East Asian Economic Growth—An Evolutionary Perspective

Copyright © 2011 SciRes. JSSM

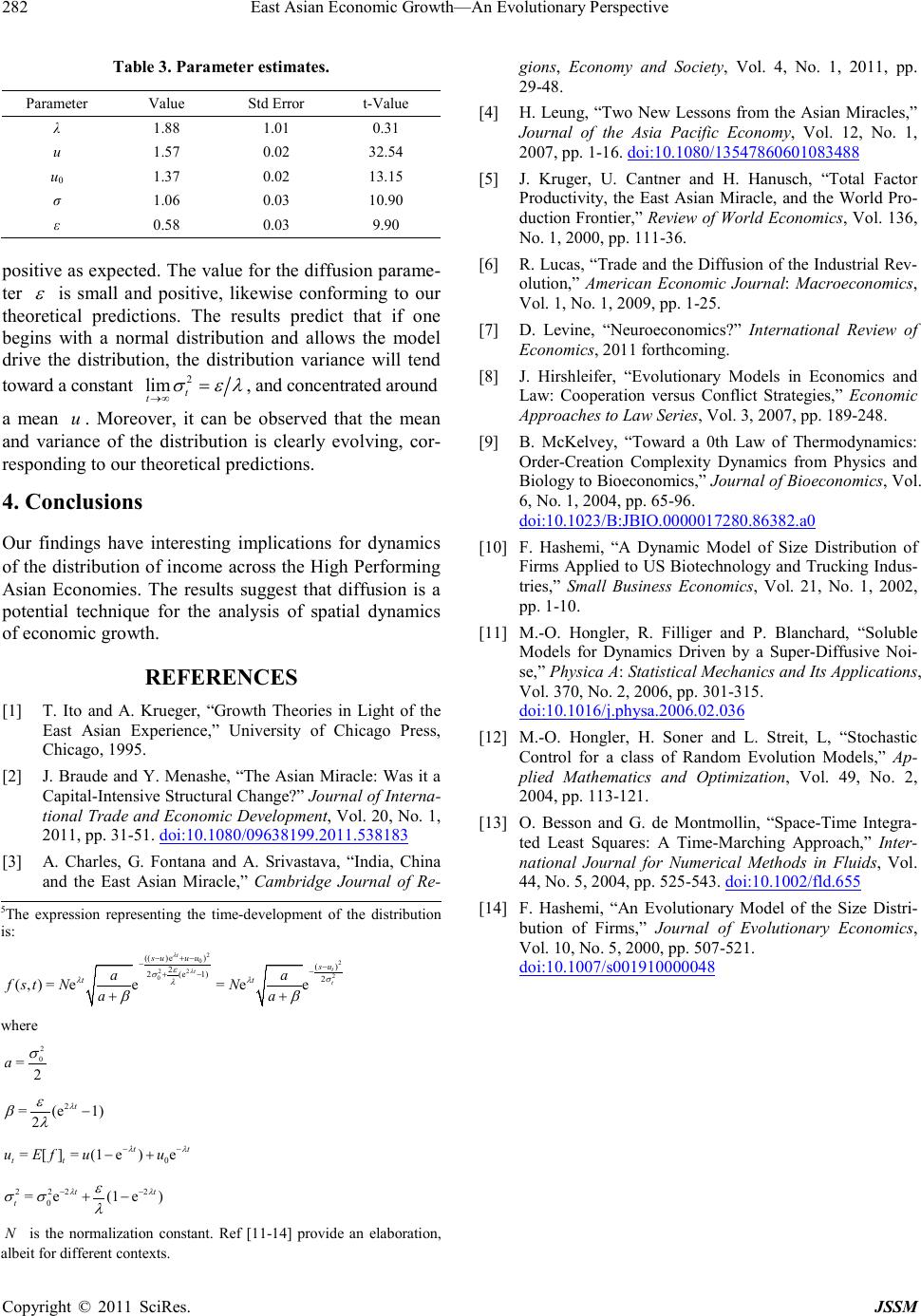

Table 3. P arameter estimates.

Paramet er Valu e Std Error t-Value

λ 1.88 1.01 0.31

u 1.57 0.02 32.54

u0 1.37 0.02 13.15

σ 1.06 0.03 10.90

ε 0.58 0.03 9.90

positive as expected. The va lue for the dif fusio n par ame-

ter

is small and positive, likewise conforming to our

theoretical predictions. The results predict that if one

begins with a normal distribution and allows the model

drive the distribution, the distribution variance will tend

toward a c ons tant

, and concentrated around

a mean

. Moreover, it can be observed that the mean

and variance of the distribution is clearly evolving, cor-

responding to our theoretical predictions.

