Theoretical Economics Letters

Vol.06 No.05(2016), Article ID:70645,10 pages

10.4236/tel.2016.65095

FII Ownership in Indian Equity Securities: The Firm-Level Determinants

B. Hariprasad

Finance & Accounting Area, Indian Institute of Management, Indore, India

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: July 16, 2016; Accepted: September 16, 2016; Published: September 19, 2016

ABSTRACT

This paper studies the stock ownership in Indian firms by Foreign Institutional Investors during 2013 to 2015. Several firm-level characteristics are used to measure the extent to which information asymmetry affects the level of FII ownership in these firms. The analysis reveals that the firm-size and the book-to-market ratio are significant variables in selecting the equity investments by this investor group. There is not much empirical support for beta or the export ratio as determinants of firm-level ownership. In their holdings of large-firm stocks, there is a strong evidence that FIIs prefer to hold more shares of high exports firms.

Keywords:

Foreign Ownership, Firm Attributes, International Portfolio Selection, Emerging Markets

1. Introduction

The Governments of emerging market economies have taken measures to attract foreign direct investments and foreign portfolio investments to bridge the savings?in- vestment gap and to finance the current account deficit. While the foreign investors continue to invest across countries to diversify the risk of their investment portfolio and to achieve higher returns, the host countries felt that foreign financial capital provide an impetus to economic growth and the domestic financial market development [1] - [3] .

The portfolio equity flows to developing countries increased multi-fold during this century. Of all the developing countries, the major recipients of foreign portfolio equity flows have been China, Brazil, India, Russia, and South Africa, out of which China, India, and Brazil account for almost 70% of the total portfolio equity flows to all developing countries [4] .

India is an emerging economy with a unique institutional and corporate governance environment that differs from many other emerging economies. The Government of India has removed controls on capital flows and has deregulation agenda to address the institutional structure of the domestic financial market. There has been a rapid increase in the level of stock ownership and trading volume by foreign investors in Indian equity market. Foreign investment has also led to higher overall levels of trading, improved visibility and extensive analyst coverage of the listed companies. The characteristics of foreign investment behavior and their choices between investment classes and the choice within a specific investment class has thus become an important area of financial market research. This paper examines foreign ownership in Indian stock market, to elucidate international portfolio selection, using a rich and detailed firm level data. Several firm-level attributes including size, risk, book-to-market ratio and exports-ratio have been considered to provide an empirical assessment of the link between stock ownership by foreign institutional investors and the domestic firm characteristics.

The remainder of this paper is structured as follows. Section two reviews the literature on the relationship between foreign ownership and firm attributes. Section three introduces the data and summary measures. Section four presents the research methodology and empirical results. Section five examines the size effect further to identify the role of exports-ratio, and finally, section six concludes the paper.

2. Literature Review

The international CAPM predicts that investors hold a global portfolio, a domestic portfolio and a bond portfolio [5] . While the theory posits that international investments improve the portfolio performance of domestic investors, the empirical evidence is the strong preference of these investors towards domestic equities [6] - [8] . This disproportional holding of stocks is evident in domestic portfolio selection as well [9] - [11] . The domestic institutional investors consider the special advantages when selecting their foreign investments [11] - [14] .

The academic literature attributes these findings about international investments to the investment barriers and information asymmetry between domestic investors and foreign investors in the foreign market. The investment barrier hypothesis posits that the barriers caused the local investors not to hold foreign assets until their return is sufficiently high to compensate these barrier costs [15] . The “investor base” hypothesis posits that investors only receive information from firms familiar to them [16] . Though these do not fully explain this phenomenon, they are important in explaining portfolio selection bias.

The models of informational differences between domestic and foreign investors predict that foreign investors are at an informational disadvantage, and trade on new information with a time lag [17] . Prior studies have identified many special factors that these investors consider while selecting foreign stocks [10] [18] . The institutional and other effects suggest that trade-offs are made by foreign investors and that there is a pecking order associated with cross-border portfolio investment [19] . The foreign investors prefer stocks of large firms to that of small firms to minimize the impact of information asymmetry as more relevant information is available for big firms and are well covered by the analysts [11] - [14] . Similarly, foreign investors should favour blue- chip stocks as book-to-market equity (B/M) is a proxy for profitability and growth [20] . Prior studies provide that foreign investors would hold more shares of low B/M firms [13] [14] . These investors prefer the stocks of firms with a conservative financial policies in terms of leverage and liquidity as they compare the firm with the type of firms in their local markets. They are likely to have more knowledge and information about the firms with higher foreign sales than about the ones with low or no exports. The foreign investors in Japan prefer large, low leveraged firms and the firms that export more [14] . The foreign investors in Swedish marker prefer large firms and those with high liquidity [11] .

