Modern Economy

Vol.05 No.12(2014), Article ID:51801,5 pages

10.4236/me.2014.512105

Game analysis of behavior between central and local government under Housing price control policy

huan Yang

Jinan University Management School, Guangzhou, China

Email: hnyanghuan@gmail.com

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 10 October 2014; revised 14 November 2014; accepted 24 November 2014

ABSTRACT

In recent years, the rapid growing housing prices and the continuing expanding real estate bubbles have become a hidden danger to the Chinese economy. Price regulation has also become one of the current hot issues. Though the central government issued a number of decrees, the price has been increasing, especially in first-tier cities, like Beijing, Shanghai, Guangzhou, and Shenzhen. What factors contributed to the high prices? The central and local governments play an important role in housing price regulation. From the perspective of game theory, behavior of central and local government under price control policies are described and analyzed in this article. We established a game model and got equilibrium between the two games. In the end, we raised some reasonable policy recommendations by the results of game analysis.

Keywords:

House price regulation, Central government, Local government, Game Theory

1. Introduction

In 1993, China’s real estate began to develop and has become a pillar industry of the national economy. The rapid development of real estate market has greatly promoted economic growth, but has also left a hidden danger on the national economy, sustainable development, and social harmony. More and more young people cannot afford a house because of the high price. Once the real estate bubble burst, it is bound to bring incalculable consequences. The 2008 US “subprime crisis” triggered the global economic crisis because the real estate industry brought irrational prosperity and development. With the increasingly prominent issue of high prices, scholars studied factors that influenced prices from different perspectives. First, scholars studied single factor or factors affecting the economic fundamentals of the prices and concluded that income, population, taxes, interest rates, land prices, and construction costs had short-term or long-term impact on prices. But with the rising level of China’s real estate market prices much higher than the current economic and income growth, visible factors of economic fundamentals have been insufficient to explain the rising price. Scholars began to focus on the real estate market speculation. Speculation can make prices continue to rise over the basic values and thus the real estate bubble economy appears. However, a very important institutional factor has been neglected. Since 2003, the central government has intensively introduced land policy, tax policy, credit policy, administrative regulation, and other regulatory measures (see Table 1). However, these policies did not work. Instead, the housing price is getting higher and higher. After China’s enforcement of tax sharing system, the central government’s fiscal revenue has grown rapidly, and simultaneously the local government has assumed overburden of obligations on fiscal expenditure. Thus, local governments began to actively gather money through the land, which resulted in local government’s over-reliance on real estate. On the other hand, financial authority and powers of local governments do not match. Chinese-style of fiscal decentralization and local competition together have become joint incentive to implement fiscal policies of land. In this case, the higher prices, the greater the effectiveness of local government will be. Therefore local governments have intrinsic motivation to push prices to rise. Due to the unknown relationship between the effectiveness of local government and housing turnover, local governments generally prefer mansion but ignore supply of small and medium size, mass housing, low-rent housing, and affordable housing. Under the situation of “land finance” and local governments’ competition, it is very difficult for the central government to control housing prices. The central government introduced effective price control policy, but local governments passed the buck or executed it passively. Some local governments even collude with real estate developers, driving up land and housing prices. Gradually, a kind of policy game situation of “there’s always countermeasure to the policy” formed.

In this context, scholars carried out many useful explorations. Zuo Feng [1] believes that the game of central and local government has both a negative side also a positive side. We should look at the game relationship

Table 1. Central government policies and measures of regulation of the real estate market.

between them dialectically. Yu Jianyuan [2] adopted the method of game theory to analyze the relationship between central and local government’s interest in the regulation of prices, and found that the central and local short-term interests and long-term interests in the real estate market were difficult to integrate effectively. Li ran [3] established an incomplete information dynamic game model to explore the central and local governments’ game behavior in regulatory policy choices, and found an indirect relationship between policy game and continually rising housing prices. Jiang Hanchen [4] used dynamic game equilibrium to explore the commission central and local-Agent Game relations and suggested that how to change the local government revenue’s over-re- liance on the “land finance” was the crux of the problem. These studies explored the central and local governments game under price control policy issues, only offered descriptive analysis of the problems in the tax system that was causing the land finance, but did not describe specific acts of local government’s changes in the game and reasons for weak enforcement or failure to implement price control policy after the central government introduced control policies. Therefore, this article aims to explore the non-cooperative situation between the central and local governments in implementing price control policy. What impact will be produced by this kind of game behavior? An in-depth analysis of the game between central and local governments through the establishment of Nash equilibrium game model was conducted to seek a balanced solution in order to explore ways of effective implementation of price control policy.

