Paper Menu >>

Journal Menu >>

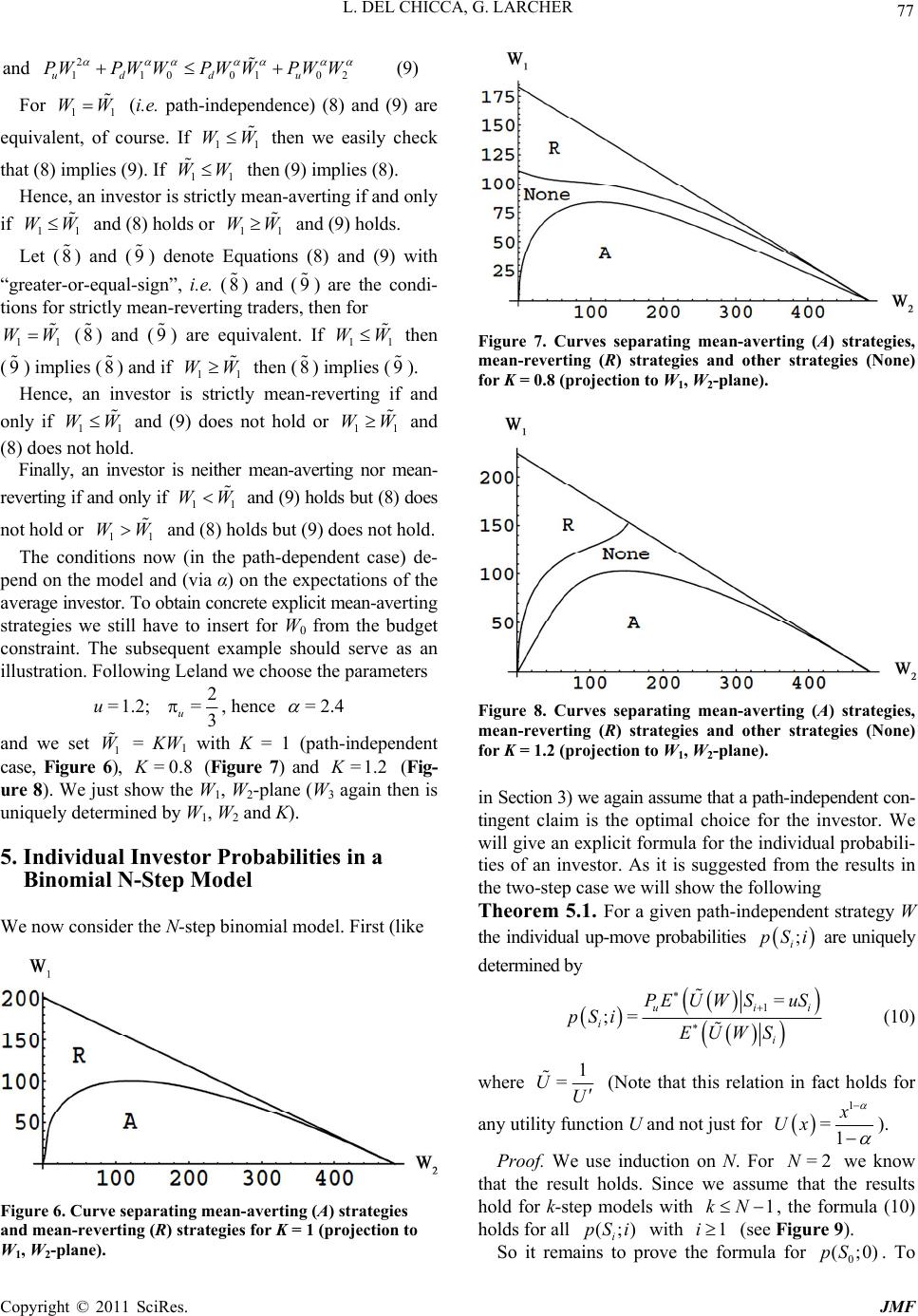

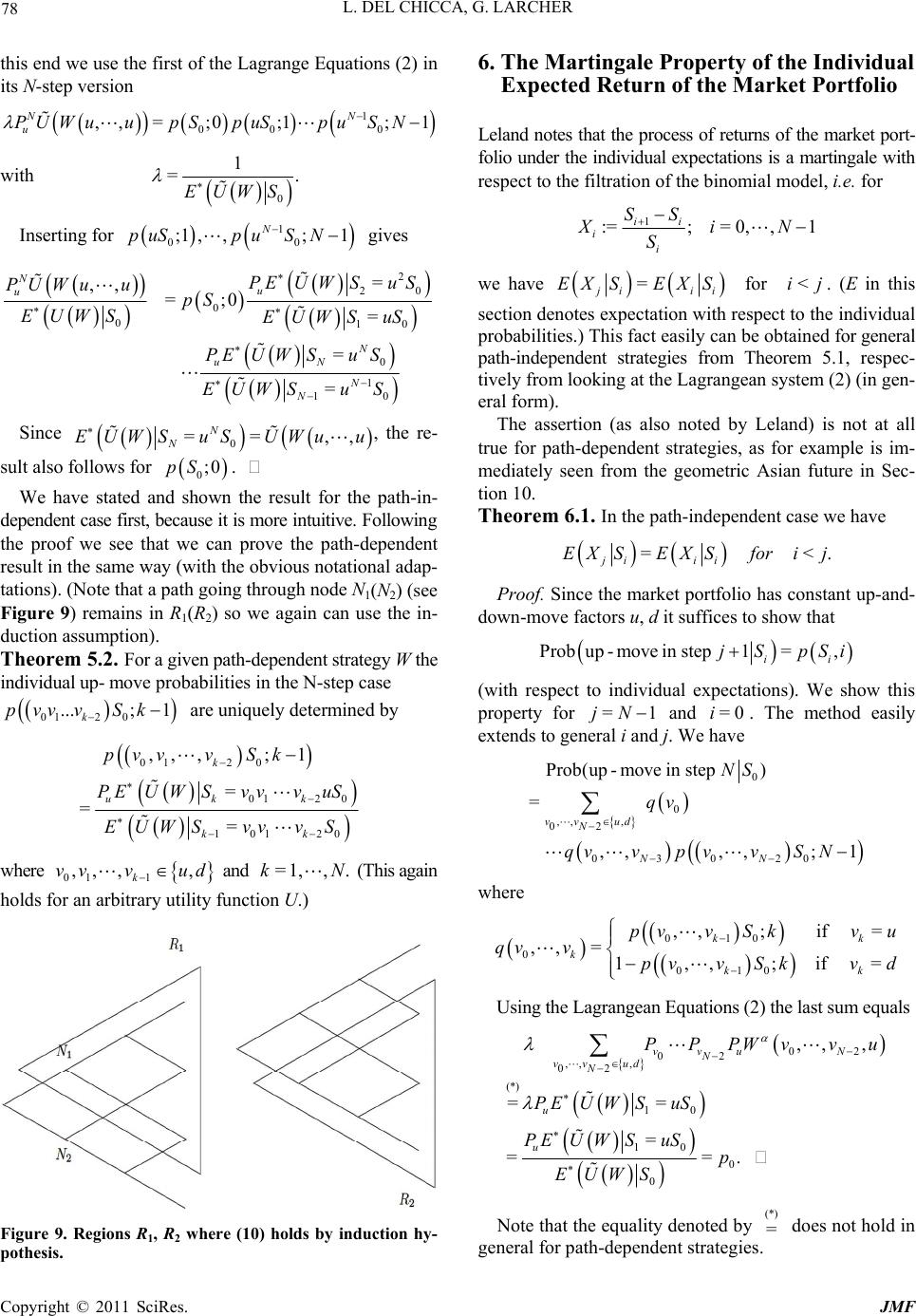

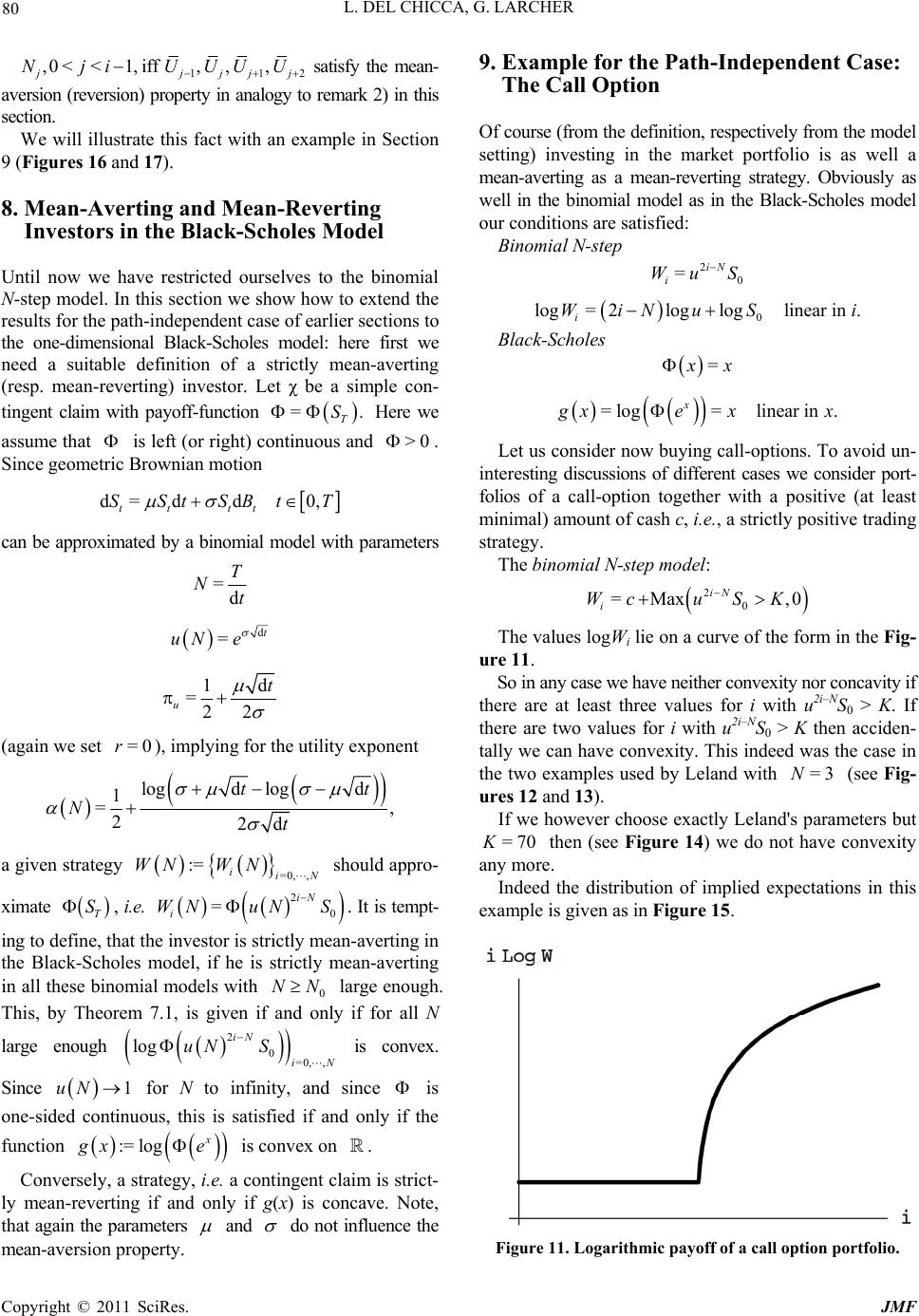

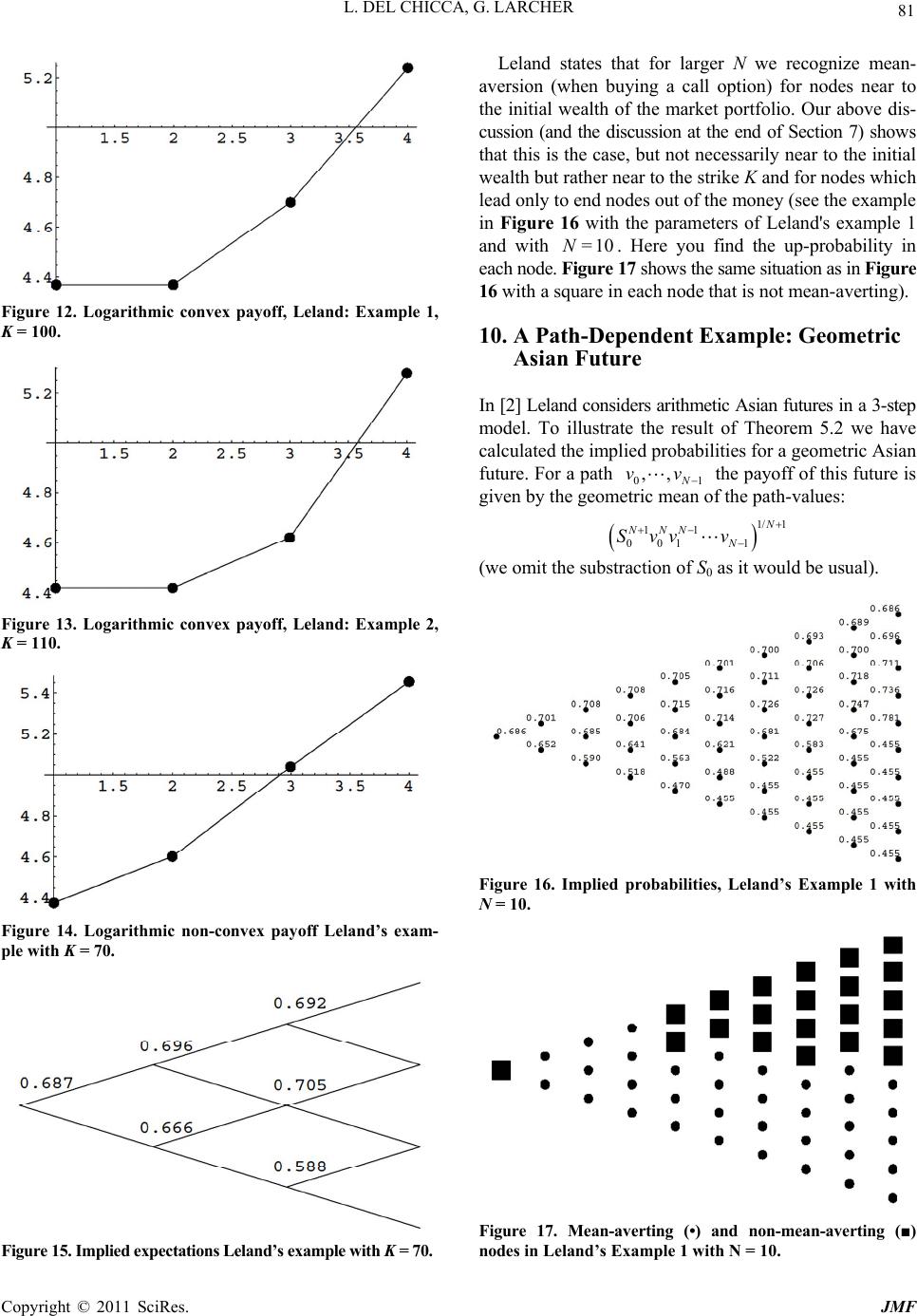

Journal of Mathematical Finance, 2011, 1, 72-82 doi:10.4236/jmf.2011.13010 Published Online November 2011 (http://www.SciRP.org/journal/jmf) Copyright © 2011 SciRes. JMF On the Individual Expectations of Non-Average Investors Lucia Del Chicca, Gerhard Larcher Institute of Financial Mathematics, University of Linz, Altenberger Strasse Linz, Austria E-mail:{lucia.delchicca, gerhard.larcher}@jku.at Received August 25, 2011; revised October 1, 2011; accepted October 15, 2011 Abstract An “average investor” is an investor who has “average risk aversion”, “average expectations” on the market returns and should invest in the “market portfolio” (this is, according to the Capital Asset Pricing Model, the best possible portfolio for such an investor). He is compared with a “non-average investor”. This—in our set- ting—is an investor who has the same “average risk aversion” but invests in other investment strategies, for example options. Such a “non-average investor” must consequently have expectations on the market return that are different from the average: the “non-average expectations”. In this paper we give an explicit formula for the “non-average expectations” in an arbitrary N-step model and for the extended concept in a Black- Scholes model, in the path-independent case and in the path-dependent case. Further we explicitly classify all the investment strategies for which the resulting “non-average expectations” show this mean aversion property. Various examples are given in the paper. These investigations were part of more general investiga- tions initiated by an investment company carrying out certain subtle option trading strategies. Keywords: Binomial Model, Black-Scholes Model, Options, Expectations, Mean Averting Strategies 1. Introduction Often it is interesting for fonds-managers, asset managers, or consultants to know which kind of investor is appro- priate to a certain strategy. So in this work we give an answer to the following question: “which sort of investor (differing from the average) is interested in trading a given (alternative) strategy?” This question occurs amon- gst others in the field of behavioral finance. It deals with the psychology of investors and the consequences of their expectations about the market which lead to investment decisions. We give an answer to this question with the help of certain mathematical model first introduced by H. Leland. In two inspiring articles [1,2] Leland trys to identify the characteristics of investors who buy or sell European call options or other path-independent or path-dependent contingent claims. In both papers Leland considers in- vestors who trade in those options just out of speculative reasons. In the first article he concentrates on investors who have the same return expectations as an average in- vestor and he asks for their individual risk aversion. In the second article he considers investors with the same risk aversion as the average investor and he studies their dif- fering expectations on the market return. Our work will be based on this second article. In this article Leland considers an asset (market portfolio) in a binomial 3-step model and an “average investor” with given “average expectations” on the market returns, and with “average risk aversion”, i.e. with a utility function U for which the above market portfolio maximizes the utility of the average investor. This “average investor” is com- pared with a “non-average investor” who has the same utility function U, but who follows investment strategies differing from just buying the market portfolio. Espe- cially in [2] certain basic types of (path-dependent and of path-independent) option strategies in the binomial 3-step model are considered. As Leland points out the average investor will never purchase (or sell) fairly-priced op- tions since options are in zero net supply. Thus