Modern Economy, 2011, 2, 528-537 doi:10.4236/me.2011.24058 Published Online September 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME On Macroeconomic Reforms and Macroeconomic Resiliency: Lessons from the Great Recession Peter J. Montiel Department of Economics, Williams College, Williamstown, USA E-mail: pmontiel@williams.edu Received March 30 , 20 1 1; revised May 20, 2011; accepted May 29, 2011 Abstract What are the payoffs from macroeconomic reforms? Whether such reforms yield higher long-term growth has long been controversial. However, the experience of the Great Recession suggests that other important benefits may have been neglected in the controversy over the growth benefits of reform. Specifically, in con- trast with previous international recessions, recovery from the Great Recession has been led by emerging and developing economies, many of which have implemented significant reforms over the past two decades. How much of the resilience of these economies can be attributed to these reforms, and what do these lessons suggest for the desirability of further reforms? This paper is intended to provide some preliminary answers to these questions. Keywords: Great Recession, Macroeconomic Reform, Countercyclical Policies 1. Introduction The last two decades have been a period of intensive macroeconomic reform in emerging and developing economies. These reforms have proven immensely con- troversial. Some critics have argued that their content was too narrow,1 while others have argued that it was too broad.2 The debate over reform strategies has taken for granted that the objective of reforms is to stimulate growth. Consequently, criticism of orthodox reform has often centered on the dual observations that countries that have grown rapidly in the past have not always adopted orthodox reform prescriptions, and countries that have adopted orthodox reform prescriptions have often not grow n ve ry rapidly.3 While such a perspective is not inappropriate in the sense that the objective of reform is ultimately to im- prove living standards, this may be to take too narrow a view of the potential benefits of reform. Economic wel- fare depends not just on the level of income that a coun- try achieves, but also on the stability of that income. Moreover, income stability may matter not just for its own sake, but also for its eventual positive effect on economic growth. Thus, reforms that enhance income stability may improve economic welfare both directly and indirectly. Yet the role of economic reforms in pro- moting income stability has received little attention to date. The Great Recession of 2007-2010 provides an op- portunity to take stock of the extent to which the macro- economic reforms of the last two decades have indeed helped to promote macroeconomic stability among emerging and developing economies by helping those economies become more resilient in the face of shocks. The fact that this recession has been unique among re- cent recessions in that internation al recovery has actually been led by emerging and developing economies is sug- gestive. The key question, however, concerns the extent to which this growth resilience among emerging and developing economies can be attributed to the macro- economic reforms that these countries implemented prior to the outbreak of the r ecession in 2007. 1Stiglitz [1] argued that the strategy embodied in the Consensus needed “broader goals and more instruments.”Specifically, he claimed that it neglected government effectiveness, transparency, sound financial regulation, competition policy, and policies for techno l og y transfer. 2The “growth diagnostics” strategy of Hausmann, Rodrik, and Velasco [2], for example, is based on identifying the binding constraints on growth, rather than adopting a multitude of reforms in the hope o kick-starting growth. 3On the former, see [3]. On the latter, see [4-7]. This paper examines this question. The next section examines what we know about why growth has proven to be so much more volatile in emerging and developing countries than in high-income countries. Its purpose is to  P. J. MONTIEL529 investigate whether the sources of high volatility in such countries are likely to be such that they can indeed be addressed through the types of reforms that these economies have recently implemented. Section 3 then documents the content of reform in the two decades or so leading up to the Great Recession. This sets the stage for an examination of experience with the Great Recession itself. The effects of the recession on the macroeconomic environment facing emerging and developing economies —in other words, the channels of transmission of the recession to those economies—is the subject of Section 4. This is followed by an examination of these countries’ macroeconomic policy responses in Section 5. Section 6 then examines the post-crisis performance of those economies and links it to th e reforms that they previously undertook. The final section summarizes and concludes. 2. Growth Volatility in Developing Countries Explanations for macroeconomic volatility tend to be of two types. Researchers who have examined cross-coun- try differences in volatility have tended to emphasize structural factors. The roles of such factors can be inter- preted as determinin g a country’s suscep tibility to sho cks as well as its fragility in response to such shocks. A dif- ferent strand of literature, typically focused on individ- ual-country experiences (e.g., case studies), has empha- sized the roles of domestic macroeconomic policy re- gimes, especially concerning fiscal policy (degree of procyclicality), monetary policy (Central bank inde- pendence and the monetary policy regime) and exchange rate policies (e.g., fixed versus floating, the performance of “hard” exchange rate pegs). Of course, these perspectives are not mutually exclu- sive. A common-sense interpretation of the sources of volatility would view observed volatility as the outcome of a complex interaction among the frequency and sever- ity of shocks and the fragility of the domestic economy in the face of such shocks in the absence of a policy re- sponse, on the one hand, and the effectiveness of domes- tic policy responses, on the other. Indeed, it is possible to read much of the evidence on the determinants of volatil- ity in exactly this way. That evidence suggests that sustained growth accelera- tions tend to be associated with financial and macroeco- nomic reforms, and that episodes of negative growth rates are associated with financial and macroeconomic shocks (see, e.g., [8]). The question, then, is what ac- counts for such shocks? Financial and macroeconomic shocks could emerge in two ways: they could represent shocks triggered by