Journal of Service Science and Management

Vol.08 No.04(2015), Article ID:58693,8 pages

10.4236/jssm.2015.84054

Research of the Game and Countermeasure about Collusion between Executives of State-Owned Enterprises and Government Officials

Qiuyue Wei, Hanmin Liu

Management School, Jinan University, Guangzhou, China

Email: wqy0215@126.com

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 22 July 2015; accepted 7 August 2015; published 10 August 2015

ABSTRACT

In recent years, the cases which the executives of state-owned enterprise and government officials, internal staff, the third party audit institutions to realize the conspiracy for acquiring enterprise assets or increase their welfare are increasing in China. For maximizing their economic interests, executives of state-owned enterprise and government officials often conspire to obtain extra gains under asymmetric information. This article first analyses the stakeholders of state-owned enterprise in China, and sets up a game model about collusion between the executives of state-owned enterprise and government officials in order to obtain the condition of the collusion. And then, the paper focuses on the trilateral game model of executives of state-owned enterprise, government officials and commission for discipline inspection and puts forward discipline inspection strategy to overcome the collusion problem. The study results show that commission for discipline inspection can effectively reduce collusion motivation by enhancing the supervision success rate, reducing the examination costs, and increasing the punishment force.

Keywords:

Executives of State-Owned Enterprise, Government Officials, Game Model of Collusion, Discipline Inspection, Supervision and Restraint System

1. Introduction

The phenomenon that operators and some functional organizations conspire to harm the interests of the state and social public usually occurs in China, because China is in economic transition period, the market mechanism is not yet mature and the social supervision system has been not established. Furthermore, as the function of the government has not yet been completely transformed and government intervention exists in the micro-economic organizations, Chinese state-owned enterprises are still controlled by the government. Therefore, the executives of state-owned enterprise have motivation to be in collusion with government officials or audit institution in order to seek personal gain.

Now, the researches of collusion mainly focus on the framework of principal-agent theory and follow a basic paradigm which uses the principal-agent model to analyze the organization structure and operation mechanism [1] . Frascatore considered the collusion between supervisor and agent in the three layers of organization structure which contained principal, supervisor and agent [2] . Bac further discussed the influence of collusionon supervise cost in the same structure [3] . Laffont & Martimort studied the problems of mechanism design that principal hired two supervisors supervise agent at the same time. The research found that if supervision cost was not high, employing two supervisors could reduce the asymmetry of information and effectively restrain collusive behavior between supervisors and agents [4] . Soon after, Laffont & Martimort put forward the idea that dispersing the supervision forces among unfair supervisors could cause the competition between them, bring risks to agents and increase the cost of rent-seeking [5] . Mishra introduced the design problem of supervision structure when hiring many supervisors. He pointed out that when the punishment was constrained by the limited liability of supervisors, the selection of supervision structure was important to prevent collusion [6] . Ariane analyzed corruption in government procurement and found the method to prevent it [7] . Celik designed a collusion proof and supervision mechanism which was the governance mechanism of agent collusion. Agency relation was that the principal and agent 1 signed the contract, then the agent 1 provided sub contract to the agent 2 [8] . The article also deduced the final equilibrium results. Because of the special nature of the owner of Chinese state- owned enterprises, state-owned enterprises in China face a complex environment. Therefore, most of western researchers may not be suitable for Chinese state-owned enterprises, although the western researchers analyze the problem of collusion more thoroughly.