investors holding options must differ from average, i.e., in our setting, their expectations on the market return must differ from the “average expectations”. For more-step models Leland asserts that this mean-aversion can be found especially at nodes with stock-value close to the initial stock-value. For path-dependent (e.g. Asian or lookback call) contingent claim traders Leland detects “somewhat diffuse” return ex- pectations. It is the aim of this paper to fully discuss the above mod- elling in a general binomial N-step model and subsequent in a Black-Scholes model, and to give a complete answer to the following questions:  L. DEL CHICCA, G. LARCHER 73 1) Can we give an explicit formula for the “non-average expectations” in an N-step model and extend the concept in a Black-Scholes model, as well in the path- independent case as in the path-dependent case? arbitrary 2) Can we explicitly classify all the investment strate- gies for which the resulting “non-average expectations” show this mean-aversion property? 3) To what extent do the conclusions of Leland hold for N-step models, the Black-Scholes model and for ar- bitrary trading strategies? The paper is organized as follows: In Section 2 we repeat Leland’s setting and give all necessary definitions. Especially, we give an exact defini- tion of a “strictly mean-averting trader”. In Section 3 and in Section 4 we discuss the binomial 2-step model for path-independent contingent claims, re- spectively for path-dependent contingent claims in full de- tail. (Later, the general cases can be reduced to the 2-step case to some extent.) In Section 5 we provide the explicit computation tech- nique for the expectations of traders of path-independent as well as path-dependent contingent claims in the N-step model. In Section 6 we show that these expectations imply a certain martingale property. In Section 7 we explicitly characterize strictly mean- averting respectively mean-reverting investors in path- independent contingent claims in a binomial N-step model. In Section 8 we do the same in the continuous case (Black-Scholes model). In Section 9 we consider as concrete example of (path- independent) contingent claims, the case of call options. Finally in Section 10 we consider a special example of path-dependent contingent claims. Section 11 is devoted to conclusions and a final sum- mary. 2. Lelands Approach. The Model Leland [2] considers an average investor who has aver- age expectations on market returns, average risk aversion (i.e., a common average utility function) and therefore in- vests in a market portfolio S. He assumes that S follows a binomial model. In our paper we will essentially also work in a binomial model as well. Later on, however, we will also consider the Black-Scholes model. The parameters of the binomial model are given by : thenumberofstepsN : the initialvalue oftS ; 0he market portfolio : the multiplicator for an up-move; u ; :themultiplicator for a down-move,gidvenby= 1/ : the risk free interest rate in the model, assumed to be 0r d u ; These parameters determine the risk-neutral probabilities of the model d1 == d1 r u e Puu and =. 1 d u Pu These parameters are fixed for all the investors. πu: is the probability of an up-move from the view of an average investor (the consensus probability) and is time- constant. πd: the consensus probability of a down move =1 du . The risk aversion for the average investor is determined by the utility function U. We assume that this average in- vestor shares the market expectations of the model for S, that he invests in S, and that he is a rational investor. So the above market portfolio S maximizes the utility of the aver- age investor. From this assumption we can determine U as it is done in [2] (see also [3]) and we obtain: 1 =1 x Ux with log =. 