Journal of Service Science and Management

Vol.09 No.02(2016), Article ID:65556,15 pages

10.4236/jssm.2016.92020

Supply Chain Differentiation: Background, Concept and Examples

Erik Hofmann, Stephan Knébel

Chair of Logistics Management, University of St. Gallen, St. Gallen, Switzerland

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 29 January 2016; accepted 12 April 2016; published 18 April 2016

ABSTRACT

The purpose of this paper is to provide new evidence in the field of supply chain differentiation. It aims to combine insights of supply chain management with the service dominant logic to connect fundamental customer requirements with supply chain decision-making. The paper claims to provide a framework that brings together the most relevant factors in the context of supply chain differentiation. The contents of the framework were applied as source to develop a generic decision support flowchart for supply chain executives. From the perspective of “test consumers”―supple- mented with secondary data―two cases were examined. The cases provide insights for supply chain differentiation approaches of Adidas and Lego®. The crucial factor to link customer requirements with supply chain settings turned out to be the magnitude of customer co-creation along the value chain under consideration of synergies across the channels. The framework provides the opportunity to structure the complex multi-criteria decision problem constituted by supply chain differentiation. The paper provides helpful insights that could be used as starting point for the development of several industry specific decision-finding models or applications in supply chain differentiation.

Keywords:

Co-Creation, Effectiveness, Customer Requirements, Decision-Finding, Supply Chain Synergy

1. Introduction

Today, customers are becoming more and more sophisticated in terms of demand and are calling for individualized goods and services. At the same time, technological progress is shortening product life cycles and globalization is severing competition in most markets. This highly competitive, sophisticated and dynamic current economic environment is calling for innovative and adaptive business approaches.

This challenging starting situation requires effective supply chain settings. In parallel to these requirements, companies newly consider the various differentiation options offered by supply chain management (SCM). In fact, several promising chances exist to differentiate a company from its competitors and to provide its customers with unique added value through customer tailored solutions. The magic word in this instance is “supply chain differentiation” (SCD). This means executing distinct standardized supply chains for distinct customer segments from one single market. Reference [1] surveyed 150 European companies’ supply chain strategies and found that companies with a differentiated SC strategy were, on average, more successful than their competitors. Reference [2] reported that SCD represents an opportunity for dealing with increasing complexity of customer needs and variability of demand. References [3] and equally [4] present the computer manufacturer Dell’s SCD efforts. Dell has departed from its “one size fits all” pull (make-to-order) supply chain and currently operates up to six different supply chains; Nike and Oakley also introduced differentiated supply chains. The consumer goods manufacturers operate a push (make-to-forecast) and a pull supply chain in parallel to each other1. But, accomplishing SCD certain challenges have to be addressed.

A first challenge in achieving SCD is the required interconnection of customers and their demand characteristics with supply chain decision-making. Coping with this challenge, maximally customized high quality goods and services have to be taken in account, while efficiency constraints are being addressed. The mass customization discussion [5] offers a first anchoring point for this issue.

A second challenge deals with the strategic range of SCD decisions. On the one hand, SCD has to be in line with operations and distribution strategy. On the other hand, companies have to find out the optimal amount, as well as, the optimal structure of different supply chains to serve one market. Beck et al. (2012) emphasized this challenge strikingly with their statement “one size does not fit all” [6] .

A third challenge emerges from the complexity of the differentiation decision while having adaptive supply chains with structural flexibility in mind [7] . SCD does not represent a trivial task for the responsible supply chain manager. Indeed, a vast number of different interconnected factors need to be considered that directly or indirectly influence each other. Such factors include product design decisions, supplier selection and governance, manufacturing process decisions, customer interaction channel selection and distribution structure design, as well as, a magnitude of logistical considerations on each value chain stage such as production layout determination, inventories, transportation, warehouse management and several delivery service settings.

The literature in the research field of operations management so far provides several helpful approaches that aid to structure the respective complex decision issue and help connecting customer requirements with supply chain differentiation, like e.g. [8] linking SCM with customization capabilities. Although the literature gives comprehensive impulses regarding relevant SCD decision criteria there does not yet exist an integrated SCD framework and real case investigations which consider all relevant SCM decision factors collectively with product service criteria in an interconnected and directly customer linked manner. To compensate the respective research gap, the following research questions (RQs) need to be addressed:

RQ 1: How can all relevant SCD and product decision variables become part of an interdependent framework that provides a comprehensive but clear overview of the whole decision problem?

RQ 2: Which customer-specific determinant can directly link supply chain-relevant decision factors coincidentally with customer requirements?

Approaching these research questions the paper at hand builds on the preliminary work of [9] and tries to further develop the ideas of [10] by incorporating SCM with a strong customer-orientation―according to [11] ― based on a stringent service foundation [12] .

In order to provide managerial guidelines this paper applies abductive reasoning [13] . Especially, the creative- intuitive power of abductive research makes it suitable to this explorative study to allow combining theoretical insights conducted from literature with practical examinations through case studies [14] . Going forth and back between theory and practical implications, the paper first reflects, summarizes and assesses the most relevant literature of SCD (Section 2). In order to structure and combine particularly important―but so far―isolated approaches, a conceptual SCD framework is derived as a synthesis (Section 3). The framework, called SCD trinity model, is then applied and illustrated in two case studies (Section 4). The paper closes with a brief summary and an outlook (Section 5).

The basic information underlying the case descriptions stems from analyzing the supply chain settings of the companies from the viewpoint of a “test customer” supplemented with secondary data. We therefore tried to collect experience by checking out the several supply and distribution channels offered by the case companies in order to draw inferences about the respective supply chain settings. Notably, to get comprehensive information with this method, it was important to focus on consumer goods industry company examples. In order to sheet light on the upstream supply chain beyond the customer facing, the analyses were complemented by scientific literature, industry reports and industry specific literature, company reports, online newspaper articles, online financial data services and company webpage material.

2. Background: Differentiation Attributes in the Literature According to Operations Management

When talking about differentiation in the context of SCM, it is necessary to detect the respective supply chain factors that need to be considered for this purpose. As a consequence of what is understood as differentiation the respective factors need to be directly perceptible for customers. Obviously, product features themselves play an important role for the customer and also have several implications for the supply chain [15] . However, several other factors are important. One opportunity to demarcate the crucial customer perceptible factors along the supply chain is the customer decoupling point (CDP) that can simply be interpreted as the point from which the supply chain becomes customer sensitive and reacts on individual orders through customer pull [16] [17] . Upstream of the CDP, supply chains are forecast-driven and downstream of the CDP, supply chains are demand-driven [18] . Demand-driven means that production starts after customer order placement [19] . Hence, the whole supply chain downstream of the CDP can be interpreted as directly perceptible for the customer. This includes above all manufacturing processes, product allocation through logistics as well as product services. Another important factor directly perceptible for the customer is the extent of the supply chain integration into the customer process, meaning the problem solution process from the customer’s point of view. A vital role plays the customer segmentation based on buying behavior [11] . In fact, this can be compared with the term supply chain effectiveness (also called market or customer responsiveness) with regard to demand profiling [10] . Effectiveness thus can be interpreted as a measure of how intensively the supply chain is linked with customer requirements.

