P. SHEA

Copyright © 2011 SciRes. TEL

113

2

det 22

e

22

11

11

in

t

Var y2

v

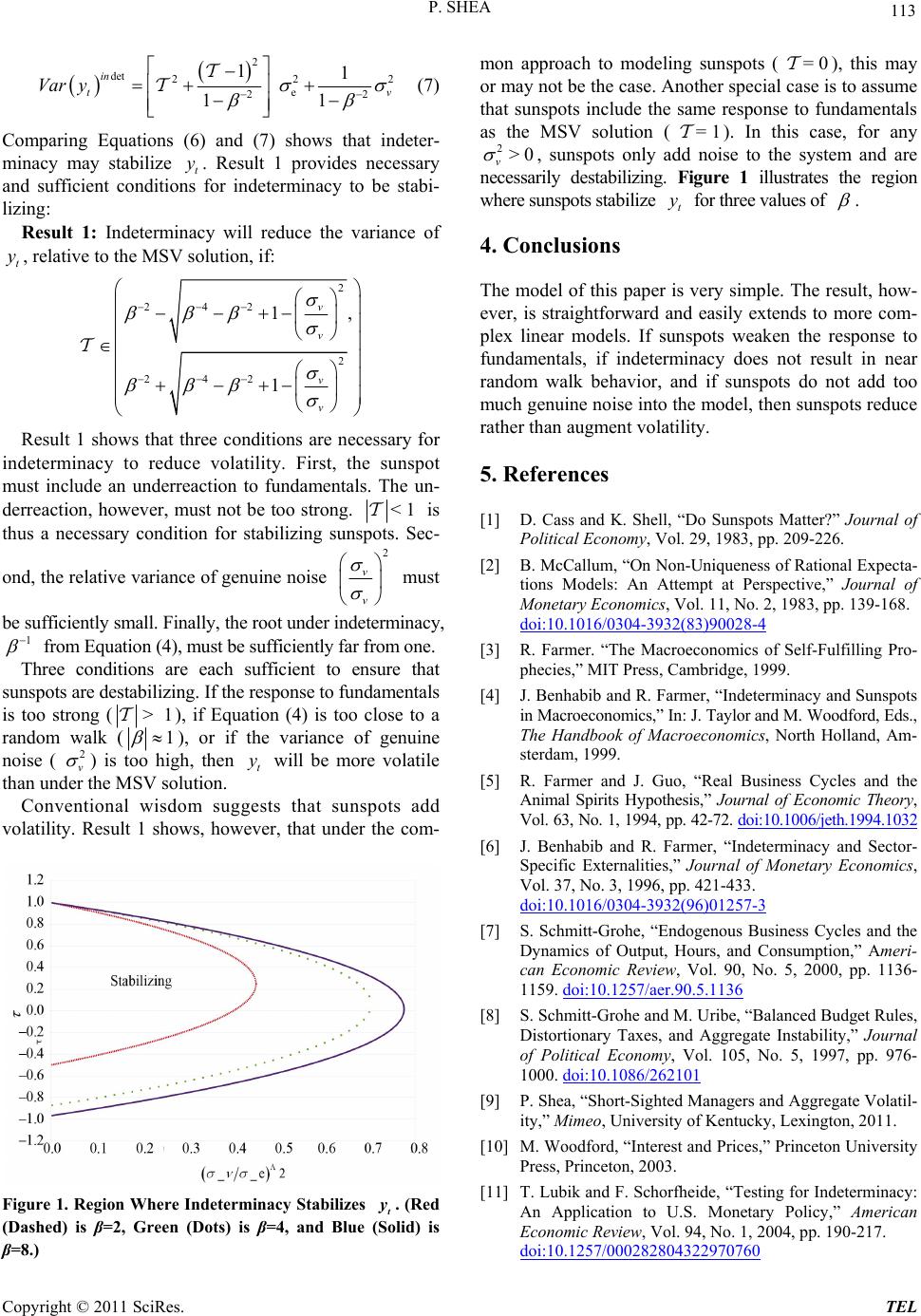

(7) mon approach to modeling sunspots (), this may

or may not be the case. Another special case is to assume

that sunspots include the same response to fundamentals

as the MSV solution (). In this case, for any

, sunspots only add noise to the system and are

necessarily destabilizing. Figure 1 illustrates the region

where sunspots stabilize for three values of

= 0

= 1

t

y

2>0

v

.

