Technology and Investment

Vol.2 No.4(2011), Article ID:8361,7 pages DOI:10.4236/ti.2011.24030

Does Venture Capital Spur Patenting? Evidence from State-Level Cross-Sectional Data for the United States

Fatih University, Istanbul, Turkey

E-mail: msakin@fatih.edu.tr, msakin2000@yahoo.com

Received June 19, 2011; revised July 15, 2011; accepted August 8, 2011

Keywords: Patent, Venture Capital, US States

Abstract

We test the venture capital and patenting hypothesis state-level cross-section data for the United States, whereas previous research has been industry and firm based. We categorize R & D funds (federal research, industry research and academic research funds). We include the income level (gdp per capita) and size of the states (gdp, population, civilian labor force). We consider human capital factors as adding science and research holders of each state through different categories (doctoral sciences and engineering degree holders, graduate students of science and engineering, post doctorate students). Finally, we include the grants received by the Small Business Innovation Center. Even after controlling so many variables, our results suggest that venture funding has a strong positive impact on patenting in state-level cross-section data. A one billion dollar increase in venture capital is associated with an increase in 440 patents whereas a one billion dollar increase in corporate R & D is associated with an increase in 140 patents. Kortum and Lerener [1] find that a dollar of venture capital is seven times more powerful in stimulating pattern than a dollar of corporate R & D. Our research suggests that this difference is three times.

1. Introduction

The link between patenting and venture capital has already been explored in the literature [1]. Our research is different for a number of reasons. First, we test statelevel cross-section data for the United States, whereas previous research has been industry and firm based [1,2]. Second, we categorize R & D funds (federal research, industry research and academic research funds). Third, we include the income level (gdp per capita) and size of the states (gdp, population, civilian labor force). Fourth, we consider human capital factors as adding science and research holders through different categories (doctoral sciences and engineering degree holders, graduate students of science and engineering, post doctorate students). Finally, we include the grants received by the Small Business Innovation Center. Even after controlling so many variables, our results suggest that venture funding has a strong positive impact on patenting in statelevel cross-section data.

Implementing brain power into the market requests a trial and error approach. If the risk is only on the shoulders of entrepreneurs, they will avoid risk. Risk-sharing has an important role in developing new ideas. Many students graduate with new ideas, but the ecosystem does not allow them to try innovative ideas. If innovation were not risky, big firms would try it, and they would use their great advantages in finance, marketing, and distribution channels. This market failure occurs because the significant uncertainties of R & D lead private investors to allocate suboptimal amounts of finance to research [3]. Therefore, big companies rely on external R & D. Financing R & D is a serious obstacle bound in economics.

One specific area of finance for a risky investment is venture capital. Venture capital is defined to be “equity or equity-linked investments in young, privately held companies, where the investor is a financial intermediary who is typically active as a director, an advisor, or even a manager of the firm” [1]. There is a vast literature regarding the role and the benefits of venture capital [4]. First, venture capitalists share the risks. Venture capital finance highly-risky potentially high-rewarded projects, purchasing equity or equity-linked shares while the firms are still privately held [4]. The investment amount is not relevant to growth [5], nor does the short-run investment amount for entrepreneurial activities matter. Therefore, the normal banking sector will not finance such longterm and risky investments because it is under the constraint of short-term goals.

Second, venture capitalists play a significant role in the development of the start-up companies [2]. The proportion of all initial public offerings backed by venture capital funding rise from 10% in the 1980s to 30% in the 1990s and 55% in 1999 [4].

Third, increases in venture capital actively in an industry are associated with significantly higher patenting rates [1]. They also find that a dollar of venture capital is seven times more powerful in stimulating pattern than a dollar of corporate R & D. Innovators do have a significantly higher number of patents than do imitators [2].

Fourth, venture capitalists play to erode informational asymmetries Venture capitalists should be prominent in industries where informational concerns are important, such as genetics and computer software [6].

Fifth, venture capitalists ease bringing companies to stock market since they don’t sell their shares rightaway and they want to raise their reputation for a following initial public offering. Therefore, investors have trust on venture capitalists to buy stocks. Venture capitalists repeatedly bring firms to the public market and therefore they need to protect their reputation against overvaluation [7].

Sixth, the choice behind venture capital is to choose a self-growth business model that depends on the customer’s payment versus scaling with venture capital cash injections. Important issue with venture capital is scaling. Thanks to venture funding, a business can grow very fast. Without venture capital, it may take generations for a company to grow.

