C. TSUJI

702

22

11

,0123 ,1

,1 ,1

ln ln

tt

Mt Mt

Mt Mt

(5)

For calculating the time-varying covariance risks in-

cluded in models (2) and (3), we use the multivariate

GARCH model ([10,11]).

3. Data

The full sample period of our data is from April 1985 to

December 2009. We first compute the market risk pre-

mium: rM,t − rf,t. Where rM,t is the market return, which is

calculated using Tokyo Stock Price Index (TOPIX)

(from TSE), and rf,t is the rates of the one-month nego-

tiable Certificate of Deposit (CD) (from Bank of Japan

(BOJ)).

We also construct the following five covariance vari-

ables, CILLIQ, CDDY, CDEF, CDTERM, and CLCIP

by using ILLIQ, DDY, DEF, DTERM, and LCIP, re-

spectively. Where ILLIQ denotes the absolute value of

return of the TSE First Section stocks (from TSE) di-

vided by the total trading volume of the TSE First Sec-

tion stocks (from TSE), DDY is the first difference of the

dividend yield of the TSE First Section stocks (from

TSE), DEF denotes the default spread between the yields

of the long-term Nikkei Bond Index (from Nikkei, Inc.)

and 10-year government bonds (from Quick Corp.), and

DTERM means the first difference of the yield spread

between the yields of 10-year government bonds (from

Quick Corp.) and the one-month CD rates (from BOJ).

Finally, LCIP is the log change of the seasonally ad-

justed industrial production (from Ministry of Economy,

Trade and Industry). We then compute the above five

variables, CILLIQ, CDDY, CDEF, CDTERM, and CLCIP,

which are the covariances between market return rM,t and

ILLIQ, DDY, DEF, DTERM, and LCIP, respectively.

Again, these time-varying covariance risks are from the

multivariate GARCH model.