Some Chinese scholars have studied the collusive behavior in the process of state-owned assets management. Liu’ article provided theory support for the state-owned assets supervision and administration commission of the state council to put the publicly audit bidding and random double audit into practice. The author analyzed the different productive manager’s collusive behaviors on the basis of prisoner’s dilemma model to prevent collusion and concluded the measures which were sending the second auditor with a certain probability, enforcing the lawful rigidity and perfecting reward mechanism could prevent audit collusion. The supervisor on state-owned enterprises can play the same effects in deter audit collusion as the real owner of the enterprise [9] . Yin proposed a model of prisoner’s dilemma game to prevent the collusion of executives of state-owned enterprises based on the ideas of decentralization in the principle-agent frame. However, the double-audit mechanism based on prisoner’s dilemma game might result in exorbitant audit cost, and its implement would subject to the restriction of limited liability of officers. Therefore, through introducing asymmetry information, it improved the prisoner’s dilemma game and made the non-collusion equilibrium achieved in more relaxed condition [10] . Jiang redefined that government was principal, that board of directors was supervisor and that general manager was agent, analyzed the situation without collusion proof mechanism, and designed two collusion proof mechanisms. One was dominated by supervisor and the other by principal [11] .

The collusion problem of state-owned asset management has aroused the attention of scholars and practitioners. However, the previous studies about commission for discipline inspection are very scarce and mainly focus on qualitative research, which includes contents, key problems, the significance and function and so on. There are also very few in the current study on the collusion between executives of state-owned enterprise and government officials, especially the corresponding discipline inspection strategy. This article analyses the stakeholders of state-owned enterprise in China, and sets up a game model about collusion between the executives of state-owned enterprise and government officials to obtain the condition of the collusion. Further, this paper focuses on the trilateral game model of executives of state-owned enterprise, government officials and commission for discipline inspection and puts forward discipline inspection strategy to overcome the collusion problem.

2. A Game Model of the Executives of State-Owned Enterprise and Government Officials

The stakeholders of state-owned enterprise mainly include countries, the executives of state-owned enterprise and government officials. The multiple principal-agent relationship in the management of state-owned enterprises usually results in the information asymmetry between the principal and the agent. Therefore, the executives of state-owned enterprise and government officials would conspire in order to pursue their own economic benefit maximization.

2.1. The Collusive Behavior between Executives of State-Owned Enterprise and Government Officials

Under the current political system in China, government has personnel control of state-owned enterprises (there are plenty of chairmen and general managers of the state-owned enterprises are appointed by the Party committee and government of higher level) [12] , so government officials and executives of state-owned enterprise can conspire through this “natural” political connection to intercept or encroach on the state-owned enterprises surplus which should belong to the state. This kind of behavior affects the state-owned enterprises’ performance and causes corruption [13] . The executives of state-owned enterprise can directly control the state-owned assets, and using this power to seek personal gain, therefore, they have the motivation of rent-seeking to seek the corresponding government officials’ protection. Furthermore, in order to gain more control benefit of the state- owned assets, the executives of state-owned enterprise on the one hand encroach on state-owned assets, on the other hand must actively to bribe government officials [14] [15] . For government, first of all, as the owner, it must entrust specific government departments and officials to exercise the residual control which the owner should do. It is that government departments (organization department, State-owned Assets Supervision and Administration Commission, etc.) still retain a part of the authority to assess and appoint the corporate executives. Simultaneously, the strategic decision of state-owned enterprises also needs approval by the competent department of government. As a consequence, the government officials have the right to influence the behavior of the executives of state-owned enterprise. Secondly, because multiple principal-agent chain leads to the asymmetric information, and the government as the agency supervisors is also short of corresponding incentive constraints, it increases the government’ supervision cost and reduces the efficiency of supervision. So government officials don’t have the enthusiasm to supervise the executives of state-owned enterprise, on the contrary, they will abuse power for personal gains more actively [16] . It is precisely because the executives of state- owned enterprise and government officials have the power to control state-owned assets, they can realize the conspiracy in the real economic life. If one party does not have the corresponding power, they will not become the object of the conspiracy, and the collusion between each other will not exist. Under the condition of the imperfect corporate governance environment, the collusion between the executives of state-owned enterprise and government officials will necessarily result in reducing the state-owned enterprises operating performance and social welfare [17] .

2.2. Set the Game Model up

1) The model hypothesis

Hypothesis 1: When the executives of state-owned enterprise work hard, they can obtain earning R*. However, if executives don’t work hard and have on-the-job consumption, they can obtain earning RD. The executives can obtain earning RA, when they work hard passively under the supervision of government officials. We assume RD ≥ RA ≥ R*.

