American Journal of Industrial and Business Management

Vol.04 No.09(2014), Article ID:50064,7 pages

10.4236/ajibm.2014.49058

A Study on the Effectiveness of Financial Supports to the Entrepreneurship of Farmers

—Based on the Data from 1978 to 2011 in China

Xinzhi Liu1,2*, Lu Li2, Chunyan Du2, Yusong Liu2

1Rural Economics and Management Research Center of Southwest University, Chongqing, China

2College of Economics and Management of Southwest University, Chongqing, China

Email: *liuxinzhi53@163.com

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 8 July 2014; revised 6 August 2014; accepted 6 September 2014

ABSTRACT

We use a fixed effect variable coefficient model to analyse effectiveness of financial supports to the entrepreneurship of farmers, based on the data from 1978 to 2011 in China. Results show that due to the significant differences in regions among farmers’ entrepreneurship, the demand of rural financial supports for the peasants’ entrepreneurship is distinct; the different rural financial supports for farmers’ entrepreneurial also exist. The financial supports of developed eastern provinces to the entrepreneurship of farmers are effective, while that of the underdeveloped provinces in middle and western China is opposite. At last, focusing on market failure that farmers in poor areas encountered, like the rural imperfect financial system, the credit guarantee system, the asymmetric information and high transaction cost, some suggestions are given in this paper, such as the encouragement of the micro-finance for farmers’ entrepreneurship, standardizing and guiding the informal finance for farmers’ entrepreneurship and the establishment of risk fund for farmers’ entrepreneurship.

Keywords:

Entrepreneurship of Farmers, Financial Supports, Panel Data, Variable Coefficient Model

1. Introduction

Under the great income gap and the serious surplus rural labor force, entrepreneurship of farmer is an effective way to solve China’s issues concerning agriculture, countryside and farmers and is key to the stable and healthy development of China’s economy in the long run, also is the safeguard to realize the grand goal of building a moderately prosperous society. Local entrepreneurs not only enhance their living standards which drive around the villagers out of poverty, but promote the consumption and expand domestic demand and improve the sense of belonging and well-being of farmers groups. However, due to asymmetric information, imperfect credit guarantee system, lack of risk management system and other issues, the competitiveness of farmers is weak and it’s awkward for them in financing in startup projects. In the case of market failure, as the supervisor and manager in the market economy, government should improve construction of relevant laws and regulations of finance, increasing the effective supply of finance, guiding the finance to service agriculture, countryside and farmers to meet the needs of entrepreneurship of farmers, which achieve social optimal allocation of resources.

Both in developed and developing countries, entrepreneurial activity is a source of economic growth (JAJoseph Alois Schumpeter). In China, there are more than 700 million farmers, accounting for half of China’s total population, and there must be for entrepreneurship of farmers to maintain national innovation, help economic growth and improve the market economy system. Meanwhile, farmers’ entrepreneurship can ease the employment pressure for cities, increase farmers’ income, transfer rural surplus labor, create rural employment opportunities and narrow the income gap between urban and rural areas. Gu Jiahua and Xie Fenghua (2012) did an empirical research by provincial panel data from 1997 to 2009, and the findings indicated that more entrepreneurial activities among the regional affect significantly the income of farmers.

For main factors affecting entrepreneurship of farmers, some researches have been studied and summarized, but all refer to the importance of financial support for entrepreneurship. Folmer H. et al. (2010) pointed out that besides age, education and other factors, financial support is also the main factor for entrepreneurship of farmers after the investigation of Bardhaman in India. Poon J.P.H. et al. (2012) mentioned the similar point of view by visiting rural areas in Vietnam. It is recommended to increase the effective supply of finance based on the analysis of factors affecting migrant workers returning home to do business (Liu Tangyu, 2010). Zhang Haiyang and Yuan Yanjing (2011) insisted that the financial environment benefits entrepreneurship of farmers and helps those who have their own business increase scales to become entrepreneurs [1] - [5] .

