Applied Mathematics, 2011, 2, 1182-1190 doi:10.4236/am.2011.29164 Published Online September 2011 (http://www.SciRP.org/journal/am) Copyright © 2011 SciRes. AM Multi-Team Bertrand Game with Heterogeneous Players Mohammed Fathy Elettreby1*, Daoud Suleiman Mashat2, Ashraf Mobarez Zenkour2 1Mathematics Department, Facu lty of Science, King Khaled University, Abha, Saudi Arabia 2Department of Mat hem at i cs, Faculty of Science , King Abdulaziz University, Jeddah, Saudi Arabia E-mail: *mohfathy@mans.edu.eg Received March 9, 2011; revised June 8, 2011; accepted June 15, 2011 Abstract In this paper, we proposed a general form of a multi-team Bertrand game. Then, we studied a two-team Ber- trand game, each team consists of two firms, with heterogeneous strategies among teams and homogeneous strategies among players. We find the equilibrium solutions and the conditions of their local stability. Nume- rical simulations were used to illustrate the complex behaviour of the proposed model, such as period dou- bling bifurcation and chaos. Finally, we used the feedback control method to control the model. Keywords: Bertrand Game, Non-Convex Dynamical Multi-Team Game, Incomplete Information Dynamical System, Marginal Profit Method, Nash Equilibrium 1. Introduction Game theory [1,2] is the study of multi-person decision problem. Such problems arise in economics. The game is called incomplete information if at least one of the players does not know the other player's payoff, such as in an auction when the bidders do not know the offers of each other. Otherwise, it is called complete information game. Also, the game can be classified to static or dyna- mic game. There are two famous economic games, the first is the Cournot game [3] and the second is the Bertrand game [4]. In economic games, the first step is to construct the game. The second step is to solve the game (get their Nash equilibrium) and study the stability of these equilibria. Nash [5] showed that in any finite game there exists at least one Nash equilibrium. Nature push us to make teams in all fields. This has at least two main advantages. The first is the improvement of our profit and the second is that living in a team reduces the risk. For example, in the forest animals live in teams (herds). Since looking for food in a team is more efficient than doing it alone and reduces predation risk due to early spotting