Hypothesis 2: We suppose the revenue function of government officials T(RA) = λ + η(RD − RA), and λ denotes the fixed salary of government officials, η is the salary incentive coefficient of the government officials (assuming that the government combines the payment of government officials with work performance, so it can motivate the government officials to work hard).

Hypothesis 3: Suppose that the executives of state-owned enterprise give the collusion income to government officials, and γ (0 ≤ γ ≤ 1) is the coefficient of collusion income, so that government officials can obtain collusion income γ(RA − R*), the executives of state-owned enterprise can obtain collusion income (1 − γ)(RA − R*).

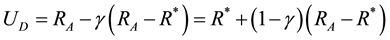

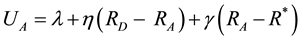

Therefore, when both sides reach the collusion, the executives of state-owned enterprise obtain the total income , the government officials obtain the total income

, the government officials obtain the total income

. If the government officials do not conspire with the executives of state-owned enterprise, the executives of state-owned enterprise can obtain income R*, the government officials can obtain income

. If the government officials do not conspire with the executives of state-owned enterprise, the executives of state-owned enterprise can obtain income R*, the government officials can obtain income . At same time, the one who does not want to conspire will report the other who requests collusion to commission for discipline inspection, and commission for discipline inspection will punish them. Assume that M denotes the punishment of government officials, M*denotes the punishment of the executives of state-owned enterprise, when they realize the collusion.

. At same time, the one who does not want to conspire will report the other who requests collusion to commission for discipline inspection, and commission for discipline inspection will punish them. Assume that M denotes the punishment of government officials, M*denotes the punishment of the executives of state-owned enterprise, when they realize the collusion.

Based on above hypothesis, we took a stab at the game model about collusion between the executives of state-owned enterprise and government officials. The payoff matrix is shown below (see Table 1).

2) Analysis the model

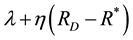

According to the above conclusion, we can see: ,

,

.

.

When γ > η, that is the coefficient of collusion income which the executives of state-owned enterprise pay to government officials is higher than the incentive coefficient which government pay to government officials, we can get : . In this case, the executives of state-owned enterprise and government officials reach the hierarchical coordination game, and there are two pure strategy Nash equilibriums in this game model. In other words, when the executives of state-owned enterprise choose collusion strategy, government officials choose collusion strategy too, and when the executives of state-owned enterprise choose no collusion strategy, government officials also choose no collusion strategy.

. In this case, the executives of state-owned enterprise and government officials reach the hierarchical coordination game, and there are two pure strategy Nash equilibriums in this game model. In other words, when the executives of state-owned enterprise choose collusion strategy, government officials choose collusion strategy too, and when the executives of state-owned enterprise choose no collusion strategy, government officials also choose no collusion strategy.

When γ < η, that is the government improves the salary incentive coefficient of the government officials to encourage them to supervise the executives of state-owned enterprise, and it can improve the cost of collusion, thus, both of them choose no collusion that is a dominant Nash equilibrium strategy.

According to the results, we can see that the condition of no collusion is that the coefficient of collusion income which the executives of state-owned enterprise pay to government officials is lower than the incentive coefficient which government pay to government officials. So we can take some measures to achieve the condition of no collusion strategy.

Firstly, the government can improve the incentive intensity of salary and strengthen the validity of motivation for government officials. Now, the government bases the position, length of service, the rank of a cadre and other conditions to calculate the salary of government officials, and compared with the enterprise in the same area, the level of salary is a relatively lower. This kind of salary calculation and level is not efficient to encourage government officials to work hard, and they will feel unfair especially compared with the executives of state- owned enterprise. Therefore, the government should appropriately raise their salaries. Moreover, government does not calculate the salary based on job performance, and severely reduces the enthusiasm to supervise the executives of state-owned enterprise. As a consequence, the government should choose the proper salary calculation to improve the government officials’ incentive coefficient.