Foreign ownership in small firms is higher for high beta portfolios than for low beta portfolios. These results are consistent with the asymmetric information hypothesis and the investment barrier model. The theory posits that the different tax rates on investment income between domestic and foreign investors influences the foreign ownership and hence an important factor in allocating assets and selecting the portfolios by foreign investors [21] . Some empirical studies shows that foreign investors hold fewer shares of firms with high dividend yields to mitigate the impact of these tax differences [22] .

This study fits in with this literature and our results are consistent with foreign investors avoiding firms where information asymmetries provide advantages to domestic investors. This study examines several factors that affect foreign investor holdings of the Indian market. Foreign investors are found to favour large firms with high export ratios, and high book-to-market equity. These results enrich the literature and are consistent with the asymmetric information hypothesis and the investment barrier model.

3. Data Description

The foreign investment policy of India, until 1991, encouraged the direct investment by foreign business firms in select industrial sectors. The Indian Government, through the economic reforms initiated in 1992, had opened more industrial sectors for foreign direct investment and also permitted the foreign portfolio investments by Foreign Institutional Investors (FIIs) and Overseas Corporate Bodies (OCBs) in Indian financial markets after due registration with Securities and Exchanges Board of India (SEBI) and are required to comply with the provisions of Foreign Exchange Management Act (FEMA). The foreign investment policy has evolved over time through the system of quantitative restriction (statutory ceilings) and sectoral caps. The foreigners were allowed to hold up to 49% of outstanding equity shares in most Indian companies that was later revised to 74%. The foreign investors are a significant shareholder group in Indian firms and they hold major stake in certain Indian companies. The Indian policy reforms and the trends in foreign portfolio flows have been well recorded in recent studies [4] .

In Indian firms are listed for trading in the Bombay Stock Exchange (BSE) and National stock Exchange of India (NSE). Some of the Indian firms have their equity shares listed for trading on foreign bourses through ADR/GDR programs. NSE holds dominant position in both secondary market trading and the trading in derivatives on these listed securities. SEBI had mandated all listed firms to report the equity shareholding patterns on quarterly basis in the prescribed lines to the stock exchanges, effective from March 2001. The investors are classified into promoters and non-promoters, with further classification under each category. The promoters are classified into Indian promoters and foreign promoters wherein the latter are classified into Non-resident Indians, foreign promoter corporate bodies, foreign promoter institutions, foreign promoter institutions, promoter qualified foreign investors and the other foreign promoters. The non-promoter investors are classified into non-promoter institutions and the non-promoter non-institutions wherein the former are further classified into non-pro- moter mutual funds (including UTI), non-promoter Indian institutions (including cen- tral and state Governments, insurances companies, banks and other financial institutions), non-promoter Indian venture capital funds, non-promoter foreign institutional investors (FIIs), non-promoter foreign venture capital funds, non-promoter qualified foreign institutions, and the other non-institutional non-promoters (the residual category). Only the holdings of FIIs are considered in this empirical study. The database service providers, such as CMIE, record the shareholding information in same lines as reported by these listed firms as at the end of each quarter. The financial year for most Indian companies ends on March 31. In this study, the data reported by the listed firms as end of the financial years 2013 to 2015 is used as both the audited financial statement information and the market information are required to carry this analysis.

Table 1 provides summary of the FII ownership for non-financial Indian firms as at end of the financial years 2013, 2014 and 2015. The summary of foreign ownership information is obtained in two different ways. First, the percentage ownership of foreign institutional investors in the equity of the firm is calculated and then averaged this percentage across firms. This equally-weighted cross-sectional average percentage equity ownership of foreign portfolio investors (FII) is provided in the third row of the Table.

Table 1. Equally and value-weighted foreign ownership for non-financial Indian firms by year.

The standard deviation and the skewness measures are shown in the next two rows as the ownership is heavily skewed. This clearly establishes that FII holdings in majority of the firms is less than 10% as evidenced by the median measure. The distribution of FII holdings is further explained in Table 3 that is covered in section four. The second summary measure of FII holdings is the value-weighted mean. This measure is provided in the last column of Table 1. The adjusted closing market price is used as weigh the FII holdings to arrive at this estimate. It could be observed that the value-weighted measure is much larger than the equally-weighted measure of FII ownership. It is clear, from this empirical pattern, that the FIIs held higher stakes in large-capitalization firms than the small-capitalization firms.