2log u d u u Following Leland in [2], we are now interested in invest- tors with the same risk aversion, i.e. with the same utility function U, who, nevertheless, follow other trading strate- gies than the average investor. Since, by assumption, these investors also maximize their utility, they must have differ- ent expectations, i.e. different probabilities for up and down moves in the model. These individual probabilities will be in the center of our interest. At every node 0; =0,,;=0,,1 iki udSik kN k i we will have one but sometimes even several such indi- vidual probabilities for an up-move in the next time-step. This depends on whether the individual trading strategy is path-independent or path-dependent. In the latter case at every such node we have such individual prob- abilities. For each path 01 1 :=, ,, k Svv v leading to we have exactly one probability 0 iki udS 0110 ;= ,,,; k pSkpv vvS k. Here , i vud stands for a vi-move in step 1i . In the path-independent case we just use the notation 0; iki pudS k . Sometimes, if no confusion is possible, we use notations with reduced information for these individual probabilities for the sake of simplicity. It is the aim to com- C opyright © 2011 SciRes. JMF  74 L. DEL CHICCA, G. LARCHER pute these individual expectations from the individual trad- ing strategies. Note that we carry out a certain “reverse en- gineering”: in usual portfolio theory, once a choice of risk and investor measure are chosen, the optimal portfolio is derived. Here we assume an optimal portfolio under a spe- cific risk measure, and we determine the investor expecta- tions. In [3] Leland for example considers the following con- crete example set of parameters 0 2 = 100;= 1.2;=, 3 u Su and an European call-option buyer who is long 1.5 op- tions with strike and who holds an amount of 79.60 in cash. This particular choice is made because of certain norming reasons. The initial value of this portfo- lio is 100 like the initial value of the market portfolio. We illustrate the situation and Leland’s results in Figures 1 and 2. = 100K The probabilities (path-independent) are the computed individual probabilities for up-moves e.g. . 000 ,;2=, ;2=;2=0.643pudS pduS pudS Figure 1. Market values in Leland’s example. Figure 2. Implied Probabilities for call-option portfolio with K = 100. Leland concludes that this investor is mean-averting in the sense that an up-move always implies a larger (or equal) probability of a further up-move than the prob- ability for an up-move in the step before. The analogous property holds for down moves. A further example in [2] with gives a simi- lar result, i.e. again mean aversion of the investor. Leland moreover gives some informal remarks on the N-step case (“there seems to be mean aversion at nodes with stock values near to the initial stock value S0”) and two exam- ples for path-dependent contingent claims in a 3-step model (here he detected rather diffuse individual expectations). = 110K We felt that a more general discussion is necessary to obtain valid conclusions. So in the following we will try to explicitely determine all contingent claims (i.e. dynamic trading strategies) which can be considered by a strictly mean-averting, respectively by a strictly mean-reverting investor in a binomial N-step model and in the Black- Scholes model. Here we use the following definition of a strictly mean-averting investor (resp. mean-reverting in- vestor) in a binomial model (the definition for the Black- Scholes model will be given later). Definition 2.1. We call an investor strictly mean-averting if his trading strategy induces individual expectations with the following properties 020 020 ,,;1,,,; kk pv vSkpv vuSk and 020 020 1,,;11,,,; kk pvvSkpvv dSk for all 02 ,,, ;=1,,1 k vv udkN . The investor will be called strictly mean-reverting if the “less or equal-sign” is replaced by the “larger or equal sign” in both inequalities. In the following we will call the corresponding strategies either mean-averting strate- gies resp. mean-reverting strategies. For path-independent strategies the above properties reduce to 11 00 ;1 ; ik iik i pudS kpudS k 1 1 00 1;11 ik iiki pudS kpudS k ; for =0,, 1;=1,,1.ikkN For our investigations we further need a suitable no- tion for contingent claims (i.e. for trading strategies) in