Applied Mathematics, 2011, 2, 1309-1312 doi:10.4236/am.2011.210182 Published Online October 2011 (http://www.SciRP.org/journal/am) Copyright © 2011 SciRes. AM A Note on Change Point Detection Using Weighted Least Square Reza Habibi Department of St at istics, Central Bank of Iran, Tehran, Iran E-mail: rezahabibi2681@yahoo.com Received July 3, 2011; revised July 14, 2011; accepted July 22, 2011 Abstract This paper is concerned with the application of weighted least square method in change point analysis. Test- ing shift in the mean normal observations with time varying variances as well as of a GARCH time series are considered. For both cases, the weighted estimators are given and their asymptotic behaviors are studied. It is also described that how the resampling methods like Monte Carlo and bootstrap may be applied to compute the finite sample behavior of estimators. Keywords: Bootstrap, Brownian Bridge, Change Point, GARCH Series, Testing Shift, Monte Carlo, Weighted Least Square 1. Introduction Change point analysis has been received considerable attentions in statistical literatures. This topic is studied from the frequentist and Bayesian point of view, by pa- rametric and nonparametric approaches, with univariate and multivariate observations and in independent and correlated data. Three important references are Csorgo and Horvath [1], Chen and Gupta [2 ] and Khodadad i and Asgharian [3]. Bai [4] tested shift in mean of a linear process using the ordinary LS (OLS) approach. In many practical situations, however, it is advised to apply the weighted LS (WLS). In the current paper, we consider the WLS method for change point detection. The ap- proach of derivation test statistics is similar to Bai [4], however, it is described briefly, as follows. Suppose that 1,, n x is a sequence of observations such that ,1,2,, iii , Ex in where 1, i Ex for and 20 =1,, ,ik, n for 0 Let i, be non-negative numbers and called them weights. To make inference about 1,, .n 1, ik w1, 2,,i 2 and 0 it is enough to minimize 1i with