in- appropriate domestic financial and macroeconomic poli- cies, or they could emerge from poor macroeconomic responses to exogenous shocks. There is evidence that both have been important in emerging and developing countries, and that the policies implicated have run the full macroeconomic gamut of fiscal, monetary, exchange rate, and financial-sector policies. An important source of macroeconomic shocks in such countries has been actual or prospective fiscal insolvency, in the form of unsustainable debt levels. Debt defaults have been quite common among emerging and developing economies, and [9] have estimated that defaults have been associated with growth shortfalls of about 2 percent per year on average over a two-year horizon and 0.8 percent on average on average over a six-year horizon. Moreover, high levels of debt and prospective insolvency have been associated with procyclical fiscal policies, (see [10]). Shortcomings in monetary policy have played a simi- lar role. Just as have debt defaults, episodes of sustained high inflation and brief hyperinflation have historically been quite common among emerging and developing economies, resulting in growth volatility associated both with the period of high inflation itself as well as with its eventual stabilization. These episodes have often been associated with the monetization of fiscal deficits, as the result of de jure or de facto fiscal dominance. A history of high inflation has also served to paralyze monetary policy as a stabilization instrument, because the fear that monetary expansion would trigger self-fulfilling infla- tionary expectations has often prevented Central banks in emerging and developing economies from lowering in- terest rates in response to recessions. Indeed, a perceived need to convince markets that monetary financing would not be forthcoming for fiscal deficits caused by recession has often caused monetary tightening—and thus procyc- licality—in countries with an inflationary history. The absence of monetary credibility has caused many emerging and developing economies to rely on the ex- change rate as a nominal anchor. Consequently, fixed exchange rate regimes have been much more common among emerging and developing economies than among high-income countries [11]. This has had two implica- tions for growth volatility. First, “soft” exchange rate pegs have proven vulnerable to currency crises, with associated negative effects on growth rates. Second, the unwillingness to countenance exchange rate flexibility has prevented the use of the exchange rate as a tool of stabilization policy. Indeed, defending the exchange rate in the face of capital outflows has been an important factor in rendering monetary policy procyclical, as in immediate post-crisis Asia. Finally, inappropriate liberalization of the domestic financial sector—liberalization without the appropriate regulatory and supervisory safeg uards in place—has also aggravated boom and bust cycles in emerging and de- veloping economies. Poor regulation and supervision of a liberalized financial sector has in many cases facilitated Copyright © 2011 SciRes. ME  P. J. MONTIEL 530 the emergence of currency mismatches and of credit booms and asset price bubbles, and the resulting vulner- ability of banks' balance sheets has not only tended to magnify the effects of exogenous shocks by coupling them with a banking crisis, but has also helped to para- lyze monetary policy for fear of adverse effects on banks’ bala nc e sheets. 3. What Has Been Reformed Reference [12] argues that variables in growth regres- sions tend to have significant effects because they are symptoms of one of three syndromes that are harmful for growth: state-led development with a non-developmental state, excessive inward orientation, and chronic or severe episodes of macroeconomic imbalance or instability. These findings provide the rationale for the orthodox reform prescription of “privatize, liberalize, stabilize.” But it is worth noting that reforms of these types need not necessarily be stabilizing. In particular, to the extent that the “liberalize” component involves enhanced real and financial openness, the effects on macroeconomic stability are ambiguous, since reforms of this type in- crease the economy’s exposure to external shocks while simultaneously altering its response to domestic shocks in ways that may be either stabilizing or destabilizing. Moreover, “second generation” reforms, especially those directed at the domestic financial sector, may also prove to be either stabilizing or destabilizing, depending on how they are implemented. One would think that the “stabilize” component of the Consensus would be stabilizing—by definition! But that is not necessarily the case. The key issue here is a tradeoff between credibility and flexibility. Reforms that seek to ensure that domestic macroeconomic policies do not themselves become a source of shocks—and thus empha- size the credibility of the domestic macroeconomic policy framework—may create rigidities that simultaneously make the economy more vulnerable to exogenous shocks and less capable of compensating for those shocks by undertaking stabilizing policy responses. The key point, then, is that what matters for stab ility is not r eform per se, but rather what has been reformed, and how. In this respect, the news is relatively good for emerg- ing and developing economies: while the reforms of the 1990s and 2000s may have left these countries more ex- posed to external shocks, the content of those reforms would have led one to expect ex ante much more resil- iency in the face of such shocks. Trade liberalization (the replacement of QRs with tar- iffs, movements to uniform tariffs, and tariff reductions), has been ongoing among emerging and developing economies over the past two decades. This has had the effect of making these countries increasingly integrated with the world economy. Capital account liberalization undertaken by many emerging and developing econo- mies after 2000 also caused them to become more inte- grated with the rest of the world financially. As would be expected, increased openness and the re- sulting increased integration with world markets has in- deed made emerging and developing countries more vulnerable to external shocks, both financial and real. Reference [13], for example, estimates that external fac- tors account for more than half of the medium-term variance of Latin American growth, with external finan- cial conditions accounting for about 35 percent, foreign growth for 10 - 15 percent, and commodity price fluctua- tions for 5 - 6 percent . Other reforms, however, have clearly been vulnerabil- ity-reducing. A key source of macroeconomic vulner- ability, for example, is the health of