Paper Menu >>

Journal Menu >>

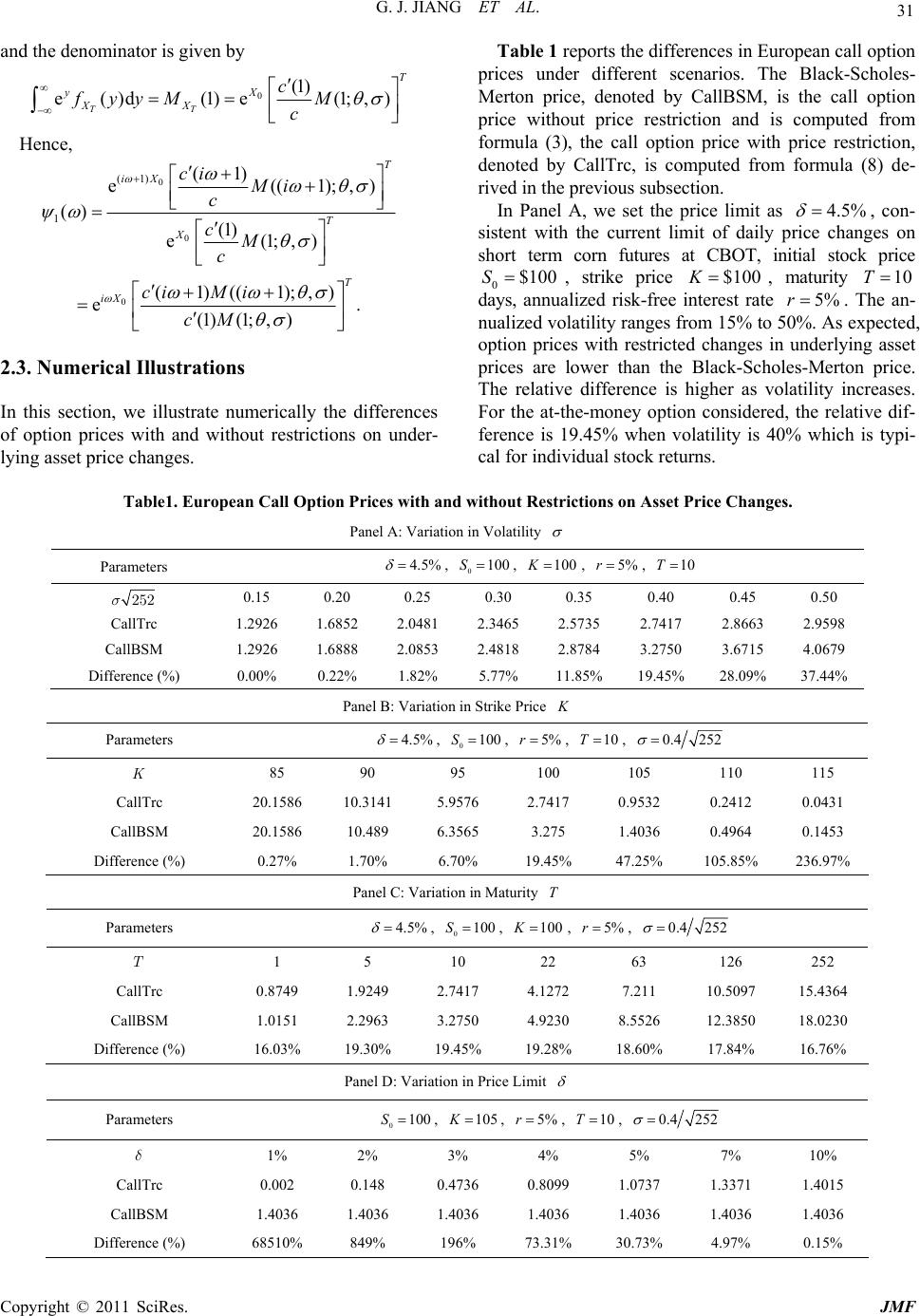

Journal of Mathematical Finance, 2011, 1, 28-33 doi:10.4236/jmf.2011.12004 Published Online August 2011 (http://www.SciRP.org/journal/jmf) Copyright © 2011 SciRes. JMF Option Pricing When Changes of the Underlying Asset Prices Are Restricted George J. Jiang1,2, Guanzhong Pan2, Lei Shi 3 1University of Arizona, Tucson, USA 2College of Finance, Yu nn a n Uni versit y of Fi na nce an d Economics, Kunming, China 2College of Statistics and Math ematics, Yunnan University of Finance and Economics, Kunming, China Email: gjiang@email.arizona.edu Received April 8, 2011; revised June 13, 2011; accepted July 10, 2011 Abstract Exchanges often impose daily limits for asset price changes. These restrictions have a direct impact on the prices of options traded on these assets. In this paper, we derive closed-form solution of option pricing for- mula when there are restrictions on changes in underlying asset prices. Using numerical examples, we illus- trate that very often the impact of such restrictions on option prices is substantial. Keywords: Option Pricing, Restrictions on Asset Price Changes, Numerical Illustration 1. Introduction Conventional option pricing models assume that there are no restrictions on changes of underlying asset prices. For example, [1,2] specify that stock prices follow a geometric Brownian motion and stock returns follow a normal distribution. Based on a portfolio replication strategy or equivalently the risk-neutral method, option prices are derived as expected payoff of the contract un- der the risk-neutral distribution, discounted by the risk- free rate. In practice, however, asset price changes may subject to restrictions imposed by exchanges. For example, CBOT (Chicago Board of Trade) and CME (Chicago Mercantile Exchange) both have daily price limits for futures contracts except currency futures. Daily price limit serves as a precautionary measure to prevent ab- normal market movement. The price limits, quoted in terms of the previous or prior settlement price plus or minus the specific trading limit, are set based on particu- lar product specifications. For example, the current limit of daily price changes on short term corn futures is 4.5%. In 1996, Chinese stock market also introduces restric- tions on daily stock price changes. Specifically, except the first trading day of newly issued stocks, the limit of stock price change in a trading day relative to previous day’s close price is 10%, and for stocks that begin with S, ST, S*ST letters, the limit is 5%. It is clear that such re- strictions reduce the value of options since extreme re- turns on a daily level are ruled out. Nevertheless, how to evaluate the prices of option contracts when changes on underlying asset prices are restricted? How much is the exact impact of such daily price limits on option prices? These questions are yet to be examined in the extant lit- erature. In this paper, we first derive the option pricing for- mula when there are restrictions on daily changes of un- derlying asset prices. We perform the analysis under the Black-Scholes-Merton model framework. Then, we pro- vide numerical comparisons between option prices with and without restrictions on underlying asset price changes. 