Open Journal of Statistics

Vol.2 No.1(2012), Article ID:17143,10 pages DOI:10.4236/ojs.2012.21009

Testing for Cross-Sectional Dependence in a Random Effects Model

1Centre for Econometrics and Allied Research (CEAR), Department of Economics, University of Ibadan, Ibadan, Nigeria

2Department of Economics, University of Cocody, Abidjan, Cote d’Ivoire

Email: aa.salisu@cear.org.ng

Received December 4, 2011; revised December 28, 2011; accepted January 10, 2012

Keywords: Cross-Sectional Dependence; Error Components Model; Lagrangian Multiplier (LM) Tests

ABSTRACT

This paper extends and generalizes the works of [1,2] to allow for cross-sectional dependence in the context of a two-way error components model and consequently develops LM test. The cross-sectional dependence follows the first order spatial autoregressive error (SAE) process and is imposed on the remainder disturbances. It is important to note that this paper does not consider alternative forms of spatial lag dependence other than SAE. It also does not allow for endogeneity of the regressors and requires the normality assumption to derive the LM test.

1. Introduction

The standard error components model assumes, among others, spatial independence across cross-sectional units. However, this restrictive assumption may not hold for a lot of panel data applications. When one begins to look at a cross section of regions, states, countries, etc., these aggregate units may exhibit cross-sectional correlation that has to be dealt with (see [3]). Ignoring cross-sectional dependence when in fact it exists, results in biased, inconsistent and inefficient estimates of regression coefficients (see [1,4,5]).

In the literature, several test statistics have been developed for spatial econometrics however in the context of either cross sectional framework or one-way error components model.1 The specification of cross-sectional dependence in linear regression models by most of these works follows either spatial autoregressive (SAR) process often defined as spatial lag dependence (see [6-10]); spatial moving average processes (SMA) often called spatial error dependence (see [11]); spatial autoregressive error process (SAE) (see [6,12,13]); SARMA (a combination of SAR and SMA) (see [2,4,14]); a combination of SAR and SARE (see [15]); direct representation form of cross-sectional dependence (see [16,17]) or spatial error component process (SEC) suggested by [18]. Consequently, various tests as well as estimators were derived against these different specification forms using either the Maximum Likelihood (ML) approach (see [2,19];

for a survey of the literature) or Instrumental Variables (IV) and Generalized Method of Moments (GMM) (see [9,20,21]).

The present study develops LM test for cross-sectional dependence in the context of panel data framework. The latter is a two-way random effects model where the cross-sectional dependence follows the SAE and is imposed on the remainder disturbances. Prominent papers that have adopted the SAE include [2,4] in the context of cross-sectional framework, and [1,22,23] in the context of one-way error components framework. Thus, the main objective of this work is to extend and generalize the works of [1,2] to allow for cross-sectional dependence in the context of a two-way error components model. The panel data model considered here is the restricted twoway random effects model assuming no cross-sectional dependence in the remainder disturbances. Thus, the LM test will be similar to the one developed by [1] if we further modify the hypothesis to test for cross-sectional dependence assuming the presence of random individual effect only (while ignoring the presence of time effects). In the same vein, the LM test will be similar to [2,4] if the hypothesis is reconstructed to test for cross-sectional dependence ignoring the presence of both the random country and time effects.

In Section 2, the structure of the two-way error random effects model is described in the context of crosssectional dependence in the remainder disturbance term. Analyses of the LM test are provided in Section 3 and Section 4 concludes the paper.

2. The Model

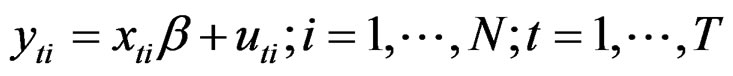

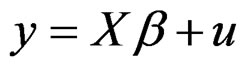

We consider the following panel data regression model:

(1)

(1)

where the index i denotes N regional units and the index t refers to the T observations of each region i. The i subscript, therefore, denotes the cross-sectional dimension whereas t denotes time-series dimension. The total number of observations is NT.  is the observation on the

is the observation on the  region over the

region over the  time period;

time period;  is the

is the  observation on k explanatory variables and

observation on k explanatory variables and  is the regression disturbance term. The error term

is the regression disturbance term. The error term  follows a two-way random effects with both regional specific and temporal effects; that is,

follows a two-way random effects with both regional specific and temporal effects; that is,

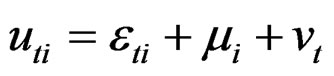

(2)

(2)

where  denotes regional specific effects,

denotes regional specific effects,  denotes temporal effects and

denotes temporal effects and  represents the remainder disturbance term. Stacking the N observations of each timeperiod t, Equation (2) may be written as:

represents the remainder disturbance term. Stacking the N observations of each timeperiod t, Equation (2) may be written as:

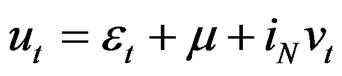

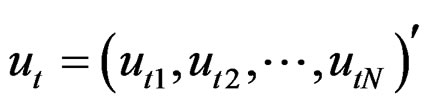

(3)

(3)

where ,

,  is a vector of ones of N dimension,

is a vector of ones of N dimension,  and

and .

.

Assumption 1: Both  and

and  are assumed independent and normally distributed according to,

are assumed independent and normally distributed according to,

(4)

(4)

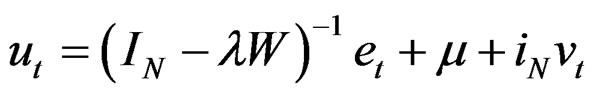

The remainder disturbance term  is assumed to follow the first order spatial error correlation (see [2,3]), that is:

is assumed to follow the first order spatial error correlation (see [2,3]), that is:

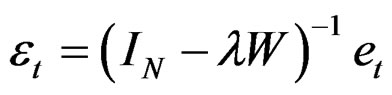

(5)

(5)

where  and

and . The term

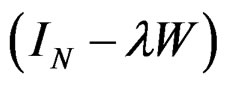

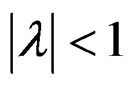

. The term  is the scalar spatial autoregressive coefficient with

is the scalar spatial autoregressive coefficient with . The matrix W is an

. The matrix W is an  spatial weight matrix which represents the degree of potential interaction between neighboring locations whose diagonal elements are zero and off-diagonal elements are non-zero. Equation (5) can be further simplified as:

spatial weight matrix which represents the degree of potential interaction between neighboring locations whose diagonal elements are zero and off-diagonal elements are non-zero. Equation (5) can be further simplified as:

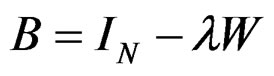

(6)

(6)

Given Equation (6), the weight matrix W also satisfies the condition that  is nonsingular for all

is nonsingular for all .

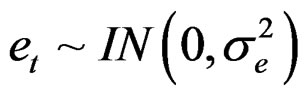

.  is also assumed to be independent and normally distributed as:

is also assumed to be independent and normally distributed as:

(7)

(7)

The  process is also independent of the

process is also independent of the  and

and  terms.

terms.

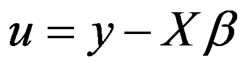

The model (1) can be re-written in matrix notation as:

(8)

(8)

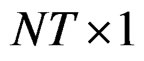

where y is of dimension  vector, X is an

vector, X is an  matrix,

matrix,  is

is  vector and u is

vector and u is  vector. The matrix X is assumed to be of full column rank and its elements are assumed to be asymptotically bounded in absolute value. Given Equation (6), Equation (3) can be re-written as:

vector. The matrix X is assumed to be of full column rank and its elements are assumed to be asymptotically bounded in absolute value. Given Equation (6), Equation (3) can be re-written as:

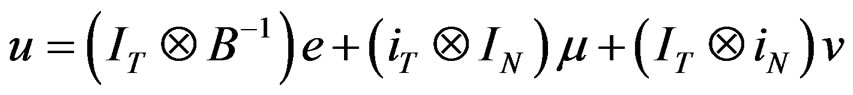

(9)

(9)

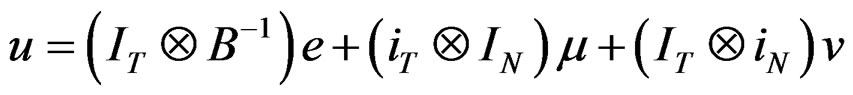

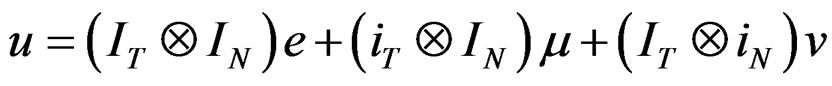

We can write Equation (8) in vector from as:

(10)

(10)

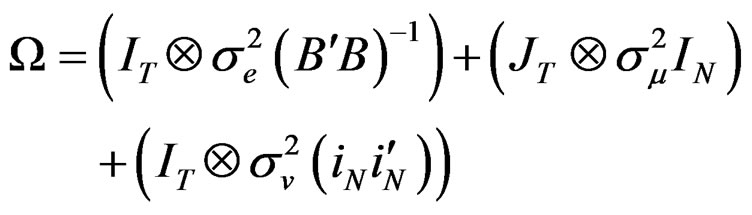

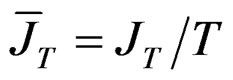

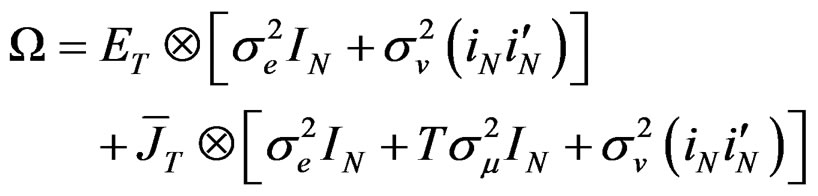

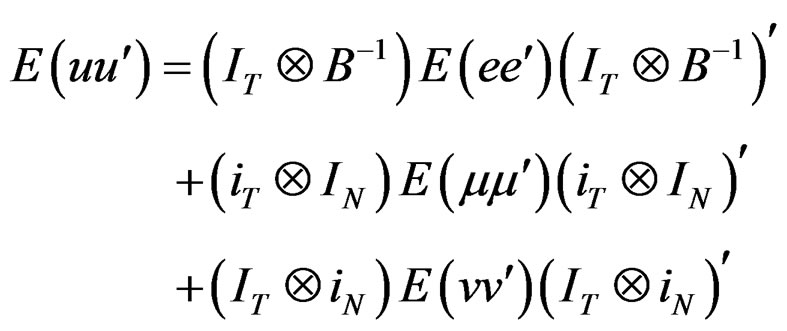

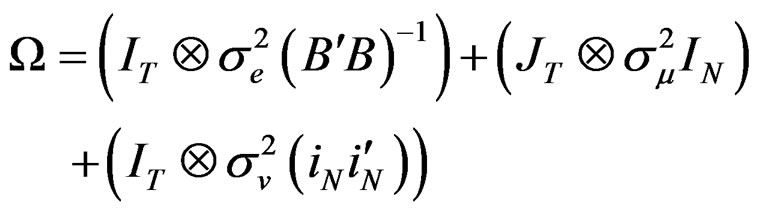

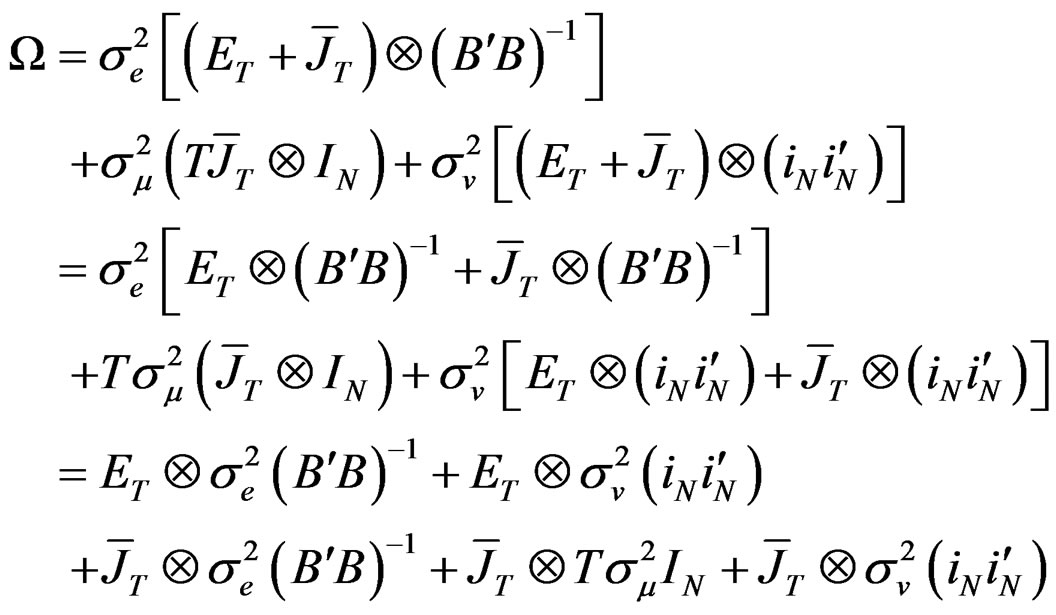

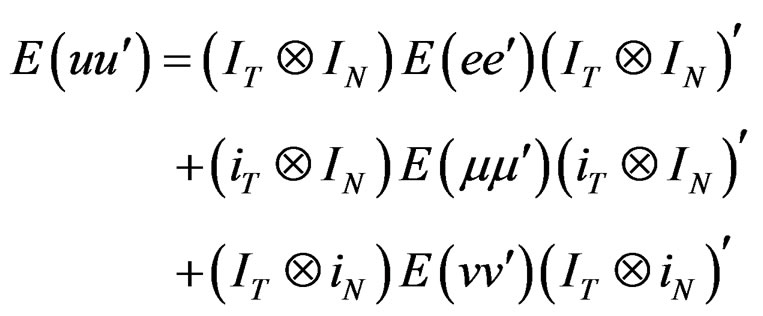

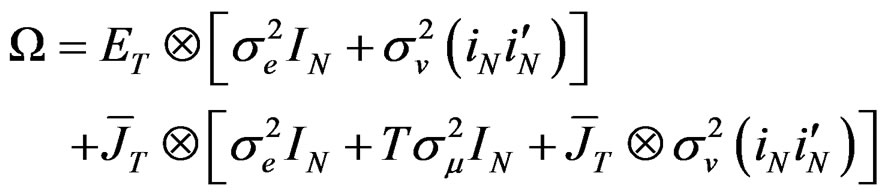

The variance-covariance (VCV) matrix  of Equation (10) (that is, the unrestricted model) can be expressed as:

of Equation (10) (that is, the unrestricted model) can be expressed as:

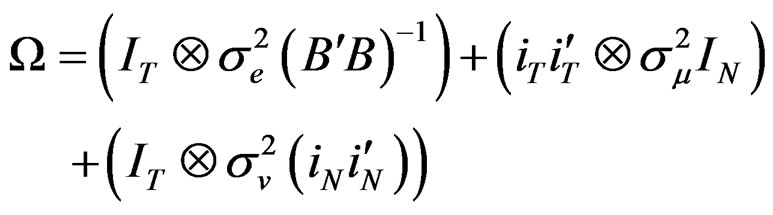

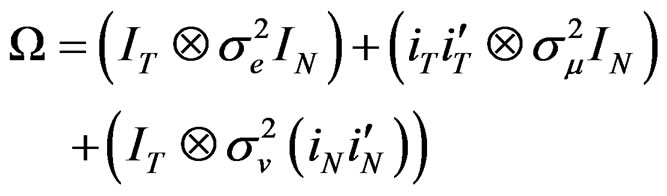

(11)2

(11)2

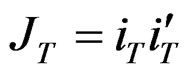

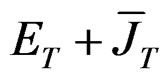

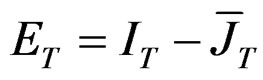

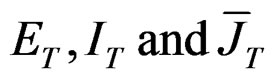

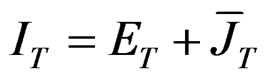

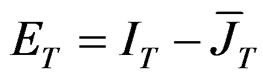

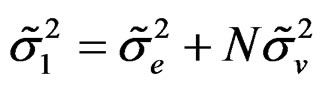

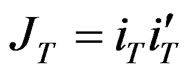

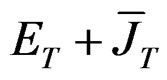

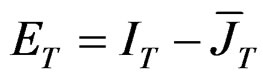

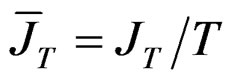

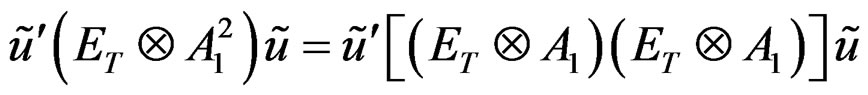

where  and it is a matrix of ones of dimension T. To obtain the spectral decomposition of Equation (11), we use the [24] method. Essentially, we replace

and it is a matrix of ones of dimension T. To obtain the spectral decomposition of Equation (11), we use the [24] method. Essentially, we replace  by

by  and

and  by

by  where

where  and

and  and consequently, we obtain3:

and consequently, we obtain3:

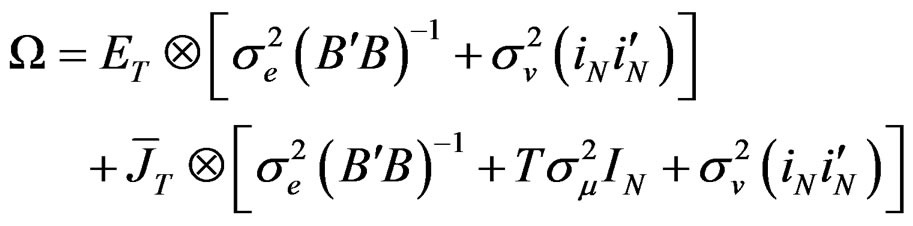

(12)

(12)

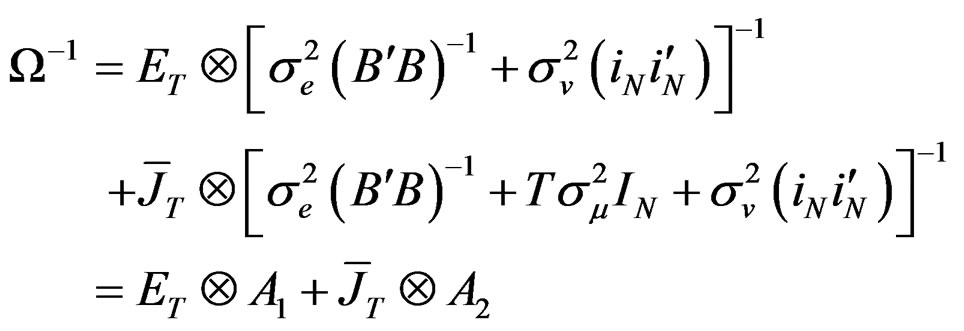

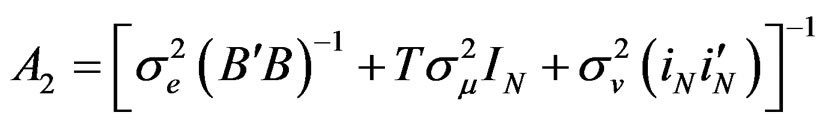

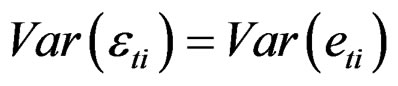

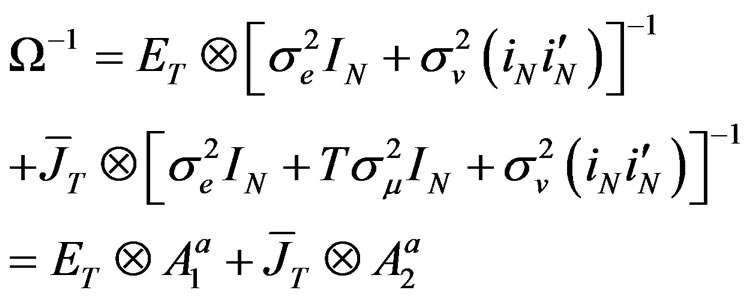

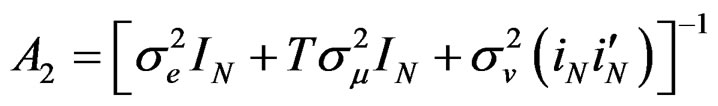

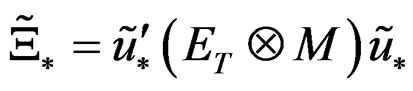

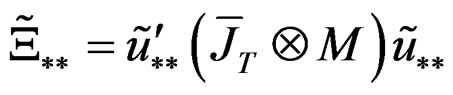

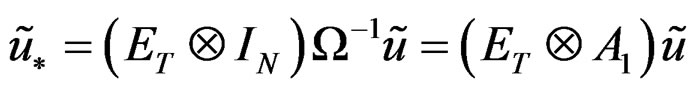

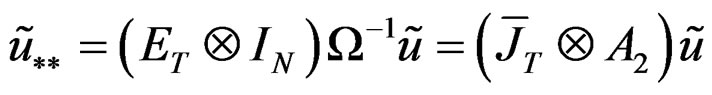

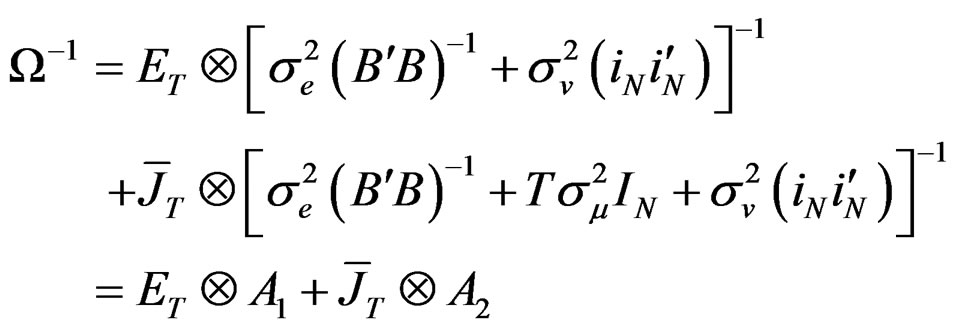

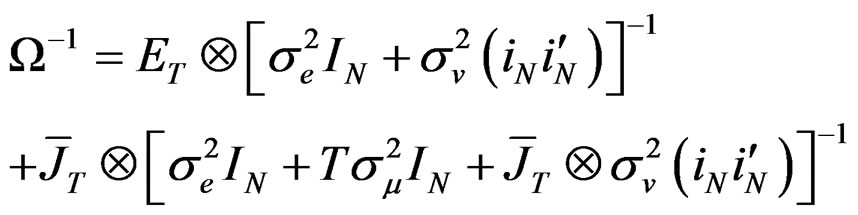

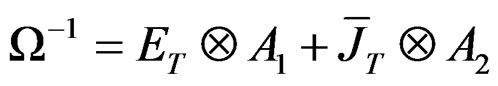

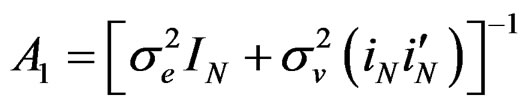

Also, using the [25] method of inversion, Equation (12) can be expressed as:

(13)

(13)

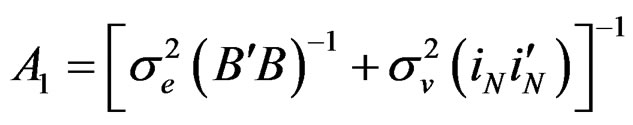

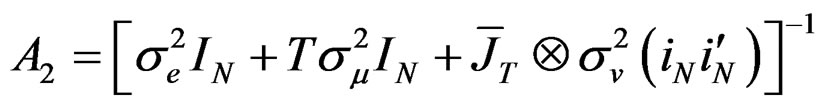

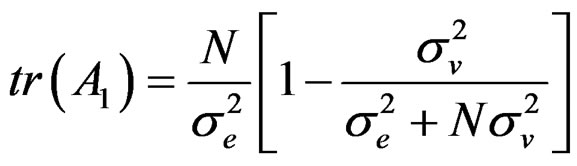

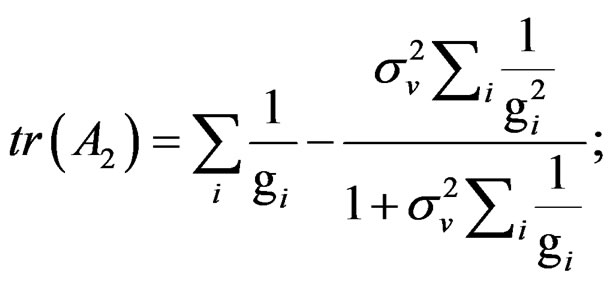

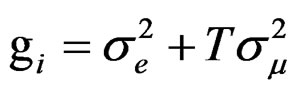

where  and

and

.

.

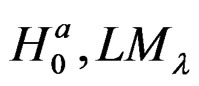

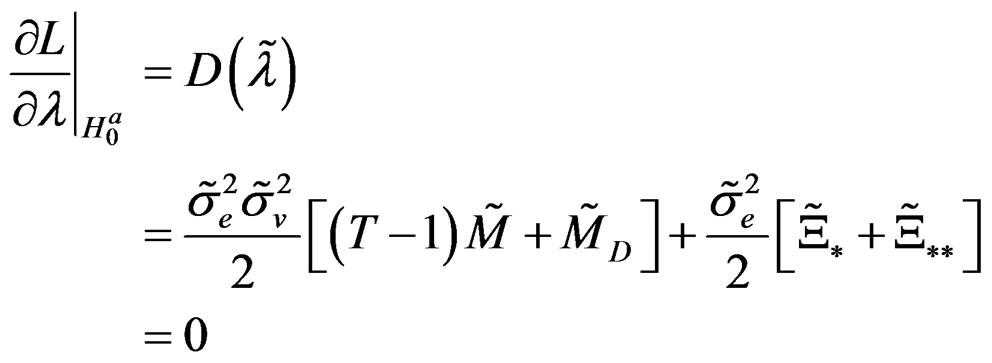

3. Derivation of the LM Test

In this section, we derive the LM test for testing for no cross-sectional dependence in a two-way random effects model. We employ the Maximum Likelihood (ML) approach and consequently, the log-likelihood function. The LM test derived is based on the idea that the score of the likelihood function evaluated under the null is equal to zero when the null hypothesis is true, so that a  test based on the square of the score divided by the appropriate element of the information matrix (since this is the variance of the score) can be constructed. The use of the normal likelihood function requires the assumption of normality of the error term.

test based on the square of the score divided by the appropriate element of the information matrix (since this is the variance of the score) can be constructed. The use of the normal likelihood function requires the assumption of normality of the error term.

