Paper Menu >>

Journal Menu >>

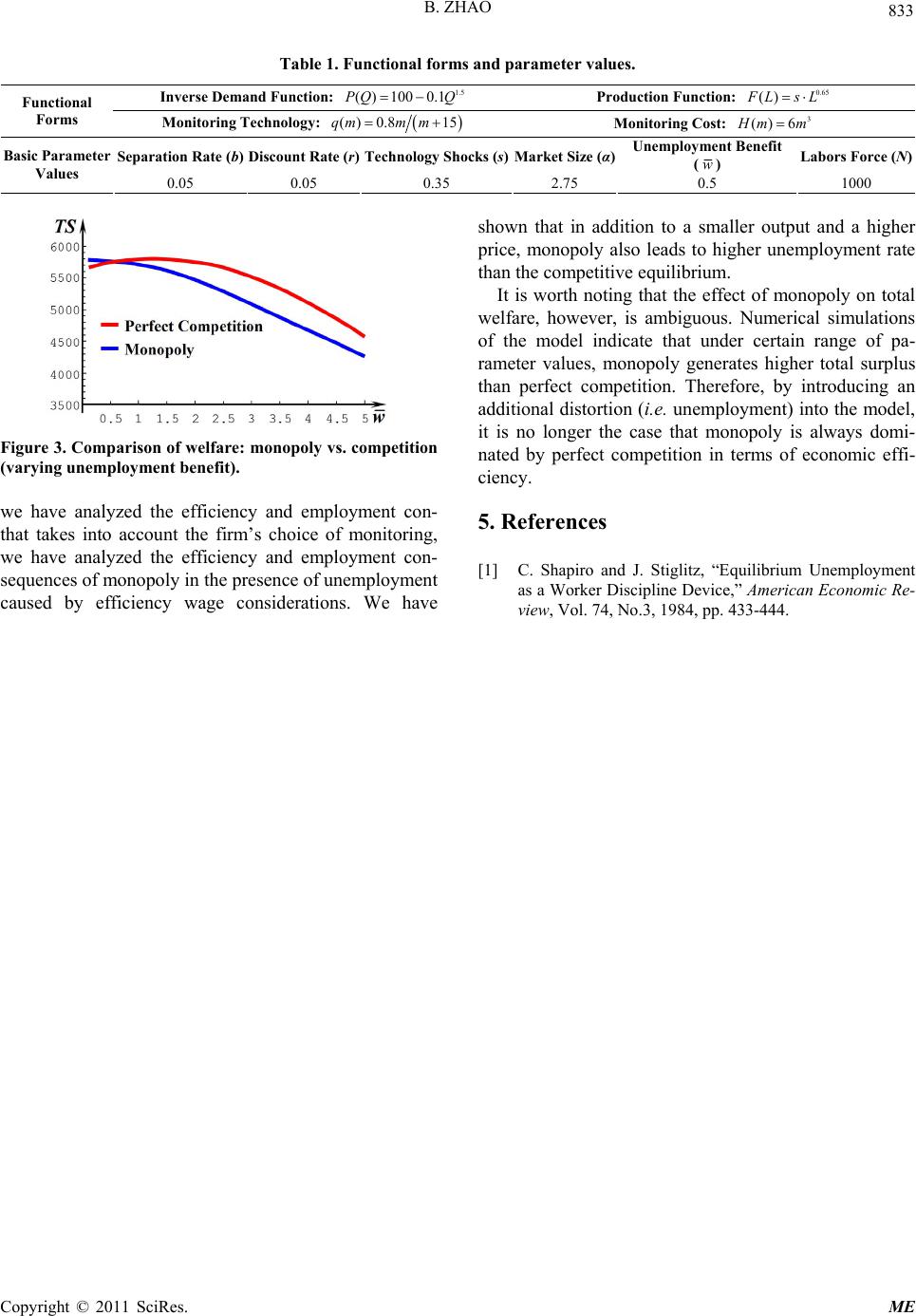

Modern Economy, 2011, 2, 830-833 doi:10.4236/me.2011.25092 Published Online November 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Monopoly and Economic Efficiency: Perspective from an Efficiency Wage Model Bo Zhao School of International Trade and Economics, University of International Business and Economics, Beijing, China E-mail: todd_zb@hotmail.com Received June 8, 2011; revised July 23, 2011; accepted August 19, 2011 Abstract The objective of this paper is to analyze the efficiency consequences of monopoly from the perspective of an efficiency-wage model based on Shapiro and Stiglitz (1984). An important innovation of our model is that a firm can raise the probability that a shirking worker is detected by increasing its effort or investment in the monitoring of workers. By comparing with the competitive equilibrium we find that monopoly is associated with higher unemployment rate and less monitoring. Surprisingly, however, monopoly is not necessarily dominated by perfect competition in terms of economic efficiency. Keywords: Monopoly, Economic Efficiency, Unemployment, Efficiency Wage 1. Introduction It is well-known that monopoly causes inefficient alloca- tion of resources. Traditionally, deadweight losses, pro- ductive inefficiencies and rent seeking activities are cited as reasons for efficiency losses of monopoly. However, there is one area of potential efficiency losses of monop- oly that so far has rarely been explored in microeco- nomic theory, that is, the effects of monopoly on unem- ployment. Given that output is an increasing function of labor, reduction in output by a monopoly will normally cause a reduction in labor employed. Therefore, it seems plausible that monopoly cause higher rate of unemploy- ment. On the other hand, however, the effect of monopoly on economic efficiency, if taking unemployment into con- sideration, is not that clear and has not been studied deeply in microeconomic theory. Therefore, the main objective of this paper is to analyze the efficiency con- sequences of monopoly from the perspective of an effi- ciency wage model of unemployment based on Shapiro and Stiglitz [1]. In this model a monopolist has to offer a wage high enough to induce workers to expend efforts on the job. An important feature of our model is that a mo- nopolist can raise the probability of shirking detection by increasing its effort or investment in the monitoring of workers1. Using this model we find that monopoly does not necessarily lead to lower welfare level than perfect competition. This result is surprising in light of the common belief about the welfare losses of monopoly. The rest of this paper is organized as follows. Section 2 presents the model and compares the monopoly equi- librium with the competitive equilibrium. Section 3 ana- lyzes the welfare consequence of monopoly and presents the main results from simulations. And conclusions are in section 4. 