71

T. G. SCHMITZ ET AL.

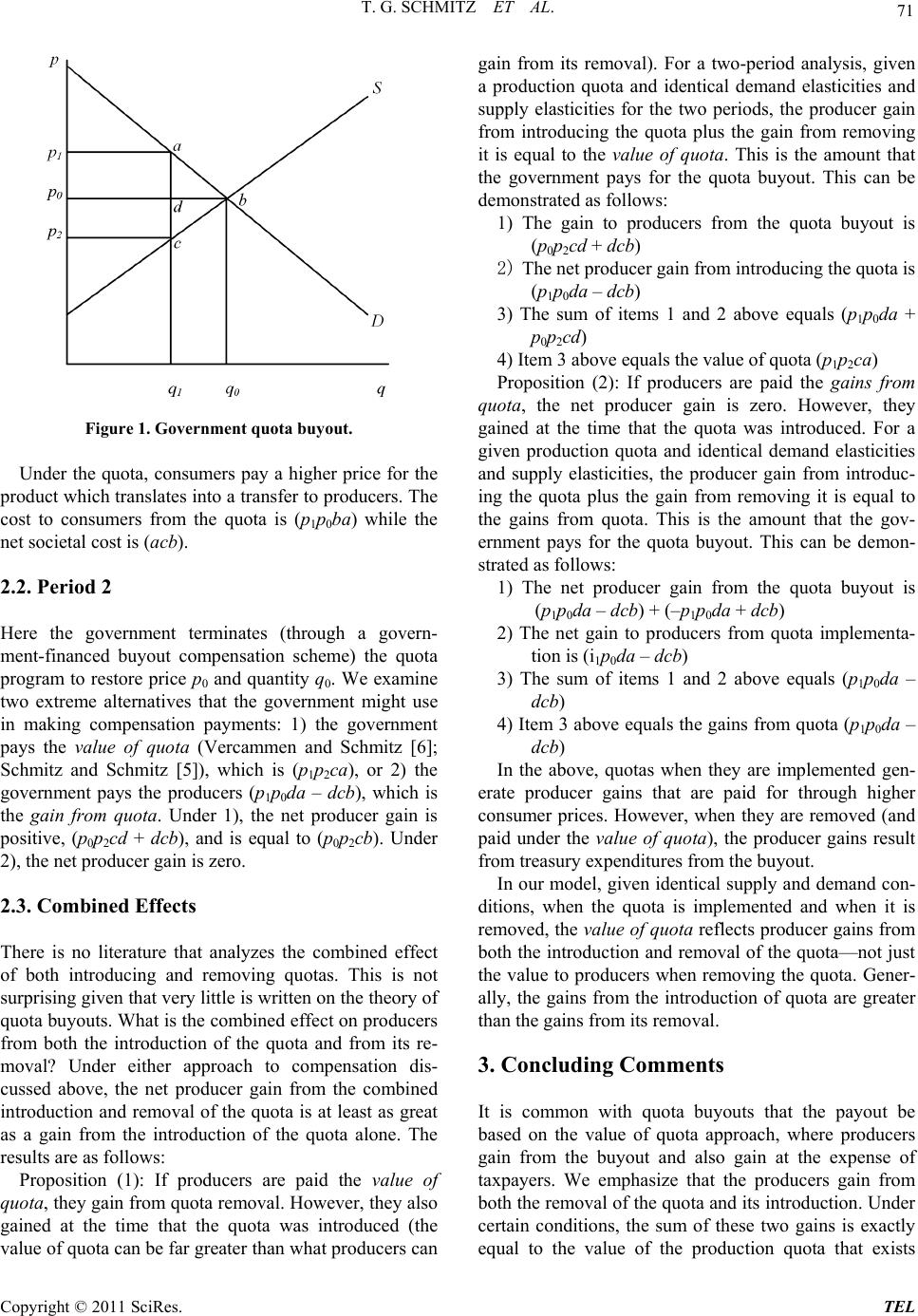

Figure 1. Government quota buyout.

Under the quota, consumers pay a higher price for the

product which translates into a transfer to producers. The

cost to consumers from the quota is (p1p0ba) while the

net societal cost is (acb).

2.2. Period 2

Here the government terminates (through a govern-

ment-financed buyout compensation scheme) the quota

program to restore price p0 and quantity q0. W e examine

two extreme alternatives that the government might use

in making compensation payments: 1) the government

pays the value of quota (Vercammen and Schmitz [6];

Schmitz and Schmitz [5]), which is (p1p2ca), or 2) the

government pays the producers (p1p0da – dcb), which is

the gain from quota. Under 1), the net producer gain is

positive, (p0p2cd + dcb), and is equal to (p0p2cb). Under

2), the net producer gain is zero.

2.3. Combined Effects

There is no literature that analyzes the combined effect

of both introducing and removing quotas. This is not

surprising given that very little is written on th e theory of

quota buyouts. What is the combined effect on producers

from both the introduction of the quota and from its re-

moval? Under either approach to compensation dis-

cussed above, the net producer gain from the combined

introduction and removal of the quota is at least as great

as a gain from the introduction of the quota alone. The

results are as follows:

Proposition (1): If producers are paid the value of

quota, they gain from quota removal. However, they also

gained at the time that the quota was introduced (the

value of quota can be far greater than what produ cers can

gain from its removal). For a two-period analysis, given

a production quota and identical demand elasticities and

supply elasticities for the two periods, the producer gain

from introducing the quota plus the gain from removing

it is equal to the value of quota. This is the amount that

the government pays for the quota buyout. This can be

demonstrated as follows:

1) The gain to producers from the quota buyout is

(p0p2cd + dcb)

2) The net producer gain from introducing the quota is

(p1p0da – dcb)

3) The sum of items 1 and 2 above equals (p1p0da +

p0p2cd)

4) Item 3 above equals the value of quota (p1p2ca)

Proposition (2): If producers are paid the gains from

quota, the net producer gain is zero. However, they

gained at the time that the quota was introduced. For a

given production quota and identical demand elasticities

and supply elasticities, the producer gain from introduc-

ing the quota plus the gain from removing it is equal to

the gains from quota. This is the amount that the gov-

ernment pays for the quota buyout. This can be demon-

strated as follows:

1) The net producer gain from the quota buyout is

(p1p0da – dcb) + (–p1p0da + dcb)

2) The net gain to producers from quota implementa-

tion is (i1p0da – dcb)

3) The sum of items 1 and 2 above equals (p1p0da –

dcb)

4) Item 3 above equals the gains from quota (p1p0da –

dcb)

In the above, quotas when they are implemented gen-

erate producer gains that are paid for through higher

consumer prices. However, when they are removed (and

paid under the value of quota), the producer gains result

from treasury expenditures from the buyout.

In our model, given identical supply and demand con-

ditions, when the quota is implemented and when it is

removed, the value of quota reflects producer gains from

both the introduction and removal of the quota—not just

the value to producers when removing the quota. Gener-

ally, the gains from the introduction of quota are greater

than the gains from its removal.

3. Concluding Comments

It is common with quota buyouts that the payout be

based on the value of quota approach, where producers

gain from the buyout and also gain at the expense of

taxpayers. We emphasize that the producers gain from

both the removal of the quota and its introd uction. Under

certain conditions, the sum of these two gains is exactly

equal to the value of the production quota that exists

Copyright © 2011 SciRes. TEL