Theoretical Economics Letters

Vol.05 No.04(2015), Article ID:58586,5 pages

10.4236/tel.2015.54059

Reference-Dependent Consumption with Endogenous Labor Supply

Lin Zhang

School of Economics, Kanazawa Seiryo University, Kanazawa-shi, Japan

Email: z-lin@seiryo-u.ac.jp

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 6 July 2015; accepted 2 August 2015; published 5 August 2015

ABSTRACT

This paper investigates time-consistent plans by incorporating the reference-dependent consumption model with endogenous labor supply. To what extent these plans can help the consumer overcome the double self-control problems of over-consumption and late-retirement is discussed. The consumption level and labor supply of the preferred personal equilibrium solution are compared with those of ex-ante optimal solution and present-biased solution. For all preferred personal equilibrium plans, both consumption level and labor supply are lower than those of the consumer who is present-biased but without reference-dependent preference. Although the preferred personal equilibrium solutions do not include the ex-ante optimal level, they help mitigate the welfare loss caused by present bias.

Keywords:

Reference-Dependent Preference, Endogenous Labor Supply, Time Consistency, Self-Control

1. Introduction

People usually desire immediate gratification but underrate the wellbeing in the future. This present-biased preference causes self-control problems. To overcome the self-control problem, internal commitment devices are often employed, such as goals and self-rewards (Hsiaw, 2013 [1] ; Koch et al., 2014 [2] ; Koch and Nafziger, 2011 [3] ).

An individual with present-biased preference suffers from double self-control problems of over-consumption and late-retirement (Diamond and Köszegi, 2003 [4] ; Zhang, 2013 [5] ). Meanwhile, reference-dependent preference (Köszegi and Rabin, 2009 [6] ) captures the feature that people derive utility by using rational expectations as the reference point. The inclusion of loss aversion which is rooted in the prospect theory (Kahneman and Tversky, 1979 [7] ) provides people with a motivation to overcome self-control problems. This paper aims to investigate that to what extent the double problems of over-consumption and late-retirement can be mitigated by a single time-consistent plan of an individual with reference-dependent consumption preference.

In this model, quasi-hyperbolic discounting is employed to approximate present-biased preference. The ex-ante perspective in the first period is optimal in the long run. In order to identify the time-consistent plan solution, referred as the preferred personal equilibrium (PPE) by Köszegi and Rabin (2009) [6] , this paper discusses the scenario that forms this equilibrium. This paper also investigates the PPE solutions corresponding to each degree of present bias by jointly considering consumption and working behavior. Through comparative statics, it is shown that these time-consistent plan solutions can alleviate the double self-control problems caused by present bias. However, the ex-ante optimal consumption plan is always time inconsistent, which is different from Köszegi and Rabin (2009) [6] .

The main novel point which makes the results of this paper different from Köszegi and Rabin (2009) [6] and other studies is that endogenous labor supply is incorporated. Hence, in this model the consumer who makes time-consistent plans is facing double self-control problems: over-consumption and late-retirement at the same time. Therefore, for a PPE consumption plan, the consumer does not only have to decide the consumption allocation, but also the retirement timing. In other words, the equilibrium consumption plans help a rational consumer regulate herself in two aspects: saving more and working shorter, but not back to the optimal level in the long run. In this context, this paper underlines the importance of rational plans, and also provides an explanation for that even if a rational individual can be failed in complete self-control.

Furthermore, the following novel points are also made. First, for a time-consistent PPE plan, the reference- dependent preference is a factor which helps the consumer overcome her self-control problem. In this model, the consumer is facing double problems, but her instrument (the plan, or the “goal” as in Hsiaw, 2013 [1] ; Koch et al., 2014 [2] ; Koch and Nafziger, 2011 [3] ) is only one. This paper shows that the single plan of consumption cannot help the consumer overcome the double self-control problems completely. This result is hardly ever discussed by the related studies. Second, the reference-dependent preference is domain dependent in that only the consumption involves gain-loss utility.

2. The Model

Consider a representative consumer who lives for three periods . In period 0, the consumer doesn’t

. In period 0, the consumer doesn’t

consume or work, but she can form a consumption plan for the next periods. The consumer decides labor supply l in period 1 with wage rate

given, and allocates the consumption between periods 1 and 2. Variable

given, and allocates the consumption between periods 1 and 2. Variable

(t = 1, 2) denotes the consumption level in each period. The intertemporal budget constraint is

(t = 1, 2) denotes the consumption level in each period. The intertemporal budget constraint is

. (1)

. (1)

The consumer has present-biased preference. Following Laibson (1997) [8] , her life-time utility function with quasi-hyperbolic discounting is

. (2)

. (2)

For simplicity, the long-run discount factor

is set to be 1. Present-bias parameter

is set to be 1. Present-bias parameter

captures the consumer’s impatience for immediate satisfaction. e(l) denotes the consumers disutility of working in period 1. Assume that the disutility function of working is convex

captures the consumer’s impatience for immediate satisfaction. e(l) denotes the consumers disutility of working in period 1. Assume that the disutility function of working is convex .

.

is the instantaneous utility of consumption in period t. Following Köszegi and Rabin (2009) [6] , I assume the preference of the consumer as follows.

is the instantaneous utility of consumption in period t. Following Köszegi and Rabin (2009) [6] , I assume the preference of the consumer as follows.

