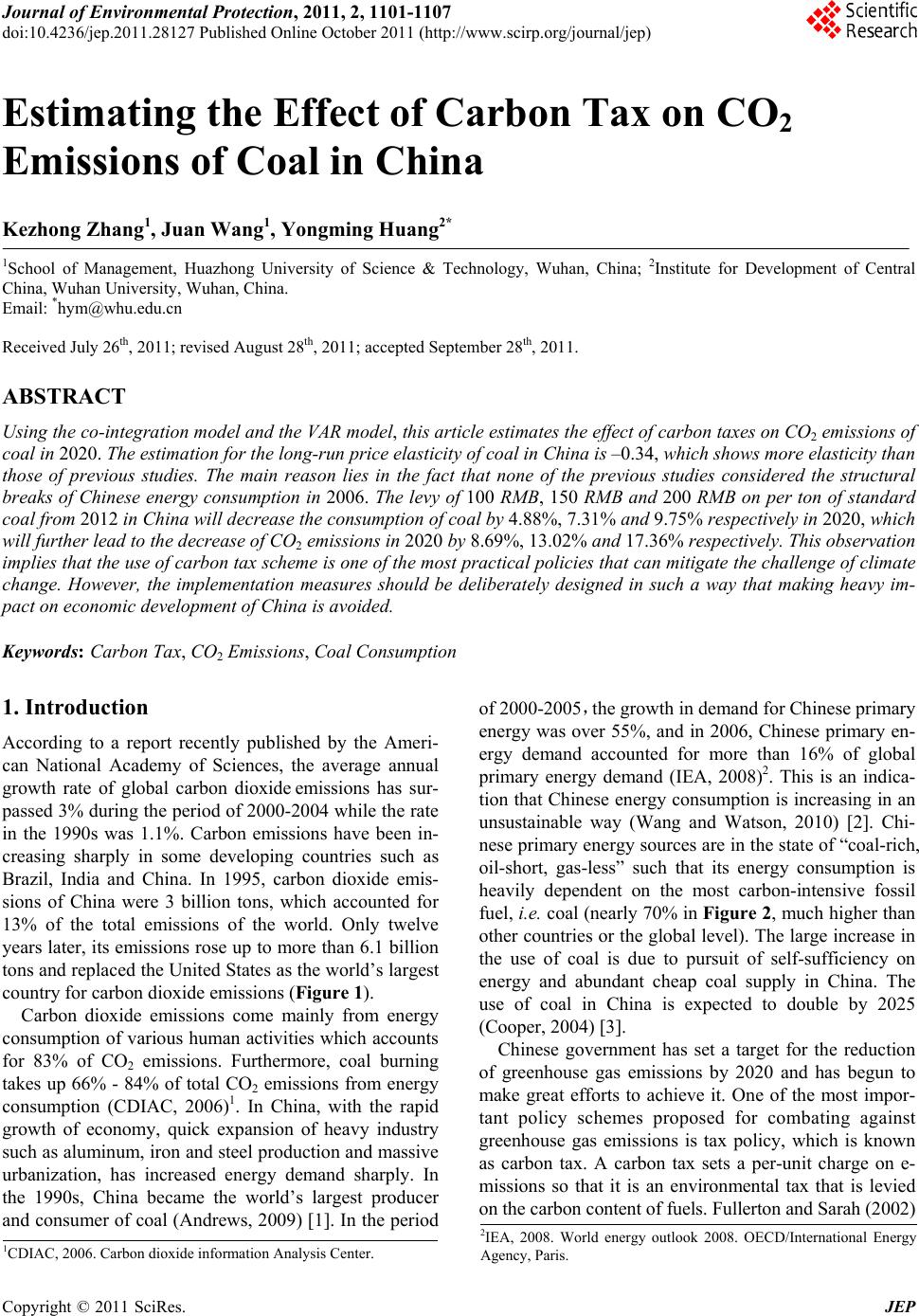

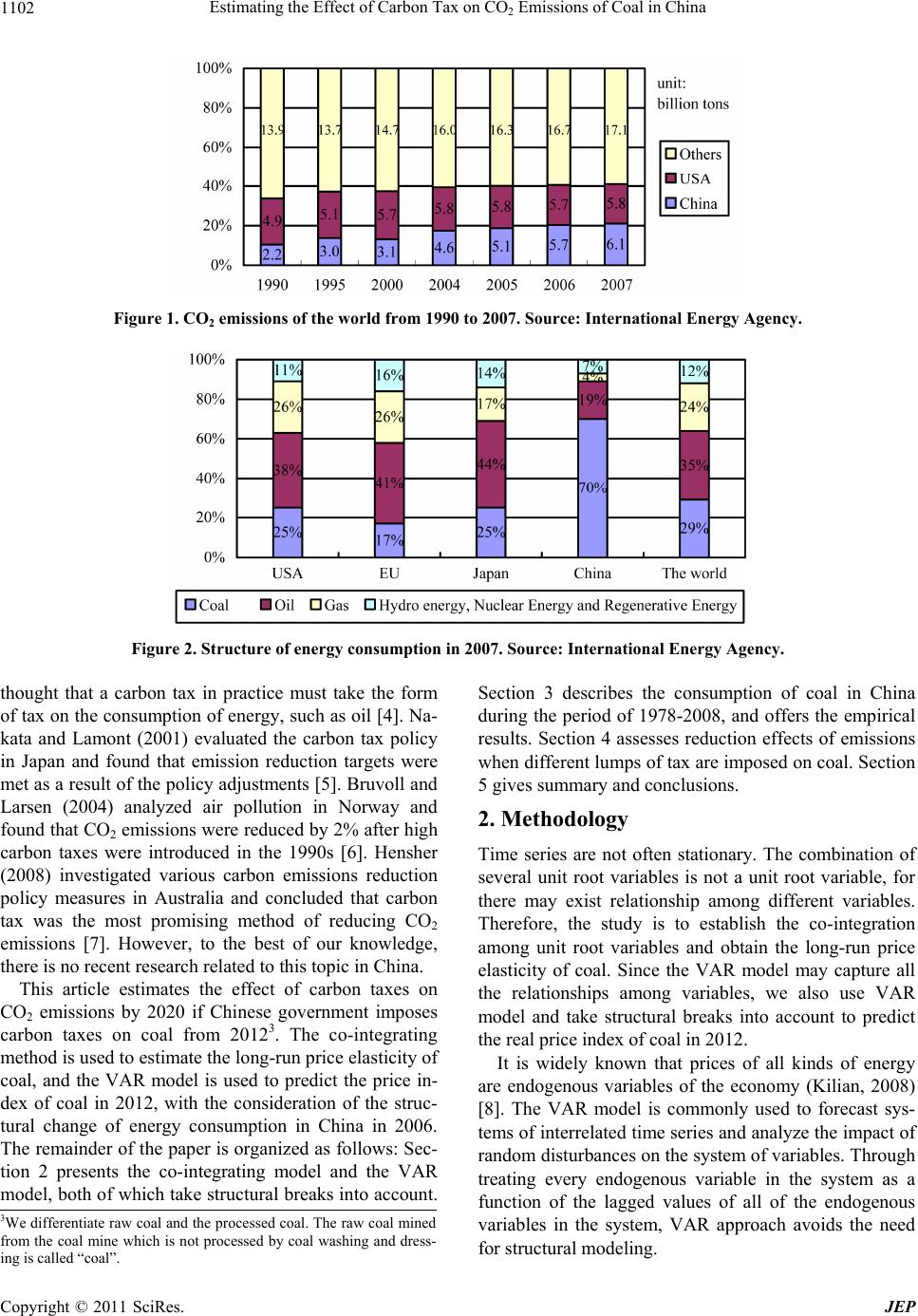

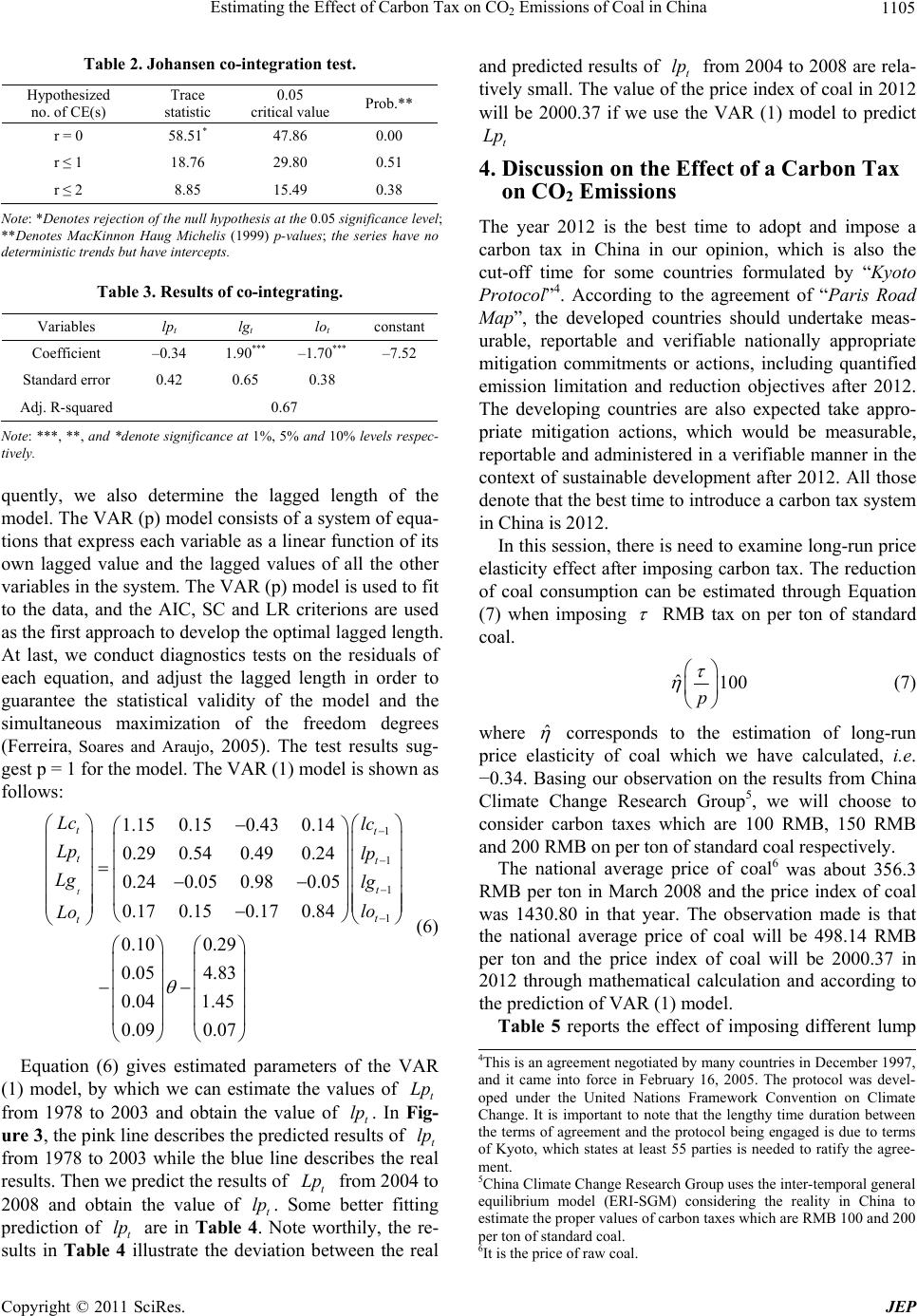

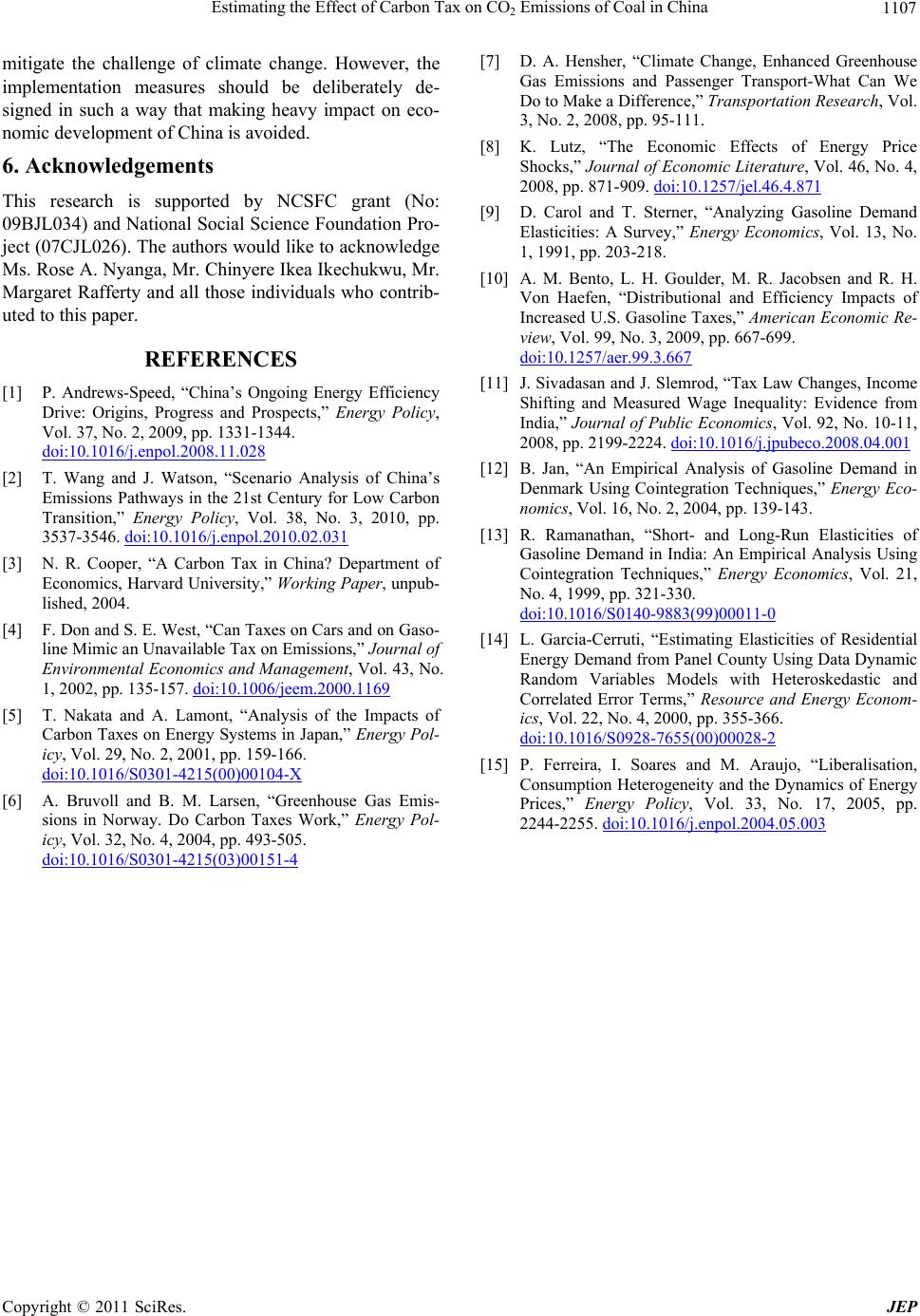

Journal of Environmental Protection, 2011, 2, 1101-1107 doi:10.4236/jep.2011.28127 Published Online October 2011 (http://www.scirp.org/journal/jep) Copyright © 2011 SciRes. JEP Estimating the Effect of Carbon Tax on CO2 Emissions of Coal in China Kezhong Zhang1, Juan Wang1, Yongming Huang2* 1School of Management, Huazhong University of Science & Technology, Wuhan, China; 2Institute for Development of Central China, Wuhan University, Wuhan, China. Email: *hym@whu.edu.cn Received July 26th, 2011; revised August 28th, 2011; accepted September 28th, 2011. ABSTRACT Using the co-integration model and the VAR model, this article estimates the effect of carbon taxes on CO2 emissions of coal in 2020. The estimation for the long -run price elasticity of coal in China is –0.34, which shows more elasticity tha n those of previous studies. The main reason lies in the fact that none of the previous studies considered the structural breaks of Chinese energy consumption in 2006. The levy of 100 RMB, 150 RMB and 200 RMB on per ton of standard coal from 2012 in China will decrease the consumption of coal by 4.88%, 7.31% and 9.75% respectively in 2020, whic h will further lead to the decrease of CO2 emissions in 2020 by 8.69%, 13.02% and 17.36% respectively. This observation implies that the use of carbon tax scheme is one of the most practical policies that can mitigate the challenge of climate change. However, the implementation measures should be deliberately designed in such a way that making heavy im- pact on economic development of China is avoided. Keywords: Carbon Tax, CO2 Emissions, Coal Consumption 1. Introduction According to a report recently published by the Ameri- can National Academy of Sciences, the average annual growth rate of global carbon dioxide emissions has sur- passed 3% during the period of 2000-2004 while the rate in the 1990s was 1.1%. Carbon emissions have been in- creasing sharply in some developing countries such as Brazil, India and China. In 1995, carbon dioxide emis- sions of China were 3 billion tons, which accounted for 13% of the total emissions of the world. Only twelve years later, its emissions rose up to more than 6.1 billion tons and replaced the United States as the world’s largest country for carbon dioxide emissions (Figure 1). Carbon dioxide emissions come mainly from energy consumption of various human activities which accounts for 83% of CO2 emissions. Furthermore, coal burning takes up 66% - 84% of total CO2 emissions from energy consumption (CDIAC, 2006)1. In China, with the rapid growth of economy, quick expansion of heavy industry such as aluminum, iron and steel production and massive urbanization, has increased energy demand sharply. In the 1990s, China became the world’s largest producer and consumer of coal (Andrews, 2009) [1]. In the period of 2000-2005,the growth in demand for Chinese primary energy was over 55%, and in 2006, Chinese primary en- ergy demand accounted for more than 16% of global primary energy demand (IEA, 2008)2. This is an indica- tion that Chinese energy consumption is increasing in an unsustainable way (Wang and Watson, 2010) [2]. Chi- nese primary energy sources are in the state of “coal-rich, oil-short, gas-less” such that its energy consumption is heavily dependent on the most carbon-intensive fossil fuel, i.e. coal (nearly 70% in Figure 2, much higher than other countries or the global level). The