When considering literature in the field of supply chain differentiation several concepts can be identified [9] . Within the identified approaches with their respective authors are listed (lines) and evaluated regarding whether they take into account the defined SCD attributes (columns). The symbols indicate either that the respective attribute is considered (\/), partially considered ([\/]) or not considered (X). The literature review supports the research gap identified.

The summary within Table 1 points out that none of the identified concepts relevant for SCD provides a comprehensive and holistic framework including all customer-relevant differentiation attributes. Thus, it makes sense to develop a framework that holistically frames current isolated concepts. Such a framework hence will include all of the above defined differentiation attributes and finally can be used as conceptual foundation that has to become connected with customer requirements

3. Concept: Supply Chain Differentiation Trinity Model

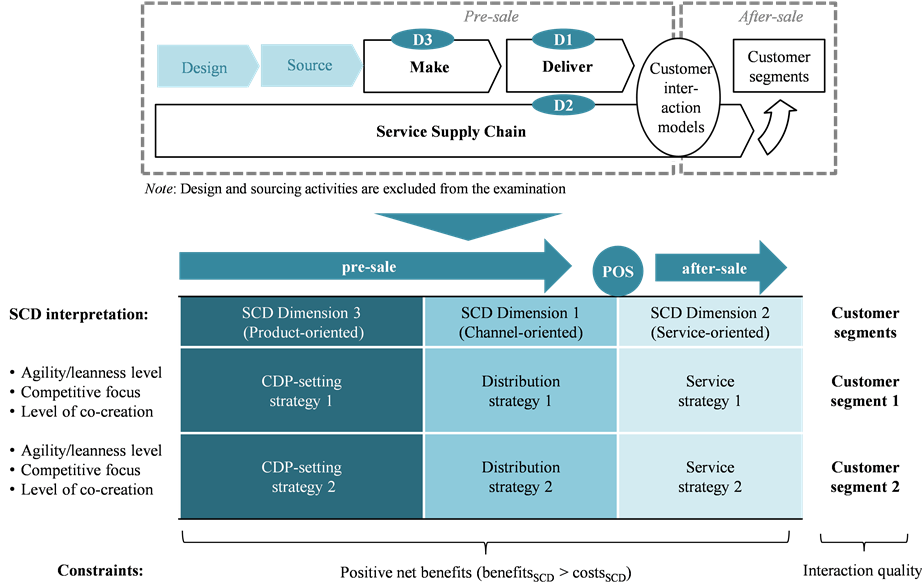

In order to frame the identified supply chain concepts and to connect them with customer requirements the co- production approach of [10] can be brought in. Co-production namely connects customer requirements with supply chain processes (design, source, make, deliver and product utilization) through aspects of the service dominant logic (SDL) [50] - [52] . Applying SDL principles on SCD, a three-dimensional framework (trinity model) can be defined where the crucial determinant that allocates supply chain decision factors to a certain dimension is the amount of customer co-creation [9] :

The first dimension (D1) includes all classical supply chain activities that are necessary to assure product allocation, indicated with “deliver” and distribution channels.

The second dimension (D2) is associated with differentiation options considering all relevant product service options, the “service supply chain”.

The third dimension (D3) encompasses supply chain activities that directly influence the product features as well as the product manufacturing process. The respective supply chain activities are located within the supply chain phase “make”.

Table 1. Summary of the results from the literature review about supply chain differentiation

According to SDL, the supply chain is split into pre-sale and after-sale activities because the service supply chain is integrated into the consumption process (direct utilization of products or services) of the customer? hence expanding the supply chain beyond the POS. All activities are focusing on single, delimited groups of customers with similar requirements. When utilizing SCD, each customer segment is served with a standardized supply chain that is differentiated from the others.

Dimension 1―Supply chain differentiation through “value-of-availability” (differentiation of product allocation): SDL suggests that an enterprise can only offer value propositions but not deliver value. This means that the customer needs to accept the value proposition before value is created, thereby acting as co-creator of value. From the view point of SCM, acceptance of the value proposition by the customer leads to the customer’s effort to gain accessibility to the offered value proposition. Thus, value creation emerges by delivering goods or services to the customer, or in other words by making value available. Value creation through availability of goods or services is the main added value of logistics services. In the broader sense, the task of providing availability of value to customers is located within the delivery phase of the supply chain and affects the distribution strategy in general and distribution logistics activities in the narrow sense. Hence, the sub-dimensions of D1 include all activities of the distribution strategy that are necessary to make goods or services accessible or available at the POS. Within SCD these activities can be structured as follows: First: Distribution channel differentiation― Indirect (IDR) or direct shipment (DIR) options [40] as well as the selection of different bi-directional customer- company interaction channels (CIC) including information flows, marketing activities and sales platforms [42] . Second: Delivery flexibility differentiation―(i) a company for a certain customer segment focus on general delivery flexibility (GDF) that stands for flexibility in terms of order lead time, ordering administration and delivery volume. GDF represents the highest possible amount of customisation options with respect to the delivery flexibility determinants; (ii) the company can focus on transport flexibility (TSF) and offer customers flexible choice in terms of transportation means; (iii) in case of information flexibility the company offers its customers access to different distribution-specific information through different information channels all the time. When a company does not execute a clear differentiation in terms of the delivery flexibility for respective customers segment it chooses the last option, called standard delivery flexibility (STF). Third, Delivery service differentiation―Here the model offers options to further differentiate standard delivery or distribution services (SDS) in order to optimise the lead time (LTO), the delivery readiness (DRO) as well as the delivery quality (DQO).