of predators and that existing in a team gives a higher probability that the predator will attack another member of the team. Another example is the competition between firms in the market. Suppose branches of McDonald fast food shops compete against branches of Kentucky fast food shops. N Multi-team game has been studied in [6]. In their work, they proposed and applied the concept of multi-team game in the hock-dove game, prisoner dilemma game and Cournot game. Also, the Cournot multi-team game has been studied in [7-11]. The standard static Bertrand game has been studied in [12]. A duopoly Bertrand game with bounded rationality is studied in [13]. Multi-team bertrand game is studied in [14] with two teams but the second team consists of one player. We will construct the model in Section 2. In Section 3, we will analysis the model, i.e., we will find its equi- librium points and their stability conditions. Some nume- rical analysis will be done in Section 4 to show the com- plexity behaviour of the model. Finally in section 5, we will use the feedback control method to control our odel. m 2. The Model Bertrand game is a model of competition used in eco- nomics. It describes interaction among firms that set prices and their customers that choose quantities at that price. In this game there are at least two firms producing homogeneous products and compete by setting prices simultaneously. Consumers buy everything from a firm with a lower price. If all firms have the same price, consumers randomly select among them. Suppose there are totally firms (produce certain product) in the market and these firms are divided into teams. Let ij be the price per unit of that product produced by the firm in the team and let ij c be the marginal cost of producing one unit of that product n Npj i  M. F. ELETTREBY ET AL.1183 by the firm in the team . Then, the payoff of the firm in the team , if it played without the team, is given by the following equations; j = ij i 1,, a i ji , pc π=, 1,, =, ij ijijlkij i bppp iNjN (1) where is the number of teams and i is the number of firms in the team . The positive constants are the demand parameters where is the slop of the demand function. N N ,ab b We propose that, firms in the same team share some of their payoffs with their team mates. So, let i lj be the payoff rate that firm will takes from the payoff of firm in the same team . It is clear that , j i lj =1 12 12 l i lj i0< <1 i lj <1 l of the first firm of the first team , if he played with the team, is given by the followimg; and . For example, the final payoff <1 j j =1i π i 11 1 131 11 1 11 1 21311 1 11 =1 π π, N NN 11 13 ππ lj where 1 is the number of firms in the first team. In general, the final payoff of the firm in the team i is given by; Nj =1 π NN ii i ijjlijlj il lj (2) In the case of two teams =2N =2 where each team consists of two firms and from Equation (1), we get the following payoffs of the firms in each team; 12 =NN 11 = = = b b b b , , . 12 21 22 1111 11122122 12121211 21 22 2121212211 12 22222221 11 12 =, pca p p pp pcapppp pcapp pp pcapppp π π π π (3) Using the assumption in Equation (2) of sharing some of the payoffs and Equation (3), we get the final payoffs of the firms as follows: 11 11121121 12 11 12211212 11 22 21122121 22 22 22212212 21 =1 ππ, =1 ππ, =1 ππ, =1 ππ. (4) In this model, we assume that the firms in the first team use the marginal profit method [15], to expect their profit for the next time according to the following equations; 1 1 1111 1 =, tj tt t jjjj tj pp pj p =1,2, (5) where 1 is the speed (rate) of adjustment and it is a function of the price 1 p. The firms in the second team use Nash equilibrium [2], to make their decision for the next step by solving the following equations; 2 2 =0, =1,2. tj tj j p (6) In this model, we assume that the speed of adjustment will be linear and take the form 11 11 = tt jj pp j , and 1>0 j . Substituting from Equation (4) in Equations (5) and (6), we get the following system (7); Then, Equation (7) describe a system of two teams, each team consists of two firms with homogeneous strategies among each firms in each team and heteroge- eous strategies among teams. n 3. The Analysis of the Model The steady state (equilibrium) solutions are very interest [16]. In the context of difference equations, an equilibrium solution is defined to be the value that satisfies the relations 1== tt xx . Then, we can get the equilibrium solutions for our model by the following. Let 11 1 11 12 1 21 22 t p 111112111112212221 1212 11 1 121221121211 21 22121111 2 21 22111222 22 2 12 =1 2, =1 2, 1 =, 221 tt tttttt tt tttttt ttttt ppabcbpppp pc ppabcbpppp pc cppp pc bb 11 12 21 p p bpa 2 12 21 11 122121 2 21 1 =. 221 tttt abpppp c bb 1 22 c (7) Copyright © 2011 SciRes. AM  M. F. ELETTREBY ET AL. Copyright © 2011 SciRes. AM 1184 , . 