large increase in the use of coal is due to pursuit of self-sufficiency on energy and abundant cheap coal supply in China. The use of coal in China is expected to double by 2025 (Cooper, 2004) [3]. Chinese government has set a target for the reduction of greenhouse gas emissions by 2020 and has begun to make great efforts to achieve it. One of the most impor- tant policy schemes proposed for combating against greenhouse gas emissions is tax policy, which is known as carbon tax. A carbon tax sets a per-unit charge on e- missions so that it is an environmental tax that is levied on the carbon content of fuels. Fullerton and Sarah (2002) 2IEA, 2008. World energy outlook 2008. OECD/International Energy Agency, Paris. 1CDIAC, 2006. Carbon dioxide information Analysis Center.  Estimating the Effect of Carbon Tax on CO Emissions of Coal in China 1102 2 Figure 1. CO2 emissions of the world from 1990 to 2007. Source: International Energy Agency. Figure 2. Structure of energy consumption in 2007. Source: International Energy Agency. thought that a carbon tax in practice must take the form of tax on the consumption of energy, such as oil [4]. Na- kata and Lamont (2001) evaluated the carbon tax policy in Japan and found that emission reduction targets were met as a result of the policy adjustments [5]. Bruvoll and Larsen (2004) analyzed air pollution in Norway and found that CO2 emissions were reduced by 2% after high carbon taxes were introduced in the 1990s [6]. Hensher (2008) investigated various carbon emissions reduction policy measures in Australia and concluded that carbon tax was the most promising method of reducing CO2 emissions [7]. However, to the best of our knowledge, there is no recent research related to this topic in China. This article estimates the effect of carbon taxes on CO2 emissions by 2020 if Chinese government imposes carbon taxes on coal from 20123. The co-integrating method is used to estimate the long-run price elasticity of coal, and the VAR model is used to predict the price in- dex of coal in 2012, with the consideration of the struc- tural change of energy consumption in China in 2006. The remainder of the paper is organized as follows: Sec- tion 2 presents the co-integrating model and the VAR model, both of which take structural breaks into account. Section 3 describes the consumption of coal in China during the period of 1978-2008, and offers the empirical results. Section 4 assesses reduction effects of emissions when different lumps of tax are imposed on coal. Section 5 gives summary and conclusions. 2. Methodology Time series are not often stationary. The combination of several unit root variables is not a unit root variable, for there may exist relationship among different variables. Therefore, the study is to establish the co-integration among unit root variables and obtain the long-run price elasticity of coal. Since the VAR model may capture all the relationships among variables, we also use VAR model and take structural breaks into account to predict the real price index of coal in 2012. It is widely known that prices of all kinds of energy are endogenous variables of the economy (Kilian, 2008) [8]. The VAR model is commonly used to forecast sys- tems of interrelated time series and analyze the impact of random disturbances on the system of variables. Through treating every endogenous variable in the system as a function of the lagged values of all of the endogenous variables in the system, VAR approach avoids the need for structural modeling. 