J. LI 467

Why Did the Australian Government Introduce

HECS

There are several rationales for the Australian HECS system.

Primarily, HECS reduces the cost to government of financing

higher education. In 2002 HECS contributed about $1.8 billion

or 16% of the total expenditure on higher education (ABS

2005). Reducing the per capita cost means that more money can

be spent on increasing participation. According to OECD (2004:

Table 3.3; 2007: Chart C2.1) indicators the proportion of young

persons at university (Type A Tertiary education in OECD

terms) in Australia is amongst the highest in the OECD.

Barr (2004) argues that income contingent loan schemes are

economically desirable since they provide price signals, in-

crease flexibility and choice, and promote access through ex-

pansion of the higher education sector. In an earlier article he

makes the point that free tuition is not affordable in mass higher

education systems. In addition, there is the social equity argu-

ment. Free university education means that workers on low to

average wages substantially subsidize the university education

of the children of higher income families, whom as a result of

their university education will, on average, receive much higher

incomes. Therefore, “free” university education involves a

substantial transfer of money from low income to high income

households. In addition, it cannot be argued that HECS is no

longer appropriate since university degrees do not deliver the

income premiums they once did. Despite the substantial in-

creases in the proportion of the Australian population with uni-

versity degrees, the income premium to university degrees, in

the region of 30%, is no lower among younger cohorts (OECD

2004: Indicator 11). In other words, there has been no change

over-time in the rate of return to university education. Univer-

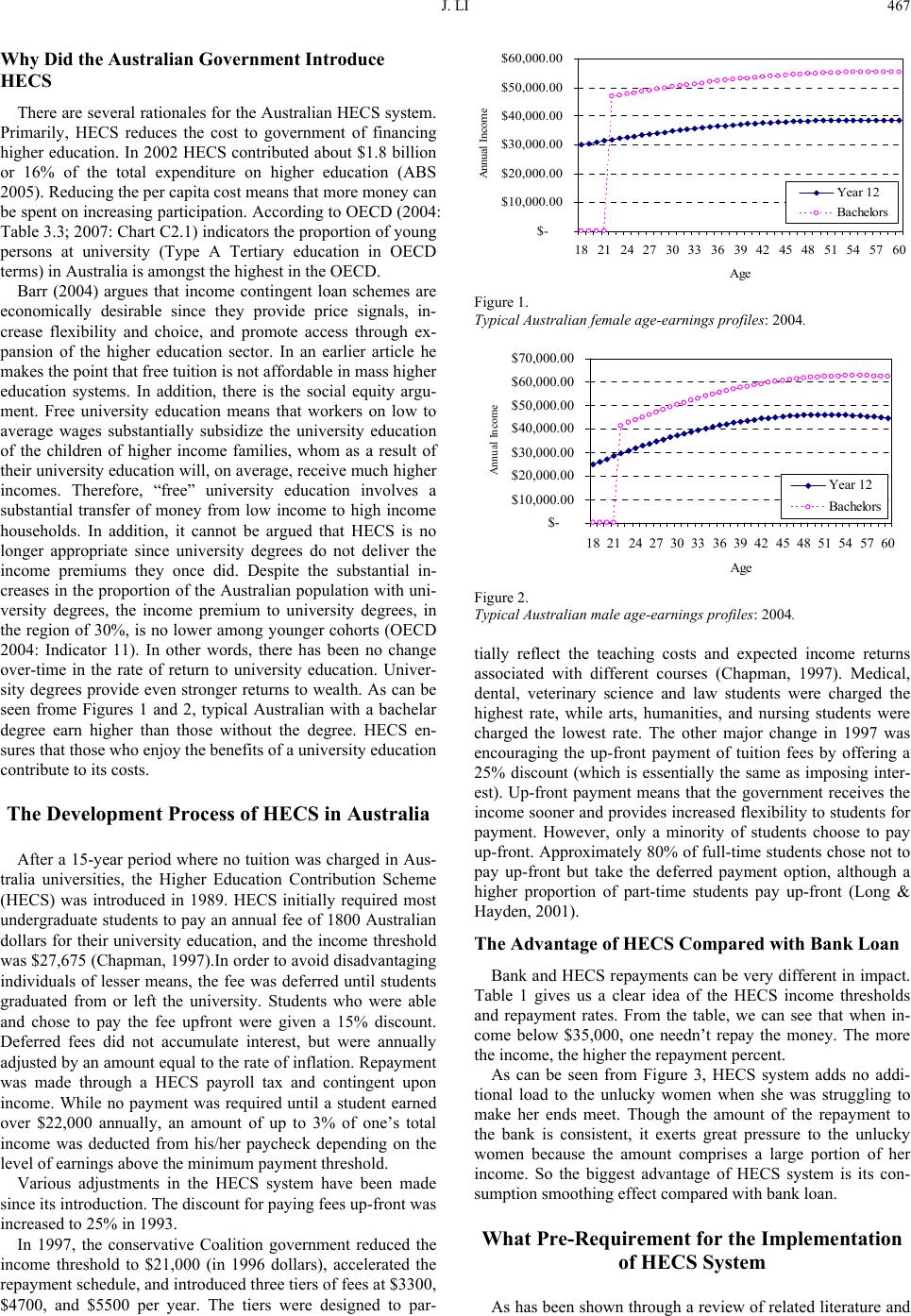

sity degrees provide even stronger returns to wealth. As can be

seen frome Figures 1 and 2, typical Australian with a bachelar

degree earn higher than those without the degree. HECS en-

sures that those who enjoy the benefits of a university education

contribute to its costs.

The Development Process of HECS in Australia

After a 15-year period where no tuition was charged in Aus-

tralia universities, the Higher Education Contribution Scheme

(HECS) was introduced in 1989. HECS initially required most

undergraduate students to pay an annual fee of 1800 Australian

dollars for their university education, and the income threshold

was $27,675 (Chapman, 1997).In order to avoid disadvantaging

individuals of lesser means, the fee was deferred until students

graduated from or left the university. Students who were able

and chose to pay the fee upfront were given a 15% discount.

Deferred fees did not accumulate interest, but were annually

