China’s domestic investment based on the data from 1979 to 2001. Studies suggest that there is some substitution effect of FDI on China’s domestic investment instead of simply driving effect, which should be recognized by the government when attracting the foreign investment [4]. With empirical test of China’s provincial panel data, Luo Changyuan found that FDI exerts mainly crowding-in effect on China’s domestic investment, which may be related to the way and industry that FDI enters China. FDI usually enters China by setting up local plants and subsidiaries, and mostly invests in manufacturing industry; moreover, due to the government’s policy bias, FDI plays a greater part in the crowding-in effect on state-owned and collective capital than on private capital [5]. The researches mentioned above described how FDI affected China’s domestic investment from different timing and angles. Du Jiang, etc. made analysis of provincial panel data from 1991 to 2006 and found that taking China as a whole, FDI exerts crowding-out effect on China’s domestic capital [6].

Wang Zhipeng and Li Zinai (2004) established absolute crowding-in and crowding-out model and made empirical test with panel data of provinces in eastern, central and western China from 1987 to 2001. Analysis showed that overall speaking, FDI has no significant crowding-in or crowding-out effect on China’s domestic investment; however, in some provinces in central China, FDI has significant crowding-in effect on domestic investment; in eastern provinces, FDI has significant crowding-out effect on China’s domestic investment; in western provinces, there’s some insignificant crowdingout effect [7]. Bo Wenguang (2006) extended the Agosin model and made empirical test with panel data of China’s 29 provinces from 1985 to 2003. The results showed that before 1992, FDI has crowding-in effect on China’s domestic investment while after 1992 the effect turns to crowding-out effect. From the view of the whole country, FDI exerts mainly crowding-in effect on China’s domestic investment; however, in the Pearl River Delta, FDI characterized by labor intensive and export oriented industry has significant crowding-out effect; in the Yangtze River Delta, FDI characterized by capital deepening and import substitution has no significant crowding-out effect [8]. Chen Jiatao’s conclusions (2009) from empirical tests from 1982 to 2007 are as follows. In the long term, FDI’s crowding-in effect on China’s domestic investment exists, but not significantly; in the short term, the increase of FDI significantly promoted the increase of domestic investment. However, regional differences exist. In central and eastern China, FDI’s increase promoted the domestic investment’s increase, while in western China, FDI has crowding-out effect [9].

The scholars above have recognized that foreign investment should be rationally used within a certain range, and also put forward to make suitable policies to introduce foreign investment in different regions; however, it is still controversial about the crowding-in and crowding-out effect, especial how FDI affects China’s domestic investment in different regions. The conclusion drawn from different timing and methods are quite different and further investigation and analysis are needed. Based on this, this paper tries to investigate the causes of the different effects and make recommendations for further adjustment of China’s foreign capital policy.

3. Regional Differences of FDI’s Effect on Domestic Investment in Eastern, Central and Western China1

3.1. FDI’s Current Situation in Eastern, Central and Western China

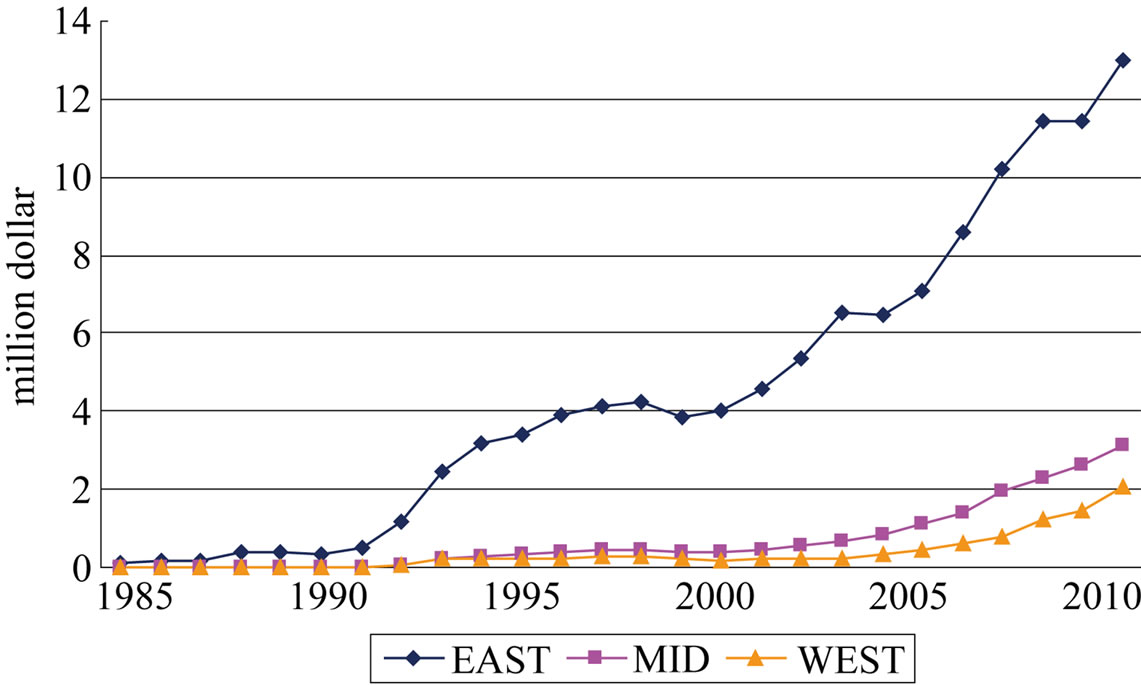

As we can see from Figure 1, since 1990, the gap of utilization of FDI between eastern regions and central and western regions has gradually become wider. During the following 20 years, the actual use of FDI in China is extremely uneven, presenting a stepped distribution

Figure 1. FDI’s current situation in eastern, central and western China.

situation which is “high in the east while low in the west”. At the same time, the flow of FDI shows a strong centralized tendency, mainly concentrated in the Pearl River delta, the Yangtze River delta and Bohai Bay district. In recent years, the introduction of FDI of five provinces and cities which are Guangdong, Jiangsu, Shanghai, Shandong and Fujian, accounted for more than 60% of the national total. Since 2001, with China’s accession to WTO and the implementation of Western Development policy, the utilization of FDI in central and western regions has begun to increase; however, there is still a long way to go. From the view of long-term development, with the central and western provinces undertaking the industrial transfer from the eastern provinces, FDI will gradually advance to the west; however, this propulsion to west can only be gradual instead of great-leap-forward. In the long term, FDI plays an important role in the economic development of eastern regions, and its influence is marching toward the central and west regions. The degree of FDI’s effect on the domestic investment is what to research as follows.