Secondly, we can adopt effective measures to reduce the possibility of collusion between the executives of state-owned enterprise and government officials. First of all, we should perfect the corporate governance structure of state-owned enterprises, make themselves have more initiative, and try to realize the equity diversification to solve the problem of owner absence of state-owned enterprises. At same time, simplifying the principal- agent relationship between government and state-owned enterprises can transform the state-owned enterprise into a completely independent economic entity. Besides that, the board of directors, board of supervisors and managers should perform their respective duties, and gradually establish effective monitoring mechanism for management to prevent insider control behavior. In this way, we can prevent the collusion between the executives of state-owned enterprise and government officials from the system. Then, state-owned enterprises can choose the appropriate professional managers through open recruitment in the market, and bring in the competitive selection mechanism of the public to reach the employment marketization of the executives of state-owned enterprise. What’s more, in order to shorten the principal-agent chain, we should try to avoid the administrative appointment of the executives of state-owned enterprise. Last but not least, perfecting the mechanism of legislation and punishment is efficient to improve the corruption cost. We should punish the corruption strictly passing

Table 1. Payoff matrix of collusion game model.

legislation, including Party discipline punishment, administrative punishment, criminal penalties, and economic punishment, and they cannot be replaced by each other. The punishment for the briber is more lenient than for the bribe taker, it can break the Nash equilibrium of the collusion game model. As a result, one side is easy to be prosecuted, the other party is increased the risk cost, making them difficult to or afraid to conspire.

Due to the multiple principal-agent problems of state-owned enterprises, state-owned enterprises do not become real independent operating companies. In addition, state-owned enterprises are still affiliated with the government in the very great degree, and between the executives of state-owned enterprise and government officials exists systematic “father and son” relationship, so it is very common that government officials intervene daily production and business operation activities of state-owned enterprises. And the executives of state-owned enterprise will consciously to curry favor with the superior leadership for the sake of collusion. Therefore, to strengthen the supervision and inspection of the third party is an efficient method to prevent the collusion between the executives of state-owned enterprise and government officials.

3. Analysis of the Discipline Inspection Strategy under the Case of Collusion between the Executives of State-owned Enterprise and Government Officials

To fully exert its key political role, it is an important aspect for Party organization instate-owned enterprises to do a wonderful job of discipline inspection. The Central Commission for Discipline Inspection puts forward specific requirements for Party construction and anti-corruption work of the state-owned enterprises every year and gives the commission for discipline inspection in state-owned enterprises the power of supervision and inspection.

3.1. The Supervision Behavior of Commission for Discipline Inspection in State-Owned Enterprises

Commission for discipline inspection is the specialized organ that is responsible for the Communist Party of China inner-party supervision. According to article 44 of “Constitution of the Communist Party of China”, the main tasks of the Party’s commissions for discipline inspection at all levels are as follows: to uphold the Constitution and other statutes of the Party, to check up on the implementation of the line, principles, policies and resolutions of the Party and to assist the respective Party committees in improving the Party’s style of work and in organizing and coordinating the work against corruption. The Party’s Central Commission for Discipline Inspection functions under the leadership of the Central Committee of the Party. The Party’s local commissions for discipline inspection at all levels and primary commissions for discipline inspection function under the dual leadership of the Party committees at the corresponding levels and the next higher commissions for discipline inspection. Commission for discipline inspection shall assist the respective Party committees to organize and coordinate the inner-party supervision work, and carry out the supervision of inner-party supervision work. Therefore, the Party’s commissions for discipline inspection at all levels have the right to supervise and inspect the executives of state-owned enterprise and government officials.