Dimension 2―Supply chain differentiation through “value-in-use” (differentiation of product services): Vargo and Lusch (2008: p. 7) states within the SDL that “goods are a distribution mechanism for service provision” and “goods [...] derive their value through use the service they provide” [52] . This in fact makes sense since the customer has to use or consume the product to finally profit from the value proposition of the company selling the product. Within D1, customers are just influencing value availability by being part of or simply selecting logistics options. As soon as customers start to use the product or service, however, one can observe an obvious increase in terms of customer value co-creation. The shift in value co-creation leads to the next differentiation dimension (D2). For D2 it has to be noted that although consumption normally exceeds the POS, this does not mean that the supply chain ends at this point. There exist several service options going beyond the simple distribution of products. These services downstream the POS focus on assisting the customer by using or consuming the product, hence supporting the customer by creating value through use. A useful approach to structure D2 is offered by Oliva and Kallenberg (2003) who describe (customer-) process and product oriented services with regard to whether they are transaction based or reach beyond the point of sale and are relationship based [48] . SVC1 stands for product- and transaction-orientated services (like installation services). SVC1 includes more relationship-based services (like spare parts management or maintenance). SVC3 offers process-oriented services like engineering and consulting. Finally, SVC4 stands for broad process-and relationship-based services like life cycle support (Figure 1).

Dimension 3―Supply chain differentiation through “value-of-co-production” (differentiation of product features through differentiation of manufacturing processes): The maximal amount of customer co-creation is reached as soon as the customer becomes part of the production phase as co-producer (at least for physical goods) [52] . Within D2, individual customer requirements are influencing service chain settings that are focused on value in-use especially beyond the POS. This third dimension (D3) is reached by extension from value in-use to value through co-production and can be interpreted as the physical customization of products [45] . The crucial supply chain settings with-in D3 are first of all the postponement strategies (manufacturing postponement (MPS), logistics postponement (LPS), full postponement strategy (FPS) or full speculation strategy (FSS)) described by [31] . Second, it is necessary to derive the manufacturing strategies and CDP settings (manufacture to order (MTO), assemble to order (ATO), package to order (PTO) or manufacture to stock (MTS)) as discussed in the literature for example by [27] .

Figure 1. Differentiation options of the service supply chain [48] .

As a consequence, different degrees of co-creation, or in other words, different degrees of customer influence on the value creation process will determine several supply chain settings with regard to how extensively and in what manner the customer needs to be integrated into the value creation process. Obviously, the dimension order demarcates supply chain dimensions with different possible extents of customer integration (D1 low to D3 high) into the process of value creation. Summing up a first working definition of SCD:

Supply chain differentiation means running at least two supply chains with modularized settings for one market, where the different supply chains are distinguished concerning the degree of customer value-of-availability, value-in-use and value-of co-production. Consequently, with respect to the supply chain-specialized focus on distinct customer segments and their individual requirements, SCD is a curious driver for competitive advantages.

Constraints-Positive net benefit and interaction quality of supply chain differentiation: Even if the proposed SCD framework is focused on customer orientation and on effectiveness, efficiency must be considered as a constraint. To facilitate this, synergies across the supply chains side by side are necessary which ensures that the positive effects generated by differentiated supply chain design are not overcompensated through costs incurred by SCD. Therefore, an additional task is to find the number of concurrently operated supply chains that also yields the best financial performance. This goal is endangered if an extensive number of supply chains is used to satisfy customer needs, since this may lead to poor operational performance and substantial cost increases. Furthermore, a certain quality level within the customer interaction is required: the higher the intervention of the customers in the value creation as co-producers, the more the performance of the supply chain depends on the quality of the collaboration itself.

To finally form a framework, it is necessary to summarize and illustrate the variables discussed. The authors therefore suggest an SCD outcome spreadsheet (Figure 2).

4. Examples: Case Investigations on Supply Chain Differentiation

4.1. Overview of Case Studies

The following case examples represent companies that actually execute different supply chains for different

Figure 2. Supply chain differentiation outcome spreadsheet.

customer segments in one market and explain the respective SCD. The cases will help to explain SCD approaches and will demonstrate that it is able to describe the most important features of real SCD examples. In fact, the cases are necessary to prove the practicability of the suggestions as well as to analyze in an explorative manner corresponding correlations between several independent variables (customer requirements) and dependent variables (supply chain settings). Each case is illustrated with the respective SCD outcome spreadsheet as a resulting document. The selection of the cases was focused on consumer goods industry as outbound supply chain settings are characterized as one (manufacturer) to many (costumer segments). By analyzing the SCD approaches, we took the perspective of an end-consumer. The insights made are largely based on self-experiences with the different offers used. As from such an end-consumer perspective upstream parts of the supply chain are widely not accessible, the analyses were supplemented with company information and practical industry reports (secondary data). Table 2 gives an overview of the companies examined.

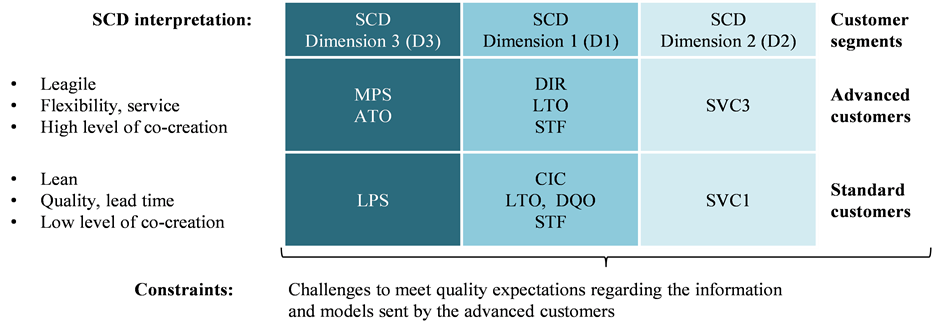

4.2. Supply Chain Differentiation at LEGO®

The first case example is the Danish toy manufacturer LEGO®2. The company’s current supply chain settings represent a good example to illustrate SCD. In fact, the toys produced by LEGO® are nothing else than assembly kits consisting of several different basic building bricks. All building bricks are universally compatible with each other [53] . The basic stock of possible building bricks so far is comprehensive but limited. The number of different variants of the final product (within this paper interpreted as the assembly kit itself and not the single building bricks), however, is nearly infinite. The assembly that in the wider sense can be seen as part of the toy’s experience is very easy since originally designed to be compatible with very young customers.

