Journal of Mathematical Finance, 2011, 1, 15-27 doi:10.4236/jmf.2011.12003 Published Online August 2011 (http://www.SciRP.org/journal/jmf) Copyright © 2011 SciRes. JMF 15 On Some Class of Distance Functions for Measuring Portfolio Efficiency Carlos Barros1, Walter Briec2, Hermann Ratsimbanierana2 1School of Econ omics and Management, Techn ical University of Lisbon, Lisbon, Portugal 2Centre d’Analyse de l’Efficience et Performance en Économie et Management, University of Perpignan, Perpignan, France E-mail: cbarros@iseg.utl.pt, {briec, hermann.ratsimbanierana}@univ-perp.fr Received May 19, 2011; revised July 22, 2011; accepted August 1, 2011 Abstract Morey and Morey [1] have developed an approach for gauging portfolio efficiencies in the context of the Markowitz model. Following some recent contributions [2,3], this paper analyzes the axiomatic properties of distance functions extending an earlier approach proposed by Morey and Morey. The paper also focuses on the hyperbolic measure and the McFadden gauge function [4]. Among other things, overall, allocative and portfolio improvements possibilities (in term of return expansion or/and risk contraction) based upon the in- direct mean-variance utility function are analyzed. Along this line, duality results are established in each case. This enables us to calculate the degree of risk aversion maximizing the investor indirect mean-variance util- ity function in either return expansion or risk contraction. An empirical illustration is provided and reveal ranking of preferred risks aversion for some “CAC40” assets. Keywords: Distance Functions, Portfolio Selection, Efficient Frontier, Dualities, Risk Aversion 1. Introduction Distance functions, have been introduced by Shephard to measure by Shephard [5] for efficiency measurement ei- ther in input or output orientation. At the same time, Markowitz [6,7] has formulated the mean-variance model, a mathematical approach for determining the optimal riskreturn trade-off for portfolio selection. This approach is based upon quadratic programming. However, its computational cost was very high. Hence, Sharpe [8,9] had developed the simplified diagonal model and later formulated the capital asset pricing model (CAPM) with Lintner [10]. Markowitz [11] criticized the relation be- tween risk and excess returns described by the linear model due to Sharpe and Lintner. He argued that differ- ent expected returns might surely be obtained from the same risk structure. Nevertheless, the mean-variance approach is the cor- nerstone of portfolio management and risk assessment. The purpose of this paper is to provide a general taxon- omy of ratio-based performance indicator for risk man- agement. This contribution extends the analysis proposed by Morey and Morey [1] and also provides a new look at some more recent contributions. In [2,3] a general framework was introduced that is based upon the short- age function a concept introduced by Luenberger [12] in microeconomic analysis. Transposed in a portfolio opti- mization context, this function looks for possible simul- taneous improvement of return and reduction of risk in the direction of a vector g. Though this approach gener- alizes that of Morey and Morey in the mean-variance space, the choice of a direction remains much arbitrary. In this paper, we make other investigations about meas- ures involving a proportionate improvement of risk and return. It is shown that the measure proposed by Morey and Morey satisfies a special type of duality, termed “fractional duality”. It is also established that one can obtain a duality result linking the indirect mean-variance utility both to the hyperbolic measure and the McFadden gauge function [4]. Some mathematical programs are also proposed and we propose a procedure to measure the risk aversion from the Khum and Tucker multipliers. Among other things we propose a procedure to com- pute the distance functions introduced by Morey and Morey in the case where short sales are allowed. Hence, it is then possible to measure the impact the budget con- straint has on performance. This we do by introducing a special version of the Thomson metric.  C. BARROS ET AL. 16 0 This paper is organized as follow. In Section 2, suc- cinctly presents the basic tools of the portfolio manage- ment approach proposed in Briec et al. [2]. Section 3 focusses on the distance function proposed by Morey and Morey. We then study some of their more appealing properties. Duality results are analyzed in Section 4 and allow us to decompose efficiency following the Farrell approach [13]. Hence, the preferred risk aversion in input or output orientation can be computed. Sources of per- formances change are discussed in Section 5. Section 6 introduces an indicator based under the Thomson metric to measure the impact on the performance of managerial constraint. In the next section the dual properties of hy- perbolic measures and McFadden gauge are analyzed. They are compared to the return oriented measure. The last section provides an empirical illustration with some “CAC40”. A concludingsection outlines conclusions and possible extensions. 