Other scholars are also aware of the lack of financial support for entrepreneurship. Stiglitz (1981) and Carter (1988) proposed that the shortage of venture capital and financing difficulties are unresolved problems. Cheng Yu and Luo Dan (2009) believed that credit constraints would affect the resource allocation structure and the level and ability of entrepreneurship during entrepreneurial process based on data surveyed from Rural Financial Development Research Center of the State Council. At the same time, Xiao Huafang and Bao Xiaolan (2011) used Biprobit model by survey data from 930 rural micro-enterprises in Hubei Province. They proved that there appeared entrepreneurship credit constraints of farmers from the test of entrepreneurs financing channel selection and credit rationing decisions of formal financial institutions. Insufficient funds have limited entrepreneurship of farmers to expand production scale. Luo Mingzhong (2012) also deemed that the shortage of funds was urgently expected to be solved for farmers and most farmers hoped to get the entrepreneurial risk compensation from government [6] - [10] .

Although the above literatures have studied the importance of financial support for farmers’ entrepreneurship from all aspects, there is no in-depth analysis of the effectiveness of the financial support for farmers’ entrepreneurship. On the basis of the time series and panel data, this paper will analyze the demand of entrepreneurship of farmers to finance by econometric methods, from the point of the impact of entrepreneurial farmers on agricultural loans. Meanwhile, we will also study situation of financial supporting farmers’ entrepreneurship, as well as the problems faced and deep-seated reasons resulting from regional differences, and recommend the corresponding countermeasures at last.

2. Mechanism of Financial Support to Entrepreneurship of Farmers

According to “Schulz-Popkin proposition”, farmers as the individuals with limited rational behavior will make self-benefit judgments of future risks and interest expectations to determine whether they are willing to do business or they would do borrowing to start business.

When faced the employment pressure, living conditions improvement and personal development, farmers intend to start a new business. If the farmers have enough economic strength and funds, in the case of other conditions permitted, they will directly go for entrepreneurial activity. When the expected benefits outweigh the risks, farmers will solve the funding problem by debit and credit even if money is limited, then farmers will raise the demand of financing.

With the sound local financial system, the perfect relevant laws and regulations and effective financial support to entrepreneurship of farmers, farmers will enter the start-up phase. Given the entrepreneurial behavior of farmers adapting to the needs of the market and making a profit, they achieve entrepreneurial success. This passion will affect farmers around with the same entrepreneurial willingness and improve their earnings expectations, which contribute to entrepreneurship and entrepreneurial behavior throughout farmers groups. If the farmers start their business, due to risks or expansion of the operation scale, they will return to long for financing.

Conversely, market failures like asymmetric information, high transaction costs, and “adverse selection” of financial institutions cause the loss of financial support, resulting entrepreneurship projects or entrepreneurial behavior of farmers suspend due to the lack of funds. When the entrepreneur ship gets failed, passive attitude will also affect the entrepreneurial willingness of other farmers and improve their risk expectations. Thereby it will inhibit entrepreneurship and entrepreneurial behavior throughout the farmers groups.

From the above analysis, we can conclude that when farmers increase demand for finance, the government should reasonably guide the financial resources to supply, which can eliminate the negative effects of market failure, so that Pareto optimal allocation of resources can be reached.

3. Analysis of Panel Data

Due to the unbalanced development of China’s financial system between regions, therefore we can not put all the provinces in China as a homogeneous whole. If we only consider the time series model when studying the demand of financial support from entrepreneurship of farmers, we will inevitably ignore individual differences between various regions and it is difficult to reasonably explain the relationship between the variables. If we only consider the cross-section data in a given year, it will be hard to reflect the long-term dynamic relationship between economic variables. The panel data contains cross-section, periods and variables information, we can construct a more realistic economic equation. When reducing multiple collinearity, it also brings more information, more freedom and greater estimated efficiency.

