Paper Menu >>

Journal Menu >>

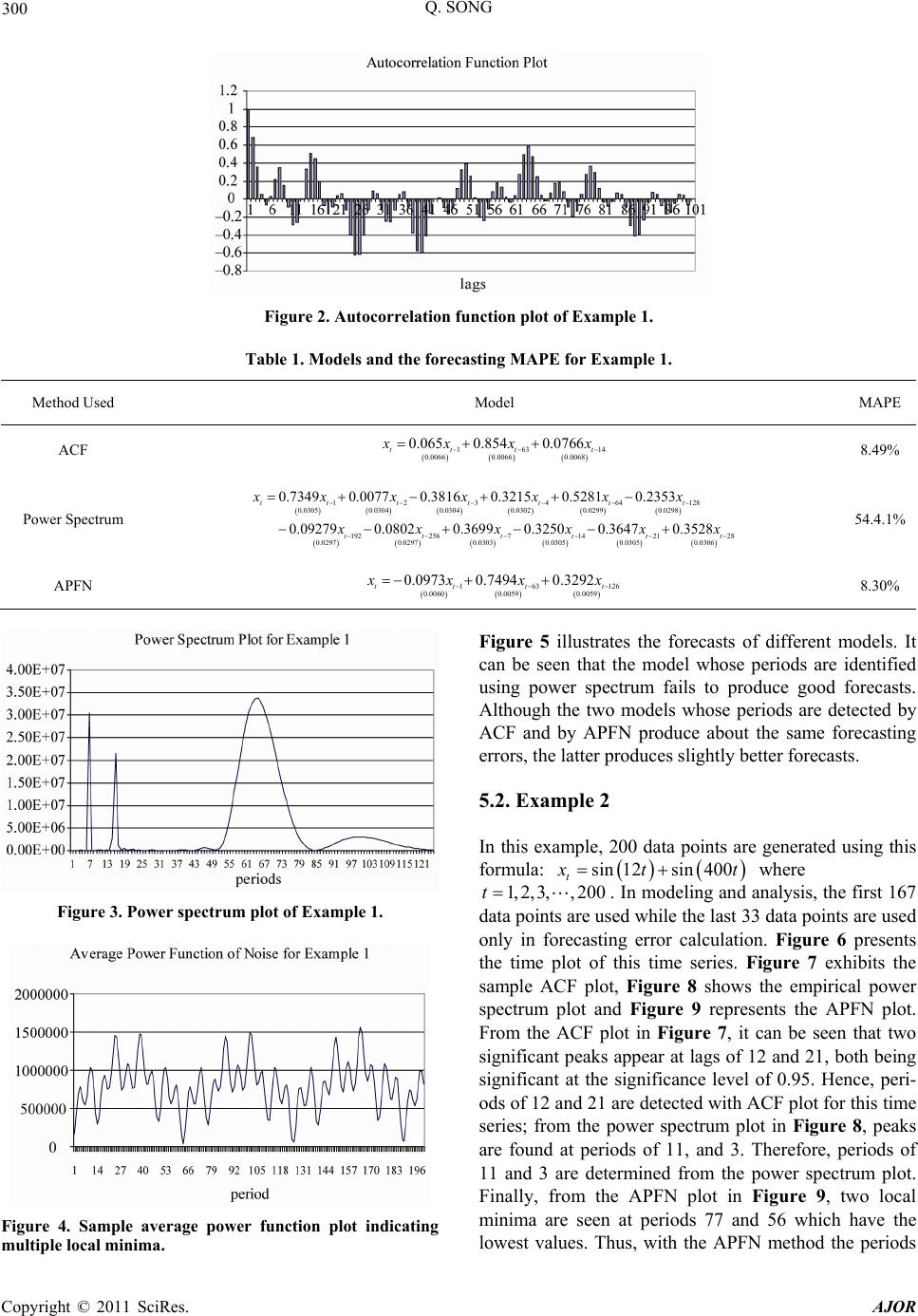

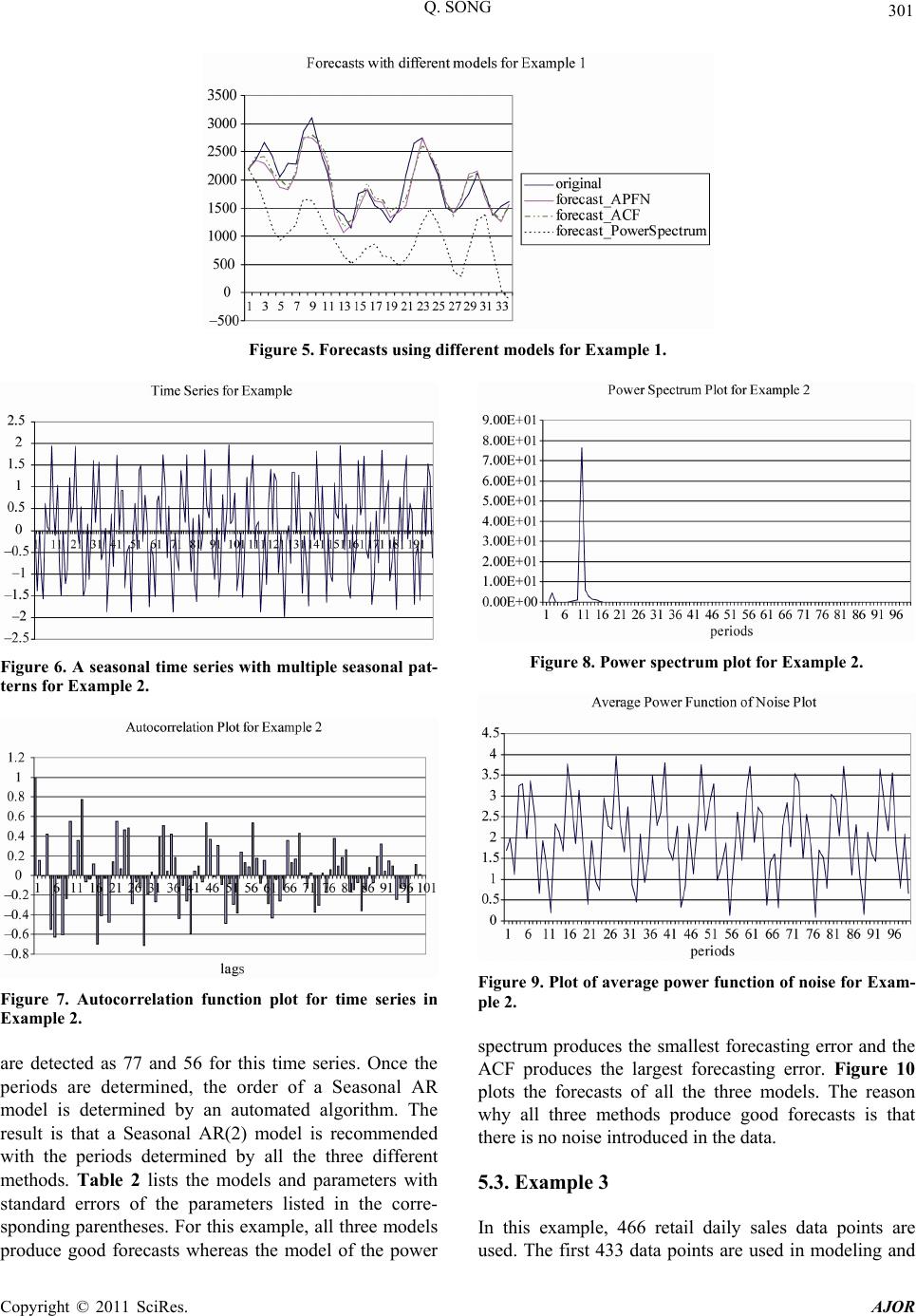

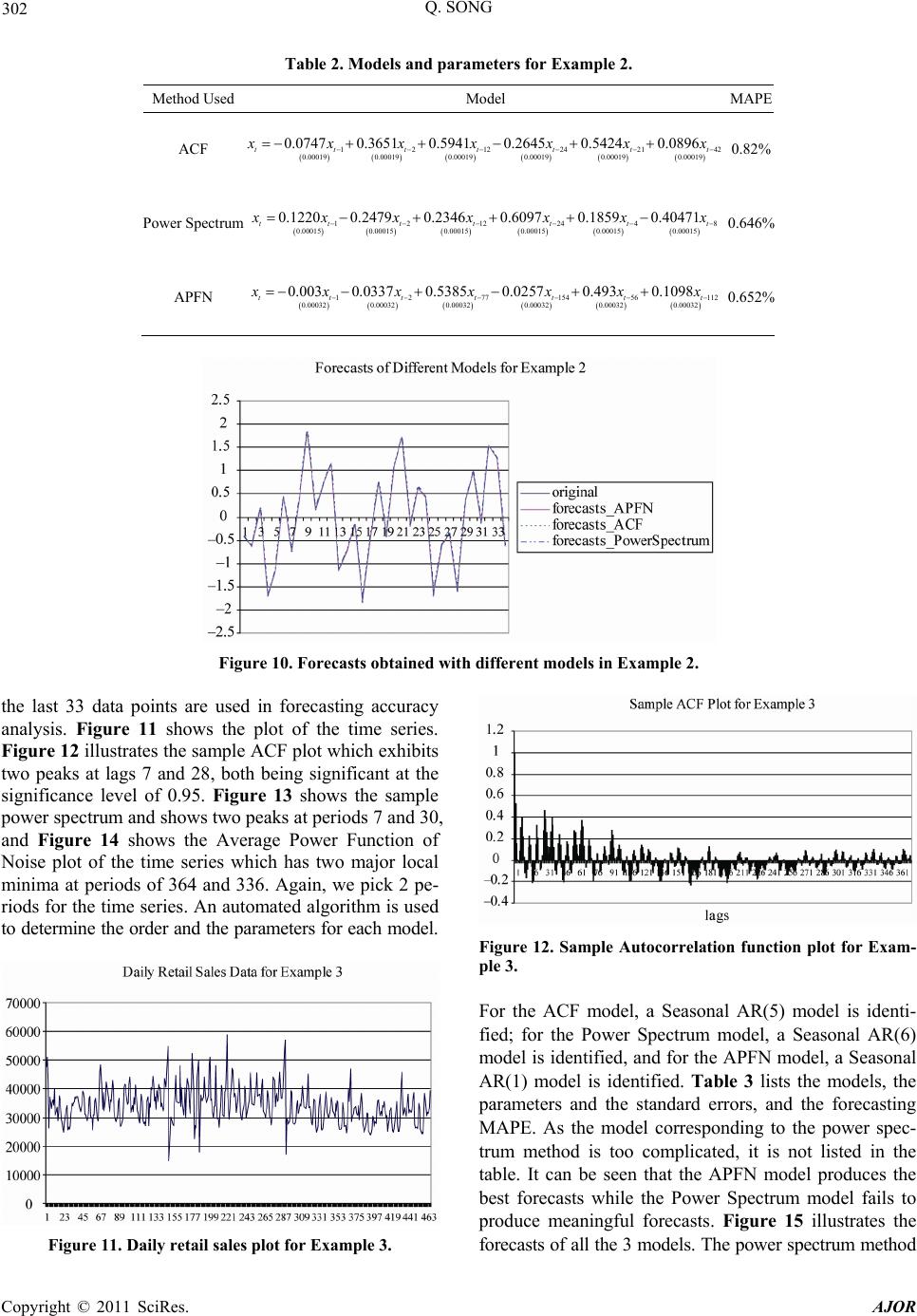

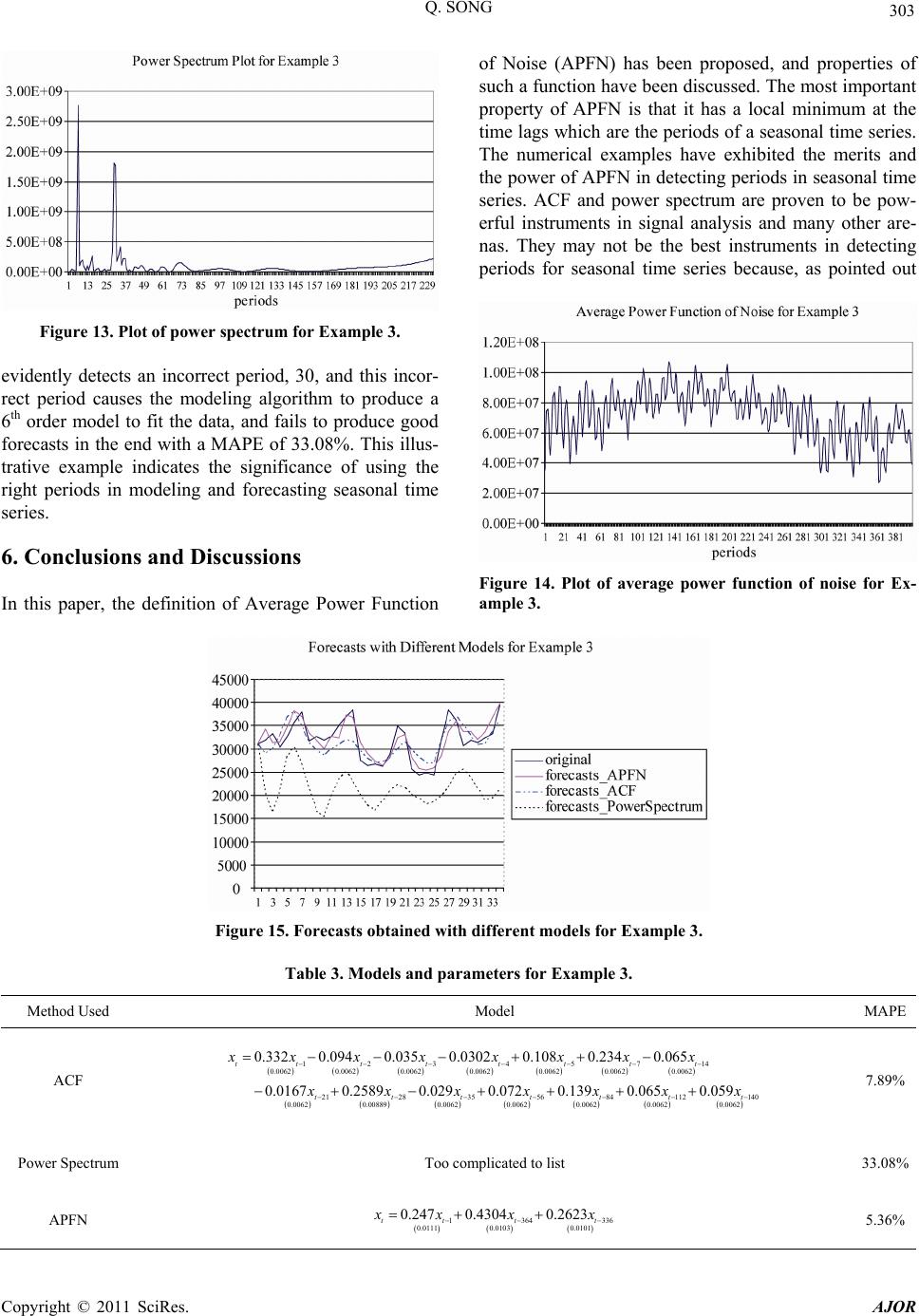

American Journal of Oper ations Research, 2011, 1, 293-304 doi:10.4236/ajor.2011.14034 Published Online December 2011 (http://www.SciRP.org/journal/ajor) Copyright © 2011 SciRes. AJOR 293 Average Power Function of Noise and Its Applications in Seasonal Time Series Modeling and Forecasting Qiang Song RedPrairie Corporation, Alpharetta, USA E-mail: qiang.song@redprairie.com, qsong3@hotmail.com Received August 29, 2011; revised Septembe r 25, 2011; accepted Octo ber 11, 2011 Abstract This paper presents a new method of detecting multi-periodicities in a seasonal time series. Conventional methods such as the average power spectrum or the autocorrelation function plot have been used in detecting multiple periodicities. However, there are numerous cases where those methods either fail, or lead to incor- rectly detected periods. This, in turn in applications, produces improper models and results in larger fore- casting errors. There is a strong need for a new approach to detecting multi-periodicities. This paper tends to fill this gap by proposing a new method which relies on a mathematical instrument, called the Average Power Function of Noise (APFN) of a time series. APFN has a prominent property that it has a strict local minimum at each period of the time series. This characteristic helps one in detecting periods in time series. Unlike the power spectrum method where it is assumed that the time series is composed of sinusoidal func- tions of different frequencies, in APFN it is assumed that the time series is periodic, the unique and a much weaker assumption. Therefore, this new instrument is expected to be more powerful in multi-periodicity de- tection than both the autocorrelation function plot and the average power spectrum. Properties of APFN and applications of the new method in periodicity detection and in forecasting are presented. Keywords: Seasonal Time Series, Forecasting, Seasonality Detection, Average Power Function of Noise, Average Power Spectrum, Autocorrelation Functions 1. Introduction Recently, modeling and forecasting seasonal time series with multiple periodicities has regained attentions from researchers [1-8]. There is an abundance of literature on modeling and forecasting time series with a single period [9,10]. However, with multiple periodicities existing in a seasonal time series, modeling and forecasting such a time series becomes quite complicated. An important task in modeling su ch time series is the determination of the cycle length of each period. In the literature of mod- eling and forecasting seasonal time series with multi- periodicities, the lengths of periods are determined by human beings, based on either their experience or their specific domain knowledge of the time series under study. For example, in determining the cycle lengths of periods in modeling and forecasting daily electricity load [7] two distinct periods are determined manually based on power spectrum and autocorrelation plots, one being the intraday period which corresponds to 24 hours, and the other being the intraweek period which corresponds to 168 hours. When the plurality of time series to work with is small, it may not be a significant problem for human beings to determine the length of each period. Nevertheless, it will become a forbidding task if the number of time series is in the range of tens of thousand s, not to mention the possibility that the periodicities may change over time. In this case, one has to resort to auto- mated algorithms to detect the periodicities in a time series. Traditionally, the average power spectrum and the autocorrelation functions have been used in detecting multiple periods [9-11]. Usually, if the number of peri- ods M in a seasonal time series is pre-determined, then the periods corresponding to the largest N peaks of the average power spectrum will be the periods in the time series [11, p. 161]. With ACF plot, one looks at the re- peating peaks and decides proper periods [9, p. 342]. However, there is a certain degree of subjectivity with those two approaches. This is reflected in applications  Q. SONG 294 where not all the M largest peaks of the average power spectrum are used in estimating the periods and not all the repeating peaks on the ACF plot are used as the pe- riods [5], and there could be conflicting outcomes from those two approaches. For instance in [5], two periods, 224 and 32, are determined for the five Central Teleph- ony series. Period 224 corresponds to the l arge st peak on the power spectrum plot while the peak at lag 224 on the ACF plot is even not significant at the confidence level of 0.95. Period 32 corresponds to a very small and even ignorable peak on the power spectrum; however, it