Seventh, The greater availability of venture capital might have caused a fall in the unemployment rate [8]. There is an important transmission mechanisms from venture capital availability to labor market performance. According to [7], venture capital is likely to improve the international competitiveness, to attract higher foreign direct investment inflows and to stimulate technologies.

These start-up companies often take new innovations to market and could be important conduits to exploit and disseminate benefits from technological breakthroughs. Given this potential, the presence of venture capital could spur innovation since it could increase profitable opportunities from new discoveries. Venture capital could have contributed to 8% of industrial innovation in the late 1980’s even though it only measured less than 3% of R & D during this period [1]. Venture capital contributed to productivity growth in Taiwan [9].

The rest of this paper is organized as follows. Section 2 presents the empirical methodology. Section 3 presents results and Section 4 offers concluding discussion.

2. Empirical Methodology and Data

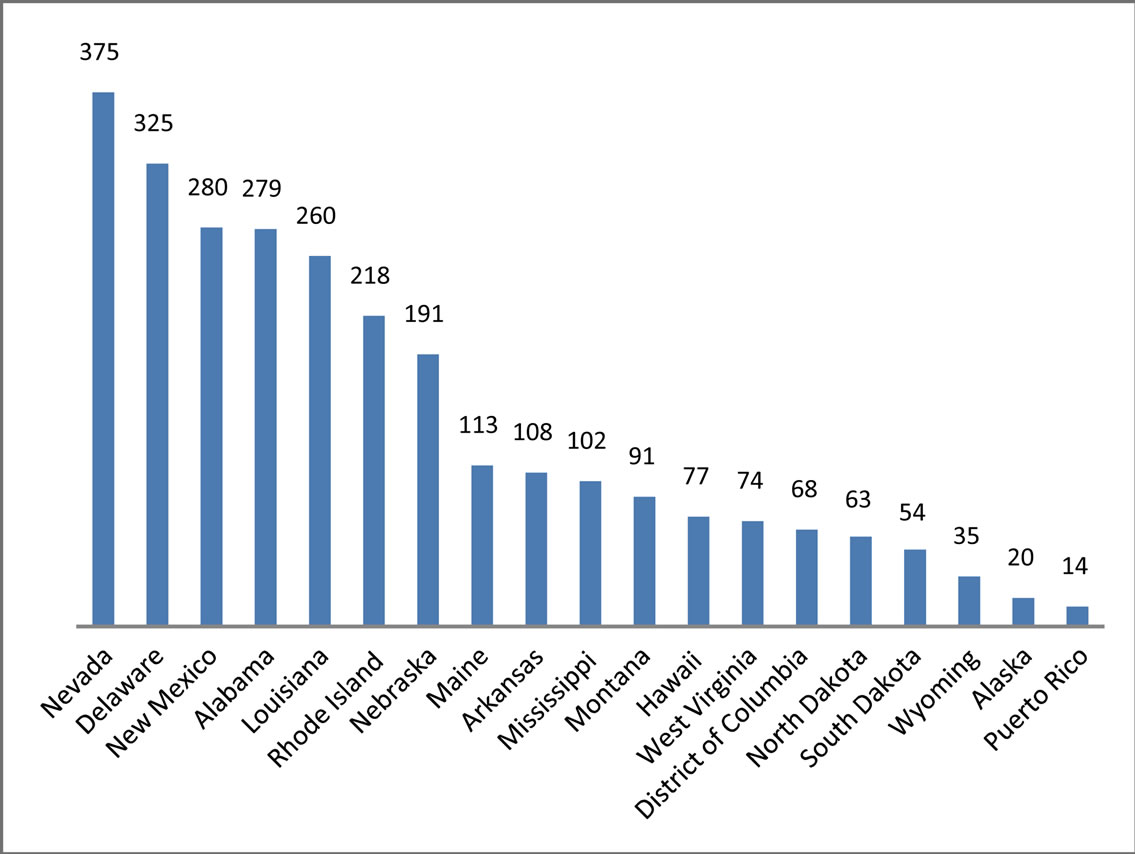

We consider a cross section of 50 states, Washington D.C., and Puerto Rico in the United States from 2006 to 2008. We chose the years between 2006-2008 since it was the latest available years in the data set (see Tables 1 and 2 for descriptive statistics). Our dependent variable is the number of patents issued by each state in the United