On data-selecting, the paper refers to the research from Gu Jiajun (2012) taking into account the available data of farmer entrepreneurship. We select the total number of private investors and self-employed entrepreneurs in rural areas as an indicator of farmers’ entrepreneurship (NC), and put agricultural loans (XD) as the indicator of rural financial support. In this paper, we will use a panel data model to do empirical analysis of NC and XD of 30 provinces and cities with data from 1997 to 2009 (due to the unavailable data of Hong Kong, Macao and Taiwan data, and some years of data missing in Tibet, so we exclude these areas) (Chongqing began Territory in 1996 and statistics differ greatly, so we start from 1997; while statistical changes in agricultural loans in 2010, in order to make model estimate more reasonably, so we end in 2009). Data from “China Statistical Yearbook” and to avoid heteroskedasticity these variables will be taken the form of logarithm (LNNC and LNXD) to represent [11] -[13] .

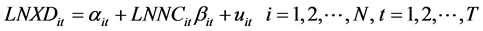

Empirical model established in this paper:

(1)

(1)

N represents the number of the cross-section, T is the total number of the observation period of each section; the parameters represent the constant of model and the number of explanatory variables. Random error term is independent, and meets assumptions of the zero mean and equal variance.

Whether the constant term and the coefficient vector is a constant, the panel data models are divided into three types: mixed regression model (both constant), variable intercept model (coefficient term is a constant) and variable coefficient model (both no constant). The panel data estimation combines with information of section, period, and variable. If the form of the model set incorrectly, then the result will be far away from the economic realities. Therefore, before the establishment of the panel data model, we need to test whether  and t

and t  of the explanatory variables

of the explanatory variables  for all sections is the same. That’s to say, it means to test what form match with sample data by avoiding deviation in model setting and improving the effectiveness of parameter estimation. Firstly it is assumed that three models are as follows:

for all sections is the same. That’s to say, it means to test what form match with sample data by avoiding deviation in model setting and improving the effectiveness of parameter estimation. Firstly it is assumed that three models are as follows:

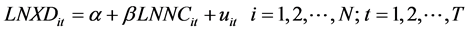

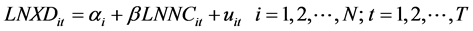

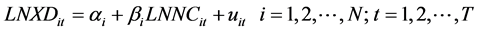

Mixed regression model:

Variable intercept model:

Variable coefficient model:

3.1. Unit Root Tests

Before co-integration test, we must examine whether variables in the model is stable. A unit root test under the same circumstances root, which means that each section of the sequence is assumed to have the same panel unit root processes, such as inspection LLC, Breitung test and Hadri test; another way for the unit root test scenarios under different root, that assumes that each section of the sequence has a different panel unit root processes, such as Im-Pesaran-Skin test, Fishier-ADF test and Fisher-PP test. From Table 1, the combination of all the test results to determine LNXD, LNNC are non-stationary. This indicates that there may be long-term and stable relationship between the two variables co-integration, and there is a great need for further verification.

3.2. Cointegration Test

On the basis of the panel unit root tests, panel cointegration tests of LNNC and LNXD will be conducted to determine whether there is cointegration between non-stationary time series.

Panel ADF-Statistic and Group ADF-Statistic are more suitable for small sample data in previous studies, so we can use these two tests to determine whether there is cointegration between two. As shown in Table 2, Panel ADF-Statistic and Group ADF-Statistic pass the test at 5% probability, and the test probability from Kao Residual Cointegration Test makes it pass the 5% significance level, which means farmers’ entrepreneurship and agricultural loans have long-term stable relationships.

3.3. Panel Data Model

On the Basis of the existence of cointegration between LNNC and LNXD, there is the need to test what the panel model suit for the sample data. In this paper, we will do covariance test and use F to count the statistic.

Table 1. Unit root test results.

Table 2. Cointegration test results.

(1)

(1)

(2)

(2)

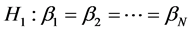

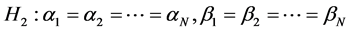

To test the following two hypotheses:

is residual sum of squares of varying coefficient model, variable intercept model and mixed regression model respectively. k is the number of explanatory variables; N is the number of sections; α is the constant and β is coefficient vector.

is residual sum of squares of varying coefficient model, variable intercept model and mixed regression model respectively. k is the number of explanatory variables; N is the number of sections; α is the constant and β is coefficient vector.

