Modern Economy, 2011, 2, 850-861 doi:10.4236/me.2011.25095 Published Online November 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Many Roads to Paris: A Comparative Review of Pension Policies in Two OECD Countries Jacob Assa New School for Social Research, New York, USA E-mail: assaj401@newschool.edu Received April 26, 2011; revised June 23, 2011; accepted July 27, 2011 Abstract Common (neoliberal) wisdom warns against the detrimental effects of demographic changes and fiscal pres- sures on traditional (both defined-benefit and public) pensions and urges a paradigm shift towards defined- contribution plans and personal retirement accounts. This paper examines these claims, promoted by the OECD and World Bank, among others, by comparing the experiences of two OECD members—Israel and Ireland. While Ireland, one of the founders of the OECD, has pursued typical neoliberal policies of re- trenchment, Israel—the newest member of the OECD—has taken a more sinuous path, reversing some re- trenchment and eventually making pensions mandatory and almost doubling employer contributions to them. The outcomes of these policies seem to be far more positive in Israel than in Ireland, both in terms of their effects on retirees and workers, as well as their impact via aggregate demand on the overall economy, par- ticularly in the aftermath of the Great Recession. Keywords: Welfare, Demography, Retirement, Pension 1. Introduction Pension policies are often at the forefront of political and economic debates, even more so now following the larg- est recession since the Great Depression. Various argu- ments relating to pension plan sustainability, benefit a- dequacy, and the relationship between pensions and the overall economy have been made. Among the leading voices in the debate, the Organization for Economic Co- operation and Development (OECD) has usually taken a conservative, neoliberal approach, advocating private savings for retirement, in particular defined-contribution (DC) type plans as well as personal savings accounts, as a magic bullet to cure all pension-related ills. In its vari- ous reports, including the three editions of Pensions at a Glance, the OECD has warned of demographic pressures and fiscal imbalances that would cause the traditional defined-benefit (DB) plans and public-pensions schemes to become unsustainable. There has indeed been a shift in many countries, including within the OECD, from DB to DC pensions. Countries have cut benefits, raised re- tirement ages, and shifted much of the risks of old-age insurance from employers or the state to employees. The OECD and the World Bank suggest that this would sta- bilize pension funds as well as strengthen the general economy. The purpose of this paper is to examine these claims— as well as the accompanying policy prescriptions—in light of the evidence, using a comparative study of two different country experiences within the OECD mem- bership. While some countries such as Ireland have in- deed followed the narrow (and austere) path to salvation, as it were, others such as Israel—the OECD’s newest member—have gone through a more sinuous process, facing various pressures and finding a middle-ground with the active involvement of labor. There are indeed many roads to Paris (the OECD’s headquarters) in par- ticular, and pension and economic viability in general. The rest of the paper proceeds as follows: Section 2 examines pension policies in the OECD, both as recom- mended in its latest publication as well as in practice, comparing the experience of Israel, its newest member, with that of Ir eland, one of the original founders. Section 3 continues the comparative analysis using two theoreti- cal frameworks, and examines the role of labor in the development and reform of pension policies in Israel and Ireland. Section 4 focuses on the macroeconomic impact of various pension policies, starting from the World Bank’s multi-pillar model and proceeding to look at ac- tual impacts of pensions on the economy and financial  851 J. ASSA markets in Israel and Ireland, as well as impact of the financial crisis on pensions in these two countries. Sec- tion 5 concludes. 2. Pension Policies 2.1. The OECD’s Pensions at a Glance 2009 The OECD’s Pensions at a Glance 2009 report is the third edition in the series. It looks at the state of pens ions of the organization’s 30 member countries (as of May 2009), and examines the effects on these pension systems of the financial and economic crises. It also looks at old- age poverty, pension reforms, and voluntary private pen- sions. The report acknowledges the heavy impact of the fi- nancial crisis in 2008 on private pensions, which lost $5.4 trillion, equivalent to 23% of their aggregate value. Public pensions have also been impacted, both by longer demographic trends as well as by the crisis’s indirect effects through lower earnings and higher unemployment [1]. The effects differ according to their impact on specific groups. Young people are projected to be less affected than those near retirement. Private defined-contribution plans, followed by private defined-benefit plans, suffered much more than public pension plans. The latter have not been directly affected, but the effects of the financial crisis cascaded into an overall economic crisis which placed recessionary pressures on wages and employment (leading to lower contributions and perhaps more early retirements). The report also highlights the overall shift in the pri- vate pensions sector from defined-benefit (DB) occupa- tional plans to defined-contribution (DC) plans in the OECD. The U.S. has made the earliest shift, increasing the ratio of occupational-plan members covered by a DC plan from 32% in 1980 to 71% in 2003; the same ratio increased in Canada from 14% in 1993 to 24% in 2003 and in Ireland from under 40% in 1999 to 50% in 2005; coverage under DB private-pension schemes in the UK dropped from 23% in 1998-1999 to 12% in 2002-2003; and by 2006, both of Sweden’s largest occupational pen- sion plans (for white-collar and blue-collar workers) have been fully converted to defined-contribution [1]. In evaluating policy respon ses to the crises in its report, the OECD notes with alarm that “the losses incurred in private pensions have already led to pressures to allow people to switch back into the public scheme” [1]. It ar- gues against such policies, claiming that they will desta- bilize the pension system. It further downplays concerns about investment risks as short-term thinking, emphasiz- ing instead more long-term risks such as demographic changes and fiscal sustainability. It is quite remarkable, and a testament to the OECD’s ideological bent, that in the face of heavy losses by private pension funds in the recent financial crisis and the resulting increases in old- age poverty, it still recommends continuing austerity- reforms of pension systems, mostly involving retrench- ment and privatization . Some of the recent reforms mentioned and lauded by the OECD report are the introduction of DC plans in Mexico, Poland, Hungary and Slovakia, cutting life-time benefits in 16 OECD members by 16%, reducing civil- service pensions for early retirement in Ireland, and in- creasing retirement ages in 14 countries [1]. 