2. Efficient Frontier and Portfolio Management This section introduces main ideas of the portfolio selec- tion problem. Let us consider a market with n financial assets. Note E[Ri] for i = 1, ..., n the expected return of the asset i and the covariance matrix of these assets such that , ijij for i, j {∈1, ..., n}. A portfo- lio is an combination of one or more of these assets. Their proportions may be represented by the vector x = (x1, x2, ... , xn) with and xi > 0 if short sales is not allowed. , Cov R R 1 nx1 ii It is assumed throughout the paper that economic con- straints (Pogues [14], Rudd and Rosenberg [15]) are lin- ear functions of the asset weights. Thus, the set of the admissible portfolios may be written as follow : 1 :1, n n Ai i xxAx, (2.1) where A is an affine m × n map whose the range on is a subset of . If Ax is null for all x ∈ then we say that short-sales are allowed. In such a case, the set of admissible portfolios is extended from the unit simplex to an unbounded hyperplane. In general, the constraint Ax ≥ 0 represents the economic and managerial con- straints the manager must deal with. The return of port- folio x is 1i . The expected return and its variance can be defined as follows: 1 n i xE m Rx n x n ii xR n i ER i Rand , respec- tively. For the sake of simplicity, let us denote x , j R, i Cov R n iji j x xVarR ERx and VarR x . (2.2) In addition, we consider the map de- fined by 2 : A , xx (2.3) See for instance [20] for more details about mean- variance approaches and stochastic dominance. The return and the variance are continuous in x. Hence A is a compact subset of . Following the Markowitz ap- proach, the subset 2 A is important to identify the efficient portfolios. However, it is not convex and, conse- quently, this subset cannot be used for a quadratic pro- gramming approach. Briec, Lesourd and Kerstens [2] have extended the subset A as follows: A DRA (2.4) It is important to notice that DRA is convex. Equiva- lently, one has: 2 ,: ,,, A A DRr m rmx x (2.5) This set is not only compatible with the definition in Markowitz [6], it guarantees a minimum variance of the feasible portfolios analogously to a “Free-Disposal Hull”. The subset of the all the mean-variance points that are not strictly dominated is termed the “efficient frontier”. It is useful to define the efficient portfolios from the above definition. Definition 2.1. The set of the weakly efficient portfo- lios n the simplex is defined as: :, , , MA A xxxrm rm DR For a given degree of risk aversion, Markowitz [6] de- fined the following utility function to compute the cor- responding efficient portfolio. , A Uxx x where 0 and 0 . The following program maximize this mean-variance utility function. , 1 max .. 0 1, 0 A n i i Uxx x st Ax xx where the ratio 0, stands for risk aver- sion. 3. Portfolio Efficiency Measures Measuring efficiency in a portfolio context accounts usually the possible return improvements and/or risk contractions. In this paper, we propose some class of measures which consider investor preferences for risk. Copyright © 2011 SciRes. JMF  C. BARROS ET AL. 17 3.1. The Morey and Morey Distance Functions Two distance functions were introduced by Morey and Morey to gauge portfolio performance. The first function computes the maximum expansion of the mean of return for a given level of risk. The map :1, A RE Dx defined as: sup :, A E Dxxx DR A 0 (3.1) is called the Morey return expansion distance function. It is easy to see that this measure has some drawbacks for portfolios whose the return is not positive. Thus, we shall restrict its domain to the subset of defined by: : AA xx . (3.2) Focusing on the risk contraction, the map : A RC D 0,1 defined by: inf :, A C DxxxDR A (3.3) is called the Morey risk contraction distance function. Notice that this function may be zero valued when there is a riskless asset whose the variance is 0. We propose some of their elementary properties which are essentials in portfolio performance gauging. To simplify the nota- tions, we introduce the partial order defined by: , , yxx y y. (3.4) Proposition 3.1. Let A E D be the mean expansion re- turn distance defined in (3.1). A E D has the following properties: i) 1 A ARE xDx 1 AM ii) C ,xy A iii) , if Dx (Weak efficiency). y then AA RE RE yD x (Weak monotonicity). iv) A E D is continuous on A. Proof. Let us prove i). The first inequality is immedi- ate. From the definition of the representation set, if then the subset x ,:, , A CxveDRvexx is bounded. It trivially follows that RE Dx . To prove ii), assume that . In such a case, there exists some MA x ,A veDR such that , ve , x . But, from Definition (3.1), it immedi- ately follows that . Consequently, it can be deduced that 1Dx 1 A A RE M EA . To prove the converse, assume that . We get: Dx A x 1 A RE Dx ,, RE Dx xxx . It can immediately be deduced that MA x . Let us prove iii). , if , A xy x and then A x A RE Dy RE D. From the notations above, we have Cx Cy , for all , A xy . Con- sequently, :,: AA , xDRyy DR , and the result follows. We end by proving iv). Let : A TDR R be the function defined by A DR,sup:m r,Tr m Since DRA is convex and satisfies the free disposal rule, it is easy to show the continuity of T (see Shephard [5]). Hence A RE Dx is continuous on . A The next result analyzes the case where the distance function involves a risk contraction of portfolios. Proposition 3.2. Let A C D be the risk contraction dis- tance function defined in (3.3). We have the following properties. i) If there is no riskless asset then 01 A RC Dx ii) For all A Dxx, RC 11 AA RE Dx x MA (Weak efficiency) iii) ,xyA , A A RCRC yDyDx (Weak monotinicity). iv) A C D is continuous on . A Proof. With obvious changes, the proofs are similar to those of Proposition (3.1). 3.2. The Efficiency Improvement Possibility Function To gauge portfolio efficiency, Briec, Lesourd and Ker- stens [2] have introduced a variation of the shortage function which computes simultaneously risk reduction and expected return improvement. For a portfolio x in DR, the direction of the shortage function is determined by the vector g = (−gV, gE). Formally, this efficiency im- provement possibility function is defined by: g V DR 1 i i R R sup;g , g Sxx x E (3.5) The following quadratic program computes the maxi- mum percentage improvement of the portfolio yk: 1 =1 =1 max .. () , =1, 0,= n kE i i n kV i i ii in st ygxE yg xV xbx xin For more details of the basic properties about this function, see for instance Briec et al. [2]. 