If the calculated value of F2-statistic is less than the critical value under the designated significance level, the hypothesis  will be accepted and the mixed model will be used for fitting the sample. If not, F1 will be for testing hypothesis

will be accepted and the mixed model will be used for fitting the sample. If not, F1 will be for testing hypothesis , and when the calculated value of F1-statistic is less than the critical value under the designated significance level, the hypothesis

, and when the calculated value of F1-statistic is less than the critical value under the designated significance level, the hypothesis

We take LNXD as the dependent variable, LNNC as explanatory variable; while N = 30, k = 1, T = 13. S1 = 125.9390, S2 = 173.5203, S3 = 331.4439 can be reached by Eviews 6.0. F1 = 4.2999, F2 = 9.2843 are calculated through (1) and (2). From F distribution table, we can see F1 > F(29, 330) and F2 > F(58, 330) at the 5% significance level, which means we will refuse both H1 and H2. Therefore, we prefer variable coefficient model, which also highlights the impact of differences between the provinces on the overall level.

To reduce the serial autocorrelation, generalized difference method is used in this paper and adding AR (1) term to increase the value of DW stat. Result can be seen in Table 3.

Expression is like this:

Coefficient of determination of the adjusted model is high; F statistic is also larger than the critical value; DW test shows no residual serial correlation exists, indicating a good overall fitting of the model.

As shown in Table 4, αi in the more developed coastal areas, such as Tianjin, Liaoning, Shanghai, Guangdong, is negative, reflecting funds of farmers in these areas are more, private financing is more convenient, so that the loan demand of farmers will be reduced at the beginning of startup, which showing the level of wealth

Table 3. Regression result.

Note: Values in parentheses is probability and * means P < 0.05.

closely links with the entrepreneurial choice (Evans and Jovanovic, 1989). αi in relatively developing central and western regions, such as Hainan, Hubei, Jiangxi, Chongqing, Guangxi, Shanxi, Gansu, Qinghai, Xinjiang and other provinces is also negative. Due to the imperfect financial system and credit guarantee system, asymmetric information, entrepreneurial farmers initially are difficult to finance through agricultural loans.

From Table 5, βi is positive in most areas, which indicate that farmers have a large demand of venture capital. Agricultural loans as one of the main sources of financing for farmers, showing a close positive correlation on farmers’ entrepreneurial behavior. Financial system, laws and regulations, infrastructure are better in relatively developed areas and the farmers’ entrepreneurship stimulate farmers’ income, so that rural private enterprises and self-employed business operate smoothly and get profitable, resulting in the reduction of agricultural loans in all aspects in subsequent years. The economy is relatively backward in some regions like Hainan, Anhui, Guizhou, Qinghai, Ningxia, and Inner Mongolia, because of the limited opportunities of farmers’ entrepreneurship, slow development of education and S&T, inadequate infrastructure, the imperfect financial system, leading venture losses or even bankruptcy, thereby reducing farmers’ demand for agricultural loans.

4. Conclusions and Suggestions

In this paper, we do an empirical research of the relationship between farmers’ entrepreneurship and financial

Table 4. αi in different areas.

Table 5. βi in different areas.

supports. Conclusions are as follows: Through cointegration analysis of panel data, there exists the long-term cointegration between entrepreneurship of farmers and financial support (loan support to agriculture) in China’s 30 provinces. On the basis of a series of tests, we establish a fixed effect variable coefficient model and get the relative functions. Different coefficients in different provinces indicate greater regional differences in the financial environment and different effectiveness of financial supports on entrepreneurship of farmers.

In order to help farmers solve their own funding problem when business starts up and further develops the role of financial support for farmers entrepreneurship, this paper makes the following recommendations:

First, large commercial banks and other formal financial institutions should be guided for innovation and develop new financing channels for farmers entrepreneurship projects such as rural financing guarantee, small and medium banks, venture investment and leasing financing, to provide follow-up support for the development of farmers’ projects.

Second, most farmers lack guarantees and collateral and commercial bank often reject farmers’ loans. Due to the bad situation, the main channel of financing of rural credit should be functioned to promote micro-credit loans for farmer entrepreneurship. Farmer entrepreneurship micro-finance credit rating system and farmers’ credit file management should be improved; scientific and reasonable evaluation index and farmer credit system should be established, which intend to increase the speed of loan approval, and improve efficiency and better service for the majority of farmers’ entrepreneurship. Meanwhile, farmers’ guaranteed loans through a network of village organizations and guarantee fund system should be built to solve large amounts of loan demand problems from farmers, individual business men and private enterprise.