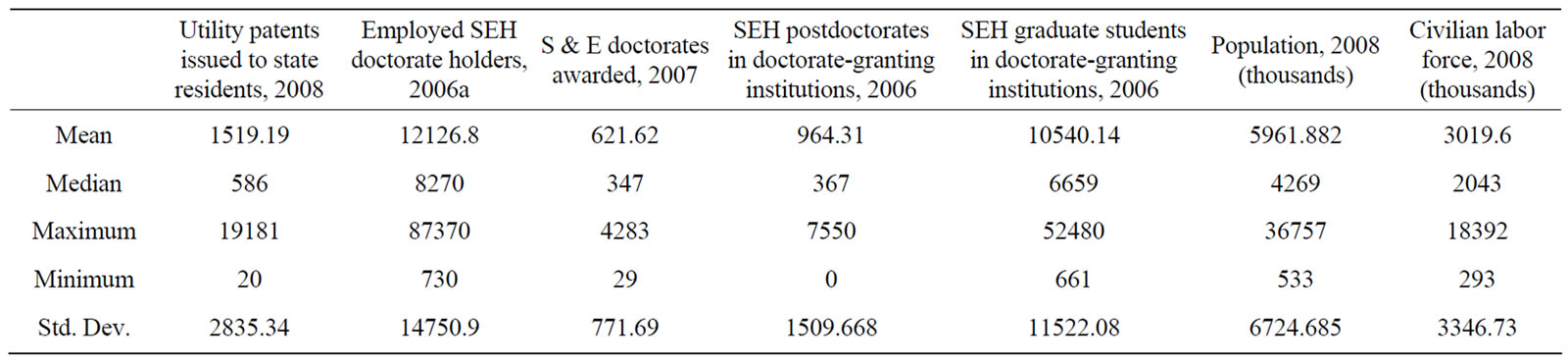

Table 1. Descriptive statistics.

Table 2. Descriptive statistics.

States and our data have been reported by [10-12].