our models. We denote trading strategies by 01 :=, ,;, Ni WWvvvud where 01 1 ,, , N Wvv v denotes the payoff of the stra- tegy if path 01 ,, N vv happens. In the path-independent case this reduces to C opyright © 2011 SciRes. JMF  L. DEL CHICCA, G. LARCHER 75 0 :=;= 0,,. iNi W WudSiN We will also use the notation . We restrict to “admissible” trading strategies, i.e. to strategies with 0 := iNi i WWudS 01 1 ,, ,0 N Wvv v always. In later sections we will proceed by induction, and it will turn out that much of the work is already contained in the full discussion of a 2-step model. This will be done in the next two sections. 3. Mean-Averting Investors in the Two-Step Model: The Path-Independent Case We start with our “reverse engineering” in the 2-step mo- del by assuming an optimal strategy (portfolio) W, the av- erage utility function U and by calculating from this the investor expectations p. An arbitrary strategy in the 2-step case is given by = ,,,,,,,WWuuWudWduWdd. The price at time zero of the strategy is 22 ,, , uuddud PW uuPPW udPPW duPW dd,. Since we compare strategies W with the average strategy of buying the market portfolio S we have the budget con- straint 2 0=,,,, uuddud SPWuuPPWudPPWdu PWdd 2 . 1 (1) The trader following W is maximizing his utility 00 00 00 00 ;0 ;1, ;0 1;1, (1(;0))(;1)(( , )) (1(;0))(1(;1))(( ,)). pSpuSUWuu pSpuS UWud pSpdS UWdu pSpdS UWdd Hence by Lagrange we obtain the equations 2 00 00 00 2 00 ,=;0;1 ,= ;01;1 ,=1 ;0;1 ,=1;01 ; u ud du d PU Wuup SpuS PPUWudp SpuS PPU Wdup Sp dS PU Wddp Sp dS (2) where 1 =UU (for our special case =UW W ). The sum of the right hand sides is 1, so that 0 1 =EUWS (3) where E* denotes expectation with respect to the risk neutral measure. This of course easily generalizes in obvious form to higher step number. Since in this section we are interested in traders whose optimal contingent claim turns out to be path-independent, we have ,= ,Wud Wdu for simplicity we use the notation: 01 2 =,,=,=,,=,WWdd WWduWudWWuu and 001 020 =;0,= ;1,= ;1ppSppuS ppdS . It is easily checked that (1),(2),(3) has a unique solution p0, p1, p2, namely 20 1 2 10 10 2 20 2 1 21 10 21 0 2110 10 00 = == = = == = = = = = u u ud u u ud uud uu ddu d u PEU WSudS PW pPWPWEUWSdS PEUWSu S PW pPWPWEUWS uS PPW PW p PPW PWPPW PW PEU WSuS EUWSS (4) (Si is the price of the market portfolio at time i). In these relations W0, via the budget constraint (1), is uniquely determined by W1 and W2. We only consider ad- missible strategies, i.e. 012 So the definition region for W is the triangle in Figure 3. ,, 0.WWW Figure 3. Definition region for strategy W. C opyright © 2011 SciRes. JMF  L. DEL CHICCA, G. LARCHER 76 10 p 2 Strict mean-aversion now is determined by and . 0 pp022 11ppp Easy calculation based on (4) shows that the two con- ditions are equivalent and reduce to the single vivid con- dition 2 10 WWW (5) (so in any case there are no investors who are neither mean- averting nor mean-reverting). It is worth noting that the condition is in no way de- pendent on α or on the average expectations πu and πd. It is dependent on Pu only via the dependence of W0 on W1, W2 through the budget constraint: inserting 2 0 012 2 =2 uu dd d SPP WWW PP P into (5) leads to 202 12 0= u d WP SW WW P . This determines the region for strictly mean-averting investors A and for strictly mean-reverting investors R. The boundary belongs to both regions. g and the -axis are tangents to 1 W , that is the projection of onto the plane 12 (See Figures 4 and 5). Buying the market portfolio is mean-averting and mean-reverting, hence it is located on WW . (Just insert 2 20 =,WuS 0 2 S d 10 0 =, =WSW to check this once more). Figure 4. Projection of to the W1, W2-plane. Figure 5. Curve separating mean-averting (A) and mean-reverting (R) strategies W. 4. Mean-Averting Investors in the Two-Step Model: The Path-Dependent Case We just have to return to the system (2), now with ,Wdu and ,Wud not necessarily being equal. We write ,du 1:=WW and , solve (2) and obtain now 1:= ,WWud 20 1 2 10 10 2 20 2 1 21 10 21 0 211 0 10 00 = == = = == = = = == u u ud u u ud uu d uu ddu d u PEU WSduS PW pPW PWEUWS dS PEUWSuS PW pPW PWEUWS uS PPW PW pPPW PWPPW PW PEU WSuS EUWSS (6) The two mean-averting conditions 01 0 and 11ppp p 2 (7) now are not equivalent in general. Inserting (6) into (7) leads to the following two mean-aversion conditions 2 112120duu d PWPW WPWWPWW 2 (8) C opyright © 2011 SciRes. JMF  L. DEL CHICCA, G. LARCHER 77 2 and 2 110010uddu PWPW WPW WPW W (9) For (i.e. path-independence) (8) and (9) are equivalent, of course. If 1 WW 1 11 WW WW then we easily check that (8) implies (9). If then (9) implies (8). 