Modern Economy

Vol.4 No.5(2013), Article ID:32391,6 pages DOI:10.4236/me.2013.45043

Limitations of Kuwait’s Economy: An Absorptive Capacity Perspective*

1Techno Economic Division, Kuwait Institute for Scientific Research, Kuwait City, Kuwait

2Supreme Council for Privatization, Council of Ministers, Kuwait

3Techno Economic Division, Kuwait Institute for Scientific Research, Kuwait City, Kuwait

Email: mrammad@yahoo.com, aah@kuwaitbox.com, reemalhajji@gmail.com

Copyright © 2013 Mohammad Ramadhan et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received April 2, 2013; revised April 30, 2013; accepted May 20, 2013

Keywords: Absorptive Capacity; Kuwait’s Economy; Resource Balance

ABSTRACT

This paper aims to examine the absorptive capacity of Kuwait’s economy over the period (1970-2010). The paper will expand on the analytical framework to estimate the absorptive capacity of the Kuwaiti economy developed previously by the main author. The absorptive capacity of the Kuwaiti economy has been increasing steadily over the years. Domestic absorption depicted a slow growth pattern during the period 1970-2000. However, it has accelerated significantly over the last decade rising by almost three fold from $29.1 bil in 2001 to $82.2 bil in 2010. However, the constant positive resource balance and the excess of foreign exchange earnings indicate the limitations of the economy absorptive capacity. The paper highlights the main constraints that limit the ability of the Kuwaiti economy to absorb resources and provide few policy recommendations that should help in increasing the absorptive capacity in long run.

1. Introduction

The State of Kuwait is characterized as a small rich open economy with abundance in crude oil that is entirely owned by the state. The economy depends heavily on oil exports, and specifically, oil revenues accounts for 50% of GDP, 95% of exports, and 90% of government income (GDP in 2010 was around 125 bil US$). The other two important economic activities with sizable contribution to GDP were financial and personal services (35% of GDP), and the trade and logistics activities (12% of GDP). The remaining economic activities had minimal contribution toward the GDP. More importantly, the huge oil revenues over the last decade allowed the government to enjoy constant surpluses in the public budget. For example, in 2010 oil income was around 65.2 bil US$, representing around 92.0% of total government income (70.9 bil US$). Fiscal expenditures were around 53.4 bil US$, hence the government was able to realize a budget surplus of 17.5 bil US$. While constant budget surpluses emphasize strong fiscal position, it also points out the weakness of the government in spending within the domestic economy, particularly in initiating developmental projects and upgrading the current deteriorating infrastructure.

It should be emphasized that the economy generated high rates of savings, mostly through the public sector, while investing surprisingly little in the domestic economy. Most of Kuwait’s high savings are invested abroad, both in the form of FDI and as portfolio investment. These large capital outflows largely serve to balance the country’s international accounts, offsetting the large visible trade surplus (mostly a consequence of high oil exports). During the oil boom period (1976-1982), Kuwait enjoyed huge surpluses in its public budget and balance of payments. Yet, most of the financial surpluses were not channeled back to be invested in the economy. In fact, large part of the financial surpluses fled out of the country for investment in income-producing assets abroad, which took a huge hit after the 2008 global financial crisis. The constant capital outflow supported the widely held view that Kuwait has a limited absorptive capacity, since it was unable to utilize these surpluses internally in productive investment projects.

The fiscal situation had changed radically following the downturn in oil prices in late 1982, leading to real budget deficits over the period (1983-1989). The Iraqi invasion in August 1990 reinforced this trend, which resulted in both internal and external deficits. Presently, the Kuwaiti economy is going through a critical stage. After the liberation of Iraq in 2003, the private sector has benefited from government spending on developmental projects and the opportunity of increased business activities due to the rebuilding of Iraq. Unfortunately, this recent growth in economic activities has resulted in unprecedented levels of inflation, mainly due to the lack of absorptive capacity, and the inability to absorb the large amounts of liquidity generated from these surpluses. In comparison, the average level of inflation during the periods 2006-2008, and 2003-2008 were 7.34% and 4.77%, respectively. However, this business environment was halted by the sever hit of the financial crisis in the late 2008.

Based on the aforementioned, this paper aims to analytically address the concept of absorptive capacity in Kuwait's economy over the last four decades. The paper will expand on the analytical framework to estimate the absorptive capacity of the Kuwaiti economy developed by the main author [1]. The paper consists of the following sections: Section two explains the concept of absorptive capacity. Section three presents the theoretical background for the absorptive capacity mathematical model. Section four analyzes the results of Kuwait's absorptive capacity model. The main constraints that limit the ability of the Kuwaiti economy to absorb resources are highlighted in section five. Finally, conclusions and policy recommendations are summarized in section six.