Assumption. The consumer has the reference-dependent preference on consumption. The instantaneous utility of consumption

consists of the following two terms

consists of the following two terms

(3)

(3)

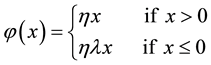

where

(4)

(4)

The first term

is the utility directly coming from the consumption in period t

is the utility directly coming from the consumption in period t . It is assumed that the consumption utility function is concave

. It is assumed that the consumption utility function is concave . The second term is the gain-

. The second term is the gain-

oss utility from comparing with the reference level . Note that

. Note that

In period 0, the consumer evaluates the consumption of period 1 and period 2 equally, and makes the optimal allocation of consumption from the ex-ante perspective. However, this ex-ante optimal consumption allocation may not be preferred by self-1 because of present-biased preference. As the interest of this paper, we consider the time-consistent plans that will be implemented eventually, which is consistent with preferred personal equilibrium PPE by Köszegi and Rabin (2009) [6] .

3. Consumption Plans with Endogenous Labor Supply

3.1. Consumption and Working Behavior

For self-0, the optimal consumption level

Note that

For a consumption plan

where

There could be four scenarios where period-1 consumption and labor supply deviate from the ex-ante optimal level (

When

In the neighborhood of the ex-ante optimal level

Since

Lemma 1. In the case of

Self-0 prefers a smooth allocation

tion plan because her loss aversion is strong. However, when

Lemma 2. In the case of

The consumer with present-biased preference has to work longer to get higher income. Working longer leads to higher income level for the whole life, but also higher immediate disutility. When

3.2. PPE Consumption Plans

In period 1, the present-biased preference causes the consumer to confront with two self-control problems: (1) how to allocate income; and (2) whether to work longer. Note that we consider endogenous labor supply, so consumption level and labor supply are simultaneously determined. Therefore, we have to jointly consider Lemma 1 and Lemma 2.

When

for the consumer in period 1. If the consumer in period 0 adopts it as the consumption plan, it will be implemented eventually, referred as the PPE consumption plan. With the same method, the other PPE consumption

plans under each condition (

Proposition 1.

(1) when

(2) when

(3) when

Remark 1. In this model with endogenous labor supply and reference-dependent preference, the ex-ante optimal level

Associating with different levels of present-bias discount factor

To investigate whether these could mitigate the two self-control problems, consider the case without reference-dependent consumption utility. In the case without gain-loss utility, the first-order conditions in period 1 read

Compare Equation (12) with the first-order conditions in Proposition 1, and since

Proposition 2. For all the PPE consumption plans, consumption level

By taking derivatives of first-order conditions under each case of

Proposition 3. For the PPE consumption plans, consumption level (

(1) when

(2) when

(3) when

According to Proposition 3, it is easy to show that for all PPE consumption plans, there exists a minimum value for period-1 consumption and labor supply when

Under the conditions of Equation (13), the consumption and labor supply are the closest to the ex-ante optimal level. And when

4. Conclusion

This paper incorporates endogenous labor supply into the model of reference-dependent consumption, and derives the consumption level and labor supply in the preferred personal equilibrium. It is shown that the PPE consumption plans can attenuate the double self-control problems caused by present-biased preference. The smooth consumption pattern which is optimal for the ex-ante utility is not a time-consistent plan.

Acknowledgements

The author acknowledges the financial support from Research Subsidy of Kanazawa Seiryo University.

Cite this paper

LinZhang, (2015) Reference-Dependent Consumption with Endogenous Labor Supply. Theoretical Economics Letters,05,503-508. doi: 10.4236/tel.2015.54059

References

- 1. Hsiaw, A. (2013) Goal-Setting and Self-Control. Journal of Economic Theory, 148, 601-626. http://dx.doi.org/10.1016/j.jet.2012.08.001

- 2. Koch, A.K., Nafziger, J., Suvorov, A. and Ven. J. (2014) Self-Reward and Personal Motivation. European Economic Review, 68, 15-167. http://dx.doi.org/10.1016/j.euroecorev.2014.03.002

- 3. Koch, A K. and Nafziger, J. (2011) Goals and Psychological Accounting. IZA Discussion Paper No. 5802.

- 4. Diamond, P. and Koszegi, B. (2003) Quasi-Hyperbolic Discounting and Retirement. Journal of Public Economics, 87, 1839-1872. http://dx.doi.org/10.1016/S0047-2727(02)00041-5

- 5. Zhang, L. (2013) Saving and Retirement Behavior under Quasi-Hyperbolic Discounting. Journal of Economics, 109, 57-71. http://dx.doi.org/10.1007/s00712-012-0302-8

- 6. Koszegi, B. and Rabin, M. (2009) Reference-Dependent Consumption Plans. American Economic Review, 99, 909-936. http://dx.doi.org/10.1257/aer.99.3.909

- 7. Kahneman, D. and Tversky, A. (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47, 263-291. http://dx.doi.org/10.2307/1914185

- 8. Laibson, D. (1997) Golden Eggs and Hyperbolic Discounting. Quarterly Journal of Economics, 112,443-477. http://dx.doi.org/10.1162/003355397555253

Appendix

When

Taking derivatives of

Equations (A2) and (A3) imply that a decrease in

NOTES

1See the Appendix for the other three scenarios.