3.3. Hyperbolic and McFadden Distance Function We introduce two distance functions defined in the mean- Copyright © 2011 SciRes. JMF  18 C. BARROS ET AL. variance graph. We analyze the basic properties and establish a duality result. Measuring efficiency in a portfolio context accounts the possible return improve- ments and/or risk contractions. In the following, we in- troduce two specific measures. The first one, called hy- perbolic distance function, computes the maximum si- multaneous shrinkage and expansion of the risk and ex- pected return respectively. It is defined as: 1 ()=sup:((),()) A H Dxxx DR A (3.6) We also introduce the McFadden gauge that computes the maximum proportionate expansion of the risk and expected return respectively: ()=sup{ :((),())} A FA Gxxx DR (3.7) We propose some of their elementary properties which are essentials in portfolio performance gauging. Figure 1 illustrate the basic ideas behind the definitions above. The “hyperbolic distance function” simultaneously invol- ves a contraction of the risk and an expansion of the expected return. The “McFadden gauge function” is very different because it computes simultaneously the maxi- mum expansion of the risk and the expected return of investors. Proposition 3.3. The map A D defined in (3.1) has the following properties: i) ()< A H xDx () 0x ii) if , then ()=1( ) AM A Dx x (Weak efficiency). iii) , if ,xy y then (We ak monotonicity). () () AA HH Dy Dx iv) A D is continuous on A . Proof. The proofs are very similar to those concerning the maximum risk expansion distance function and thus it is omitted. The mathematical program, one need to solve is the following: Figure 1. Hyperbolic Distance Function and McFadden Gauge. =1 , ,=1 =1 () = max .. () 1 () =1, 0. A H n ii i n ij ij ij n i i Dy ty xER y xAx x x } (PH) The next result analyzes the case where the distance function involves a risk contraction of portfolios. In the following we denote . ()={: < AA MFA MF GxG A Proposition 3.4. Let F be the map defined in (3.3). We have the following properties. G i) If ()>0x then . ()< A MF Gx ( ) M ii)()=1 A F x ,,xy A Gx (Weak efficiency) iii)A ((),())(( ),( ))( )( ) AA MF MF yxxGyG x . Proof. i) Since A is a compact set it follows that () A A MF Gx is a compact subset of . Therefore it is norm bounded. Consequently, by definition, is bounded in its return dimension. Thus . ii) Clearly, if then the point (( 2 A MF Gx A DR < ()) () ), ()=1 x lies on the upper part of the mean-variance frontier. However, all these frontier points are efficient which ends the proof. The proof of iii) is immediate. Notice that, in general, the gauge function is not continuous on A . Moreover, it does not characterize the weak efficient frontier. The next result offers a comparison between all the distance functions introduced in the paper. Lemma 3.5. For all A x and such that ()>0x , we have: . () () AA A HR Dx Dx() E x G MF Proof. Clearly, we have the inclusion 1 :(),(){:(( ),())} AA xDRx xDR , hence we obtain the first inequality. To prove the second one, fix = . By definition () A RE Dx ((), ()). A xDR However, by construction . Since =( AA DR DR ) 1 , we then deduce that ((),()) A xDR . Thus, A F G ()x which ends the proof. Suppose that ()>0y , the mathematical program one should compute is the following: =1 , ,=1 =1 () = max .. () () =1, 0. A MF n ii i n ij ij ij n i i Gy ty xER yx xAx x (PMF) Copyright © 2011 SciRes. JMF  C. BARROS ET AL. 19 4. Duality and Graph Distance Functions Following our earlier results, we establish a link between these distance functions and the indirect mean-variance utility function, except for the shortage function which has already been discussed in [2]. The indirect mean- variance utility gives the portfolio which achieves a maximal utility of an agent given his (her) risk aversion. Thus, fixing some parameters , , it is well known that an efficient portfolio maximizing the utility can be calculated using standard procedures of quadratic optimi- zation. The mean-variance indirect utility function is defined by by: 2 : A V x(, )=sup{()():} AA Vxx (4.1) This function associates to the pair (,) , which stands for the risk aversion, the maximal utility level a fund manager can expect. 4.1. Morey and Morey Fractional Duality Morey and Morey’s approach allows to distinguish two dual relations with the indirect mean-variance utility functions. They are expressed in term of return expansion and risk contraction respectively. We show that the distance functions we have introduced can be related to the maximisation of this utility functions with an optimal degree of risk aversion. Following Briec, Kerstens and Lesourd [2], duality results allows a decomposition of efficiency measures. This is done paralleling an earlier concept due to Farrell [13] in a production theory context. However, in view of the nature of the tools they used, these duality results have an additive structure, while the measure proposed by Morey and Morey has a multiplica- tive one. In this subsection, we shall prove that the distance functions proposed by Morey and Morey also have a dual interpretation based upon the indirect mean- variance utility function. 