con- curs with a significant peak (at the confid ence level 0.95) at lag 32 on the ACF plot (see Figure 4 and Figure 5 of [5] for details). It couldn’t be an easy job to manually choose 224 and 32 as the periods before actually running the forecast. This apparent contradiction lies in the sub- jectivity in detecting periods using the average power spectrum and the ACF plots, and for this reason it re- quires human intervention, modeling experience, and even domain knowledge. For the past decades, the average power spectrum has been utilized as a powerful apparatus in analyzing the distribution of the energy of a signal over different fre- quencies. It helps detect frequency components in a sig- nal. Undoubtedly, this tool is extremely helpful in signal analysis, communications, circuitry design, and many other areas. Nevertheless, the average power spectrum may not be as effective as one would expect in deter- mining periods in seasonal time series and forecasting simply because the frequencies or the periods with the strongest energy may not be the right periods needed in forecasting. Figure 11 in this paper presents a time series of the daily sales at a retail store for over one year period of time. This time series exhibits 3 major different peri- ods: 7, 28 and 364 due to the operational business cycles. On the sample ACF plot in Figure 12, there are signifi- cant peaks at lag 7 and at lag 28, and both are significant at the significance level of 0.95. However, the peak at lag 364 is not significant at the significance level of 0.95. At lag 28, the ACF plot has the largest peak. At lag 7, the ACF plot has the second largest peak. On the sample power spectrum in Figure 13, period 7 has the largest peak, and period 31 has the second largest peak. Now, let us suppose we need to determine the periods of this time series, and we pick the highest peaks on either the ACF plot or the power spectrum which is common practice in the literature. Here is the dilemma with the power spec- trum and the ACF methods: If only two periods are cho- sen, those two methods would generate different results. Seasonal time series repeats itself after a certain time lag [9], in spite that du e to the noise in th e time series the degree to which the time series repeats varies. The right period should be the one at which the time series repeats itself with the smallest discrepancy, not necessarily the one repeating the most frequently but with a larger dis- crepancy. The largest peak on the power spectrum is the period in which the time series repeats the most fre- quently. For example, in the illustrative time series in Figure 11, the sample power spectrum has the largest peak at period 7. This is because the business activity of the store repeats week after week, and this pattern re- peats the most frequently. However, the state of the business of the store in different weeks of the same month could be quite different due to different patterns of customer spending behaviors. Thus, it is hard to say that the business repeats itself v ery well week after week. Looking at the time series plot, it seems that the business of the store repeats much better month after month than week after week. However, the sample power spectrum does not have the largest peak at period of 28. Instead, it has a peak at period 31. The sample ACF plot of this time series has the largest peak at lag 28; but, this is not consistent with the sample power spectrum. A deadlock has been encountered here in selecting a period for this seasonal time series based on the ACF plot and the power spectrum plot. Therefore, it is necessary to search for a new and different apparatus that does not depend on the frequencies in the time series, but depends on the degree to which the time series repeats itself. The goal of this paper is to presen t the construction and properties of such an instrument, namely, Average Power Function of Noise. This paper is organized as follows. In Section 2, the definition and properties of Average Power Function of Noise are presented. Distribution of the local minimum of the sample APFN is discussed in Section 3, followed by a discussion of measure of seasonality in Section 4. Three illustration examples are presented in Section 5, and conclusions and discussions are given in Section 6. 