The company found itself in massive crises during 2004 and was forced to overthink its outdated supply chain practices [54] . As a result, the company restructured its production system, switched to highly flexible machines to profit from economies of scope and focused its production on several main locations in Denmark, Hungary, Mexico, China and the Czech Republic. The most important step however was to centralise its distribution logistics within one large distribution centre in the Czech Republic near the production location. The whole distribution today is organised by the contractor DHL. Today, the main supply chain is organised as follows: The basic bricks in several colours are produced during a first step (melting) in Danmark, Mexico, China and Hungary. The production machines that melt plastics granulates and press them into several forms are highly flexible. It takes about two hours to switch them to another brick. The raw bricks than are stored within automatised high rack warehouses. From there on the raw bricks are shipped to the processing manufactury in the Czech Republic where during step 2 (processing) they get their final look. Subsequently, the assembly of the final products follows. In fact, the assemly and the packaging can be seen as the same since the final product is sold as a building kit. Hence, assembly in this case is nothing else than sorting and pooling the accurate bricks for a certain product, the building kit. This is executed through primary packaging (step 3) and secondary packaging (step 4). The final products then are stored in the DHL distribution center where orders are processed, products are labeled and finally shipped to retail stores and toy stores [53] [55] .

From the viewpoint of SCD the respective supply chain is organised as follows3: The whole supply chain from the melting to the distribution center is forecast-driven, lean and focused on lead time optimisation. Com- bined with the centralised distribution center the whole process can be interpreted as an LPS. The distribution

Table 2. Overview of case examples crucial numbers and locations.

center of DHL serves the several retail stores worldwide while the factory with its smaller warehouse in Billund handles the internet orders of single customers [55] . In fact, this can be seen as a classical multi-channel distribution strategy, internet and retailer. Since the CDP is very far upstream, the final products exhibit just low customisation. Next to this lean, forecast-driven supply chain for final, completely assembled products, the company executes another supply chain for its more advanced customers. LEGO® offers free software4 for interested customers allowing the virtual construction of an individual assembly kit. The software generates not only a virtual construction blueprint of the respective product; indeed, upon having virtually designed his individual product, the customer is able to submit the blueprint to LEGO® that collects, packages and ships the necessary bricks to the customer. The respective activities are executed in the Billund factory. The unprocessed bricks stem from the warehouse where the raw bricks are stored. The CDP of the respective supply chain comes just after the melting production step (first intermediate) and can be interpreted as ATO within D3 of the framework. Since the customer acts as product co-designer, the level of customization is much higher in terms of this second supply chain. Hence, the respective supply chain setting can be interpreted leagile with focus on flexibility as well as service.

The service supply chain settings (D2) for the two supply chains look as follows: The leagile supply chain for the advanced customers focuses on SVC3, predominantly on process-oriented engineering and R&D. In fact, the digital designer software can be understood as a design support tool since it generates not only a customized product but also a customer-specific construction manual, hence supporting the customer’s process of arranging the bricks in the right manner. The software thereby represents an interesting example of process-oriented services for consumer goods. The lean supply chain on the other hand focuses on SVC1 through services like standard construction manuals (installation service) and help desks or customer hot lines. Both supply chains further offer spare parts managements through the online pick a brick5 function.

The respective SCD outcome spreadsheet Figure 3 summarizes the SCD implications. The supply chain for standard customers is described as lean with quality and lead time focus. How-ever, the whole supply chain exhibits further flexibility potential. The reason is the many planning points along the modularised production process (step 1-4) that represent several CDP-setting options in terms of further customization need or when demand becomes more volatile cf. [29] .

When applying the operationalised independent variables of the SCD frame of reference to the respective case, the chosen customer segments exhibit clear differences. The co-creation need concerning the advanced customers leads to nearly infinite product variety requiring ATO that enables the respective customisation magnitude on D3. The consumption complexity for advanced customers is rather high since the customer designs his product himself. Hence, extensive design support through SVC3 services is necessary within D2. For the standard customers, both, product variety and consumption complexity are rather low when compared to advanced customers. Within D1, the advanced customers are served through direct distribution with focus on lead time optimisation. Most important is temporal accessibility as soon as the internet design process is terminated. For the

Figure 3. Supply chain differentiation at LEGO®.

standard customers it is further important to offer the opportunity of locally available toy store experience for kids what leads to the respective multi-channel distribution strategy.

The SCD-relevant segmentation in this case distinguishes between advanced and standard customers. This can be seen as segmentation with respect to the product utilisation behaviour of the customers. In fact, the download and utilisation of the software needs several skills in terms of arranging the bricks in the accurate way to get the preferred product. The customers further need time, motivation and also a certain age to handle the software. Actually, the digital designer user satisfies his needs at least partially by the design process itself. Standard customers on the other hand are new customers or children that are more interested in the assembled final product and not in the assembly and design process itself.

After six years running, the company discontinued the Lego Digital Designer in 2012. According to the firm’s web page, the download of the design tool is still possible, but no longer the production and delivery of customized physical models. Lego announced that the “Design by Me” service was going to end due to its failure to meet quality expectations (a lot of self-designed models were flimsy and break easily) and for being too complex (for children). The company stated that the rebuild of the entire setup would have made the offering too expensive.

The implications from the SCD were that the starting point of supply chain relevant customer segmentation is customer requirements that define the magnitude of customisation per customer. The customer itself is signalling his need for customisation through co-creation. When taking a look to the different products, services and distribution channels offered by LEGO® one can exactly detect these crucial differences in co-creation and customisation. The conceptual foundation of the company’s customisation is founded in the product structure itself. The modularity of the basic building bricks and the simplicity of product assembly together with the infinite number of finally assembled product variants make the product the ideal basic for application of mass customisation or customisation in general and thereby offers many opportunities for SCD. Nevertheless, the case shows also two substantial constraints: (i) the necessary level of quality requirements of customers as a co-producer and (ii) the supplementary costs respective not realized synergies between the two supply chains side-by-side.

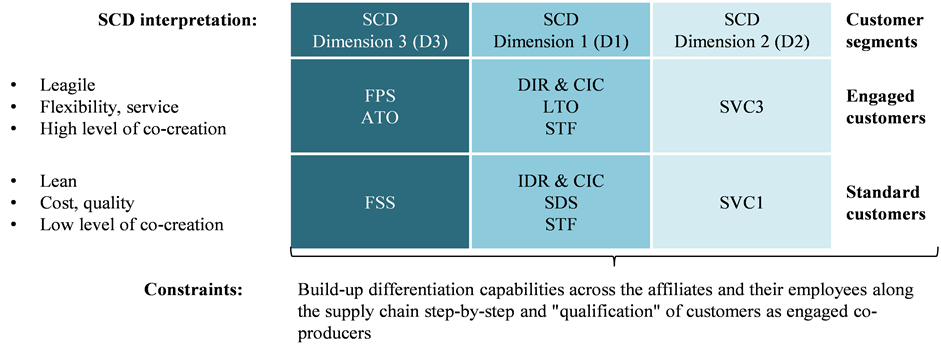

4.3. Supply Chain Differentiation at Adidas

Another example that can be used to illustrate SCD is the supply chain concept of the Adidas group6. When consulting the annual report (2011) one can find the following statement about the supply chain vision of the company: “Become closest to every consumer by building and managing a supply chain that quickly responds to changing market needs and supports multiple distinct business models” [56] . The Adidas supply chain is seen as a competitive advantage in making the company “the partner of choice” for consumers and customers. In fact, this just means that the company is focusing on differentiation of its supply chain(s) with regard to customer needs.