3.2. Stationarity of Data

In order to evaluate FDI’s impact on China’s domestic investment, based on the 27 years’ data from 1985 to 2011, this paper selected three variables: Foreign Direct Investment (FDI), China’s gross domestic product (GDP) and Domestic total social Investment in fixed assets (DI).

To avoid the influence of price, this paper deflated GDP with price deflator; each year’s FDI was converted into RMB according to the exchange rate that year, and then deflated. Total investment in fixed assets subtracted the amount of FDI in it, after adjustment of GDP deflator, equaled DI.

In order to avoid spurious regression, we must make sure that all variables were in the stationary time series and the linear combinations of variables were stationary. Therefore, unit root test and Johanson co integration test were applied to the growth rate of GDP, FDI and DI of eastern, central and western China. The results showed that the growth rate of GDP, FDI and DI are integrated of order one; Trace test and maximum eigenvalve test showed that three co integration equation existed at the significant level of 5%, i.e. long-term co integration existed between the growth rate of DI, FDI and GDP of eastern, central and western China.

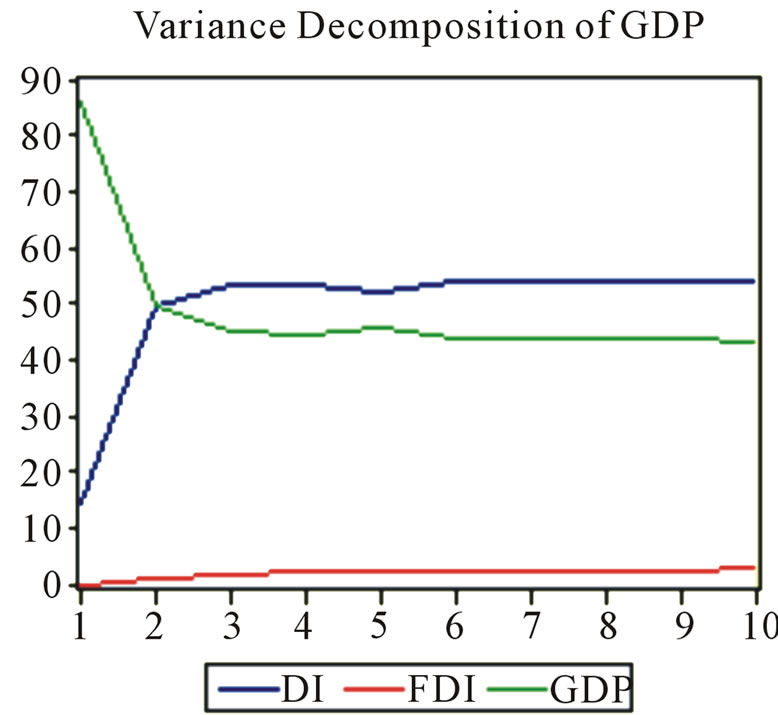

3.3. Variance Decomposition Analysis

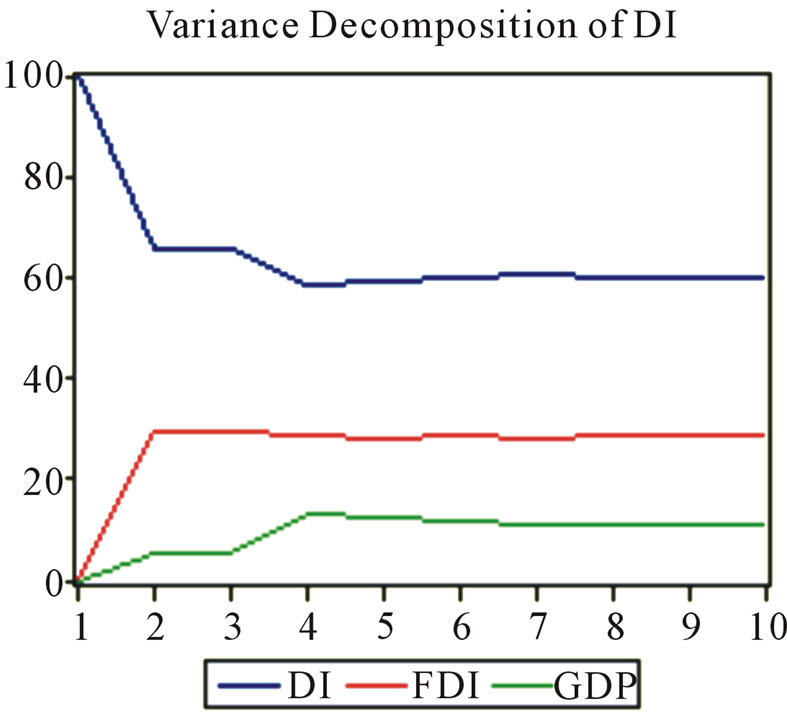

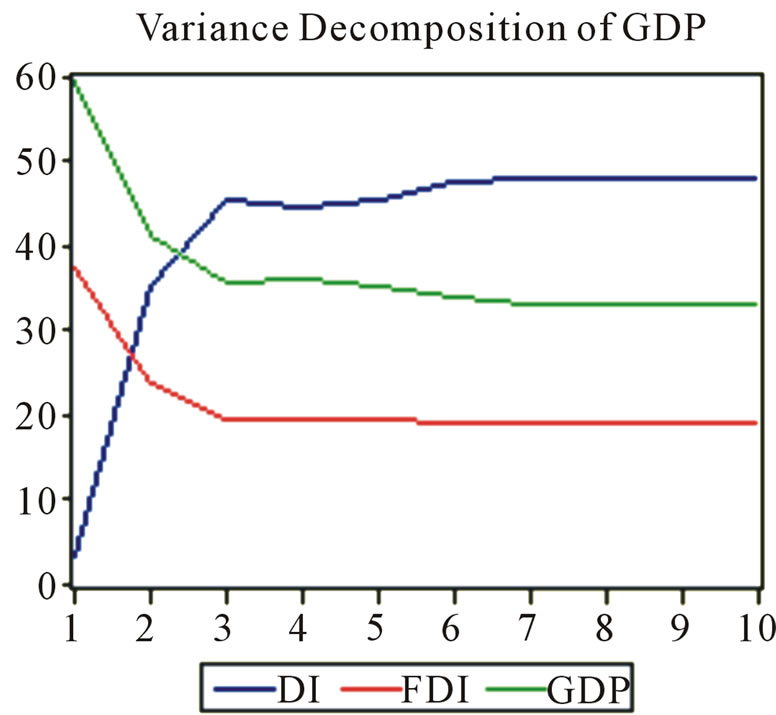

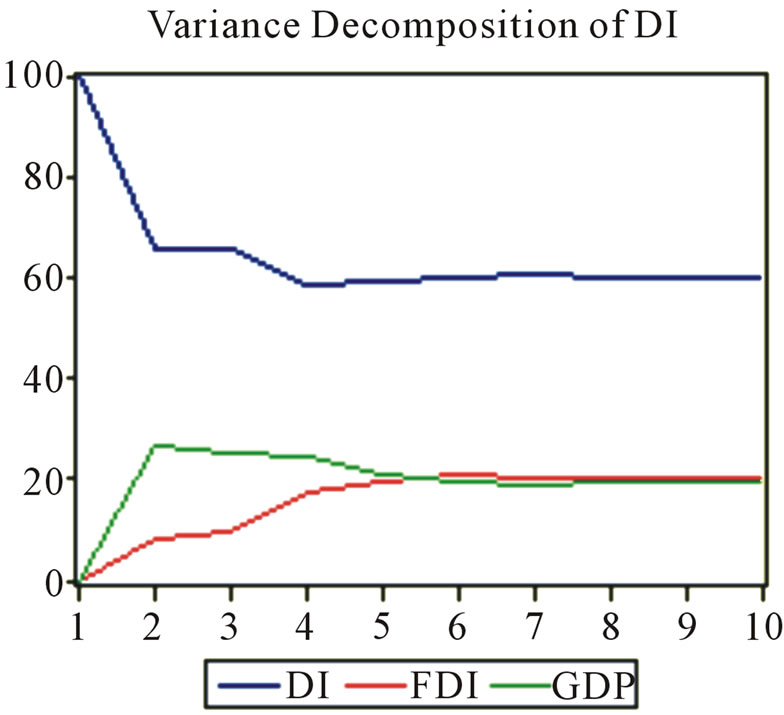

Contribution to the variance was used to analyze every structure variable’s impact on endogenous variable GDP.