2.2. Israel’s Accession to the OECD The OECD was created in 1961 as a successor to the Organization for European Economic Co-operation (OEEC) which was set up in 1947 for the reconstruction of Europe under the Marshall Plan. The OECD’s mission has been “to help its member countries to achieve sus- tainable economic growth and employment and to raise the standard of living in member countries while main- taining financial stability—all this in order to contribute to the development of the world economy” [2]. Until recently, the organization consisted of thirty countries; in 2010, Chile, Slovenia and Israel became the newest Member Countries, bringing the total to thirty- three. The accession process normally involves the fol- lowing steps: 1) An OECD resolution to open discussions with a potential member; 2) Approving a road map for the new member’s ac- cession to the organization; 3) A meeting of numerous OECD specialized com- mittees to review the country’s suitability in various as- pects; 4) A formal invitation to join; 5) Signing of an accession agreement and accepting the OECD’s legal instruments by th e candidate country; 6) Signing the OECD convention. Given the organization’s prestige and the economic benefits (both real and perceived) of membership in this “rich-man’s club”, countries are obviously interested in joining. In March 2006, Israel’s Ministry of Finance published an 80-page docu ment entitled Israel: Ready for the OECD. It describes in detail “Israel’s progress in meeting the international objectives and best practices pursued by OECD members” as well as its “activities in OECD bodies during the years 2004-2005”, at the time when Israel was already “a full participant, regular ob- server, or ad-hoc observer in 50 OECD working bodies” [3]. Copyright © 2011 SciRes. ME  J. ASSA 852 The OECD adopted a resolution on 16 May 2007 on “enlargement and enhanced engagement” to begin open discussions for membership with Israel, as well as with Chile, Estonia, the Russian Federation and Slovenia. Israel’s roadmap for accession was approved on 30 No- vember 2007, detailing the process the country need ed to go through, including review by 18 OECD committees of issues such as investments, fiscal affairs, environment, corporate governance, financial markets, insurance and private pensions, competition, and consumer policy (Is- rael had already been an observer at the OECD’s Insur- ance and Private Pensions Committee since 2005) [3]. The process took over two years, and on 10 May 2010 Israel was officially invited to become a member of the OECD. It signed the accession agreement on 29 June 2010 and became a member o n 7 September 2010. In terms of substance, a country wishing to join the OECD is expected to show that it shares “fundamental values and like-mindedness” with the organization, in- cluding “adherence to open and transparent market e- conomy principles” [4]. More specifically in regards to pensions, Core Principle 3 of the OECD Recommenda- tions on Occupational Pensions says such pensions should be fully-funded, and that unfunded, pay-as-you go plans “should generally be prohibited” [5]. This is in line with the trend towards privatization and overall re- trenchment described in the above discussion of Pen- sions at a Glance 2009. Israel’s pension-system history, however, tells a more complex story. 2.3. A Brief History of Israel’s Pension System A former British Mandate territory, Israel became inde- pendent on May 14, 1948. Like many of Israel’s eco- nomic, social and political institutions, its trade-unions organization—the Histadrut—was created well before independence, in 1920, while still under British rule. Today the Histadrut covers about a third of the popula- tion, and roughly 85% of wage-workers. The retirement system in Israel has three pillars— universal social security (Old Age Allowance, OAA), an income-supplement (means-tested), and individual pen- sion fund savings [6]. Before 1995 pension saving for retirement in Israel consisted of occupational pension funds (defined-benefit). Workers in the public sector, large banks and utilities were given similar benefits in programs funded by employers (there was no employee contribution). Part of the salary not covered could be deposited in a private savings account (for at least 15 years). The government provided tax breaks and subsi- dized return s . These funds were closed in March 1995 to new mem- bers, together with a reduction in benefits for current members. New defined-contribution funds were intro- duced, but the government still subsidized 70% of the returns and guaranteed the other 30% (at a 3.5% rate). The retrenchment process continued in 2002-2003. Cuts in public spending on pensions were made in 2002- 2003, consisting of increasing retirement ages and re- ducing the real value of payments by the National Insur- ance Institute (NII). Government-guaranteed returns were dropped in 2002. In 2003, the retirement age was raised for both men (from 65 to 67) and women (from 60 to 64). Early retirement benefits were cut and conditions became stricter. In 2005-2006, however, the cuts were reversed due to adverse effects on old-age poverty, but because wages have since increased faster than pensions, the “relative incomes of those with no other source of in- come were still below the 2002 level in 2007” [7]. The private pension system in Israel is under the su- pervision and regulation of the Ministry of Finance, Capital Market Insurance and Savings Division (CMISD). The assets are managed by external entities, not employ- ers or banks. They are “set up as limited companies hold- ing insurance licenses and are entitled to operate solely in two areas of activity: p ension fund and provident fund management” [7]. The five main private pension-saving types are desc ribed schematically in Table 1. 