3We differentiate raw coal and the processed coal. The raw coal mined from the coal mine which is not processed by coal washing and dress- ing is called “coal”. C opyright © 2011 SciRes. JEP  Estimating the Effect of Carbon Tax on CO Emissions of Coal in China1103 2 Price is usually assumed as the basic variable which determines coal demand. In some other literatures, such as Dahl, Carol, Thomas Sterner (1991) [9], Kilian (2008), Bento, Goulder, Jacobsen and Roger (2009) [10], GDP was assumed as another macroeconomic controlled vari- able. Our model takes price and GDP as the main factors affecting the demand for coal. Besides, we also treat the consumption of oil as the controlled variable since it is an alternative for coal. In order to eliminate the factor of population expansion, we use per capita consumption and per capita GDP. There are four kinds of data: per capita consumption of coal, the fixed basic price index of coal in real terms, real per capita GDP, and per capita consumption of oil. All these variables are in logarithm form and denoted t, t, t and t respectively. It is easy to know the coefficient of is the price elas- ticity of coal. lc lp lg lo t lp Furthermore, we use the dummy variable to define the vital event concerning structural changes of energy consumption in the sample from 1978 to 2012. The State Council of the People’s Republic of China formally promulgated the first document for energy conservation in 2006, which explicitly announced the preferential taxation policies for energy saving. The taxation policy is a useful and efficient tool to promote energy saving and reduce pollution, and is often used to modify firm be- havior, especially in developing countries (Sivadasan and Slemrod, 2008) [11]. As coal will become more expen- sive in the long run, a lot of firms and households may adjust their demand for coal or choose some “cheaper and renewable” fuel as alternatives. Thus, we have 0,1978, 2005 1,2006, 2012 t t where denotes the time point of structural change, and [ ] denotes the period. The co-integrating equation used in this paper is 2006=t 01 23 4tttt lclp lg lot (1) where t is the residual and all the data for variables are annual. In order to test the property of each variable in the data, which is the order of integrating of the variables of Equation (1), we use the PP test and KPSS test to deter- mine the stationary of four variables t, t, t and t. The null hypothesis of PP test is non-stationary, while the null hypothesis of KPSS test is stationary. Af- ter estimating Equation (1), the unit root test is applied to the residual series lc lplg lo t as shown in Equation (2) 11 1 ˆˆ ˆ k tt it i where ˆt is the estimated residual of Equation (1), k is the number of lags making-up the residuals of Equation (2) to approximate a white noise process, and (if 1k 1k , 00 ). Subsequently, taking the structural change as exoge- nous variable, we use the residual-based co-integrating to examine whether all the variables have a stable relation- ship in a long term. Remark that all the variables should have the same order of integration in order to do the co-integrating regression. In this paper, the unit root tests indicate all variables that will be presented in the next section have the same order of integration. Some other studies have proved that there exists a co-integrating relationship between energy demand and macroeconomic variables for gasoline demand in Denmark (Bentzen, 2004) [12] and for gasoline demand in India (Ramana- than, 1999) [13]. If the residual series are stationary at a level after applying the unit root test, then