97

H. NAKAMURA ET AL.

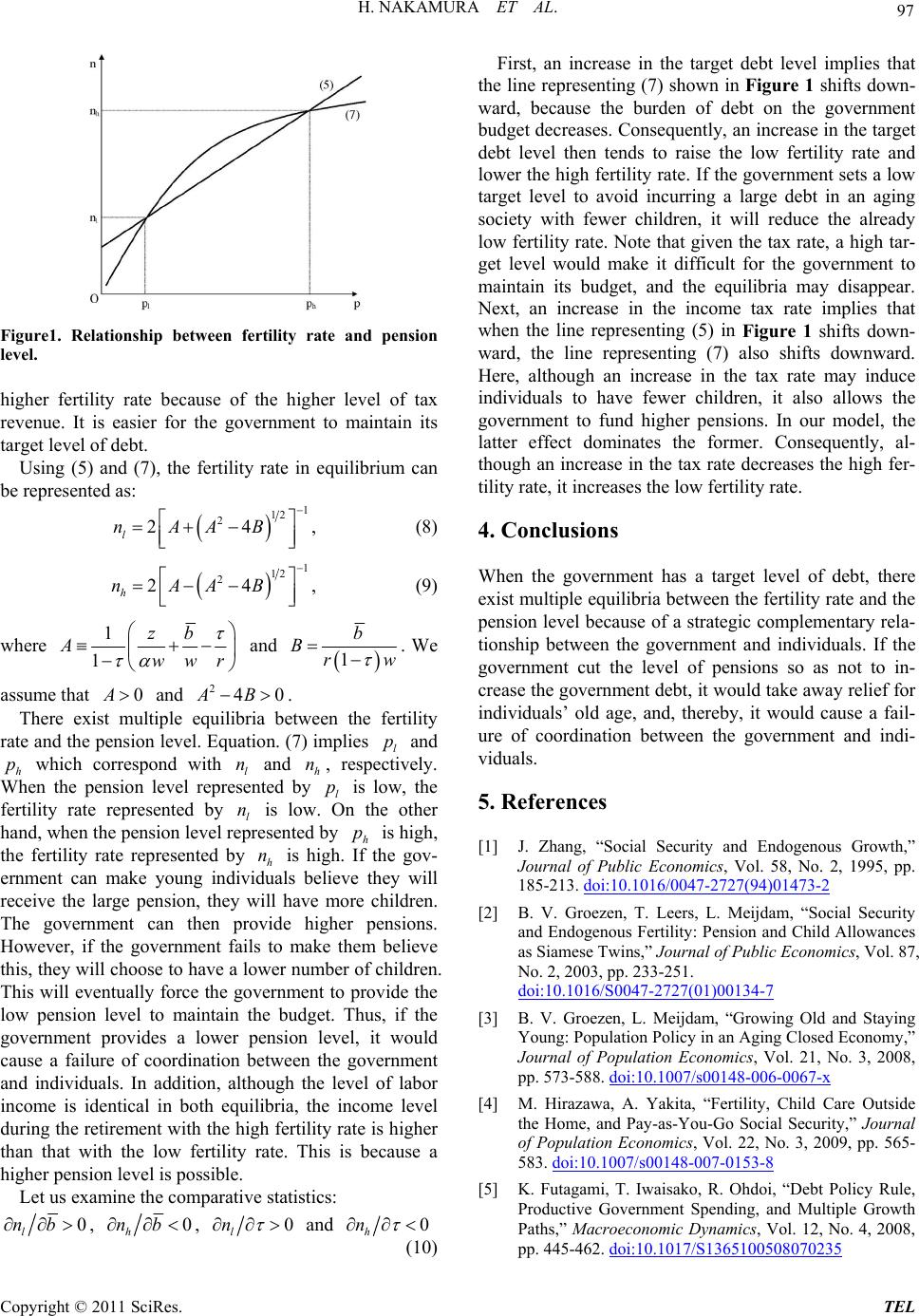

Figure1. Relationship between fertility rate and pension

level.

higher fertility rate because of the higher level of tax

revenue. It is easier for the government to maintain its

target level of debt.