4. Methodology and Empirical Results

In this section, a number of firm-specific attributes are introduced which are then used in the empirical analysis of FII equity ownership. To enable easy comparison, the same attributes are chosen as those identified by leading research in this field [11] - [14] . These variables are:

i) Beta: Beta coefficient of the market model, a measure of systematic risk present in the firm’s equity shares, as estimated by CMIE has been used in this study. Stulz [15] developed an international investment barrier model, showing that investment barriers raise the cost of cross-border investment. Accordingly, foreign investors seek assets with higher expected returns to cover these costs. The foreign investors, who face such barriers, are expected to hold more shares of high beta stocks, yielding higher expected returns.

ii) Size: This variable is the natural log of market capitalization of the firm at the March-end of the calendar year. Size could play a role in portfolio allocations. Some prior studies argue that investors prefer familiar securities [16] . It is more likely that FIIs will invest in those Indian firms where they have some knowledge, or familiarity. It is commonly assumed that more information is available on large firms relative to small firms and hence the large firms are favored.

iii) Book-to-market ratio: This is a market valuation measure of the firm. It is measured as the book value of equity divided by the market value of equity at March- end of the calendar year. This ratio is a proxy for profitability and growth. The financial performance of low book-to-market firms is more consistent than high book-to- market firms. It is expected that FIIs would prefer to hold more shares of low B/M firms.

iv) Export ratio: This is defined as the export-to-sales ratio for the year preceding foreign ownership measurement. The export-oriented firms are expected to be more familiar to the FIIs than the domestic-oriented firms. It could play an important role in the portfolio allocations of FIIs. Hence, it is expected that the FIIs would prefer to hold more shares of high export-oriented Indian firms.

The dividend yield is not considered as these institutional investors are not taxed differently from that of the other investors. The descriptive statistics of these firm-level attributes is provided in Table 2. Both FII ownership (FOWN) and the export ratio (ER) are in percentages. It can be observed that the correlation of the beta and the firm-size have negative correlations with other firm-level attributes during this sample period. This can have some implications for the empirical relationships.

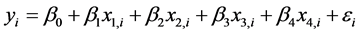

Given the importance of each firm-level attributes identified above, the multiple regression analysis has been used to establish the relationship between the proportions of equity shares held by FIIs in a firm to these four firm-level attributes. The multivariate regression analysis is used every year, as there is no requirement that complete information shall be available for each firm every year. The estimated equation is a standard linear regression model as follows.

where yi represents the FII ownership in firm i; xj represents the firm characteristic variable j, and ei is the error term for firm i. The White’s procedure is used to correct the standard error of the estimated coefficients.

The correlation between foreign ownership and various firm-level attributes is presented in Table 2. It can be seen that foreign ownership is positively and significantly correlated with firm size in all years. However, it is weakly positively correlated with the export ratio. It exhibits a weak negative correlation with beta and Book-to-market ratio.

Table 2. Descriptive statistics of firm-level attributes.

The cross sectional regression results for years 2013 to 2015 are presented in Table 3 along with the results of pooled regression results for these three years together. As mentioned, the dependent variable is the proportion of FII ownership in Indian firms while the independent variable are the firm’s characteristics. The coefficients for firm size measure are positive and significant in all regressions, thereby confirming that firm size is a key determinant of stock selection. The firm size is associated with its visibility and recognition in emerging markets such as India. The large firms are the focus of analyst reports and are well recognized by FIIs for their better governance and lower degrees of information asymmetry. This finding is consistent with prior studies upholding the view that foreign investors hold shares in familiar firms to overcome information asymmetry [11] - [14] .

The coefficients of book-to-market measure in the multiple regression equations are also positive and are significant at 1% level. This indicates that FIIs tend to invest more in firms with high book value relative to market. This observation is in conformity with the hypothesis that emerging market share prices tend to depart from the true value [12] .

The coefficients of exports-ratio in the regression equations are positive, although the statistical significance decreasing over the years. It is positive and statistically significant at 1% level in year 2013. This is a weak evidence that FIIs tend to hold more shares in firms with higher export-to-sales ratios. This evidence is in contrast to the findings of the past studies that argued that FIIs invest more in firms with high export-to-sales ratio as they are familiar to them [11] - [13] . The results for beta are also mixed. Although it is positive in year 2013 only, none of the coefficients are significant. Hence, there is no significant evidence that FIIs hold more shares of firms with high-beta.

Table 3. Regression estimates of foreign ownership on explanatory variables.