we reject the hypothesis of ˆ=0 . The test statistics of Johansen co-integrating mainly have Trace Statistic. The null hy- pothesis of Trace Statistic means that the number of co-integrating equation(s) is r, otherwise, it is . The formula is k 1 ln 1 k tr i ir LRr kT (3) where i is the i-th characteristics root of a matrix ar- rayed in descending sequence. Then, the VAR model is used and the structural change is treated as exogenous variable to predict the price index of coal in 2012. The reduced form of VAR (q) model is 11tt ptpt yAyAyDx t (4) where is a vector of time series, 1t y×1K,, q A are × K matrices of coefficients to be estimated, t is a vector of exogenous variables, is the coefficients of exogenous variables and t D is vector of in- novations and unobservable zero mean white noise proc- ess which is also called forecast error. t ×1K may be con- temporaneously correlated but are uncorrelated with their own lagged values and uncorrelated with all variables in the right-hand side. The same logic applies in the more general VAR (p) model that allows for additional unrestricted delayed feedback among per capital coal consumption and its price index, per capital GDP, per capital oil consumption. All the variables are modified corresponding to a lagged order . Where , and p ,,, ttttt ylclplglo 1234 ,,, ttttt . Then, the structural form of the t (2) VAR (p) model is as follows: Copyright © 2011 SciRes. JEP  Estimating the Effect of Carbon Tax on CO2 Emissions of Coal in China Copyright © 2011 SciRes. JEP 1104 1 11 14 1 1 41 44 1 11 14 41 44 1 1 2 2 33 44 lg lg lg tt tt tt tt tp tp tp tp t t t t lc lc AA lp lp AA lo lo lc ZZ lp ZZ lo B B B B (5) contrast, according to PP test, the non-stationarity of the differentiated series can be rejected for t significant at the 10% level and other series at least significant at the 5% level. Meanwhile, based on the KPSS test, the sta- tionarity could not be rejected for all the differentiated series. According to the results of unit root test in Table 1, it is reasonable to assume that t, t, t and tare stationary after one differentiation, and they all have one unit root I(1). lc lplc lg lo Based on the results in Table 1, all the time series have the same order of integration which satisfies the requirement of co-integration regression. This results in the need to test the possibility of co-integration among the variables. Table 2 shows the results of the Johansen co-integration test if the fact that time series have no deterministic trends and the co-integration equations have intercepts is considered. With consideration of structural change in 2006 in China, the results indicate that there is one co-integrating relationship among the five variables at 5% significant level. Therefore, we get the stable relationship among , , and in the long run. t lc t lp t lg t lo where is the exogenous variable which presents structural change and is matrice of coefficients. In order to decide the length of lag period, we should consider the freedom degree of variables. The tools such as AIC and SC can be used. We apply information crite- ria to select proper model and determine the length of lag period for the VAR model. Smaller values of the infor- mation criterion are preferred. Besides, we also use the LR test to assist the PP test and KPSS test to verify the hypothesis that the coefficients on lag are jointly zero. Table 3 gives the regression results of normalized pa- rameters estimation. There exists a negative relationship between the per capita consumption and price index of coal