2. Game Analysis of the central and local governments

Since 1994, China’s implementation of the tax system, with the implementation of the central and local governments, “eating in separate kitchens” and “fiscal decentralization” and other policies, local governments have gradually evolved into its own political and economic organization of the utility function to maximize their own interests into the goal. Under the tax sharing the background of fiscal decentralization has expanded each year are caused by local governments to pursue fiscal institutional factors of land, the land size of local government finance has a significant positive impact on the high level of China’s urban housing prices. Therefore, in the course of the real estate market regulation policy passed, the game between the central government and the local government will be created.

2.1. Assumption of the model

Central and local government in the formulation and implementation of the real estate market regulation policy will make different choices based on the actual economic situation faced .According to the basic principles of game theory, game model should be a mixed strategy Nash equilibrium and we can obtain some assumptions as follow.

1) Assumed that participants both central government and local governments are rational, are seeking to maximize collective interests, and both are also risk neutral;

2) Suppose now that the real estate market was overheated, price control policy formulated by the central government is A, Utility factor for a policy implementation is a;

3) Assumed functional form is a linear function;

4) Assume that the utility of the probability obtained by the central government policy is , the local government was obtained as

, the local government was obtained as ;

;

5) Violation of the local government is β ( ,

, means no violations,

means no violations,  indicates the pres-

indicates the pres-

ence of irregularities), the probability of extra utility obtained when violation is b;

6) Central monitoring costs is C, if the local governments violations are found by monitoring will fine D.

2.2. Model

We can learn from the above assumptions and based on Utility Theory. If the local government is not illegal in the implementation of the policy, then the effectiveness of the policy generated for , the central govern-

, the central govern-

ment income utility for , the effectiveness of local government income for

, the effectiveness of local government income for .

.

If the local government irregularities in the implementation of the policy process, the effectiveness of the policy generated for . Local government violate in the implementation of the policy process, then the violation would be bring additional revenue

. Local government violate in the implementation of the policy process, then the violation would be bring additional revenue  for the local government.

for the local government.

Under different conditions, the central government and local government utility is as follows:

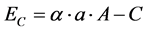

1) The central government does not regulate, local government is not illegal utility of the central government:

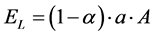

utility of the local government:

2) The central government regulate, local government is not illegal utility of the central government:

utility of the local government:

3) The central government does not regulate but local government violate and obtain additional revenue, the central government has lost .

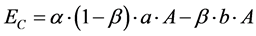

utility of the central government:

utility of the local government:

4) Central government regulate, local government violate, and the central government can find violations and penalties .

utility of the central government:

utility of the local government:

5) Central government regulate, local government violations, but violations have not been found.

utility of the central government:

utility of the local government:

2.3. Model solution

violation probability of local government in the implementation of policies is p, the probability of the central government will be able to find local government’s violation is r, and the probability of supervision is q, then, the probability of local government violate in the implementation of policy is p, under the conditions and Utility function theory:

Expected utility of the central government to carry out supervision and management is:

Expected utility of the central government does not regulate is:

Because Yc1 and Yc2 as a linear function, when Yc1 = Yc2 , the two functions intersect, you can get the best probability of local government in the implementation of policy violations, that is, for local governments, the central government’s supervision and not regulatory is indifference.

Can be calculated by the equation:

Under the situation that probability of the central government rugulate local is q, expected utility of the local government in the implementation of the policy in violation:

Expected utility of local government in the implementation of policy is not illegal is:

Because YL1 and YL2 are linear functions, when

In summary, you can get mixed strategy game model Nash equilibrium is:

3. Conclusions and recommendations

3.1. Improve regulatory efficiency, reduce regulatory costs

In the process of policy implementation for behavioral choice between central and local government is concerned, the best result is not the central government oversight, while the local government is not illegal, then the policy of the central authorities will be able to successfully implemented, but lack of reality. Game analysis drawn from the equilibrium point of view, we should be through institutional arrangements to encourage the probability of local governments violation and the central government oversight as small as possible. In order to make the probability of violation of local governments as small as possible, we have to reduce the equilibrium

solution

To reduce the probability of central government revenue sharing ratio and regulatory costs, increased central government regulation and found irregularities, local governments should increase the penalties for violations. Improve the efficiency of central regulatory supervision need a high-quality team, the real estate market regulation policies related to taxation, financial, economic and other aspects of professional knowledge, but also the departments involved is relatively broad. On the other hand, must have a good government, in order to prevent regulatory teams in the actual regulatory process be bought. To reduce the regulatory costs of the central government, we must actively use modern technology and management methods, establish and improve housing prices nationwide monitoring system, efforts to improve information on the level of work; should give full play to the supervisory role of the people, to establish a multi-regulatory networks and regulatory channels. In 2011 the central government began in the real estate market regulation policy implemented interviews and accountability of local officials, but the price is not enough tough, our latest data from the National Bureau of July, the real estate prices continue to rise, indicating that such administrative means no efforts to curb housing prices. We must increase the person’s responsibility of local government administrative sanction violations, and include individual performance into evaluation; thorough investigation of unfair trade practices to regional prices soaring to prevent collusion and big money-making phenomenon.