11 11 1111121212 11 212121 222222 ==,== ==,== tt tt tt tt pppppp pppppp (8) Then, using Equation (8), the equilibrium points are given by solving the following system: 11 11 11121111122122211212 11 1212211212 11 21 22121111 2 21 212122111222 22 2 12 2 12 222221 11 1221 2 21 12 12 1 =, 221 1 =221 t t pabcbpppppc pabcbpppppc pabcppp pc bb pabcpppp bb 21 .c =0, =0, (9) We get three boundary equilibrium solution points and the fourth one is the coexistence equilibrium one. The first boundary equilibrium one is given by 12 1 11 =0,0, ,, ll Edd where 22 222 22 11221211212 =4 1111,db 21 222222222222 121 121221211221121221222112 =12112 11111,labc bcb 2 21 2222 22222222 21221211221122112 222112212112 =1211112 111.la bcbcb 2 The second boundary equilibrium one is given by 12 212 22 =0,,,, nn Ep dd where 2 122 22222 221122112212112 =1411112 1212 12,db bbbb 222 11 121 122121121121 12222 22 21 211221121221 12222 2 2121 22211221 =2 11211 211 21411112 12 2114112 12, nbba bcbc bcbbb b bcbbbb 1 12 222 11 212211221121121 12222 2 211221122112 12222 22 21 221221212112 =2 11211 211 2114112 12 2141111212. nbbabcbc bcbbbb bcbbb b 1 12 and 1 12 21212 11 12 1 221 =. 221 abc dnnc pbd b The third boundary equilibrium one is given by 12 311 33 =,0,, mm Ep dd , where 2 122 22222 312122112212112 =1411112121212db bbb b 222 11 121 122112121121 12222 22 12 211221121221 12222 2 1221 22211221 =2 11211211 21411112 12 2114112 12, mbba bbcc bcbbb b bcbbbb 1 12  M. F. ELETTREBY ET AL.1185 222 11 212211212121121 122222 1212 21122112 1222222 12 221221212112 =2 112112(1)1 2114112 12 21411112 12. mbba bbcc bcbbbb bcbbb b 1 12 and 1 11 31221 12 11 1 312 =. 221 abcdmmc pbd b The most important one is the coexistence one 4444 411122122 =,,,Epppp,where 43113443 123443213443223443 4 11 43 34 21111 221121 22 121122 122122 1 4 12 21 12 431134431234432134 43 4 21 2 = , 2 = , 2 = aBBcDBFBcEBHBcFBDBcHBEB pAB AB aBBcDBFBcEBHBcFBDBcHBEB pAB AB aAAcDAFAcEAHAcFADA p 22 3443 43 34 21111221121221 211221 221221 4 12 21 12 , 2 = , cHAEA BA BA aAA cDAFAcEAHA cFADA cHAEA pBA BA where, 1 21 11111 122112 2112 21 111 1221 12 3 21 11111 122112 2112 21 111 2112 21 2 22 22222 122112 2112 21 222 1221 12 = 81 1211, 1121 = 81 1211, (1) 121 = 81 1211, (1) 121 A b b A b b B b b B 4 22 22222 122112 2112 21 222 2112 21 = 81 1211, 1121 b b 2 11 1111 12211212 2121 111 1221 12 = 