2. The Concept of Absorptive Capacity

One of the earlier definitions for the concept of “absorptive capacity” was affirmed by Stevens, who stated that the absorptive capacity of a country is the ability of the domestic economy to absorb resources at an acceptable rate of return within a given period [2]. However there was no consensus among economists in regard to the nature of resources and the component that lead to and define an acceptable rate of return. Within the context of oil producers such as the GCC, economists interpret absorptive capacity in terms of the ability to utilize foreign exchange effectively [3]. Put differently, to the extent that oil revenues are received by the governments in these countries and financial surpluses are accumulated over the years, the concept of absorptive capacity becomes the ability of the government to spend the oil revenues within a given productivity criterion.

Another predicament with the broad definition of absorptive capacity is how to derive the notion of an acceptable rate of return. It is recognized that the relevant rate which must be considered by policy makers is the “social rate of return”. However, societies differ in the way they assign weights to social values. In the case of Kuwait, the social well being of nationals must depend on how successful the policy makers are in investing the oil revenues and surpluses (funds) in ventures, which would not only pay for themselves, but also generate sufficient returns for future development. Moreover, the public sector which constitutes 70% of the GDP must be efficient in its public expenditures by minimizing unnecessary spending and promoting productivity. Hence, a more productive way to expand the absorptive capacity of the Kuwaiti economy is to expand the marginal efficiency of investment of most projects by systematically improving the quality of input factors of production.

Within the broad context of the relation between investments and economic growth that leads to more absorption of resources, the connections between investment and GDP growth are not as precise as one might expect, and are often less direct than the growth models implied [4]. This is for several reasons:

● Growth models tend to assume that investment will be in productively relevant “objects”, that good investment projects will be selected and that they will be efficiently implemented; if this is not the case in practice, then a given volume of investment will deliver less growth than a simple model would suggest. Hence, absorption capacity will not be enhanced.

● The sectoral composition of investment may differ from that assumed in a given model, and since some sectors are inherently far more capital intensive than others, the link between investment and growth naturally becomes less predictable.

● Investment may be less effective than it should be due to regulatory and bureaucratic barriers that cause delays and higher costs. This is a well known constraint within the GCC countries, particularly in Kuwait.

3. Production Expenditure Identities

The concept of the absorptive capacity model for the State of Kuwait was stated previously by El-Mallakh and Atta through a simple system of national income and production accounts [5]. The absorptive capacity mathematical model was elaborated by the main author to allow for detailed analysis of constraints and challenges.

The production expenditure identities that explain the conceptual issues can be structured within the production-consumption framework.

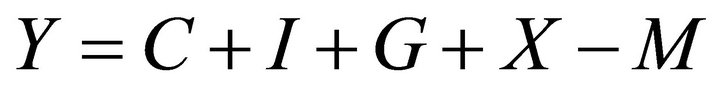

(1)

(1)

where (X - M) is net exports.

The national income identity indicates that income can be either consumed or saved (private and government), and can be stated as:

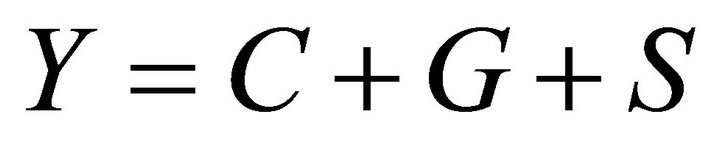

(2)

(2)

where, C = Private consumption;

G = Government consumption;

I = Total domestic investment;

M = Total imports;

S = Total saving;

X = Total exports;

Y = Gross domestic product.

Identities (1) and (2) specify the uses to which the resources may be allocated. By equating the production and income identities the following equation is obtained:

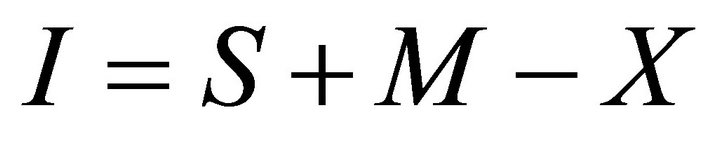

(3)

(3)

Therefore, investment is financed through saving and net capital inflow (M-X). Since the Kuwaiti economy has, in most years, a balance of payments surplus, the expression which more appropriately describes its situation can be derived from rearranging Equation (3) as follows:

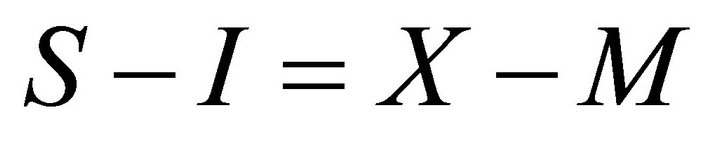

(4)

(4)

The excess of domestic savings over investment is equal to the net capital outflow. More specifically, Equation (4) indicates that when domestic absorptive capacity is limited, the economy seeks outside channels to invest its surplus savings.