Essentially, the derivation of the LM test involves the following steps:

Step 1: Derive the VCV matrix for the unrestricted model;

Step 2: Derive the VCV matrix for the restricted model;

Step 3: Derive the spectral decomposition for the matrices obtained in steps 1 and 2;

Step 4: Derive the inverse of the matrices obtained in steps 1 and 2 using the results from step 3;

Step 5: Derive the general log-likelihood function;

Step 6: Use the information in steps 1 - 5 to derive the score functions of the likelihood evaluated from the restricted ML under ;

;

Step 7: Derive the information matrix and its inverse;

Step 8: Use the results obtained in steps 6 and 7 to develop the LM test.

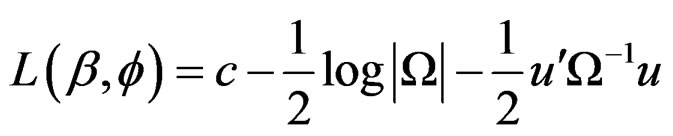

The log likelihood function, L under normality of disturbances is given as:

(14)

(14)

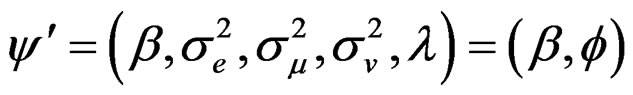

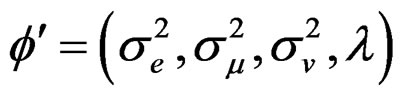

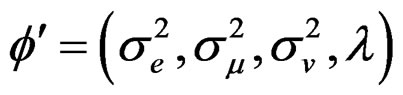

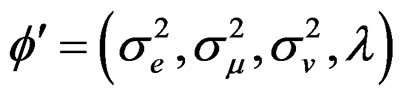

where  and the vector of parameters is denoted as

and the vector of parameters is denoted as  where

where

.

.

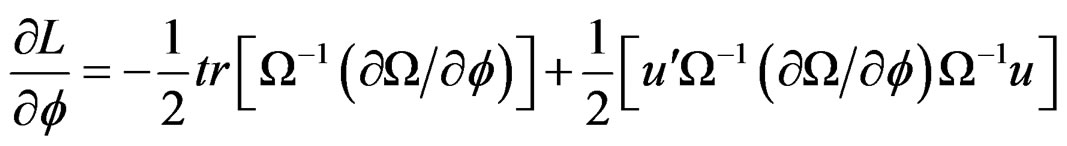

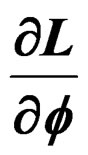

Since our test statistic requires information only on the vector of parameters , consequently, information due to

, consequently, information due to  is ignored. Following [26], the gradient of the log likelihood with respect to

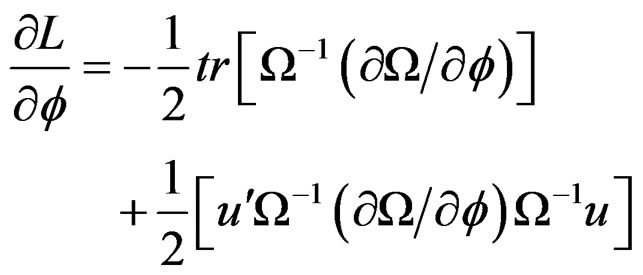

is ignored. Following [26], the gradient of the log likelihood with respect to  can be expressed as:

can be expressed as:

(15)

(15)

(16)

(16)

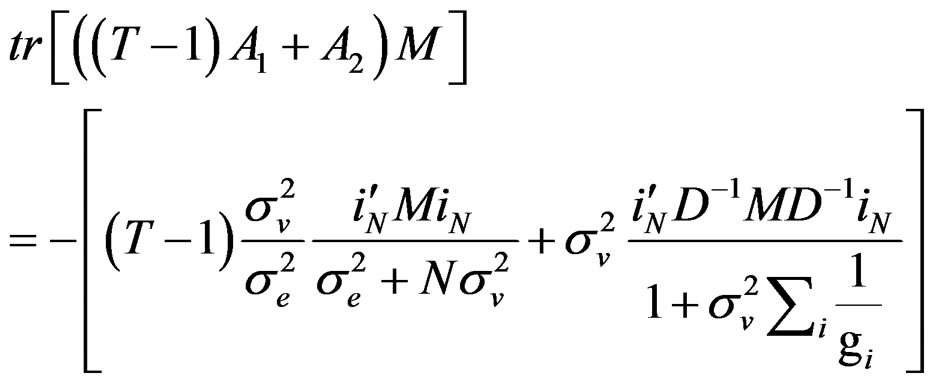

By further simplification, it is easy to show that:

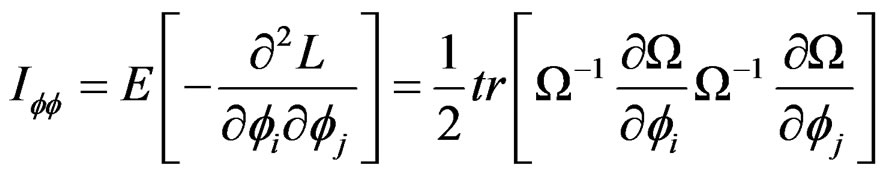

For  Equations (15) and (16) represent the score function and the information matrix respectively. The information matrix-

Equations (15) and (16) represent the score function and the information matrix respectively. The information matrix- is block diagonal. The LM statistic can, therefore, be written generally as:

is block diagonal. The LM statistic can, therefore, be written generally as:

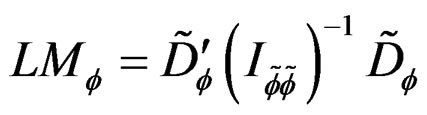

(17)

(17)

where  and

and  are the score function and information matrix respectively evaluated at the null hypothesis. The LM test statistic expressed in (17) is distributed as

are the score function and information matrix respectively evaluated at the null hypothesis. The LM test statistic expressed in (17) is distributed as  (i.e. chi-square distributed) with

(i.e. chi-square distributed) with  degrees of freedom,

degrees of freedom,  being the number of parameters in the vector

being the number of parameters in the vector . Based on Equation (17), therefore, the following hypotheses can be tested in relation to cross-sectional dependence:

. Based on Equation (17), therefore, the following hypotheses can be tested in relation to cross-sectional dependence:

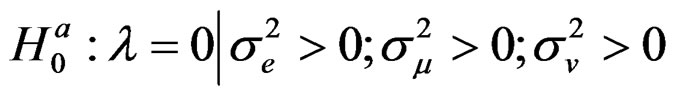

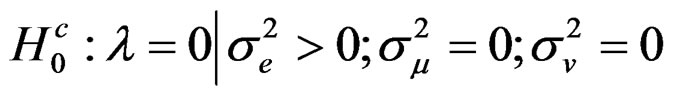

(18)

(18)

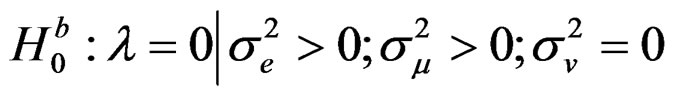

This is a test of no cross-sectional dependence assumeing the presence of random individual and time effects. This is the null hypothesis this study sets out to test.

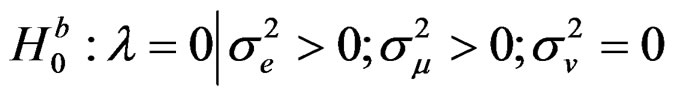

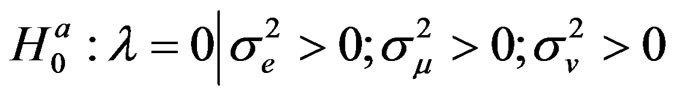

(19)

(19)

This hypothesis tests for cross-sectional dependence assuming the presence of random individual effect only (while ignoring the presence of time effects). This test is similar to [1] LM test for spatial error correlation as well as random country effects.

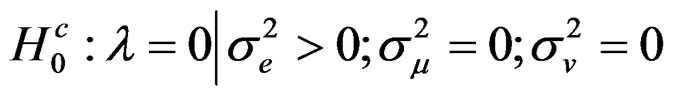

(20)

(20)

This hypothesis tests for cross-sectional dependence ignoring the presence of both the random country and time effects. This is similar to the LM test by [2,4].

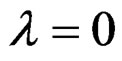

We derive below the score function for the null hypothesis expressed in (18) above which is the focus of this paper; that is:

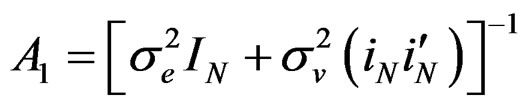

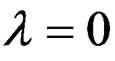

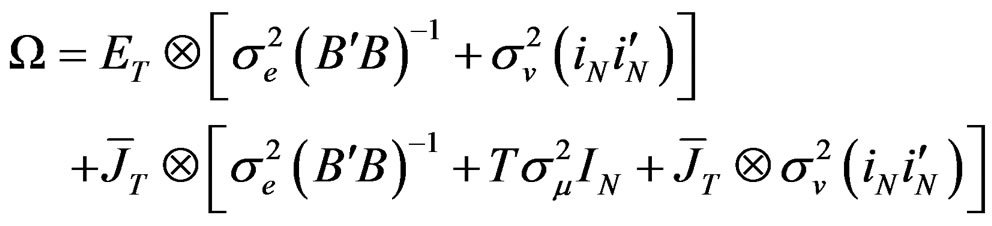

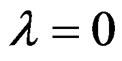

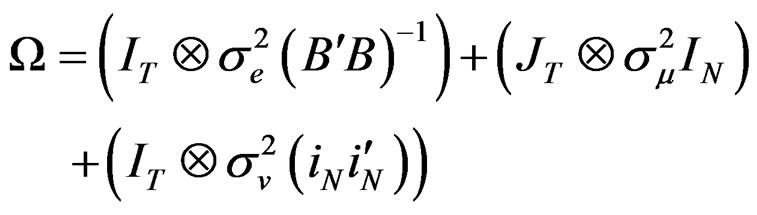

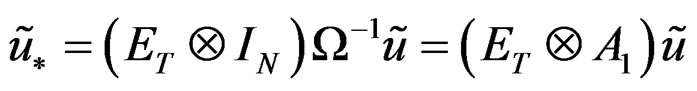

Under the null hypothesis in (18), the VCV matrix reduces to:4

(21)

(21)

Given that ; then

; then  and, therefore,

and, therefore, . The Equation (21) is the VCV matrix for the restricted model. Using [25] Lemma 2.1, the inverse of Equation (21) can be expressed as:

. The Equation (21) is the VCV matrix for the restricted model. Using [25] Lemma 2.1, the inverse of Equation (21) can be expressed as:

(22)

(22)

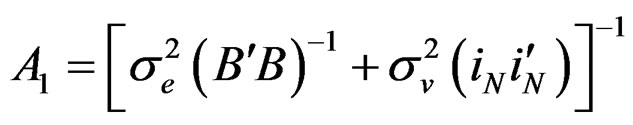

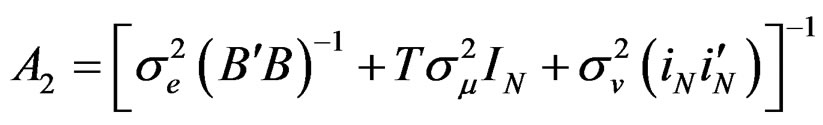

where  and

and

.

.

The Equation (22) is the reduced form of Equation (13) and is also the VCV matrix for the familiar two-way random effects error components model. In addition, it is a principal component required in the log-likelihood function to derive the LM test. In particular, both Equations (21) and (22) are required to derive the partial derivatives and information matrix for the LM test.