41 211211 , 1121 A b b 4 11 1111 12211212 2121 111 2112 21 = 41 211211 , 1121 A b b 1 22 2222 12211212 2121 222 1221 12 3 22 2222 12211212 2121 222 211221 = 41 211211 , 1121 = 41 211211 , 1121 B b b B b b 11 12 21 111 21 12 211111 12211221 12 3111 2112 21 22 12 21 222 21 12 2222 22 12211221 12 4222 2112 21 21 =, 12 (1) 4112 1 =, 1121 21 =, 12 1 4112 1 =, 1121 b Db b Db b Db b Db 11 12 21 311 12 21 2111 11 12212112 21 1111 1221 12 21 =, 12 1 4112 1 =, 1121 b Eb b Eb Copyright © 2011 SciRes. AM  M. F. ELETTREBY ET AL. 1186 22 12 21 422 12 21 2222 22 12212112 21 2222 1221 12 21 =, 12 1 4112 1 = 1121 b Eb b Eb , 22 12 21 122 21 12 22 2 12 1221 322 2112 21 11 12 21 211 21 12 11 1 12 1221 411 2112 21 22 21 12 322 12 21 2 21 21 1 21 =, 12 1 21 1 = 2 1 11 21 21 =, 12 1 21 1 =, 1121 21 =, 12 1 21 = b Fb b Fb b Fb b Fb b Hb H , 22 12 222 1221 12 11 21 12 411 12 21 11 1 21 2112 2111 1221 12 1 , 1121 21 =, 12 1 21 1 =. 1121 b b b Hb b Hb The stability of this equilibrium solutions is based on the eigenvalues of the Jacobian matrix of the system (7), which is given by (10); where 1 112 11111221 1 21 1212 =14 tt tt t abcbp p pp pc 22 and 1 2211212112122 1 12 11 11 =14 tttt t abcbpppp pc . The equilibrium solution will be stable if the eigenvalues , =1,2,3,4 ii of the Jacobian matrix (10) satisfy the conditions <1, =1,2,3,4 ii . The eigenvalues for the first equilibrium point are given by 1 E 111 11 , 212 12 , and 22 22 12212112 3,4 22 2 12 21 11 41 1b . For the other equilibrium points it is very difficult to compute these eigenvalues. Instead, we find the characteristic polyno- mial, which has the following form: 432 123 =,Paaa 4 a Then, the necessary and sufficient conditions [17], for all roots of the characteristic polynomial P to satisfy the conditions that <1, =1,2,3,4 ii are the following: 1234 1234 4 2 4341 22 2 4341 2 2 24 341143 1)1= 1>0, 2) 1=1>0, 3)< 1, 4) 1>, 5) 1 >1 Paaaa Paaaa a aaaa aaaa aa aaaaaa . (11) The coefficients of the characteristic polynomial for the most important one (coexistence) are as follows: 1111122 2111122 11 11 11 1211 1212212112 11 11 1112121221 22 22 12212112 22 2 12 21 =2 , =1 1 11 11 11 , 411 a a pp pp bb b 11 11 1111111 12211111 12 1111 12 111 1 12 12211212212 122112 1221 22 12 21 2 12 22 21 12 2 21 111 11 11 1 11 , 0 22 21 1 11 0 22 21 ppp pp bb b bb b 1 p (10) Copyright © 2011 SciRes. AM  M. F. ELETTREBY ET AL.1187 1222222 11 