4. The Absorptive Capacity Model

The Kuwaiti absorptive capacity can be measured according to the following mathematical relationship:

(5)

(5)

where, AC = Absorptive capacity;

C = Private consumption;

I = Total domestic investment;

G = Government expenditure.

The economy is said to have a limited absorptive, when it persistently has a positive resource balance; i.e.

(6)

(6)

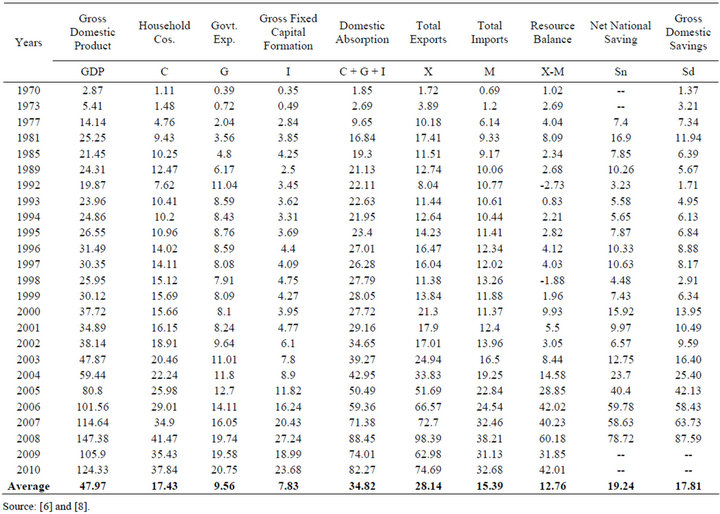

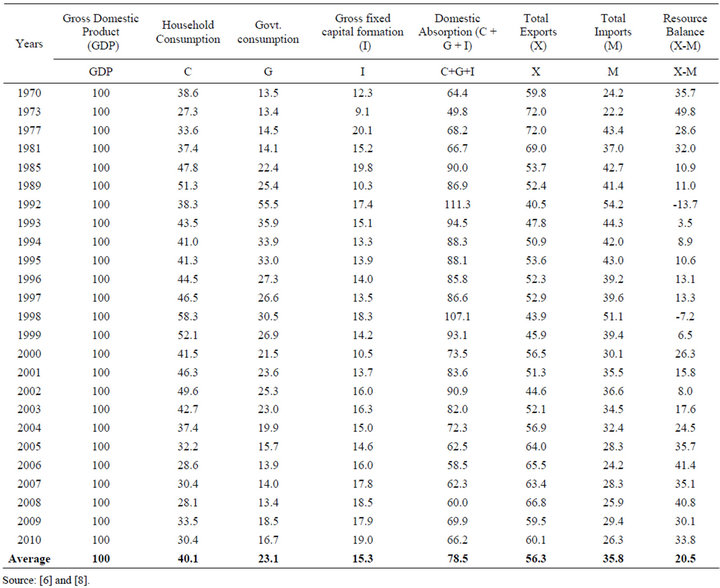

Applying the conditions specified in (5) and (6) to the Kuwaiti economy over the period (1970-2010), we obtain the data in Tables 1 and 2. Specifically, the components (variables) of Kuwait's domestic absorptive capacity and resource balance are identified and presented in Table 1. Moreover, Table 2 shows the share of these components in the GDP in order to demonstrate the significance of each variable within the domestic absorption concept. Estimating the absorptive capacity model reveals the following important facts:

Table 1. Indicators of Kuwait absorptive capacity (billions US dollars at current prices).

Table 2. Share of absorptive capacity indicators in total GDP.

1) The absorptive capacity of the Kuwaiti economy has been increasing steadily over the years. The capacity is measured by domestic absorption ability (consumption, gross fixed capital formation, government expenditure). The average domestic absorption for the period was estimated at $34.8 bil (around 78.5% of average GDP). While the growth of domestic absorption depicted a slow pattern during the period 1970-2000, the size of domestic absorption has accelerated significantly over the last decade rising by almost three fold from $29.1 bil in 2001 to $82.2 bil in 2010.