th e financial system. As the result of financial reforms undertaken over the past decade and a half, including improvements in finan- cial regulation and supervision, enhanced competition in the financial system, and in some cases the recent resolu- tion of banking crises, the financial systems of many emerging and developing economies are healthier today than they have been in the past. The entry of foreign banks has also significantly contributed to the health of domestic financial systems, especially in Latin America and sub-Saharan Africa.4 The key development in the area of exchange rate management is that many emerging and developing economies, especially in Asia and Latin America, have transitioned to more flexible exchange rate arrang ements, reducing vulnerability to the disru ptiv e d iscrete exch ang e rate depreciations that are associated with currency crises, and providing an automatic stabilizin g effect in response to external financial sh ocks . Moreover, desp ite still being pronounced in some countries, financial dollarization has declined, reducing the impact of a factor that has weak- ened or even reversed the otherwise expansionary effect of exchange rate depreciation in the past.5 However, these regimes remained heavily managed, as Central banks in many emerging and developing econo- mies engaged in heavy sterilized intervention to avoid 4However, the situation was rather different before the outbreak of the Great Recession in the transition economies of Central and Eastern Europe. Banking sectors were liberalized there after transition in the early 1990 s. However, the institutional infrastructure for the financial sector remains deficient in many countries, and in particular, the local subsidiaries of foreign banks have not always been well capitalized. Many banks in the region relied heavily on nondeposit funding, espe- cially from parent banks in Western Europe. Moreover, while their domestic loans were generally denominated in foreign currency, they tended to be extended to unhedged domestic borrowers, supporting activities in the nontraded goods sector such as real estate investments. 5To the extent that currency mismatches are induced by fixed exchange rate regimes combined with lax financial regulation, improved regula- tion and more flexible exchange rate management could be behind the reduction in the extent of such mismatches in Latin America. Copyright © 2011 SciRes. ME  P. J. MONTIEL531 real exchange rate appreciation.6 Heavy Central bank intervention in foreign exchange markets resulted in many of these economies building up truly massive stocks of foreign exchang e reserves by 2007, as show n in Figure 1. Although the move to floating rates was less pro- nounced outside of emerging Asia and Latin America, reserve accumulation was a common feature. In the Middle East and Central Asia, for example, both coun- tries with fixed regimes as well as those with managed floats accumulated large stocks of foreign exchange re- serves prior to 2007.7 In the area of monetary policy, the key development in many emerging and developing economies is that Central banks have been substantially strengthened as macro- economic institutions. Not only have they been accorded legal independence, but they have taken responsibility for maintaining low and stable inflation rates—often by adopting formal inflation targeting—and to a significant extent they have achieved that goal in recent years, en- hancing their credibility. Reforms in the fiscal area have encompassed both fis- cal institutions and fiscal policy regimes. The reform of fiscal institutions has typically taken the form of the en- actment of fiscal responsibility laws of various types. In some cases reforms in expenditure processes, improve- ments in tax administration, and reforms of the tax structure have enhanced the flexibility of fiscal systems Figure 1. International Re serves, Emerging and Developing Countries, 2000-2010 (US $ billions); Source: IMF, Interna- tional Financial Statistics. and strengthened the effects of automatic fiscal stabiliz- ers. But the most important changes in fiscal policy re- gimes have involved the demonstration in many coun- tries of both the political will as well as the economic ability to make significant fiscal adjustments—especially to exercise fiscal restraint during good times. This has been an important break from the procyclical fiscal be- havior of the past. These reforms and changes in fiscal policy regimes have enhanced fiscal credibility, as evi- denced in many cases by reductions in sovereign risk premia. One important consequence of these changes in fiscal performance is that public debt stocks as a propor- tion of GDP have declined in many emerging and de- veloping countries over the past several years.8 In short, emerging and developing economies became increasingly integrated with the world economy during the past two decades, along both real and financial di- mensions. While this has increased their exposure to ex- ternal shocks, a better composition of external financing, stronger domestic financial systems with improved cor- porate governance, better monetary policy frameworks, strong fiscal positions, more flexible exchange rate re- gimes, and large reserve accumulation have all reduced vulnerability and placed these economies in a more fa- vorable position to respond to such shocks with expan- sionary policies. All of these factors suggest that the large external shock that the Great Recession represented for emerging and developing economies would be less disruptive than the history of these economies would otherwise have led one to believe. Most important, per- haps, is that reforms to domestic financial systems and moves to more flexible exchange rate regimes rendered the sudden disruptions associated with “twin” banking and currency crises less likely, that the credibility g ained by financial and macroeconomic policy institutions would make short-run deviations from medium-term policy stances less disruptive to expectations, and that policymakers entered the crisis with means at their dis- posal to counter shocks – in the form of large reserve stocks – that were not available to them in the past. 4. Crisis Transmission and Impact The Great Recession began with a collapse in housing prices in the United States, which triggered a financial panic because of the opaque nature of securitized mort- gage instruments, which quickly became “toxic assets.” The financial panic was followed by a collapse of real activity as the result of reduced asset values and the freezing up of credit flows. An initial channel of interna- tional transmission was financial, and primarily affected 6For the evolution of exchange rate regimes in post-crisis Asia, see [14]. 