adjusted by an amount equal to the rate of inflation. Repayment

was made through a HECS payroll tax and contingent upon

income. While no payment was required until a student earned

over $22,000 annually, an amount of up to 3% of one’s total

income was deducted from his/her paycheck depending on the

level of earnings above the minimum payment threshold.

Various adjustments in the HECS system have been made

since its introduction. The discount for paying fees up-front was

increased to 25% in 1993.

In 1997, the conservative Coalition government reduced the

income threshold to $21,000 (in 1996 dollars), accelerated the

repayment schedule, and introduced three tiers of fees at $3300,

$4700, and $5500 per year. The tiers were designed to par-

$-

$10,000.00

$20,000.00

$30,000.00

$40,000.00

$50,000.00

$60,000.00

18 21 2427 3033 36 394245485154 57 60

Age

Annual Inco me

Year 12

Bachelors

Figure 1.

Typical Australian female age-earnings profiles: 2004.

$-

$10,000.00

$20,000.00

$30,000.00

$40,000.00

$50,000.00

$60,000.00

$70,000.00

18 21 24 2730 33 36 3942 45 4851545760

Age

Annual Income

Year 12

Bachelors

Figure 2.

Typical Australian male age-earnings profiles: 2004.

tially reflect the teaching costs and expected income returns

associated with different courses (Chapman, 1997). Medical,

dental, veterinary science and law students were charged the

highest rate, while arts, humanities, and nursing students were

charged the lowest rate. The other major change in 1997 was

encouraging the up-front payment of tuition fees by offering a

25% discount (which is essentially the same as imposing inter-

est). Up-front payment means that the government receives the

income sooner and provides increased flexibility to students for

payment. However, only a minority of students choose to pay

up-front. Approximately 80% of full-time students chose not to

pay up-front but take the deferred payment option, although a

higher proportion of part-time students pay up-front (Long &

Hayden, 2001).

The Advantage of HECS Compared with Bank Loan

Bank and HECS repayments can be very different in impact.

Table 1 gives us a clear idea of the HECS income thresholds

and repayment rates. From the table, we can see that when in-

come below $35,000, one needn’t repay the money. The more

the income, the higher the repayment percent.

As can be seen from Figure 3, HECS system adds no addi-

tional load to the unlucky women when she was struggling to

make her ends meet. Though the amount of the repayment to

the bank is consistent, it exerts great pressure to the unlucky

women because the amount comprises a large portion of her

income. So the biggest advantage of HECS system is its con-

sumption smoothing effect compared with bank loan.

What Pre-Requirement for the Implementation

of HECS System

As has been shown through a review of related literature and