Using (5) and (7), the fertility rate in equilibrium can

be represented as:

1

12

2

24

l

nAAB

,

(8)

1

12

2

24

h

nAAB

,

(9)

where 1

1

zb

Awwr

and

1

b

Brw

. We

assume that and .

0A240AB

There exist multiple equilibria between the fertility

rate and the pension level. Equatio n. (7) implies l and

h which correspond with l and h, respectively.

When the pension level represented by l is low, the

fertility rate represented by l is low. On the other

hand, when the pension level represented by h is high,

the fertility rate represented by h is high. If the gov-

ernment can make young individuals believe they will

receive the large pension, they will have more children.

The government can then provide higher pensions.

However, if the government fails to make them believe

this, they will choose to have a lower number of children.

This will eventually force the government to provide the

low pension level to maintain the budget. Thus, if the

government provides a lower pension level, it would

cause a failure of coordination between the government

and individuals. In addition, although the level of labor

income is identical in both equilibria, the income level

during the retirement with the h igh fertility rate is higher

than that with the low fertility rate. This is because a

higher pension level is possible.

p

p n

n

np

p

n

Let us examine the comparative statistics:

0

l

nb

, 0

h

nb

, 0

l

n

and 0

h

n

(10)

First, an increase in the target debt level implies that

the line representing (7) shown in Figure 1 shifts down-

ward, because the burden of debt on the government

budget decreases. Consequently, an increase in the target

debt level then tends to raise the low fertility rate and

lower the high fertility rate. If the government sets a low

target level to avoid incurring a large debt in an aging

society with fewer children, it will reduce the already

low fertility rate. Note that given the tax rate, a high tar-

get level would make it difficult for the government to

maintain its budget, and the equilibria may disappear.

Next, an increase in the income tax rate implies that

when the line representing (5) in Figure 1 shifts down-

ward, the line representing (7) also shifts downward.

Here, although an increase in the tax rate may induce

individuals to have fewer children, it also allows the

government to fund higher pensions. In our model, the

latter effect dominates the former. Consequently, al-

though an increase in the tax rate decreases the high fer-

tility rate, it increases the low fertility rate.

4. Conclusions

When the government has a target level of debt, there

exist multiple equilibria between the fertility rate and the

pension level because of a strategic complementary rela-

tionship between the government and individuals. If the

government cut the level of pensions so as not to in-

crease the government debt, it would take away relief for

individuals’ old age, and, thereby, it would cause a fail-

ure of coordination between the government and indi-

viduals.

5. References

[1] J. Zhang, “Social Security and Endogenous Growth,”

Journal of Public Economics, Vol. 58, No. 2, 1995, pp.

185-213. doi:10.1016/0047-2727(94)01473-2

[2] B. V. Groezen, T. Leers, L. Meijdam, “Social Security

and Endogenous Fertility: Pension and Child Allowances

as Siamese Twins,” Journal of Public Economics, Vol. 87,

No. 2, 2003, pp. 233-251.

doi:10.1016/S0047-2727(01)00134-7

[3] B. V. Groezen, L. Meijdam, “Growing Old and Staying

Young: Population Policy in an Aging Closed Economy,”

Journal of Population Economics, Vol. 21, No. 3, 2008,

pp. 573-588. doi:10.1007/s00148-006-0067-x

[4] M. Hirazawa, A. Yakita, “Fertility, Child Care Outside

the Home, and Pay-as-You-Go Social Security,” Journal

of Population Economics, Vol. 22, No. 3, 2009, pp. 565-

583. doi:10.1007/s00148-007-0153-8

[5] K. Futagami, T. Iwaisako, R. Ohdoi, “Debt Policy Rule,

Productive Government Spending, and Multiple Growth

Paths,” Macroeconomic Dynamics, Vol. 12, No. 4, 2008,

pp. 445-462. doi:10.1017/S1365100508070235

Copyright © 2011 SciRes. TEL