7The transition economies of Central and Eastern Europe wereonce again somewhat different. In seeking to integrate with Western Europe, many of the countries in emerging Europe maintained fixed exchange rates. While these countries also received large capital inflows in the re-crisis period, those inflows were just enough to finance large cur- rent account deficits. Therefore, unlike emerging and developing economies elsewhere, those in emerging Europe entered the Great Recession with low ratios of reserves to short- te rm external debt. 8Pre-crisis public sector balance sheets were relatively strong even in emerging Europe, in the sense that public sector debt/GDP ratios tended to be lower than t hose in other emerging-econ omy regions. Copyright © 2011 SciRes. ME  P. J. MONTIEL 532 Western European countries whose private capital mar- kets are tightly integrated with those of the United States, and whose financial institution s had acquired toxic assets issued in the United States. However, financial institu- tions in emerging and developing countries did not typi- cally acquire such assets, so they did not experience the direct hit suffered by similar institutions in many indus- trial countries. A second financial link was less direct, but had more worldw ide effect. A s the crisis deepene d in the ad vanced economies, all projections for the world economy be- came more uncertain. This increase in worldwide eco- nomic and political uncertainty acted like a “monsoon effect” that sharply reduced productive asset values throughout the world. Stock markets around the world moved in sympathy, and the crisis spread through a worldwide decline in equity prices, affecting more di- rectly emerging and developing economies with more highly developed stock markets. A third financial channel of transmission operated through a reallocation of international financial portfo- lios from risky assets to those assets perceived as safest: United States government obligations and gold. This had two important implications. First, it increased sovereign borrowing costs for emerging and developing countries. Second, countries with currencies closely tied to the U.S. dollar faced an additional negative shock in the form of real effective exchange rate appreciation, pulled along by the appreciation of the dollar, while those with floating rates faced pressure for their currencies to depreciate as capital flowed out of their economies. Whether this re- sulted in an additional negative effect on aggregate de- mand in these countries or a positive one depended on their domestic vulnerability to exchange rate deprecia- tion. The fourth channel of transmission arose from a dra- matic contraction in economic activity in the North At- lantic economies. This manifested itself in three “real” channels of transmission: a decline in the demand for the exports of developi ng countries, a reduction in commod- ity prices, and a sharp contraction in flows of worker remittances. The crisis had differential effects on emerging and developing economies, depending on the nature of their links with the international economy. The initial impact of the crisis on Asian and Latin American economies was financial. Stock markets peaked in many such coun- tries in October of 200 7, and by February 2009, they had fallen by 60 percent. Net portfolio equity inflows and bank lending flows collapsed, and access to external bond financing became much harder. Increased “real” integration subseque ntly caused the crisis to be transmit- ted to both regions through markets for goods and ser- vices. Exports to the United States and the European Union from emerging Asia fell sharply in 2007, and emerging economies in Asia suffered some of the sharp- est contractions in real output experienced anywhere, including in the industrial countries where the crisis originated. Real GDP in emerging Asia excluding China and India contracted by 15 percent on an annualized ba- sis in the fourth quarter of 2008, for example, compared to six percent in the United States. Finally, countries in Latin America, especially Mexico and countries in Cen- tral America, suffered a sharp contraction in flows of workers’ remittances. In the Middle East and Central Asia, the collapse in oil prices caused by the reduced level of economic activity in oil-importing countries played an important role in crisis transmission. As in other regions, stock markets contracted and spreads for banks that borrowed heavily from abroad widened. Similar to elsewhere, countries in the Middle East and Central Asia also suffered a decline in FDI flows, reduced demand for the region’s exports, lower tourism receipts, and a sharp reduction in flows of worker remittances. Because many countries in this re- gion were pegged to the US dollar, the ‘safe haven’ ap- preciation of the dollar resulted in a real effective appre- ciation of their currencies, adding an additional contrac- tionary shock. The most important financial channel of transmission for most countries in sub-Saharan Africa was reduced FDI inflows. As in other regions, real transmission oc- curred through reduced demand for exports, lower com- modity prices, and reduced flows of remittances. Countries in emerging Europe are highly integrated with Western Europe, in both real and financial markets, and they rely much more on external bank financing than do other emerging economies. As in Asia and Latin America, the crisis hit early. Sovereign risk premia be- gan to turn up in mid-2007, and increased continuously thereafter. Private external bond issues also contracted sharply in mid-200 7, and stock prices turn ed down at the same time. The sharp contraction in foreign bank credit to these countries caused the collapse of a real estate boom that had emerged in the Baltic economies prior to 2007, which contributed to dramatic contractions in economic activity in these countries, similar to those observed in Asia and in countries, such as Mexico, that were tightly integrated with advanced economies at the epicenter of the crisis. The upshot is that emerging and developing econo- mies had not “decoupled” at the outset of the Great Re- cession. Far from it, the macroeconomic reforms that they had implemented in the decade and a half or so prior to the crisis—particularly the “liberalizing” reforms that can caused them to open their current and capital ac- Copyright © 2011 SciRes. ME  P. J. MONTIEL533 counts, and therefore to greatly increase their real and financial integration with the advanced economies—if anything made them more susceptible to the crisis in the advanced economies, through a diverse set of transmis- sion channels. Moreover, the reform and development of their domestic financial sectors, by strengthening cross- border banking links and giving a more prominent role to stock markets in the domestic economy, may independ- ently have strengthened financial channels of transmis- sion. Not surprisingly, then, emerging and developing economies all over the world suffered severe initial out- put contractions, in many cases much more severe than those that afflicted the countries at the epicenter of the crisis. 