Analysing the different supply chains of Adidas, each serving another distribution channel, one can identify different magnitudes of customisation with respect to important supply chain settings. The crucial distinction is made between e-commerce that offers a high level of customisation and standard channels via wholesale and retailing [56] . Customer segments can be described respectively. In fact, to customise a product, customers need to exhibit a certain will to engage in the co-creation process, either because of higher product functionality (professional or semi-professional sports athletes) or because of the will to demonstrate individual life style. The resulting segment within SCD is called engaged customers that try to profit either from rational or emotional benefits through co-creation. The other customer segment, preferring buying standard products within retail stores is called standard customers (just like for the LEGO® case). The crucial difference between the two customer segments is the magnitude of product variety. The resulting SCD is illustrated in Figure 4.

The customisation initiative of Adidas is called “mi Adidas”. For the first customer segment (engaged customers) there basically exist two different CIC to start their co-creation process: Either through consulting the online configuration tool on the mi Adidas webpage7 or through physically moving to one of the Adidas flag ship stores, either brand stores or concept stores [56] [57] . Shoes can then be customised and personalised through choosing size, colours of several different parts of the shoe, personal icons and several functional specifications (especially for sports ware). After ordering the shoe, a completely automatic ordering processing systems chooses the optimal manufacturing location (several plants are located in different Asian countries) for the respective model and initiates assembly of the customised shoe out of a limited amount of shoe building modules.

Figure 4. Supply chain differentiation at Adidas.

On D3, hence, the supply chain setting can be interpreted as ATO. However, through focusing on Asian assembly plants, one could also interpret the setting of D3 as (continental) FPS. Assembly of shoes is time consuming and together with the continental logistics postponement this results in relative long lasting ordering lead times for mi Adidas products from around 21 days. Consequently, on D1, the Adidas group chooses a clear LTO focus in terms of delivery service. The latter allows compensation of the lead time elongation during product assembly. In the USA Adidas therefore cooperates with FedEx, in Europe and Asia with DHL that provide high speed courier services [57] . Customers are supplied directly (DIR) but can choose different CIC. Since only courier services are used, the delivery flexibility is standardised (STF). In terms of D2 differentiation, the engaged customers profit from several SVC3 service opportunities. Especially when ordering mi Adidas shoes within the flagship stores, customers can profit from intensive process-oriented engineering support through experienced employees as well as several technologies to fit the personal requirements with the customisation process (for example foot-scanning technology and fitting expert support) [58] . Furthermore, Adidas offers services like “mi coach”, a fully electronic tool to generate an individual training and fitness program. The latter can be interpreted as process-oriented training or even (when replacing sport with business) as business-oriented consulting service, especially in terms of professional athletes. The whole supply chain for engaged customers hence is leagile with focus on flexibility and service as well as a high level of customer co-creation through the customisation process. Differentiation mainly occurs on D3 of SCD.

For its less engaged customers (standard customers), the Adidas group executes a completely different second supply chain. The crucial difference can be found in the fact that standard customers are served through a completely forecast-driven mass production supply chain (FSS) focused on leanness, cost and quality of the products. Neither courier services nor special delivery flexibility are necessary and standard products for selling through wholesale and retail channels are stored within several distribution centers [58] . On D2, services are restricted to SVC1, either through product-oriented trainings (general sales consulting at the POS) or help desks and hotlines.

Implementing the supply chain differentiation approach, Adidas had to handle a range of challenges in the upstream supply chain and at the level of retailers. Despite Adidas has large mass production facilities (especially third-party manufacturers), the internal and external supply chain affiliations had to be enabled to handle the new customization idea on a large scale (mass customization). The company decided to follow a controlled expansion of SCD step-by-step. With growing demand, Adidas allocated more and more resources in the supply chain to deal with the technology-driven differentiation approach. The SCD approach was sequentially enhanced on further categories (starting with soccer footwear in 2000, the running, basketball and tennis footwear followed in the years 2001 to 2003). The years after, other sport goods and wear succeed8. In order to handle additionally cost of inventory together with higher production cost for the customized products, Adidas tried to integrate the new approach into existing functions. Potential problems with SCD at the retailer level?especially the “qualification” of customers as engaged co-producers?have been avoided as far as possible by first introducing the approach at Adidas’ owned outlets (e.g. in flagship stores).

4.4. Summary of Case Examples

The presented practical case examples demonstrate that it is possible to represent the logic of the SCD framework. Interestingly, the LEGO® examples as well as the SCD executed by Adidas are predominantly a result of customer segments exhibiting completely different requirements with respect to functional product variety as a consequence of high requirement for customer co-production. The respective SCD settings hence are focused on D3. The differentiations with respect to D2 can be subsequently interpreted as a consequence of D3 settings, namely as services necessary to support customers during the co-production process. Additionally, the case examples nicely illustrate the connection of the SDL with SCD thereby supporting the service and customer-centered origin of the differentiation approach. The results of the case examples thus emphasize the need for a clear understanding of customer requirements when considering SCD decisions. Notably, the cases showed different possible motives for SCD, each influencing SCD decisions within different dimensions in advance that subsequently might result in further need for SCD on other dimensions.

5. Conclusions and Outlook

5.1. Scientific Impact

The overall goal of the paper was the building-up on the ideas of Hofmann and Knébel to deliver new insights into the field of SCD by bringing together the most relevant decision factors within one conceptual framework [9] . The customer segmentation concept of [10] was combined with mass customization [57] and the co-pro- ducer idea [45] together with the servitization approach of [50] as well as [12] . The predominant question behind the paper’s objective was how customers and their demand characteristics can be connected to supply chain decision-making. The two research objectives have been achieved: First, we identified the most important factors that need to be considered with respect to well performing SCD; Second, we derived and illustrated a meaningful concept to connect customer requirements with supply chain relevant decision factors.

Dependent on the customer requirements derived from the customer’s need for co-creation, the optimal magnitude of differentiation for each customer segment can be defined through the proposed SCD dimensions. The amount of distinct supply chains necessary to optimally serve customers with a certain product can vary significantly since specific product characteristics generate distinct sensitivities of the supply chain settings towards changing customer requirements. Nevertheless, we feel confident seeing SCD as a substantial cornerstone for “supply chain 2.0 thinking” pronounced by Christopher and Holweg [7] .