4.1.1. Efficiency Decompositions Given portfolio, the overall return expansion is the ratio computed as its maximum return by its return value independently of the asset price information. Suppose that ()>0x , i.e. A. The overall return expansion x () E O index is then defined as the quantity: (,,) =sup{ :()()( ,)}. RE A Ox xxV (4.2) Hence, one can equivalently write (, )() (, ,)=() A RE V Ox x x (4.3) The allocative return expansion E index corres- ponds to the portfolio reallocation required to achieve the maximum of the the indirect mean-variance utility. It is defined as follow: (, ,)=(,,)() A RERE RE xOxD x ) (4.4) The portfolio return expansion ( E P index t is the quantity: ()= () A RE RE Px Dx. (4.5) The Farrell decomposition is then, by definition: (, ,)=(, ,)() RERERE OxAx Px . (4.6) Using a symmetrical approach, one can introduce an overall risk contraction ( C) index, an allocative risk contraction ( O E ) index and a portfolio risk contraction () C P index. The overall risk contraction ( C O) index defined as follows: (, ,) =inf:()()( )(,). RC A Ox xxV (4.7) Equivalently, one has: ()( ,) (, ,)=() A RC xV Ox x (4.8) The allocative risk contraction index is (, ,)=(, ,)() A RCRC RC xOxD x, (4.9) and the portfolio risk-contraction index is: ()= () A RC RC Px Dx . (4.10) By definition, we have: (, , )=(, ,)() RCRC RC OxAxPx (4.11) If the overall risk contraction RC RC then we have an efficient portfolio and the allocative risk contrac- tion is certainly equal to one. ==OP1 =1 RC A 4.1.2. Implicit Risk Aversion Duality between indirect utility functions and Morey and Morey’s distance functions involves an implicit risk aversion which makes the selected portfolio optimal re- garding to the mean-variance utility function. Allocative return expansion may change with respect to the risks aversion parameter. Given portfolio, one can calculate by how much the level of =/ needs to be increased to optimize overall portfolio efficiency. The earlier decompositions show that Allocative return ex- pansion is greater than zero excepted whenever the selected portfolio lies on the indifference curve of the mean-variance utility function at its optimal level. Hence, if * = MRE O , we have: ( ,)=()() A Vx x (4.12) Copyright © 2011 SciRes. JMF  20 C. BARROS ET AL. It follows that: (, )() =() A V x x (4.13) It follows that . Hence, we have: *() A RE Dx (, )() () () A A RE V Dx x x . (4.14) Proposition 4.1. For all portfolio such that A x ()>0x , we have (, )() ()=inf:( ,)0 () A RE Vx Dx x )} . Proof. From its definition, the representation set that is convex, then it is the intersection of all its supporting hyperplanes (see [2]). Hence, we have: 2 (,)0 ={(,): (, A A DRv eevV . We can equivalently write ()=inf{ :( (),())} A E Dxxx DR A . Let us denote 2 (, )={(,):A veev V (, )} for all (, )0 . It follows that 2 (,)0 ()=inf:( (),())\( ,) A RE Dxx xH . Since (, )() inf{: ((),())(,)} =() A V xxH bx x , we immediately deduce the result. Paralleling the approach above, one can consider the situation where the risk of a given portfolio is contracted while fixing the returns at an arbitrary level. Following, Farrell decompositions, Allocative risk contraction is equal to one if a portfolio maximizes the mean variance- utility function. In such a case the Overall risk contraction is equal to one. Hence, in general, if we have *= C O , we have * * ( ,)=()() ()( ,) =. () A A Vxx xV x (4.15) Therefore, we deduce that ()( ,) () () A A RC xV Dx x (4.16) In the next result, we show that one can go a bit further by establishing the following duality result: Proposition 4.2. For all portfolio , we have A x ()( ,) ()=sup:( ,)0 () A A RC xV Dx x )} . Proof. From the definition of the representation set we have: (,)0 2 ={(,): (, A A DRveevV . We can equivalently write ()=sup{ :((),())} A CA Dxxx DR . It follows that 2 (,)0 ()=sup:( (),())\( ,) A RC DxxxH , where 2 (, )={(,):(, )} A HveevV ) 0 for all (, . Since ()( ,) sup{:(( ),( ))(,)}=() A xV xxH x , we immediately deduce the result. 4.1.3. Computing the Implicit Risk Aversion Degree In this subsection we show how to compute the implicit risk aversion. First, we define the mathematical programs one should deal with to compute the distance functions. Notice that though these programs have some analogies to those proposed in [16] and its subsequent development, they are not non-parametric [17,18]. In fact the frontier has a quadratic functional representation and, conse- quently the model is parametric. An illustration is pro- posed in [19,20], where a stochastic frontier approach is proposed. However, the piecewise approximation ob- tained from the projection onto the frontier is a non- parametric estimation of the disposal representation set (see [2]). The following programs where first proposed by [1]. In the risk-oriented case we have, for all portfolio : y =1 , ,=1 =1 () = min .. () () =1, 0. A RC n ii i n ij ij ij n i i Dy ty xER yx xAx x (PRC) In the return-oriented case, if ()>0y , we have: =1 , ,=1 =1 () = max .. () () =1, 0. A RE n ii i n ij ij ij n i i Dy ty xER yxx xAx (PRE) It will be proven in the remainder that the implicit risk Copyright © 2011 SciRes. JMF  C. BARROS ET AL. 21 aversion can be deduced from the Kuhn-Tucker multi- pliers of the above programs. Two set valued maps taking into account either a risk-contraction or a return-expan- sion distance function are now introduced. Definition 4.3. The set-valued map 2 :2 A defined by ()( ,) ()=argmax:(,)0 () A RC xV xx is called the adjusted risk-contraction function. The set- valued map defined by 2 :2 A (, )() ()=argmin:( ,)0 () A RE Vx xx is called the adjusted return-expansion function. Notice that, in the return oriented case, we have limited our definition to A that is a portfolio subset of . These definitions allow to provide a formal definition of the implicit risk aversion. Definition 4.4. Suppose that the maps C and E are single-valued at . The implicit risk-aversion degree in the risk oriented and return oriented case are defined respectively by: ,1 ,2 () ()= () RC RC RC RA x and ,1 ,2 () ()= () RE RE RE RA x . In the case where C and E are not single- valued at , we say the the risk aversion is undefined. The next result shows that the Kunh-Tucker Multi- pliers of the mathematical programs above can be used to find the implicit risk aversion. Proposition 4.5. Suppose that the maps C is single- valued at . Let (,) CRC denotes the Kuhn-Tucker multipliers of the first and second constraints of Program () C P, respectively. We have ()=(,) CRC xRC and ()= C RC C RA x . Proof. To prove this result, we use an earlier result due to Briec et al. [2] who used the shortage function A S that is defined