11 Hence, an investor is strictly mean-averting if and only if and (8) holds or and (9) holds. 1 WW 1 1 1 1 WW Let () and () denote Equations (8) and (9) with “greater-or-equal-sign”, i.e. (8) and () are the condi- tions for strictly mean-reverting traders, then for ( 8) and () are equivalent. If 8 11 W 9 9 W9 1 WW then (9) implies (8) and if then (8) implies (9). 11 Hence, an investor is strictly mean-reverting if and only if 11 and (9) does not hold or and (8) does not hold. W W WW 1 WW 1 1 Finally, an investor is neither mean-averting nor mean- reverting if and only if and (9) holds but (8) does not hold or and (8) holds but (9) does not hold. 1 WW 11 The conditions now (in the path-dependent case) de- pend on the model and (via α) on the expectations of the average investor. To obtain concrete explicit mean-averting strategies we still have to insert for W0 from the budget constraint. The subsequent example should serve as an illustration. Following Leland we choose the parameters WW 2 =1.2;=3 u u, hence =2.4 and we set 1 = KW1 with K = 1 (path-independent case, Figure 6), (Figure 7) and (Fig- ure 8). We just show the W1, W2-plane (W3 again then is uniquely determined by W1, W2 and K). W =0.8K=1.2K 5. Individual Investor Probabilities in a Binomial N-Step Model We now consider the N-step binomial model. First (like Figure 6. Curve separating mean-averting (A) strategies and mean-reverting (R) strategies for K = 1 (projection to W1, W2-plane). Figure 7. Curves separating mean-averting (A) strategies, mean-reverting (R) strategies and other strategies (None) for K = 0.8 (projection to W1, W2-plane). Figure 8. Curves separating mean-averting (A) strategies, mean-reverting (R) strategies and other strategies (None) for K = 1.2 (projection to W1, W2-plane). in Section 3) we again assume that a path-independent con- tingent claim is the optimal choice for the investor. We will give an explicit formula for the individual probabili- ties of an investor. As it is suggested from the results in the two-step case we will show the following Theorem 5.1. For a given path-independent strategy W the individual up-move probabilities ; i pSi are uniquely determined by 1= ;= ui i i PEU WSuS pSi EUWS i (10) where 1 =UU (Note that this relation in fact holds for any utility function U and not just for 1 =1 x Ux ). Proof. We use induction on N. For we know that the result holds. Since we assume that the results hold for k-step models with , the formula (10) holds for all with (see Figure 9). =2N pS 1kN 1i(;) i pS i So it remains to prove the formula for . To 0 (;0) C opyright © 2011 SciRes. JMF  78 L. DEL CHICCA, G. LARCHER this end we use the first of the Lagrange Equations (2) in its N-step version 1 00 0 ,, =;0;1;1 N u PUWuupSpuSpuS N N with 0 1 =. EUWS Inserting for gives 1 00 ;1 ,,;1 N puSpuSN 2 20 0 010 0 1 10 = ,, =;0= = = N u u N uN N N PEUWSu S PUWu upS EUWS EUWS uS PEU WSuS EUWSu S Since 0 == ,, N N EUWS uSUWu u , the re- sult also follows for . 