Commission for discipline inspection in state-owned enterprises is the special supervisory institutions of Party organization. The main functions of commission for discipline inspection in state-owned enterprises are as follows: to check the enterprise leader’s decision, to urge the enterprise leaders to seriously implement the Party’s line, principles, policies, national laws and regulations, to properly make enterprises’ production and operation decision, to improve Party’s style of work and to coordinate the work against corruption. The Party’s Central Commission for Discipline Inspection has put the anti-corruption work of state-owned enterprises as an important part of the construction of the Party style for years. In addition, they put forward to strengthen the supervision and inspection of enterprises’ investment and management decisions, establishing and perfecting the enterprises’ internal control mechanism. Commission for discipline inspection in state-owned enterprises is acquainted with enterprises’ daily operation and management, and it is more easily to get information, thus, commission for discipline inspection in state-owned enterprises can play a more effective role of supervision and inspection.

3.2. Set the Game Model up

1) The model hypothesis

Hypothesis 1: For commission for discipline inspection, they have two choices: “inspection” or “no inspection”. The executives of state-owned enterprise and government officials also have two choices:”collusion” or “no collusion”.

Hypothesis 2: The owner of the state-owned assets is all the people in China, the government represents the state and the people to implement management and supervision functions. Commission for discipline inspection is the inspection organ of the Communist Party of China, maintaining the Party’s discipline and conduct. At same time, it supervises and investigates the violations of Party members on behalf of the party and the people and is responsible for the supervision of the executives of state-owned enterprise and government officials. Therefore, the collusion between the executives of state-owned enterprise and government officials brings the loss of the state and state-owned enterprises can be understood as the loss of commission for discipline inspection. Suppose that µ denotes the probability of collusion between the executives of state-owned enterprise and government officials, and R*, the extraneous income of collusion, kER* is the loss of commission for discipline inspection, kE is the amplification coefficient of loss, and kE ≥ 1, γ* (0 ≤ γ* ≤ 1) denotes the ratio of collusion rent. We can see that the collusion income of government officials is γ*R*, and the collusion income of the executives of state-owned enterprise is (1 − γ*)R*.

Hypothesis 3: Due to the limitation of technical strength and personnel configuration, it is very difficult for commission for discipline inspection to check on all the operation process of state-owned enterprises. Suppose that commission for discipline inspection inspects the collusion between the executives of state-owned enterprise and government officials with the probability p, and gives the cost of supervision CE. Commission for discipline inspection inspects the collusion leads to two results: success or fail. We assume that the probability of inspection success is q. If commission for discipline inspection discovers the collusion between the executives of state-owned enterprise and government officials, the collusion income of the executives of state-owned enterprise will be confiscated and additional fineis kD(1 − γ*)R*, and kD is the coefficient of punishment. As such, the collusion income of government officials will be confiscated and additional fine is kAγ*R*, and kA is the coefficient of punishment. Based on above hypothesis, we can get the payoff matrix of trilateral game model (see Table 2).

2) Mix strategy Nash equilibrium in the model

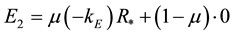

When µ denotes the probability of collusion, commission for discipline inspection inspecting or doing not inspect the collusive behavior can get the expected payoff expression:

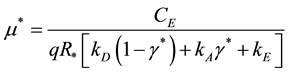

When E1 = E2, we can get an optimum probability µ* of collusion between the executives of state-owned enterprise and government officials.

When p denotes the probability of commission for discipline inspection inspecting the collusion between the

Table 2. Payoff matrix of trilateral game model.

Note: the first expression is the income of the executives of state-owned enterprise, the second is the income of government officials, the third is the income of commission for discipline inspection.

executives of state-owned enterprise and government officials, the executives of state-owned enterprise choosing collusion strategy or no collusion strategy can get the expected payoff expression:

When E3 = E4, the executives of state-owned enterprise reach the game equilibrium, commission for discipline

inspection can get an optimum probability  of inspecting the collusion between the executives

of inspecting the collusion between the executives

of state-owned enterprise and government officials.

In a similar way, when government officials reach the game equilibrium, commission for discipline inspection

can get an optimum probability  of inspecting the collusion between the executives of state-

of inspecting the collusion between the executives of state-

owned enterprise and government officials.