2.4. Recent Developments in Israel By 2008 the aged population (65+) in Israel comprised around 10% of the pop ulation, as co mpared to the OECD average of 1 5%. Large cohorts of people born after 1945 are about to retire, however, and the old-age dependency rate in Israel is projected by the OECD to increase from 19% in 2000 to 35% in 2050 [7]. About half of the workers in Israel before 2008 were covered by private pensions, with fund balances equaling nearly a third of GDP. Life insurance firms held balances equal to an additional 20% of GDP [7]. Workers could choose between lump-sum products (pension funds and life polices) and annuities. In 2007, the Histadrut signed an agreement with em- ployers’ organizations mandating a pension for every employee, regardless of union membership or coverage by a collective agreement. Employers would contribute 10% while employees would pay in 5% [6]. Pensions became compulsory as of 1 January 2008 (for workers with income up to average wage), and coverage in- creased to 66%. All new pension funds pay annuities, with the exception of people making 60% of the average wage (who can choose a lu mp-sum instead) [7]. Worker s now also had a choice of saving vehicles (pension fund, provident fund or a life insurance policy), a choice pre- iously made by unions or employers [7]. v Copyright © 2011 SciRes. ME  J. ASSA Copyright © 2011 SciRes. ME 853 Table 1. Israel’s five main private pension savings types. Accrual Benefit Investment Commen ts Old pension funds (until 1995)—DB 2% of earnings for each year of service % accrued of last three years before retirement 30% of assets in non-tradable government bonds Actuarial deficits in the 80s, c lo s ed in 1 9 95 to n e w e mployees, cuts in benefits. A compromise reached where the government will pay 80 billion shekels over 35 years, with the particip ants responsible for the rest of the liabilities. New pension funds (since 19 95 )—Pseudo-DC (savings convert e d in to a nnuity) Up to double average earnings, employees contribute 5% - 5.5% and employers 11% - 14.3% Depends on savings and fiscal criteria (e.g. death of members leading to surplus) 30% of assets in non-tradable government bonds Benefits cannot be taken before age 60; new pension funds must rovide members with disability and survivor insurance. New general pension funds (since 1999)—Retirement savings only (not disability and survivors) For savers with earnings of more than double the average Provident funds—Retirement savings only (not disability and survivors) Capital returns proportiona l to members’ shares in assets of fund Only govern- ment bonds Lump-sum after 15 years allowed until 2005. Since then, only at 60 with a minimum amount withdr awn as annuity. Life insurance—Policies for disability and survivors may have a savings part. Assets managed by external limited companies (not employers), limited to managing ensions funds and provident funds. After the financial crisis began, a compensation plan was created by Israel’s government for workers near retirement (57+) who lost money in their DC funds since November 2008. By comparison, “no OECD country [at the time] bailed out workers who had lo st money through saving in voluntary occupational or individual schemes” [7]. On 7 September 2010, on the eve of the Jewish New Year, the Histadrut and employers’ organizations signed another agreement, increasing employer contributions to pension funds by 2.5% a year starting in 2010. The His- tadrut chief hailed the agreement as proof that workers benefits can be increased. The employers’ organizations chairman described this increase as a real show of con- cern for employees in all sectors. The main beneficiaries would be new employees or low-wage earners (or mini- mum-wage earners) not covered by collective agree- ments (and receiving only a 7.5% pension contribution from their employer). The new agreement would in- crease the 10% employer contribution to 17 .5% by 2014. Pension funds would receive hundreds of millions of shekels in further fu nds as a result. 2.5. Ireland’s Pension System Ireland was one of the 20 original fou nd ers of the OECD, signing its Convention on 14 December 1960. It serves as a good contrast to Israel, since it has pursued clear neoliberal policies in general and with regards to pen- sions in particular. According to the OECD, Ireland’s public pension spending in 2006 was less than half of the OECD’s av- erage (as % of GDP), at only 3.4% [1]. While the pro- portion of elderly in Ireland (at 17.7%) is lower than the OECD average (23.8%), more than 30% of its pensioners live in poverty (higher than the OECD average, and third-highest of its members) [1]. Contributory pensions were first introduced in Ireland in 1961. The current public pension has a basic flat rate component, and a means-tested element targeted at lower income pensioners. Around half of Irish employees have private occupational pensions. These are split more or less evenly between defined-benefit and defined-contri- bution plans. The DB plan pays a portion (1/60) of the last salary for every year of work, calculated by the OECD as equivalent to “a contribution rate of 1.67%” [7]. If people also have the public pension in addition, it is deducted from their entitlement. Occupational DC plans have an average of 10% of earnings contribution rate. There is no early retirement allowed. Ireland is also one of the only two countries in the OECD (as of May 2009) to not mandate a second-tier pension (the other country is New Zealand) [7]. There has been an intense debate in Ireland about the relative merits of DC and DB plans. Some think that “the sustainable PAYG is superior, delivering pensions of the order of one-fifth higher for the same level of contribu- tion due to lower administrative costs” [8], whereas the DC plans understate pension cost by ignoring investment risks. Others, such as the OECD, support moving to-  J. ASSA 854 wards personal retirement savings accounts, and suggest “linking the standard retirement age to longevity” and tightening “the link between the pension and years of contributi ons” [9]. The government of Ireland published a Green Paper on Pensions in 2007, weighing various reform options. While generally criticizing the existing public system as not sustainable, it also expressed concerns about the de- cline in DB pensions, warning that “retirement benefits [under DC schemes] are too low” and that a move to DC plans involves “a change in the allocation of risks from employers to employees” [10]. The same document also suggested that DC plans may lead to inadequate income, predicting that “ most DC members are unlikely to have a retirement income equal to, or greater than, the NPPI target” [10], referring to the standard aimed at by the National Pensions Policy Initiative. 