0;0pS We have stated and shown the result for the path-in- dependent case first, because it is more intuitive. Following the proof we see that we can prove the path-dependent result in the same way (with the obvious notational adap- tations). (Note that a path going through node N1(N2) (see Figure 9) remains in R1(R2) so we again can use the in- duction assumption). Theorem 5.2. For a given path-dependent strategy W the individual up- move probabilities in the N-step case 012 0 ...; 1 k pvvv Sk are uniquely determined by 012 0 0120 10120 ,, ,;1 = = = k ukk kk pvvv Sk PEU WSvvvuS EUWSvvvS where 01 1 ,, ,, k vv vud and (This again holds for an arbitrary utility function U.) =1,, .kN 6. The Martingale Property of the Individual Expe Figure 9. Regions R1, R2 where (10) holds by induction hy- pothesis. e- cted Return of the Market Portfolio land notes that the process of returns of the market portL folio under the individual expectations is a martingale with respect to the filtration of the binomial model, i.e. for 1 :=;= 0,,1 ii i SS XiN i S we have =for ji ii EX SEXSij<. (E in this es expectation with respect to th es.) This fact easily can be obtaine section denote individual probabilitid for general path-independent strategies from Theorem 5.1, respec- tively from looking at the Lagrangean system (2) (in gen- eral form). The assertion (as also noted by Leland) is not at all true for path-dependent strategies, as for example is im- mediately seen from the geometric Asian future in Sec- tion 10. Theorem 6.1. In the path-independent case we have =<. ji ii EX SEXSforij Proof. Since the market portfolio has constant up-and- down-move factors u, d it suffices to show that Probup -move instep1=, ii jS pSi (with respect to individual expectations). We show this property for =1jN and . The method easily =0i extends to general i and j. We have 0 0 ,, , 02 030 20 Prob(up - moveinstep)NS = ,,,,; 1 vv ud N NN qv qv vpvvSN where 010 0 010 ,,;if = ,, = 1,,;if kk k kk pvvSkv u qv vpvv Skvd = Using the Lagrangean Equations (2) the last sum equals 02 02 ,, , ,, , vvu N N vv ud PPPWvvu 02 (*) 10 10 0 0 == = == . N u u PE U WSuS PEUWSuSp EUWS Note that the equality denoted by does not hold in general for path-dependent strategies. (*) = C opyright © 2011 SciRes. JMF  L. DEL CHICCA, G. LARCHER 79 7. e Mean Averting Investors in a Binomial N-Step Model: The Path Indpendent Case Now we can explicitly classify the strictly mean-averting an-reverting strategies in the path-independent case. and me Theorem 7.1. The path-independent strategy =0, , =iiN WW (i W is the strategy value at 0 iNi udS ) is strictly mean-averting if and only if 2 11iii WWW ) for all =1,,1. iN (11 Wi is strictly mean-reverting if and only if 2WW 11ii i W (12) fo Remarks we have connt individual probabilities if and r all =1, ,1.iN 1) Sosta only if 12 11 = i Wii 2) Trivially, for our special utility function U in- equalitynt to 2 i U WW for all (11) is equivale and (12) is eq from Theor f both sides o11) and of (12)) the following C y mean- =1, ,1.iN 11i i UU uivalent to 2 11 . iii UUU We will refer to this later. ( := kk UUW ) We conclude em 7.1 (taking the logarithm of ( orollary 7.2. If >0 i W for all i, then the path- inde- pendent strategy =0,, =( ) ii N WW is strictl averting if and only if log,,log 0 N WW is convex and the path-indepe =WW is nd nd only if ent strategy=0, , iiN strictly mean-reverting if a , log 0 log , N WW is concave. Remarks 3) If 0foralland=0 for i WiW some k k version if and only if ,=0 i iW N that can be >0. , then we except for W for som andnly if or an have mean-a 0 and W 4) If 0 i W for all i and Wk = 0e k, then we have mean-reversion if o1 d always when there are at least three successive =0 k W 1=0 k W 12 1 ,,>0,log,log,log jj jjj WW WWW is c Proof of the Theorem: 7.1. Again we use induction on is true for 2j W oncave. N, and again we know that the assertion =2 and assume that it is true for 1.KN Since we have mean-aversion in regions R1 and R2 of Figure 9 if andly if (11) holds for 1,, N on N WW res 01 ,, N WW we see that (11) is a necessary condition. Let now (11) be satisfied. Furthell =0,,j p. for ar let for 3N g condition hold true PWPWPW PWPW i.e. the condition (11) not only the followin 1 (13) holds for the terminal wealth W at the time N but also for time 2 3212ujdjujdjujdj PW 1N for values the 1N EUWS (see Figure 10). for th . We show that (d the proof is fin Then by Theorem 5.1 and by induction hypothesis we have mean-aversion also for R3 and hence e whole strategy11) implies (13) an