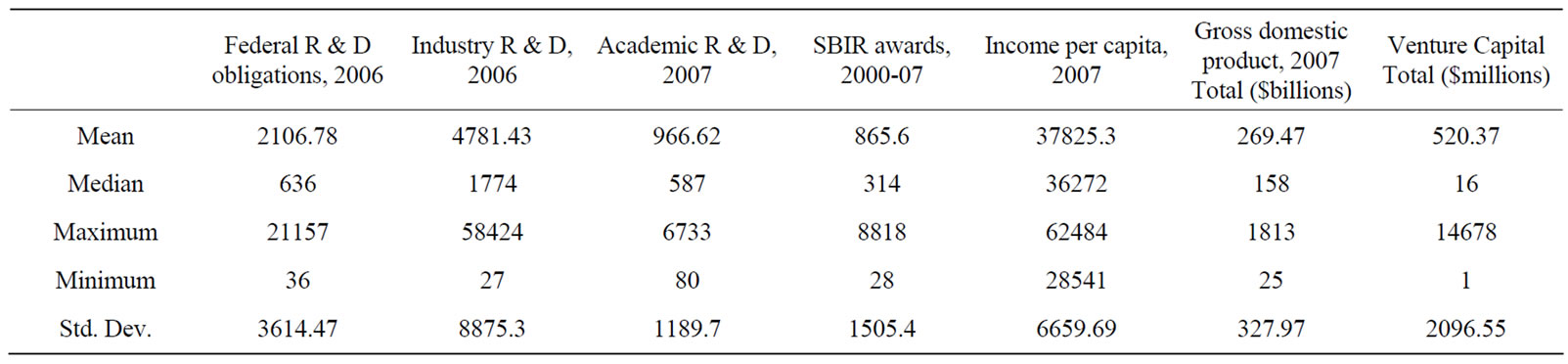

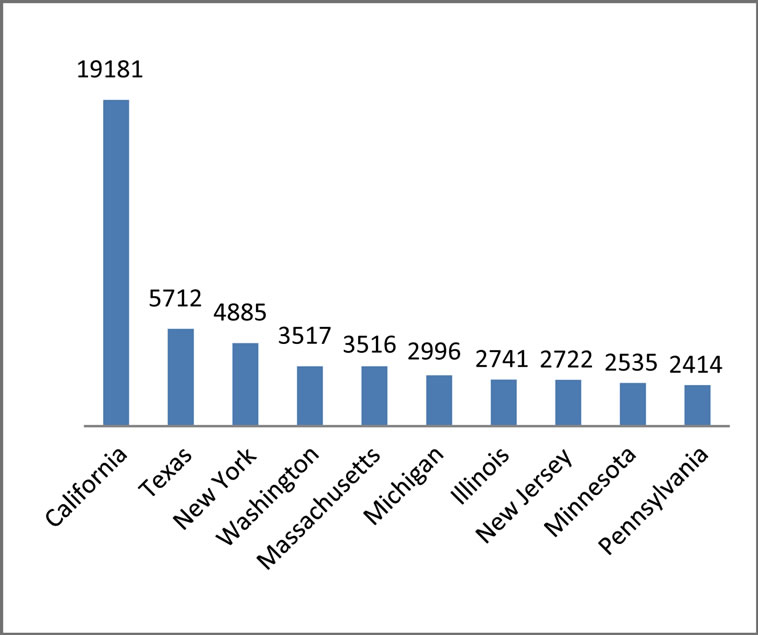

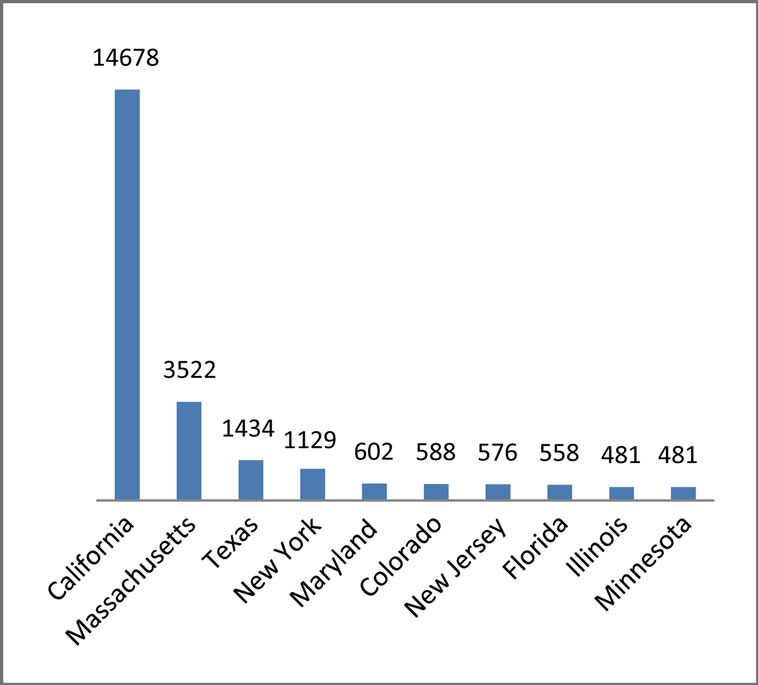

When patent disbursements are viewed geographically, a little more than one-fourth of patents went to Califormia, a little less than one-third goes to Texas, New York, Washinton, Massachusetts, Michigan, Illinois, New Jersey, Minnesota, and Pennsylvania (Figure 1). The poorest19 states in patenting hardly pass the number of patents in Pennsylvania (the 10th lowest in the leading states) (Figure 2).