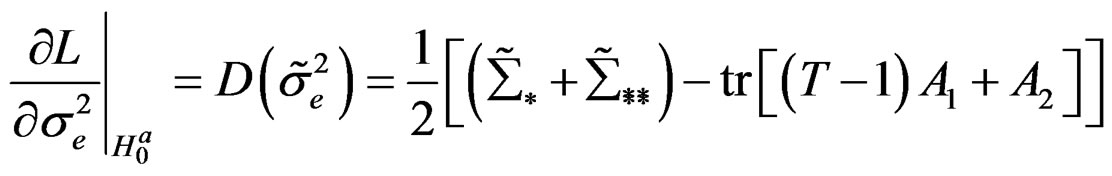

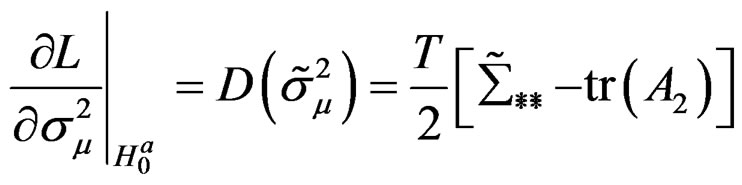

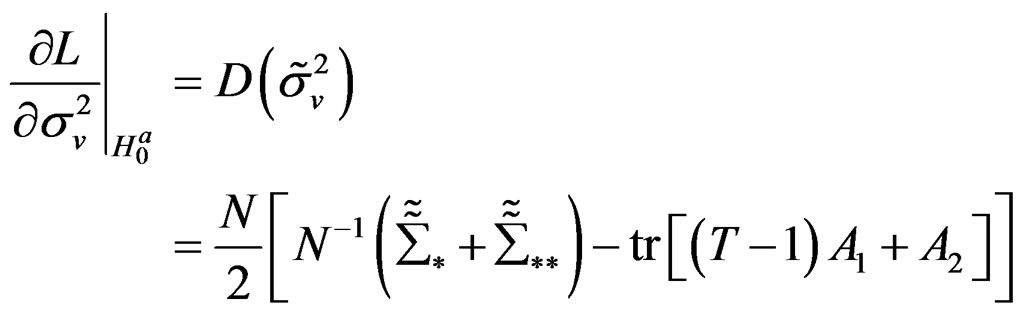

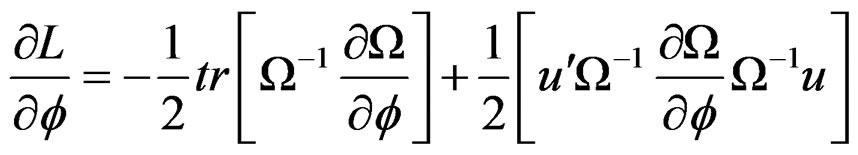

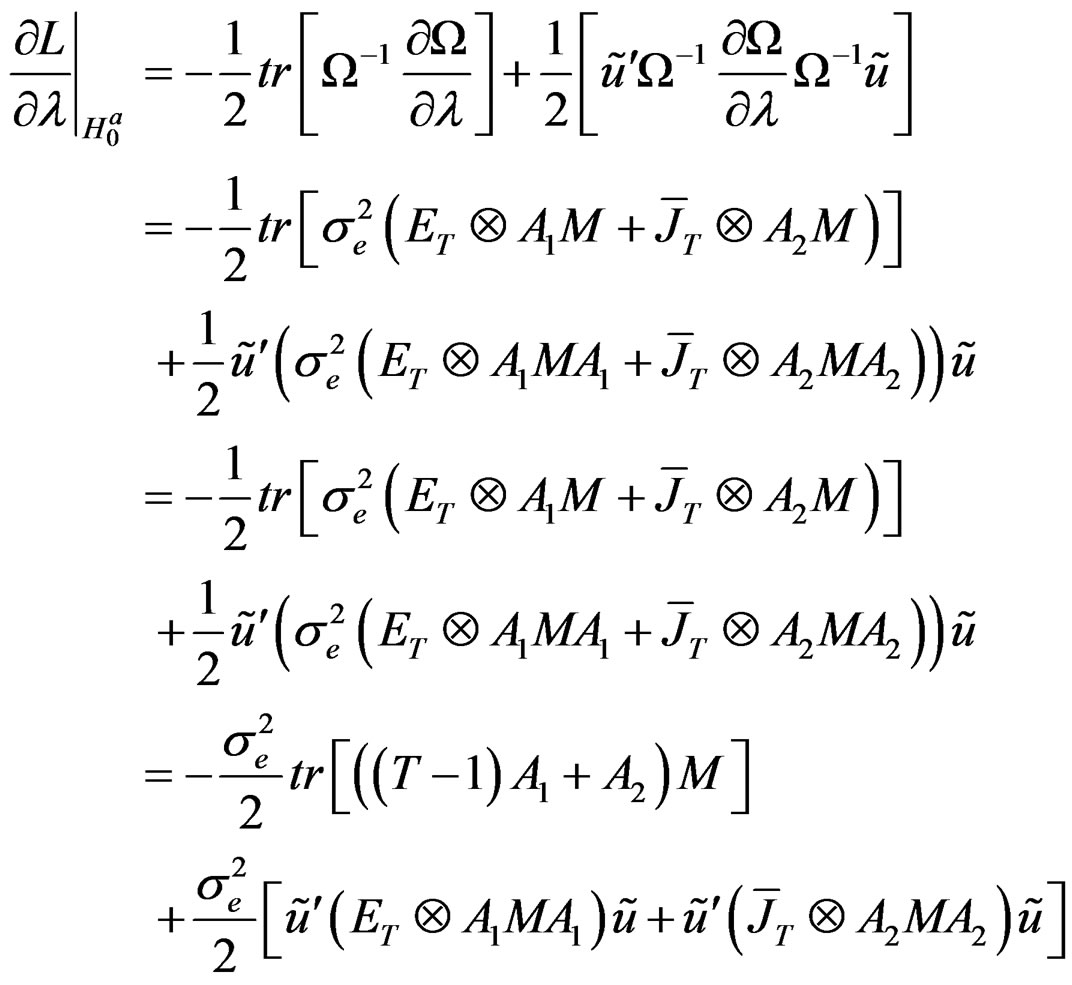

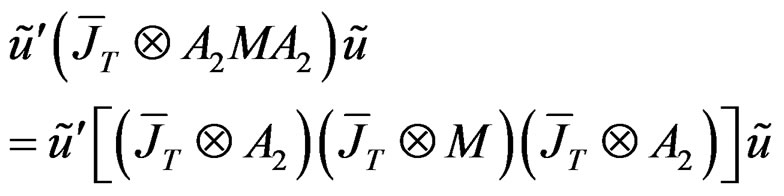

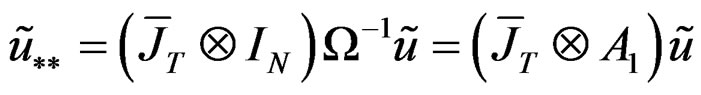

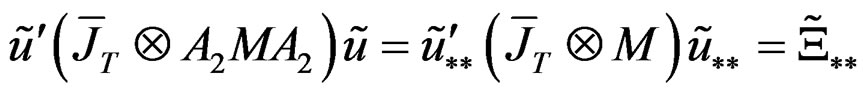

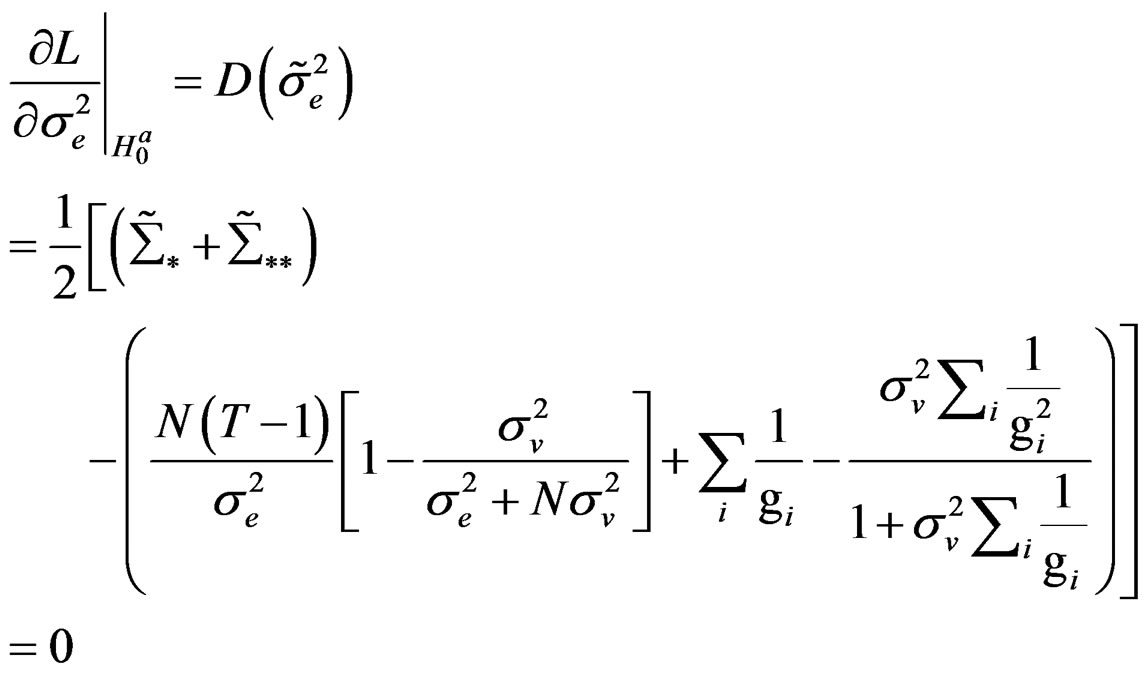

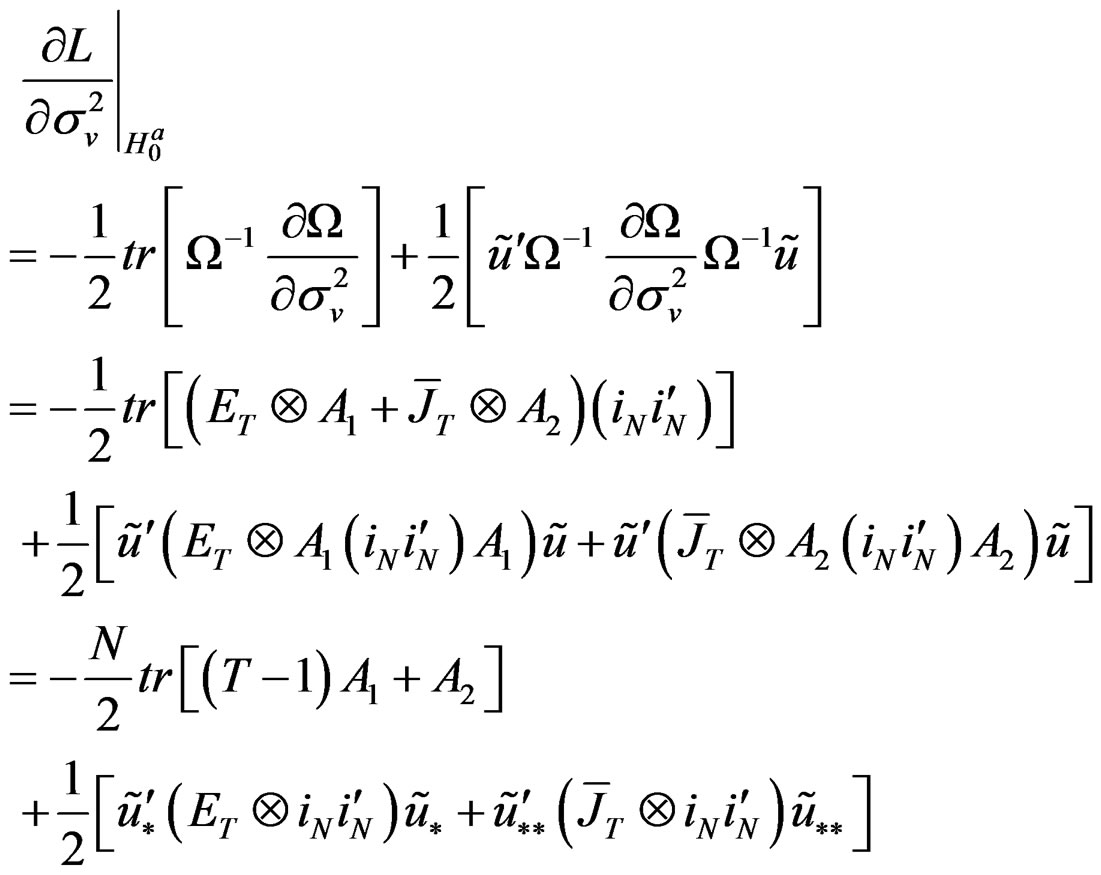

Using the general formulas on log likelihood differentiation, we derive its gradients evaluated at the restricted ML under  as follows:

as follows:

Recall Equation (15):

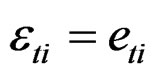

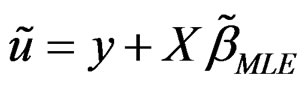

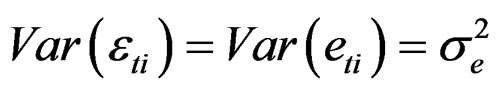

Assumption 2: Let , then

, then

. Recall,

. Recall,  and since under

and since under ,

, ; then

; then  and

and .

.

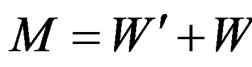

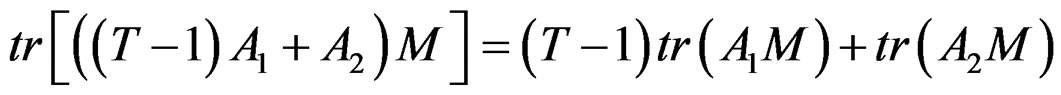

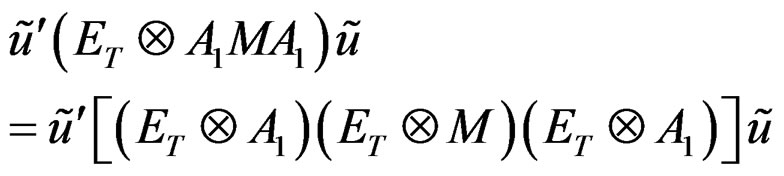

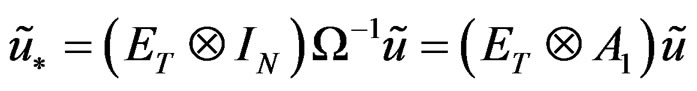

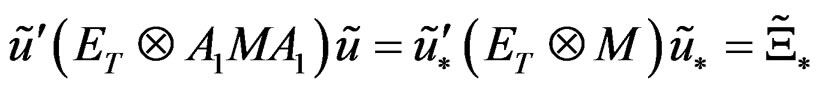

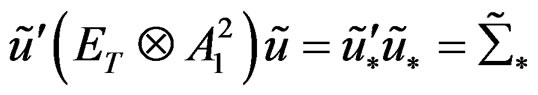

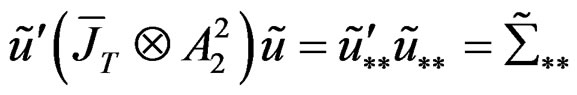

Assumption 3: If  are idempotent and symmetric matrices, we can write that

are idempotent and symmetric matrices, we can write that  where

where . Then,

. Then,  and

and  are orthogonal (see [3]).

are orthogonal (see [3]).

