Applied Mathematics

Vol.05 No.17(2014), Article ID:50753,8 pages

10.4236/am.2014.517259

Topological Properties of the Catastrophe Map of a General Equilibrium Production Model with Uncertain States of Nature

Pascal Stiefenhofer

University College London, London, UK

Email: p.stiefenhofer@ucl.ac.uk

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 10 August 2014; revised 29 August 2014; accepted 13 September 2014

ABSTRACT

This paper shows existence and efficiency of equilibria of a production model with uncertainty, where production is modeled in the demand function of the consumer. Existence and efficiency of equilibria are a direct consequence of the catastrophe map being smooth and proper. Topological properties of the equilibrium set are studied. It is shown that the equilibrium set has the structure of a smooth submanifold of the Euclidean space which is diffeomorphic to the sphere implying connectedness, simple connectedness, and contractibility. The set of economies with discontinuous price systems is shown to be of Lebesgue measure zero.

Keywords:

Differential Topology, General Equilibrium, Uncertainty, Production

1. Introduction

This paper considers the Arrow-Debreu model with a complete set of contingent claims [1] and production. Existence and efficiency of equilibria of this model are shown by [2] in a seminal paper. This paper, however, derives global topological properties of the set of equilibria. The structure of this set has been studied before by Balasko [3] in the context of deterministic pure exchange economics. Such models lack a time structure, and as a consequence do not incorporate uncertainty [3] - [5] (Balasko (Preprint 2011) for example).1

The aim of this paper is to consider a reformulation of the Arrow-Debreu model in terms of an exchange model with production in the utility function. Preliminary results are found in [6] . A version of the decentralized production model is found in [7] . The formulation of the production model considered in this paper allows extending some of the known results about deterministic economies to production economies with uncertainty and production of adjusted demand functions. It is shown that the set of equilibria is a smooth manifold. Its dimension depends on the number of goods available for consumption, the number of uncertain states of nature and the number of consumers. This manifold is also shown to be diffeomorphic to a sphere. This result has deep economic implication. It implies that geodesics can be defined on it. This property is particularly useful when designing economic policies.

The paper is organized in three sections. Section 2 introduces the model. Section 3 establishes the results, and Section 4 is a conclusion.

2. The Long Run Private Ownership Production Model with Uncertain States of Nature

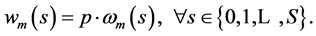

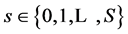

We describe the two period private ownership production model  introduced in [1] , chapter 7. Uncertainty is defined by a finite set of mutually exclusive and exhaustive states of nature denoted by

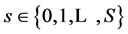

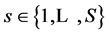

introduced in [1] , chapter 7. Uncertainty is defined by a finite set of mutually exclusive and exhaustive states of nature denoted by , where s = 0 is the certain event in time period one. In total there are S + 1 states of nature. There are

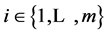

, where s = 0 is the certain event in time period one. In total there are S + 1 states of nature. There are  consumers,

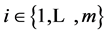

consumers,  producers, and

producers, and  physical goods. For all consumers

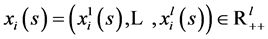

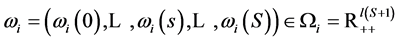

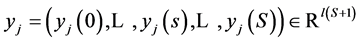

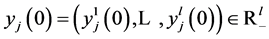

physical goods. For all consumers , a consumption bundle is a collection of vectors

, a consumption bundle is a collection of vectors , where consump-

, where consump-

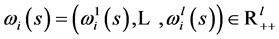

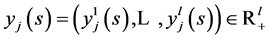

tion in a particular state  is a vector

is a vector . Associated with physical

. Associated with physical

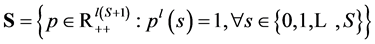

commodities is a set of normalized prices, denoted . Consumers

. Consumers

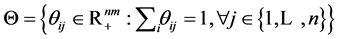

are further endowed with a fraction  of the profits of each firm.