3. Comparative Analysis Having looked at the details of pension policies in Israel and Ireland and tracked recent changes in those policies, it is useful to look at these two coun tries through the lens of several theoretical frameworks relevant to under- standing differences in pension systems and policies. 3.1. Israel vs. Ireland Based on Pampel and Williamson’s 5 Perspectives In their book Old-Age Security in Comparative Perspec- tive, John Williamson and Fred Pampel discuss five theories for understanding policy development in the area of old-age security and pensions. They emphasize throughout th e book that, in most cases, no single theory is sufficient and each has its merits and drawbacks, de- pending on the specific context of place and period. The first theory, the industrialism perspective, applies particularly well to post World-War II developed coun- tries. It traces both the demand for and introduction of public pension programs in particular and social welfare policies in general to industrialization, technological de- velopment, urbanization and the resulting changes in the labor force. This theory views spending on public pen- sions “as a more or less automatic response to the needs generated by industrialization” [11]. As a result, the drawback of this perspective is that it often ignores or minimizes political forces. Applying this theory to compare Israel and Ireland, one can use Wagner’s law to see whether “the size of the public sector relative to the private sector increases as real per capita income increases” [11]. Figures 1 and 2 show the trends of public spending as % of GDP and per capita income, respectively, for Israel and Ireland for all available years. While neither country began its industrialization in the 1960s or 1980s, the data available constrain our analysis to these starting dates. Ireland actually had a lower real per-capita income in 1960, but has since overtaken Israel dramatically. By 2009 Ireland’s income of $36,712 was 45.3% higher than Israel’s $ 25,268. In terms of public spending, however, Ireland has been far more conserva- tive. Its government spending as % of GDP peaked at 21% in 1980-1981, and has since fallen to a level of around 15%. Israel peaked at 43.4% in 1975, and also declined but only to about 25% currently. It appears that the country that has had less dramatic income growth managed to maintain a more generous public spending than its counterpart. Figure 1. GDP per capita, PPP (constant 2005 international $). World Bank, November 2010. Copyright © 2011 SciRes. ME  855 J. ASSA Figure 2. General government final consumption expenditure (% of GDP). World Bank, November 2010. The social democratic perspective places more weight on a democratic struggle between classes to use the gov- ernment to their benefit. It stresses “the role of organized labor and leftist political parties as determinants of how much influence the working class is likely to hav e” [11]. Indicators for measuring this include social spending as a share of GNP, prevalence and strength of unions, and the number of years a leftist party is in power. Looking at the trends for Israel and Ireland for these three indicators, one gets a clear sense of contrast. Fig- ure 3 shows social expenditures as % of GNI. Israel has increased its social expenditures as a per- centage of GNI from 0.3% in 1970 to 1% in 1992 and to 1.5% in 2007. The Labor party has been in power in Is- rael all the way through 1977, after which the righ t-wing Likud party came to power, until another reversal in 1984. Power changed hands several more times, includ- ing a few unity governments. In the period shown in Figure 3 below, Labor was in power 1992-1996, Likud from then until 1999, One Israel (leftist) 1999-2001, Li- kud 2001-2006, and finally Kadima (center) 2006-2009. This political pattern does not match the data very well, implying perhaps a broad support for social spending across party lines (Likud’s rise to power in 1977 does actually fit the decrease in overall government expendi- ture shown in Figure 1 above). Ireland has shrunk its social expenditures from 1.4% of GNI to 0.8% from 1992 to 2007. In 1992 its govern- ment was shared between the Republicans (Fianna Fáil), Progressive Democrats and Labor though a Republican was head of state (Taoiseach). In 1994 power was shared by three parties: Fine Gael (right), Labor and Democratic Left. From 1997-2007 both the Republicans and Pro- gressive Democrats were in power. In all the years since Figure 3. Government expenditure on social protection as % of GNI. UN Statistics Division, November 2010. Copyright © 2011 SciRes. ME  J. ASSA 856 1997 a Republican was Taoiseach. This dominance of the right may explain more closely in Ireland’s case the constant decrease in social spending. Union membership in Ireland has also dropped re- cently. According to the Central Statistics Office, in 1994 over 45% of employees were members, while in 2004 only about a third belonged to a union [12]. In Is- rael, membership of the Histadrut dropped from 79% of workers (wage earners and salaried) in 1981 to 49% in 1996. Five percent of workers belonged to other unions, so total union membership was higher than the above figures. However, before 1980 membership of unions is estimated at 80% - 85%, so there was a clear decline [13]. This fits the social-democratic perspective, and explains both the long-term weakening of labor and pensions in Ireland, as well as the move in 1995 from DB to DC plans and retrenchment trends in Israel until 2007 (though some parts were later reversed as shown above). The