2. The Average Power Function of Noise and Its Properties In general, a seasonal time series exhibits periodic be- havior with period p, or a seasonal time series repeats itself after p basic time units [9, p. 327]. However, due to the noise in the time series, a seasonal time series rarely repeats itself in a perfect fashion. There is always dis- crepancy when comparing the observations of a seasonal time series at two different times over exactly p time unit span. Mathematically, a seasonal time series can be de- scribed as x tp xtt where t is the discrepancy and p is the period. Here, p should be under- stood as the minimum integer value that can be found and is greater than 1. This discrepancy, when processed properly, could be an indicator of periodicity of the sea- Copyright © 2011 SciRes. AJOR  Q. SONG Copyright © 2011 SciRes. AJOR 295 Definition 1 (Average Power Function of Noise): Let x t be a stochastic process. Then, for any given real numbers , if the following limit exists, it will be called the Average Power Function of Noise (APFN) of x t at lag : sonal time series. This is because if the time span be- tween two observations is indeed the period of the sea- sonal time series, the discrepancy should be smaller than if the time span is not the period of the seasonal time series. If the seasonal time series possesses multiple pe- riods, then the discrepancies at different periods may be quite different. A smaller discrepancy indicates a closer and better similarity between the observations at differ- ent times with zero discrepancy being the perfect and ideal case. We will explore and extend this idea in this section. 2 APFN limd 2 T TT xt xt Et T (1) Obviously, APFN is an even function of if x t is periodic. First, we consider the case where x t has a unique period p. Then, we have the follow- ing major result. Without loss of generality, we will work with stochas- tic processes and extend the obtained results to time se- ries in the sequel. In literature, discrepancies can be in various forms, such as absolute deviations, square of errors, and even absolute relative errors, just to name a few. Therefore, it is quite likely to obtain certain results parallel to what will be reported in this paper, if different forms of discrepancies are adopted. In this paper, we choose the square of errors as the form of discrepancy simply because of its good analytical properties. Theorem 1. Let x t be a stochastic process and be expressed as x tat t where at is the mean process of x t, i.e., , and is a deterministic function of t, and at t Ex t is a white noise process, i.e., t follows 2 0,N . If at is a periodic function of t with a unique period p so that atat p , then AP FN has a strict local minimum when p . Proof: As x tp atptp , if setting p in (1), then (1) can be written as First, we present the definition of Average Power Function of Noise, the corn er stone of this paper. 22 22 APFNlimd limd 22 2 limd 2 T T T T T T T TT at pt pattt pt pE tE TT tptp tt Et T t Exchanging the order of integration and expectation above and noticing that tp and t are inde-pendent, we obtain 22 22 22 APFNlimd limd 2 22 T T T T T T Etp tpt t pt TT t (2) When ,pNp where 0 and ,Np is a neighborhood of p, we have 2 2 2 2 APFNlimd limd 22 2 lim d 2 TT TT TT T TT xt pxtat ptpatt pE tE TT atp atatp attpttpt E t T t Exchanging the order of in tegration and mean calcula- tion and noticing that t is white noise and 0at pat , we will get That is, we have APFN APFNp p. (3) 22 2 22 2 APFN limd 2 limd22 2 T TT T TT at pat pE T at pat Et T t Therefore, AP FN has a strict local minimum at p. This finishes the proof. One of the forecasting methods, called naïve method, is to use the most recent history data as the forecast of the future. Here, if we use the history data exactly time units ago as the forecast, then x tx t can  Q. SONG 296 be interpreted as the forecasting error of xt using x t. Thus, (1) may be interpreted as the average power of forecasting errors using the naïve method. Theorem 1 implies that if a stochastic process is seasonal and if we use the right period in the naïve method to predict its future, the mean square function of the forecasting errors will have a local minimum. Intuitively, this is quite natural as for seasonal stochastic process, observations with the same periodicity are quite close to each other and therefore the differences are minimal. One of the merits of (1) is that it relates periods in a seasonal sto- chastic process to a type of forecasting errors in a natural way. This gives one an instrument helpful in detecting periods from multiple candidates: When detecting peri- ods for a seasonal stochastic process, select those periods that correspond to the smallest APFN values in (1). Fig- ure 14 presents the plot of the sample APFN of the sea- sonal time series of daily sales at a retail store. It can be seen that the APFN plots have a local minimum at period 7, 28, and 364, and the values of APFN at those three periods are different. With Theorem 1, it is easy to prove the follow ing cor- ollaries which assume that x t has a unique period. Corollary 1. APFN has the same periods as x t if x(t) itself is periodic. Corolla ry 2 . If p is a period of x t, then NAPF has a strict local minimum at any integral multiples where n is a nonzero integer. That is, if p is a period of np x t, then the corresponding local minima will repeat with the same period. Corollary 3. If x t is a white noise, then APFN is a constant with respect to . Corollary 