2) On average, consumption constituted the largest component of domestic absorption around 50%, followed by government consumption at 27% and then gross fixed capital formation at 23%. However, a close look at the data reveals that GFCF has passed government consumption in total values over the period (2006-2010), except for 2009. This has to do with increased oil revenues that facilitated more developmental projects.

3) Kuwaiti enjoyed a positive resource balance over the last four decades, except for 1992 and 1998. The persistence of a positive resource balance is a significant indicator of absorptive capacity limitations. The average resource balance over the period was estimated at $12.7 bil (around 20.5% of average GDP). While resource balance has fluctuated below the average for most of the period, it has increased significantly since 2004 reaching the highest in 2008 at $60. 2 bil. The resource balance has declined sharply after the global financial crisis in 2008.

4) The continual positive resource balance (due to net exports) suggests that Kuwaiti foreign exchange earnings exceeded its currencies requirements for imports of goods and services (plus workers’ remittances). A country is said to have a limited absorptive capacity if its foreign exchange earnings persistently exceed its foreign exchange requirements. The fact that Kuwaiti economy has a persistent foreign exchange surpluses is another clear indication of its limited absorptive capacity.

5) Domestic saving exceeded gross domestic investment in each year during the last four decades. The excess saving is almost equal to the resource balance. In other words, the economy tends to save more than its ability to invest, which is another indicator of absorptive capacity limitations. Again the accumulation of positive resources (financial revenues) over the years in terms of foreign currencies from oil exports verify the fact that oil surpluses did not find the proper opportunities to be channeled back into the economy.

6) Gross national saving has been much greater than gross domestic saving. The excess of domestic savings over investment is equal to the net capital outflow. The accumulated savings is another indicator of absorptive capacity. When domestic absorptive capacity is limited, the economy seeks outside outlets for its surplus savings.

7) The share of government consumption in Kuwaiti absorptive capacity has been increasing at a much faster rate than other types of domestic spending. This government spending represents merely spending on education, health and social welfare. Some might argue that human development through spending on education and health is vital for economic growth. However, irrational and inefficient spending on social welfare, particularly hikes in wages/salaries and subsidies can have a diverse affect on growth and development in the long run.

The above findings indicate that Kuwait’s average domestic absorption for the period represented around 78.5% of average GDP. It should be noted that in comparison with three selected developed economies (Japan, United Kingdome, USA), the average domestic absorption for these economies during the period (1970-2010), constituted around 98.1%, 99.9%, and 101.5% of average GDP, respectively [6]. In other words, the above developed economies have the ability to absorb resources effectively, even though their resource balances vary to a large degree (surpluses in the case of Japan and deficits in the case of UK and USA). The gap between Kuwait's domestic absorption and GDP entails the introduction of economic initiatives to enhance the economic ability to absorb resources. Moreover, determining the size of the absorptive capacity signifies the importance of the private sector bridging the gap between current and potential domestic absorptive capacity.

5. Absorptive Capacity Constraints

The ability of Kuwait to undertake investments at a desirable rate of (social) return, or to absorb foreign exchange through increased imports has been limited by a number of constraints and limitations that can be identified in the following:

● Market limitations: The small and limited market size is probably the most influential factor in constraining Kuwait’s absorptive capacity. By the end of 2010, total labor force in Kuwait reached 2,158,210 (365,585 Kuwaiti and 1,792,625 Non-Kuwaiti). The purchasing power of the two types of population differs significantly. The main source of income of the non-Kuwaiti labor force is the compensation of employees of foreign labor in the private sector. The fact that the private sector role in economic activities is very limited (around 30% of GDP in 2010), it tends to employ unskilled and inefficient foreign labor at low wages. On the other hand, over 93% of the Kuwaiti labor force is employed in the public sector with lucrative wage and compensation structure. Thus, the domestic market of the Kuwaiti economy is limited by the relatively low income of the majority of the labor force which is expatriates. This fact has some serious implications for largescale industries and highly priced products which must be produced in large quantities for efficient operation.