Figures in brackets are t-values. *, **, ***Denotes significance at the 10%, 5% and 1%, respectively.

The results of the pooled regressions are presented in last column of Table 3. It could be observed that coefficients of firm size, book-to-market ratio and the exports-ratio are positive and significant at 1% level. The coefficient of beta is negative and not significant. While the results for firm size and book-to-market are in the lines of cross-sectional results, the result for exports-ratio and beta are not. Given that the coefficient of exports-ratio turned significant at 1% level, it has to be examined further.

5. Firm Size, Export Ratio, and Foreign Ownership

To separate the effect of firm size and the effect of export ratio on the foreign ownership, portfolios are formed on firm size and then export ratio over the 2013 to 2015 period. For each year, firms are first divided into five size quintiles, each of which is then divided into five quintiles based on exports-ratio. The results are presented in Table 4. The cells in the table provide time-series mean (median) of the yearly means (medians). The bold values in the last row represent the mean difference between the largest and the smallest exports-ratio samples in each size quintile with the t-statistic.

Ignoring exports-ratio, foreign ownership increases monotonically from 3.491% for the smallest size quintile to 16.399% for the largest size quintile. Ignoring firm size, the foreign ownership decreases from 8.932% for the smallest export ratio quintile to 6.690% for the third largest exports-ratio quintile, and then increases to 9.148% for the largest exports-ratio quintile. This observation is in contrast with the past studies that

Table 4. Mean and median foreign ownership (%) by portfolios formed on the basis of size quintiles and the exports-ratio quintiles.

Figures in brackets are t-values. *, **, ***Denotes significance at the 10%, 5% and 1%, respectively.

have reported a monotonic increase in this regard [3] [13] . In each exports-ratio quintile, the foreign ownership gradually increases from the smallest to the largest size quintile, although the change is not monotonic. In the size quintile 1, 4 and 5, the foreign ownership also gradually increases from the smallest to the largest export ratio quintile, but the change is not monotonic. An exactly opposite behaviour is observed in size quintiles 2 and 3, with the change not being monotonic.

The shaded cells of the last column represent the mean difference between the largest and the smallest firm sizes in each exports-ratio quintile. Foreign ownership in largest firms is significantly higher than that in small firms in all exports-ratio quintiles. For comparison, the mean difference between the highest and lowest exports-ratios in each size quintile is reported in the shaded cells of the last row.

The foreign ownership in the highest exports-ratio firms is significantly higher than in lowest exports-ratio firms in the largest quintile only, and the difference is insignificant for the remaining size quintiles. The mean difference between the largest and smallest sizes is then tested, ignoring exports-ratio, and the mean difference between the highest and lowest exports-ratios is tested, ignoring firm size. The mean differences are 12.890% and 0.982%, respectively. While the first figure differ significantly from zero at the 5% level, the other is not. Therefore, only the firm size influences foreign ownership, but not the exports-ratio. This result is not consistent with that of the prior studies [13] [14] .

6. Conclusion

Foreign investment is vital to the development of emerging market economies. This study attempts to identify some firm-level determinants of FII ownership of Indian equity shares. The findings indicate that FIIs prefer to invest in equity shares of large firms and the valued stocks (high book-to-market value), due to information asymmetry. A further examination of weak evidence about firms with high export ratios revealed that FIIs prefer large firms with high export ratio relative to large firms with low export ratio. Finally, FIIs tend to hold shares of stocks with high beta. However, the evidence for this claim is mixed and weak.

Acknowledgements

I would like to thank the anonymous reviewer for the helpful comments.

Cite this paper

Hariprasad, B. (2016) FII Ownership in Indian Equity Se- curities: The Firm-Level Determinants. Theo- retical Economics Letters, 6, 917-926. http://dx.doi.org/10.4236/tel.2016.65095

References

- 1. Karolyi, A., Ng, D.T. and Prasad, E.S. (2013) The Coming Wave. Finance & Development, 30-33.

http://dx.doi.org/10.2139/ssrn.2289579 - 2. Dell’Ariccia, G., di Giovanni, J., Faria, A., Kose, A., Mauro, P., Ostry, J.D., et al. (2008) Reaping the Benefits of Financial Globalization. IMF Occasional Paper No. 264.

http://dx.doi.org/10.5089/9781589067486.084 - 3. Obstfeld, M. (2009) International Finance and Growth in Developing Countries: What Have We Learned? IMF Staff Papers, 56.

http://dx.doi.org/10.1057/imfsp.2008.32 - 4. Garg, R. and Dami, P. (2014) Foreign Portfolio Investment Flows to India: Determinants and Analysis. World Development, 59, 16-28.

http://dx.doi.org/10.1016/j.worlddev.2014.01.030 - 5. Solnik, B.H. (1974) An Equilibrium Model of the International Capital Market. Journal of Economic Theory, 8, 500-524.

http://dx.doi.org/10.1016/0022-0531(74)90024-6 - 6. French, K.R. and Poterba, J.M. (1991) Investor Diversification and International Equity Markets. American Economic Review (AEA Papers and Proceedings), 81, 222-226.