4. Let APFN* be the global minimal value of the average power function of noise. Then, we have *2 2AP FN , or *2 APFN 2 . Corollary 4 implies that the global minimal value of APFN, when divided by 2, can be used as an upper bound of the variance of the noise in the stochastic proc- ess. This will be seen very useful in estimating the fore- casting error variance. A seasonal stochastic process may have multiple pe- riods. Now, let us consider the potential sources that contribute to the error or discrepancy when forecasting a seasonal stochastic process, including processes with a unique period and multiple periods. Of course, the major source is the noise in the data. This noise will always produce error in forecasting. There is a second source, however, that is any improper time lags chosen in fore- casting xt when multiple periods exist. For dif- ferent values of , the errors could be quite different. This is reflected in the APFN plot which exhibits multi- ple local minima with different values. We intend to in- terpret this phenomenon by means of the conditional variance of the noise defined as a deterministic periodic function of . With this said, we could have the fol- lowing theorem. Theorem 2. Let x t be a stochastic process and be expressed as x tat t where at is the mean process of x t and is a deterministic periodic function of t, and t is a noise process which follows 2 0,N and the conditional variance 2 Et t is a deterministic periodic function of and 0 i Etp t . If both at and have the same periods i so that p i pat at, has a local minimum when i p and i p j where , then there exists a such that 1, 2,,iM APFN has a global minimum when i p where 1. jM Proof: Let be one period. It can be shown that i p 22 22 2 APFN lim im iT T TT pE d 2 2 ld 2 Tii T ii tptp ttt T Etptpt t t T In the above, it is assumed that the orders of the inte- gration and the expectation operations can be exchanged. Conditioning the expectation on t , we obtain 22 2 EE t E tp2 2 APFN limd 2 2() lim d 2 Tii iT T Tii TT pt pttt pt T EtEtEtptEtt T As 2 Et t function of and 0 i Etp t is a deterministic periodic , we have Copyright © 2011 SciRes. AJOR  297 Q. SONG 22 APFN limd 2 Ti iT T EEt pt pt T 2 i p When i p , 2 2 2 2 2 2 2 APFN limd 2 2 limd 2 2 limd 2 T TT T TT T at atat attttt Et T EEat atat attttttt T at at EEat attttEEtttt T 2 limdAPFN 2 T T Ti T i T EEt ptttp T for in the above 2 limd 0 2 T TT atat t T , 0Et t , and 0Et Therefore, i is a strict local minimum. Among the M local minima, there must be one that is the smallest, and that minimum must correspond to a certain period APFN p j p. This finishes the proof. Theorem 2 explains why the APFN could have multi- ple local minima with different values in the case where multiple periods exist: it is due to the conditional vari- ance function of t which has different values at different periods. From Corollary 2, we can prove that if is a period of i p x t for , then 1, 2,,iM AP FN will have a local minimum at any multiples of i, i.e., i is also a local minimum. Hence, we have the following con clusion. p FN AP np Corollary 5. If x t APF has multiple distinct periods 12 , then ,,, m pp p N has a strict local mini- mum at each period where . i From Theorem 2, we may conclude that not all periods have equal APFN values. The period that yields the global minimum APFN value is the most important one and is the one that must be found in modeling as it may produce the smallest forecasting error using the naïve method. For this reason, we give the following defini- tion. np 1, 2,,iM Definition 2. Suppose x t is a stochastic process and can be expressed as x tat t where at is a deterministic periodic function of t and t is a noise process which follows 2 0,N and the conditional variance ()t 2 Et is a determinis- tic periodic function of . Suppose also that both at and 2()Et t have the same periods i p where 1, 2,,iM , then the period that yields the smallest APFN value is called the primary period while all others secondary periods. Hence, if only one period is chosen for a seasonal sto- chastic process, it should be the primary period. How- ever, one may not be able to find the primary period if using the power spectrum or ACF plot. The APFN plot can also be used to identify if a deter- ministic trend exists in a process. Corollary 6. If x tbt t where is a non- zero constant andb t is a white noise process, then APFN is an increasing function of . To apply APFN in detecting the cycle lengths of mul- tiple periods for a seasonal stochastic process, we rec- ommend the following outline which can be used as a basis in designing detailed algorithms. Step 1. Determine the number of periods, M, to be de- tected for a given seasonal time series; Step 2. Calculate APFN(t) using formula (4) to be given in the next section for different integer values of t; Step 3. Detect all local minima of APFN(t) and find the corresponding