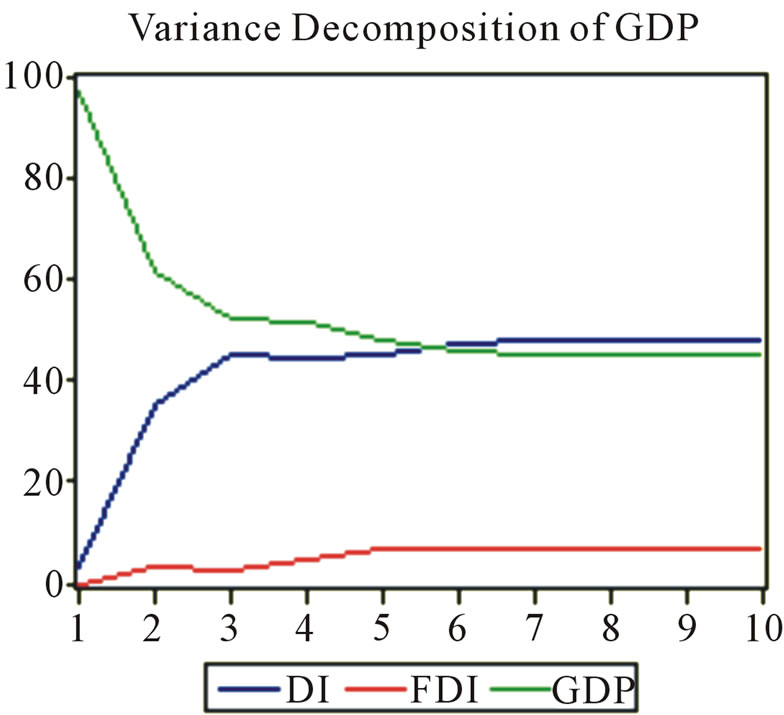

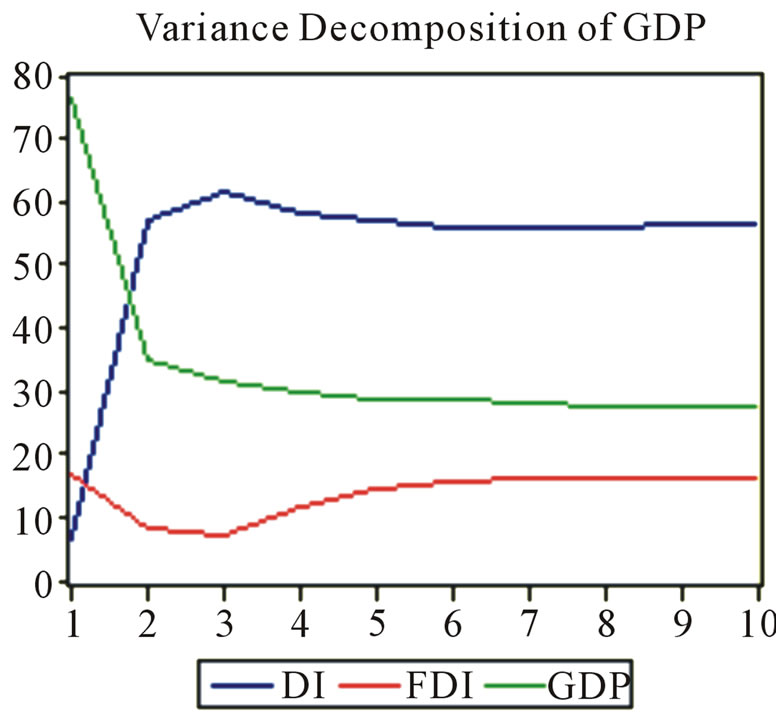

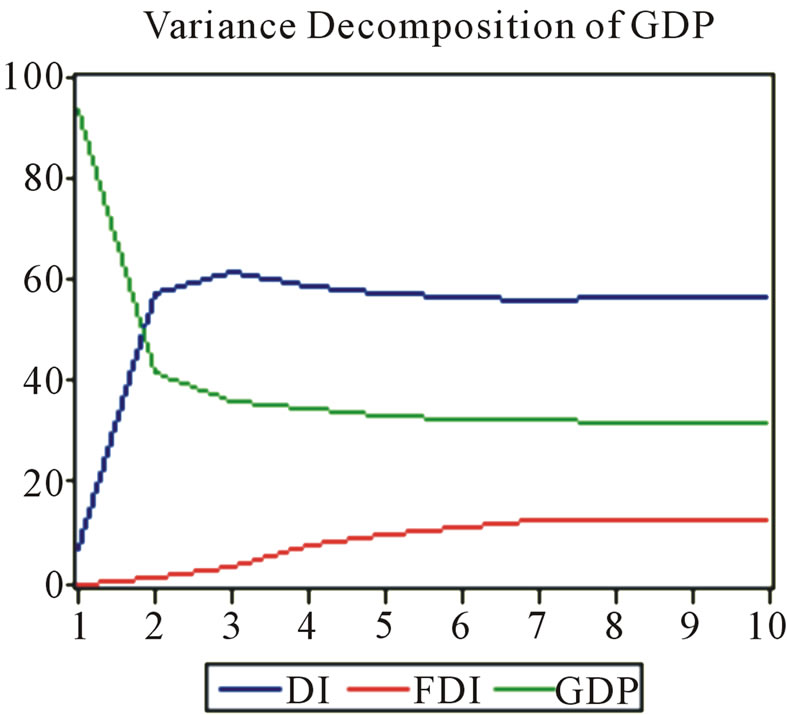

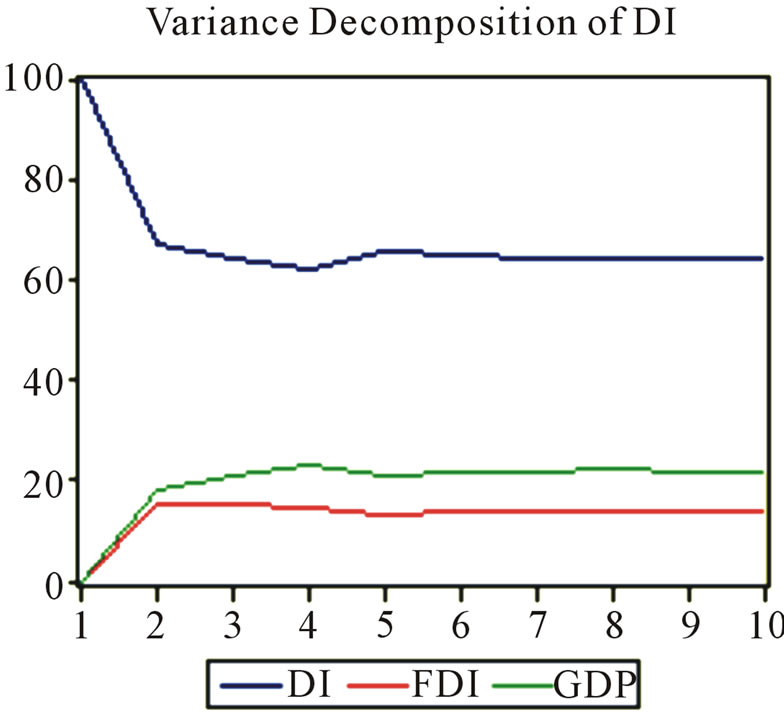

Concluding from the Figures 2 and 3, in the sequence of DI-FDI-GDP, FDI’s contribution rate to DI reached 28.8%; in the sequence of DI-GDP-FDI, FDI’s contribution rate to DI was almost 20.7%, which exceeded GDP’s contribution to DI. Therefore, we could conclude that in eastern China, FDI’s contribution to DI reached 20%. Besides, FDI’s contribution rate to GDP ranged from 7% to 19%, which showed that FDI had great impact on economic growth in eastern China.

