Modern Economy

Vol.07 No.12(2016), Article ID:71904,11 pages

10.4236/me.2016.712132

Partial Privatization in Upstream Mixed Oligopoly with Free Entry

Chu-Chuan Hsu

Department of Marketing and Logistics Management, YuDa University of Science and Technology, Taiwan

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: October 10, 2016; Accepted: November 7, 2016; Published: November 10, 2016

ABSTRACT

Utilizing the model with upstream mixed oligopoly in which there are one public and n private wholesalers in the upstream market, and m private retailers in the downstream market, this paper examines the optimal privatization policy of the upstream public wholesaler. It shows that: Firstly, in an environment with mixed oligopoly in the wholesale market and many private firms in the retail market, the public wholesaler should be partially privatized in the short run. Besides, the more private firms are in wholesalers or retailers market, the higher degree of privatization the government should take. Secondly, the public wholesaler should be partially privatized in the long run; moreover, the more private retailers firms are in the market, the less degree of privatization the government should take. Thirdly, the difference of optimal degree of privatization between long run and short run is increasing in the market scale and decreasing in the entry cost. Hence, the optimal degree of privatization in long run is smaller than in short run, when the market scale is restricted and the entry cost is high.

Keywords:

Upstream Mixed Oligopoly, Free Entry, Privatization

1. Introduction

Recently, a growing amount of literature on the privatization issue in mixed oligopoly has been seen. Regarding the policy of partial privatization1, Matsumura [1] in mixed duopoly explicitly considered the possibility of partial privatization, and showed that neither full privatization nor full nationalization is optimal. In a closed-market homogeneous oligopoly, Matsumura and Kanda [2] demonstrated that partial privatization is the optimal policy in the short-run; full nationalization is always optimal in the long run with free entry among private firms. Brandão and Castro [3] extended the framework by Matsumura and Kanda [4] , and demonstrated that the presence of a public enterprise can be an alternative to direct regulation to avoid the excess entry problem. Fujiwara [4] developed a differentiated mixed oligopoly model to establish what implication product differentiation has for the optimal privatization policy and showed that the short-run-optimal policy is non-monotonic in the degree of love of variety, while the optimal degree of privatization is monotonically increasing in the consumer’s preference for variety in the long run.

Wang and Chen [5] envisage three scenarios, which are one benchmark regarding an autarky market and two open-market counterparts, to explore the influences of cost efficiency gain and foreign competitors on equilibrium outcomes. In contrast to the case in Matsumura and Kanda [2] , critical cost gap determines that long-run degree of privatization is larger than the short-run one. In particular, regarding the scenario wherein one public firm competes with domestic private firms and foreign private firms, equilibrium price is lower than marginal cost of public firm instead of being equivalent to marginal cost of the public firm. They find that public firm’s outputs, profit, and social welfare are the largest in the autarky scenario; contrarily, public firm’s outputs, profit, and social welfare are the smallest in mixed oligopoly wherein one public firm competes with domestic private firms and foreign private firms.

While Matsumura and Kanda [2] and Wang and Chen [5] show an important limitation of the “optimal privatization policy at the free entry market” and provide important policy implications, they have ignored an important market structure, viz., the input of the final goods. Hence, a more comprehensive treatment incorporating the input pricing activities of the intermediate goods producers and the final goods producers deserve attention in examining privatization policy of entry in a vertical structure. We take up this issue in this paper and derive the following findings: Firstly, in an environment with mixed oligopoly in the wholesale market and many private firms in the retail market, the public wholesaler should be partially privatized in the short run. Besides, the more private firms are in wholesalers or retailers market, the higher degree of privatization the government should take. Secondly, the public wholesaler should be partially privatized in the long run; moreover, the more private retailers firms are in the market, the less degree of privatization the government should take. Thirdly, the difference of optimal degree of privatization between long run and short run is increasing in the market scale and decreasing in the entry cost. Hence, the optimal degree of privatization in long run is smaller than in short run, when the market scale is restricted and the entry cost is high.

The remainder of this paper is organized as follows. We present the basic model in Section 2. Major results are derived and explained in Sections 3 and 4. The final section is the concluding remarks.