for a given portfolio by: ()=sup{:( (),())} A ve Sxxgxg DR A Setting, =() v x and , we obtain: =0 e g ()=1 () AA gR SxD xC . However, from [2], we have: (,)0 (, )()() ()= inf A A gve Vx Sx gg x . Since =() v x and , we have =0 e g (,)0 (, )()() ()= inf () A A gVx Sx x x . (4.17) Making an elementary transformation, we obtain: ()( ,) ()=1sup:( ,)0 () A A gxV Sx x . Hence, from Proposition 4.2 the solution of the dual optimization program in (4.17) is identical to () RC . However, from [2], this solution coïncides with the Kuhn and Tucker multiplier. If the dual solution is unique the result follows. Proposition 4.6. Suppose that the ma ps E is single- valued at A x . Let (,) ERE denotes the Kuhn- Tucker multipliers of the first and second constraints of Program () E P, respectively. We have ()=(,) ERE xRE , and ()= E RE E RA x . Proof. The proof is similar to that of Proposition using [2] and setting, and =0 v g=() e x . 4.2. Hyperbolic and McFadden Distance Functions and Duality Result We can also establish duality between these distance functions and the indirect mean-variance utility function. Proposition 4.7. For all portfolio such that A x ()>0x , we have 21/2 (,)0 ()= [(,) 4()()]](,) . inf 2() A H AA Dx VxxV x Proof. From the definition of the representation set we have: 2 (,)0 ={(,):(,) A Ave DRv eevV} . We can equivalently write 1 ()=inf:((), ()) A HA Dxxx DR . Let us denote 2 (, )={(,):A veev V (, )} for all (, )0 . It follows that 2 (,)0 1 ()=inf:((),())\( ,) A H Dxx xH . Solving a second order equation yields: 2 21/2 1 inf:((),())\(,) [(,)4 ()()](,) =. 2() AA xx H VxxV x Copyright © 2011 SciRes. JMF  C. BARROS ET AL. 22 2 ,)H Since 2 (,)0 (,)0 \(,)= \(H , we immediately deduce the result. A simpler duality result can be established regarding to the McFadden Gauge function [4]. Proposition 4.8. For all portfolio such that () , we have >0 (,)0, (,) ()= inf () A A MF A V Gx Ux . Proof. The result is immediate using the fact that, if ( A) F xdom G, there is at least some halfspace (,H ) such that 2 , (,) inf{: ((),())\(,)} =() A A V xx HUx . 5. Impact of Managerial Constraints on Portfolio Selection and Short Sales This section analyzes how performance measurement varies regarding to the managerial constraints summa- rized by the constraint . First, notice that if for all , then the set of portfolio is defined by 0Ax =0Ax n x 0 1 =: n ni i xx 1 . (5.1) Since in such a case the map is identically null, we replace the subscript “ ”, with “”. Suppose is an affine map defined on . Let be the set of all the affine maps defined on A. In the following, for all , we denote 0 B n ,AB B if xBx for all . Next, we introduce a specific measure inspired from the Thomson metric that has some similarities to the well known Hilbert projective metric. n Definition 5.1. The map de- fined by :[1, RC ] (, )=(,) sup RC x xAB Bd AB where () () (,)=max , () () AB RC RC xBA RC RC DxDx dAB DxDx is called the risk oriented distance between and . B Typically, d is inspired from the Thomson metric, because it computes from a radial projection the maxi- mum difference at a between and . The main difference comes from the fact that the Thomson metric computes the distance between two points. Hence, B d allows to define the map that measures some kind of distance between two sets of managerial constraints. By virtue of its nature, this index takes values greater than one for portfolios whose the efficiency score is affected by the managerial constraints. If the metric is equal to one for each portfolio of a sample, then the efficiency scores are not affected by the managerial constraints. However, this does not mean that the effi- cient frontiers respectively obtained from and is identical. An interesting case arise in the situation where B is the identity map (that is = I ) and is identically null. In such a case this measure allows to compare the situations with and without short sale and we not . The following properties are trivial: B =0B BA Lemma 5.2. Suppose that . = AB i) If then () () Dx Dx (, )= ma inf xAB AB x A RC B RC RC = ii) If B then . (, )= RC AB >1 = 1 iii) If then (,)AB RC B . Figure 2 depicts the idea the measure is based on. In line with [14,15], the efficient frontier is modified ac- cording to the managerial constraints an investor is dealing with. Hence, the performance of portfolios is also modified by shift of the frontier. In particular, this measure is useful to test the impact of short sales impact on the performance of a given portfolio . In such a case, we have: 0 ,RC I RC 0 () (,0)=max () I RC RC Dx dI Dx () () Dx Dx x ) , (5.2) and 0 (,0)=inf RC xI (,0 x dI . (5.3) Since, 0I , we have (,0)= sup RC x xI (,0) dI . (5.4) If there exists some portfolio 0 such that y()y =() and ()< ()( I RC ) Dx )>1 x then it is easy to see that RC. Hence, in this situation, the possibi- lity of short sales enables decision makers to find a risk- (,0I Figure 2. Impact of Managerial Constraints. Copyright © 2011 SciRes. JMF  C. BARROS ET AL. 23 ] less portfolio. A similar approach is possible when one looks for possible improvement of the return. Definition 5.3. The map de- fined by :[1, RC (, )=(, ) sup RE x xAB BAB where () () (, )=max, () () AB RE RE xBA RE RE DxDx AB DxDx (5.5) is called the risk oriented distance between and . B Lemma 5.4. The following properties are also trivial. Suppose that = AB A. i) If then B () (,)= max sup () B RE RE A xRE AB Dx AB Dx ii) If = B then . (, )=1 RE AB >1 = iii) If then (, )AB RE B . This measure is useful to test whether or not the short sales impact the return expansion given some portfolio . In such a case, we have: 0 0 () () (,0)=max , () () I RE RE xI RE RE DxDx IDxDx , (5.6) and since, , we have 0I (,0)=(,0) sup RE x xI I . (5.7) If there exists some portfolio 0 such that y ()y =() and , then it is easy to see that RC. Hence, in this situation, the possibi- lity of short sales enables decision makers to find a riskless portfolio. () ()<( I RE Dx x 0)>1 )y (,I In general, it is difficult to compute the map (, RE and )B(,) RC B. However, one can compute an approximation based upon each specific asset. By construction, we have i , for where =1, ,n is the canonical basis of . This we do by defining ()= i Re R=1,i n,n {} ii e 1, , (,0) max(,0)i RC e in dI and (5.8) 1, , (,0) max(,0)i RE e in I . (5.9) To analyse the case where there are short sales, an approach based upon quadratic programming may be used. However, since the optimization constraints are binding, it is possible to give a solution in closed form for * , * and * . 