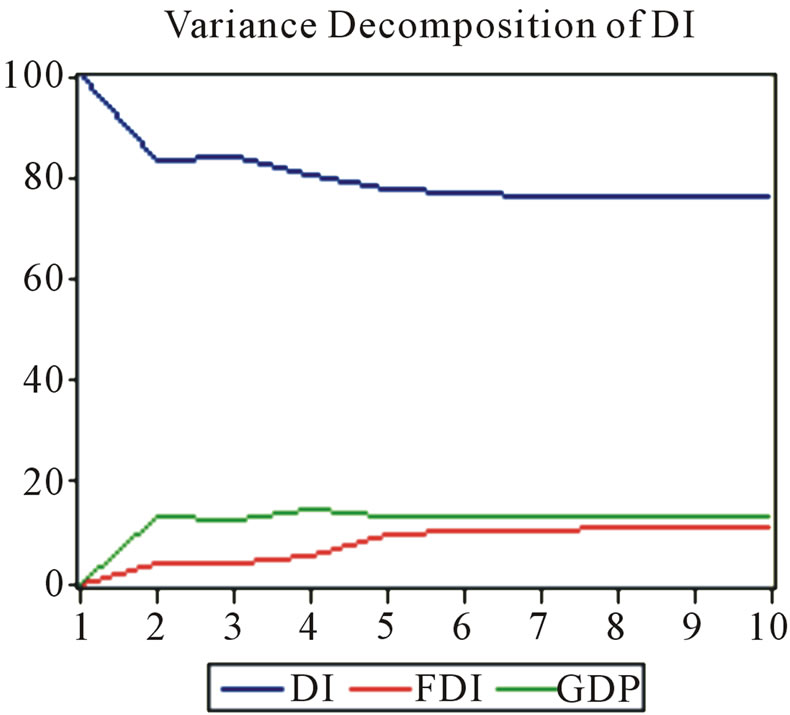

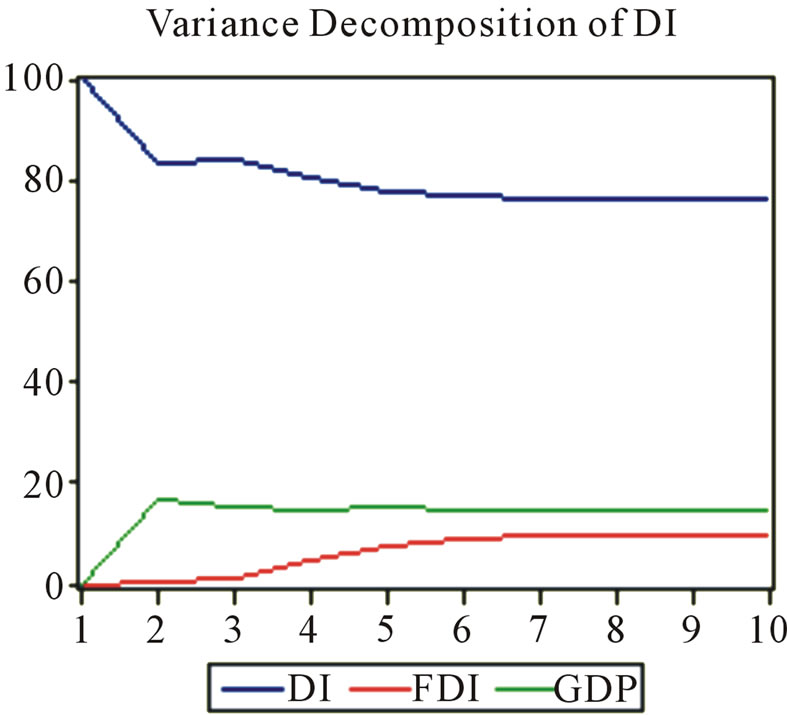

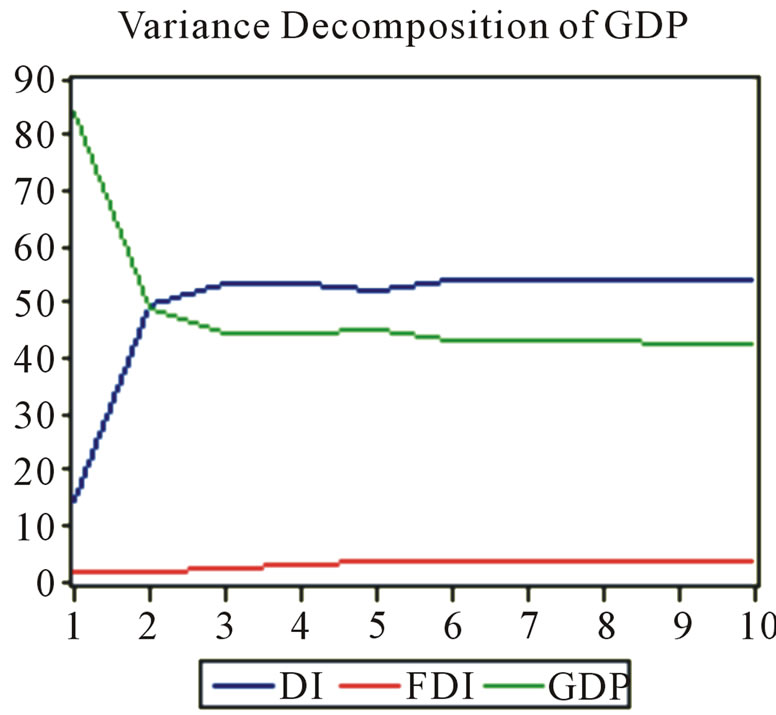

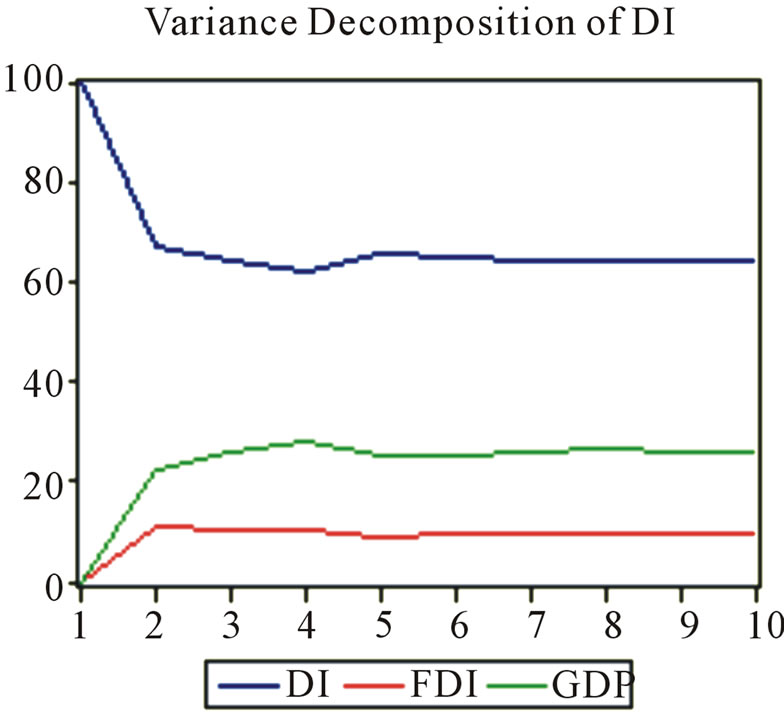

Figures 4 and 5 showed that FDI’s contribution rate to DI was around 10.8%, which meant that in central China, FDI exerted some influence on DI. The results of variance decomposition of GDP showed that FDI’s contribution rate to economic growth ranged from 10% to 16%.

In western China, as Figures 6 and 7 showed, FDI had obvious effect on DI with contribution rate ranging from 9.6% to 13.7%; however, FDI contributed little to GDP, with contribution rate of 2% to 3%.