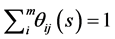

of the profits of each firm.  represents the exogenously determined ownership structure of the private ownership production economy. It satisfies for each

represents the exogenously determined ownership structure of the private ownership production economy. It satisfies for each  and

and ,

,  , and

, and . Denote the set of ownership structures

. Denote the set of ownership structures

Consumers are endowed with a collection of vectors of initial resources

where initial endowments in a particular state

where

Producers are characterized by production sets and their smooth supply functions. The main property of the long run production model is that all activities of the firm are variable. An activity

state

2.1. Equilibrium

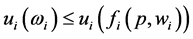

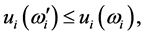

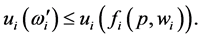

Each consumer

be the market excess demand function in state

An equilibrium is a price vector

where

The model of the producer is to maximize profits. Each producer solves a constraint optimization profit maximization problem. Hence, each

where the state dependent production set

Definition 1. An equilibrium of the two period private ownership production model with uncertainty

An equilibrium allocation is a pair

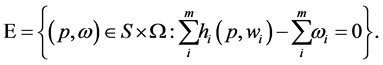

A study of the qualitative equilibrium structure of the two period private ownership production model with uncertainty amounts to a study of the structure of the solution set of the equilibrium equation

Let

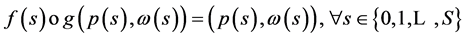

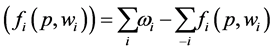

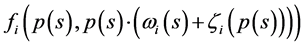

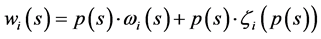

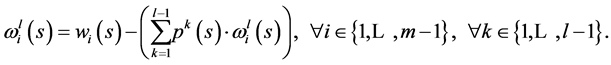

denote the individual demand function of the two period “production adjusted” exchange model

in every

where

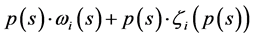

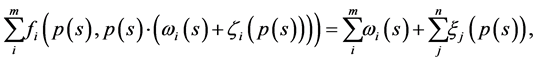

denotes the individual demand function. This follows immediately from rewriting the excess demand equation in terms of demand equal to supply. Rewriting

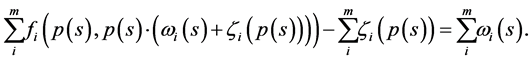

Hence, the equilibrium equation of the production model

since

This is the equilibrium equation of the exchange model with production adjusted demand functions

since

Theorem 1. For fixed

We have established a relationship between the production model with a long term time structure and uncertainty

The result suggests that the decentralized production model can be reformulated as a centralized model. It is efficiently applied in establishing many properties about production economies in the next section.

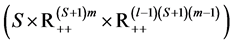

2.2. Equilibrium Structure

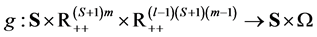

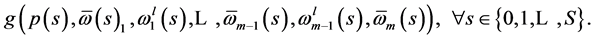

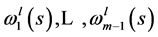

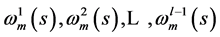

Let

and in the case of the production adjusted exchange model

Theorem 2. The set

Proof.

Theorem 3. The set

Proof. Consider the mapping

By theorem the regular value theorem

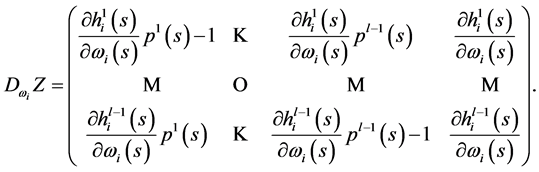

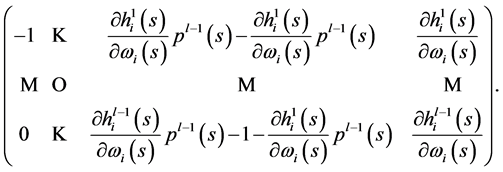

By simple algebraic manipulations we obtain the new matrices

Finally, we obtain

from which we extract the information required. Rank

The following theorem illustrates other economically interesting global properties of the equilibrium manifold. It says that by construction of a diffeomorphism