in long run, just as our expectation. From Table 3, it is easy to deduce that the long-run price elasticity of coal is −0.34. The coefficient of t (column 3 of Table 3) is significantly different from zero at the 1% level, which indicates that per capita consumption of coal is positively correlated with real per capita GDP. In addition, column 4 of Table 3 illustrates that per capita consumption of coal is negatively correlated with per capita consumption of oil, which may be the result of an apparent substitu- tion effect. Some other studies, like Garcia-Cerruti (2000) [14] and Ferreira, Soares, Araujo (2005) [15], also de- tected negative cross-price elasticity between some types of energy. lg 3. Data and Empirical Results The period of sample covers 1978 to 2008, which is con- fined by the availability of data. All these data are in chronological. Data for price index of coal has not ap- peared in Price Yearbook of China until the recent years, so the data series available for this study starts from 1978. In the research, 1978 is defined as the base year for price index, and all the data series have eliminated the influ- ence of inflation. Data of coal and oil consumption are collected from the Chinese Energy Statistical Yearbook, and both are in million tons of standard coal equivalents. Data on population and GDP come from the Chinese Statistical Yearbook. In addition, the data on GDP are deflated on the basis of the price in 1978. VAR model is estimated on a set of stationary vari- ables. Table 1 indicates that all the variables have one unit root I (1), but the first difference series are stationary. So we can obtain the stationary data series by using cal- culus of differences, which can be denoted t, t, t and t respectively. The next step is to estimate the VAR (p) model using all the new variables. Conse- Lc Lp Lg Lo The empirical results in Table 1 does not establish sta- tionarity for the levels of anyone of the series, so the null hypothesis of a unit root in PP test is accepted while the null hypothesis of stationarity in KPSS test is rejected. In Table 1. Unit root test. lct① Lct② lpt① Lpt② lgt① Lgt② lot① Lot② PP –1.38 –2.75* –1.89 –3.14** –1.88 –3.13** –3.14 –3.75** KPSS 0.13* 0.21 0.12* 0.17 0.18** 0.13 0.16** 0.35 Note: ***, **, and *denotes significance at 1%, 5% and 10% levels resp ectively; L() denotes first difference; ①Denotes the variables contain intercept and trend; ②Denotes the variables contain intercept only.  Estimating the Effect of Carbon Tax on CO Emissions of Coal in China1105 2 Table 2. Johansen co-integration test. Hypothesized no. of CE(s) Trace statistic 0.05 critical value Prob.** r = 0 58.51* 47.86 0.00 r ≤ 1 18.76 29.80 0.51 r ≤ 2 8.85 15.49 0.38 Note: *Denotes rejection of the null hypothesis at the 0.05 significance level; **Denotes MacKinnon Haug Michelis (1999) p-values; the series have no deterministic t rends but have intercepts. Table 3. Results of co-integrating. Variables lpt lgt lot constant Coefficient –0.34 1.90*** –1.70*** –7.52 Standard error 0.42 0.65 0.38 Adj. R-squared 0.67 Note: ***, **, and *denote significance at 1%, 5% and 10% levels r espec- tively. quently, we also determine the lagged length of the model. The VAR (p) model consists of a system of equa- tions that express each variable as a linear function of its own lagged value and the lagged values of all the other variables in the system. The VAR (p) model is used to fit to the data, and the AIC, SC and LR criterions are used as the first approach to develop the optimal lagged length. At last, we conduct