5.2. Managerial Implication

The developed frame of reference revealed several interesting managerial implications. First of all, it is important to emphasize its opportunities in general to further differentiate companies within highly competitive environments (like in the consumer goods industry). Thus, it makes sense to consider factors defining an adequate SCD for a company.

Second, the framework offers practitioners a tool to easily structure their comprehensive decision problems when considering SCD and it provides new access to the so far most crucial scientific findings within the field of supply chain management. Furthermore, the framework also includes several customer service factors within a holistic approach.

Third, the paper’ results offer an opportunity for supply chain managers to assess customers with respect to their requirements relevant for supply chain settings. Evaluating customers with respect to their need for co- creation actually may help to detect the crucial location within the supply chain where differentiation should take place.

However, SCD constraints have to be addressed while developing and realizing the approach. Besides a positive net benefit of SCD―highlighting synergies between the parallel supply chains―the quality of the customer input has to be given. The synergies across the different supply chains can be archived by a gradual implementation approach. After building up the first experience, the SCD can be rolled out to further commodities, customer groups or regions. A very meaningful question for decision makers will be asked in the future: “How many different supply chains do I need for my businesses?”, “How to achieve supply chain synergies across the different channels side-by-side?”. An overview of chosen differentiating practices is given in Table 3 [59] .

Table 3. Overview of supply chain differentiating practices (Source: PwC [59] ).

5.3. Future Research and Outlook

Altogether, we demonstrated an approach that can be applied to frame SCD decisions in retrospect but they left open how to apply the framework to crucial SCD decisions in advance, meaning how exactly changing independent variables affect the manifestations of the multiple and interconnected dependent variables. Hence, to provide real decision support for decision makers, the framework components need to be further developed. Future research needs to fulfill the following requirements: 1) Research should consider the most relevant independent and dependent SCD variables; 2) It is important that the interconnection of SCD dimensions is addressed; 3) Future investigations should support decisions and should consider the experience of supply chain managers, not replace them; 4) To be practicable, the complexity level should be minimized; 5) Last but not least, the influence of customer requirements on the supply chain settings can also affect phases upstream the manufacturing process as well as the network level. In fact, this might remain one huge future research branch in the field of SCD.

All-in-all, more investigations are required in order to achieve an adequate basis for SCD that encompasses not only strategic, but also operational and tactical considerations of SCM: Firstly, make-or-buy considerations have to be made. Once an adequate outline of SCD on a generic level is determined, the question has to be asked whether―from an operational point of view―the right activities are performed in-house and outsourced. This question includes resources and capabilities considerations in accordance with the resource-based and relational view [60] . Secondly, target supply chain configurations have to be derived in accordance with a strategy-struc- ture discussion [61] . This has to occur for each individual supply chain in order to support its specific customer segment. Besides the factors identified, necessary infrastructure elements need to be determined in order to provide an adequate basis of internal and external supply chain resources. Thirdly and finally, a SCD on the corporate level has to be addressed in order to realize synergies through combination of business areas as well as through coordination of corporate activities and interaction with stakeholders [62] .

Acknowledgements

The authors want to thank the reviewers of this paper for their useful and motivating comments. Furthermore, special thanks go to the attendees of the NOFOMA Conference 2014 in Copenhagen, Denmark, for their valuable and inspiring feedback given to the presentation of the very first version of this article (working paper status).

Cite this paper

Erik Hofmann,Stephan Knébel, (2016) Supply Chain Differentiation: Background, Concept and Examples. Journal of Service Science and Management,09,160-174. doi: 10.4236/jssm.2016.92020

References

- 1. Mayer, S., Thiry, E. and Frank, C.-B. (2009) Supply Chain Excellence amidst the Global Economic Crisis: 6th European A.T. Kearney/ELA Logistics Study 2008/2009. European Logistics Association, Brussels.

- 2. Malik, Y., Niemeyer, A. and Ruwadi, B. (2011) Building the Supply Chain of the Future. McKinsey Quarterly, 1, 62-71.

- 3. Davis, M. (2010) Case Study for Supply Chain Leaders: Dell’s Transformative Journey through Supply Chain Segmentation. Gartner Research ID Number: G00208603, Gartner, Stamford.

- 4. Tu, Q., Vonderembse, M.A. and Ragu-Nathan, T.S. (2001) The Impact of Time-Based Manufacturing Practices on Mass Customization and Value to Customer. Journal of Operations Management, 19, 201-217.

http://dx.doi.org/10.1016/S0272-6963(00)00056-5 - 5. Mikkola, J.H. and Skjott-Larsen, T. (2004) Supply-Chain Integration: Implications for Mass Customization, Modularization and Postponement Strategies. Production Planning & Control, 15, 352-361.

http://dx.doi.org/10.1080/0953728042000238845 - 6. Beck, P., Stölzle, W. and Hofmann, E. (2012) One Size Doesn’t Fit All: An Approach for Differentiated Supply Chain Management. International Journal of Services Science, 4, 213-239.

http://dx.doi.org/10.1504/IJSSCI.2012.051059 - 7. Christopher, M. and Holweg, M. (2011) “Supply Chain 2.0”: Managing Supply Chains in the Era of Turbulence. International Journal of Physical Distribution & Logistics Management, 41, 63-82.

http://dx.doi.org/10.1108/09600031111101439 - 8. Liu, G. and Deitz, G.D. (2011) Linking Supply Chain Management with Mass Customization Capability. International Journal of Physical Distribution & Logistics Management, 41, 668-683.

http://dx.doi.org/10.1108/09600031111154125 - 9. Hofmann, E. and Knébel, S. (2013) Alignment of Manufacturing Strategies to Customer Requirements Using Analytical Hierarchy Process. Production & Manufacturing Research, 1, 19-43.

http://dx.doi.org/10.1080/21693277.2013.846835 - 10. Godsell, J., Diefenbach, T., Clemmow, C., Towill, D. and Christopher, M. (2011) Enabling Supply Chain Segmentation through Demand Profiling. International Journal of Physical Distribution & Logistics Management, 41, 296-314.

http://dx.doi.org/10.1108/09600031111123804 - 11. Hjort, K., Lantz, B., Ericsson, D. and Gattorna, J. (2013) Customer Segmentation Based on Buying and Returning Behavior. International Journal of Physical Distribution & Logistics Management, 43, 852-865.