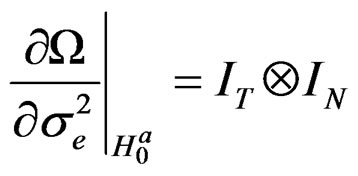

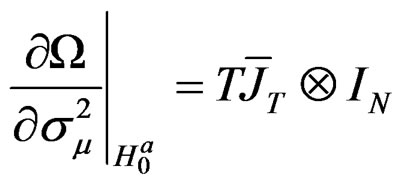

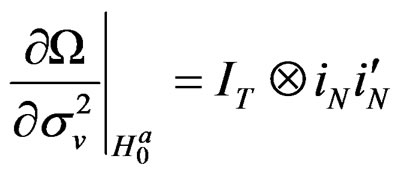

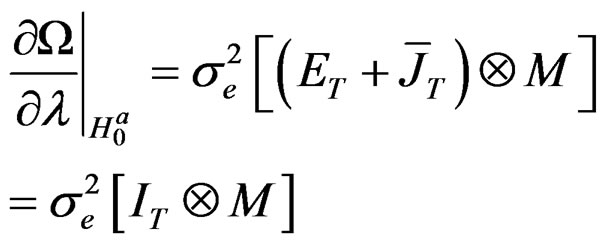

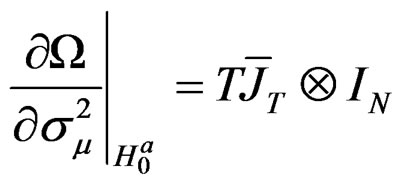

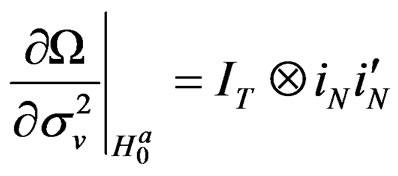

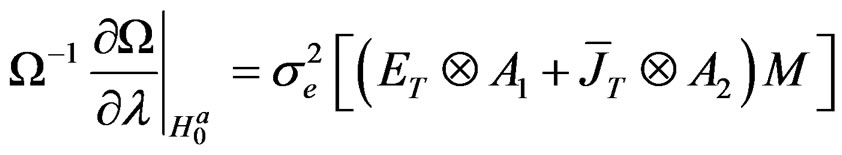

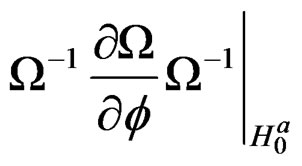

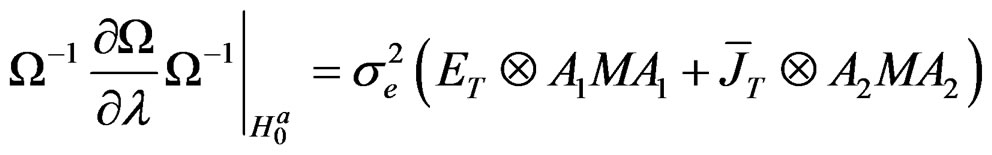

Proposition 1: Based on assumptions 2 and 3, we can write the derivatives  for the parameters,

for the parameters,  ,

,

,

,  and

and , respectively, as:

, respectively, as:

Proof:

(24)

(24)

Based on assumption 1, it is easy to establish from Equation (24) that:

(25)5

(25)5

(26)

(26)

(27)

(27)

(28)

(28)

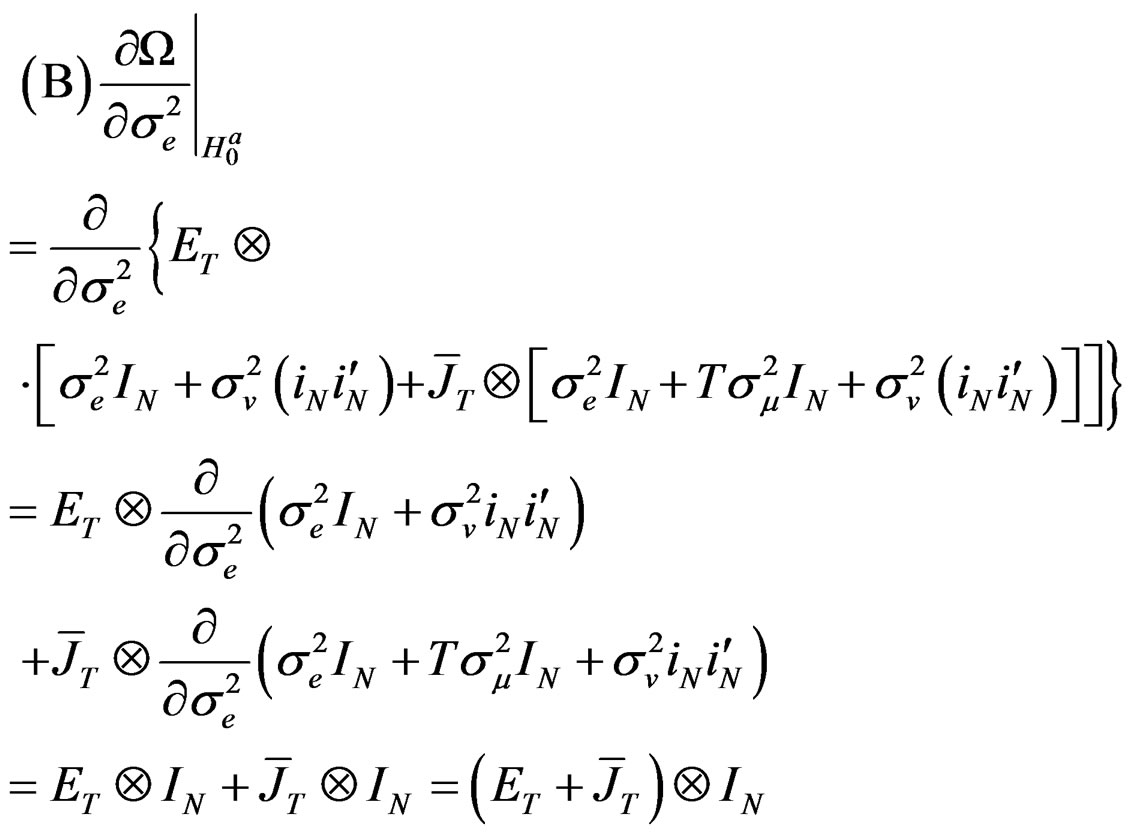

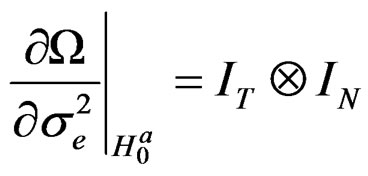

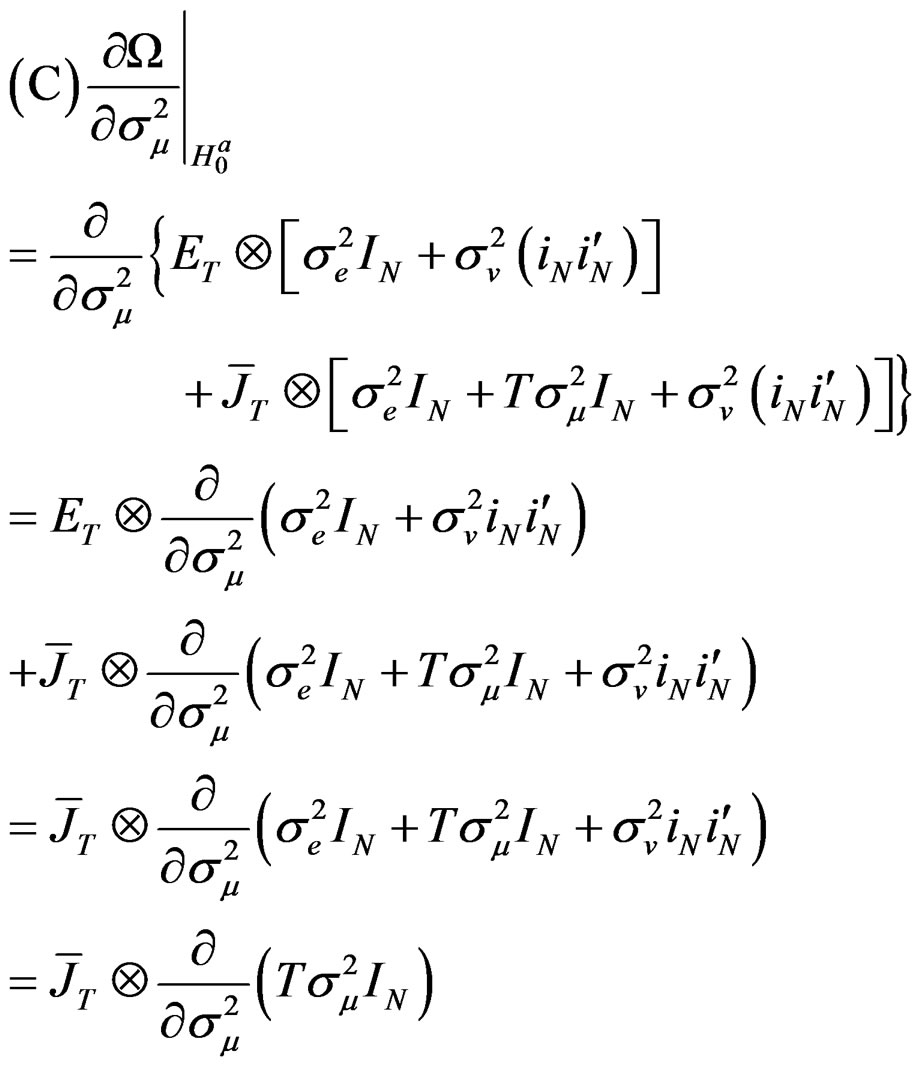

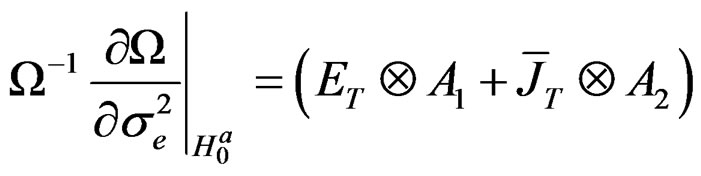

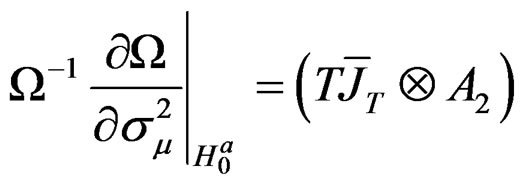

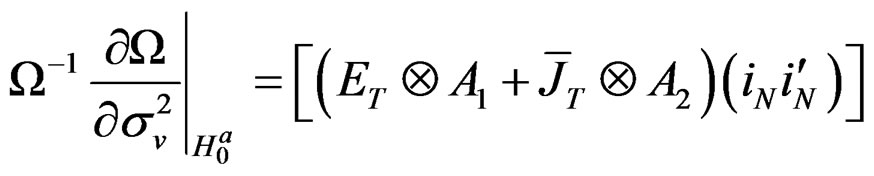

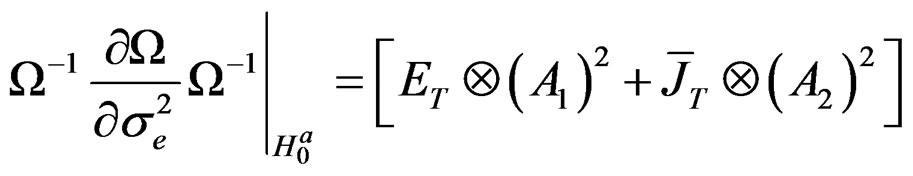

Proposition 2: Based on proposition 1 and assumptions 2 and 3, we can write the derivations of  for the parameters,

for the parameters,  ,

,  ,

,  and

and , respectively, as:

, respectively, as:

wang#title3_4:spProof:

These derivatives are quite straightforward to show particularly using the information in proposition 1.

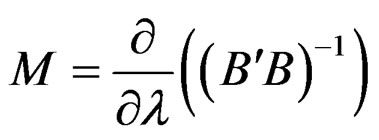

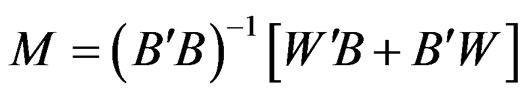

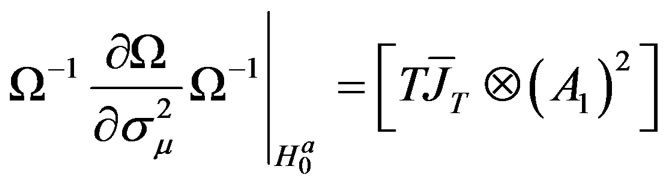

Proposition 3: Based on propositions 1 and 2 and assumptions 2 and 3, we can write the derivations of

for the parameters,

for the parameters,  ,

,  ,

,  and

and

, respectively, as:

, respectively, as:

wang#title3_4:spProof:

These derivatives are straightforward to show using the information in proposition 2.