6. Empirical Illustration This section presents a numerical example. It is shown that some key contributions of this paper can be easily implemented using standard methods of quadratic pro- gramming. The data are obtained from the CAC 40 monthly stocks over a period running from January 1984 to December 2008. For each of the 38 stocks, we have calculated monthly expected returns, covariances, varian- ces with a monthly percentage return. After computing the efficient frontier, we set parameters =1 and = . Below, Tables 1 and 2 respectively summarize in the risk oriented and return oriented cases the decompo- sition of monthly performances for each asset. Remember that overall efficiency looks for a global improvement of a title following a chosen direction. Hence, it can be decomposed in two parts reflecting portfolio efficiency and allocative efficiency. 2 As it is shown in Table 1, asset 1 (Accor) has a low return and therefore it is too risky. The investor can Table 1. Decomposition of “CAC 40” performance (Risk Oriented). Asset C O C C C Accor 2.9767 0.0358 2.9409 0.0000 Air france 0.8191 0.0291 0.7900 0.0140 Air liquide 9.6218 0.0935 9.5283 0.0000 Alcaltel –0.1972 0.2086 –0.4058 0.0133 Alstom –0.6221 1.0000 –1.6221 0.0196 Arcelor mittal3.6585 0.0438 3.6147 0.0000 Axa 1.8391 0.0225 1.8166 0.0000 Bnp 2.5783 0.0336 2.5447 0.0000 Bouygues 2.6120 0.0269 2.5851 0.0000 Cap gemini 0.5518 0.0147 0.5372 0.0230 Carrefour 5.0090 0.0489 4.9601 0.0000 Credit agricole2.1384 0.1024 2.0360 0.0097 Danone 6.1840 0.0623 6.1218 0.0000 Dexia –0.1622 0.3111 –0.4733 0.0128 Eads 1.2664 0.0392 1.2272 0.0175 Edf 17.4122 0.1721 17.2401 0.0000 Essilor intl 9.2642 0.0716 9.1925 0.0000 France telecom0.1872 0.0333 0.1539 0.0107 Gdf suez 41.1744 0.3918 40.7825 0.0000 Lafarge 2.5799 0.0362 2.5437 0.0000 Lagardere 2.3142 0.0272 2.2869 0.0000 Loreal 6.2259 0.0522 6.1737 0.0000 Lvmh 2.4824 0.0286 2.4539 0.0000 Michelin 2.6201 0.0354 2.5847 0.0000 Pernod ricard6.5931 0.0642 6.5289 0.0000 Peugeot 1.8569 0.0284 1.8285 0.0000 Ppr 2.1359 0.0258 2.1101 0.0000 Renault 0.9004 0.0209 0.8794 0.0319 Saint gobain2.7787 0.0324 2.7463 0.0000 Sanofi aventis9.4330 0.1144 9.3185 0.0000 Schneider 3.0940 0.0356 3.0584 0.0000 Societe generale2.2684 0.0269 2.2415 0.0000 Stmicroelec- tronics 0.9322 0.0161 0.9161 0.1430 Suez E. 15.3026 0.9597 14.3429 0.0071 Total 7.2215 0.0662 7.1553 0.0000 Unibail 5.4427 0.0559 5.3868 0.0000 Vallourec 2.1729 0.0181 2.1548 0.0000 Veolia environ2.1113 0.0484 2.0628 0.0337 Vinci 3.9696 0.0393 3.9303 0.0000 Vivendi 1.8895 0.0288 1.8607 0.0000 Copyright © 2011 SciRes. JMF  24 C. BARROS ET AL. Table 2. Decomposition of “CAC 40” performance (Return Oriented). Asset E O E E E Accor 33.6665 33.6640 0.0025 0.0133 Air france 2.5886 2.5561 0.0325 0.0135 Air liquide –5.8125 –5.5131 –0.2994 0.0128 Alcaltel 1.8827 1.5611 0.3215 0.0170 Alstom 1.3252 1.0000 0.3252 0.0196 Arcelor mittal 37.7219 37.5822 0.1397 0.0132 Axa 27.2942 26.9360 0.3582 0.0135 Bnp 11.8982 11.8983 –0.0001 0.0133 Bouygues –11.7382 –11.6888 –0.0494 0.0134 Cap gemini 3.7739 3.4874 0.2865 0.0142 Carrefour –6.6492 –6.5984 –0.0508 0.0132 Credit agricole 1.7816 1.7288 0.0528 0.0130 Danone –7.8429 –7.6831 –0.1599 0.0131 Dexia 1.3169 1.3140 0.0030 0.0134 Eads 2.4821 2.4815 0.0005 0.0134 Edf –6.1239 –5.4436 –0.6804 0.0122 Essilor intl –2.3266 –2.2569 –0.0697 0.0130 France telecom 2.3786 2.1740 0.2046 0.0147 Gdf suez –4.6683 –3.7145 –0.9538 0.0103 Lafarge 7.5510 7.5500 0.0010 0.0133 Lagardere 77.9918 77.6968 0.2950 0.0134 Loreal –3.2041 –3.1702 –0.0339 0.0132 Lvmh –307.6488 –306.9223 –0.7265 0.0134 Michelin 9.2097 9.2095 0.0001 0.0133 Pernod ricard –6.2128 –6.0738 –0.1390 0.0130 Peugeot 5.7738 5.7592 0.0146 0.0134 Ppr 33.6970 33.4996 0.1974 0.0134 Renault 3.4948 3.4060 0.0888 0.0135 Saint gobain 162.9716 162.9394 0.0322 0.0134 Sanofi aventis 25.2989 23.5278 1.7711 0.0126 Schneider –252.3979 –252.3878 –0.0100 0.0133 Societe generale 56.2202 55.9829 0.2373 0.0134 Stmicroelec- tronics 5.2064 4.9761 0.2303 0.0136 Suez environnement 1.4416 1.0284 0.4132 0.0037 Total –4.4442 –4.3357 –0.1085 0.0130 Unibail –9.4252 –9.2927 –0.1325 0.0131 Vallourec –4.2453 –4.1137 –0.1315 0.0135 Veolia environ 2.7819 2.7700 0.0119 0.0132 Vinci –7.6228 –7.6144 –0.0085 0.0133 Vivendi 5.8051 5.7926 0.0125 0.0134 choose an efficient portfolio that is less risky and does not require risk-taking ( 0,0 36% =0 RC ). Considering only risk aversion, it is possible to pursue reduction of risk to maximize the utility of a portfolio but, due to the market imperfections, this result cannot be achieved without short sales. In the return expansion case, the first asset is less efficient (Table 2) than is the risk oriented case. Given the same level of risk, it should be 50 times more profitable (). However, technically, we can only select a portfolio that produces 33 times more important return (). The market imperfec- tions again limits this return improvement (). Here, the investor must take 6 units of risk to increase his (or her) return of a one unit amount ( = 33.6665 RE O = 3 RE D3.6641 = 0.0025 RE A = 0.0133 RE ). Table 3 details implicit risk aversion of risk reduction Table 3. Implicit Risk Aversion. Asset Risk Oriented Return Oriented