neo-Marxist perspective is less optimistic regard- ing the merits of the democratic process and the pros- pects for workers’ political power. It assumes that the ruling class controls the government in industrialized countries. This theory and its proponents have mixed views about public pe nsions. Such po licies are often seen as a means to control and co-opt workers, with little or no redistributive effects. The theory explains fiscal crises by the attempts of governments to “socialize the costs of production while privatizing profits” [11]. Israel does not seem to fit this story, since it started with 29 years of Labor party rule and a near monopoly of the Histadrut in pension and health-care provision. The later pull-and- push process with regards to pensions only proves the relative strengths of various factions , rather than exhibit- ing any control of government by the elite. In Ireland, however, the history has been far clearer, with the intro- duction of contributory schemes in 1961, the absence of an early retirement option, the high elderly poverty rate and the overall con ser vativ e appro ach of governmen t and employers to pensions. The neo-Pluralist perspective goes beyond political parties and classes and emphasizes civil society and in- terest groups. This environment can at times facilitate policy compromises, but at other times leads to political stalemates. One such group which is often powerful is the aged population. An important implication of the neo-pluralist perspective is that “pension policy is inher- ently political”, in clear contrast to the industrialism and neo-Marxist perspectives “which see pensions as a more automatic response to industrial and demographic changes or changes in productive relations” [11]. Looking at the size of the elderly-group over time, there does seem to be a sizeable increase in the percent- age of the elderly in Israel, from 3.6% in 1950 to over 10% in 2005. In Ireland the increase has only been from 9.2% to 11%. Thus the neo-pluralist theory may well explain the greater political weight of the aged in Israel than in Ireland, and the resulting effect on pensions de- scribed above. Finally, the state-centered perspective sees the gov- ernment as having some autonomous power in policy making, rather than being under the control of classes or interest groups. Some aspects of state structures are the existence and degree of democracy, the centralization or de-centralization of government, and corporatist theories. Corporatism can take democratic forms (e.g. Sweden and Austria) in which case it facilitates negotiations and co- operation between capital and labor. When corporatism is authoritarian (e.g. fascist Italy), however, the govern- ment is more in control and attempts to retain and en- hance its own power “while at the same time decreasing the influence of various interest groups, particularly or- ganized labor” [11]. A highly developed and specialized group of civil service can serve as “technocratic experts who have a substantial impact on program formulation and reform due to their specialized knowledge” [11]. In a review of organized labor in Israel, Cohen et al. suggest that the trade unions in Israel were exceptional before 1980 due to both “extensive ownership of eco- nomic activity” as well as the part they took in the proc- ess of nation building [13]. The economic power of the Histadrut (which represented up to 85% of workers in the 1970s) included “control over the pension market” and an “almost monopolistic position in the provision of health care” [13]. It should be remembered that Israel was founded with a strong social-democratic vision, in- cluding experiments such as the Kibbutzim (collective agricultural commun ities), free healthcare and education, and mandatory military conscription. Politically it re- ceived support first from the USSR and then from France, until the six-day war in 1967. Since then, and under a growing American support and influence, Israel’s econo- my and society have been trending to the right, breaking away (albeit gradually at first) from socialist ideals to- wards Anglo-style capitalism. Cohen et al. describe the consequences of this “transi- tion from a system that most resembled corporatist sys- tems, sharing features with countries such as Austria, Germany and Belgium, to a much more pluralist system, hence more similar to that in the United States” [13]. These include decreasing union membership rates, lower collective bargaining coverage, union decentralization, and an increase in representation by non-unions. The pre- 80s system was a tri-partite arrangement between the Histadrut, the ruling Labor party and employers’ organi- zations. The political alliance between the Histadrut and the Labor governments (in rule continuously from inde- Copyright © 2011 SciRes. ME  857 J. ASSA pendence in 1948 until 1977) allowed “a strong interv en- tionist position take n by th e state” [13] in nego tiatio ns on wages and work co nditions. Due to the loss of political power to the Likud party in 1977, as well as globalizatio n, increased share of migrant workers, “decline of traditional unionized industries, and increased workers’ heterogeneity” [13], the Israeli cor- poratist system started to fall apart, weaken and decen- tralize in the late 1970s. Worker membership in the His- tadrut fell from a peak of 79% in 1981 to 45% in 2000 (with coverage of only 56% of wage workers). Inde- pendent unions gained from the Histadrut’s losses, cov- ering about 20% of workers by 2000 (especially profes- sional unions such as teachers, academics, doctors and journalists). In general, union membership is still high in public sector industries (health, education, welfare and utilities) and some private ones (manufacturing and banking). Agriculture and construction, dominated by low wages and many migrant workers, are “predomi- nately nonunion” [13]. 