values of t; Step 4. Sort all the local minima from the least to the greatest, and rearrange the corresponding t values ac- cordingly. Then, the t values of the first M local minima are the cycle lengths, and the first t value is the primary period. Some comments are in order regarding the number of data points required in calculating the value of APFN(t). In applications, one uses the sample APFN function in detecting cycle lengths. Evidently, the more data used in calculation, the more reliable the results. Although it is not clear at this stage what the minimum number of data points should be needed in calculating APFN, our em- Copyright © 2011 SciRes. AJOR  Q. SONG 298 pirical results suggest that it is reasonable to have at least 50 data points in calculating each value of APFN in or- der to get good results. Nevertheless, this is still an op en problem that requires more research. 3. Distribution of Local Mini ma of the Sample Average Power Functions of Noise In applications and especially when working with time series, we use the following form of definition of APFN: 2 1 1 APFN limN Nt pxtp N xt (4) As local minima of the APFN are the only interest to us, and at each local minimum at pat , denote pttp t . Then, the above Equation (4) can be written as 2 1 1 APFN limN Np t pt N . Now, we want to derive the distribution of APFN(p) for any finite values of N. As t follows 2 0,N by assumption, we know that pttp t follows 2 0,2N . Furthermore, we can infer that pt is independent of p where t m0m , and 2 pt follows 1 2 . It is easy to see that 22 2 p Et . To find the variance of 2t p, notice that 22 0ttpcov , , 0tp 2 cov ,tt , and t tp 2 cov ,tp 0 . Then, we would have, 22 2 22 var var2 varvar4var pttpttpt tptt tp As 2 24 2 44 44 2 42 var as 0 3as () follows 0, 2var. tEt Et Et Et tN tp 2 22 22 22 22 22 var as 0 as and are indepen tp tEtptE tp t Etpt Etpt EE tpttE tEtpt EtEtptp t 22 4 dent . Hence, 24 var 8 pt . Thus, we have proved the foll owi ng theorem. Theorem 3: Under the assumptio ns in Theorem 1, for any finite values of N > 0, any lo cal min imum APFN(p) follows 2N with degree of freedom N, mean 2 2 and variance4 8 where p is the unique period of the N time series and N is the sample size of the time series. When multiple distinct periods exist, the distributions of local minima can be treated similarly, but they are more involved, and for this reason will be studied later. 4. Measure of Seasonality of Seasonal Time Series It is not uncommon to hear people ask such a question: “How seasonal is a time series?” This question seems not easy to answer. Some time series is obviously very sea- sonal whereas others are not so. To answer this question, one needs a number from 0 to 1 as the measure of how seasonal a time series is. This measure must be very low (close to zero) if a time series is almost a white noise and must be very high (close to 1) if a time series is gener- ated by a sinusoidal process. We intend to provide an approach to measuring the seasonality of a time series by means of APFN. Suppose a seasonal time series has a unique period P (>1). Then, this time series will repeat after any periods K which is a multiple of P, i.e., K = mP where m is a positive integer. On the APFN plot, a local minimum would appear at each lag of K. The lags of all the local minima are multiples of P. In other word, 100% of the lags of all local minima can be expressed as a multiple of P. Due to noise in the data, or due to a different period in the time series, lags of the local minima of the APFN may not be all multiples of P. Some lags of the local minima may be multiples of a period different from P. In this case, less than 100% of the lags of local minima are multiples of P. Such a seasonal time series is less sea- sonal than the one with 100% of lags of local minima being multiples of P. When a time series is pseudo-white noise, a much smaller portion of the lags of local minima Copyright © 2011 SciRes. AJOR  299 Q. SONG can be expressed as a multiple of P. Thus, the percentage of local minima that can be expressed as a multiple of a certain positive integer P (>1) can be used as a measure or indicator of how seasonal a time series could be. Based on this argument, we propose the following defi- nition of measure of seasonality. Definition (Measure of Seasonality) Let t x be a time series and assume are co-prime positive inte- gers greater than 1 where . Denote per(Pi) as the percentage of local minima on APFN plot which can be expressed as multiples of Pi. Then, max{per(Pi) for } is defined as the measure of season- ality of i P1,2, , iM M 1,2, , i t x . With the above definition, the seasonality measure of the illustrative time series in Figure 11 is 0.60. Comments are in order to interpret measure of season- ality: If this measure is 100%, one knows that the periods of the time series has a common factor, P. Then, if P is used in a seasonal