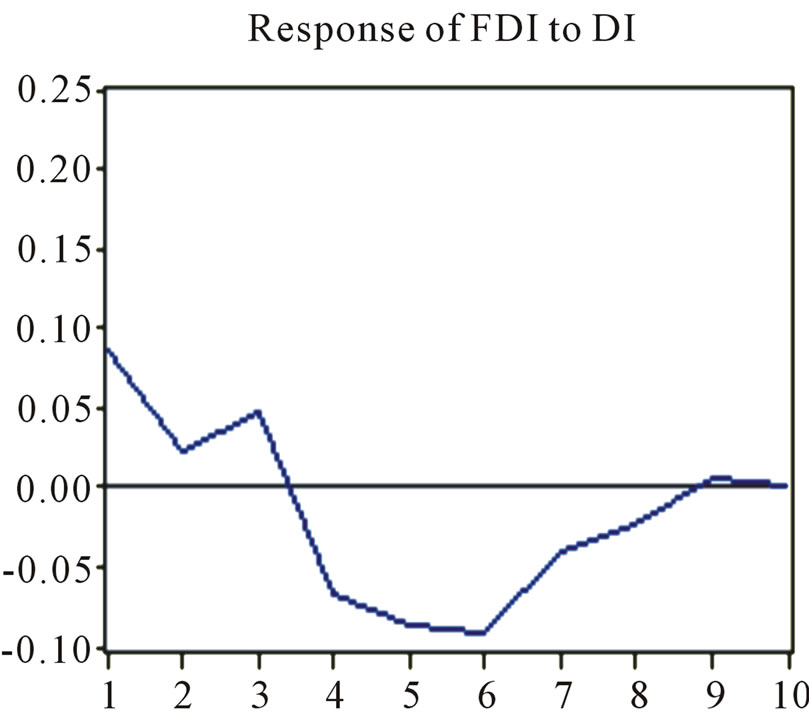

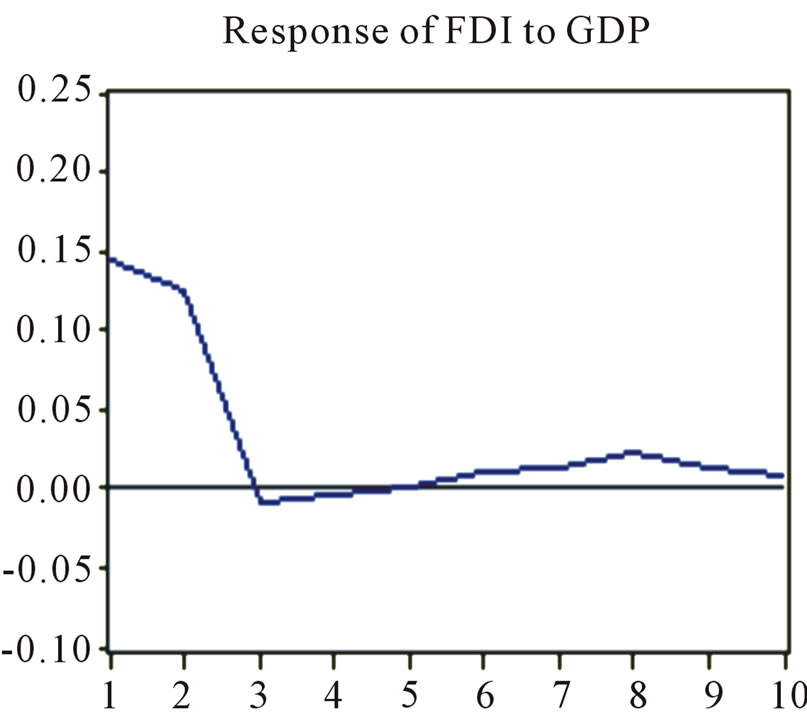

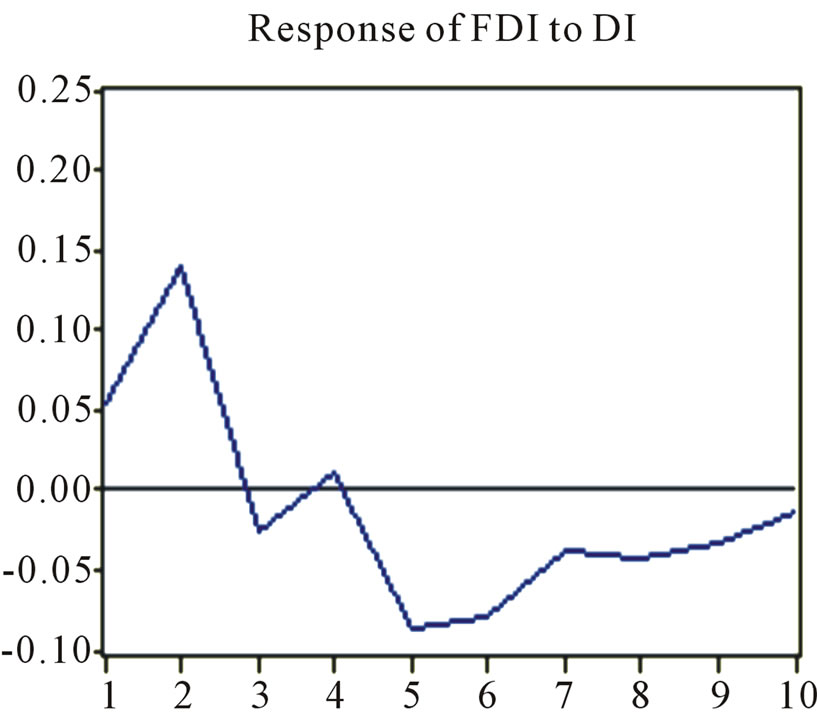

3.4. Impulse Response Function

Next, impulse response functions were used to analyze how FDI affected DI. The results were as follows.

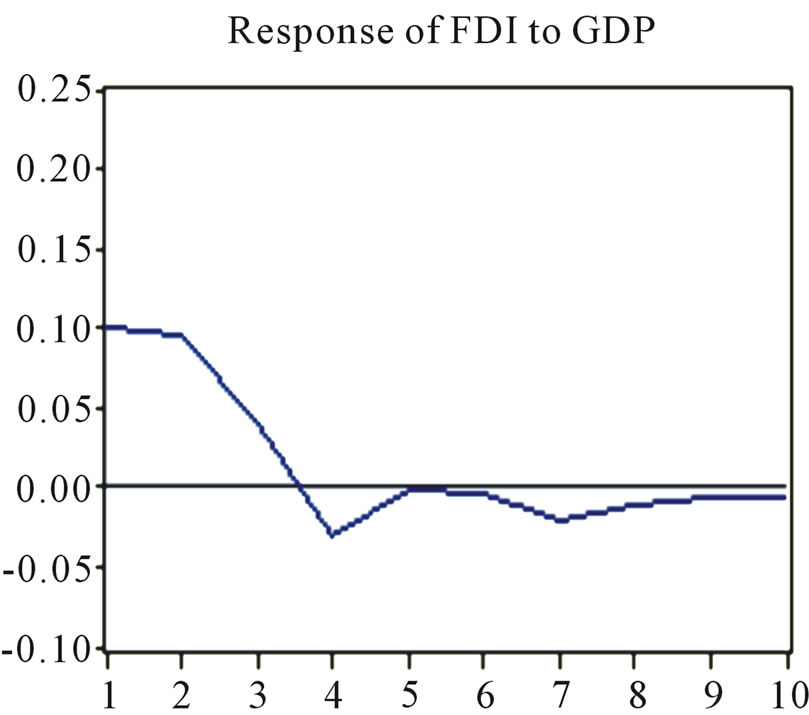

Concluding from Figure 8, FDI brought positive effect to DI in the first three years, while from the fourth year to the ninth year, the effect turned to negative, which meant that in eastern China, in the first three years, FDI exerted crowding-in effect on DI, while in the next six years, FDI exerted crowding-out effect on DI. As to GDP, FDI exerted positive promoting effect.