Therefore, we claim that we have found the mixed strategy Nash equilibrium, here is as follows:

3) Analysis the model

On the basis of the mixed strategy Nash equilibrium, the optimum probability of collusion between the executives of state-owned enterprise and government officials is µ*. If the executives of state-owned enterprise conspire with government officials by the probability µ > µ*, commission for discipline inspection will choose inspection strategy. On the contrary, if the executives of state-owned enterprise conspire with government officials by the probability µ < µ*, commission for discipline inspection will choose no inspection strategy.

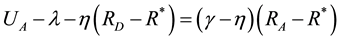

According to the expression:

between the executives of state-owned enterprise and government officials is inversely proportional to the probability q of inspection success, the penalty coefficient kD of the executives of state-owned enterprise and the penalty coefficient kA of the government officials. However, the optimum probability µ* is direct proportional to the inspection cost of commission for discipline inspection.

For commission for discipline inspection, whether to inspect the collusion between the executives of state- owned enterprise and government officials mainly depends on the tendency of executives of state-owned enterprise and government officials to maximize benefit in collusion. If the executives of state-owned enterprise have stronger tendency of benefit maximization than government officials, commission for discipline inspection will inspect the executives of state-owned enterprise by the optimum probability PD. If commission for discipline inspection inspects the executives of state-owned enterprise by the probability p > PD, the optimal choice of the executives of state-owned enterprise is no collusion strategy. Instead, the optimal choice of the executives of

state-owned enterprise is collusion strategy. In addition, you can see from the expression

the value of PD depends on two variables: one is the probability q of commission for discipline inspection inspecting success, the other is the penalty coefficient kD of the executives of state-owned enterprise. Similarly, we can get the supervision strategy of commission for discipline inspection for government officials.

Therefore, when commission for discipline inspection participates in the supervision of the state-owned enterprise operation and management, it can change the information asymmetry between the executives of state- owned enterprise and government officials. Commission for discipline inspection can promote the probability of inspection success, reduce the inspection costs, and increase the punishment level of collusion to efficiently reduce the possibility of collusion in state-owned assets management.

There are two measures for commission for discipline inspection to raise their probability of inspection success. Firstly, they need to cultivate professional inspection power, and focus on the link that takes place collusion easily in state-owned assets management. Secondly, Commission for discipline inspection should integrate social supervision resources, improve the ways of working and hire the people have professional knowledge such as finance, management, corporate governance and so onto participate in the inspection, so as to enhance the capacity and efficiency of inspection, reduce the cost of inspection.

4. Conclusions

Government intervention in state-owned enterprises’ operation and management can improve the quality of state-owned asset management to a certain extent, but the executives of state-owned enterprise and government officials have the motivation of collusion to maximize self-interest, and may further damage the interests of the country and the people. This paper uses the game theory to analyze the collusion between the executives of state-owned enterprise and government officials. The results show that the relation between the incentive coefficient of government officials and the coefficient of collusion income constitutes the condition of collusion. For government, promoting the incentive coefficient of government officials and perfecting its incentive mechanism can efficiently break the condition of collusion. Moreover, we can take measures to prevent collusion by perfecting the corporate governance structure of state-owned enterprises, establishing executive’s market appointment and supervision mechanism and improving the mechanism of legislation and punishment.

In addition, this paper focuses on the trilateral game model of executives of state-owned enterprise, government officials and commission for discipline inspection and puts forward a discipline inspection strategy to overcome the collusion problem. Based on the results obtained, the optimum probability of collusion between the executives of state-owned enterprise and government officials is inversely proportional to the probability of inspection success and the penalties for conspirators. However, it is direct proportional to the inspection cost of commission for discipline inspection. As a consequence, commission for discipline inspection should improve inspection ability and reduce inspection costs, jointing relevant departments to increase the penalties for conspirators.