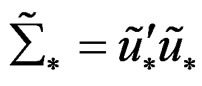

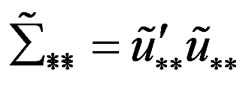

Proposition 4: Following propositions 1 - 3, we can easily calculate the partial derivates  for

for

,

,

and , respectively, evaluated at the restricted MLE:

, respectively, evaluated at the restricted MLE:

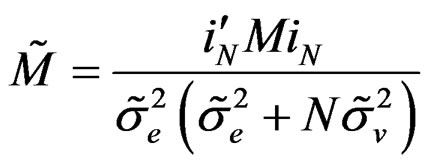

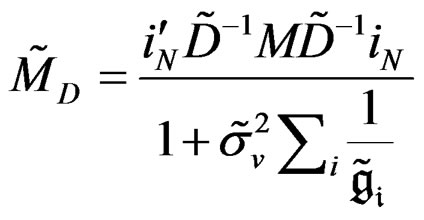

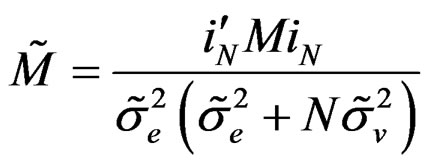

where ;

;

;

;

where ;

;  and

and .

.

where  and

and

.

.

Proof:

See the appendix for further simplifications and proofs of the partial derivatives.

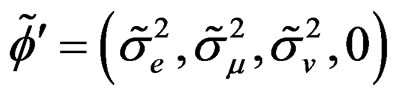

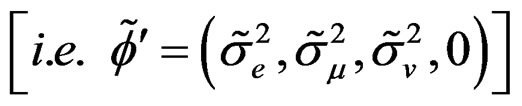

Recall that we define , thereforeunder

, thereforeunder ,

,  can be defined as the solution obtained after maximization of the first order condition and

can be defined as the solution obtained after maximization of the first order condition and  is the corresponding residual under

is the corresponding residual under . Note that all the parameters

. Note that all the parameters

were evaluated when

were evaluated when

at the restricted MLE except

at the restricted MLE except  . This is because we are testing whether

. This is because we are testing whether  is statistically different from zero. Thus, the partial derivatives under

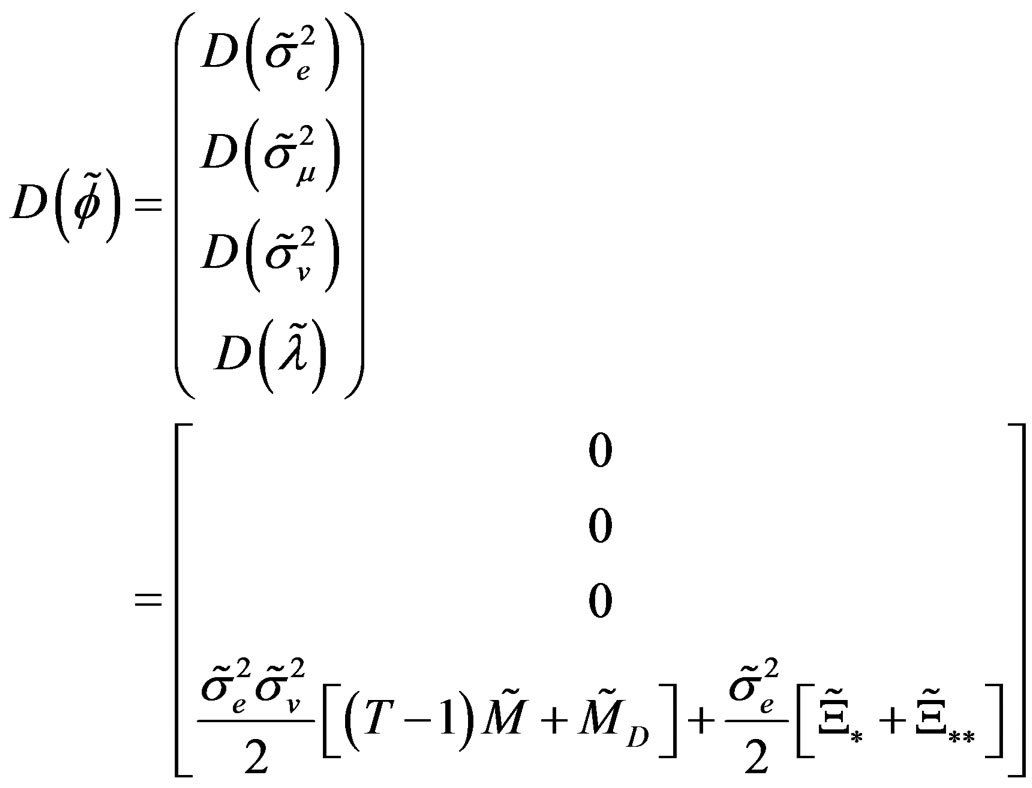

is statistically different from zero. Thus, the partial derivatives under  are rewritten in vector form as:

are rewritten in vector form as:

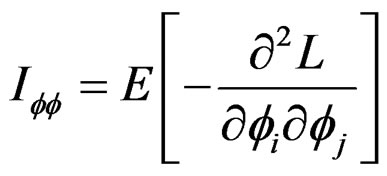

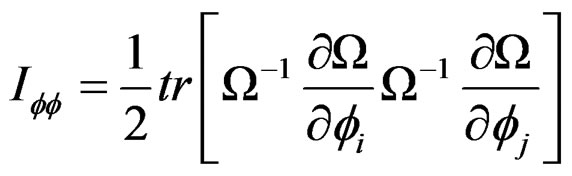

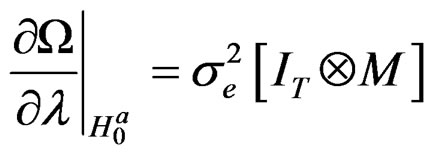

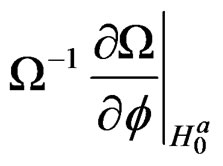

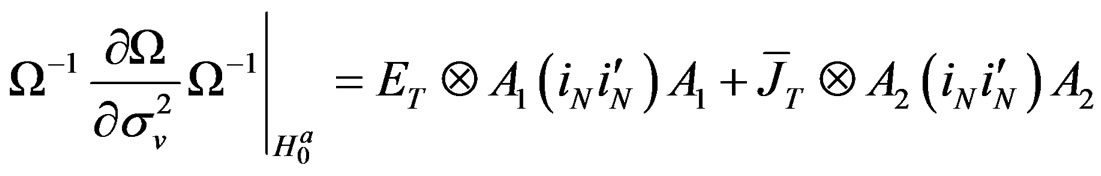

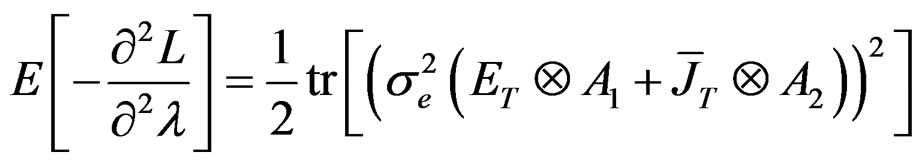

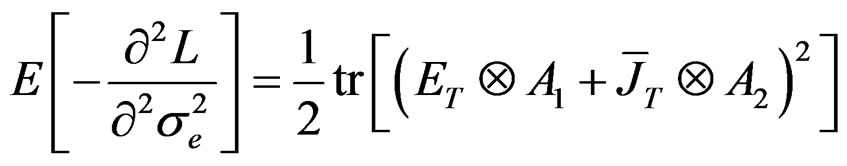

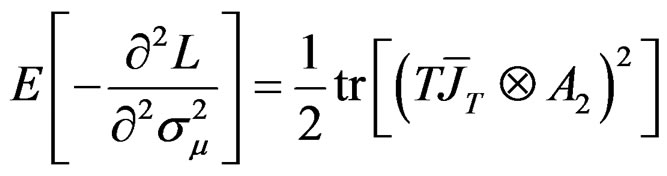

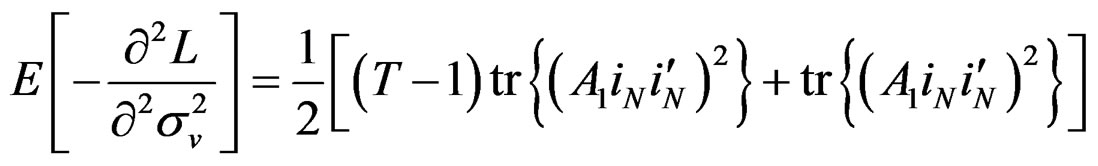

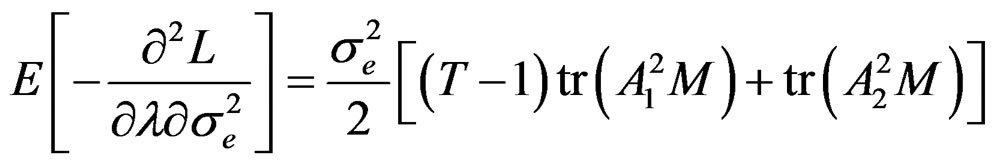

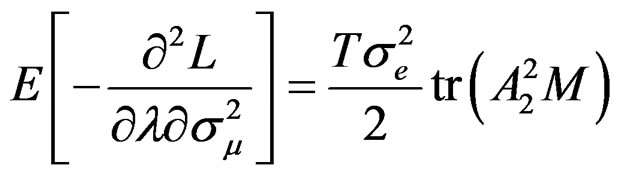

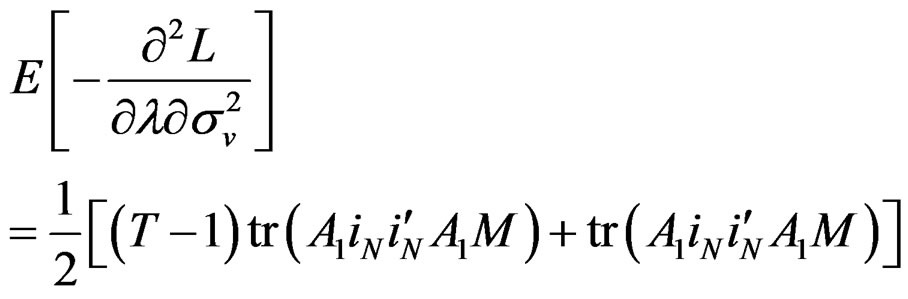

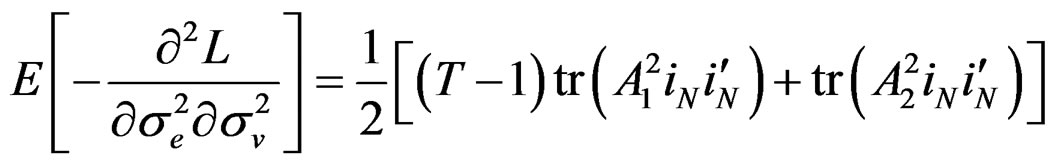

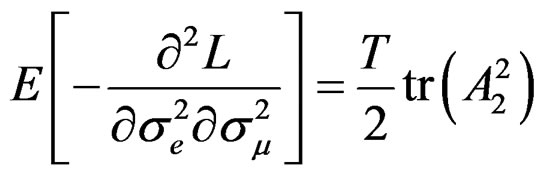

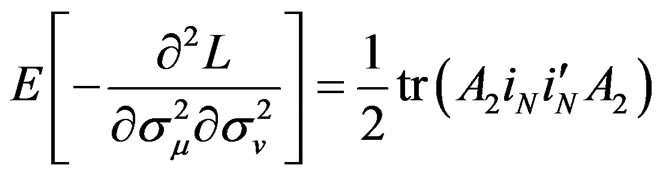

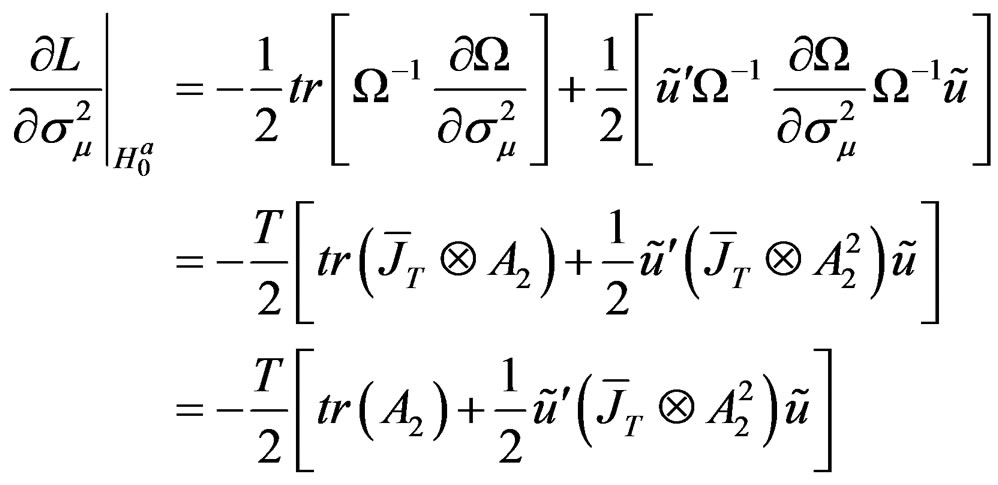

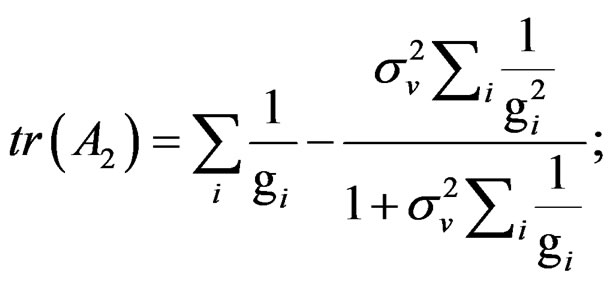

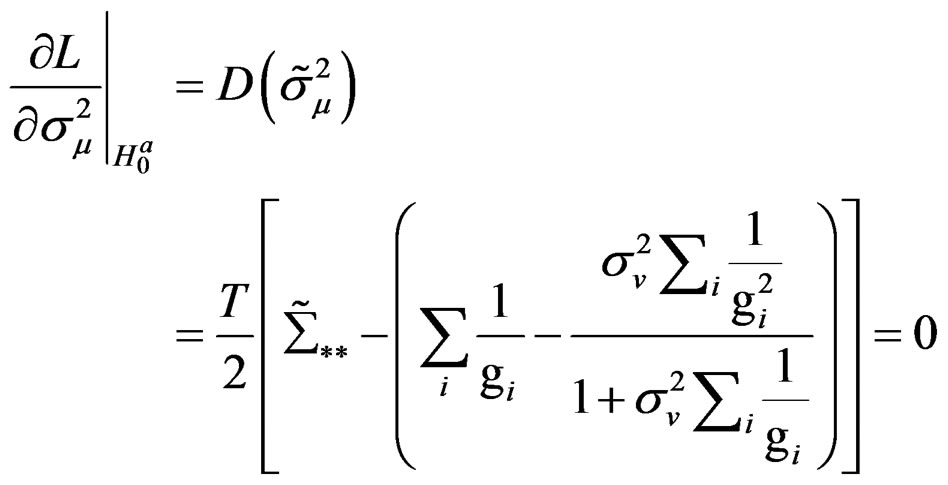

Also, using the method developed by [27], we obtain the information matrix under . The information matrix is given by:

. The information matrix is given by:

(29)

(29)

Proposition 5: Using the formular expressed in Equation (29) and information in proposition 2, we can derive respective elements in  under

under  for the vector of parameters

for the vector of parameters  as follows:

as follows:

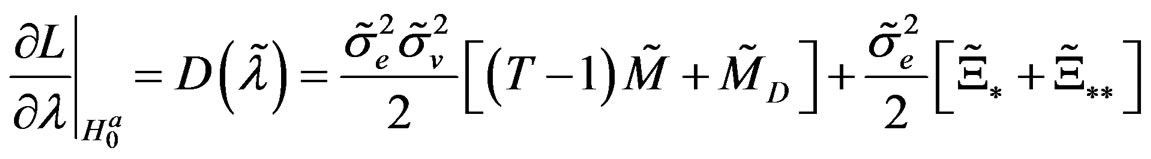

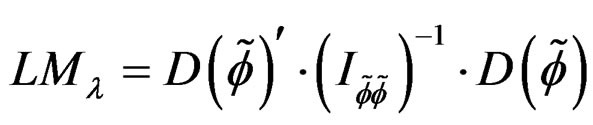

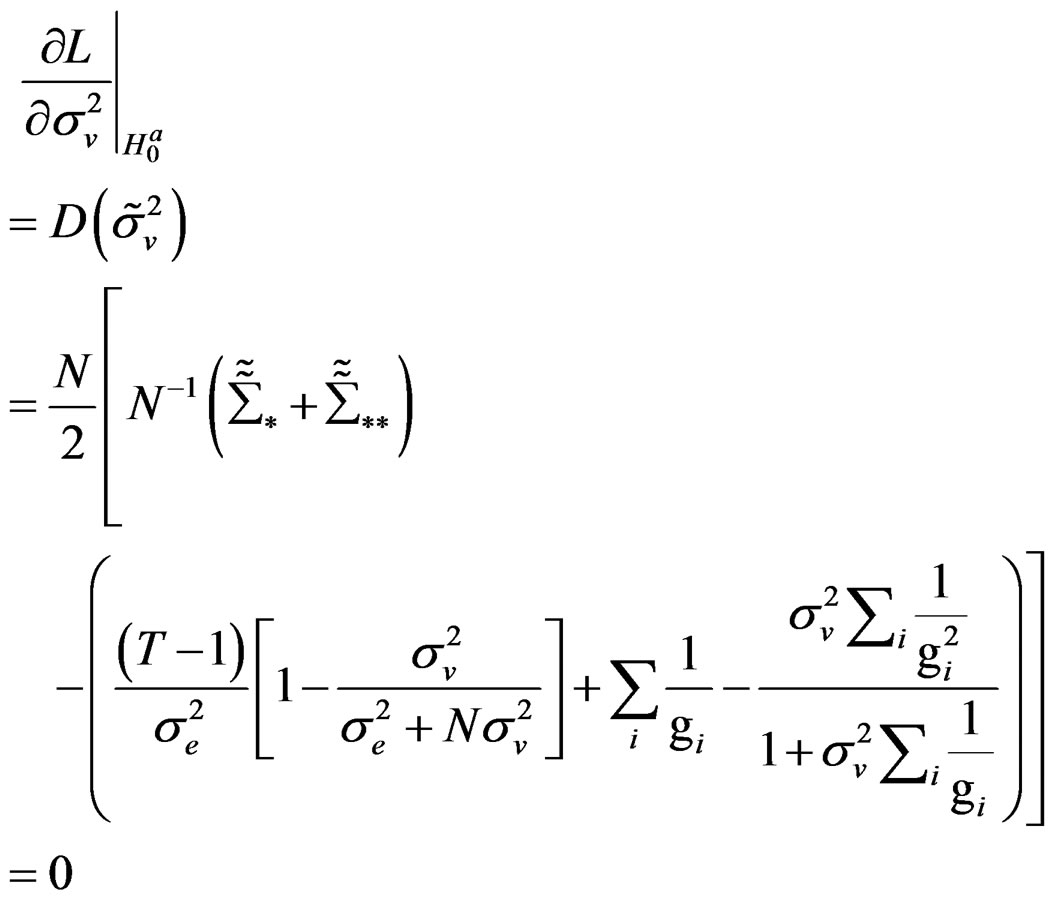

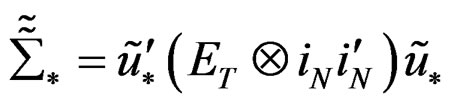

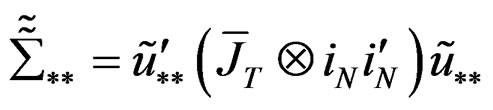

Given these information under , the LM statistic is given by,6

, the LM statistic is given by,6

(30)

(30)

Under  is distributed as

is distributed as . The statistic expressed in (30) is the LM test statistic, which tests for no cross-sectional dependence in a two-way random effects model.

. The statistic expressed in (30) is the LM test statistic, which tests for no cross-sectional dependence in a two-way random effects model.

Decision Criteria:

The LM statistic is a scalar and the value obtained when the test is performed on the two-way error components model is compared with the critical value for the chi-squared distribution— . The intention is to ascertain whether to reject the null hypothesis,

. The intention is to ascertain whether to reject the null hypothesis,  , that there is no cross-sectional dependence problem in a two-way random effects model. Essentially, if

, that there is no cross-sectional dependence problem in a two-way random effects model. Essentially, if  is less than the critical value for the chi-squared distribution, then, we do not reject the null hypothesis implying that there is no cross-sectional dependence; otherwise, we reject it.

is less than the critical value for the chi-squared distribution, then, we do not reject the null hypothesis implying that there is no cross-sectional dependence; otherwise, we reject it.

4. Concluding Remarks

This paper provides a framework for testing for no crosssectional dependence assuming the presence of random individual and time effects. Thus, several important issues have not been incorporated. These include testing other hypotheses earlier specified, that is;  which tests for crosssectional dependence assuming the presence of random individual effect only (while ignoring the presence of time effects; and

which tests for crosssectional dependence assuming the presence of random individual effect only (while ignoring the presence of time effects; and  which tests for cross-sectional dependence ignoring the presence of both the random country and time effects. Also, the empirical applications section involving Monte Carlo experiments is also not yet considered. These are some of the suggestions for future research.

which tests for cross-sectional dependence ignoring the presence of both the random country and time effects. Also, the empirical applications section involving Monte Carlo experiments is also not yet considered. These are some of the suggestions for future research.

REFERENCES

- B. H. Baltagi, S. H. Song and W. Koh, “Testing Panel Data Regression Models with Spatial Error Correlation,” Journal of Econometrics, Vol. 117, No. 1, 2003, pp. 123- 150. doi:10.1016/S0304-4076(03)00120-9

- L. Anselin, “Rao’s Score Tests in Spatial Econometrics,” Journal of Statistical Planning and Inference, Vol. 97, No. 1, 2001, pp. 113-139. doi:10.1016/S0378-3758(00)00349-9

- B. H. Baltagi, “Econometric Analysis of Panel Data,” 6th Edition, Wiley, Chichester, 2008.

- L. Anselin, “Spatial Econometrics: Methods and Model,” Kluwer Academic Publishers, Dordrecht, 1988.

- L. Anselin and S. Rey, “Properties of Tests for Spatial Dependence in Linear Regression Models,” Geographical Analysis, Vol. 23, No. 2, 1991, pp. 112-131. doi:10.1111/j.1538-4632.1991.tb00228.x

- J. Ord, “Estimation Methods for Models of Spatial Interaction,” Journal of the American Statistical Association, Vol. 70, No. 349, 1975, pp. 120-126. doi:10.2307/2285387

- A. Brandsma and R. Ketellapper, “Further Evidence on Alternative Procedures for Testing of Spatial Autocorrelation among Regression Disturbances,” In: C. Bartels and R. Ketellapper, Eds., Exploratory and Explanatory Analysis in Spatial Data, Martinus Nijhoff, Boston, 1979, pp. 11-36. doi:10.1007/978-94-009-9233-7_5

- H. Bloommestein, “Specification and Estimation of Spatial Econometric Models: A Discussion of Alternative Strategies for Spatial Economic Modeling,” Regional Science and Urban Economics, Vol. 13, No. 2, 1985, pp. 251-270. doi:10.1016/0166-0462(83)90016-9

- H. Kelejian and I. R. Prucha, “A Generalized Moments Estimator for the Autoregressive Parameter in a Spatial Model,” International Economic Review, Vol. 40, No. 2, 1999, pp. 509-533. doi:10.1111/1468-2354.00027

- H. H. Kelejian, I. R. Prucha and E. Yusefovich, “Instrumental Variable Estimation of A Spatial Autoregressive Model with Autoregressive Disturbances: Large and Small Sample Results,” In: J. LeSage and R. K. Pace, Eds., Spatial and Spatiotemporal Econometrics (Advances in Econometrics), Vol. 18, Elsevier, New York, 2004, pp. 163-198. doi:10.1016/S0731-9053(04)18005-5

- R. Haining, “Spatial Data Analysis in the Social and Environmental Sciences,” Cambridge University Press, Cambridge, 1988.

- L. Anselin and A. K. Bera, “Spatial Dependence in Linear Regression Models with an Introduction to Spatial Econometrics,” In: A. Ullah and D. E. A. Giles, Eds., Handbook of Applied Economic Statistics, Marcel Dekker, New York, 1998.

- P. Burridge, “On the Cliff-Ord Test for Spatial Autocorrelation,” Journal of the Royal Statistical Society, Vol. 42, 1980, pp. 107-108.

- J. S. Huang, “The Autoregressive Moving Average Model for Spatial Analysis,” Australian Journal of Statistics, Vol. 26, No. 2, 1988, pp. 169-178. doi:10.1111/j.1467-842X.1984.tb01231.x

- A. Case, “Spatial Patterns in Household Demand,” Econometrica, Vol. 59, No. 4, 1991, pp. 953-965. doi:10.2307/2938168

- K. V. Mardia and R. J. Marshall, “Maximum Likelihood Estimation of Models for Residual Covariance in Spatial Regression,” Biomerika, Vol. 71, No. 1, 1984, pp. 135- 146. doi:10.1093/biomet/71.1.135

- K. V. Mardia, “Maximum Likelihood Estimation for Spatial Models,” In: D. A. Griffith, Ed., Spatial Statistics: Past, Present and Future, Institute of Mathematical Geography, Ann Arbor, 1990, pp. 203-251.

- H. Kelejian and D. P. Robinson, “Spatial Correlation: A Suggested Alternative to the Autoregressive Model,” In: L. Anselin and R. Florax, Eds., New Directions in Spatial Econometrics, Springer-Verlag, Berlin, 1995, pp. 75-95. doi:10.1007/978-3-642-79877-1_3

- L. Anselin and R. Moreno, “Properties of Tests for Spatial Error Components,” Regional Science and Urban Economics, Vol. 33, No. 5, 2003, pp. 595-618. doi:10.1016/S0166-0462(03)00008-5

- L. Anselin, “Some Robust Approaches to Testing and Estimation in Spatial Econometrics,” Regional Science and Urban Economics, Vol. 20, No. 2, 1990, pp. 1-17. doi:10.1016/0166-0462(90)90001-J

- H. Kelejian and I. R. Prucha, “A Generalized Spatial Two Stage Least Squares Procedure for Estimating a Spatial Autoregressive Model with Autoregressive Disturbances,” Journal of Real Estate Finance and Economics, Vol. 17, No. 1, 1998, pp. 99-121. doi:10.1023/A:1007707430416

- B. H. Baltagi, S. H. Song, B. C. Jung and W. Koh, “Testing for Serial Correlation, Spatial Autocorrelation and Random Effects Using Panel Data,” Journal of Econometrics, Vol. 140, No. 1, 2007, pp. 5-51. doi:10.1016/j.jeconom.2006.09.001

- B. H. Baltagi, S. H. Song and J. H. Kwon, “Testing for Heteroscedasticity and Spatial Correlation in a Random Effects Panel Data Model,” Computational Statistics and Data Analysis, Vol. 53, No. 8, 2009, pp. 2897-2922. doi:10.1016/j.csda.2008.06.009

- T. J. Wansbeek and A. Kapteyn, “A Simple Way to Obtain the Spectral Decomposition of Variance Components Models for Balanced Data,” Communications in Statistics, Vol. 11, No. 18, 1982, pp. 2105-2112. doi:10.1080/03610928208828373

- J. R. Magnus, “Multivariate Error Components Analysis of Linear and Nonlinear Regression Models by Maximum Likelihood,” Journal of Econometrics, Vol. 19, No. 2-3, 1982, pp. 239-285. doi:10.1016/0304-4076(82)90005-7

- J. R. Magnus and H. Neudecker, “Matrix Differential Calculus with Applications in Statistics and Econometrics,” Wiley Series in Probability and Statistics, Chichester, 1988.