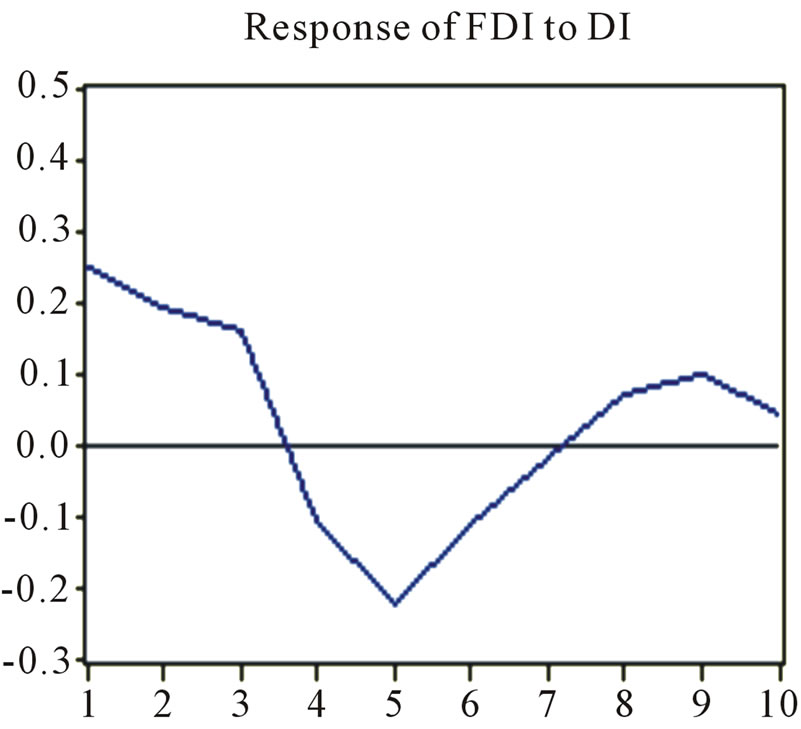

In central China, as Figure 9 showed, during the first three years, FDI’s impact turned out to be positive, and then converted to negative.

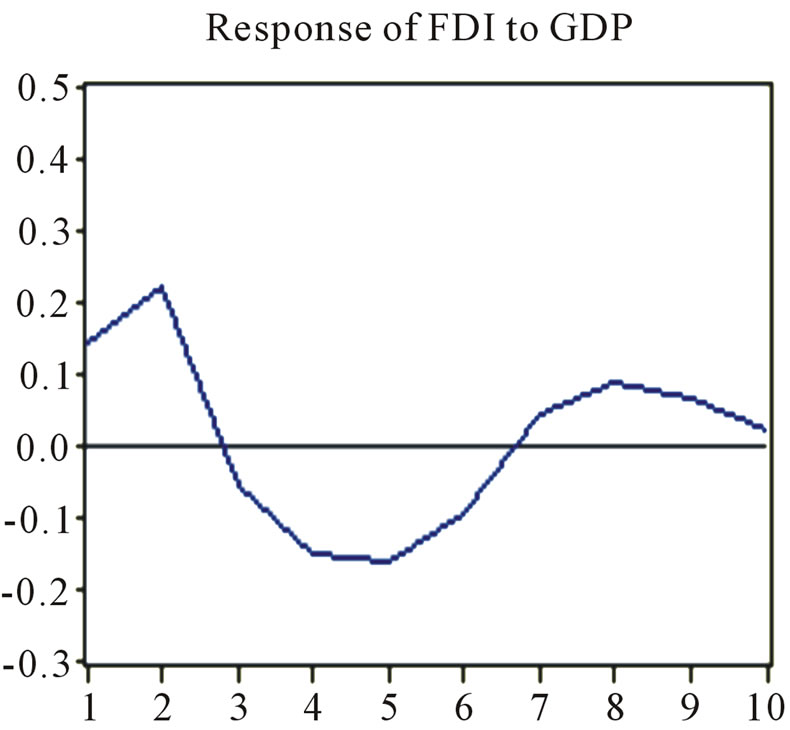

We could draw from Figure 10 that, one unit of FDI’s positive impact would bring DI positive effect in the first three years; however, from the fourth year to the seventh year, the effect turned to be negative; from the eighth year to the tenth year, this effect turned back to be positive. This reflected that in western China, FDI exerted crowding-in effect to DI in the first three years; then since the fourth year to the seventh year, the effect turned to be crowding-out effect; from the eighth year to the tenth year, the effect turned back to crowding-in effect.

Figure 2. Variance decomposition of DI, GDP in eastern China in the sequence of DI-FDI-GDP.

Figure 3. Variance decomposition of DI, GDP in eastern China in the sequence of DI-GDP-FDI.

Figure 4. Variance decomposition of DI, GDP in central China in the sequence of DI-FDI-GDP.

Figure 5. Variance decomposition of DI, GDP in central China in the sequence of DI-GDP-FDI.

Figure 6. Variance decomposition of DI, GDP in western China in the sequence of DI-FDI-GDP.

Figure 7. Variance decomposition of DI, GDP in western China in the sequence of DI-GDP-FDI.

Figure 8. Generalized impulse response of FDI to DI and GDP in eastern China.

Figure 9. Generalized impulse response of FDI to DI and GDP in central China.

Figure 10. Generalized impulse response of FDI to DI and GDP in western China.

4. Causes Analysis of Regional Differences of FDI’s Impact on DI

In eastern and central China, FDI’s impact on DI turned out to be crowding-in effect in short term (in 3 years), crowding-out effect in long term. In western China, overall speaking, FDI brought crowding-in impact to DI. Here were the possible causes.

First of all, significant differences of geographic advantage and congenital conditions. Due to the advantages of geography, human resources and infrastructure, eastern and central China was quite attractive to foreign capital. The more the amount of foreign investment, the easier to have crowding-in effect on domestic enterprises. The western China, with underdeveloped infrastructure and construction funds shortage, was given new development power by the inflows of FDI. Trapped in the congenital inferior position, the western area was confronted with backward economic development. The inflows of FDI expanded the scale of construction, increased the employment, promoted local economic growth, and also promoted the local enterprises’ investment.