1112122112211221 322 2 12 21 1222 222 12 1221122112211221 22 2 12 21 1111 11 11 1211 12122112211221 1 11 11122 111 11 =41 1 111 11 41 1 1111 1112 p ab p b pp b p 12 121221111112212211221 22 2 12 21 1111211 , 21 1 p bb 222 11122 22 11 12 11 1221122121121221 4222 21 12 111 2222 11 12 11 1212211221121221 222 21 12 11 1122 1112111221 12122121 12 11 11 =411 11 11 411 1111 pp ab pp b pp 22 12 21 222 12 21 1 1 22 2222 22 11 1112122121221111 21 12122121 121221 22222 21 1221 12 22 22 11 112221121221 22 12 41 1 11 11 11 11 411 411 11 11 411 b pp bb b 2 2 21 . Then, the equilibrium solution 4 of the system (7) is stable under the conditions (11). This means that in the long run all firms are coexist. So, the market will be stable. E 4. Numerical Simulations In this section, we will use some numerical simulations to show the complicated behaviour of the model (sta- bility, period doubling bifurcation and chaos). Figure 1 shows the bifurcation diagram of the prices and profits with respect to the adjust speed 11 while the other parameters are constant and have taken the values , , , , , , , , , , , , , and 0 11 =0.30p 1 12 =0.2 12 =0.13c 12 =0.2 0 12 =0.55p 1 21 =0.3 2 12 21 =0.21 c 0 21 p =0.1 =0 =0.2 =0.60 2 21 3a 0 22 =0.64p 411 =0.1c =3b c. =1 1 22 . This figure shows that the equilibrium point = 0.5212497,0.5254234,0.5638708,0.5599204p is locally stable for 11 < 0.7569938 , after this value it became periodic and finally the system became chaotic. The same thing occur to the profits in figure 1B at the same value of 11 . Figure 2 shows the effect of changing the parameters i lj . We get a bifurcation diagram for the prices and profits with respect to 1 12 with the values of the other parameters are the same as in Figure 1 except that 11 became constant and takes the value 12 =0.9 and 1 12 became variable. We note that the small cooperation among the firms in the same team () will lead to a complex behaviour in the system, while the increasing this ooperation will lead to the stability. 1 12 < 0.3459991 c 5. Chaos Control As we seen in the last section, the adjustment rate ij and the payoff return i lj of the boundedly rational firms play an important role in the stability of the market. So, to avoid this complexity we will try to control the chaos. We will use the feedback method [18] to control the adjustment magnitude. Modifying the first equation in our system will give us the following controlled system; Copyright © 2011 SciRes. AM  M. F. ELETTREBY ET AL. Copyright © 2011 SciRes. AM 1188 Figure 1. The bifurcation diagram of the prices and the profits with respect to α11. Figure 2. The bifurcation diagram of the prices and the profits with respect to 1 12 . 