model, errors due to the inaccuracy in P can be ignored. However, if this measure is less than 100%, say, 60%, then 40% of the local minima of the APFN do not share the same common factor as the rest 60% of the local minima. This indicates that the period of the time series changes over time. If P is the period shared by most of the data, it could happen that when P is used in modeling the part of the data that have a dif- ferent period, then large modeling errors could be pro- duced simply because the period P is not properly used. 5. Applications In this section, we provide numerical examples to illus- trate how to use the Average Power Function of Noise in determining cycle lengths of different periods in seasonal time series forecasting. For this purpose, we will work with three time series, and apply the sample power spec- trum, the sample ACF, and the APFN to identify the pe- riods. Then, for each of the three methods, we implement the identified periods in different models to produce forecast in order to compare different forecasting models. The algorithms used in detecting periods are as follows: To utilize sample ACF plot, the lags corresponding to the highest peaks are used as the periods; to utilize the power spectrum plot, the periods corresponding to the highest peaks are treated as the periods; to utilize the APFN, the discrete form of the definition (4) is used in calculation, and the periods corresponding to the lowest values are used as the periods. For simplicity and to be consistent to literature [5-7], only two periods are used in modeling and forecasting. 5.1. Example 1 In this example, we generate a time series of 251 data points with this formula: 500sin0.4 sin0.9sin0.1 2000 x tttt t where 1,2,3,,251t , and t is a random number sampled from uniform distribution U(0,1). Figure 1 il- lustrates this time series. Figure 2 illustrates the sample ACF, and Figure 3 illustrates the power spectrum of this time series. Out of the 251 data points, the first 218 data points are used in modeling while the last 33 data points are used in calculating forecast error and are therefore not used in modeling. The sample ACF plot indicates 4 major peaks at lags of 63, 14, 49 and 77. All the peaks are significant at the significance level of 0.95. On the power spectrum plot, three major peaks are seen at peri- ods of 64, 7, and 16. Figure 4 illustrates the APFN plot which exhibits 4 major local minima at periods of 63, 126, 189, and 140. For reasons mentioned above, we choose the first two major periods in modeling and fore- casting. To model the time series, an additive seasonal autoregressive model with 2 different periods is selected while the order of the model is determined by an algo- rithm to ensure the modeling error is white noise. The additive seasonal autoregressive model is given by this equation [12] 12 1 M titii i tip tip i xaxbxcx where , and are the two different periods in the model. Once the periods are determined, the order of each model is determined by an automated algorithm. A Seasonal AR(1) model is identified with the periods de- termined by both the ACF and the APFN methods while a Seasonal AR(4) model is identified with the periods detected by the Power Spectrum method. Table 1 lists the models with periods detected using different methods and model parameters. Numbers within the parentheses are the standard errors of the corresponding parameters. 1 p2 p Figure 1. A seasonal time series exhibiting multiple season- lities. a Copyright © 2011 SciRes. AJOR  Q. SONG Copyright © 2011 SciRes. AJOR 300 Figure 2. Autocorrelation function plot of Example 1. Ta. Method Used MAPE ble 1. Models and the forecasting MAPE for Example 1 Model ACF 14t 163 0.0066 0.00660.0068 0.065 0.0766 tt t 0.854 x xx x 8.49% 123464128 0.0305 0.0304 0.0304 0.03020.02990.0298 1922567 1421 0.02970.02970.0303 0.03050 0.7349 0.00770.38160.32150.52810.2353 0.0927 90.08020.36990.32500.3647 tt tt t tt ttttt xx xxx xx xxxxx 28 .0305 0.0306 0.3528 t x Power Spectrum 54.4.1% APFN 126t 163 0.0060 0.00590.0059 0.0973 0.74940.3292 ttt x xx x 8.30% Figure 3. Power spectrum plot of Example 1. Figure 4. Sample average power function plot indicating multiple local minima. Figure 5 illustrates the forecasts of different models. It can be seen that the model whose periods are identified his using power spectrum fails to produce good forecasts. Although the two models whose periods are detected by ACF and by APFN produce about the same forecasting errors, the latter produces slightly better forecasts. 