respect to ,k 2 ii i wx Ex n 1, 2 and Note that 0.k 0 22 1 111 0 . k n ii iiiii iiik wx Exwxwx For a fixed 1, ,1,kn define 111 ˆ, kk kii ii wx w i and 2=1 =1 ˆ= n kii ik i wx w . k i Following Bai [4] (WLS estimation of is the minimizer of ˆ k 0)k 22 ˆ2 1 11 ˆˆ . kn iiii k k iik wx wx One can see that is the maxi mizer ( arg max) o f given by ˆ kk v ˆ2 1 ˆˆ 1, kkk k k vpp at which 11 . kn ki ii pw i w Therefore, the WLS estimate of 1 is ˆ 11 ˆˆ . k To write 22 ˆˆ k , it is enough to replace ˆ =1 k i with in ˆ =1 n ik 1 ˆ. The large values of test statistic 11 , max k kn Tv 2 2 n rejects the null hypothesis of no change point 01 2 :H versus 11 2 : H In practice, i’s may be determi- nistic or random. They can be known or they may be function of unknown parameters (see the Example 2, as follows). In these cases, they are replaced by their esti- mations ’s and consequently, ’s are changed to w k p ˆi w  1310 R. HABIBI ˆk p’s. Under the null hypothesis, the plot of k against the number of observation k oscillates around zero. It re- mains between two specified boundaries (horizontal lines) with high probability. When there is a change in mean, the plot of v k v creates a peak out of a boundary (see the following examples). Two horizontal lines (in examples) are obtained by the simulating null distribution using the Monte Carlo method. We can detect the change if T ex- ceeds the boundary value at 0. This suggests that the change point estimator is given by k 11 ˆargmax . nkn kv k t Remark 1. This problem also appears in continuous time processes cases. Suppose that t denote the time (in continuous case) price of a specified stock. Let The Black Scholes formula implies that S t = log. t US , tt tt dUdt dW where t is a Brownian motion over W 0,tT. Here, we assume that t follows a GARCH(1,1) process and the mean process t has a change point in . Suppose that the process is observed at equidistant discrete times 0, with n t t 1n t U 01 ni tt tT i U and .T n n For simplicity reasons, we write it i U , , it i WWt ii