diagnostics tests on the residuals of each equation, and adjust the lagged length in order to guarantee the statistical validity of the model and the simultaneous maximization of the freedom degrees (Ferreira, Soares and Araujo, 2005). The test results sug- gest p = 1 for the model. The VAR (1) model is shown as follows: 1 1 1 1 1.150.150.43 0.14 0.290.54 0.49 0.24 0.240.05 0.980.05 0.17 0.150.17 0.84 0.10 0.29 0.05 4.83 0.04 1.45 0.09 0.07 t tt tt t t t Lc lc Lp lp Lg lg lo Lo (6) Equation (6) gives estimated parameters of the VAR (1) model, by which we can estimate the values of t from 1978 to 2003 and obtain the value of t. In Fig- ure 3, the pink line describes the predicted results of t from 1978 to 2003 while the blue line describes the real results. Then we predict the results of t from 2004 to 2008 and obtain the value of t. Some better fitting prediction of t are in Table 4. Note worthily, the re- sults in Table 4 illustrate the deviation between the real Lp lp lp Lp lp lp and predicted results of t from 2004 to 2008 are rela- tively small. The value of the price index of coal in 2012 will be 2000.37 if we use the VAR (1) model to predict lp t Lp 4. Discussion on the Effect of a Carbon Tax on CO2 Emissions The year 2012 is the best time to adopt and impose a carbon tax in China in our opinion, which is also the cut-off time for some countries formulated by “Kyoto Protocol”4. According to the agreement of “Paris Road Map”, the developed countries should undertake meas- urable, reportable and verifiable nationally appropriate mitigation commitments or actions, including quantified emission limitation and reduction objectives after 2012. The developing countries are also expected take appro- priate mitigation actions, which would be measurable, reportable and administered in a verifiable manner in the context of sustainable development after 2012. All those denote that the best time to introduce a carbon tax system in China is 2012. In this session, there is need to examine long-run price elasticity effect after imposing carbon tax. The reduction of coal consumption can be estimated through Equation (7) when imposing RMB tax on per ton of standard coal. ˆ100 p (7) where ˆ corresponds to the estimation of long-run price elasticity of coal which we have calculated, i.e. −0.34. Basing our observation on the results from China Climate Change Research Group5, we will choose to consider carbon taxes which are 100 RMB, 150 RMB and 200 RMB on per ton of standard coal respectively. The national average price of coal6 was about 356.3 RMB per ton in March 2008 and the price index of coal was 1430.80 in that year. The observation made is that the national average price of coal will be 498.14 RMB per ton and the price index of coal will be 2000.37 in 2012 through mathematical calculation and according to the prediction of VAR (1) model. Table 5 reports the effect of imposing different lump 4This is an agreement negotiated by many countries in December 1997, and it came into force in February 16, 2005. The protocol was devel- oped under the United Nations Framework Convention on Climate Change. It is important to note that the lengthy time duration between the terms of agreement and the protocol being engaged is due to terms of Kyoto, which states at least 55 parties is needed to ratify the agree- ment. 5China Climate Change Research Group uses the inter-temporal general equilibrium model (ERI-SGM) considering the reality in China to estimate the proper values of carbon taxes which are RMB 100 and 200 er ton of standard coal. 6It is the price of raw coal. Copyright © 2011 SciRes. JEP  Estimating the Effect of Carbon Tax on CO Emissions of Coal in China 1106 2 Figure 3. The contrast between real results and predicted results from 1978 to 2003. Table 4. The real and predicted results of lpt from 2004 to 2008. 