Cite this paper

QiuyueWei,HanminLiu, (2015) Research of the Game and Countermeasure about Collusion between Executives of State-Owned Enterprises and Government Officials. Journal of Service Science and Management,08,536-544. doi: 10.4236/jssm.2015.84054

References

- 1. Laffont, J.J. and Martimort, D. (1996) Collusion under Asymmetric Information. Econometrica, 65, 875-911.

http://dx.doi.org/10.2307/2171943 - 2. Frascatore, M.R. (1998) Collusion in a Three-Tier Hierarchy: Credible Beliefs and Pure self-Interest. Journal of Economic Behavior & Organization, 34, 459-475.

http://dx.doi.org/10.1016/S0167-2681(97)00079-6 - 3. Bac, M. (1996) Corruption and Supervision Costs in Hierarchies. Journal of Comparative Economics, 22, 99-118.

http://dx.doi.org/10.1006/jcec.1996.0013 - 4. Laffont, J.J. and Martimort, D. (1998) Collusion and Delegation. Rand Journal of Economics, 29, 280-305.

http://dx.doi.org/10.2307/2555889 - 5. Laffont, J.J. and Martimort, D. (1999) Separation of Regulators against Collusive Behavior. Rand Journal of Economics, 30, 232-262.

http://dx.doi.org/10.2307/2556079 - 6. Mishra, A. (2002) Hierarchies, Incentives and Collusion in a Model of Enforcement. Journal of Economic Behavior and Organization, 47, 165-178.

http://dx.doi.org/10.1016/S0167-2681(01)00201-3 - 7. Ariane, L. and Konstantin, S. (2003) Corruption and Collusion in Procurement Tenders. Working Paper, 1-31.

- 8. Celik, G. (2009) Mechanism Design with Collusive Supervision. Journal of Economic Theory, 144, 69-95.

http://dx.doi.org/10.1016/j.jet.2008.02.006 - 9. Liu, J.F. (2009) Game Analysis of the Prisoner’s Dilemma to Deter Collusion: An Inspiration for State-Owned Enterprise’s Supervision. Auditing Research, 5, 58-64.

- 10. Yin, H. (2010) Analysis on Prisoner’s Dilemma Game for Preventing Collusion of Executives of State-Owned Enterprises. Technology Economics, 10, 99-129.

- 11. Jiang, S.Z. (2011) Mechanism Design of Collusion Proof in State-controlling Corporate Governance. Economic Review, 1, 116-126.

- 12. Fan, J., Wong, T.J. and Zhang, T. (2007) Politically Connected CEOs, Corporate Governance, and Post-IPO Performance of China’s Newly Partially Privatized Firms. Journal of Financial Economics, 84, 330-357.

http://dx.doi.org/10.1016/j.jfineco.2006.03.008 - 13. Shleifer, A. and Vishny, R.W. (1994) Politicians and Firms. The Quarterly Journal of Economics, 109, 995-1025.

http://dx.doi.org/10.2307/2118354 - 14. Ding, S.J., Jia, C.X., Wu, Z.Y. and Zhang, X.Q. (2014) Executive Political Connections and Firm Performance: Comparative Evidence from Privately-Controlled and State-Owned Enterprises. International Review of Financial Analysis, 36, 153-167.

http://dx.doi.org/10.1016/j.irfa.2013.12.006 - 15. He, L.R., Wan, H. and Zhou, X. (2014) How Are Political Connections Valued in China? Evidence from Market Reaction to CEO Succession. International Review of Financial Analysis, 36, 141-152.

http://dx.doi.org/10.1016/j.irfa.2014.01.011 - 16. Chen, C.J.P., Du, J. and Su, X. (2014) A Game of Accounting Numbers in Asset Pricing: Evidence from the Privatization of State-Owned Enterprises. Journal of Contemporary Accounting & Economics, 10, 115-129.

http://dx.doi.org/10.1016/j.jcae.2014.05.001 - 17. Boubakri, N., Cosset, J.C. and Saffar, W. (2008) Political Connections of Newly Privatized Firms. Journal of Corporate Finance, 14, 654-673.

http://dx.doi.org/10.1016/j.jcorpfin.2008.08.003