C C C E E E Accor 0.000 1.000 0.000 0.006 0.482 0.013 Air france0.000 0.011 0.014 0.008 0.613 0.013 Air liquide0.000 1.000 0.000 0.003 0.284 0.012 Alcaltel 0.006 0.462 0.013 0.020 1.197 0.017 Alstom 0.030 1.534 0.019 0.030 1.534 0.019 Arcelor mittal0.0001.000 0.000 0.005 0.4330.013 Axa 0.000 1.000 0.000 0.008 0.616 0.013 Bnp 0.000 1.000 0.000 0.006 0.499 0.013 Bouygues 0.000 1.000 0.000 0.007 0.5610.013 Cap gemini0.000 0.008 0.023 0.012 0.8460.014 Carrefour 0.000 1.000 0.000 0.005 0.4080.013 Credit agricole0.000 0.014 0.009 0.004 0.3320.013 Danone 0.000 1.000 0.000 0.004 0.358 0.013 Dexia 0.003 0.287 0.012 0.007 0.542 0.013 Eads 0.000 0.010 0.017 0.006 0.5090.013 Edf 0.000 1.000 0.000 0.002 0.195 0.012 Essilor intl0.000 1.000 0.000 0.004 0.331 0.013 France telecom 0.001 0.105 0.010 0.013 0.890 0.014 Gdf suez 0.000 1.000 0.000 0.001 0.095 0.010 Lafarge 0.000 1.000 0.000 0.006 0.480 0.013 Lagardere 0.000 1.000 0.000 0.007 0.557 0.013 Loreal 0.000 1.000 0.000 0.005 0.394 0.013 Lvmh 0.000 1.000 0.000 0.007 0.5430.013 Michelin 0.000 1.000 0.000 0.006 0.485 0.013 Pernod ricard0.000 1.000 0.000 0.004 0.352 0.013 Peugeot 0.000 1.000 0.000 0.007 0.5450.013 Ppr 0.000 1.000 0.000 0.007 0.573 0.013 Renault 0.000 0.006 0.031 0.009 0.668 0.013 Saint gobain0.000 1.000 0.000 0.006 0.5090.013 Sanofi aventis0.000 1.000 0.000 0.003 0.252 0.012 Schneider 0.000 1.000 0.000 0.006 0.484 0.013 Societe generale 0.000 1.000 0.000 0.007 0.561 0.013 Stmicroelec- tronics 0.000 0.001 0.143 0.009 0.7330.013 Suez E. 0.000 0.017 0.007 0.000 0.021 0.003 Total 0.000 1.000 0.000 0.004 0.346 0.013 Unibail 0.000 1.000 0.000 0.005 0.380 0.013 Vallourec 0.000 1.000 0.000 0.009 0.689 0.013 Veolia environ0.000 0.006 0.033 0.005 0.429 0.013 Vinci 0.000 1.000 0.000 0.006 0.459 0.013 Vivendi 0.000 1.000 0.000 0.007 0.5410.013 and return expansion for each asset. Note that some assets have a negative performance indicator. This can be explained by the fact that they have a negative return. The portfolio may have a greater risk than their expected returns and their respective utility functions measures the potential loss of each invested euro. This is not consistent with the objective of maximizing behaviour the investors have and, in such a case, allocative efficiency makes no sense. Improvements both based on increasing expected returns and risk contraction are presented in Table 4. In general, the shortage function and the hyperbolic function give almost the same improvement of performance (0.008 for asset 1). The Hyperbolic functions provide a seven times greater improvement than those obtained from these two functions. Hence, much more return, but Copyright © 2011 SciRes. JMF  C. BARROS ET AL. 25 Table 4. “CAC 40” Efficiencies. Asset S C E F G Accor 0.001 0.036 33.664 17.796 55.920 Air france 0.006 0.029 2.556 2.109 3.759 Air liquide 0.001 0.093 –5.513 10.691 Alcaltel 0.007 0.208 1.561 1.410 1.695 Alstom 0.000 1.000 1.000 1.000 1.000 Arcelor mittal 0.001 0.044 37.582 17.622 65.610 Axa 0.001 0.022 26.936 15.078 39.517 Bnp 0.002 0.033 11.898 7.769 19.444 Bouygues 0.002 0.026 –11.688 37.171 Cap gemini 0.008 0.014 3.487 2.646 4.330 Carrefour 0.002 0.048 –6.598 20.440 Credit agricole 0.001 0.102 1.728 1.574 2.045 Danone 0.002 0.062 –7.683 16.060 Dexia 0.001 0.311 1.314 1.242 1.458 Eads 0.004 0.039 2.481 2.082 3.583 Edf 0.001 0.172 –5.443 5.809 Essilor intl 0.002 0.071 –2.256 13.958 France telecom 0.008 0.033 2.174 1.820 2.652 Gdf suez 0.000 0.391 –3.714 2.552 Lafarge 0.003 0.036 7.550 5.304 12.570 Lagardere 0.000 0.027 77.696 30.111 120.149 Loreal 0.003 0.052 –3.170 19.150 Lvmh 0.000 0.028 –306.922 35.013 Michelin 0.002 0.035 9.209 6.271 15.251 Pernod ricard 0.002 0.064 –6.073 15.570 Peugeot 0.004 0.028 5.759 4.160 9.004 Ppr 0.001 0.025 33.499 18.262 51.040 Renault 0.007 0.021 3.406 2.643 4.776 Saint gobain 0.000 0.032 162.939 30.859 263.763 Sanofi aventis 0.001 0.114 23.527 8.552 50.616 Schneider 0.000 0.035 –252.387 28.082 Societe generale 0.001 0.027 55.983 25.723 86.276 Stmicroelec- tronics 0.006 0.016 4.976 3.564 6.620 Suez E. 0.000 0.959 1.028 1.017 1.057 Total 0.003 0.066 –4.335 15.103 Unibail 0.002 0.056 –9.293 17.886 Vallourec 0.007 0.018 –4.114 55.354 Veolia environ 0.004 0.048 2.770 2.306 4.102 Vinci 0.003 0.039 –7.614 25.461 Vivendi 0.004 0.029 5.793 4.184 9.091 also much more risk (56 more times for asset 1) are involved with the McFadden Gauge [4]. Intuitively, this last measure may be use for a risk- lover manager. The mean return expansion function is suitable for risk-neutral investor. Risk averse manager may be appreciate by risk contraction, hyperbolic or shortage functions. Finally, regarding to all the results calculated in Table 4, il clearly appears that the efficient frontier is entirely characterized by two funds: Asset 5 (Alsthom) and Asset 34 (Suez environment). This is an illustration, of the two funds theorem. 7. Conclusions This paper has analyzed duality relations between the indirect mean-variance utility function and a broad class of portfolio efficiency measures. It has been shown that such approaches are useful to measure the impact of managerial constraints on the performance. In addition, the implicit risk aversion of an optimal solution can be deduced from the Kuhn-Tucker optimality conditions. 8. References [1] M. R. Morey and R. C. Morey, “Mutual Fund Perform- ance Appraisals: A Multi-horizon Perspective with En- dogenous Benchmarking,” Omega, Vol. 27, No. 2, 1999, pp. 241-258. doi:10.1016/S0305-0483(98)00043-7 [2] W. Briec, K. Kerstens and J.