http://dx.doi.org/10.1108/IJPDLM-02-2013-0020 - 12. Flint, D.J., Lusch, R.F. and Vargo, S.L. (2014) The Supply Chain Management of Shopper Marketing as Viewed through a Service Ecosystem Lens. International Journal of Physical Distribution & Logistics Management, 44, 23-38.

http://dx.doi.org/10.1108/IJPDLM-12-2012-0350 - 13. Kovács, G. and Spens, K.M. (2005) Abductive Reasoning in Logistics Research. International Journal of Physical Distribution & Logistics Management, 35, 132-144.

http://dx.doi.org/10.1108/09600030510590318 - 14. Wacker, J.G. (1998) A Definition of Theory: Research Guidelines for Different Theory-Building Research Methods in Operations Management. Journal of Operations Management, 16, 361-385.

http://dx.doi.org/10.1016/S0272-6963(98)00019-9 - 15. Fisher, M.L. (1997) What Is the Right Supply Chain for Your Product? A Simple Framework Can Help You Figure out the Answer. Harvard Business Review, 75, 105-116.

- 16. Manson-Jones, R. and Towill, R.D. (1999) Using the Information Decoupling Point to Improve Supply Chain Performance. The International Journal of Logistics Management, 10, 13-26.

http://dx.doi.org/10.1108/09574099910805969 - 17. Razmi, J. and Rahnejat, H. (1998) Use of Analytic Hierarchy Process Approach in Classification of Push, Pull and Hybrid Push-Pull Systems for Production Planning. International Journal of Operations & Production Management, 18, 1134-1151.

http://dx.doi.org/10.1108/01443579810231705 - 18. Olhager, J. (2010) The Role of the Customer Order Decoupling Point in Production and Supply Chain Management. Computers in Industry, 61, 863-868.

http://dx.doi.org/10.1016/j.compind.2010.07.011 - 19. Murakoshi, T. (1994) Customer-Driven Manufacturing in Japan. International Journal of Production Economics, 37, 63-72.

http://dx.doi.org/10.1016/0925-5273(94)90008-6 - 20. Agarwal, A., Shankar, R. and Tiwari, M.K. (2006) Modeling the Metrics of Lean, Agile and Leagile Supply Chain: An ANP-Based Approach. European Journal of Operational Research, 173, 211-225.

http://dx.doi.org/10.1016/j.ejor.2004.12.005 - 21. Agarwal, A., Shankar, R. and Tiwari, M.K. (2007) Modeling Agility of Supply Chain. Industrial Marketing Management, 36, 443-457.

http://dx.doi.org/10.1016/j.indmarman.2005.12.004 - 22. Christopher, M. and Towill, D.R. (2002) Developing Market Specific Supply Chain Strategies. The International Journal of Logistics Management, 13, 1-14.

http://dx.doi.org/10.1108/09574090210806324 - 23. Lee, H.L. (2002) Aligning Supply Chain Strategies with Product Uncertainties. California Management Review, 44, 105-119.

http://dx.doi.org/10.2307/41166135 - 24. Lin, C., Chiu, H. and Chu, P. (2006) Agility Index in the Supply Chain. International Journal of Production Economics, 100, 285-299.

http://dx.doi.org/10.1016/j.ijpe.2004.11.013 - 25. Van Hoek, R.I., Harrison, A. and Christopher, M. (2001) Measuring Agile Capabilities in the Supply Chain. International Journal of Operations & Production Management, 21, 126-147.

http://dx.doi.org/10.1108/01443570110358495 - 26. Christopher, M., Peck, H. and Towill, D.R. (2006) A Taxonomy for Selecting Global Supply Chain Strategies. The International Journal of Logistics Management, 17, 277-287.

http://dx.doi.org/10.1108/09574090610689998 - 27. Hilletofth, P. (2009) How to Develop a Differentiated Supply Chain Strategy. Industrial Management & Data Systems, 109, 16-33.

http://dx.doi.org/10.1108/02635570910926573 - 28. Naim, M.M. and Gosling, J. (2010) On Leanness, Agility and Leagile Supply Chains. International Journal of Production Economics, 131, 342-354.

http://dx.doi.org/10.1016/j.ijpe.2010.04.045 - 29. Olhager, J. (2003) Strategic Positioning of the Order Penetration Point. International Journal of Production Economics, 85, 319-329.

http://dx.doi.org/10.1016/S0925-5273(03)00119-1 - 30. Kumar, S. and Wilson, J. (2009) A Manufacturing Decision Framework for Minimizing Inventory Costs of a Configurable Off-Shored Product Using Postponement. International Journal of Production Research, 47, 143-162.

http://dx.doi.org/10.1080/00207540701477792 - 31. Pagh, J.D. and Cooper, M.C. (1998) Supply Chain Postponement and Speculation Strategies: How to Choose the Right Strategy. Journal of Business Logistics, 19, 13-33.

- 32. Van Hoek, R.I. (1998) Reconfiguring the Supply Chain to Implement Postponed Manufacturing. The International Journal of Logistics Management, 9, 95-110.

http://dx.doi.org/10.1108/09574099810805771 - 33. Da Silveira, G., Borenstein, D. and Fogliatto, F.S. (2001) Mass Customization: Literature Review and Research Directions. International Journal of Production Economics, 72, 1-13.

http://dx.doi.org/10.1016/S0925-5273(00)00079-7 - 34. Jiao, J., Ma, Q. and Tseng, M.M. (2003) Towards High Value-Added Products and Services: Mass Customization and Beyond. Technovation, 23, 809-821.

http://dx.doi.org/10.1016/S0166-4972(02)00023-8 - 35. Tu, Q., Vonderembse, M.A. and Ragu-Nathan, T.S. (2001) The Impact of Time-Based Manufacturing Practices on Mass Customization and Value to Customer. Journal of Operations Management, 19, 201-217.

http://dx.doi.org/10.1016/S0272-6963(00)00056-5 - 36. Ketchen, D.J., Rebarick, W., Hult, G.T.M. and Meyer, D. (2008) Best Value Supply Chains: A Key Competitive Weapon for the 21st Century. Business Horizons, 51, 235-243.

http://dx.doi.org/10.1016/j.bushor.2008.01.012 - 37. Zhang, Q., Vonderembse, M.A. and Lim, J.-S. (2005) Logistics Flexibility and Its Impact on Customer Satisfaction. The International Journal of Logistics Management, 16, 71-95.

http://dx.doi.org/10.1108/09574090510617367 - 38. Zhang, Q., Vonderembse, M.A. and Lim, J.-S. (2006) Spanning Flexibility: Supply Chain Information Dissemination Drives Strategy Development and Customer Satisfaction. Supply Chain Management: An International Journal, 11, 390-399.