11 1 11 11111112111112212221 1212 11 1 12121212211212 11 21 22121111 2 121 212122111222 22 2 12 2 =1 2 1 =1 2 1 =, 221 tt tttttt tt tttttt ttttt pp pabcbpppppc k pp pabcbpppppc pabcppppc bb p , , 2 112 222 2111122121 2 21 1 =, 221 ttttt abcpppp c bb (12) where the parameter is the control factor. The Jacobian matrix of the controlled system will be: >0k  M. F. ELETTREBY ET AL.1189 1111 11 11122111 111211 1112 11 1 111 1 12 12211212212 1221121221 22 12 21 2 12 22 21 12 2 21 11 1111 11 1 1 11 0 22 21 1 11 0 22 21 ppp kkkk pp bb b bb b 1 1 1p (13) The original system is chaotic for the parameter values , , , , , , , , 11, , 21 , 22 , , , 11 0 11 =0.30p 1 12 =0.2 12 =0.13c =1.1 0 12 =0.55p 1 21 =0.3 2 12 =0.21c 0 21 =0.60p =0.1 2 21 =0 =0.23 0 22 =0.64p 4=0.1c =1 =3b . a1 c and 12 =0.2 . But the controlled system is stable (i<1, =1,2,3,4i ) for all the above parameters values and for . > 0.455k9977 Figure 3. The bifurcation diagram of the prices with respect to the controlling factor k. Figure 4. The bifurcation diagram of the prices with respect to the controlling factor k = 0.5. From Figure 3, we find that the controlled system begin chaotic, periodic and then stable by increasing the control factor . k Figure 4 shows the stability behaviour of the controlled system when . This means that if the firms in the first team adopt the feedback adjustment, the price system can switch from a chaotic to a regular or equilibrium state. = 0.5k 6 . Acknowledgements We would like to express our appreciation to the Deanship of Scientific Research at King AbdulAziz University, Saudi Arabia for its financial support of this study, Grant No. 3-058/430. 7. References [1] R. Gibbons, “A Primer in Game Theory,” Simon and Schuster, New York, 1992. [2] B. R. Myerson, “Game Theory: Analysis of Conflict,” Harvard University Press, Cambridge, 1997. [3] A. Cournot, “Researches into the Mathematical Principles of the Theory of Wealth,” Macmillan, New York, 1897. [4] J. Bertrand, “Theorie Mathematique de la Richesse Soaiale,” Journal des Savants, Vol. 67, 1883, pp. 499- 508. [5] J. Nash, “Equilibrium