2. The Basic Model

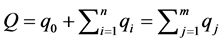

We assume that in a mixed oligopoly structure, there are one partially state-owned wholesaler and n private wholesalers in the upstream, while there are m private retailers in the downstream. All the upstream wholesalers, no matter whether it is the public or the private ones, sell homogeneous intermediate goods. It requires one unit of intermediate goods for producing one unit of final goods. Both the upstream and the downstream markets are engaging in Cournot competition. The market demand is characterized by a linear function , where

, where  denotes the market scale,

denotes the market scale,  stands for the market price.

stands for the market price.  is the total market output, where

is the total market output, where ,

,  and

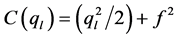

and  are respectively, the sale amount of the public wholesaler, the private wholesalers and private retailers .We assume that both public and private wholesalers have the same increasing marginal cost function2; namely,

are respectively, the sale amount of the public wholesaler, the private wholesalers and private retailers .We assume that both public and private wholesalers have the same increasing marginal cost function2; namely,  ,

,  , where

, where  stands for the fixed cost. The only cost that private retailers entail is the wholesale price

stands for the fixed cost. The only cost that private retailers entail is the wholesale price  determined by the wholesaler, excluding the fixed or variable costs, say the warehouse or transportation costs. Moreover, we also assume that the objective of this public firm, before privatization, is to maximize the social welfare. To launch the privatization policy, the government, adopting the equity offering, restructures the public firm into a mixed enterprise, and shares the ownership with private investors.

determined by the wholesaler, excluding the fixed or variable costs, say the warehouse or transportation costs. Moreover, we also assume that the objective of this public firm, before privatization, is to maximize the social welfare. To launch the privatization policy, the government, adopting the equity offering, restructures the public firm into a mixed enterprise, and shares the ownership with private investors.

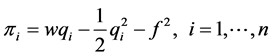

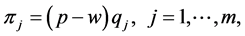

The profit functions of the public wholesaler, the private wholesalers, and the private retailers are as follows respectively:

(1)

(1)

where  denotes the social welfare, and

denotes the social welfare, and  is the consumer surplus. The social welfare function is the summation of consumer surplus and the profits of all the public and the private firms. Accordingly, the social welfare function is

is the consumer surplus. The social welfare function is the summation of consumer surplus and the profits of all the public and the private firms. Accordingly, the social welfare function is

. (2)

. (2)

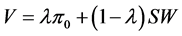

The objective function of the public firm is the weighted average of both its profit and social welfare. Thus, we express its objective function as

. (3)

. (3)

where

In the following, a three-stage game is used to explore how the government determines the optimal privatization policy. At Stage 1, by maximizing the social welfare, the government determines the optimal degree of privatization; at Stage 2, it is the Cournot competition where the public firm, given the privatization degree, determines the optimum wholesale amount and competes with other private wholesalers; at Stage 3, the private retailers are in Cournot competition as well. As usual, this game is solved by subgame perfection deduced through backward induction.

3. Optimal Privatization Policy at Regulated Entry

We start by considering Stage 3. Retailers are in Cournot competition to determine the optimal retail quantity (

We then get the equilibrium retail price

From Equation (5), we obtain the retailer’s profit, the wholesale price and the aggregate profit of the wholesale market respectively in the following expression:

Then, in Stage 2, we find the optimal wholesale output for the wholesalers. By substituting the preceding solutions into Equation (1), the profit functions of the public wholesaler and the private firm are rewritten as follows:

The first-order conditions of the above maximization problems are

The wholesale market is in homogeneous goods competition, we express

The equilibrium input price is

From comparative static analysis, we obtain that:

In the short run, the equilibrium input price of intermediate good will increase because the increase of the derive demand which is called the “pass through effect”; when the number of the firm in the wholesaler market increases, the equilibrium input price of intermediate goodwill decrease because the market is soften; the higher degree of the privatization will push up the equilibrium input price of intermediate good is because the decrease in the production of the public firm will decrease the supply of the intermediate goods.

Substituting

From Equations (8) and (9), we find that the output of the public wholesaler outnumbers that of the private wholesaler. Similar to the results obtained in other studies without concerning vertical market structure, our finding also indicates that the public firm will produce more for the consideration of social welfare.

Moreover, by using the foregoing equations, we can derive the impact of privatization degree

3The second order condition

From the above equations, we see that as the degree of privatization increases, the output of the public wholesaler shrinks, while that of the private wholesaler expands and that of private retailer decreases. The aggregate market output goes down and that will boost up the market price. Hence, consumer surplus declines.