Secondly, the differences of implementation of preferential policy. Since China’s opening up is a gradual process, the eastern coastal areas were given the priority earlier to enjoy super national preferential policies, which were made to attract foreign investment. Besides, the coastal cities and the provinces have also been approved to establish special economic zone. Nowadays, super national treatment has been canceled; however, the past years’ policy tilt gave foreign investment better treatment than domestic enterprises and each coastal economic zone has formed its own aggregation advantage. All of these encouraged foreign investment to some extent and caused inhibition of domestic investment. Under the influence of gradient transfer rule, foreign investment decreased from the east to west. In western China, foreign investment hasn’t reached the scale that could extrude domestic investment. The market competetion hasn’t turned white-hot completely; therefore foreign investment and domestic investment are in a relatively good condition.

Moreover, the stages of industry to which foreign investment inflows were not the same. In eastern and central areas, foreign investment rarely flowed to new products or services; on the contrary, they almost flowed to domestic existing products and services, which caused the competition between multinational enterprises and domestic enterprises. The imbalance of investment structure resulted in the low efficiency of capital utilization, and the introduction of new technology by multinational enterprises would inevitably eliminate some domestic enterprises. The larger scale is the foreign investment, the easier for the domestic investment to be crowed out. In western areas, most of foreign investment flowed to manufacturing industries to take advantage of relatively cheap labor, but the industry structure of western areas was relatively backward, which allowed foreign investment to promote the development of downstream Industries with association effects.

Finally, the way foreign investment enter China has changed. Since 2008, 78% of FDI has entered as single proprietorship. The establishment of wholly-owned enterprises gradually became the main way for multinational enterprises to enter China, especially in eastern and central China. The trend of single proprietorship made it easier for the foreign enterprises to take advantage of market internalization, reduce costs and increase profits. On the one hand, this slowed down the spillover of advanced technology; on the other hand, market internalization impaired the pull effect of upstream and downstream industries locally. However, in western China, the expansion of foreign capital is still in the experimental stage that such effects can be avoided.

5. Conclusions and Suggestions

From the analysis above, we can arrive at such conclusions. The inflows of FDI brought China funds of economic construction, at the same time, extruded part of domestic investment in eastern and central China. Compared with the eastern coastal areas, western China was less developed and attracted relatively less foreign investment, but FDI exerted some crowding-in effect on domestic investment. Based on the actual situation, the policy suggestions are as follows.

Firstly, the Chinese government should fully recognize the “double-edged sword” role played by foreign investment, i.e. FDI exerts negative influences on the domestic investment in eastern and central regions while promotes the domestic investment in western region. Therefore, policy formulation in different areas should be different according to the local situation. On the one hand, the scale of foreign investment should be limited in eastern and central areas to avoid crowding-out effect. On the other hand, policy tilt can be properly increased to help western area attract more foreign investment. The infrastructure construction of western area, such as public transportation, telecommunications and energy supply, should be strengthened and the investment environment should be improved to enhance the size and quality of foreign investment. Crowding-in effect should be used fully in western region to promote the economic development.

Secondly, the Chinese government and investors should pay joint efforts to avoid over-concentration of foreign investment, and to minimize the adverse competitive behavior, especially in labor-intensive manufacturing industries in eastern and central areas. The government should try to attract the foreign investment of high-tech and strong correlation effects, and to encourage the introduction of new products, services or domestic core industries. Some projects established and developed maturely in eastern and central areas can be transferred to the western region; therefore the mature technique and management methods can be used efficiently. The opportunity of foreign investment transfer should be taken to form a good system of industry acceptance and transfer, to stimulate the rapid economic development of the western area, and to narrow the differences between various regions.

Thirdly, the experience exchange and technical cooperation between foreign and domestic enterprises should be encouraged and strengthened. What the foreign investment brought to the host countries are not just capital, but also first-class technique and management concept. Through communication with the multinational companies, the domestic enterprises can learn advanced technology and management experience, and improve operational efficiency with the acceleration of the pace of technology spillover. Ultimately foreign investment and domestic investment can complement and promote each other and stimulate the economic development of the host countries jointly.

REFERENCES

- United Nations Conference on Trade and Development, “World Investment Report (1999),” United Nations, New York, 2000.

- A. R. Manuel and R. Machado, “Foreign Investment in Developing Countries: Does It Crowd in Domestic Investment?” Oxford Development Studies, Vo1.33, No. 2, 2005, pp. 149-162.

- S. Tang, “Does Foreign Direct Investment Crowd out Domestic Investment in China?” School of International Business and Asian Studies, Griffith University, Brisbane, 2005.

- Q. X. Zhang, “The Analysis of Alternative or Complementary Effect between FDI and Domestic Investment,” Economist, Vo1. 16, No. 6, 2004, pp. 77-83.

- C. Y. Luo, “FDI and Domestic Capital: Crowding out or Crowding in,” China Economic Quarterly, Vo1. 6, No. 2, 2007, pp. 381-391.

- J. Du, H. Li and Z. Li, “The Research on the Crowding-In and Crowding-Out Effects of FDI on China’s Domestic Capita,” Journal of Sichuan University (Social Science Edition), Vo1. 1, No. 5, 2009, pp. 99-104.

- Z. P. Wang and Z. N. Li, “Reconstructing of the Absolute Crowding in or Out Relationship between FDI and Domestic Investment,” Statistical Research, Vo1. 21, No. 7, 2004, pp. 37-43.

- W. G. Bo, “Does FDI Crowd in or Crowd Out of Chinas Domestic Investment?” Collected Essays on Finance and Economics, Vo1. 19, No. 1, 2006, pp. 64-72.

- J. T. Chen, “Effects of FDI on Domestic Investment of China: Crowd out or Crowd in?” Finance & Economics, Vo1. 30, No. 4, 2009, pp. 110-116.

NOTES

1Eastern China includes Beijing, Shanghai, Tianjin, Hebei, Guangdong, Hainan, Liaoning, Jiangsu, Zhejiang, Fujian, Shandong; Western China includes Neimenggu, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang; Central China includes Henan, Hunan, Hubei, Jilin, Heilongjiang, Shanxi, Anhui, Jiangxi; Tibet is not indlucded.