● Compensation of labor: The private sector is reluctant to pay high wages to Kuwaiti nationals despite the fact that the producers sell their goods and services at prices comparable to international prices. The private sector has unlimited supply of unskilled and inefficient foreign labor at low wages. As a result of selling at international prices while paying low wage rates; the operating surplus in the Kuwaiti private industries is extremely high relative to the compensation of employees [7]. Moreover, the private sector would not accept to offer Kuwaiti nationals similar lucrative conditions of employment as the public sector. This dichotomy in compensation between the public and private sectors will reinforce the structural imbalances with the domestic economy. The end results are the unwillingness of the national labor force to move to the private sector, and the inability of the private sector to increase its role in economic activities.

● Development of productive sectors: The market limitations and unavailability of factors inputs have put real constraints on the development of various non-oil productive sectors. The government efforts to expand the productive capacity of the economy are still below expectations. This is an important factor for seeking outside outlets for the excess foreign exchange. The industrial sector which can be a good source for huge investments in large industrial projects constitute only 5.80% of GDP in 2010. Many factors inhibit the development of the industrial sector including; smallness of domestic market, inadequate business environment, lack of foreign direct investment and technology, and dependence on unskilled and inefficient expatriate labor.

● Dominance of service-based activities: The large services sector comprises the following activities: wholesale and retail trade, restaurants and hotels; transport, storage and communication, finance, insurance, real estate and business services and community social and personal services. This sector employed over 70 per cent of total labor force and contributed 48.1 per cent of GDP in 2010. As to the absorptive capacity of this sector, we notice that the services provided by the government (education, health and economical services) have consumed a large volume of resources over the years. With the aid of increased oil revenues, Kuwait has created one of the most comprehensive welfare systems in the world. Government spending on education and health has contributed to the development of human capital, which raised the productive capacity of the economy. Investments in education and health services takes time to yield dividends and will contribute indirectly in future growth and development. However, the real question is whether this type of spending results in an “acceptable rate of social return”. Allocating a large share of oil revenues for the expansion in public goods will result in bias towards service-based activities and national labor force compensation over output-based activities. This will distort income diversification efforts of stimulating the non-oil activities and increasing absorptive capacity.

6. Conclusions and Policy Recommendations

The above analysis indicates clearly that Kuwait has a limited absorptive capacity over the last four decades. This is evident from the fact that the economy persistently has a positive resource balance. Moreover, the foreign exchange earnings of Kuwait exceeded its foreign exchange requirements. The analysis suggests that the limitations on the absorptive capacity of Kuwait are likely to continue unless some fundamental measures are adopted to create new investment opportunities in the economy. New measures and initiatives include: in order to overcome the problem of market limitations, Kuwait must look outward toward regional markets, particularly within the GCC. This entails among others energizing the role of the private sector in the manufacturing sector and in trade and logistics activities. Kuwait must adopt sound measures to attract FDI and bring the multinational corporations into the local market (Kuwait currently attracts hardly any incoming FDI). This approach is the most appropriate and efficient way to transfer technology and managerial know-how. The FDI can significantly increase the absorptive capacity of Kuwait by easing its bottlenecks in the areas of entrepreneurial and managerial capabilities, international marketing, innovative business development, new export opportunities, availability of financial resources, and lastly state-of-the-art technology. Finally, Kuwait must work hard in achieving its strategic vision of becoming a regional Trade and Financial Center. This should promote the private sector in providing services in the trade and financial activities. This vision will open the economy to new frontiers in trade and finance and sets Kuwait in its along waited proper place in the region.

REFERENCES

- M. Ramadhan, “The Absorptive Capacity of Kuwaiti Economy: Analysis of Size and Determinants,” Journal of the Gulf & Arabian Peninsula Studies, Vol. 31, No. 116, 2005, pp. 11-29.

- W. J. Stevens, “Capital Absorptive Capacity in Developing Countries,” A.W. Sijthoff, Leiden, 1971.

- D. Soliman, “The Kuwait Fund and the Political Economy of Arab Regional Development,” Praeger, New York, 1976.

- M. M. Shirley and P. Walsh, “Public versus Private Ownership: The Current State of the Debate,” World Bank Working Paper 2420, The World Bank, Washington DC, 2001.

- R. El-Mallakh and J. K. Atta, “The Absorptive Capacity of Kuwait,” Lexington Books, Toronto, 1981.

- United Nations Conference of Trade and Development, UNCTAD Handbook of Statistics, 2012.

- M. Metwally, “Causes and Consequences of Wage Differentials in the GCC Countries: A Case Study,” The Middle East Business and Economic Review, Vol. 9, No. 2, 1997, pp. 22-32.

- World Bank, World Development Report, 2001.

NOTES

*This project was partially funded by Kuwait Foundation for the Advancement of Sciences under Project Code: 2010-1103-02.