ished. But this is just simple calculation (note that (11) 2 213 j jj WWW and 2 12123 j jjj jjj WWW WWWW ). Strictly mean-revert- ing strategies are treated quite analogously. be much averting or reverting strategies. It seems to us to harder to explicitely classify the path-dependent strict mean- Let us consider now an investor (again in the path-in- dependent case) who is neither mean-averting nor mean- reverting and let us ask the question at which nodes of the corresponding model we have local mean-aversion or reversion. By the above investigations (especially on the 2-step case) it is clear how to detect all strings of local monoto- nicity of expectations: just fix a certain point in time i. Then calculate i EUW S for all possible values of i S. The resulting values (ordered from below) say 0,, i UU determine in which nodes ,,NN (ordered from 01i below) of step 1i we h, n (rever- ave local mean-aversionor local mean-reversion. We have mean-aversio sion) in 001 ,iff, ,NUUsatisfy the mean-aversion (reversion) property in analogy to remark 2) in this section. 2 U 1 ,i i N21 ff, , iii UUU satisfy the mean-aversion (re- version) property in analogy to remark 2) in this section Figure 10. Region R3 where (11) holds by induction hy- pothesis. C opyright © 2011 SciRes. JMF  80 L. DEL CHICCA, G. LARCHER 11 ,0< <1,iff,,, 2 j jjjj Nji UUUU satisfy the mean- aversion (reversion) property in analogy to remark 2) in this section. We will illustrate this fact with an example in Section 9 (Figures 16 and 17). 8. Mean-Averting and Mean-Reverting Investors in the Black-Scholes Model Until now we have restricted ourselves to the binomial N-step model. In this section we show how to extend the results for the path-independent case of earlier sections to the one-dimensional Black-Scholes model: here first we need a suitable definition of a strictly mean-averting (resp. mean-reverting) investor. Let χ be a simple con- tingent claim with payoff-function Here we =. T S assume that is left (or right) continuous and >0 . Since geometric Brownian motion d= dd0, tt tt SStSBtT can be approximated by a binomial model with parameters =d T Nt d =t uN e 1d =22 u t (again we set =0r), implying for the utility exponent logd logd 1 =, 22 tt N a given strategy dt := i WNWN should- =0, ,iN appro ximate T S, i.e. 2 =iN i WNuN ial models with 0 NN rem 7.1, is given if and onl 2 0=0,, log iN iN uNS 0 S larg y . It is tempt- in all te enough. This, if for all N is convex. Since ing to define, that the investor is strictly mean-averting in the Black-Scholes model, if he is strictly mean-averting hese binom by Theo large enough 1 for N to infinity, and uNsince is one-sided continuous, this is log x satisfied if and only if the function := g xe is convex on . Conversely, a strategy, i.e. a contingent claim is strict- ly mean-reverting if and only if g(x) is concave. Note, that again the parameters and do not influenthe mean-aversion property. ep ce 9. Example for the Path-Independent Case: The Call Option Of course (from the definition, respectively from the model setting) investing in the market portfolio is as well a mean-averting as a mean-reverting strategy. Obviously as well in the binomial model as in the Black-Scholes model our conditions are satisfied: Binomial N-st 0 = i Wu S 2iN 0 log=2logloglinear in. i WiNuSi Black-Scholes = x x = log=linear in.x g xexx Let us consider now buying call-options. To avoid un- - fol gether with a positive (at least inimal) amount of cash c, i.e., a strictly positive trading interesting discussions of different cases we consider port ios of a call-option to m strategy. The binomial N-step model: 2 0 =Max ,0 iN i WcuS K The values logWi lie on a curve of the form in the Fig- ur So in any case we have neither convexity nor concavity if there are at least three values for i with u2i–NS0 > K. If there are two values for i with u2i–NS0 > K then acciden- ta convexity. This indeed was the case in the two examples used by Leland with (see Fig- ures 12 and 13). If we however choose exactly Leland's paraeters