and . t ii Also, we assume that t is one of i t’s. The Euler approximation to the solu- tion of above SDE is 11 . ii iniii UU WW Let and Then 11inii VUU 1/2 iinii V 1/2 1. in ii WW with i is a GARCH (1,1) defined in above. Example 1. Shift in mean, time varying variances. Change point detection in the mean of normal observa- tions is studied well, see Khodadadi and Asgharian [3]. An crucial assumption in this problem is fixing the vari- ances after and before change point. Change point detec- tion in variance of normal observations is another inde- pendent inferential problem. Change point detection in mean and variance at the same time is also studied. In this example, we consider the change point detection in mean when 2 var , ii Here, 1, 2,,.in2 =1 i wi and 2 k 2 . n 11 kii ii p The plots of k v under 0 (Figure 1, page 6) and under 1 (Figure 2, page 6) are given as follows. Here, n = 100, 0 1 30,k0, 22 and 2. iin The two horizontal lines are obtained by a Monte Carlo with repe- titions. 3.13000R Remark 2. In above example, let Then our procedure reduces to test statistic proposed by Bai 22 1. i 0 20406080100 -1.0 -0.50.00.5 Figure 1. Time-varying-variance: H0. 0 20406080100 -30 -25 -20 -15 -10-5 Figure 2. Time-varying-variance: H1. [4]. By the way, we let The two 1,, ~0,1. iid n wwU horizontal action lines are . The plot of un- der 2.575k v 1 (Figure 3, page 6) when 1 100,n0 and 22 shows that our method works well again. Example 2. Shift in mean, GARCH process. Lee et al. [5] studied change point analysis in regression models wit h ARC H erro rs. They u sed t he max imum o f CU SUM of square, based on estimated residuals, as test statistic. Here, we use the WLS method to change point detection in mean of GARCH process. Assume that i ’s come from a GARCH process, that is iii (,)pq ,h where , i 1, 2,i are iid random variables with zero mean and unit variance. The conditional variance ’s are given by i h 0, ii hBB i h where 1q q BB B and Copyright © 2011 SciRes. AM  R. HABIBI 1311 1 p BB B with 1 If we want to