4. Empirical Results

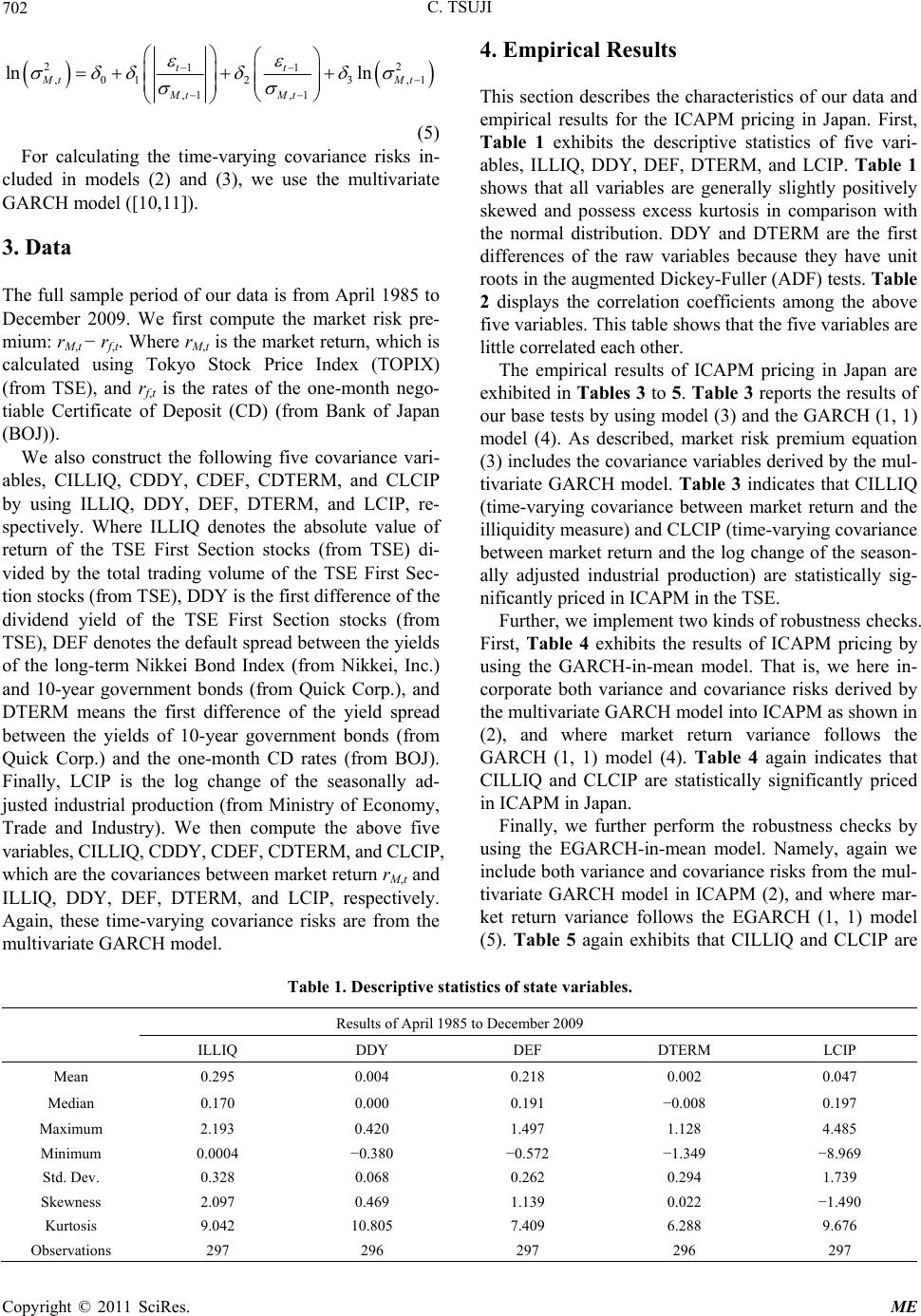

This section describes the characteristics of our data and

empirical results for the ICAPM pricing in Japan. First,

Table 1 exhibits the descriptive statistics of five vari-

ables, ILLIQ, DDY, DEF, DTERM, and LCIP. Table 1

shows that all variables are generally slightly positively

skewed and possess excess kurtosis in comparison with

the normal distribution. DDY and DTERM are the first

differences of the raw variables because they have unit

roots in the augmented Dickey-Fuller (ADF) tests. Table

2 displays the correlation coefficients among the above

five variables. This table shows that the five variables are

little correlated each other.

The empirical results of ICAPM pricing in Japan are

exhibited in Tables 3 to 5. Table 3 reports the results of

our base tests by using model (3) and the GARCH (1, 1)

model (4). As described, market risk premium equation

(3) includes the covariance variables derived by the mul-

tivariate GARCH model. Table 3 indicates that CILLIQ

(time-varying covariance between market return and the

illiquidity measure) and CLCIP (time-varying covariance

between market return and the log change of the season-

ally adjusted industrial production) are statistically sig-

nificantly priced in ICAPM in the TSE.

Further, we implement two kinds of robustness checks.

First, Table 4 exhibits the results of ICAPM pricing by

using the GARCH-in-mean model. That is, we here in-

corporate both variance and covariance risks derived by

the multivariate GARCH model into ICAPM as shown in

(2), and where market return variance follows the

GARCH (1, 1) model (4). Table 4 again indicates that

CILLIQ and CLCIP are statistically significantly priced

in ICAPM in Japan.

Finally, we further perform the robustness checks by

using the EGARCH-in-mean model. Namely, again we

include both variance and covariance risks from the mul-

tivariate GARCH model in ICAPM (2), and where mar-

ket return variance follows the EGARCH (1, 1) model

(5). Table 5 again exhibits that CILLIQ and CLCIP are

Table 1. Descriptive statistics of state variables.

Results of April 1985 to December 2009

ILLIQ DDY DEF DTERM LCIP

Mean 0.295 0.004 0.218 0.002 0.047

Median 0.170 0.000 0.191 −0.008 0.197

Maximum 2.193 0.420 1.497 1.128 4.485

Minimum 0.0004 −0.380 −0.572 −1.349 −8.969

Std. Dev. 0.328 0.068 0.262 0.294 1.739

Skewness 2.097 0.469 1.139 0.022 −1.490

Kurtosis 9.042 10.805 7.409 6.288 9.676

Observations 297 296 297 296 297

Copyright © 2011 SciRes. ME