3.2. Israel vs. Ireland Using Weaver’s Three R’s Another insightful theoretical perspective with which to compare and contrast pension policies in different coun- tries is that of Kent Weaver. In both Cutting Old-Age Pensions and The Politics of Public Pension Reform, Weaver details both the pressures faced by governments to cut pensions, as well as their strategies to reduce blame and minimize political backlash. This approach implies that pension policies and reforms are not purely economic decisions, but have a large and quite compli- cated political contex t in which they need to be viewed. The first political aspect of pensions is th e relative po- litical strength of the elderly in many countries. This is a “large, politically active group, and they are v iewed sym- pathetically by the rest of the electorate” [14]. Young people also sympathize with retirees, both because one day they will be in their place, and because any cuts in pensions might increase their own share of the burden in supporting older relatives. As is shown in Figure 4 be- low, the proportion of elderly to total popu lation in Israel nearly tripled from 1950 and 2005, thus increasing the potential for pressure in favor of maintaining or expand- ing pensions. At the other end of the political debate on pensions are various pressures on governments to restrain or cut spending. These include demographic factors such as ageing populations, budget deficits, and political resis- tance to (at times bordering on demonization of) raising taxes. Weaver also mentions the effect of lower poverty rates among the elderly (compared to the general popula- tion), which can create a perception, common in the U.S. and Canada (and perhaps other OECD countries), that “substantial pension benefits are received by persons who are relatively well off and do not ‘need’ them” [14]. Another source of increased political pressure is th e neo- liberal philosophy that people can manage their savings (for retirement and in general) better than the govern- ment. This has manifested itself in increased attempts to replace DB with DC plans, and to create or expand per- sonal savings accounts. The problem with this philosophy is that it gives peo- ple too much credit for being able to “do-it-yourself”. Teresa Ghilarducci examines this myth, among others, in her book When I’m Sixty-Four: The Plot against Pen- sions and the Plan to Save Them. In addition to stagnat- ing growth in pension coverage, she mentions three other Figure 4. Population 65 and over as % of total population. UN Population Division, November 2010. Copyright © 2011 SciRes. ME  J. ASSA 858 consequences of shifting from DB to DC plans. These three “i’s” include inefficiency (low income security to savings ratio), inadequacy (of savings for retirement) and inequality (workers bearing more risk than employers, middle-class workers more than upper-class ones). Peo- ple tend to be myopic about both their longevity and fu- ture income, and as a result are “unsuited and unable to earn the maximum return on their pension savings when individual accounts are the vehicle to do so because of high and hidden management fees, the lack of investment experience, and the difficulty of saving enough to elimi- nate the downside r isk of not hav ing enough to r etire on” [15]. It is also common sense that, in a modern, special- ized economy, the average worker does not have the time, skills and experience of an investment specialist or actu- ary in planning for retirement. The three options available to government facing such pressure are, according to Weaver’s framework, re- trenchment, refinancing or restructuring, which can be used separately or in combination. The first option, re- trenchment, can take the form of cutting pension benefits, reducing inflation adjustments, raising the retirement age, forbidding or restricting early retirement, and making criteria for receivin g various ben efits stricter. Th e second option, refinancing, seeks rather to increase pension sys- tem revenues. This can happen through increasing the tax rate or the tax base, channeling government (general) revenues into pension systems, and adding new groups previously not paying payroll tax towards pensions. The final option, restructuring, can work through abolishing existing universal pension pillars, and making private, occupational pension s mandatory as a substitute for pub- lic-pension pillars. Various strategies have been used by reformers to re- duce the blame associated with each of these steps. Weaver mentions delaying, phasing-in, use of compli- cated formulas to reduce transparency, targeting weak groups, and grandfathering of “current retirees and the near-elderly into [the] current system” [14]. All of these are meant to reduce or shift the blame for pension cuts and minimize the political retaliation by voters (at times by completely shifting it away to the next administra- tion). Israel has experienced some retrenchment and re- structuring as described above, notably in the closing of DB plans to new members in 1995, cutting benefits and raising retirement ages in 2002-2003. It also used some refinancing by dropping initial government guarantees for the DC plans. Ireland has also seen retrenchment and refinancing in the ever-decreasing share of public spend- ing to GNI as shown above. Restructuring has been evi- dent in the relative increase in DC plans at the expense of DB plans. 3.3. The Role of Labor in Israel vs. Ireland Pushing back against retrenchment, organized labor has played a far greater role in Israel than in Ireland. The Histadrut was created in 1920, 28 years before inde- pendence, and played a major role in both social and economic development as well as in nation building. As described above, a corporatist tripartite system was at work, centrally determining wages and work conditions and supported by the ruling Labor party until 1977. Some ground was lost later, with the election of Likud to power, and decentralization of collective bargaining. However in recent years, the Histadrut and other unions made great strides in protecting and even expanding pen- sion coverage. Two important examples are the mandat- ing of pensions for every employee since 2008, and the very recent agreement (September 2010) to raise em- ployer contributions towards pensions from 10% to 17.5% by 2014. In Ireland there was never such dominance of labor- unions, and recently membership has further dropped from 45% to around a third as described above (compare with Israel’s pre-1980s level of 80% - 85%). The strug- gle on the politics and economics of pensions in Ireland seems to have been fought more through political parties (cf. the Green Paper mentioned above) than through col- lective bargaining. 