5.2. Example 2 In this example, 200 data points are generated using t 12sin 400 formula: sin t x tt 1,2,3,,200t where . In modeling and analysis, the firs t 167 ror calculati plot of data points are used while the last 33 data points are used only in forecasting eron. Figure 6 presents the time this time series. Figure 7 exhibits the sample ACF plot, Figure 8 shows the empirical power spectrum plot and Figure 9 represents the APFN plot. From the ACF plot in Figure 7, it can be seen that two significant peaks appear at lag s of 12 and 21, both being significant at the significance level of 0.95. Hence, peri- ods of 12 and 21 are detected with ACF plot for this time series; from the power spectrum plot in Figure 8, peaks are found at periods of 11, and 3. Therefore, periods of 11 and 3 are determined from the power spectrum plot. Finally, from the APFN plot in Figure 9, two local minima are seen at periods 77 and 56 which have the lowest values. Thus, with the APFN method the periods  301 Q. SONG Figure 5. Forecasts using different models for Example 1. Figure 6. A seasonal time series with multiple seasonal pat- terns for Example 2. Figure 7. Autocorrelation function plot for time series in Example 2. determined, the order of a Seasonal AR are detected as 77 and 56 for this time series. Once the periods are model is determined by an automated algorithm. The result is that a Seasonal AR(2) model is recommended with the periods determined by all the three different methods. Table 2 lists the models and parameters with standard errors of the parameters listed in the corre- sponding parentheses. For this example, all three models produce good forecasts whereas the model of the power Figure 8. Power spectrum plot for Example 2. Figure 9. Plot of average power function of noise for Exam- ple 2. spectrum produces the smallest forecasting error and the ACF produces the largest forecasting error. Figure 10 plots the forecasts of all the three models. The reason s no noise introduced in the data. why all three methods produce good forecasts is that there i 5.3. Example 3 In this example, 466 retail daily sales data points are used. The first 433 data points are used in modeling and Copyright © 2011 SciRes. AJOR  Q. SONG 302 le 2. Models and parameters for Example 2. Method UsedM Tab odel MAPE ACF t 1 2 12242142 0.00019 0.000190.000190.000190.000190.00019 0.0896 tttttt 0.0747 0.3651 0.59410.26450.5424 x xxx xx x 0.82% Power Spectrum8t 1212244 0.00015 0.000150.000150.000150.000150.00015 0.12200.24790.23460.60970.18590.40471 tt tttt x xxxxx x 0.646% APFN 1277154 56112 0.00032 0.000320.000320.000320.000320.00032 0.003 0.03370.53850.02570.4930.1098 ttt tttt x xxx xx x 0.652% Figure 10. Forecasts obtained with different models in Example 2. the last 33 data points are used in forecasting accuracy analysis. Figure 11 shows Figure 12 illustrates the sample ACF plot which exhibits the plot of the time series. two peaks at lags 7 and 28, both being significant at the significance level of 0.95. Figure 13 shows the sample power spectrum and shows two peaks at periods 7 and 30, and Figure 14 shows the Average Power Function of Noise plot of the time series which has two major local minima at periods of 364 and 336. Again, we pick 2 pe- riods for the time series. An automated algorithm is used to determine the order and the parameters for each model. Figure 12. Sample Autocorrelation function plot for Exam- ple 3. For the ACF model, a Seasonal AR(5) model is identi- fied; for the Power Spectrum model, a Seasonal AR(6 model is identified, and for the APFN m AR(1 , the parameters and the standard errors, and the forecasting MAPE. As the model corresponding to the power spec- trum method is too complicated, it is not listed in the table. It can be seen that the APFN model produces the best forecasts while the Power Spectrum model fails to produce meaningful forecasts. Figure 15 illustrates the forecasts of all the 3 models. The power spectrum method ) odel, a Seasonal ) model is identified. Table 3 lists the models Figure 11. Daily retail sales plot for Example 3. Copyright © 2011 SciRes. AJOR  303 Q. SONG Figure 13. Plot of power spectrum for Example 3. evidently detects an incorrect period, 30, and this incor- rect period causes the modeling algorithm to produce a 6th order model to fit the data, and fails to produce good forecasts in the end with a MAPE of 33.08%. This illus- trative example indicates the significance of using the right periods in modeling and forecasting seasonal time series. 6. Conclusions and Discussions In this paper, the definition of Average Power Function of Noise (APFN) has been proposed, and properties of such a function have been discussed. The most important property of APFN is that it has a local minimum at the time lags which are the periods of a seasonal time series. The numerical examples have exhibited the merits and the power of APFN in detecting periods in seasonal time series. ACF and power spectrum are proven to be pow- erful instruments in signal analysis and many other are- nas. They may not be the best instruments in detecting periods for seasonal time series because, as pointed out Figure 14. Plot of average power function of noise for Ex- ample 3. Figure 15. Forecasts obtained w Table 3. Models and pa