2. The Model Consider an industry served by a monopolist2, whose objective is to maximize profits. The demand for the good produced by the monopolist is represented by ()pPQ , where p is the price and Q is the output with () 0PQ and 2() ()0PQP Q Q (to ensure the monopolist’s marginal revenue is decreasing in output), and 0 ()Ys FeL measures the market size. The monopolist produces the good according to the production function with () 0F ()F and , where Y is the output, L is the number of workers employed, e is the effort level expended by the representative worker (hence, eL represents the effective amount of labor em- 0 1Shapiro and Stiglitz [1] discuss informally the case of endogenous monitoring. They indicate that in general it is impossible to ascertain whether the competitive equilibrium entails too much or too little em- p loyment. 2Thus, we do not distinguish the firm’s wage and the economy-wide wage. Alternatively, we may assume that there are many monopolized industries in the economy and it can be shown that this assumption does not shatter our major results in this paper.  831 B. ZHAO ployed by the firm), and s is an exogenous technology parameter. To incorporate unemployment into the model, we use the efficiency wage model of Shapiro and Stiglitz [1]. Specifically, we assume that workers may shirk (i.e. ex- erting no effort) on the job. The firm, however, cannot perfectly observe workers’ effort. In other words, if a worker shirks, there is some probability, denoted by q, that the worker will be caught and fired. In the standard Shapiro-Stiglitz efficiency wage model, the detection probability q is taken as exogenous. In our model, we endogenize q by assuming that q is a function of the ef- fort and/or investment by the firm in monitoring the workers, with ()qqm() 0qm and () 0qm , where m denotes the monitoring level. To discourage workers from shirking, the firm has to pay a wage high enough (i.e. the efficiency wage or non- shirking wage): * () e wwe abr qm (1) where, 0w is the unemployment benefit received by an unemployed worker; a denotes the job acquisition rate, b is the natural separation rate and r represents the in- tertemporal discount rate. Taking the efficiency wage into consideration, the monopolist’s optimization problem is written as: , max π() () () () mL PsFeL sFeL e weabrLHm qm (2) where () H m 0 is the cost of monitoring workers with and 3. ()H () 0H Note that in the steady state of the labor market, the flow into and the flow out of the unemployment pool per unit time are equal. That is, bLa NL or abLNL (3) Then the first order conditions for Equation (2) can be rewritten as: 2 () () 0 () eL qmbNrHm NL qm (4) 2() ()() ()() s ePsFeLFeLFeL s ePsFeLF eL 0 () ebN we r qmN L Let L = Am(m) and L = Bm(m) denote the functional re- lationships implied by Equations (4) and (5), respectively. Thus, graphically, the intersection of these two curves in the (m, L) space is the monopoly equilibrium ** , mm mL . Proposition 1. Both curves, L = Am(m) and L = Bm(m), are strictly upward sloping in the (m, L) space. Moreover, at the equilibrium point, the slope of L = Am(m) is greater than the slope of L = Bm(m). As a result, there is a unique monopoly equilibrium4. Now consider a perfectly competitive industry, where all firms are price-takers. The representative firm’s opti- mization problem is: , max()( ) () mL e psFeLw ea brLHm qm (6) Equilibriums in the product and the labor markets re- quire that ()pPsFeL and or bLa NL abLNL . Then the first order conditions for Equation (6) can be rewritten as: 2 () () 0 () qm bN eLrHm NL qm (7) ()() 0 () sePsF eLFeL ebN we r qmN L (8) Let L = Ac(m) and L = Bc(m) be the curves implied by Equations (7) and (8), respectively. Then