- D. A. Harville, “Maximum Likelihood Approaches to Variance Component Estimation and to Related Problems,” Journal of the American Statistical Association, Vol. 72, No. 358, 1977, pp. 320-338. doi:10.2307/2286796

Appendix

(A) Derivation of the VCV Matrix for the Unrestricted Model

Here,  and the VCV matrix of u can be derived as follows.

and the VCV matrix of u can be derived as follows.

Recall Equation (10),

Using assumption (1), the VCV matrix can be expressed as:

(A.1)

(A.1)

Let  in this case be represented by

in this case be represented by , and by further simplification, (A.1) becomes:

, and by further simplification, (A.1) becomes:

(A.2)

(A.2)

(A.3)

(A.3)

where  and it is a matrix of ones of dimension T. To obtain the spectral decomposition of (A.3), we use the [24] method which involves replacing

and it is a matrix of ones of dimension T. To obtain the spectral decomposition of (A.3), we use the [24] method which involves replacing  by

by  and

and  by

by  where

where  and

and  in (A.3). This is done as follows:

in (A.3). This is done as follows:

(A.4)

(A.4)

Using the [25] method of inversion, therefore, the inverse of Equation (A.5) can be expressed as:

(A.5)

(A.5)

where  and

and

(B) Derivation of the VCV Matrix for the Restricted Model

Here,  and as a consequence,

and as a consequence, . Given this assumption, Equation (10) reduces to:

. Given this assumption, Equation (10) reduces to:

(B.1)

(B.1)

Then, using assumption (1), the VCV matrix can be expressed as:

(B.2)

(B.2)

Thus, (A.4) under the unrestricted model reduces to:

(B.3)

(B.3)

(B.4)

(B.4)

Just as before, we use the [24] method to obtain the spectral decomposition of (B.4) and following the same procedure as Appendix A, we have:

(B.5)

(B.5)

Similarly, using the [25] method of inversion,  can be expressed as:

can be expressed as:

(B.6)

(B.6)

where  and

and

.

.

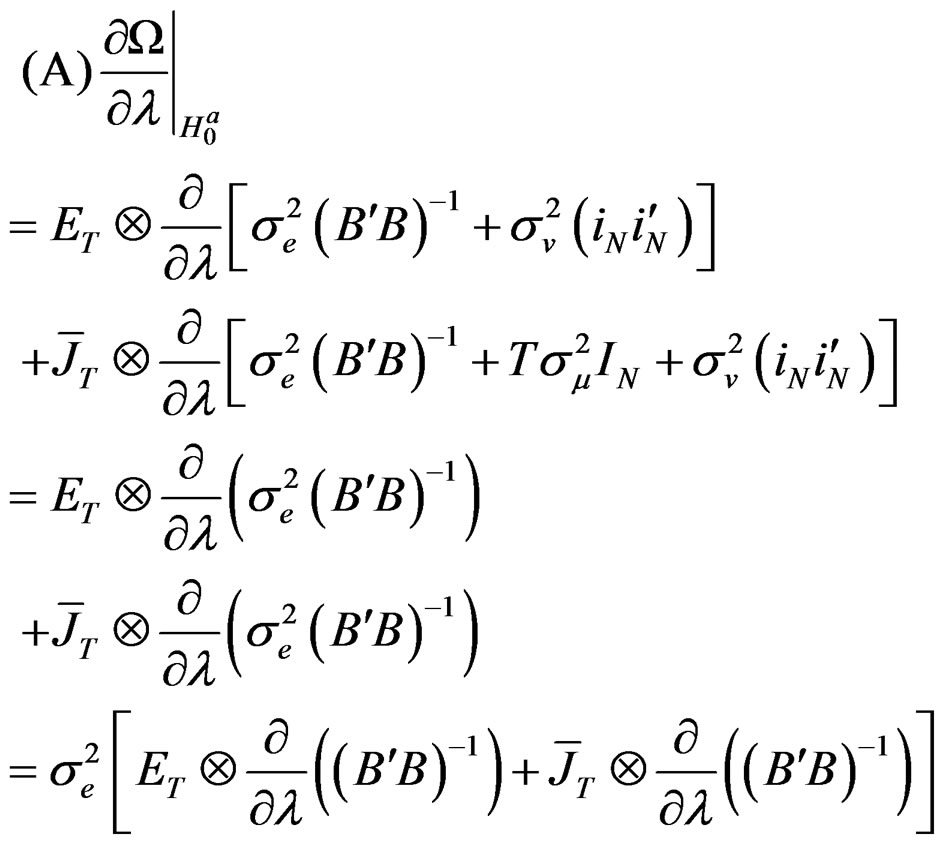

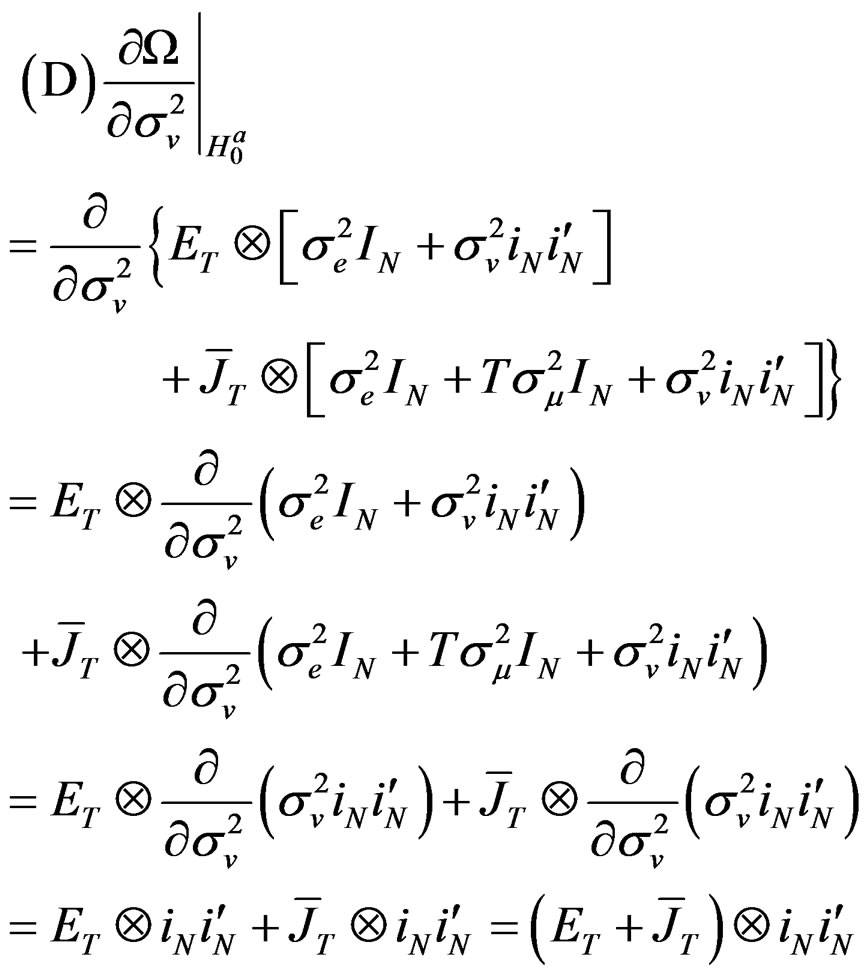

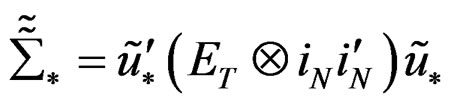

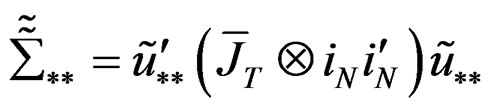

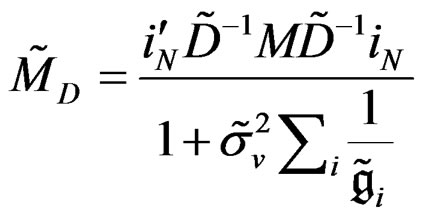

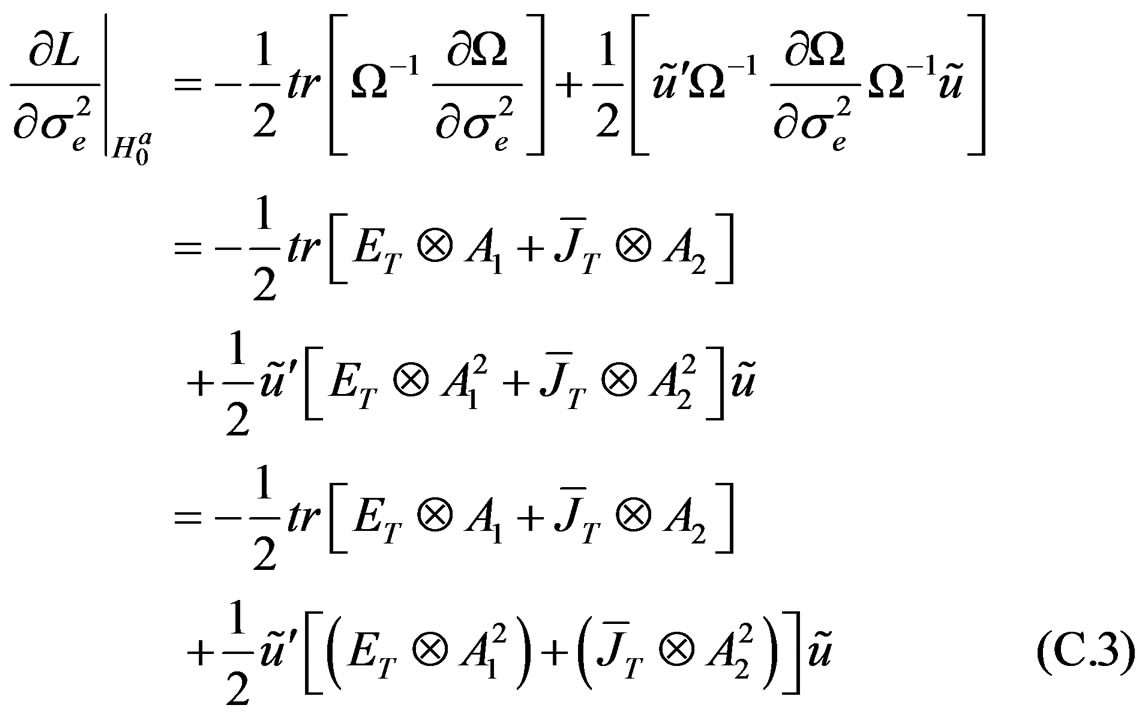

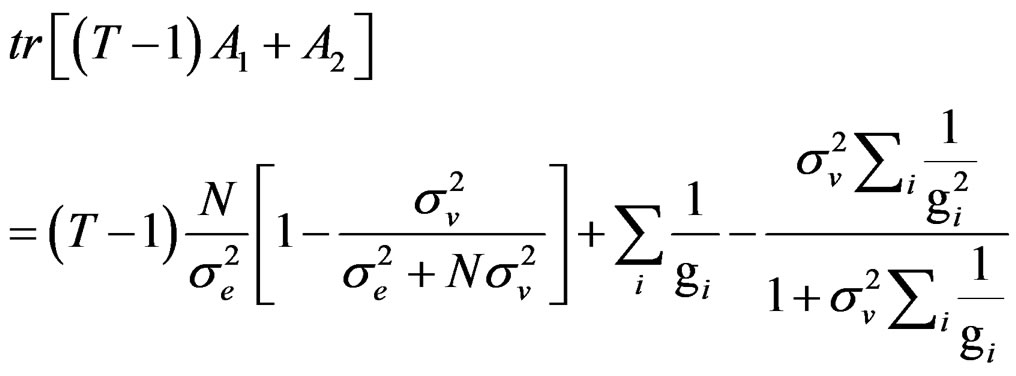

(C) Derivation of the Partial Derivatives

(C.1)

Note that:

where .

.

Therefore,

By some algebraic simplifications, we can write that:

Note further that:

in which case,

therefore;

therefore;

Similarly,

in which case,

therefore;

therefore;

.

.

As a consequence, we can write (C.1) as:

(C.2)

(C.2)

where ;

;

Using the information leading to (C.2), we can prove that:

And also with the representations that:

in which case,

in which case,

therefore;

therefore;

;

;

and in the same vein,

.

.

Given this information therefore, (C.3) becomes:

(C.4)

(C.5)

(C.5)

Using the information that:

;

;

and

(C.5) becomes,

(C.6)

(C.6)

(C.7)

where  and

and

.

.

NOTES

1A review of score test statistics for alternative specifications in spatial econometrics in the context of cross sectional data and one-way error components model can be found in [2,3] respectively.

2See the appendix for the derivation.

3Note that  and

and  are symmetric idempotent matrices.

are symmetric idempotent matrices.

4See the appendix for the derivation.

5We also replace  by

by  where

where .

.

6Details of derivations of the information matrix can be provided on request.