5. Policy Response Based on past experience, the effect of such severe out- put contractions in emerging and developing economies would have been expected to have been a prolonged pe- riod of stagnation, perhaps another “lost decade,” such as the one that Latin America suffered through after the 1982 debt crisis. Dislocations in domestic financial sys- tems, the drying up of cap ital inflows as a result of a loss of confidence by international investors, and procyclical fiscal policies focused on reductions in public sector in- vestment, driven by revenue shortfalls and the absence of means to finance deficits other than by printing money, would all have contributed to such an outcome. Such destructive policies would have been abetted by high inflation if the difficulty of financing fiscal deficits caused the affected countries to turn on the monetary spigot (as after the 1982 Latin American crisis), or by its opposite—very tight monetary po licies—if worries about currency mismatches in domestic balance sheets con- strained monetary expansion (as after the 1997 Asian crisis). Such outcomes would have been expected to have been even more likely if recovery were slow in the ad- vanced economies, as was indeed the case. In the event, in the majority of emerging economies as well as many developing countries, none of this hap- pened. Countries that had undertaken significant macro- economic reforms prior to the crisis instead respond ed to the severe external shock that the Great Recession repre- sented for them by adopting countercyclical po licies – in some cases very aggressive ones. The resiliency of reformed financial sectors in emerg- ing economies, and lessons learned from the past about how to safeguard these systems, provided an important buffer for these economies. Asian credit markets, for example, were not disrupted in 2007, when these coun- tries’ exports collapsed. Although confidence in some Asian banks suffered after the collapse of Lehman Brothers in September of 2008, several governments quickly created liquidity facilities and expanded deposit insurance. As a result, credit did not freeze up in Asia, as it did temporarily in the United States and Western Europe. A similar situation prevailed in Latin America. Floating exchange rates also contributed to stabilizing aggregate demand in most (but not all) emerging econo- mies. The “safe haven” effect that saw capital flow from all over the world into US Treasury bills put pressure on the exchange rates of emerging economies with floating rates to depreciate. Most such economies did not resist depreciation, though several accepted some reserve losses in order to smooth their exchange rate changes. The experience of the seven largest Latin American economies (the LAC-7) is shown in Figure 2.9 Low inflation and monetary credibility made it possi- ble for a large number of both emerging and developing economies, both with floating as well as officially-de- termined exchange rates, to respond to the crisis with monetary easing without fear of igniting inflation expec- tations. Monetary conditions began to be eased in Asia the spring of 2007, when the recession began to affect Asian exports, and easing b ecame more aggressive in the last quarter of 2008, after the collapse of Lehman Broth- ers. The median decline in policy rates in the region from the 3rd quarter of 2008 to the 2nd quarter of 2009 ex- ceeded 2 ¼ percent, five times as much as in past reces- sions [15]. Monetary policy turned expansionary in Latin America somewhat later than in Asia, but as in Asia be- came even more expansionary in late 2008. Policy rates were lowered in all the major inflation-targeting emerg- ing economies in the region, as well as in non-inflation targeting countries such as the Dominican Republic, Honduras, Paraguay, and Venezuela [16]. In sub-Saharan Africa, two-thirds of the countries lowered one or more Figure 2. Bilateral US $ Exchange Rates, LAC-7, 2007:1 to 2009:1 (2007:1 = 100); Source: IMF, International Financial Statistics 9A decrease in the exchange rate index in the figure is an appreciation. Copyright © 2011 SciRes. ME  P. J. MONTIEL 534 policy interest rates after the crisis began. Modest debt levels and large stocks of foreign ex- change reserves created the “fiscal space” for many emerging economies to implement fiscal expansions without fear of perceived threats to fiscal solvency. The IMF’s calculations show a positive fiscal stimulus in China, India, the four tigers, and the ASEAN-4 econo- mies (Indonesia, Malaysia, the Philippines, and Thailand) during 2009 that were comparable or larger in size than those on the G-20 countries on average (2 ¾ percent of GDP, compared to about 2 percent in the G-20 coun- tries).10 Throughout the region discretionary fiscal meas- ures were heavily weighted toward spending, especially investment in infrastructure, and were implemented quickly. The Fund fo und the fiscal policy respon se to the current recession in Asia to be stronger than in past re- cessions, with a median increase in the fiscal deficit of over 3 ½ percent, more than double the response after the Asian crisis. Aggressive fiscal policy responses were also implemented in Latin America, though those pack- ages were more modest than those in Asia. The fiscal authorities in Brazil, Chile, Colombia, Mexico and Peru provided the most support, increasing their average do- mestic primary deficit by some 3.5 percent of GDP in 2009. This reflected not just automatic stabilizers, but also discretionary measures, since the cyclically-adjusted primary balance was loosened in those countries, result- ing in positive fiscal impulses.11 Fiscal policy was eased in some three quarters of sub-Saharan African countries in response to the Great Recession [18]. Fiscal deficits increased as the result of automatic stabilizers as well as discretionary responses. The IMF notes that nearly two-thirds of the Sub-Saharan African countries that ex- perienced growth slowdowns as a result of the crisis were actually able to increase government spending to stabilize their economies [19]. The turnaround in fiscal balances amounted to some 6 percent of GDP on average in 2008, a sharp contrast with experience during past recessions. In the Middle East and Central Asia, coun- tries with substantial fiscal cushions undertook