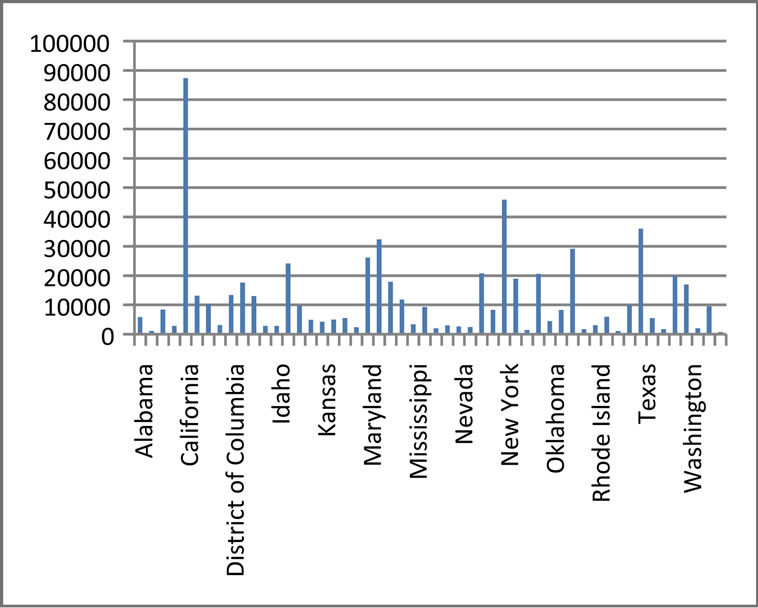

When venture capital (VC) disbursements are viewed geographically, half of venture capital went to Califormia (in patenting, California was granted one-third), and the other leading states received more than one-fourth of venture capital (Figure 3). This indicates that there is a strong, inequal distribution of venture capital availability across the United States. This time, we needed 35 states to capture the 10th lowest leading venture capital state— Minnesota (Figure 4).

GDP per capita income (Cap-State) and GDP (GDPState) of each state are used as a proxy for income level. We are controlling for level of income, so venture capital spending is not just earning higher incomes. Distinctions among GDP (we also test states’ population and labor force) and GDP per capita will help determine whether the income level (rich versus poor states) or the size of the state (big versus small states) matters most for acquiring patents. In terms of Cap_State, the average income is $37.825 and the lowest income per capita is $28.000 and the highest income per capita is $62.484 (Table 2). In the U.S. the income gap between the richest and the poorest of states is 2 to 1.

The major explanatory variable for patenting is R & D expenditures [1]. In our research, we divide expenditures into the categories such as industrial, academic, and federal R & D.

Among our control variables, we include human capital as adding science and engineering degree holders to each state (for the years of 2006-2008) (Figure 5). We

Figure 1. Top 10 leading states in patenting (2008). Source: Natioanl sciences foundation [10]. (Total patent number in the US is 77,793).

Figure 2. Poorest states in patenting (2008) (19 states). Source: Natioanl sciences foundation [10] (Total patent number in the US is 77,793).

Figure 3. Top 10 leading states in venture capital (2007). Source: PriceWaterCoopers-National venture capital association [11] (Total venture capital in the US is $26 billion 555 million).

Figure 4. Poorest states in venture capital (35 states). Source: PriceWaterCoopers-National venture capital association [11].

use four cathegories: 1) accumulated Ph.D. holders in science and engineering (SE), 2) current graduate students in SE, 3) new graduate post-doctorate students, and iv) new graduates with master’s and Ph.D. degrees in SE. As seen in the graph, the important technology centers such as California and New York attract a large sum of degree holding engineers.

Additionally, we include the awards granted by the Small Business Innovation Center to each state. The U.S. Small Business Administration (SBA) Office of Technology administers the Small Business Innovation Research (SBIR) Program. SBA ensures that the nation’s small, high-tech, innovative businesses are a significant

Figure 5. Ph.D. holders of science and tech. Source: National science foundation [10] (total US: 620,140).

part of the federal government’s research and development efforts.

Given the control variables of the research, human capital and income resources, does venture capital remain statistically significant? We will address and answer this question in the following section.