2. Option Pricing with Restrictions on Underlying Asset Price Changes 2.1. Risk-Neutral Valuation under the Black and Scholes [1] and Merton [2] Framework In this section, we first review the risk-neutral approach of option pricing under Black-Scholes-Merton frame- work. The same approach will be used in the next sub- section to derive option pricing formula when there are restrictions on underlying asset price changes. Black and Scholes [1] and Merton [2] assume that stock price follows a geometric Brownian motion: t S dd tt t SStSd t W (1) where and are expected return and volatility, t is a standard Brownian motion. It is also assumed that the continuously compounded risk-free interest rate, W  G. J. JIANG ET AL. 29 denoted by , is constant. The key feature in Black- Scholes-Merton framework is that asset return volatility is constant and market is complete. As such, in a risk- neutral world, expected return of the underlying stock is equal to risk-free interest rate. That is, r ddd Q tt tt S rStSW . (2) where is a standard Brownian motion under the risk-neutral probability measure . Q t WQ Consider a European call option with strike price K and maturity measured in the number of trading days. The price of such option can be computed as T e[max(,0 rT QT CESK )], where Q EQ indicates expectation under risk-neutral measure , and is the time interval of a trading day. As shown in many derivatives textbooks, for example [3], the option pricing formula is given as: 01 2 ()e () rT CS dKd , (3) where 2 2 1 ()e d 2π u x x u is the cumulative distri- bution function (cdf) of standard normal distribution, and 2 0 1 d 1 ln(/) () 2 SK rT T , 21 dd T . This is the famous Black-Scholes-Merton option pric- ing formula. By constructing a riskless portfolio with option and underlying stock and based on no arbitrage argument, [1] and [2] derive the above option pricing formula as a solution to a partial differential equation (PDE). 2.2. Closed-Form Option Pricing Formula with Restrictions on Underlying Asset Price Changes As mentioned in the introduction, many exchanges im- pose restrictions on daily price changes of traded assets. As a result, the range of asset return (in logarithmic form) is no longer , but truncated from both below and above. The restriction is particularly important in option pricing since the tail behavior of asset returns has a sig- nificant effect on the payoff of options contracts. (, ) Let us start with a normal random variable ~X 2 (, ) with probability density function: 2 2 () 2 1 () e 2π x fx . In addition, and are two positive constants. Truncating the left tail of the normal density b a be- low the mean, and the right tail by b above the mean, the truncated normal distribution is illustrated in Figure 1 . Normalizing the truncated density function to make sure the total probability is equal to , we obtain the pdf of a truncated normal random variable ab y 1 trc ~,X 2 , trc 1 () () f xf c x], [, x ab , where () f x is the normal density function and 1 ba c , (4) where is the cdf of standard normal distribution. In practice, price restrictions are often imposed in terms of daily simple returns. For example, daily simple returns in absolute value are restricted to be less than , then for log returns, these restrictions are ln(1a) and ln(b1 ) . For the purpose of option pricing, it is also convenient to obtain the characteristic function (CF) of stock returns. As derived in the Appendix, the characteristic function of the truncated normal variable X is given by: trc () () () ci c , (5) where 