Third, high transaction costs of farmers financing from formal financial institutions make it hard to meet the financing needs of entrepreneurship. Private lending is very rampant in rural areas and there exists a huge amount of private financing. Therefore we must strengthen supervision of private capital, accelerate the reform of financial system, encourage private capital to initiate or participate in the establishment of village banks, loan companies and rural mutual cooperatives, even other financial institutions, reduce restrictions of the lowest funded ratio of corporate banking in village and community banks, and guide private lending to be organizational, institutional, standardized by subsidies, which effectively solve problems in farmers’ entrepreneurial activities.

Fourth, free or subsidized farmers venture fund should be established by the government in the underdeveloped regions. Funds can be taken to reduce the threshold for registration, reduce or waive taxes and other measures, which will effectively reduce the initial venture capital investment, to support those poor farmers’ projects with ideas and technology.

Funding

Funded by Chongqing Humanities and Social Science Research Institute Fund Project (12SKB003).

References

- Hao, C.Y., Ping, X.Q., Zhang, H.Y. and Liang, S. (2012) Entrepreneurial Choice and Its Influencing Factors of Farmers-Evidence from “Financial Investigation”. Chinese Rural Economy, 4, 57-65.

- Gu, J.J. and Xie, F.H. (2012) Analysis on Entrepreneurial Activities Affecting Farmers’ Income in Different Regions— Based on Provincial Panel Data from1997 to 2009. Issues in Agricultural Economy, 2, 19-23.

- Folmer, H., Dutta, S. and Qud, H. (2010) Determinants of Rural Industrial Entrepreneurship of Farmers in West Bengal: A Structural Equations Approach. International Regional Science Review, 33, 367-396. http://dx.doi.org/10.1177/0160017610384400

- Foon, J.P.H., Thai, D.T. and Naybor, D. (2012) Social Capital and Female Entrepreneurship in Rural Regions: Evidence from Vietnam. Applied Geography, 35, 308-315.

- Liu, T.Y. (2010) Analysis on the Impact Factors of the Peasant Workers’ Returning to Hometown to Venture: Based on the Survey of Ganzhou Area in Jiangxi Province. Issues in Agricultural Economy, 9, 81-87.

- Zhang, H.Y. and Yuan, Y.J. (2011) Village’s Financial Environment and Farmers’ Entrepreneurship. Zhejiang Social Sciences, 7, 2-12.

- Stiglitz, J. and Weiss, A. (1981) Credit Rationing in Markets with Imperfect Information. American Economic Review, 71, 393-410.

- Carter, M.R. (1988) Equilibrium Credit Rationing of Small Farm Agriculture. Journal of Development Studies, 28, 83- 103.

- Cheng, Y. and Luo, D. (2011) Entrepreneurial Farmers’ Choiceunder Credit Constraints—An Empirical Analysis of Chinese Household Survey. Chinese Rural Economy, 3, 28-35.

- Xiao, H.F. and Bao, X.L. (2009) Credit Constraints of Farmer Entrepreneurship—An Empirical Study of 930 Rural Micro-Enterprises in Hubei Province. Journal of Agrotechnical, 11, 25-38.

- Zhao, X.H. and Zhou, S.D. (2012) Current Situation of Farmer Entrepreneurship, Its Influencing Factors and Countermeasures. Jianghai Academic Journal, 1, 217-222.

- Luo, M.Z., Zou, J.Y. and Lu, Y.X. (2012) The Motivation, Demand and Support for Farmers’ Entrepreneurship. Issues in Agricultural Economy, 2, 14-19.

- Evans, D.S. and Jovanovic, B. (1989) An Estimated Model of Entrepreneurial Choice under Liquidity Constraints. Journal of Political Economy, 94, 808-827. http://dx.doi.org/10.1086/261629

NOTES

*Corresponding author.