3. Results

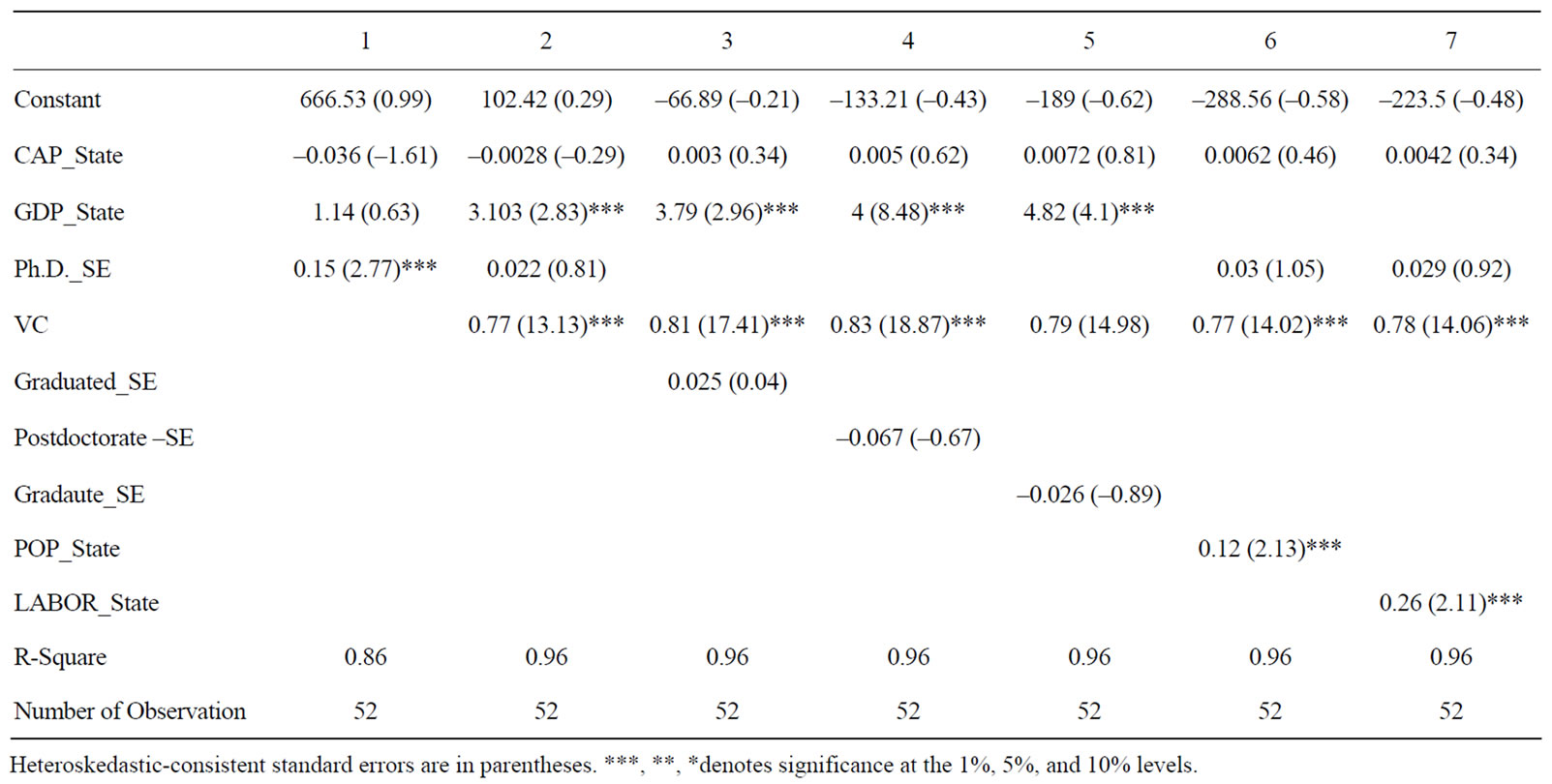

Table 3 presents findings for the full sample of states and assesses human capital and income variables. Table 4 considers research fund variables.

The first column presents the baseline specifications. We run CAP_State, GDP_State, and Ph.D._SE. Ph.D._SE is significant. In column we add VC, our main research variable. VC remains statistically significant in all regressions. The t-value is extremely high (t is 13.13). Ph.D._SE lost its significance.

The coefficient for GDP is positive, whereas the other income variable, GDP per capita, is not significant. So, income level does not play an important role on patenting but the size of a big state (GDP).

In columns 3, 4, and 5, we add other human capital variables; Graduated_SE, Postdoctorate –SE, and Gradaute_SE. None of the human capital variables are significant. We may comment that human resources may not be sufficient unless the supporting institutions exist. In this case, VC represents a funding, an operational and a risk sharing institution.

In columns 6 and 7, we test other sizes of the state variable and both population and civil labor force are statistically significant.

This finding in Table 3 suggests that promoting venture capital might contribute to an increase in patenting.