Points in an n-Person Games,” Proceedings of the National Academy of Sciences, Vol. 36, No. 1, 1950, pp. 48-49. doi:10.1073/pnas.36.1.48 [6] E. Ahmed, A. S. Hegazi, M. F. Elettreby and S. S. Askar, “On Multi-Team Games,” Physica A: Statistical Mechan- ics and Its Applications, Vol. 369, No. 2, 2006, pp. 809- 816. doi:10.1016/j.physa.2006.02.011 [7] T. Puu, “Chaos in Duopoly Pricing,” Chaos, Solitons & Fractals, Vol. 1, No. 6, 1991, pp 573-581. [8] T. Puu, “The Chaotic Monopolist,” Chaos, Solitons & Fractals, Vol. 5, No. 1, 1995, pp. 35-44. [9] M. F. Elettreby and S. Z. Hassan, “Dynamical Multi- Team Cournot Game,” Chaos, Solitons & Fractals, Vol. 27, No. 3, 2006, pp. 666-672. [10] E. Ahmed and A. S. Hegazi, On Dynamical Multi-Team Copyright © 2011 SciRes. AM  M. F. ELETTREBY ET AL. 1190 and Signaling Games,” Applied Mathematics and Com- putation, Vol. 172, No. 1, 2006, pp. 524-530. doi:10.1016/j.amc.2005.02.030 [11] S. S. Asker, “On Dynamical Multi-Team Cournot Game in Exploitation of a Renewable Resource,” Chaos, Soli- tons & Fractals, Vol. 32, No. 1, 2007, pp. 264-268. [12] E. Ahmed, M. F. Elettreby and A. S. Hegazi, “On Puu’s Incomplete Information Formulation for the Standard and Multi-Team Bertrand Game,” Chaos, Solitons & Fractals, Vol. 30, No. 5, December 2006, pp. 1180-1184. [13] J. X. Zhang, Q. L. Da and Y. H. Wang, “The Dynamics of Bertrand Model with Bounded Rationality,” Chaos, Solitons & Fractals, Vol. 39, No. 5, 2009, pp. 2048- 2055. [14] D. Zhanwen, H. Qinglan and Y. Honglin, “Analysis of the Dynamics of Multi-Team Bertrand Game with Het- erogeneous Players,” International Journal of Systems Science, Vol. 42, No. 6, 2010, pp. 1047-1056. [15] G. Gigerenzer and R. Selten, “Bounded Rationality,” MIT Press, Cambridge, 2002. [16] L. Edelstein-Keshet, “Mathematical Models in Biology,” Random House, New York, 1988. [17] E. I. Jury, “The Inners Approch to Some Problems of System Theory,” IEEE Transactions on Automatic Con- trol, Vol. 16, No. 3, 1971, pp. 233-241. doi:10.1109/TAC.1971.1099725 [18] E. M. Elabbasy, H. N. Agiza and A. A. Elsadany, “Ana- lysis of Nonlinear Triopoly Game with Heterogeneous Players,” Computers & Mathematics with Applications, Vol. 57, No. 3, 2009, pp. 488-499. Copyright © 2011 SciRes. AM

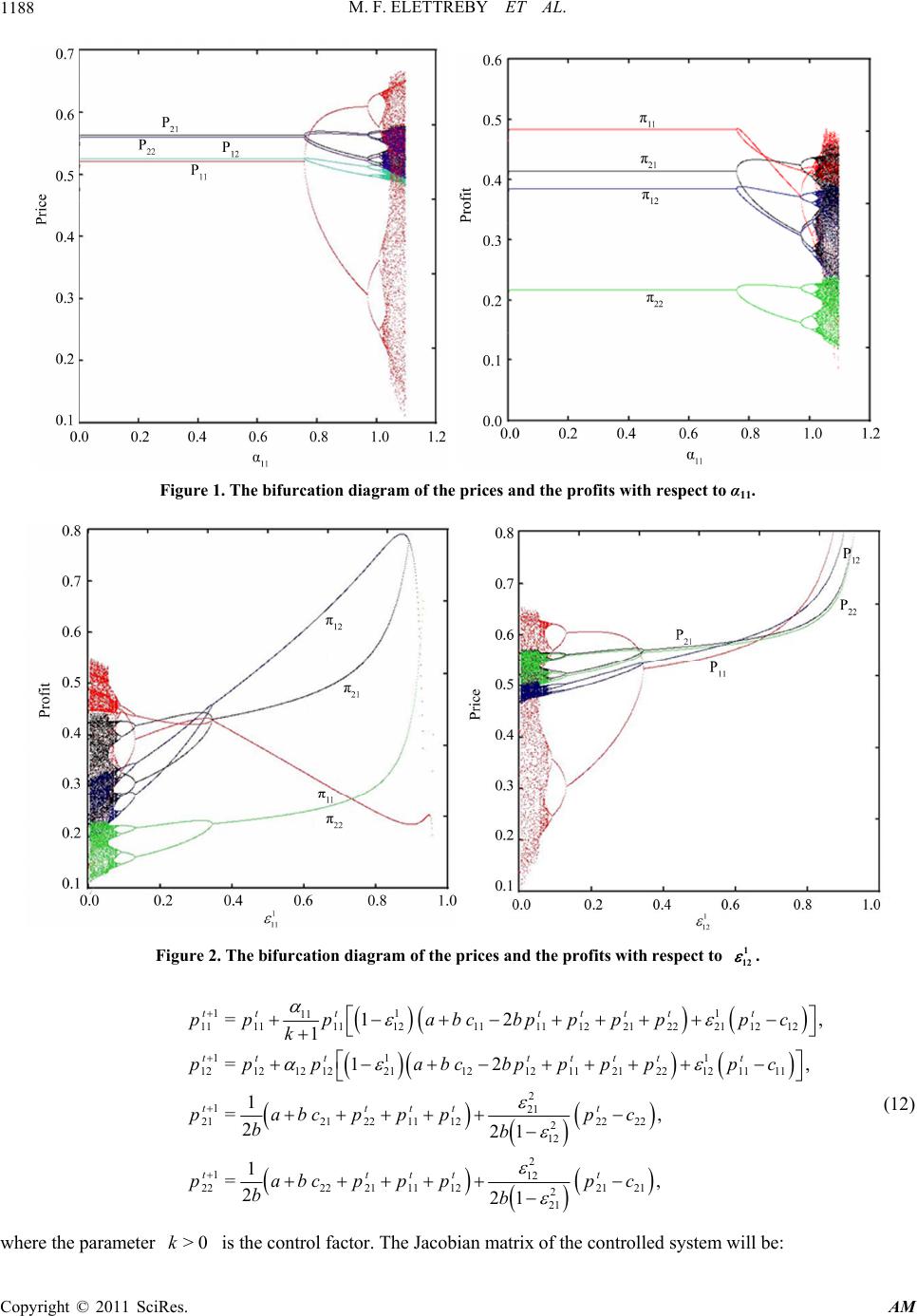

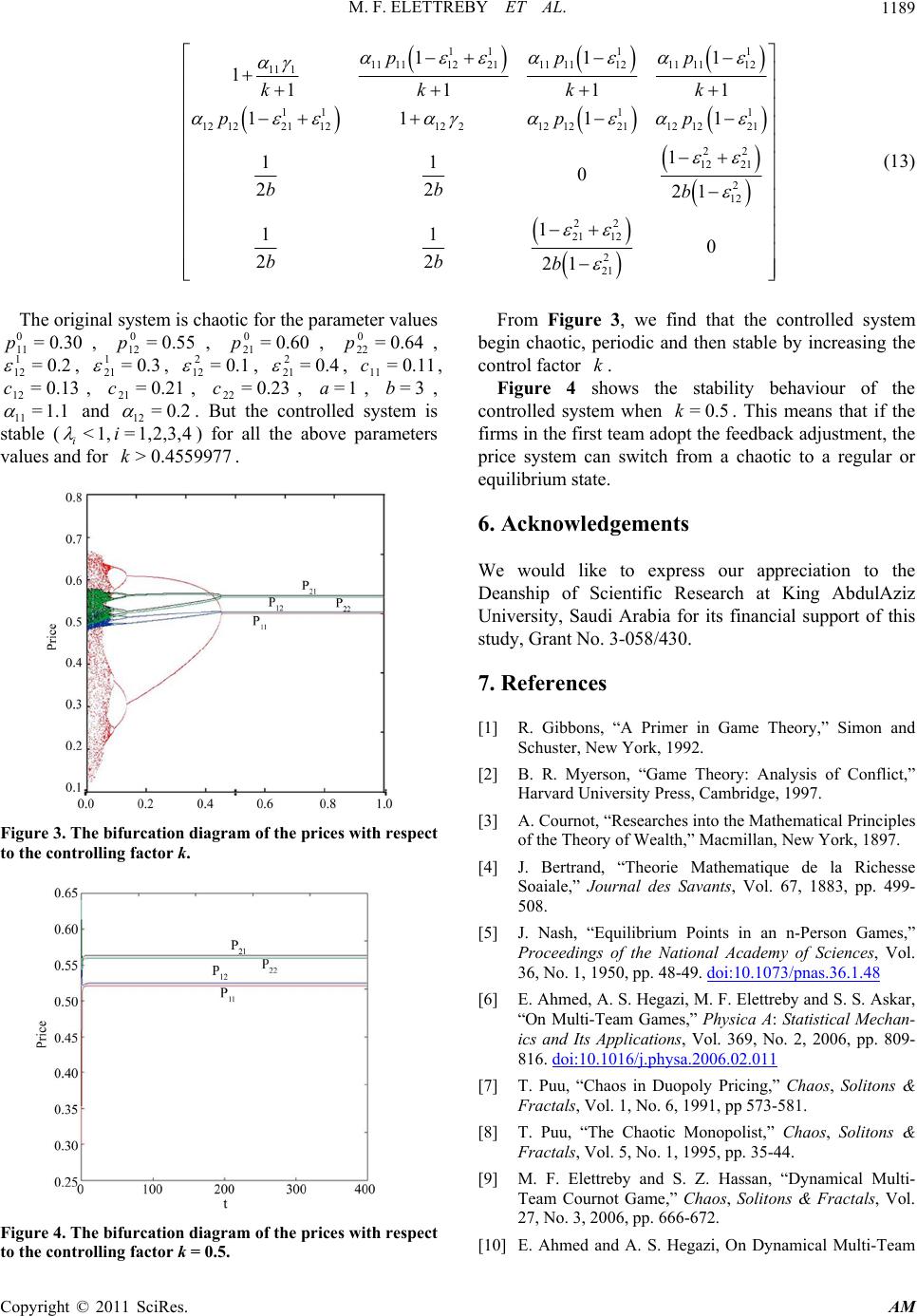

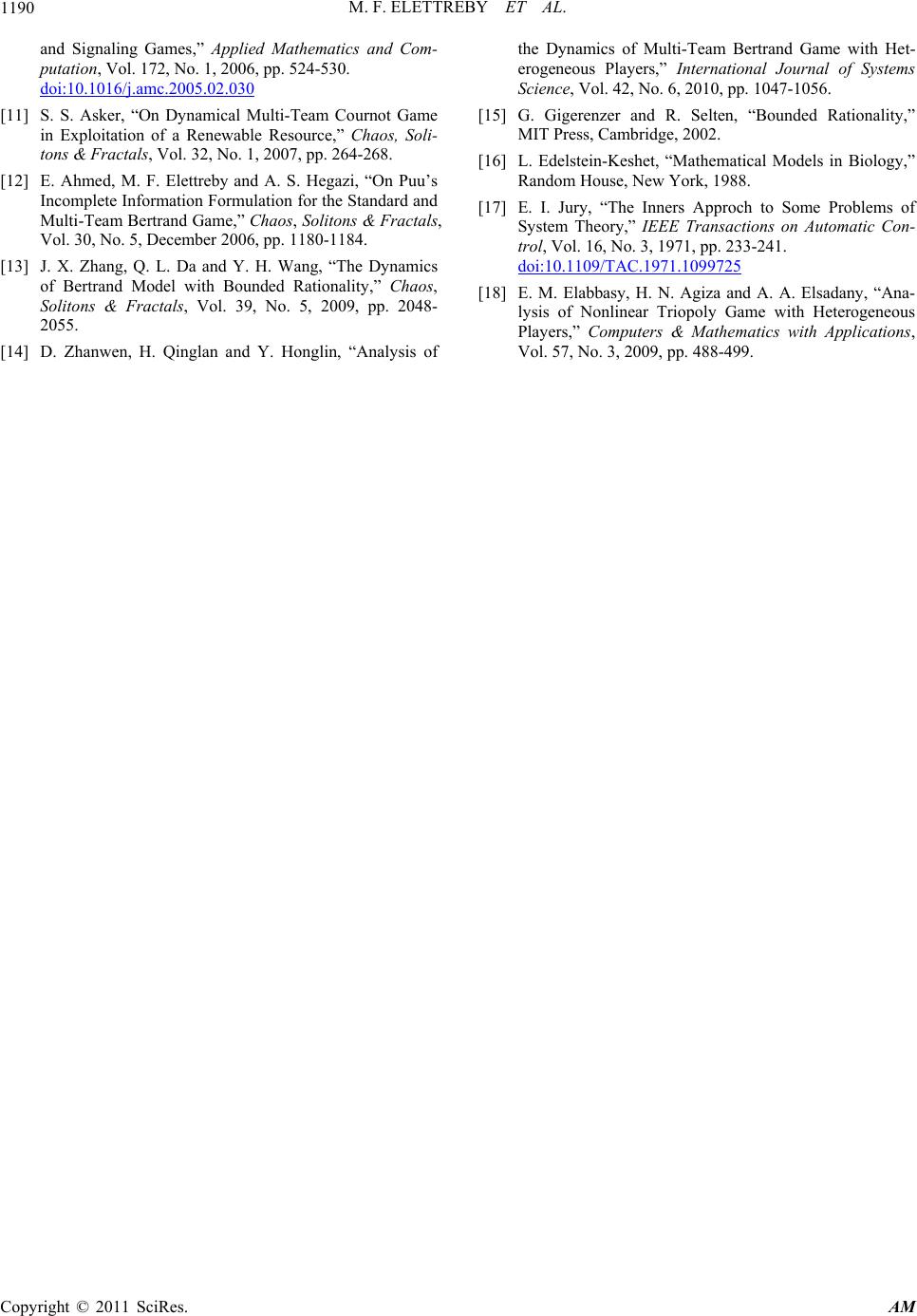

|