substan- tial fiscal stimulus programs, as in Asia and Latin Amer- ica. Where they were present, sovereign wealth funds responded to the contraction in capital inflows associated with the crisis by lending more actively in th eir domestic economies and funding public sector projects. Fiscal stimulus was also widely undertaken by countries in the Caucasus and Central Asia, especially in countries such as Azerbaijan, Turkmenistan and Uzbekistan, which had saved during the boom. This international experience reflects the gradual easing of constraints on counter- cyclical fiscal response in the form of high debt, high inflation, and large fiscal deficits during boom times. However, this experience was not uniformly shared among developing countries. Problems in the financial sectors of emerging Europe resulted in credit collapses and contributed to severe output contractions there. In addition to recapitalizing banks, all of the emerging economies in Europe had to substantially increase de- posit guarantees, many of those countries negotiated ad- justment programs with the In ternational Monetary Fund, in exchange for exceptional financing.12 Outside Europe, Kazhakstan had a major banking crisis that was reminis- cent of crises in Asia, Mexico, and Chile in previous decades. Despite capital outflows, exchange rate depreciation was also not universal. Most European emerging econo- mies kept their exchange rates stable against the euro, and since their trade was dominated by Eurozone coun- tries, real effective exchange rate depreciation did not make a significant contribution to shoring up demand. The same was true, of course, for countries in sub-Sa- haran Africa, such as those in the CFA zone, that main- tain fixed rates against the euro. Dollarized economies in Latin America, such as Ecuador and El Salvador, and many countries in the Middle East, both oil exporters and importers, that maintain fixed or heavily managed ex- change rates against the US dollar, saw their nominal effective exchange rates appreciate, following the appre- ciation of the dollar. On the other hand, countries in the Caucasus and Central Asia with more flexible exchange rate regimes were constrained on the extent to which they could allow their currencies to depreciate by an old problem: currency mismatches in the balance sheets of their banks and corporations. Several emerging and a larger group of developing countries Asia were not in a position to mount a forceful policy response to the crisis. Fiscal policy was actually tightened on average among the group of countries that the IMF classifies as “other” commodity exporters in Latin America (Argentina, Bolivia, Ecuador, Paraguay, Suriname, Trinidad and Tobago, and Venezuela,) result- ing in negative fiscal impulses, and thus pro-cyclical fiscal policy. Similarly, tourism-intensive commodity importing countries, the IMF’s term for a variety of 10See [15]. China announced a large fiscal stimulus package in No- vember of 2007 focused on a massive program of public investment. The four “tiger” economies of Hong Kong, Korea, Singapore and Taiwan allowed an increase in their fiscal deficits by 2 ¼ percent o GDP in 2008. 11Reference [17] using a different indicator of fiscal stimulus (the compounded annual growth rate of real exhaustive government spend- ing) found that among the OECD economies, three of the five coun- tries that implemented the largest fiscal stimulus in response to the Great Recession were emerging economies (Chile, Korea, and Mexico) These three countries were also found to have pursued countercyclical fiscal policies in the period before the Great Recession. 12As of April 14, 2009, IMF programs were in place in Belarus, Bos- nia-Herzegovina, Hungary, Latvia, Romania, Serbia, and Ukraine, and Poland availed itself of the IMF’s unconditional new Financial Credit Line. Copyright © 2011 SciRes. ME  P. J. MONTIEL535 small economies in the Caribbean, tended to have large stocks of public debt on average, and maintained fixed exchange rates in the context of open capital accounts with a fairly high degree of financial integration. These countries consequently had little scop e for either fiscal or monetary stimulus. Most low-income economies in Asia found themselves in similar fiscal straits. Those countries were hit by lower commodity prices, reduced demand for nontraditional exports such as garments, lower tourism receipts, and reduced FDI flows. However, weak public solvency positions, reduced fiscal revenues because of lower commodity prices and lower revenue from import taxes, ineffective monetary transmission mechanisms, and inflexible exchange rates rendered countercyclical responses much more difficult to implement in those countries. A similar situation played out in the Middle East. Many countries in that region simply had no fiscal cushions. This was true of oil exporters such as Iran, Sudan, and Yemen, which had to reduce their fiscal defi- cits in the face of the crisis in order to preserve fiscal sustainability. It was also true on average of the oil-im- porting countries in the region, which averaged public sector debt to GDP ratios of over 60 percent. Indeed, according to [20], among Middle Eastern oil importing countries, all but Morocco and Tunisia adopted pro-cy- clical policies in response to the crisis, tightening fiscal policy to preserve fiscal sustainability in the face of de- clining revenues. 6. Post-Crisis Performance The pattern of economic recovery among emerging and developing countries followed closely that of the policy response. The heavily export-dependent economies in the Asian region suffered the sharpest output contrac- tions as the result of the crisis, but also the most deter- mined policy response and the fastest recoveries. While the initiation of recovery in Asia during the first quarter of 2009, was led by exports (as the result of an inventory cycle in the United States and the European Union), it was also supported by expansionary domestic policies. Simulations with the IMF’s Global Integrated Monetary and Fiscal model (GIMF) reported in [21] estimate that fiscal stimulus in those countries added 1 ¾ percent on average to growth in Asia during the first half of 2009. The region benefited in particular from an increase in regional exports to China, responding to the boost given to Chinese demand by the infrastructure investment as- sociated with Chinese fiscal stimulus, as well as to in- creased private investment in that country caused by the countercyclical relaxation of credit restrictions. These measures, together with the recovery in world trade, had the effect that by August of 2009, alone among the major economies of the world China was growing at rates above its long-run trend. Foreign