22 1 2 () e i is the CF of a normal random variable and () 1 ba ci ii . Since limits are typically imposed on daily price changes and option maturity can be more than one day, we need to derive the distribution of returns over multiple days. Denote t ln t X S as the log price, ln tt YSln t S as the daily log return. Suppose we have T trading days, , and the daily log returns are iid truncated normal random variables, i.e., 1,, T ~Yiid( , ttrc 2) . The log price at the end of day is T Figure 1. Truncating normal density. Copyright © 2011 SciRes. JMF  30 G. J. JIANG ET AL. 0 1 T Tt t X XY , 2 trc ~iid (,) t Y . Similarly, as derived in the Appendix, the CF of T X is given by 0() () e() T T iX Xci c . (6) In the following, we follow the same risk-neutral ap- proach as outlined in the previous subsection to price options when there are restrictions on underlying asset price changes. As seen in the Black-Scholes-Merton framework, when we move from real world into risk- neutral world, volatility remains the same, but expected return is equal to risk-free interest rate. Option prices are then calculated as expected payoff under the risk-neutral measure, further discounted by risk-free interest rate. In the following, we first derive the risk-neutral distribution of asset returns when daily returns follow truncated nor- mal distributions, and then derive a closed-form formula for European call options. Lemma Let 2 ~iid (,) ttrc Y , and the time interval between observations is , we have 1, ,t T i) Under the risk-neutral measure where the ex- pected return of the asset is given by the risk-free rate , we have Qr 2 ~iid (,) ttrc Y , , with 1,t,T 2 1 ln 2 c rc (1) . (7) ii) The price of a European call option with strike price K and maturity T is given by trc0 12 (ln)e (ln rT TT CSPX KKPX K ), (8) The probabilities and can be computed nu- merically as 1 P2 P 0 11exp( )() () Red 2π ix PX xi , (9) where () is the CF corresponding to . P Proof: i) Let be the time interval of each trading day, and the fact that expected return is equal to risk free rate leads to: 0 []e rT QT ES S From the moment generating function of a truncated normal distribution as derived in the Appendix, we have 2 1 2 0 (1) [] ee T T X QT Qc ESES c , From the above two equations, we have the expression for . ii) According to risk-neutral pricing method, the price of a European call option with strike price K and ma- turity is T ln ln ln e[max(,0)] e[max(e,0)] e(e)()d ee()de() T T TT rT QT X rT Q rTx X K rT xrT XX KK CESK EK Kfxx d. f xxKf xx where T X() f x is the pdf of log price T X at time . In addition, under the risk-neutral measure, T 0e[]e e ee()d T T X rT rT QT Q rTy X SES E fyy So we have 0 e e()d T rT yX S f yy . Substituting this into option price , we get C 0ln ln e() de ()d e()d T T T xXrT X KK yX fx CSxKf xx fyy , Denote e() () e()d T T xX yX fx gx f yy . Since () 1gx , () g x is a pdf. Therefore, we can write the European call option price as 01 2 (ln)e(ln rT TT CSPX KKPX K ). à End of proof. As shown in [4] that the probabilities in (8) can be computed numerically by their corresponding CFs as follows. From the Fourier inversion, we have 0 11exp( )() () Red 2π ix PX xi . To compute the CF corresponding to () g x, denoted as 1() , by definition, we have 1 e() ()e ()ded e()d T T xX ix ix yX fx g xx x f yy (1) e( e()d T T ix X yX )d f xx f yy where the numerator is given by 0 (1) (1) e()d(1) (1) e((1), TT