Finally, we go to the first stage, and solve the government’s social welfare maximization problem to get the optimal degree of privatization. From the first order condition for social welfare maximization with respect to

We obtain the optimal degree of privatization

When

Proposition 1: In an environment with mixed oligopoly in the wholesale market and many firms in the retail market, the public wholesaler should be partially privatized in the short run.

Besides, from Equation (14), we perceive how the number of private wholesalers or that of private retailers affects the optimal degree of privatization. It shows that:

The optimal degree of privatization for the public firm depends on the number of private wholesalers or that of private retailers. When the number of private firms increases in wholesalers and retailers market, the government should increase the optimal degree of privatization.

4. Optimal Privatization Policy with Free Entry of Upstream Firms

In the long run, the government may liberalize the market with free entry4 which leads to zero profit for all the private wholesalers. Substituting Equation (8) and Equation (9) into

From Equation (17), we derive the number of the private wholesalers under free entry:

From Equation (18), we find that the impact of the optimal privatization degree or private retailer number on the optimal number of private wholesaler in the free entry upstream market. We express them respectively in the following equations:

From Equation (19), we also perceive that with free entry in the upstream market, the optimal private wholesaler number (

Substituting Equation (18) into Equations (5), (8) and (9), we get the outputs of the public firm and the private firms and wholesale price in the following expression:

From comparative static analysis, we obtain that:

In the long run, the equilibrium input price of intermediate good will decrease rather than increase is due to the deterrence effect of entry cost that will make the number of the firm in the downstream market becomes smaller and consequently, decreases the derive demand. The long run effect of firm entry in downstream market on the equilibrium input price of intermediate good is different from the short run “pass through” effect.

Furthermore, we find that:

From the results of Equations (25) and (26), we find that, in the industry environment with free entry, the government’s optimal privatization policy will only affect the optimum wholesaler number in the market or the output of the public firm. Neither the output of any individual private firm nor the optimum wholesale price is affected5.

Then, we go back to the first stage. In an industry environment with free entry, we solve the government’s social welfare maximization problem with respect to the optimal privatization degree. Substituting Equation (18) to Equation (2) gives us the long run social welfare level. From the first order condition, we get the long run optimal privatization degree as follows6:

6When

7

8Matsumura and Kanda [2] suggest that the government’s optimum privatization policy in the long run be sole public ownership in the final goods market.

From Equation (27), we perceive the impact of the private retailer number, the market scale and the entry cost on the long run optimal privatization degree as follows7:

Lemma 1: The optimal degree of privatization is decreasing in the number of private retailers and the entry cost, while it is increasing in the market scale.

The reasons for Lemma 1 are that, firstly, when the competition of downstream market is intensive, the degree of privatization should decline in order to enhance the supply of intermediate goods. Secondly, when the entry cost is increasing and the competition of upstream market is moderate, the government should decline the optimal degree of privatization.

In addition, we find that the government’s optimum policy is always partially privatization no matter in the situation with entry barrier in the short run or with free entry in the long run. The consideration of wholesale/retail structure in this paper may explain why the above result differs from that in Matsumura and Kanda [2] 8.

Proposition 2: In an environment with mixed oligopoly in the wholesale market and many firms in the retail market, the public wholesaler should be partially privatized when there is free entry in the wholesale market in the long run.

As argued in Matsumura and Kanda [2] , marginal cost pricing of the public firm is the best in mixed oligopoly at the free entry market. In other words, the optimal degree of privatization is achieved when marginal cost of the public firm is equal to the equilibrium price. After characterizing the short-run and long-run optimal privatization policies respectively, to compare which one is larger than another, we compare by

Proposition 3. The difference of optimal degree of privatization between long-run and short-run is increasing in the market scale and decreasing in the entry cost. The optimal degree of privatization in long-run is smaller than in short-run, when the market scale is restricted or the entry cost is high.

The reasoning is provided in Lemma 1.

From the comparison of Equation (16) and (28), we see that the entry of firm in the downstream market will increase the optimal degree of privatization in the short run but it may adjust the optimal degree of privatization in the long run. The reasoning is that in short run, as the market competition in the downstream market became intensive and that will make the market overproduced which lead the government to use the privatization policy in the wholesaler market as the instrument to reduce the supply of the public firm and hence, mitigate the adverse effect of overproduction in the retail market; but in the long run, since the profit of the firms in the wholesaler market is driven to zero and the number of the firm is restricted by the industry scale, the government should reduce the scale of optimal degree of privatization and increase the production of the semi-public firm to cope with the intensive competition in the retailers market.