capital began to flow into Asian countries once again in the second quarter of 2009, and inflows of portfolio equity capital contributed to a sharp rebound in reg ional stock markets, which so on returned close to pre-crisis levels. Already in 2009, the combination of sustained current account surpluses and restored capital inflows caused Asian econ omies to beg in to accumulate foreign exchange reserves once again. Latin America also sustained a strong recovery in 2009. It was driven by a combination of expansionary domestic policies, the recovery in world demand for manufactured goods mentioned above, and improved commodity prices, in turn driven by the rapid recovery in the commodity-intensive Asian economies. Both of these components of the external environment began to re- cover in 2009, though other components, such as remit- tances and tourism, did not. This meant that the large commodity-exporting countries in the region recovered more quickly than the smaller commodity-importing ones. Reference [16] estimates that Latin America’s im- proved policy environment cut the output cost of the ex- ternal shocks associated with the Great Recession from the third quar ter of 2008 to the second qu arter of 2009 in half for Brazil, Chile, Colombia, Mexico and Peru (the financially-integrated commodity exporters), from a pro- jected decline of 8 percent in real GDP to an actual one of about 4 percent. For th e other sub-groups of coun tries in the region, on the other hand, which were constrained from adopting equally stimulative fiscal and monetary measures, recovery from the Great Recession was much more dependent on the external environment: the “other” commodity exporters were assisted in recovery by in- creases in world commodity prices, while the commod- ity-importing countries in the region were hampered by the slow recovery of tourism and workers' remittances. As in Asia, capital inflows also returned to Latin Amer- ica rather quickly. Large nonresident portfolio outflows turned out to be short-lived, and inflows returned to the larger countries in the first part of 2009. Overall, foreign exchange reserv es remained above end-2007 levels in the region. Except for South Africa, most countries in the sub- Saharan African region seem to have hit bottom in the first quarter of 2009. In contrast with past crises, recov- ery in the region was faster than in the rest of the world, both because more policy shock absorbers such as lower interest rates were at work, and because countries in the region were able to resist harmful measures such as pro- cyclical fiscal policies and increased trade restrictions. While growth rates averaged over 6 percent from 2003 to 2008, growth fell to 2 percent in 2009, but was already projected by the IMF to recover to 4 1/2 percen t in 2010 Copyright © 2011 SciRes. ME  P. J. MONTIEL 536 and to over 5 percent in 2011. Oil importing countries in the region were hit less hard by the crisis than oil exporters, because of their limited financial links with the rest of the world as well as their limited manufactured exports. However, the crisis was acute for oil importers in the Caucasus and Central Asia, because of their close links with Russia, an oil-exporting country that suffered a sharp contraction in 2009. While several countries in the region have implemented coun- tercyclical monetary and fiscal policies, high levels of public debt have forced them to moderate the size of their fiscal stimulus and restrict its duration. Accordingly, these countries have been particularly affected by the crisis. On the other hand, countercyclical polices helped many oil exporters in the Middle East as well as in the Caucasus and Central Asia to moderate their growth slowdowns. Kazakhstan, however, is a special case. Banks in Kazakhstan relied heavily on borrowing from foreign banks and used those funds, often in the form of short-term liabilities, for lending to unhedged domestic borrowers in construction and real estate, very much as in the Baltics. The depreciation of the domestic currency and curtailed supply of external bank loans caused Ka- zakhstan to suffer a severe Asian-style banking crisis from which it has not yet emerged at the time of writing. Finally, the pattern of recovery in emerging Europe was linked both to the policy response to the crisis as well as to pre-crisis vulnerabilities, especially in the fi- nancial sector. Countries such as Hungary, Latvia and Romania had failed to build up fiscal space during the boom years to allow them to undertake countercyclical fiscal policies in response to the crisis, and their fiscal policies therefore responded procyclically, prolonging the output contraction in those countries. Financial sector distress slowed the recovery process in Estonia and Lithuania. By contrast Turkey, which was able to under- take countercyclical fiscal measures and avoided the fi- nancial sector weaknesses of the Baltic countries, was projected by the IMF to recover to growth rates of over 5 percent in 2010 and over 3 percent in 2011, after con- tracting by 4.7 percent in 2009. 7. Summary and Conclusions The growth payoff from the macroeconomic reforms that many emerging and developing economies undertook during the 1990 s has been hard to identify in the data. This has led some prominent observers to search for al- ternative growth strategies focusing on “second- genera- tion” (institutional) reforms or reforms focusing on the “binding constraints” on growth, which may consist of a variety of factors other than macroeconomic instability. But the growth payoff from macroeconomic stability h as often been understood as arising primarily from the im- proved allocation of resources and enhanced incentives for investment that can be achieved by preventing do- mestic macroeconomic policies from themselves destabi- lizing the macroeconomic environment in emerging and developing economies. To the extent that this is true, growth-promoting macroeconomic arrangements would be those that adopt strict rules to narrowly circumscribe policy discretion—e.g., “hard” exchange rate pegs and balanced-budget rules. I have argued in this paper that this is only part of the story—that what matters for growth is not just the pre- vention of macroeconomic instability created by domes- tic policies, but also the ability to deploy domestic mac- roeconomic policies effectively to counter the effects of exogenous shocks. Emerging and developing countries have not been characterized by an inability to accelerate growth, but rather by an in ability to sustain rapid growth in the face of large adverse shocks, and such shocks have not always been of domestic policy origin. The result has been growth instability, in the form of periods of rapid