4. Macroeconomic Impact Having looked at pension policies in relation to workers, employers, unions and governments, it is useful to widen the scope and examine the impact of various pension policies on the economy as a whole, both in theory as well as in the two countries discussed in this paper. The World Bank’s multi-pillar model can serve as a theoreti- cal starting point. 4.1. The World Bank’s Three Pillars The World Bank’s report on averting old-age crisis at- tempts to recommend policies that would both “protect the old and promote growth” (bold in original), as its name suggests. Its diagnosis of the problems in old-age financial-security systems is similar to that of the OECD, citing higher life expectancy and lower fertility and the resulting increases in dependency ratios. It also points out that traditional support systems in developing coun- tries (e.g. extended family care, community and other informal ties) are eroding fast due to “urbanization, mo- bility, wars and famine” [16]. The philosophy in the re- port is “to move toward formal systems of income main- tenance without accelerating the decline in informal sys- Copyright © 2011 SciRes. ME  859 J. ASSA tems and without shifting more responsibility to gov- ernment than it can handle” [16]. This implies a traditional distrust of government’s ability to manage pensions, but at the same time the re- port acknowledges that individuals cannot be depended on completely to save for old-age because of their short- sightedness, lack of sufficient savings instruments, in- surance market failures, information gaps and the causes of long-term poverty (insufficient life-long earnings which can only be handled by redistribution). More generally, the report cites various problems with all single-pillar systems in different settings. Provident funds, for example, are often misused, allowing govern- ment easy access to finance at low interest rates, consti- tuting “a hidden tax on labor” [1 6]. The criticism against occupational pension plans is that “they redistribute in accordance with employer rather than social objectives” [16], and are usually not funded fully. Private savings accounts are at fault since they do not deal with informa- tion gaps or long-term poverty. The recommended solution is a “multi-pillar system”. The World Bank recommends separating the three func- tions of financial security systems for the aged—redis- tribution, saving and insurance—using three pillars: a small, mandatory public pillar only meant to reduce old- age poverty; a mandatory private saving system; and a voluntary pillar. It also gives separate recommendations on how to get to this system for economies in various development stages, such as young but low-income countries, young and rapidly-aging ones, and older e- conomies that already have well-established public pil- lars. The latter group includes the OECD, among others, and faces “imminent problems with their old age system” [16]. Solely relying on and expanding the public pillar would result, according to the World Bank, in higher taxes, lower growth, and low returns. The two-stage pre- scription is to start by reforming the public pillar and then create a private one. More specifically, the first step involves “raising the retirement age, elimin ating rewards for early retirement and penalties for late retirement, downsizing benefit levels … and making the benefit structure flatter … the tax rate lower, and the tax base broader” [16]. The second step would reallocate contri- butions from the public pillar to a second private man- datory pillar or raise contributions in the first pillar and channel to them to the second pillar. The foreseen benefits of the new system would in- clude a closer link between contributions and benefits in the private pillar, enhanced saving and capital market development, and full funded growth, thus having a posi- tive macroeconomic impact. The World Bank also sug- gests that this multi-pillar system would contribute to risk diversification (since it’s mixing private and public elements), leading to improved performance. 4.2. Impact of Pension Reforms on Aggregate Demand and Macroeconomic Stability The World Bank multi-pillar model predicts positive effects on savings and growth of a smaller public pillar and a larger private pillar. Looking at data on gross sav- ings as a percentage of GNI, Figure 5 shows some in- crease in Ireland over time, though there is a beginning of a decline in 2007, coinciding with the bursting of the housing bubble and the beginning of the financial crisis. According to Eurostat, gross saving in Ireland (as % of GDP) fell to 16.4% in 2008 and 11.5% in 2009, and is forecasted to further decrease to 10.5% in 2010 and 11.0% in 2011. Israel, on the other hand, maintained a relatively steady proportion of savings to income. Its switch from DB to DC plans in 1995 does not seem to have caused an Figure 5. Gross saving as % of GNI. UN Statistics Division, November 2010. Copyright © 2011 SciRes. ME  J. ASSA 860 Figure 6. Gross domestic product growth rate. World Bank, November 2010. increase in the savings rate, as the World Bank model predicted. Turning to growth, Israel’s GDP growth rate has been more stable and more consistently positive than Ireland’s since 1961. If anything, Israel’s growth rates before its switch to DC plans in 1995 were higher (average annual growth of 3.8% between 1961 and 1994, compared to 2.5% from 1995 to 2009). 4.3. Impact of Pension Reforms on Financial Markets The lack of mandatory pension savings in Ireland and the increasing reliance on DC plans as opposed to DB plans has led to shrinking in financial assets under manage- ment of pension funds. In Israel, by contrast, the manda- tory savings plan and the recent increase in employer contributions from 10% to 17.5% (phased in until 2014) are both expected to have large positive effects on fund availability, making financial markets more liquid and increasing the po wer of labor. Figure 7 shows the trends based on available data up to 2009 from the OECD’s Global Pension Statistics da- tabase. Israel’s has constantly increased its pension fund assets as a percentage of GDP, while in Ireland the level of assets has fluctuated drastically and suffered major decreases from its peak in 2006. 