the intersection of these two curves ** , cc mL represents the levels of monitoring and employment in the competitive equilib- rium. Proposition 2. Both curves, L = Ac(m) and L = Bc(m), are strictly upward sloping in the (m, L) space. Moreover, at the equilibrium point, the slope of L = Ac(m) is greater than the slope of L = Bc(m). Therefore, there is a unique competitive equilibrium. Note that the comparison of Equations (4) and (7) in- dicates that L = Am(m) and L = Ac(m) are exactly the same curve in the (m-L) space. To determine the effi- ciency consequences of monopoly, compare the monop- oly equilibrium with that under perfect competition (as shown in Figure 1) to obtain: Proposition 3. Relative to a perfectly competitive mar- ket, a monopolist employs fewer workers and invests less in the monitoring of workers. That is, and * m mm (5) * c ** mc LL . Since the quantity produced is an increasing function of employment, Proposition 3 in turn implies that the 3It should be noted that the monitoring cost here is assumed to be inde- p endent of the number of workers. Alternatively, for future research, it may take the form of h(m)L. 4Based on the assumptions made above, it can be shown that the second order conditions are satisfied. This ensures the existence of the equilib- rium. Copyright © 2011 SciRes. ME  B. ZHAO 832 Figure 1. Monopoly equilibrium vs. competitive equilibrium. monopolist produces a smaller output and accordingly sets a higher price than a competitive firm. On the sur- face, these effects of monopoly appear to be the same as in the standard monopoly case. However, there are more factors at play in this model. Intuitively, a monopolist has a tendency to restrict output because it faces a down- ward sloping demand curve. As a result of this tendency, employment level falls, which tends to push down the non-shirking wage. In our model this has an additional effect because it induces the monopolist to reduce the level of monitoring, causing a further fall in employ- ment. 3. Welfare Effects of Monopoly Given that this is a partial equilibrium model, we use the total surplus as the measure of welfare. Note that com- pared with the standard textbook model of monopoly, we have an additional group of agents in our model, the workers. In principle, the measure of total welfare should also take into consideration the utility of workers. This raises an additional issue of how to treat the unemploy- ment benefits: 1) If the unemployment benefits are financed by lump sum taxes on consumers, they are merely a wealth trans- fer and as such should not be included in the total sur- plus; 2) Alternatively, if there are no government transfer payments and the unemployment benefits merely repre- sent the value that an unemployed worker obtain from home production, the unemployment benefits should be included in the total surplus; 3) In addition, the conventional measure of total sur- plus that takes into consideration the welfare of consum- ers and the firms only (i.e. excluding the workers). Our welfare analysis in what follows uses the first type of total surplus5: ** 0()d() Q TSP QQeLHm * (9) It is easy to obtain ** 00 ()d ()d cm QQ P QQ PQQ, , m * c eL * m eL * ()( ) c * H mHm ** cm E eL LH since m and . Thus, monopoly may lead to a higher social welfare than perfect competition does. Specifically, if and only