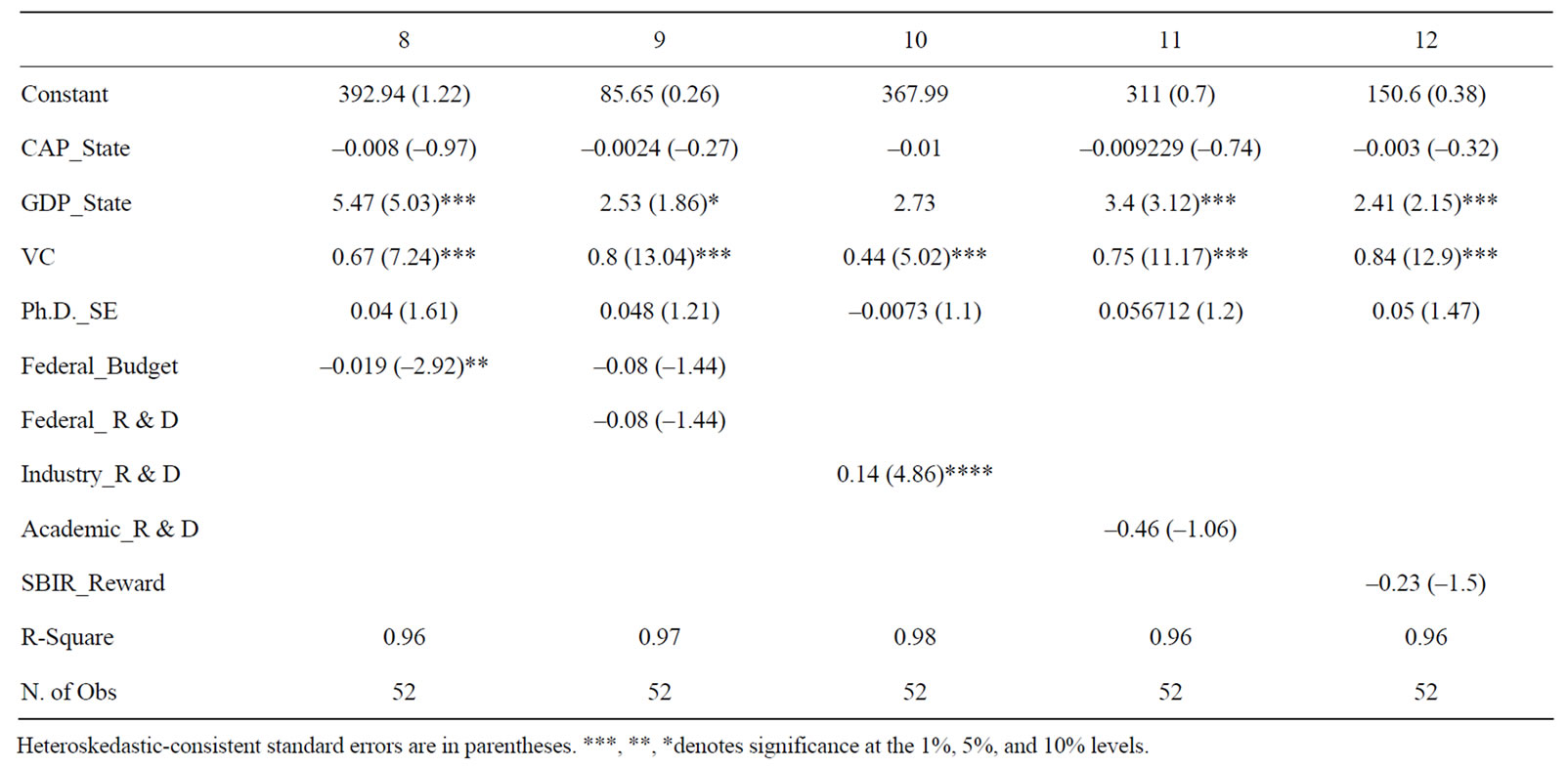

In Table 4, we add the source of funds beside Cap_

Table 3. Dependent variable: number of patent of state.

Table 4. Dependent variable: number of patent of each state.

State, GDP_State, VC and Ph.D._SE. Only the industrial research fund is statistically significant. The academic and federal research fund variables are not statistically significant. Hence, we find that venture funding and industrial research expenditures are more effective than academic and federal research funds. A one billion dollar increase in venture capital is associated with an increase in 440 patents whereas a one billion dollar increase in corporate R & D is associated with an increase in 140 patents. Kortum and Lerner [1] find that a dollar of venture capital is seven times more powerful in stimulating pattern than a dollar of corporate R & D. Our research suggests that this difference is three times. Kortum and Lerner [1] also compare venture-backed firms and nonventure backed firms in terms of patenting efficiency. They find that venture-backed firms’ patents are more frequently used by other patents. A plausible suggestion is that venture capitalists put more pressure and spend more time in pursuit of results, hence they discipline the firms holders to follow the target in a timely matters. Similarly, academic life is not as competitive as business life. Therefore, academics might work with less time pressure. Another reason might be that academics try to publish papers out of work rather than just focusing on patenting. Some research in academia may deal with basic science rather than aiming for patenting and innovation, opposite to the goal of venture capitalists. So, an academic research project may aim for a pure theoretical purpose. We also test the impact of SBIR rewards on patenting, which is not statistically significant.