http://dx.doi.org/10.1108/13598540610682408 - 39. Davis, M. and McDonnell, W. (2011) The Seven Steps of the Supply Chain Segmentation Journey. Gartner Research ID No. G00210319.

http://www.gartner.com/id=1537017 - 40. Chopra, S. (2003) Designing the Distribution Network in a Supply Chain. Transportation Research: Part E: Logistics and Transportation Review, 39, 123-140.

http://dx.doi.org/10.1016/S1366-5545(02)00044-3 - 41. Mentzer, J.T., Flint, D.J. and Hult, G.T.M. (2001) Logistics Service Quality as a Segment-Customized Process. Journal of Marketing, 65, 82-104.

http://dx.doi.org/10.1509/jmkg.65.4.82.18390 - 42. Neslin, S.A., Grewal, D., Leghorn, R., Shankar, V., Teerling, M.L., Thomas, J.S. and Verhoef, P.C. (2006) Challenges and Opportunities in Multichannel Customer Management. Journal of Service Research, 9, 95-112.

http://dx.doi.org/10.1177/1094670506293559 - 43. Neslin, S.A. and Shankar, V. (2009) Key Issues in Multichannel Customer Management: Current Knowledge and Future Directions. Journal of Interactive Marketing, 23, 70-81.

http://dx.doi.org/10.1016/j.intmar.2008.10.005 - 44. Rafele, C. (2004) Logistics Service Management: A Reference Framework. Journal of Manufacturing Technology Management, 15, 280-290.

http://dx.doi.org/10.1108/17410380410523506 - 45. Etgar, M. (2008) A Descriptive Model of the Consumer Co-Production Process. Journal of the Academy of Marketing Science, 36, 97-108.

http://dx.doi.org/10.1007/s11747-007-0061-1 - 46. Mathieu, V. (2001) Product Services: From a Service Supporting the Product to a Service Supporting the Client. Journal of Business & Industrial Marketing, 16, 39-58.

http://dx.doi.org/10.1108/08858620110364873 - 47. Mont, O.K. (2002) Clarifying the Concept of Product-Service System. Journal of Cleaner Production, 10, 237-245.

http://dx.doi.org/10.1016/S0959-6526(01)00039-7 - 48. Oliva, R. and Kallenberg, R. (2003) Managing the Transition from Products to Services. International Journal of Service Industry Management, 14, 160-172.

http://dx.doi.org/10.1108/09564230310474138 - 49. Raddats, C. and Easingwood, C. (2010) Services Growth Options for B2B Product-Centric Businesses. Industrial Marketing Management, 39, 1334-1345.

http://dx.doi.org/10.1016/j.indmarman.2010.03.002 - 50. Vargo, S.L. and Lusch, R.F. (2004) Evolving to a New Dominant Logic for Marketing. Journal of Marketing, 68, 1-17.

http://dx.doi.org/10.1509/jmkg.68.1.1.24036 - 51. Vargo, S.L. and Lusch, R.F. (2008) From Goods to Service(s): Divergences and Convergences of Logics. Industrial Marketing Management, 37, 254-259.

http://dx.doi.org/10.1016/j.indmarman.2007.07.004 - 52. Vargo, S.L. and Lusch, R.F. (2008) Service-Dominant Logic: Continuing the Evolution. Journal of the Academy of Marketing Science, 36, 1-10.

http://dx.doi.org/10.1007/s11747-007-0069-6 - 53. LEGO Group (2016) A Short Presentation. Billund.

http://www.lego.com/en-us/aboutus/lego-group/annual-report - 54. Booz and Co. (2007) Rebuilding Lego, Brick by Brick. Reprint from Strategy and Business 48, Reprint Number 07306.

http://www.strategy-business.com/article/07306?pg=all#authors - 55. Cook, J.A. (2009) Lego’s Game-Changing Move. CSCMP’s Supply Chain Quarterly, 2009/03.

http://www.supplychainquarterly.com/archives/2009/03/ - 56. Adidas Group (2011) Annual Report 2011. Herzogenaurach.

http://www.adidas-group.com/en/investors/results/ - 57. Piller, F.T., Lindgens, E. and Steiner, F. (2012) Mass Customization at Adidas: Three Strategic Capabilities to Implement Mass Customization. Social Science Research Network SSRN ID No. 1994981.

http://ssrn.com/abstract=1994981

http://dx.doi.org/10.2139/ssrn.1994981 - 58. Seifert, R.W. (2002). My Adidas Mass Customization Initiative. IMD International Institute for Management Development, Lausanne, Switzerland, ID No. IMD-6-0249.

http://www.imd.org/uupload/www01/documents/millenniumcases/IMD-6-0249_Mi_Adidas.pdf - 59. PwC (2013) Next-Generation Supply Chains. Efficient, Fast and Tailored. Global Supply Chain Survey 2013.

https://www.pwc.com/gx/en/consulting-services/supply-chain/global-supply-chain-survey/assets/global-supply-chain-survey-2013.pdf - 60. Kotabe, M., Murray, J.Y. and Westjohn, S.A. (2009) Global Sourcing Strategy and Performance of Knowledge-Intensive Business Services: A Two-Stage Strategic Fit Model. Journal of International Marketing, 17, 90-105.

http://dx.doi.org/10.1509/jimk.17.4.90 - 61. Defee, C.C. and Stank, T.P. (2005) Applying the Strategy-Structure-Performance Paradigm to the Supply Chain Environment. The International Journal of Logistics Management, 16, 28-50.

http://dx.doi.org/10.1108/09574090510617349 - 62. Hofmann, E. (2010) Linking Corporate Strategy and Supply Chain Management. International Journal of Physical Distribution & Logistics Management, 40, 256-276.

http://dx.doi.org/10.1108/09600031011045299

NOTES

1See http://www.nike.com/us/en_us/c/nikeid and http://uk.oakley.com/custom.

2http://aboutus.lego.com/en-us/default.aspx.

3An illustrative video from the National Geographic Channel about the LEGO® manufactory in Billund, Denmark can be accessed by the following link: https://www.youtube.com/watch?v=VnMA2HMQ_LI

4LEGO® digital designer software: http://ldd.lego.com/en-us/

5LEGO® pick a brick spare parts service: http://shop.lego.com/en-US/Pick-A-Brick-ByTheme

6http://www.adidas-group.com/en/sustainability/supply-chain/supply-chain-structure/

7http://www.adidas.com/us/customize