if ** c LL TS * ( )Q mQ m ** cm mm c TS ()d g QQ m * * c m CS P * () c H m H (10) The left hand side of Equation (10) is the sum of the difference of worker’s efforts put into production (ΔE) and the difference of monitoring cost (ΔH). And the right hand side is the difference of gross consumer surplus (ΔCSg). In what follows we conduct numerical simulations us- ing a version of our model with specific functional forms. The objectives of these simulations are to provide con- crete examples for the welfare effects of monopoly, in comparison with the competitive benchmark. Our simulation results, based on the specific func- tional forms and parameter values presented in Table 1, show that the total surplus under monopoly is not neces- sarily lower than that under perfect competition. As we can see from Figures 2 and 3, monopoly improves wel- fare if, ceteris paribus, market size (α) is relatively large or unemployment benefit (w) is relatively small6. These numerical simulations, together with the general analysis demonstrate that Proposition 4. Monopoly is not always dominated by perfect competition in terms of economic efficiency if an efficiency wage is offered and unemployment is taken into consideration. 4. Conclusions In this paper, by constructing an efficiency-wage model that takes into account the firm’s choice of monitoring, Figure 2. Comparison of welfare: monopoly vs. competition varying market size). ( 5It can be demonstrated that the similar results will be obtained if the 6Indeed, we also find examples that when separation rate is relatively high (say b > 0.24) or technology shock is relatively low (say 0.3 s 0.8), the total surplus under monopoly is larger than that unde r p erfect competition. To avoid verbosity, we do not present them here. other two measures are used. Copyright © 2011 SciRes. ME  B. ZHAO Copyright © 2011 SciRes. ME 833 Table 1. Functional forms and parameter values. Inverse Demand Function: 1.5 ( )1000.1 P QQ Production Function: 0.65 () F LsL Functional Forms Monitoring Technology: () 0.815qmm m Monitoring Cost: 3 ()6 H mm Separation Rate (b) Discount Rate (r)Technology Shocks (s)Market Size (α)Unemployment Benefit (w) Labors Force (N) Basic Parameter Values 0.05 0.05 0.35 2.75 0.5 1000 Figure 3. Comparison of welfare: monopoly vs. competition (varying unemployment benefit). we have analyzed the efficiency and employment con- that takes into account the firm’s choice of monitoring, we have analyzed the efficiency and employment con- sequences of monopoly in the presence of unemployment caused by efficiency wage considerations. We have shown that in addition to a smaller output and a higher price, monopoly also leads to higher unemployment rate than the competitive equilibrium. It is worth noting that the effect of monopoly on total welfare, however, is ambiguous. Numerical simulations of the model indicate that under certain range of pa- rameter values, monopoly generates higher total surplus than perfect competition. Therefore, by introducing an additional distortion (i.e. unemployment) into the model, it is no longer the case that monopoly is always domi- nated by perfect competition in terms of economic effi- ciency. 5. References [1] C. Shapiro and J. Stiglitz, “Equilibrium Unemployment as a Worker Discipline Device,” American Economic Re- view, Vol. 74, No.3, 1984, pp. 433-444. |