Method Used ith different models for Example 3. rameters for Example 3. Model MAPE ACF 0.332 0.0940.035xxxx 123 45714 0.0062 0.00620.00620.00620.00620.00620.0062 2128 35 56 0.008890.0062 0.0062 0.03020.108 0.2340.065 0.01670.25890.0290.0720.139 tttt tttt t ttt xxxx xxxxx 84 112 140 0.0062 0.00620.0062 0.065 0.059 tt xx 7.89% t 0.0062 Power Spectrum Too complicated to list 33.08% APFN t5.36% 1 364 336 0.0111 0.01030.0101 0.247 0.43040.2623 tt t xx xx Copyright © 2011 SciRes. AJOR  Q. SONG 304 at the beginning of the paper, the detected periods of a seasonal time series should be the ones at which the time series repeats with the smallest discrepancy, not neces- sarily the ones at which it repeats the most frequently. The results of seasonal time series forecasting depend on not only the model but the periods of the time series as well. Forecasts are very sensitive to the periods detected and used in the model. If periods are not properly chosen, one may end up with high order models and inferior forecast results. From the empirical examples, it is quite evident that properly detected periods of a seasonal time series almost always accompany low order model and superior forecasts, and APFN consistently produces the lowest order models in the three illustrative examples. Therefore, the significance of properly detected periods cannot be overemphasized seasonal time series. As discussed at the beginning of t pow methods could lead to conflicting results in detecting periods for the same data set. For that reason, it will be difficult to automate the detection algorithm with And power spectrum plots. However, it is rela- tively simple and easy to automate the period detection algorithm using APFN. Such an algorithm will involve selecting the first few lowest local minima, by sorting the lon ascent order. The APFN is in the form of square of discrepancy. Differrms of discrepancy are also possible and ould opted. For example, the following two dif- rent forms can be considered in lieu of APFN: 7. References [1] P. Cortez, M. Rio, M. Rocha and P. Sousa, “Internet Traf- fic Forecasting Using Neural Networks,” 2006 Interna- tional Joint Conference on Neural Networks, Vancouver, 16-21 July 2006, pp. 2635-2642. [2] A. M. De Livera and R. J. Hyndman, “Forecasting Time Series with Complex Seasonal Patterns Using Exponen- tial Smoothing,” Working Paper, Department of Econo- metrics and Business Statistics, Monash University, 2009. [3] P. G. Gould, A. B. Koehler, J. K. Ord, R. D. Sny der, R. J. Hyndman and F. Vahid-Araghi, “Forecasting Time Series with Multiple Seasonal Patterns,” European Journal of Operational Research, Vol. 191, No. 1, 2008, pp. 207- 222. doi:10.1016/j.ejor.2007.08.024 [4] B. J. Morzuch and P. G.en, “Forecasting Hospital rivals,” 26th Annual Sympo- sium on Forecasting, Santander, June 11-14 2006. rison of Univariate Time Series Methods for Forecasting Intraday Arrivals at a Call C ” Management Science, Vol. 54, No. 2, 2008, 265. doi:10.1287/mnsc.1070.0786 in modeling and forecasting his paper, ACF and er spectrum CF a cal minima in a ent fo be adc fe MAD limd 2 T TT xt xt Et T MAPE limd 2 T TT xt xtxt Et T However, it might be quite difficult to conduct theo- retic analysis based on those two for ms. It must be admitted that the results presented in this paper are quite rudimentary. Further efforts should be made in order to have a better understanding of the prop- erties of APFN. One of the issues around APFN is its connection to ACF and power spectrum. In other words, in the frequency domain, what do we know about APFN? All Emergency Department Ar [5] J. W. Taylor, “A Compaen- pp. 253-ter, [6] J. W. Taylor, L. M. de Menezes and P. E. McSharrA Comparison of Univariate Methodsor Forecastin- tricity Demand up to a Day Ahead,” International Jour- nal of Forecasting, Vol. 22, No. 1, 2006, pp. 1-16. doi:10.1016/j.ijforecast.2005.06.006 y, “ g Elec f aylor, “Short-Term Electricity Demand F ing Using Double Seasonal Exponential Smoothing,” Journal of Operational Research Society, Vol. 54, 2003, pp. 799-805. doi:10.1057/palgrave.jors.2601 [7] J. W. Torecast- , No. 8 589 [8] J. W. Taylor, “Triple Seasonal Methods for Short-Term Electricity Demand Forecasting,” European Journal of Operational Research, Vol. 204, No. 1, 2010, pp. 139- 152. doi:10.1016/j.ejor.2009.10.003 [9] in Time 2001. [11] P. Stoica and R. Moses, “Spectral Analysis of Sials,” Pearson Prentice Hall, New Jersey, 2005. [12] Q. Song and A. O. Esogbue, “A New Algorithm for Automated Modeling of Seasonal Time Series Using Box-Jenkins Techniques,” International Journal of In- dustrial Engineering and Management Systems, Vol. 7, G. E. P. Box, G. M. Jenkins and G. C. Reinsel, “Time Series Analysis,” 3rd Edition, Prentice Hall, New Jersey, 1994. [10] D. Pena, G. C. Tiao and R. S. Tsay, “A Course Series Analysis,” John Wiley & Sons, Hoboken, gn No.1, 2008, pp. 9-22. Copyright © 2011 SciRes. AJOR |