-B. Lesourd, “Single Period Markowitz Portfolio Selection, Performance Gauging and Duality: A Variation on Luenberger’s Shortage Func- tion,” Journal of Optimization Theory and Applications, Vol. 120, No. 1, 2004, pp. 1-27. doi:10.1023/B:JOTA.0000012730.36740.bb [3] W. Briec, K. Kerstens and O. Jokung, “Mean-Variance- Skewness Portfolio Performance Gauging: A General Shortage Function and Dual Approach,” Management Science, Vol. 53, No. 1, 2007, pp. 135-149. doi:10.1287/mnsc.1060.0596 [4] D. McFadden, “Cost, Revenue, and Profit Functions,” In: M. Fuss and D. McFadden, Eds., Production Economics: A Dual Approach to Theory and Applications, Amster- dam, North-Holland, Vol. 1, 1978, pp. 3-109. [5] R. W. Shephard, “Cost and Production Functions,” Princeton University Press, Princeton, 1953. [6] H. Markowitz, “Portfolio Selection,” Journal of Finance, Vol. 7, No. 1, 1952, pp. 77-91. doi:10.2307/2975974 [7] H. Markowitz, “Portfolio Selection: Efficient Diversifica- tion of Investments,” John Wiley, New York, 1959. [8] W. Sharpe, “A Simplified Model for Portfolio Analysis,” Management Science, Vol. 9, No. 2, 1963, pp. 277-293. doi:10.1287/mnsc.9.2.277 [9] W. Sharpe, “Capital Asset Prices: A Theory of Market Equilibrium under Condition of Risk,” Journal of Fi- nance, Vol. 19, No. 3, 1964, pp. 425-442. doi:10.2307/2977928 [10] J. Lintner, “The Valuation of Risk Assets and the Selec- tion of Risky Investment in Stock Portfolios and Capital Budgets,” Review of Economics and Statistics, Vol. 47, No. 1, 1965, pp. 13-37. doi:10.2307/1924119 [11] H. Markowitz, “CAPM Investors do Not Get Paid for Bearing Risk: A Linear Relation does Not Imply Payment for Risk,” Journal of Portfolio Management, Vol. 34, No. 2, 2008, pp. 91-96. [12] D. G. Luenberger, “Microeconomic Theory,” McGraw Hill, Boston, 1995. [13] M. Farrell, “The Measurement of Productive Efficiency,” Journal of the Royal Statistical Society, Vol. 120, No. 3, 1957, pp. 253-281. doi:10.2307/2343100 [14] J. A. Pogue, “An Extension of the Markowitz Portfolio Selection Model to include Variable Transaction Cost, Copyright © 2011 SciRes. JMF  C. BARROS ET AL. Copyright © 2011 SciRes. JMF 26 short Sales, Leverage Polycies and Taxes,” Journal of Finance, Vol. 25, No. 5, 1970, pp. 1005-1028. doi:10.2307/2325576 [18] R. Färe, S. Grosskopf, C. A. K. Lovell, “The Measure- ment of Efficiency of Production,” Kluwer, Boston, 1985. [19] W. Briec and J.-B. Lesourd, “The Efficiency of Invest- ment Fund Management: A Stochastic Frontier Model,” In: Dunis, Eds., Advances in Quantitative Asset Man- agement, Klwer Academic Publishers, Norwell. 2000, pp. 41-58. [15] A. Rudd and B. Rosenberg, “A Realistic Portfolio Selec- tion Model,” In: E. J. Elton and M. J. Grubber, Eds., Portfolio Theory-Lectures in Management Science, Vol. II, North Holland, Amsterdam, 1979, pp. 21-46. [20] A. Ruszczynski and R. Vanderbei, “Frontiers of Stochas- tically Nondominated Portfolios,” Econometrica, Vol. 71, No. 4, 2003, pp. 1287-1297. doi:10.1111/1468-0262.t01-1-00448 [16] A. Charnes, W. W. Cooper and E. Rhodes, “Measuring the Efficiency of Decision-Making Units,” European Journal of Operational Research, Vol. 3, No. 6, 1978, pp. 429-444. doi:10.1016/0377-2217(78)90138-8 [17] J. K. Sengupta, “Nonparametric Tests of Efficiency of Portfolio Investment,” Journal of Economics, Vol. 50, No. 1, 1989, pp. 1-15. doi:10.1007/BF01227605 [21] A. V. Fiacco and G. P. McGormick, “Nonlinear Pro- gramming: Sequential Uncontrained Minimization Tech- niques,” John Wiley, New York, 1968. Appendix: The Short Sale Case Computations 1 =1[ n] ER Ω (7.4) Since the constraints are binding. It is possible to give a solution of the case where there are short sales with an approach based upon quadratic programming. # [()][( )]ERx ERx Hence, substituting in the first order conditions, we have a three-dimensional system to solve, with: Computation of Risk Oriented Measure [] 1[]=0 tnp ERERE R (7.5) In the following, we assume that # ()( ) x ))x where . Under such an assumption, we know that RC lies on the curve representing the hyperbola relating the expected returns and the variance. We first write the Lagrangian of the optimization problem we need to solve. It is defined by # 0 argmin{() :}xxx 0 (()Dx 1 1[]1[]= tnn ERERV R Ω ( Suppose that (),(x 0 p (7.6) 1 11[] tnn ER Ω =1 (7.7) The last equation yields: , , (,,,, )= 1 ii p i pijiji ij i LxxERE R VarRx xx 7.1) 1 1 1 =1 11 tn tnn ER Ω Ω [] (7.8) Substituting in 7.5, we obtain: ** *** (,,, ,)x is solution. The fi order conditions yield: rst 1 1 1 1 []1 1[]1 11 []=0. tt nnn tnn p ER ER ERE R Ω Ω Ω , (,,,, )==0 ijij j i LxER x x (7.2) (,,,, )=1[]=0 p Lx VarR (7.3) Following (7.2); we have Hence, we obtain the optimal values:  C. BARROS ET AL. 27 * 1 =[ []1[]1[] tt t ERER ER ΩΩ 1 1 * 1 []] 1 [[]1] 11 nn tnp tnn ER ERE R Ω (7.9) and * ce is then obtained from equation 46. From 52, we dedu * . The distance function is given by * *1 1 =[] 1 1 11 n tnn Ω Var R ** 11 ** * 1 1* * 1 * 1[]1[] 1 11[]1 11 []. tnn t nn tnn ER ER ER ER ΩΩ ΩΩ Ω Ω n (7.10) Computation of Return Oriented Measure The (7.11) Suppose that In the following, we suppose that [] >0 ER p. em we neLagrangian of the optimization probled to optimize is: (, ,,,Lx , , )= 1 ii p i pijij i ij i xERE R VarRx xx ** *** (,,, ,)x is solution. The first order conditions yield: , (,,,, )=LxE =0 ijij j i R x x (7.12) (,,,, )==0 i i Lx ER x (7.13) (,,,, )=1[]=0 p Lx ER * (7.14) At the optimum, we clearly have =1/[] ER . Following (7.2); we have 1 =1[] n ER (7.14) Since the constraints are binding, substituting in the first order conditions, we have a three-d te Ω imensional sys- m to solve, with: [] 1[]=0 tn ERERE R (7.15) p 1 1[]1[ =0 tnn p ER ER Var R ] Ω (7.16) 1 11[] tnn ER Ω =1 (7.17) Combining 7.15 and 7.16 we obtain 2 1[] =0 tpp p ERERER VarR Ω (7.18) It follows that *1/2 1/2 =[ ] [][] tpp p ER ER ERVar R Ω 1/2 (7.19) Using 7.17 and 7.15 we obtain: 1 1* 1[]1 []= 0 n p ER ERE R 1 [] 1 1 11 tt nn tnn ER Ω Ω Hence, we obtain the optimal values: Ω *1 * 1 [] 1 []1. 11 tnp tnn ER ERE R 11 *=[]1[]1[] tt t nn ERERER Ω (7.20) Therefore ΩΩ * and * we de are then obtained from equa- tion 7.20. Fr 7.14,duce om* . Copyright © 2011 SciRes. JMF

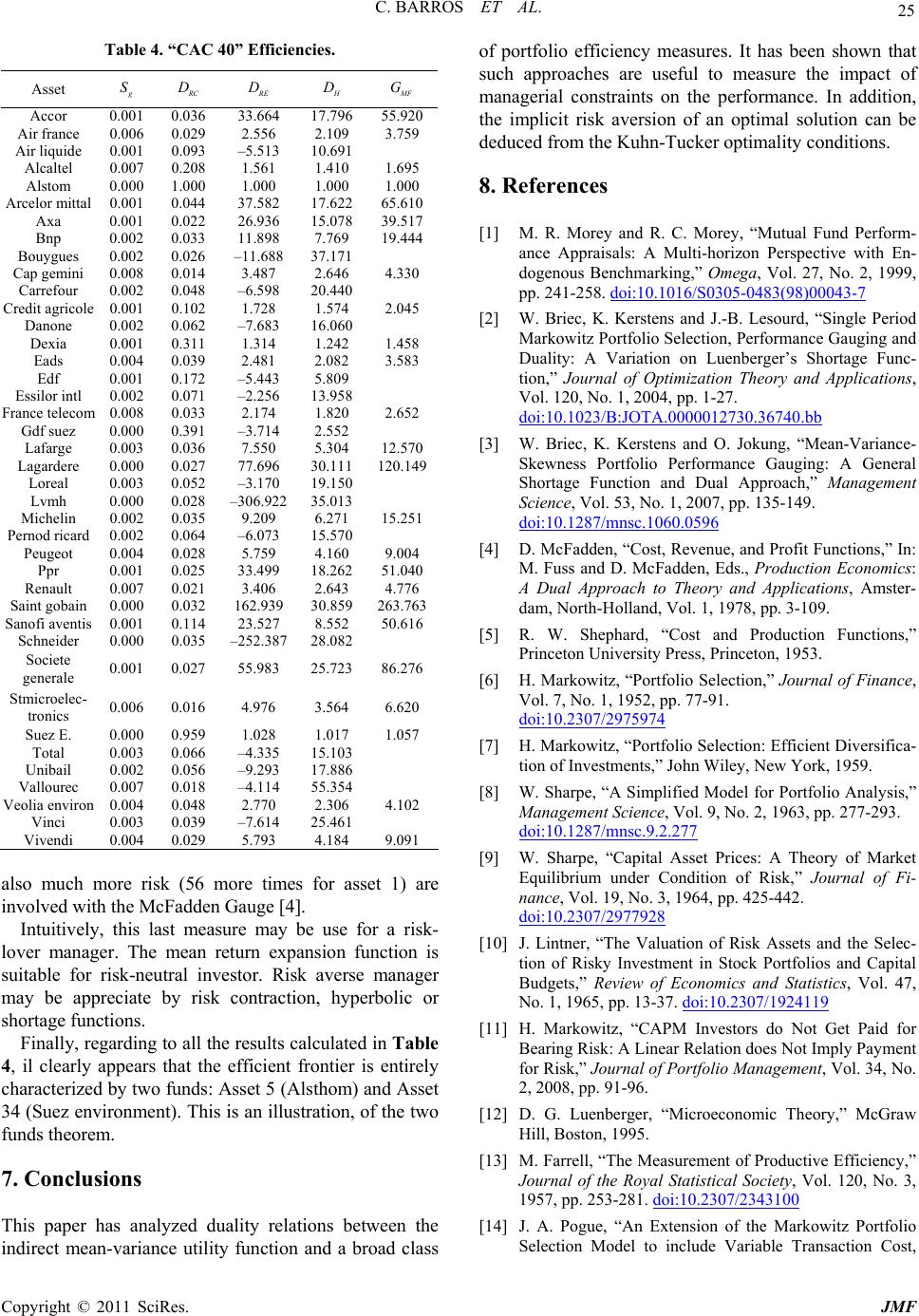

|