ix XX T iX fxxMi ci Mi c ;). Copyright © 2011 SciRes. JMF  G. J. JIANG ET AL. Copyright © 2011 SciRes. JMF 31 and the denominator is given by 0(1) e()d(1)e(1;,) TT T X yXX c fyyM M c Hence, 0 0 (1) 1 (1) e((1 () (1) e(1;,) T iX T X ci Mi c cM c );,) 0(1)((1);,) e. (1)(1; ,) T iX ciM i cM 2.3. Numerical Illustrations In this section, we illustrate numerically the d of option prices with and without restrictions on under- Table 1 reports the differences in European call option pr mit as ices under different scenarios. The Black-Scholes- Merton price, denoted by CallBSM, is the call option price without price restriction and is computed from formula (3), the call option price with price restriction, denoted by CallTrc, is computed from formula (8) de- rived in the previous subsection. In Panel A, we set the price li4.5% , ice chang con- sistent with the current limit of daily pres on short term corn futures at CBOT, initial stock price 0$100S , strike price $100K, maturity 10T lized risk-free ine 5%r. T nualized volatility ranges from 15% to 5 expected, option prices with restricted changes in underlying asset prices are lower than the Black-Scholes-Merton price. The relative difference is higher as volatility increases. For the at-the-money option considered, the relative dif- ference is 19.45% when volatility is 40% which is typi- cal for individual stock returns. days, annuaterest rathe an- ifferences lying asset price changes. 0%. As Table1. European Call Option Prices with and without Restrictions on Asset Prie Changes. on in Volatility c Panel A: Variati 4.5% , Parameters 0100S, 100K, 5%r, 10T 252s 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 CallTrc 1.2926 1.6822.7417 2.8663 2.9598 1.2926 1.6888 2.0853 2.4818 2.8784 3.6715 4.0679 Difference ) 0 1 1 2 3 52 2.0481 2.3465 .5735 CallBSM 3.2750 (%0.00%.22% 1.82% 5.77%1.85%9.45%8.09%7.44% Panel Bn in ice: VariatioStrike Pr K Parameters , 100 , r, 1T 0 S, 4.5% 5% 00.4 252 85 90 95 100 105 110 115 K CallTrc 20.1586 0.9532 0.2412 0.0431 20.1586 10.489 3565 3.275 0.0.1453 Difference (%) 0. 1. 6. 1 4 10 23 10.3141 5.9576 2.7417 CallBSM 6.1.4036 4964 27%70%70%9.45% 7.25%5.85%6.97% Panel C: Variation in Maturit Para y T meters 0100S, 100K, , 5%4.5% r , 0.4 252 T 1 5 63 126 252 10 22 CallTrc 0.8749 1.7.211 10.5097 15.4364 1.0151 2.2963 3.2750 4.9230 8.26 12.3850 18.0230 Difference (%) 16.% 19. 19 19 18. 1 1 9249 2.7417 4.1272 CallBSM 55 0330%.45%.28%60% 7.84%6.76% Panel D: Variarice Lition in Pmit Parameters 0100S, 105K , 5%r , 10T , 0.4 252 d 1% 5% 7% 10% 2% 3% 4% CallTrc 0.002 0.148 0.4736 0.8099 1.0737 1.3371 1.4015 1.4036 1.4036 1.4036 1.4036 4036 1.1.4036 Difference (%) 68 849% 196% 7 3 4. CallBSM 1.4036 510%3.31%0.73%97%0.15%  G. J. JIANG ET AL. 32 As expectedhe option srice isr, the relative difference also increases. The results are illus- trated in Panel B volatility is set as 40% um and th ranges85 t. We o -money tions y increases to 6-month () and 1- ye , when ttrike p highe where per an- n n e strike price from $o $115 te that when the strike price $110K, $115, the relative differences are more than 100% and 200%, re- spectively. Panel C illustrates the differences in option prices with different maturities. For the at-theop con- sidered, the relative differences are rather consistent even when maturit126T ar (252T). Panel D illustrates the effect of daily price limits on option prices, where is set to values