4.4. Impact of the Financial Crisis on Pensions, Aggregate Demand and Financial Markets Israel has weathered the financial crisis better than most developed countries. This is due in part to a cautious monetary policy and a sound regulatory environment. It can also be attributed in part to the important contribu- Figure 7. Pension funds’ asse ts as a % of GDP. OECD, No- vember 2010. tion of government spending in general, and on pensions in particular, to aggregate demand. As shown above, Israel’s spending on government expenditure has been around 25% of GDP in recent years (compared to Ire- land’s 15%), and it spending on social protection was 1.5% in 2007 compared to Ireland’s 0.8% of GNI that same year. As mentioned above, when the financial crisis began, Israel created a compensation plan was for workers near retirement (57+) who lost money in their DC funds since November 2008. No OECD country made a similar move. Among the 30 members of the OECD at the time, Ireland’s private pension system suffered the worst in- vestment losses, declining by 37.5% in real terms in 2008. The OECD explains this by pointing to the com- position of pension assets in Ireland, with equities com- prising two-thirds of total assets (as compared with 36% on average in the OECD) [1]. Given that in Ireland private pensions account for a third of all retirement income (the OECD average is un- Copyright © 2011 SciRes. ME  861 J. ASSA der 20%), the effects on pension benefits and old-age poverty are severe. Thirty percent of Ireland’s retirees are under the OECD poverty threshold (second only to Korea and Mexico) [1]. The safety net for old age in Ire- land is also low by OECD standards: the net replacement rate (full-career workers) is 68.4%, seventh from the bottom and well below the OECD average of 82.4% (contrast wit h Denmark’s 13 7%) [ 1] . Given the higher propensity to consume of people on fixed income, especially those below the poverty line, such a decrease in income can only lead to a large de- crease in aggregate demand, thus further depressing the Irish economy (which contracted by 3% in 2008 and 6% in 2009, compared with Israel’s growth of 4% and 1% in the same years, respectively). 5. Conclusions Common (neoliberal) wisdom has it that traditional, pub- lic or defined-benefit pension plans are unsustainable due to demographic shifts and fiscal pressures. Organizations such as the OECD and the World Bank have been vocal in promoting defined-contribution pension plans as well as personal retirement accounts as an alternative, posi- tioning this paradigm shift as the only viable alternative for countries to pursue. This paper has compared the experience of Ireland, an original OECD founder and a classical neoliberal example, with that of Israel, the newest member of the OECD. Israel’s path to both OECD membership and pension policy balance has been far more complex than the simplistic OECD model, in- volving active participation of the Histadrut as well as other labor unions, a corporatist (followed by a pluralist) national debate, and a recent strengthening of pensions by mandating coverage for every employee as well al- most doubling of employer contributions to occupational pensions plans. Defying the World Bank model’s predictions, these steps have actually led to both stable and positive gro wth in savings rates, GDP and pension assets. Ireland, by contrast, suffered major losses in its voluntary private pensions (two-third s of which were invested in equities), large increase in old-age poverty and output contraction. While pension policies may not have directly caused the differential results in the two countries, their impact on aggregate demand has certainly played an important role in the outcomes. It appears, therefore, that rather than a single path to pension stability and economic growth, countries face various options they can take to ensure positive out- comes for retirees, workers and the economy as a whole. Israel’s path to OECD membership has involved some retrenchment, but overall has displayed a collaborative approach between labor, employers and the government, and has resulted in a much more balanced system of pen- sions than that in Ireland. All roads may lead to Paris, but some are more beneficial than others. 6. References [1] Organisation for Economic Co-Operation and Develop- ment, “Pensions at a Glance 2009: Retirement-Income Systems in OECD Countries,” OECD, 2009. [2] OECD Website, “About OECD: History,” OECD, 2011. http://www.oecd.org [3] Israel, Ministry of Finance, “Israel: Ready for the O ECD, ” March 2006. [4] OECD, “Roadmap for the Accession of Israel to the OECD Convention,” C (2007)102/FINAL, OECD Coun- cil, 3 December 2007. [5] OECD, “OECD Recommendation on Core Principles of Occupational Pension Regulation,” OECD Council, 5 June 2009. [6] A. Brender, “Distributive Effects of Israel’s Pension Sys- tem,” Discussion Paper No. 2009, Bank of Israel Re- search Department, 10 October 2009, pp. 5-7. [7] OECD, “OECD Reviews of Labor Markets and Social Policies: Israel,” OECD, 2010. [8] S. Whelan, “Valuing Ireland’s Pension System,” Quar- terly Economic Commentary, Summer 2007, p. 55. [9] OECD, “OECD Economic Surveys: Ireland,” OECD, 2009. [10] Ireland, Department of Social and Family Affairs (DSFA), “Green Paper on Pensions: Executive Summary,” Dublin, 2007. [11] J. B. Williamson and F. C. Pampel, “Old-Age Security in Comparative Perspective,” Oxford University Press, Ox- ford, 1993. [12] Ireland, Central Statistics Office, “Quarterly National Household Survey: Union Membership 1994-2004,” 2010, p. 1. [13] Y. Cohen, “The State of Organized Labor in Israel,” Journal of Labor Research, Vol. 28, No. 2, 2007, pp. 255-259. [14] R. K. Weaver, “Cutting Old-Age Pensions,” In: R. K. Weaver, Ed., The Government Taketh Away: The Politics of Pain in the United States and Canada, Georgetown University Press, Georgetown, 2003, pp. 41-43. [15] T. Ghilarducci, “When I’m Sixty-Four: The Plot against Pensions and the Plan to Save Them,” Princeton Univer- sity Press, Princeton, 2008. [16] World Bank, “Averting the Old Age Crisis: Policies to Protect the Old and Promote Growth,” Oxford University Press, Oxford, 1994. Copyright © 2011 SciRes. ME

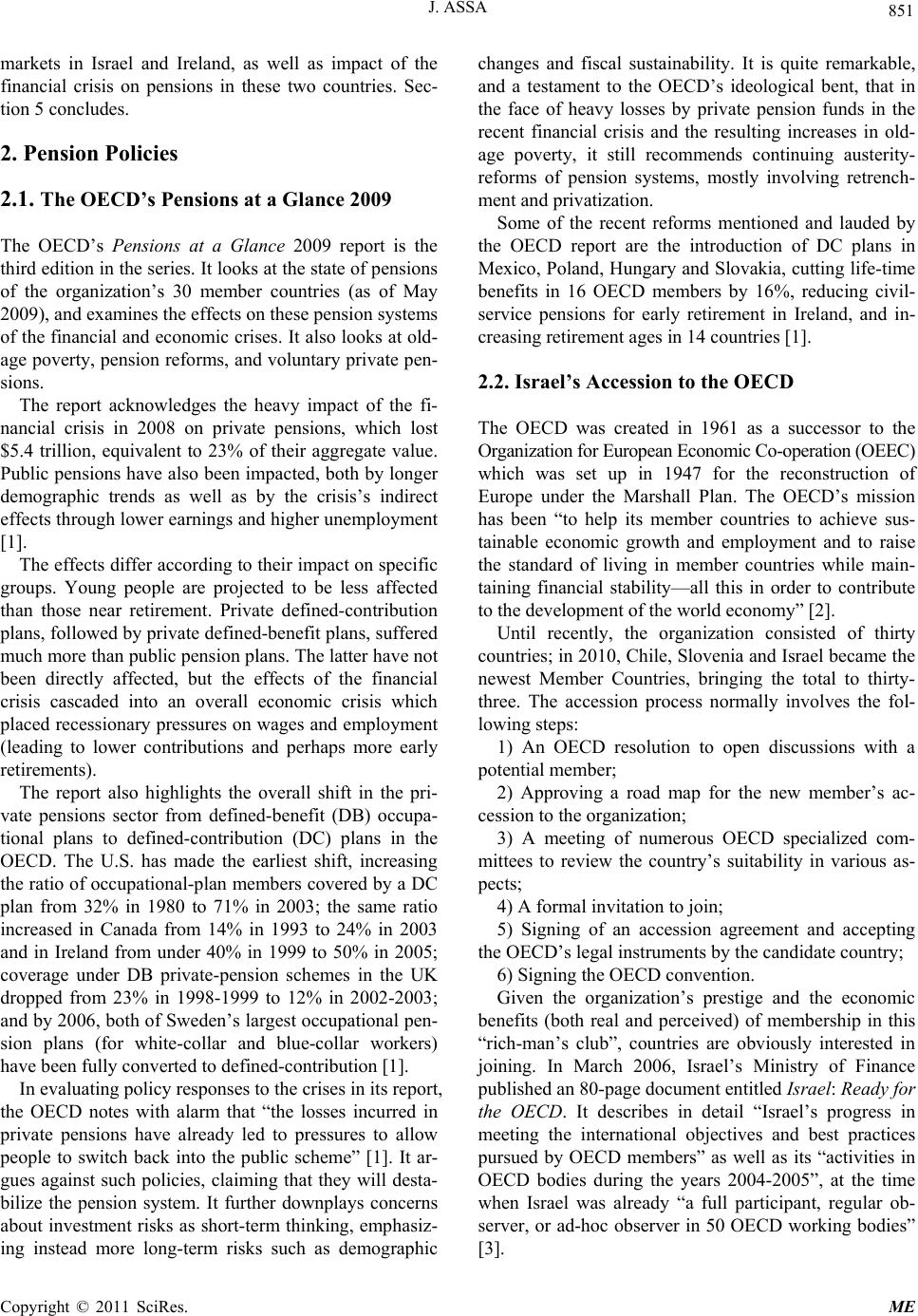

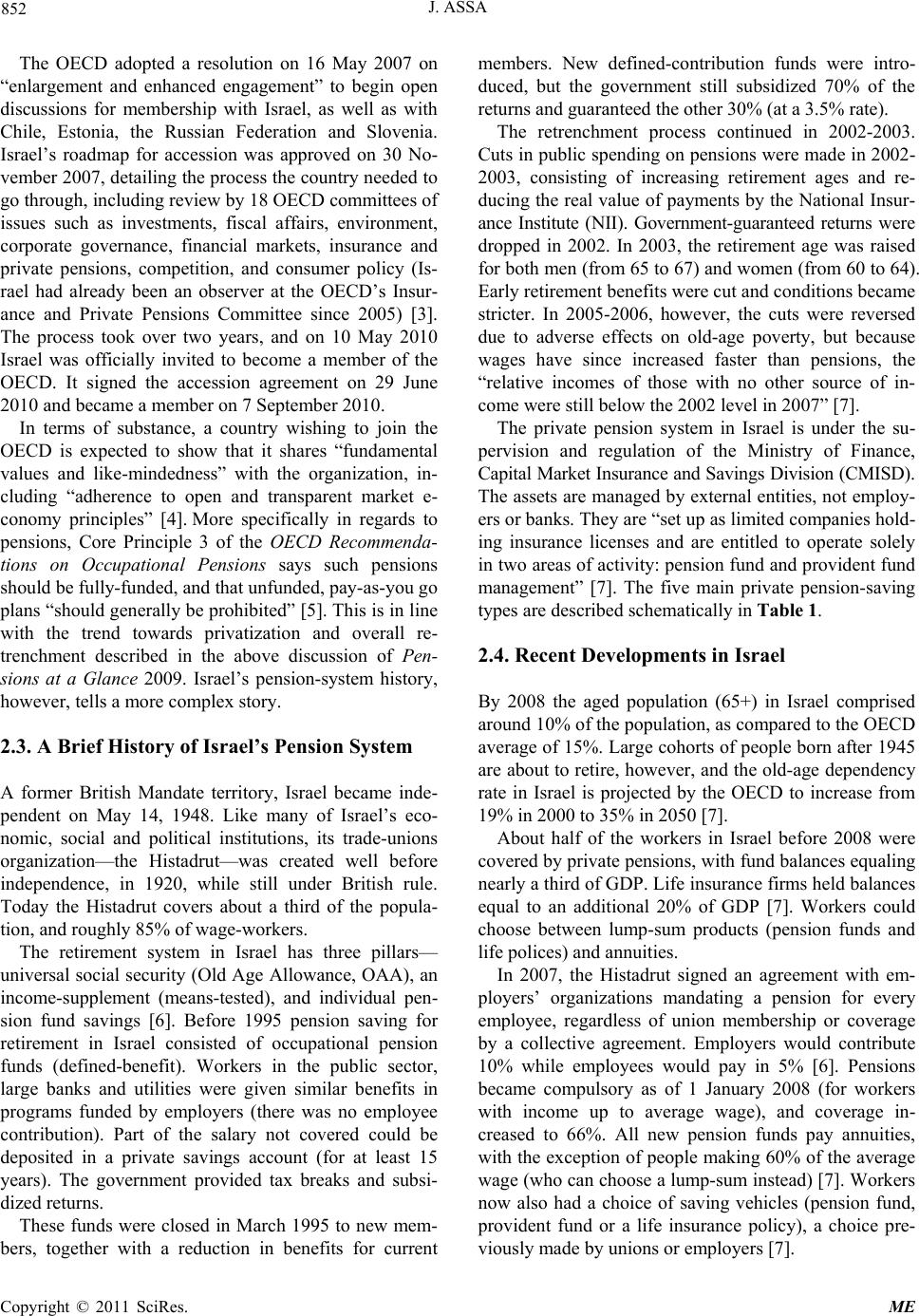

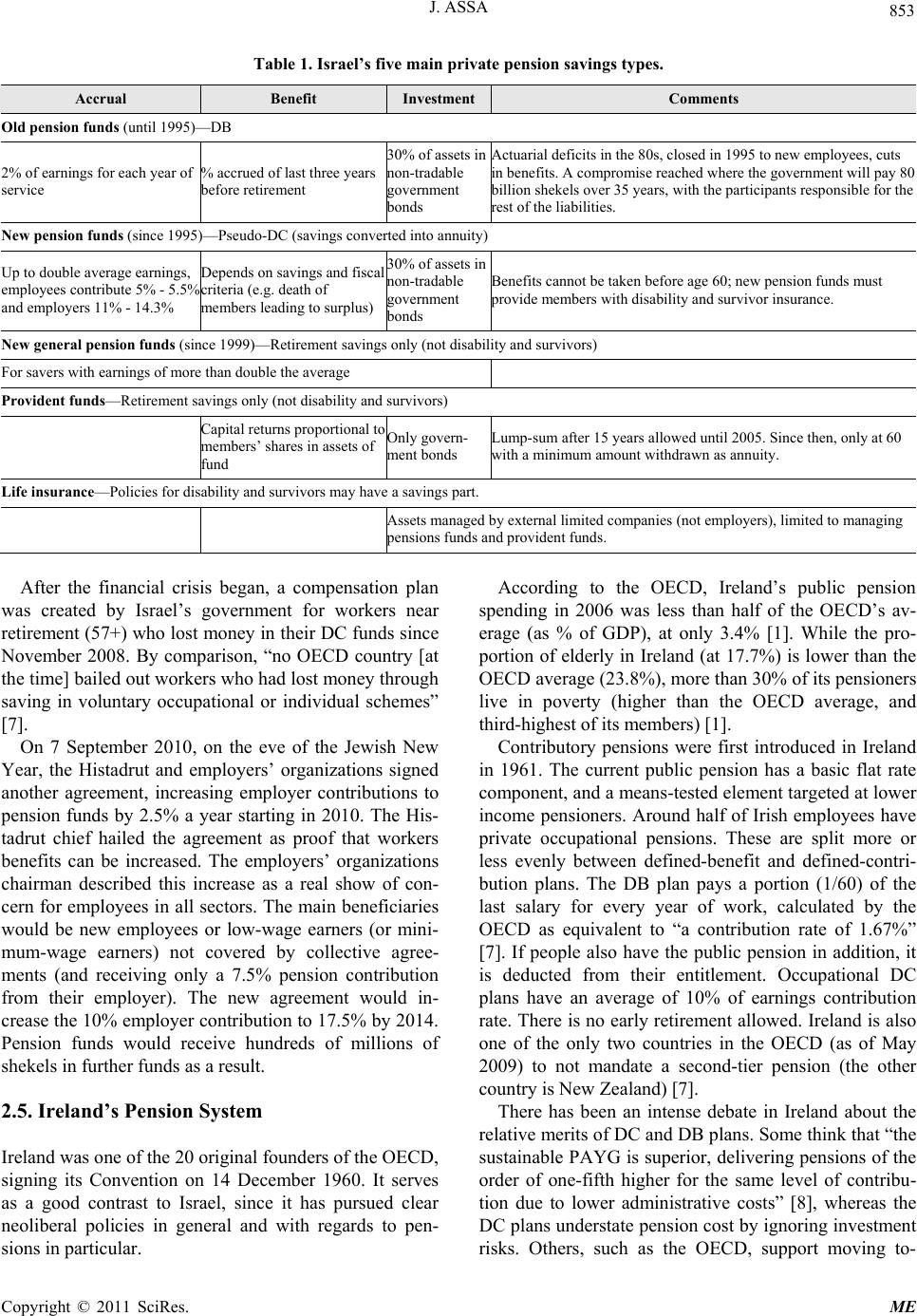

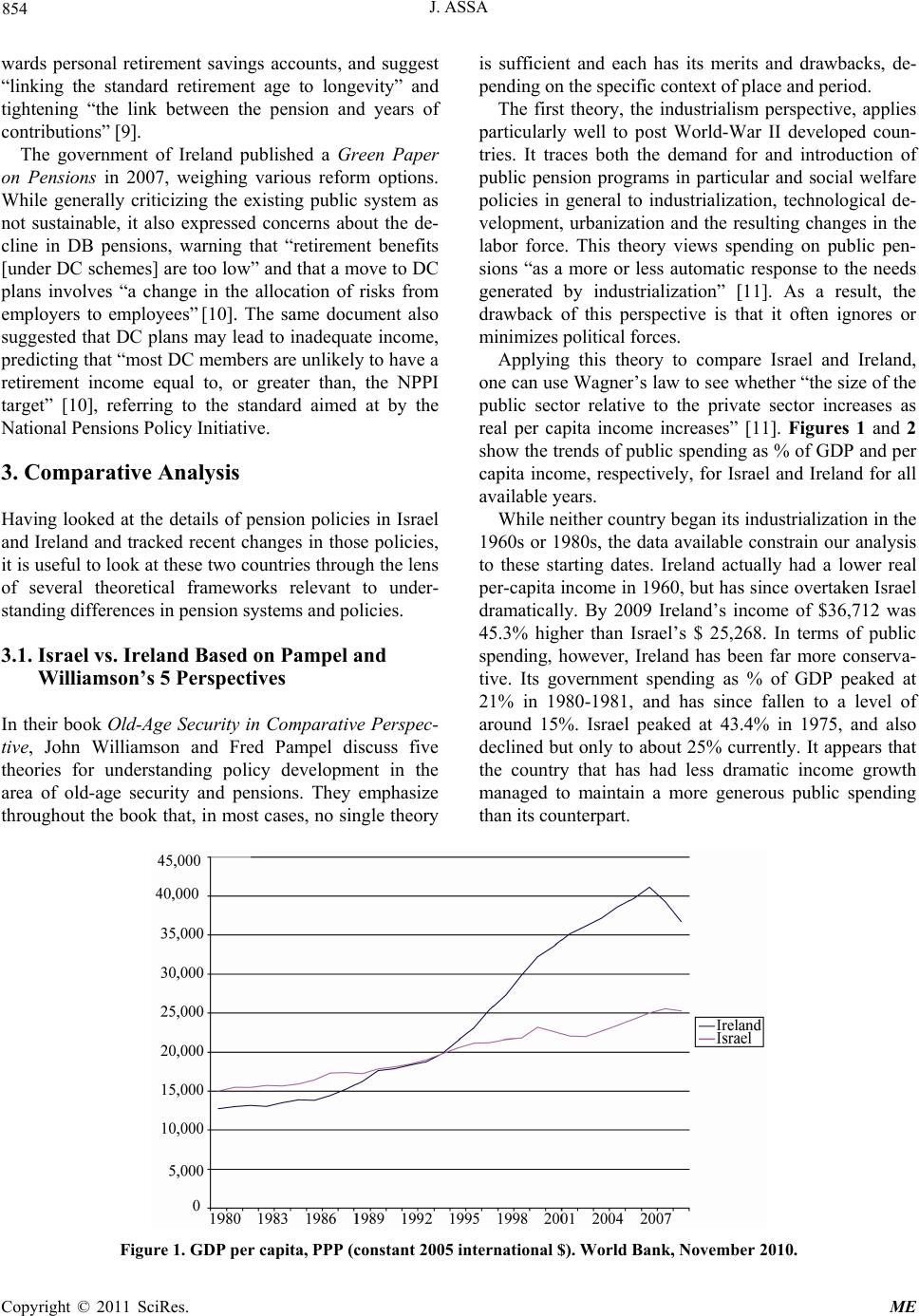

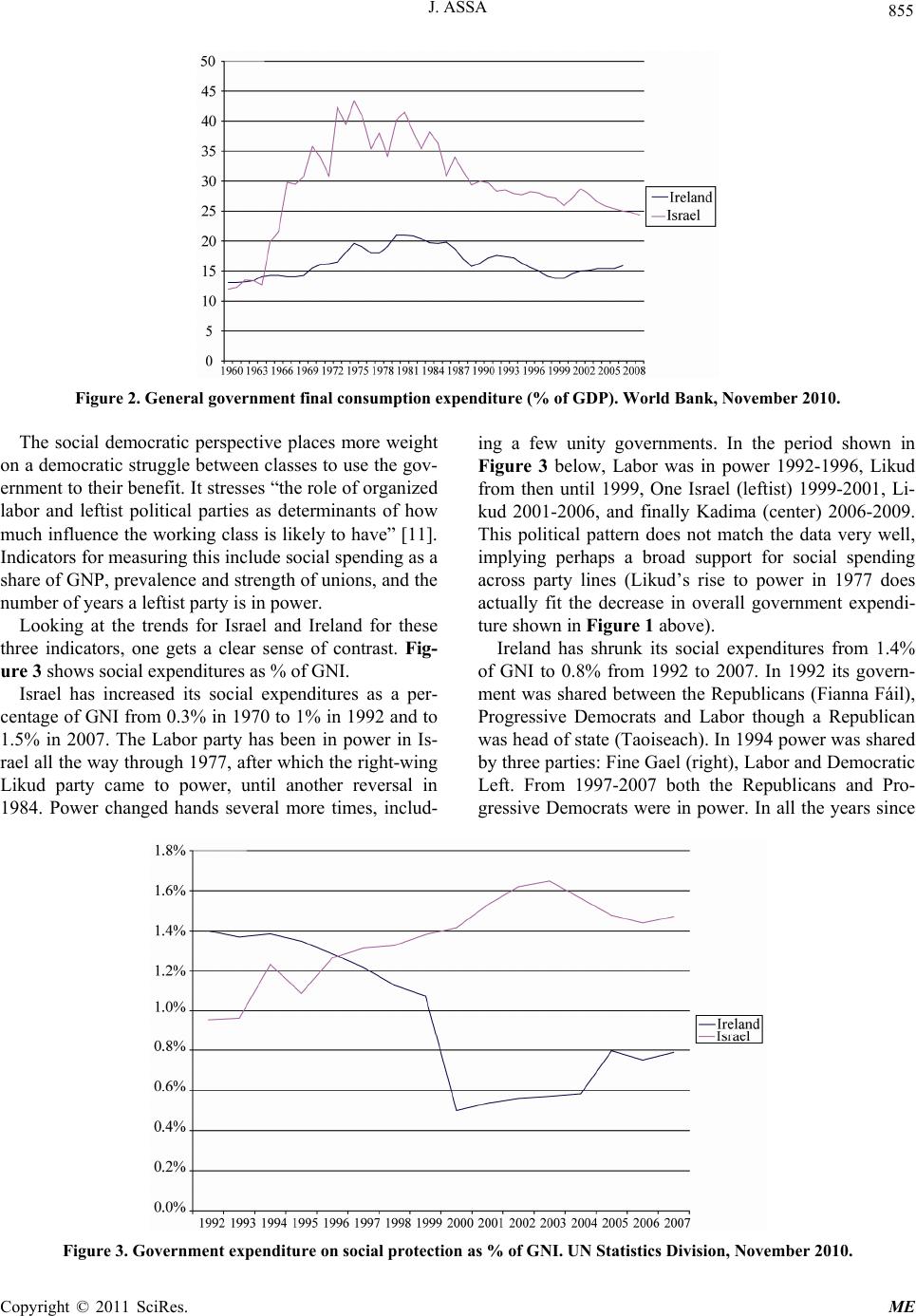

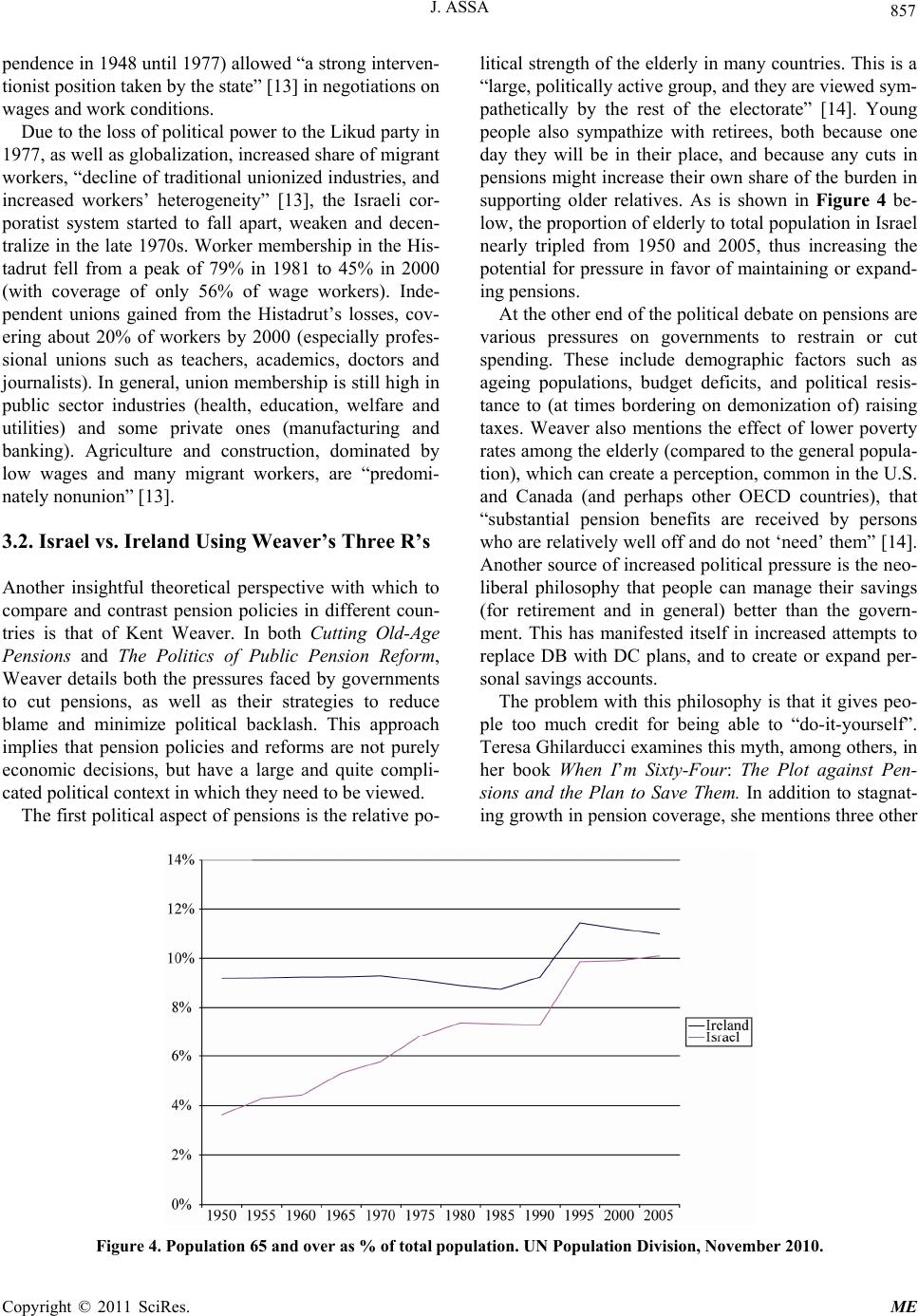

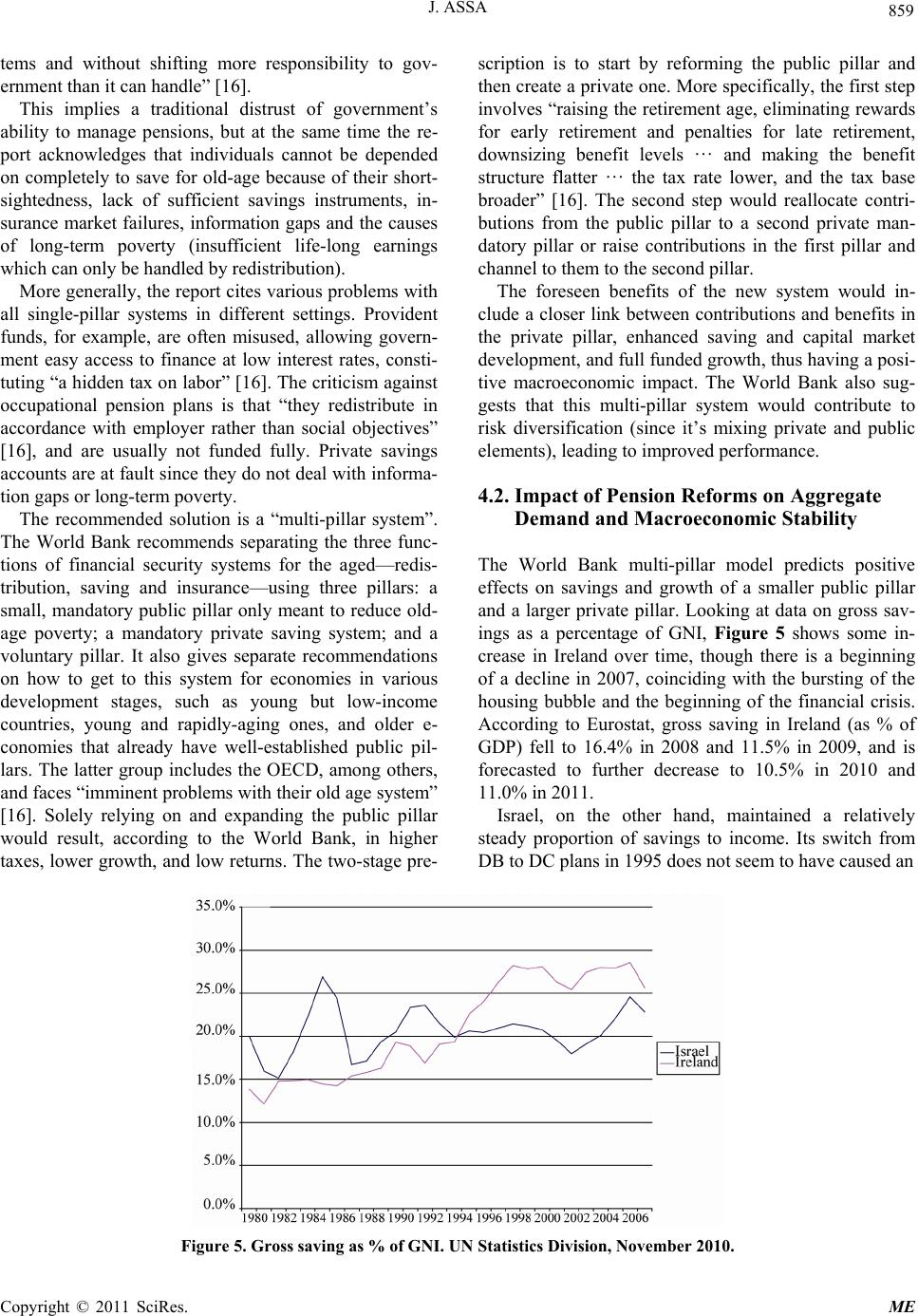

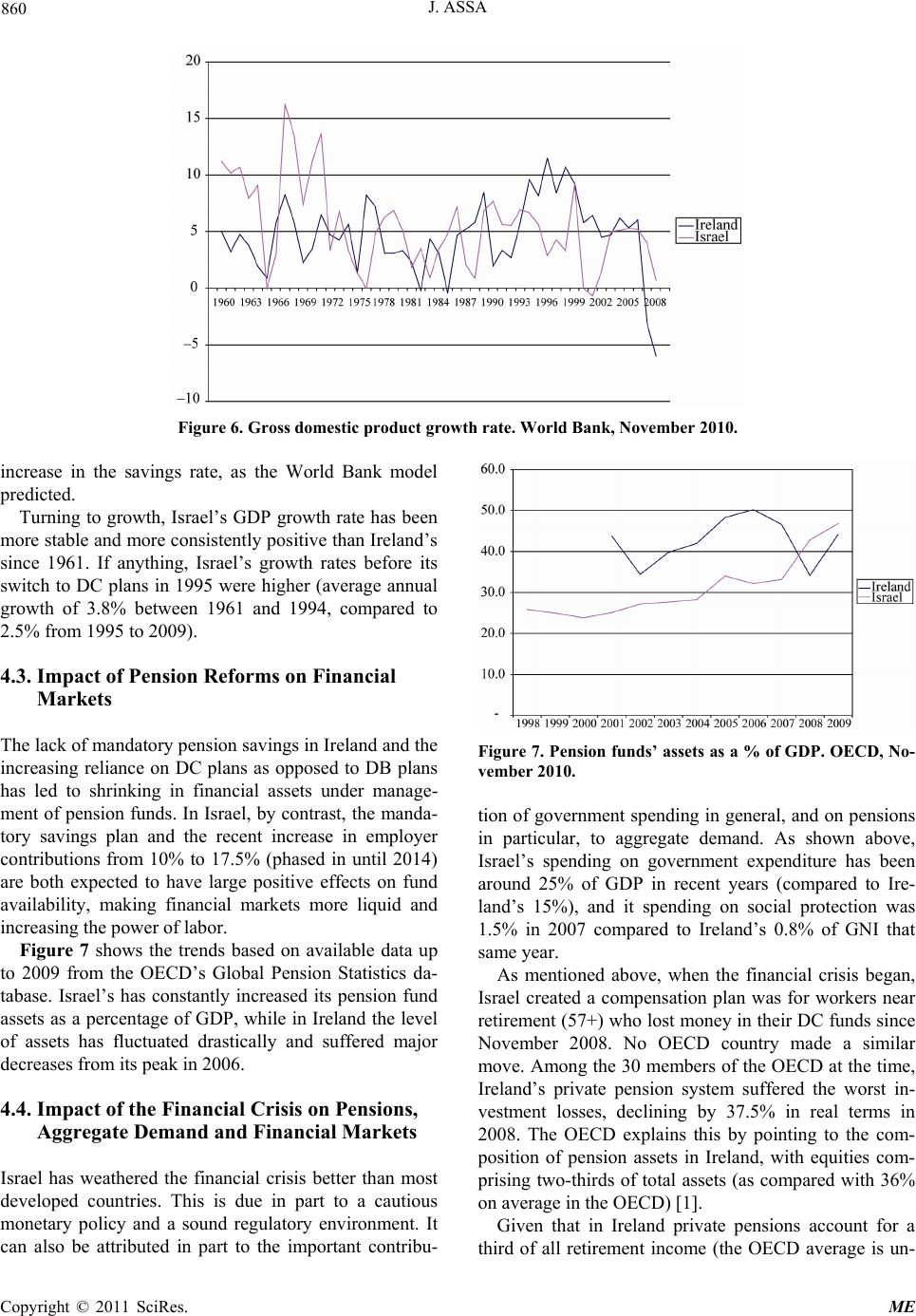

|