Theorem 4. The smooth equilibrium manifold

Proof. The aim of the proof is to define two smooth mappings between smooth manifolds such that we can apply the theorem (Hirsch [10] , pp. 15-16). Hence, let

be smooth mappings defined by

Then, let

denote smooth mappings defined by

Observe that the coordinates for the

Also observe that the coordinates for the

The application of theorem ([10] ) requires to show that

and compute the inner product of (7) with

From that a reformulation of (7) readily follows in terms of the equilibrium equation

This is the equilibrium Equation (5), hence

from which it readily follows that

where

It remains to be shown that equilibria in the long run production model with uncertainty always exist. The strategy of the proof is to show that the natural projection mapping

Theorem 5. Equilibria of the two period production model with uncertainty

Lemma 1 (Smoothness)

Proof. Recall that

The next lemma makes use of theorem (see [11] , p. 174).

Lemma 2 (Properness)

Proof. Pick an arbitrary

and by non-satiation have also

which by monotonicity of

Clearly, there exists some

by boundedness of indifference mappings from below for every

where

Clearly,

for every

The number of equilibria of the long run production model with uncertainty is odd for any regular economy

I now define a subset of points on

Definition 2.

Proposition 1.

Proof. A necessary and sufficient condition for an equilibrium pair

Definition 3.

A singular value

Proposition 2. The set of singular economies

Proof. The proof follows from the application of Sards’s theorem which describes the set of singular values of a smooth mapping having the property of Lebesgue measure zero. Hence know that

3. Conclusion

This paper discusses local and global equilibrium properties of a production economy with a long-term time structure. Production is modeled in the demand functions of the consumers. The advantage of this way of modeling production is that it enables us to establish a relationship between production and pure exchange economies. Adding uncertainty to the production model is a further step towards realism. It is shown that the equilibrium set of all production economies with uncertainty has the structure of a smooth submanifold of the Euclidean space which is diffeomorphic to a sphere. These topological properties are of significant economic importance in terms of economic policy design since they imply connectedness and contractability of the set of solutions. It is also shown that the set of singularities of the catastrophe map is closed, and of Lebesuge measure zero. The practical implication of this result is that the probability of observing an economy with a discontinuous price system is close to zero.

References

- Debreu, G. (1959) Theory of Value. Wiley, New York.

- Arrow, K. and Debreu, G. (1954) Existence of an Equilibrium for a Competitive Economy. Econometrics, 22, 265-290. http://dx.doi.org/10.2307/1907353

- Balasko, Y. (1988) The Equilibrium Manifold: Postmodern Developments in the Theory of General Economic Equilibrium. The MIT Press, Cambridge, Massachusetts.

- Jouini, E. (1993) The Graph of the Walras Correspondence. The Production Economies Cas. Journal of Mathematical Economics, 22, 139-147. http://dx.doi.org/10.1016/0304-4068(93)90043-K

- Fuchs, G. (1974) Private Ownership Economies with a Finite Number of Equilibria. Journal of Mathematical Economics, 1, 141-158. http://dx.doi.org/10.1016/0304-4068(74)90005-6

- Stiefenhofer, P. (2011) Equilibrium Structure of Production Economies with Uncertainty: The Natural Projection Approach. Discussion Papers in Economics, University of York, York, 7.

- Stiefenhofer, P. (2013) The Catastrophe Map of a Two Period Production Model with Uncertainty. Applied Mathematics, 4, No. 8A.

- Debreu, G. (1972) Smooth Preferences. Econometrica, 40, 603-615. http://dx.doi.org/10.2307/1912956

- Lee, J.M. (2004) Introduction to Topological Manifolds. Springer, New York.

- Hirsch, M. (1972) Differential Topology. Springer Verlag, New York.

- Lee, J.M. (2000) Introduction to Smooth Manifolds. Springer, New York.

- Guillemin, V. and Pollack, A. (1974) Differential Topology. Prentice Hall, Upper Saddle River.

NOTES

1Discussion paper: the natural projection approach to smooth production economies, 2011.

3“Smoothness” follows from the same reasons as in the previous section [8] . It essentially means that all functions are differentiable at any order required.

5The construction of a Riemanian metric on the equilibrium manifold would be a very useful result towards economic policy analysis.