5. Concluding Remarks

The major finding of this paper lies in the consideration of both the public wholesaler and the government’s privatization policy in a vertical structure. We analyze the economic effect of the optimal privatization policy in the short run and in the long run, and have the following conclusions: Firstly, in an environment with mixed oligopoly in the wholesale market and many private firms in the retail market, the public wholesaler should be partially privatized in the short run. Besides, the more private firms are in wholesalers or retailers market, the higher degree of privatization the government should take. Secondly, the public wholesaler should be partially privatized in the long run; moreover, the more private retailers firms are in the market, the less degree of privatization the government should take. Thirdly, the difference of optimal degree of privatization between long run and short run is increasing in the market scale and decreasing in the entry cost. Hence, the optimal degree of privatization in long run is smaller than in short run, when the market scale is restricted and the entry cost is high.

Cite this paper

Hsu, C.-C. (2016) Partial Privatization in Upstream Mixed Oligopoly with Free Entry. Modern Economy, 7, 1444-1454. http://dx.doi.org/10.4236/me.2016.712132

References

- 1. Matsumura, T. (1998) Partial Privatization in Mixed Duopoly. Journal of Public Economics, 70, 473-483.

http://dx.doi.org/10.1016/S0047-2727(98)00051-6 - 2. Matsumura, T. and Kanda, O. (2005) Mixed Oligopoly at Free Entry Markets. Journal of Economics, 84, 27-48.

http://dx.doi.org/10.1007/s00712-004-0098-z - 3. Brandao, A. and Castro, S. (2007) State-Owned Enterprises as Indirect Instruments of Entry Regulation. Journal of Economics, 92, 263-274.

http://dx.doi.org/10.1007/s00712-007-0286-y - 4. Fujiwara, K. (2007) Partial Privatization in a Differentiated Mixed Oligopoly. Journal of Economics, 92, 51-65.

http://dx.doi.org/10.1007/s00712-007-0267-1 - 5. Wang, L.F.S. and Chen, T.L. (2010) Do Cost Efficiency Gap and Foreign Competitors Matter Concerning Optimal Privatization Policy at the Free Entry Market? Journal of Economics, 100, 33-49.

http://dx.doi.org/10.1007/s00712-010-0117-4 - 6. Jiang, L. (2006) Welfare Analysis of Privatization in a Mixed Market with Bargaining. Contemporary Economics Policy, 24, 395-406.

http://dx.doi.org/10.1093/cep/byj029 - 7. Bárcena-Ruiz, J.C. and Garzón, M.B. (2003) Mixed Duopoly, Merger and Multiproduct Firms. Journal of Economics, 80, 27-42.

http://dx.doi.org/10.1007/s00712-002-0605-2 - 8. Méndez-Naya, J. (2008) Merger Profitability in Mixed Oligopoly. Journal of Economics, 94, 167-176.

http://dx.doi.org/10.1007/s00712-008-0001-7 - 9. Heywood, J. and Ye, G. (2008) Delegation in a Mixed Oligopoly: The Case of Multiple Private Firms. Managerial and Decision Economics, 30, 71-82.

http://dx.doi.org/10.1002/mde.1436 - 10. De Fraja, G. and Delbono, F. (1989) Alternative Strategies of a Public Enterprise in Oligopoly. Oxford Economic Papers, 41, 302-311.

NOTES

1In fact, recently the consideration of partial privatization is applied to various issues in mixed oligopoly. See, for example, Jiang [6] on wage bargaining, Bárcena-Ruiz and Garzón [7] and Méndez-Naya [8] on merger, Heywood and Ye [9] on delegation etc.

2De Fraja and Delbono [10] assume that both the public firm and the private firm have increasing marginal cost functions. With this assumption, it is not the optimum policy for a public firm to supply all the market demand.

4The government may liberalize the retailer market with free entry. However, since we assume retailers entail no fixed cost, the individual retailer still enjoys positive profit even in the long run with free entry. Thus, there is no optimal number of the retailer firms.

5Some relevant studies, please see Matsumura and Kanda [2] and Fujiwara [4] etc.