- 7. Tesar, L. and Werner, I.M. (1995) Home Bias and High Turnover. Journal of International Money and Finance, 14, 467-492.

http://dx.doi.org/10.1016/0261-5606(95)00023-8 - 8. Lewis, K.K. (1999) Trying to Explain Home Bias in Equities and Consumption. Journal of Economic Literature, 37, 571-608.

http://dx.doi.org/10.1257/jel.37.2.571 - 9. Falkenstein, E.G. (1996) Preferences for Stock Characteristics as Revealed by Mutual Fund Portfolio Holdings. Journal of Finance, 51, 111-135.

http://dx.doi.org/10.1111/j.1540-6261.1996.tb05204.x - 10. Coval, J.D. and Moskowitz, T.J. (1999) Home Bias at Home: Local Equity Preference in Domestic Portfolios. Journal of Finance, 54, 2045-2073.

http://dx.doi.org/10.1111/0022-1082.00181 - 11. Dahlquist, M. and Robertsson, G. (2001) Direct Foreign Ownership, Institutional Investors, and Firm Characteristics. Journal of Financial Economics, 59, 413-440.

http://dx.doi.org/10.1016/S0304-405X(00)00092-1 - 12. Brennan, M.J. and Cao, H.H. (1997) International Portfolio Investment Flows. Journal of Finance, 52, 1851-1880.

http://dx.doi.org/10.1111/j.1540-6261.1997.tb02744.x - 13. Lin, C.H. and Shiu, C.-Y. (2003) Foreign Ownership in the Taiwan Stock Market—An Empirical Analysis. Journal of Multinational Financial Management, 13, 19-41.

http://dx.doi.org/10.1016/S1042-444X(02)00021-X - 14. Kang, J.-K. and Stulz, R.M. (1997) Why Is There a Home Bias? An Analysis of Foreign Portfolio Equity Ownership in Japan. Journal of Financial Economics, 46, 3-28.

http://dx.doi.org/10.1016/S0304-405X(97)00023-8 - 15. Stulz, R.M. (1981) On the Effects of Barriers to International Investment. Journal of Finance, 36, 923-934.

http://dx.doi.org/10.1111/j.1540-6261.1981.tb04893.x - 16. Merton, R.C. (1987) A Simple Model of Capital Market Equilibrium with Incomplete Information. Journal of Finance, 42, 483-510.

http://dx.doi.org/10.1111/j.1540-6261.1987.tb04565.x - 17. Batten, J. and Vo, X.-V. (2015) Foreign Ownership in Emerging Stock Markets. Journal of Multinational Financial Management, 32-33, 15-24.

http://dx.doi.org/10.1016/j.mulfin.2015.05.001 - 18. Portes, R. and Rey, H. (2005) The Determinants of Cross-Border Equity Flows. Journal of International Economics, 65, 269-296.

http://dx.doi.org/10.1016/j.jinteco.2004.05.002 - 19. Hwang, K.-M., Park, D. and Shin, K. (2013) Capital Market Openness and Output Volatility. Pacific Economic Review, 18, 403-430.

http://dx.doi.org/10.1111/1468-0106.12031 - 20. Fama, E.F. and French, K.R. (1995) Size and Book-to-Market Factors in Earnings and Returns. Journal of Finance, 50, 131-155.

http://dx.doi.org/10.1111/j.1540-6261.1995.tb05169.x - 21. Lewellen, W.G., Stanley, K.L., Lease, R.C. and Schlarbaum, G.G. (1978) Some Direct Evidence on the Dividend Clientele Phenomenon. Journal of Finance, 33, 1385-1399.

http://dx.doi.org/10.1111/j.1540-6261.1978.tb03427.x - 22. Liljeblom, E., Loflund, A. and Hedvall, K. (2001) Foreign and Domestic Investors and Tax Induced Ex-Dividend Day Trading. Journal of Banking and Finance, 25, 1687-1716.

http://dx.doi.org/10.1016/S0378-4266(00)00148-5