apply the above mentioned method here, we should let . ii Bxx =1 . ii wh To see this, note that it is enough to minimize 02 22 2 1 11 1 0 11 k nn iii ii ii ik hx hx 2 2 , with respect to unknown parameters. Therefore, =1 ii wh. In practice, ’s are unknown and they are replaced by their estimations The two horizontal action lines are . The plot of under 1 2 i h2 ˆ. i h 2.876k v (Figure 4, page 6) when 0 1 1000, kn 300,1 and 23 shows that our method works well again. The error process i is GARCH(1,1) when 00.01 , 10.05 and 10.9. Since 11 <1 the GARCH series is stationary. In the next section, we study the application of bootstrap method in our problem. 020406080100 -6 -4 -20 Figure 3. Constant variance: H1. 0200 400 600 8001000 -20 -15 -10-50 Figure 4. GARCH series: H1. 2. Bootstrap Method The WLS estimators appear, again, in bootstrap infer- ence case. Bootstrap methods are strong practical solu- tions to the complicated problems. Chatterjee and Bose [6] proposed generalized bootstrap for estimating equa- tions by imposing random weights (say multinomial weights for paired bootstrap) to the system of estimating equations. As stated by Chatterjee and Bose [6], this is equivalent to include the random weights to the original LS (or WLS) objective function. However, Chatterjee and Bose [6] didn’t consider the change point version of their work. To extend work of Chatterjee and Bose [6] to the change point analysis, note that the bootstrapped WLS estimators of , 1 2 and 0 are the minimiz- ers ofk 022 12 00 11 0 . kn ik iiik ii iik uwx uwx The bootstrap estimator of change point (ˆ k) is the minimizer of 022 12 00 0 =1=1 0 ˆˆ , kn BB ik iikik iik iik uwx uwx 0 over 01, ,1kn . In the current formula, 00 100 0 11 ˆ, kk B kikii iki ii uwxuw and 21 00 00 ˆ. nn B kikii iki ik ik uwxuw 1 0 Finally, ˆ ˆˆ ,1,2 B iB ik Bi . In above formulas, random vectors 100 ,, kkk Uu u0 and specify the type of bootstrap method. For example for classical paired bootstrap has U multinomial distribution with parameters 1, 00 0 ,, kk nk Uu