growth ended by sharp recessions that have often been followed by “lost half-decades” or even worse, “lost decades,” in turn resulting in low, non-converging, average growth rates. The purpose of macroeconomic reforms, therefore, is not just to prevent domestic macro policies from serving as a source of destabilizing shocks, but also to permit them to play an active stabilizing role in response to ex- ogenous non-policy shocks. This role becomes more urgent as emerging and developing economies pursue growth through increased commercial and financial openness. Whether or not that strategy proves growth- enhancing, it undoubtedly increases the exposure of such economies to external real and financial shocks. This creates a premium on macroeconomic arrangements that can preserve domestic stability in the face of such shocks. What is needed, therefore, is a domestic macroeco- nomic policy framework that promotes not just credibil- ity, but also flexibility. This cannot be achieved by “ty- ing the hands” of policy makers in the areas of fiscal, monetary, exchange rate, and financial policies. Re- forms of budgetary procedures to avoid pro-cyclicality, Central bank autonomy, some degree of exchange rate flexibility, and financial sector policies that promote soundness without stifling dynamism in the financial sector, are the institutional components of such a frame- work. Low levels of government debt, high levels of for- eign exchange reserves, and high levels of confidence achieved through a track record of responsible fiscal policies and low inflation, are the “stock” components. But the key point is that these reforms are not ends in Copyright © 2011 SciRes. ME  P. J. MONTIEL Copyright © 2011 SciRes. ME 537 themselves. They are rather the means to achieve the policy flexibility required to preserve a stable growth environment in the face of ex og enous shoc ks . The Great Recession has provided a test of this propo- sition. Emerging and developing economies did not es- cape the effects of the recession, precisely because the outward-oriented components of their reforms in the 1990s and early 2000s increased their exposure to exter- nal shocks. But the reforms that many of those countries had previously undertaken in the macroeconomic sphere —in the forms of enhanced financial system soundness, improved budgetary processes, enhanced Central bank autonomy, more flexible exchange rate arrangements, reduced public debt and larger stocks of foreign ex- change reserves, together with their low-inflation track records—made it possible for a large number of them to adopt aggressive countercyclical policies in response to the recession. This constituted a sharp break from the past, and has paid off in the form of sub stantial short-run growth resilience, to the point that the international re- covery has been led by emerging and developing econo- mies. It remains to be seen whether this short-run resil- ience translates into the long-run resilience that is re- quired for convergence, but the lessons of past growth performance in these countries give grounds for opti- mism. In short, the lesson of the Great Recession is that building macroeconomic resiliency is investing in de- velopment. Like any other type of investment, invest- ment in macroeconomic resiliency is costly. Reducing public sector debt or accumulating foreign exchange re- serves, for example, implies foregoing spending or tax cuts. Such investment can therefore undoubtedly be overdone, and it therefore remains to be determined just how much investment in macroeconomic resiliency is optimal in specific country circumstances. The key les- son from the recent past, however, is that while it can be overdone, it should not be underd one. 8. References [1] J. E. Stiglitz, “More Instruments and Broader Goals: Moving toward the Post-Washington Consensus,” WIDER Annual Lectures, 1998. [2] H. Ricardo, D. Rodrik and A. Velasco, “Growth Diag- nostics,” In: J. Stiglitz and N. Serra, Eds., The Washing- ton Consensus Reconsidered: Toward a New Global Governance, Oxford University Press, New York, 2008. [3] R. Dani, “Goodbye Washington Consensus, Hello Wash- ington Confusion,” Harvard University, Unpublished, 2006. [4] E. William, N. Loayza and P. J. Montiel, “Has Latin America’s Post-Reform Growth Been Disappointing?” Journal of International Economics, Vol. 43, No. 3-4, 1997, pp. 287-311. doi:10.1016/S0022-1996(97)00004-4 [5] E. Fernandez-Arias and P. J. Montiel, “Reform and Growth in Latin America: All Pain and No Gain?” IADB, Research Department Working Paper No. 351, August 1997. [6] N. Loayza, P. Fajnzylber and C. Calderon, “Economic Growth in Latin America and the Caribbean: Stylized Facts, Explanations, and Forecasts,” Central Bank of Chile Working Paper No. 265, 2005. [7] P. J. Montiel, and L. Serven, “Macroeconomic Stability in Developing Countries: How Much Is Enough?” World Bank Research Observer, Vol. 21, No. 2, 2006, pp. 151- 178. [8] T. Becker and P. Mauro, “Output Drops and the Shocks That Matter,” IMF Working Paper WP/06/172, 2006. [9] P. Chuhan and F. Sturzenegger, “Default Episodes in the 1980s and 1990s: What Have We Learned?” Universidad Torcuato Di Tella, Unpublished, 2004. [10] M. Gavin and R. Perotti, “Fiscal Policy in Latin Amer- ica,” In: NBER Macroeconomics Annual, MIT Press, Cambridge, 1997. [11] C. Reinhart and K. S. Rogoff, “The Modern History of Exchange Rate Arrangements: A Reinterpretation,” Quarterly Journal of Economics, Vol. 119, No. 1, 2002, pp. 1-48 [12] L. Pritchett, “Understanding Patterns of Economic Growth: Searching for Hills among Plateaus, Mountains, and Plains,” World Bank Economic Review, 2000. [13] P. Osterholm and J. Zettelmeyer, “The Effects of External Conditions on Growth in Latin America,” IMF Working Paper WP/07/176, 2007. [14] L. Hernandez and P. J. Montiel, “Post-Crisis Exchange Rate Policy in Five Asian Countries: Filling in the ‘Hol- low Middle’?” IMF Working Paper WP/01/170, 2003. [15] International Monetary Fund, “Regional Economic Out- look: Asia and the Pacific,” October 2009. [16] International Monetary Fund, “Regional Economic Out- look: Western Hemisphere,” April 2009. [17] J. Aizenman and G. K. Pasricha, “Net Fiscal Stimulus during the Great Recession,” NBER Working Paper 16779, 2011. [18] International Monetary Fund, “Regional Economic Out- look: Sub-Saharan Africa,” October 2009. [19] International Monetary Fund, “Regional Economic Out- look: Sub-Saharan Africa,” April 2010. [20] International Monetary Fund, “Regional Economic Out- look: Middle East and Central Asia,” October 2009. [21] International Monetary Fund, “Regional Economic Out- look: Asia and the Pacific,” April 2010.

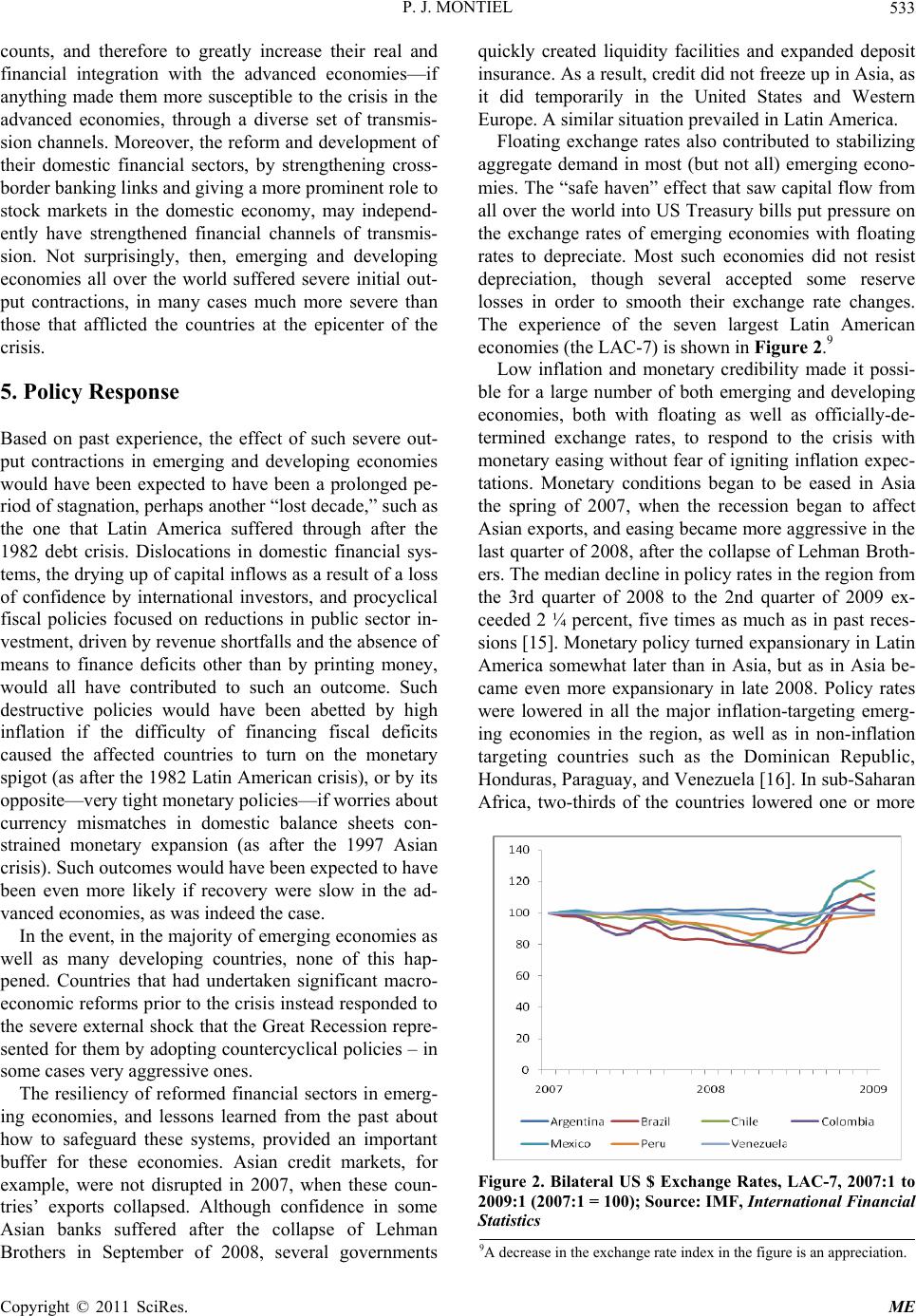

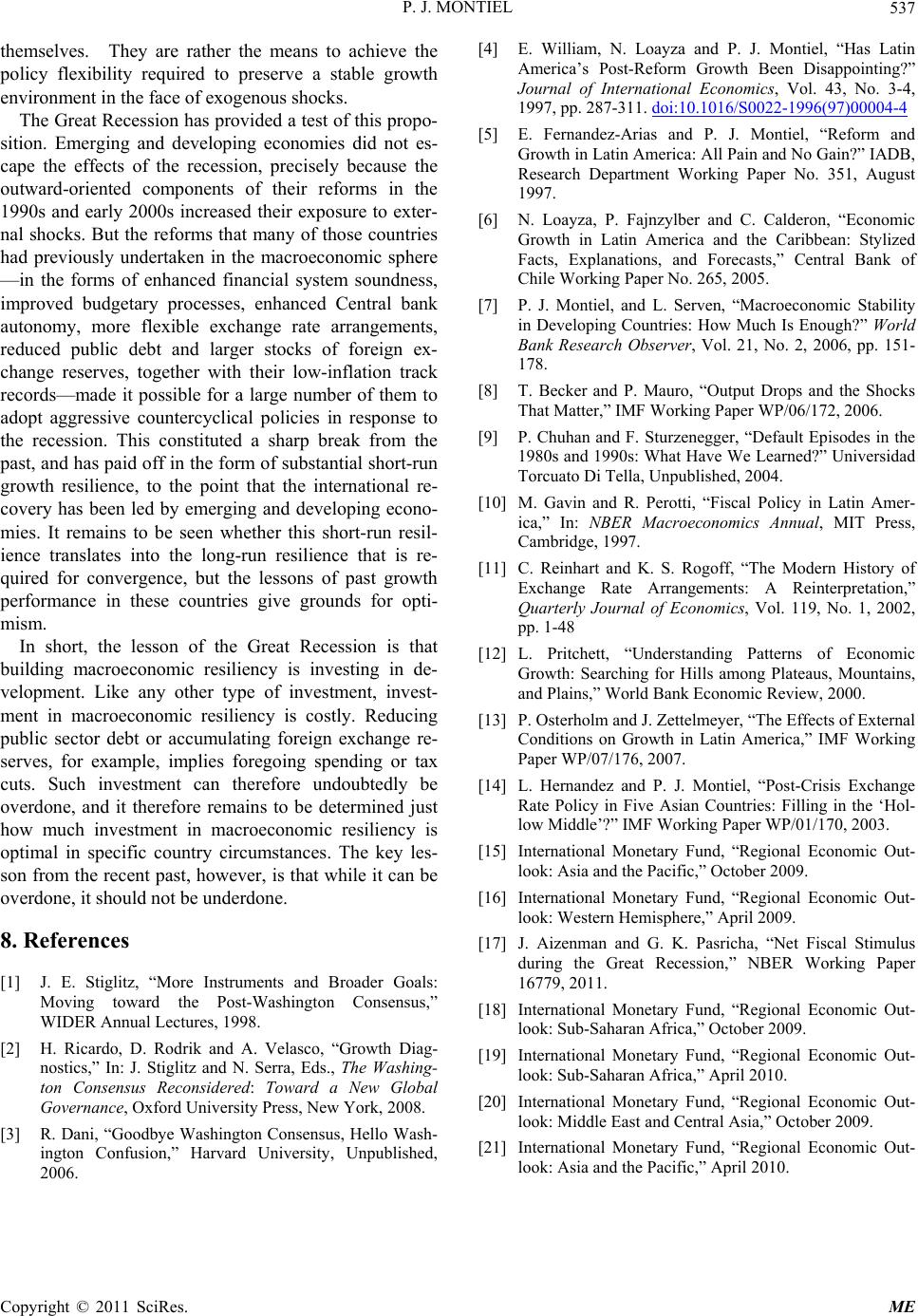

|