2004 2005 2006 2007 2008 Real results 6.67 6.86 6.92 6.94 7.20 Predicted results 6.66 6.83 6.93 7.02 7.11 Deviation 0.01 0.03 0.01 0.08 0.09 Table 5. The effect of different carbon taxes on CO2 emissions in 2020 if levying from 2012. RMB 100 per ton of standard coalRMB 150 per ton of standard coal RMB 200 per ton of standard coal Coal consumption (in percent) –4.88 –7.31 –9.75 CO2 emissions (in percent) –8.69 –13.02 –17.36 of tax on CO2 emissions. The estimation denotes that the levy of 100 RMB on per ton of standard coal in 2012 (i.e. RMB 100 × 0.7143 = RMB 71.43 per ton of raw coal)7 will reduce the consumption of coal by 4.88% in 2020. The levy of 150 RMB or 200 RMB on per ton of stan- dard coal in 2012 will decrease the consumption of coal by 7.31% or 9.75% in 2020 respectively (see row 1 of Table 5). Then we can compute the effect of such a pol- icy on CO2 emissions. According to the study of the En- ergy research institute of national development and re- form commission, the total percentage change in CO2 emissions of China is calculated by multiplying the coal consumption effect by 0.486. Hence, the decrease in CO2 emissions in 2020 is obtained when carbon taxes begin to impose on coal from 2012 (Table 5). The above estimation of decrease of CO2 emissions only considered charging tax on coal. If other energy consumption such as oil and gas are taken into consid- eration, the whole effect could be much bigger. Further- more, the uncertainty factors in future may have influ- ence on the estimated results because our prediction is based on historical data. However, the price elasticity of coal estimated by co-integration model is still of signifi- cance as it reflects the long-run equilibrium relationship. Since more renewable energy and more efficient fuel production methods can be expected, some of which may not even be available when the tax is levied from 2012. The reduction effect of CO2 emissions may be more op- timistic than the predicted results in Table 5. Further more, numerous households would become more con- scious to energy conservation and may prefer to use a more fuel-efficient lifestyle. Up coming innovations and new energy sources will also reduce the consumption of the fossil fuel. 5. Conclusions Using the co-integration model and the VAR model, this article estimates the effect of carbon taxes on CO2 emis- sions of coal in 2020. The estimation for the long-run price elasticity of coal in China is –0.34, which shows more elasticity than those of previous studies. The main reason lies in the fact that none of the previous studies considered the structural breaks of Chinese energy con- sumption in 2006. The levy of 100 RMB, 150 RMB and 200 RMB on per ton of standard coal from 2012 in China will decrease the consumption of coal by 4.88%, 7.31% and 9.75% respectively in 2020, which will further lead to the decrease of CO2 emissions in 2020 by 8.69%, 13.02% and 17.36% respectively. 7In China, there exist many kinds of energy sources which vary in calories, people set the unit of standard coal which is 7000 kilocalorie er kg (29,306 J) in order to facilitate comparing and studying in the aggregate, so 1kg raw coal = 0.7143 kg standard coal. The above observation implies that the use of carbon tax scheme is one of the most practical policies that can C opyright © 2011 SciRes. JEP  Estimating the Effect of Carbon Tax on CO Emissions of Coal in China1107 2 mitigate the challenge of climate change. However, the implementation measures should be deliberately de- signed in such a way that making heavy impact on eco- nomic development of China is avoided. 