in a range of 1% to 10%. As expected, the relative differereases as the abpric nce inc solute e t is lower. For the out-of-the- m o changes often set daily limits for the price hanges of traded assets. These restrictions have a dir options traded on these assets ey rt drahangasset. In this aper,rive ormn of pricing rmula with restrictions oninprice hangng nal exs, weate that i is supported by NSFC 61053). . References and M. Scholes, “The Pricing of Options and Corporate Liabilities,” Journal of Political Economy, Vol. , pp. 637-654. doi:10.1086/260062 limi oney option considered (strike price 105K), the relative difference inption price with restriction and without restriction is more than 30% when the price limit is set as 5%. 3. Conclusions In practice, ex cect since impact on prices of thule oumatic ces in prices p fo we declosed-f solutio underly option g asset ces. Usiumericample illustr very often the impact of such restrictions on option prices can be substantial. 6. Acknowledgements The research of Lei Sh (111 5 [1] F. Black 81, No. 3, 1973 ] R. C. Merton, “Theory of Rational Option Pricing,” Bell [2 Journal of Economics, Vol. 4, No. 1, 1973, pp. 141-183. doi:10.2307/3003143 [3] J. C. Hull, “Options, Futures, and Other Derivatives,” 8th ith Applications to Bond and Cur- Edition, Prentice Hall, Upper Saddle River, 2011. [4] S. L. Heston, “A Closed-Form Solution for Options with Stochastic Volatility w rency Options,” Review of Financial Studies, Vol. 6, No. 2, 1993, pp. 327-343. doi:10.1093/rfs/6.2.327 Copyright © 2011 SciRes. JMF  G. J. JIANG ET AL. 33 ppendix the appendix, we first derive the moment generating nction (mgf), and characteristic function (CF) of a al random variable. Recall that the pdf of truncated normal random variable ) A In fu truncated norm a2 trc ~(,X , trc 1 () () f xfx c , [,] x ab , where () f x is the normal density function and 1 ba c . (10) mgf able as ) The of a truncated normal random vari 2 trc ~(,X is derived as, 2 () 1 e e x bx2 2 2 22 2 trc trc 2 () 1 2 2 ()ee ()d d 2π 11 eed 2π () () b Xx a a x b a ME fxx x c x c cM c where 22 1 2 () eM is the mgf of a normal random variable, and 2 2 2 2 () d 2 a cx 22 22 22 () () () 22 22 1e π 11 ed ed 2π2π () () 1. x b xx ba x x ba ba Similarly, the characteristic function (CF) of a trun- cated normal random variable ) 2 trc ~(,X is given by, trc trc () ()( )() ci Mi c , where c is given by (10), and 22 1 2 () e i , is the CF of a normal random variable, () 1 b i i a ci . Next, we derive the CF of the log price with truncated distribution. Denote 1T Z XX 2 1trc ,,~(, ) T XX as the sum of the iid sequence , then the mgf of Z is trc () (;,,,) ()( ,) T T Zc MabM M c Z and the CF of is trc () (;,,,) ()() T T Zci ab c , where we emphasize that the characteristic function Z eters also depends on normal random variable param , and truncation parameters Denote as the stock price at end of day ,ab. the t S t and ln tt X S ,T distribute ), is the log price. Suppose we have trading , and the daily log returns ar d in a risk-neutral world, T i.e. days, 1, normally 2 (, trc e iid truncated , ~ t Y 1 (lnln,1,, ttt YSSt T ). day T is The log price at the end of 0 1 T Tt t X XY , 2 trc ~ iid(,) t Y . The mgf and CF of are derived as T X 0() () ee() T T T X X Xc ME M c , 0() () ee() T T T iX iX Xci Ec , where 1 ba c , () 1 ba c , 22 1 2 () eM , normal mgf 22 1 2 () e i , normal CF. Copyright © 2011 SciRes. JMF |