4. Conclusions

Our findings have interesting implications for dynamics

of the distribution of income across the High Performing

Asian Economies. The results suggest that diffusion is a

potential technique for the analysis of spatial dynamics

of ec onomic growth.

REFERENCES

[1] T. Ito and A. Krueger, “Growth Theories in Light of the

East Asian Experience,” University of Chicago Press,

Chi c a go, 1995.

[2] J. Braude and Y. Menashe, “The Asian Miracle: Was it a

Capital-Inten sive Struct ural Change?” Journal of Interna-

tional Trade and Economic Development, Vol. 20, No. 1 ,

2011, pp . 31-51. doi:10.1080/09638199.2011.538183

[3] A. Charles, G. Fontana and A. Srivastava, “India, China

and the East Asian Miracle,” Cambridge Journal of Re-

gions, Economy and Society, Vol. 4, No. 1, 2011, pp.

29-48.

[4] H. Leung, “Two New Lessons from the Asian Miracles,”

Journal of the Asia Pacific Economy, Vol. 12, No. 1,

2007, pp . 1-16. doi:10.1080/13547860601083488

[5] J. Kruger, U. Cantner an d H. Hanusch, “Total Factor

Productivity, the East Asian Miracle, and the World Pro-

duction Frontier,” Review of World Econo mics, Vol. 136,

No. 1, 2000, pp. 111-36.

[6] R. Lu cas, “Trade and t he Diffusion of the Industrial Rev-

olution,” American Economic Journal: Macroeconomics,

Vol. 1, No. 1, 2009, pp. 1-25.

[7] D. Levine, “Neuroeconomics?” International Review of

Economics, 2011 f ort hc oming .

[8] J. Hirshleifer, “Evolutionary Models in Economics and

La w: Cooperation versus Conflict Strategies,” Economic

Approaches to Law Series, Vol. 3, 2007, pp. 189-248.

[9] B. McKelvey, “Toward a 0th Law of Thermodynamics:

Order-Creation Complexity Dynamics from Physics and

Biology to Bioeconomics,” Journal of Bioeconomics, Vol .

6, No. 1, 2004, pp. 65-96.

doi:10.1023/B:JBIO.0000017280.86382.a0

[10] F. Hashemi, “A Dynamic Model of Size Distribution of

Firms Applied to US Biotechnology and Trucking Indus-

tries,” Small Business Economics, Vol. 21, No. 1, 2002,

pp. 1-10.

[11] M.-O. Hongler, R. Filliger and P. Blanchard, “Soluble

Models for Dynamics Driven by a Super-Diffusive Noi-

se,” Ph ysica A: Statistical Mechanics and Its App lications,

Vol. 370, No. 2, 2006, pp. 301-315.

doi:10.1016/j.physa.2006.02.036

[12] M.-O. Hongler, H. Soner and L. Streit, L, “Stochastic

Control for a class of Random Evolution Models,” Ap-

plied Mathematics and Optimization, Vol. 49, No. 2,

2004, pp . 113-121.

[13] O. Besson and G. de Montmollin, “Space-Time Integra-

ted Least Squares: A Time-Mar ching Approach,” Inter-

national Journal for Numerical Methods in Fluids, Vol.

44, No. 5, 2004, pp. 525-543. doi:10.1002/fld.655

[14] F. Hashemi, “An Evolutionary Model of the Size Distri-

bution of Firms,” Journal of Evolutionary Economics,

Vol. 10, No. 5, 2000, pp. 507-521.

doi:10.1007/s001910000048

5The expression representing the time-

development of the distribution

is:

2

02

22 2

0

(( )e)()

2

2(e 1)2

(,)=e e=e e

t

t

t

t

su uusu

tt

aa

f stNN

aa

λ

λ

ε

σσ

λλ

λ

ββ

− +−

−−

−

+−

++

where

2

0

=2

a

σ

0

=[] =(1e)e

tt

u Efuu

−+

2 222

0

=e(1 e)

tt

t

λλ

ε

σσ λ

−−

+−

N

is the normalization constant. Ref [11-

14] provide an elaboration,

albeit for different contexts.