6. Acknowledgements This research is supported by NCSFC grant (No: 09BJL034) and National Social Science Foundation Pro- ject (07CJL026). The authors would like to acknowledge Ms. Rose A. Nyanga, Mr. Chinyere Ikea Ikechukwu, Mr. Margaret Rafferty and all those individuals who contrib- uted to this paper. REFERENCES [1] P. Andrews-Speed, “China’s Ongoing Energy Efficiency Drive: Origins, Progress and Prospects,” Energy Policy, Vol. 37, No. 2, 2009, pp. 1331-1344. doi:10.1016/j.enpol.2008.11.028 [2] T. Wang and J. Watson, “Scenario Analysis of China’s Emissions Pathways in the 21st Century for Low Carbon Transition,” Energy Policy, Vol. 38, No. 3, 2010, pp. 3537-3546. doi:10.1016/j.enpol.2010.02.031 [3] N. R. Cooper, “A Carbon Tax in China? Department of Economics, Harvard University,” Working Paper, unpub- lished, 2004. [4] F. Don and S. E. West, “Can Taxes on Cars and on Gaso- line Mimic an Unavailable Tax on Emissions,” Journal of Environmental Economics and Management, Vol. 43, No. 1, 2002, pp. 135-157. doi:10.1006/jeem.2000.1169 [5] T. Nakata and A. Lamont, “Analysis of the Impacts of Carbon Taxes on Energy Systems in Japan,” Energy Pol- icy, Vol. 29, No. 2, 2001, pp. 159-166. doi:10.1016/S0301-4215(00)00104-X [6] A. Bruvoll and B. M. Larsen, “Greenhouse Gas Emis- sions in Norway. Do Carbon Taxes Work,” Energy Pol- icy, Vol. 32, No. 4, 2004, pp. 493-505. doi:10.1016/S0301-4215(03)00151-4 [7] D. A. Hensher, “Climate Change, Enhanced Greenhouse Gas Emissions and Passenger Transport-What Can We Do to Make a Difference,” Transportation Research, Vol. 3, No. 2, 2008, pp. 95-111. [8] K. Lutz, “The Economic Effects of Energy Price Shocks,” Journal of Economic Literature, Vol. 46, No. 4, 2008, pp. 871-909. doi:10.1257/jel.46.4.871 [9] D. Carol and T. Sterner, “Analyzing Gasoline Demand Elasticities: A Survey,” Energy Economics, Vol. 13, No. 1, 1991, pp. 203-218. [10] A. M. Bento, L. H. Goulder, M. R. Jacobsen and R. H. Von Haefen, “Distributional and Efficiency Impacts of Increased U.S. Gasoline Taxes,” American Economic Re- view, Vol. 99, No. 3, 2009, pp. 667-699. doi:10.1257/aer.99.3.667 [11] J. Sivadasan and J. Slemrod, “Tax Law Changes, Income Shifting and Measured Wage Inequality: Evidence from India,” Journal of Public Economics, Vol. 92, No. 10-11, 2008, pp. 2199-2224. doi:10.1016/j.jpubeco.2008.04.001 [12] B. Jan, “An Empirical Analysis of Gasoline Demand in Denmark Using Cointegration Techniques,” Energy Eco- nomics, Vol. 16, No. 2, 2004, pp. 139-143. [13] R. Ramanathan, “Short- and Long-Run Elasticities of Gasoline Demand in India: An Empirical Analysis Using Cointegration Techniques,” Energy Economics, Vol. 21, No. 4, 1999, pp. 321-330. doi:10.1016/S0140-9883(99)00011-0 [14] L. Garcia-Cerruti, “Estimating Elasticities of Residential Energy Demand from Panel County Using Data Dynamic Random Variables Models with Heteroskedastic and Correlated Error Terms,” Resource and Energy Econom- ics, Vol. 22, No. 4, 2000, pp. 355-366. doi:10.1016/S0928-7655(00)00028-2 [15] P. Ferreira, I. Soares and M. Araujo, “Liberalisation, Consumption Heterogeneity and the Dynamics of Energy Prices,” Energy Policy, Vol. 33, No. 17, 2005, pp. 2244-2255. doi:10.1016/j.enpol.2004.05.003 Copyright © 2011 SciRes. JEP

|