but then (see Figure 14) we do not have convexity an e 11. lly we can have =3N m =70K y more. Indeed the distribution of implied expectations in this example is given as in Figure 15. Figure 11. Logarithmic payoff of a call option portfolio. C opyright © 2011 SciRes. JMF  L. DEL CHICCA, G. LARCHER 81 Figure 12. Logarithmic convex payoff, Leland: Example 1, K = 100. Figure 13. Logarithmic convex payoff, Leland: Example 2, K = 110. Figure 14. Logarithmic non-convex payoff Leland’s exam- ple with K = 70. Figure 15. Implied expectations Leland’s example with K = 70. Leland states that for larger N we recognize mean- aversion (when buying a call option) for nodes near to the initial wealth of the market portfolio. Our above dis- cussion (and the discussion at the end of Section 7) shows that this is the case, but not necessarily near to the initial wealth but rather near to the strike K and for nodes which lead only to end nodes out of the money (see the example in Figure 16 with the parameters of Leland's example 1 and with. Here you find the up-probability in each node. Figure 17 shows the same situation as in Figure ependent Example: Geometric Asian Future In [2] Leland considers arithmetic Asian futures in a 3-step model. To illustrate the result of Theorem 5.2 we have calculated the implied probabilities for a geometric Asian future. For a path =10N 16 with a square in each node that is not mean-averting). 0. A Path-D1 01 ,, N vv etric mean of the payoff of this future is given by the geom the path-values: (we omit the substraction of S0 as it would be usual). 1/ 1 11 0011 N NNN N Svvv igure 16. Implied probabilities, Leland’s Example 1 with F N = 10. Figure 17. Mean-averting (•) and non-mean-averting (■) nodes in Leland’s Example 1 with N = 10. C opyright © 2011 SciRes. JMF  L. DEL CHICCA, G. LARCHER Copyright © 2011 SciRes. JMF 82 By Theorem 5.2 we now calculate the individual expectations 012 0 010 101 20 1 11 12 11 11 12 12 = ,,; == == ukk k kk Nk Nk Nk NK NN uNk u 11 N kNk Nk NkNk Nk NN uNkd Nku PEU WSvvvuS pvv SkEUWSvvv S PuE wwwPu PuEw wwPdEw wwPuPd NkNk NN d where Hence the individual probabilities in this example are lue of the market portfolio, so we can write p(k) shorthand. For N large we have , i wud. independent of the path, and they even are independent of the va 0=π u u ud pPuPd by the definition of Pu and 1= u u ud P pN P PP . In any case we do not have mean-aversion or mean- reversion. It is also easily checked (by using the definition of g iff in Sectt pion 2) tha(k) is monotonically increasin Based on the article [2] of Leland we have developed some techniques to calculate and to interpret the indi- vidual probabilities of an investor with average risk aver- one investing strategies. It is possible with the help of these techniques to completely discuss path-independent strategies. Teby we could pa adapt these assertions. For example we can conclude that in general the strategy obtained by combining a call o tion and cash is not a mean-averting strategy during the lot of further fu- e work should be possible: for example a classification of mean-averting path-dependent strategies, the extension to arbitrary discrete market models or to American op- tions and the inclusion of transaction costs would be a most interesting topic. 12. Acknowledgements We thank Gunther Leobacher and Friedrich Pillichsham- p- entire time to maturity. Based on the developed techniques a tur mer for technical support. 13. References [1] π uu and monotonically decreasing iff π uu P. 11. Conclusions P H. E. Leland, “Who Should Buy Portfolio Insurance?” Journal of Finance, Vol. 35, No. 2, 1980, pp. 581-594. doi:10.2307/2327419 [2] H. E. Leland, “Options and Expectations,” Institute of Business and Economic Research, University of California, Berkeley, 1996, pp. 43-51. [3] M. Brennan, “The pr sion but following n-averag icing of Contingent Claims in Discrete Time Models,” Journal of Finance, Vol. 34, No. 1, 1979, her pp. 53-68. doi:10.2307/2 327143 rtly confirm assertions of Leland, partly we had to slightly |