4. Conclusions

We consider a cross section of 50 states, Washington D.C., and Puerto Rico in the United States from 2006 to 2008 to search the link between patenting and venture capital.

When patent disbursements are viewed geographically, a little more than one-fourth of patents went to Califormia, a little less than one-third goes to Texas, New York, Washinton, Massachusetts, Michigan, Illinois, New Jersey, Minnesota, and Pennsylvania. The poorest19 states in patenting hardly pass the number of patents in Pennsylvania (the 10th lowest in the leading states).

When venture capital (VC) disbursements are viewed geographically, half of venture capital went to Califormia (in patenting, California was granted one-third), and the other leading states received more than one-fourth of venture capital. This indicates that there is a strong, inequal distribution of venture capital availability across the United States. This time, we needed 35 states to capture the 10th lowest leading venture capital state—Minnesota Ours findings suggest that promoting venture capital might contribute to an increase in patenting. A one billion dollar increase in venture capital is associated with an increase in 440 patents whereas a one billion dollar increase in corporate R & D is associated with an increase in 140 patents. Kortum and Lerener [1] find that a dollar of venture capital is seven times more powerful in stimulating pattern than a dollar of corporate R & D. Our research suggests that this difference is three times. Size of states (GDP, population and civil labor force) does matter rather than income per capita on patenting. The human capital variables (graduate degree holders in science and engineering) lose their significance when we include venture capital. We may comment that human resources may not be sufficient unless the supporting institutions exist. In this case, VC represents a funding, an operational and a risk sharing institution.

The academic and federal research fund variables are not statistically significant with patenting. A plausible suggestion is that venture capitalists put more pressure and spend more time in pursuit of results; hence they discipline the firms’ holders to follow the target in a timely matters. Similarly, academic life is not as competitive as business life. Therefore, academics might work with less time pressure. Another reason might be that academics try to publish papers out of work rather than just focusing on patenting. Some research in academia may deal with basic science rather than aiming for patenting and innovation, opposite to the goal of venture capitalists. So, an academic research project may aim for a pure theoretical purpose.

5. References

[1] S. Kortum and J. Lerner, “Assessing the Contribution of Venture Capital to Innovation,” RAND Journal of Economics, Vol. 31, No. 4, 2000, pp. 674-692. doi:10.2307/2696354

[2] T. Hellmann and M. Puri, “The Interaction between Product Market and Financing Strategy: The Role of Venture Capital,” Review of Financial Studies, Vol. 13, 2000, pp. 959-984.

[3] D. Berlitz, “Political Choice and Strategies for Growth in Israel, Taiwan, and Ireland,” Yale Press, New Haven, 2006.

[4] P. Gompers and J. Lerner, “Venture Capital Revolution,” The Journal of Economic Perspectives, Vol. 15, 2001, pp. 145-168.

[5] W. Easterly, “The Elusive Quest for Growth: Economists’ Adventures and Misadventures in the Tropics,” MIT Press, Cambridge, 2002.

[6] R. Amit, J. Brander and C. Zott, “Why Do Venture Capital Firms Exist? Theory and Canadian Evidence,” Journal of Business Venturing, Vol. 13, 1998, pp. 441-466.

[7] W. C. Megginson and K. A. Weiss, “Venture Capital Certification in Initial Public Offerings,” Journal of Finance, Vol. 46, No. 3, 1991, pp. 879-893. doi:10.2307/2328547

[8] H. Feldmann, “Venture Capital Availability and Labor Market Performance in Industrial Countries: Evidence Based on Survey Data,” Kyklos, Vol. 63, No. 1, 2010, pp. 23-54. doi:10.1111/j.1467-6435.2010.00459.x

[9] M.-C. Tang and Y.-L. Chyi, “Legal Environments, Venture Capital, and Total Factor Productivity Growth of Taiwanese Industry,” Contemporary Economic Policy, Vol. 26, No. 16, 2008, pp. 468-481.

[10] National Sciences Foundation, 2008. http://www.nef.org

[11] Pricewatercoopers-National Venture Capital Association, 2010. http://www.nvca.org

[12] US Census Bureau, 2010. http://www.census.org