3.2. Increased local government revenue, reform fiscal and the performance evaluation system

Real estate prices are rising, along with the increasingly high land prices, the two influence each other, can be seen from the actual situation. The local government is also more dependent on land finance, debt repayment of part of the local government is highly dependent on the land revenue. So that the central government and local governments to more serious conflicts of interest, lack of control policies implemented in the real estate market place. As mentioned earlier, many scholars’ study showed that the root cause lies in our land financial allocation between central and local governments uncoordinated. Since 1994 China’s implementation of the tax system, the proportion of fiscal revenue to total fiscal revenue of local governments decline, but the opposite of local government expenditure did not change, which led the game, and increased the local government to the extent of reliance on land revenue. Therefore, under the price control policy, be sure to lift the local government’s financial constraints, can ease the tension by local fiscal reform of the tax system and central government funding to promote a balance of property rights and powers. True to a certain extent in order to curb the realities on the real estate market prices soaring.

But Zhang Wuchang [5] and other scholars’ research also has shown that even lifting the financial constraints, local government will not necessarily give up the land finances. The reason is that the land finance can help local governments easily achieve GDP growth performance. This shows that easing the financial burden on local governments but also have to reform the administrative examination when the incentives change in GDP as the key link in the development of ideas to guide local governments to really concern people’s livelihood. For a long time, China’s local government and its leadership cadres mainly based on the assessment of the size of the local GDP, the number of taxes, the amount of investment and other economic indicators based. Under the stimulus of such a performance appraisal system, the local government is very prone to short-sighted, does not take into account the overall interests and long-term interests of the community, carrying out land finance, vigorously sensibilities earn achievements, in order to have the land can be sold, even at the expense of arable land, China also appeared demolitions and other illegal activities. Therefore, scientific and rational, comprehensive design the government evaluation criteria is very important, the system is directed behavior, we believe that assessment indicators should be included in respect of which the livelihood and occupy a certain percentage, such as health care, education, housing, employment and other livelihood aspects of the community benefits. Whether it can effectively maintain the real estate market, the ability to effectively meet the housing needs of the residents, the ability to effectively stabilize housing prices, the ability to effectively protect farmland resources, can effectively improve the residential housing construction, as a measure of local government officials important basis for lifting and rewards and punishments. Thus, local governments have the power to self-adjustment policies introduced, be regulated according to the actual situation of the local real estate market, so that regulatory policy can really achieve adjustment of high prices, curb speculative growth. On the other hand, to establish a system of accountability related to increased regulations constrain efforts, the local government refused to ignore the behavior of the people’s livelihood issues, prompting the central government introduced the livelihood of housing policies are actually implemented, but also makes the price control policy get real implementation.

3.3. Analysis of the root causes of rising house prices, from the source to curb soaring house prices

What kind of intrinsic motivation mechanism can lead to abnormal development of China’s real estate market that housing prices only rise and speculation prevails? What is the best price regulation? This is the challenge for policy-making and decision science. Many scholars believe that income, land, population and other economic factors drive the increase of housing prices; some scholars believe that the land policy, auction policy, the tax system and regulatory policy induce high price; the few scholars are aware of the speculative buying, and advocate the use of tax suppression speculation. Tax pilot was held in Shanghai, Chongqing, Hangzhou and other places; but because of conflicting interests in policy implementation, progress is not smooth. This paper argues that the root cause of the soaring high speed of real estate market prices is a serious imbalance between supply and demand, serious speculation. Tax policy can effectively curb speculative demand, but the policy has not been effectively implemented. The government and relevant departments at all levels need to analyze reasons for the existence of the contradiction of supply and demand structure, and develop policies to solve China’s housing problem fundamentally.

References

- Zuo, F. (2007) Game Analysis of the Central Government and Local Governments in the Field of Macro-Control. Journal of Central University of Finance and Economics, 7, 5-9.

- Yu, J.Y. (2009) Game Analysis in Price Regulation of the Central Government and Local Governments. Economist, 2, 263-264.

- Li, R. (2009) Selection of the Real Estate Market Regulation Policy—Dynamic Game Model of the Central Government and Local Governments. Economic Research Guide, 1, 29-31.

- Jiang, H.C. (2012) Price regulation Game Theory—Based on Dynamic Game Central Government and Local Governments. Journal of Changchun University of Technology, 2, 36-37.

- Zhang, W.C. (2008) China’s Economic System. Arcadia Publishing Ltd., Hong Kong.