Comparing Equations (6) and (7) shows that indeter-

minacy may stabilize t. Result 1 provides necessary

and sufficient conditions for indeterminacy to be stabi-

lizing:

y

Result 1: Indeterminacy will reduce the variance of

, relative to the MSV solution, if:

t

y4. Conclusions

2

242

2

242

1,

1

v

v

v

v

The model of this paper is very simple. The result, how-

ever, is straightforward and easily extends to more com-

plex linear models. If sunspots weaken the response to

fundamentals, if indeterminacy does not result in near

random walk behavior, and if sunspots do not add too

much genuine noise into the model, then sunspots reduce

rather than augment v olatility.

Result 1 shows that three conditions are necessary for

indeterminacy to reduce volatility. First, the sunspot

must include an underreaction to fundamentals. The un-

derreaction, however, must not be too strong. < 1 is

thus a necessary condition for stabilizing sunspots. Sec-

5. References

[1] D. Cass and K. Shell, “Do Sunspots Matter?” Journal of

Political Economy, Vol. 29, 1983, pp. 209-226.

ond, the relative variance of genuine noise

2

v

v

must [2] B. McCallum, “On Non-Uniqueness of Rational Expecta-

tions Models: An Attempt at Perspective,” Journal of

Monetary Economics, Vol. 11, No. 2, 1983, pp. 139-168.

doi:10.1016/0304-3932(83)90028-4

be sufficiently small. Fi nally, the root under indeterminacy,

1

from Equation (4), m ust be sufficiently far from one. [3] R. Farmer. “The Macroeconomics of Self-Fulfilling Pro-

phecies,” MIT Press, Cambridge, 1999.

Three conditions are each sufficient to ensure that

sunspots are destabilizing. If the response to fundamentals

is too strong (> 1), if Equation (4) is too close to a

random walk (1

), or if the variance of genuine

noise (2

v

) is too high, then will be more volatile

than under the MSV solution. t

y

[4] J. Benhabib and R. Farmer, “Indeterminacy and Sunspots

in Macroeconomics,” In: J. Taylor and M. Wo odf ord, Eds.,

The Handbook of Macroeconomics, North Holland, Am-

sterdam, 1999.

[5] R. Farmer and J. Guo, “Real Business Cycles and the

Animal Spirits Hypothesis,” Journal of Economic Theory,

Vol. 63, No. 1, 1994, pp. 42-72. doi:10.1006/jeth.1994.1032

Conventional wisdom suggests that sunspots add

volatility. Result 1 shows, however, that under the com- [6] J. Benhabib and R. Farmer, “Indeterminacy and Sector-

Specific Externalities,” Journal of Monetary Economics,

Vol. 37, No. 3, 1996, pp. 421-433.

doi:10.1016/0304-3932(96)01257-3

[7] S. Schmitt-Grohe, “Endogenous Business Cycles and the

Dynamics of Output, Hours, and Consumption,” Ameri-

can Economic Review, Vol. 90, No. 5, 2000, pp. 1136-

1159. doi:10.1257/aer.90.5.1136

[8] S. Schmitt-Grohe and M. Uribe, “Balanced Budget Rules,

Distortionary Taxes, and Aggregate Instability,” Journal

of Political Economy, Vol. 105, No. 5, 1997, pp. 976-

1000. doi:10.1086/262101

[9] P. Shea, “Short-Sighted Managers and Aggregate Volatil-

ity,” Mimeo, University of Kentucky, Lexington, 2011.

[10] M. Woodford, “Interest and Prices,” Princeton University

Press, Princeton, 2003.

[11] T. Lubik and F. Schorfheide, “Testing for Indeterminacy:

An Application to U.S. Monetary Policy,” American

Economic Review, Vol. 94, No. 1, 2004, pp. 190-217.

doi:10.1257/000282804322970760

Figure 1. Region Where Indeterminacy Stabilizes t

. (Red

(Dashed) is β=2, Green (Dots) is β=4, and Blue (Solid) is

β=8.)