u 00 0 ,1, ,1kk k and U is distributed as multinomial with parameters 00 0 ,1,,1kk k , at which 00 .knk Under the null hypothesis, since 0,kn it is enough to let has multino- mial distribution with parameters ,UUU ,1 ,,1nn n. As it is stated by Chatterjee and Bose [6], the other bootstrap methods in the literatures like the Bayesian bootstrap, the deleted d-jackknives, and the bootstrap clone are also special cases of the above bootstrap formulation. By running the bootstrap method to data, and computing the above formula, one can derive the bootstrap quantile of weighted test statistic. Also, one can remove the bias of test statistic and construct confidence intervals based on Copyright © 2011 SciRes. AM  R. HABIBI Copyright © 2011 SciRes. AM 1312 bootstrap, we have done these calculations and it has been seen that the results are very good. Interested reader can refer to Habibi [7]. 3. References [1] M. Csorgo and L. Horvath, “Limit Theorems in Phange- Point Analysis,” Wiley & Sons, New York, 1997. [2] J. Chen and A. K. Gupta, “Parametric Statistical Change Point Analysis,” Birkhäuser, Basel, 2000. [3] A. Khodadadi and M. Asgharian, “Change Point Problem and Regression: An Annotated Bibliography,” Technical Report, McGill University, Montreal, 2004. [4] J. Bai, “Least Squares Estimation of a Shift in Linear Processes,” Journal of Time Series Analysis, Vol. 15, No. 5, 1994, pp. 453-472. doi:10.1111/j.1467-9892.1994.tb00204.x [5] S. Lee, Y. Tokutsu and K. Maekawa, “The CUSUM Test for Parameter Change in Regression Models with ARCH Errors,” Journal of Japan Statistical Society, Vol. 3, 2004, pp. 173-186. [6] S. Chatterjee and A. Bose, “Generalized Bootstrap for Estimating Equations,” Annals of Statistics, Vol. 33, No. 1, 2005, pp. 414-436. doi:10.1214/009053604000000904 [7] R. Habibi, “Change Point Detection Using Weighted Least Square,” Technical Report, Central Bank of Iran, 2010.

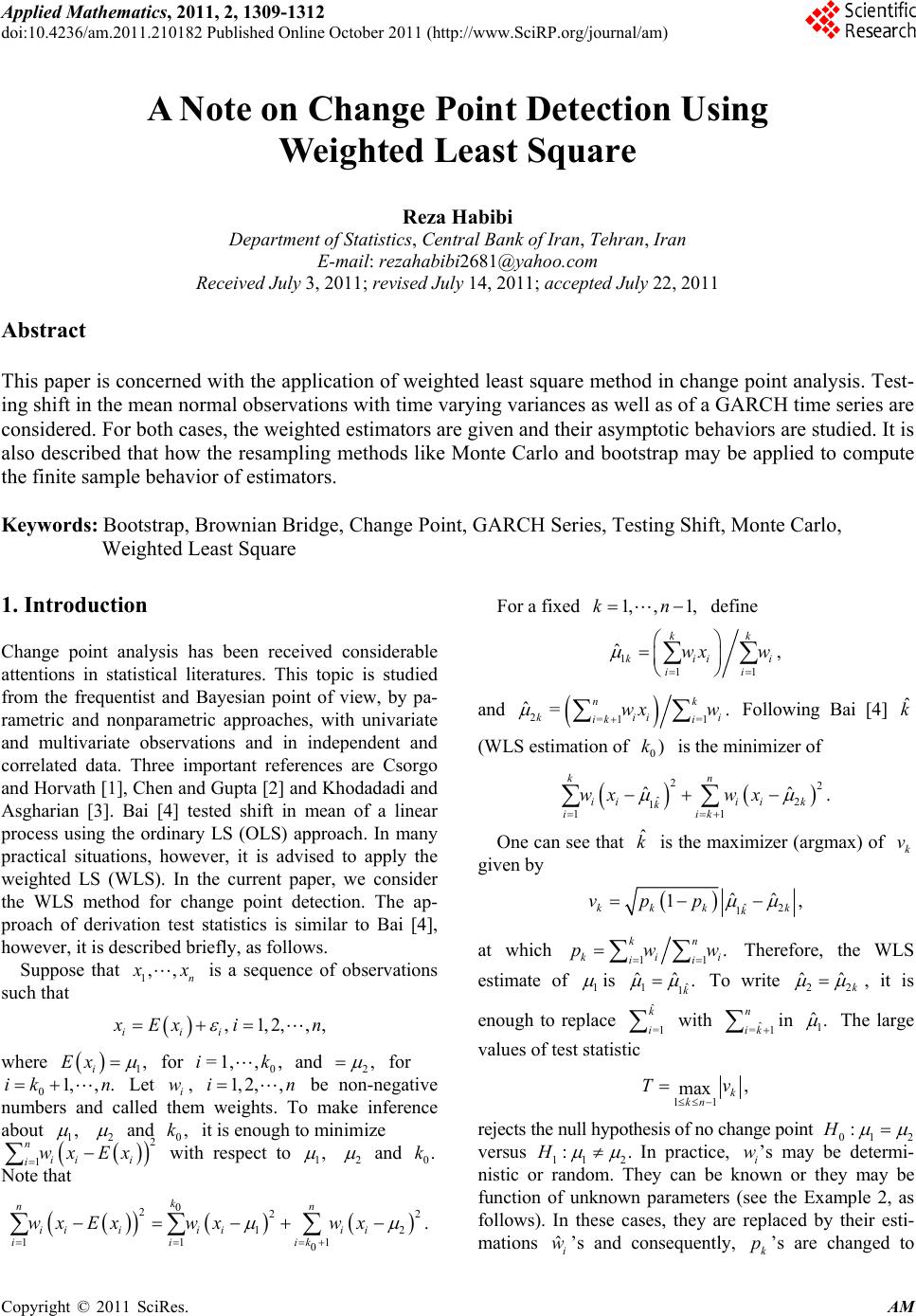

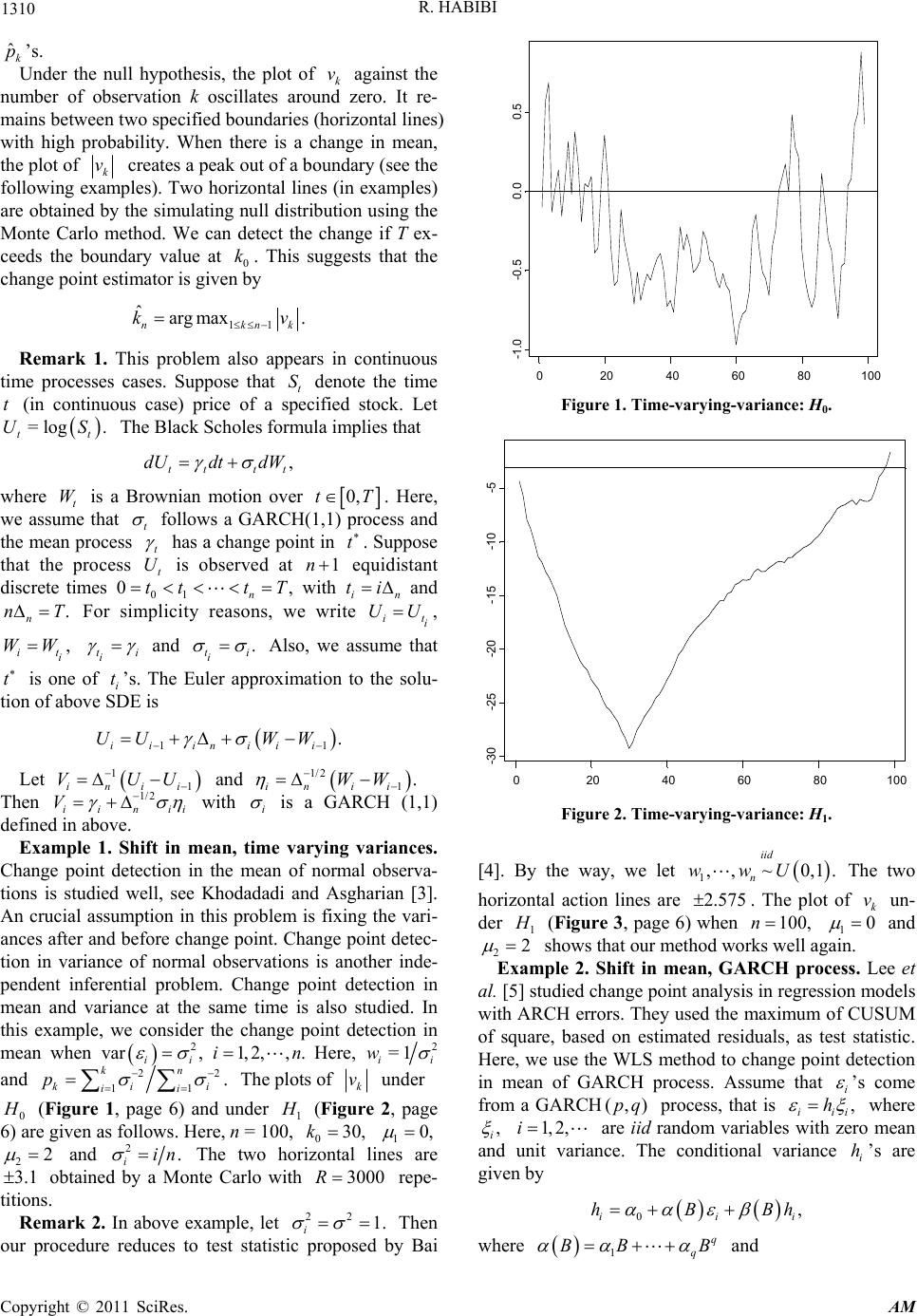

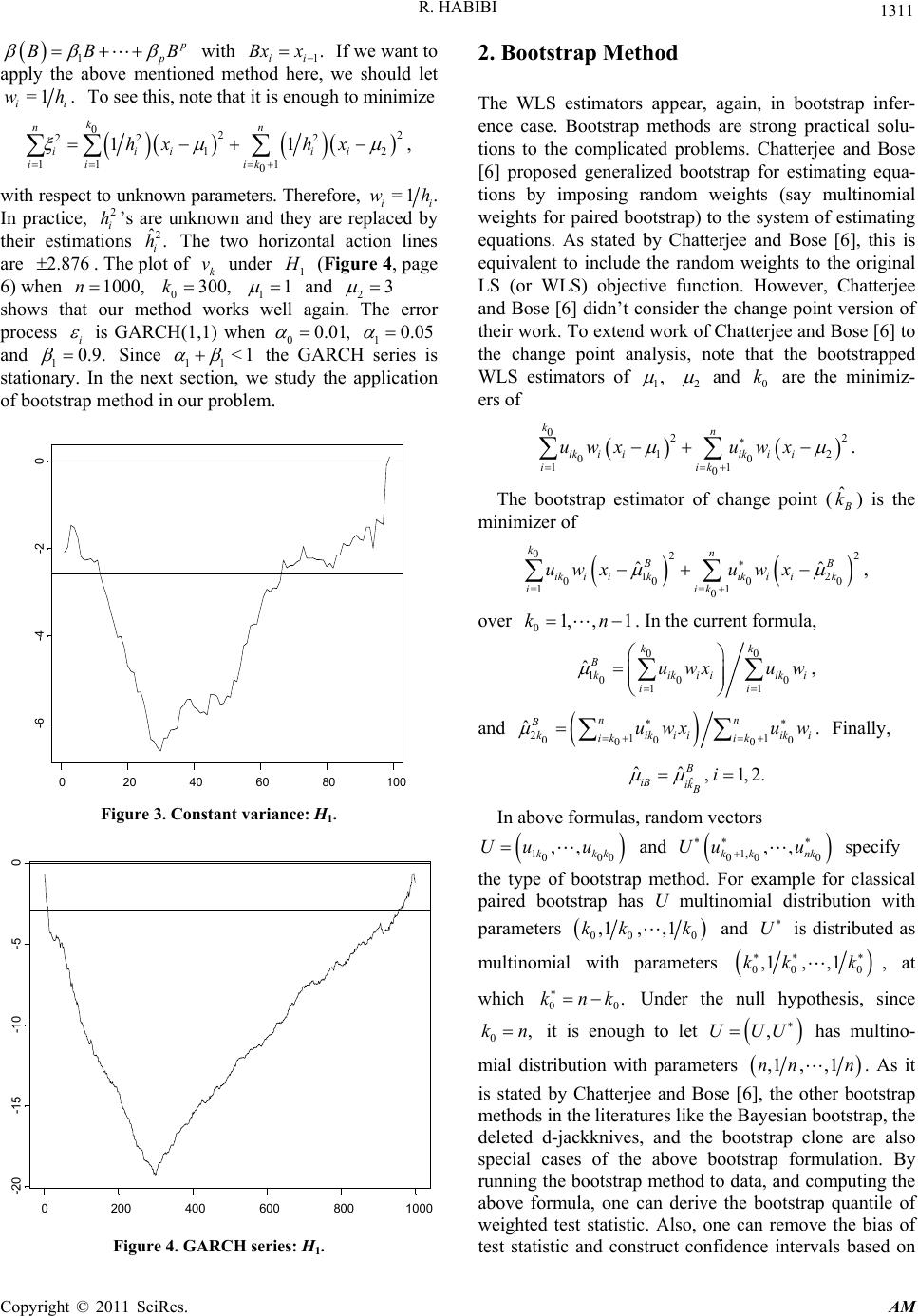

|