Wireless Engineering and Technology

Vol.2 No.3(2011), Article ID:5827,8 pages DOI:10.4236/wet.2011.23023

Uniticket: A Third Party Universal E-Ticket System Based on Mobile Phone*

![]()

School of Information Engineering, Nanchang University, Nanchang, China.

Email: wangyuhao@ncu.edu.cn

Received February 15th, 2011; revised March 30th, 2011; accepted April 15th, 2011.

Keywords: Smart Metering, WiMAX, Smart Grid, Demand Response, Electric Vehicles

ABSTRACT

Prepaid energy meters have been widely adopted by utilities in different countries across the world as an innovative solution to the problem of affordability and consumption management. However, the present smart card based systems have some inherent problems like added cost, low availability and lack of security. In the future Smart Grid paradigm, use of smart meters can completely overhaul these prepaid systems by introducing centralized accounting, monitoring and credit-control functions using state-of-the-art telecommunication technologies like WiMAX. In this paper we propose a prepaid smart metering scheme for Smart Grid application based on centralized authentication and charging using the WiMAX prepaid accounting model. We then discuss its specific application to Demand Response and Roaming of Electrical Vehicles.

1. Introduction

As the Chinese economy develops and the 3G era comes, e-ticketing has shown a broad future. On the one hand, e-ticketing is of great advantages. Compared with traditional way of ticketing, e-ticketing is convenient, safe and of low-cost. What’s more, it can extend value-added services such as WAP service and provide personnel services since it can count and manage tickets automatically and accurately [1,2]. As a consequence, although still in its infancy, e-ticketing has great market potential and already launched applications in some areas. So, all the parties on the industry chain, such as telecom operators, software providers, terminal manufacturers, banks, are trying hard to occupy the market. However, there still exist some serious problems [3]:

• Industry chain need to be developed: lots of parties are involved in mobile ticketing, and they compete with each other as well as cooperate: the financial institutions will get some share of the profits from every closed deal since it assumes the account management of the ticket-sellers and buyers; the mobile network operators will charge the service providers for some fee since they provide safe communicating channel for the payment and earn some value-added profits; the mobile payment party will charge the mobile operators and financial institutions for the permission of using payment techniques; the sellers expect to abridge the processes so that the expenses can be cut down while the customers care about the safety and convenience. Consequently, it remains a big problem how to balance the interests of so many parties and integrate various resources in order to get a win-win situation.

• Lacking a universal mobile ticketing system: to accomplish one kind of e-ticketing is not hard at all, and we can find many successful cases both outside and inside China, but what’s hard is to integrate all kinds of ticketing, such as cinema entrance tickets and transportation tickets, into one system and apply it into one mobile phone, in order to get a universal, security and long term mobile ticketing system. For the reason that each type of tickets has different characteristics and they are sold in various ways and involve enormous number of participants.

• Other problems: firstly, current ticketing systems cannot support refund and exchange tickets automatically without mankind operation. Secondly, it still needs to print out the ticket when checking in, thus there is no real sense of electronic management and operations. Besides, the security and confidentiality of mobile payments need to be enhanced.

As for all the problems mentioned above, this paper introduces a third party universal mobile e-ticket system, called Uniticket. Uniticket is an integrated ticket platform that can solve the problems mentioned above. Firstly, it requires every participants conform to the same principles made by the trusted authority, which defines the dividing of the profits and allows conciliation if disagreements arise. Therefore, it can settle down the first issue. Secondly, Uniticket not only saves the developing expenses for many ticket-sellers that try to establish an online selling system by allowing them to publish information on it, but also helps to manage the ticket market based on the communicating characteristic of the Internet via accumulate comments from both the customers and authorities [4]. Finally, it introduces a new kind of electronic receipt, dynamic two dimensional barcode, to help to enhance the security of the payment and can replace the traditional paper tickets.

Uniticket is composed of universal mobile ticket platform and external supporting environments [5]. The platform provides interfaces for both individual user clients and enterprise user clients. Hence, it can provide highquality services of both ticket booking and non-ticket reservations such as hotel reservations. And external supporting environments include users’ mobile phones, computers, payment platform, current enterprises’ ticketing systems and financial institutions such as banks and certificate authorities.

The rest of this paper is arranged as follows: Section 2 is the general framework and the functions of Uniticket, Section 3 is the components of Uniticket platform, Section 4 is the description of the security measures adopted in Uniticket, Section 5 is a case study and Section 6 is the conclusion.

2. The General Framework and the Functions of Uniticket

The purpose of designing Uniticket is to provide a security online service of inquiry, booking, payment and refund, a universal mobile ticketing platform which can be used to report false information, to facilitate the reunification and regulation of the various ticketing providers, to promote healthy competition in order to achieve a winwin situation, and to record users’ ticketing history in order to provide targeted service and thus make valueadded profits for merchants.

2.1. The Framework of Uniticket

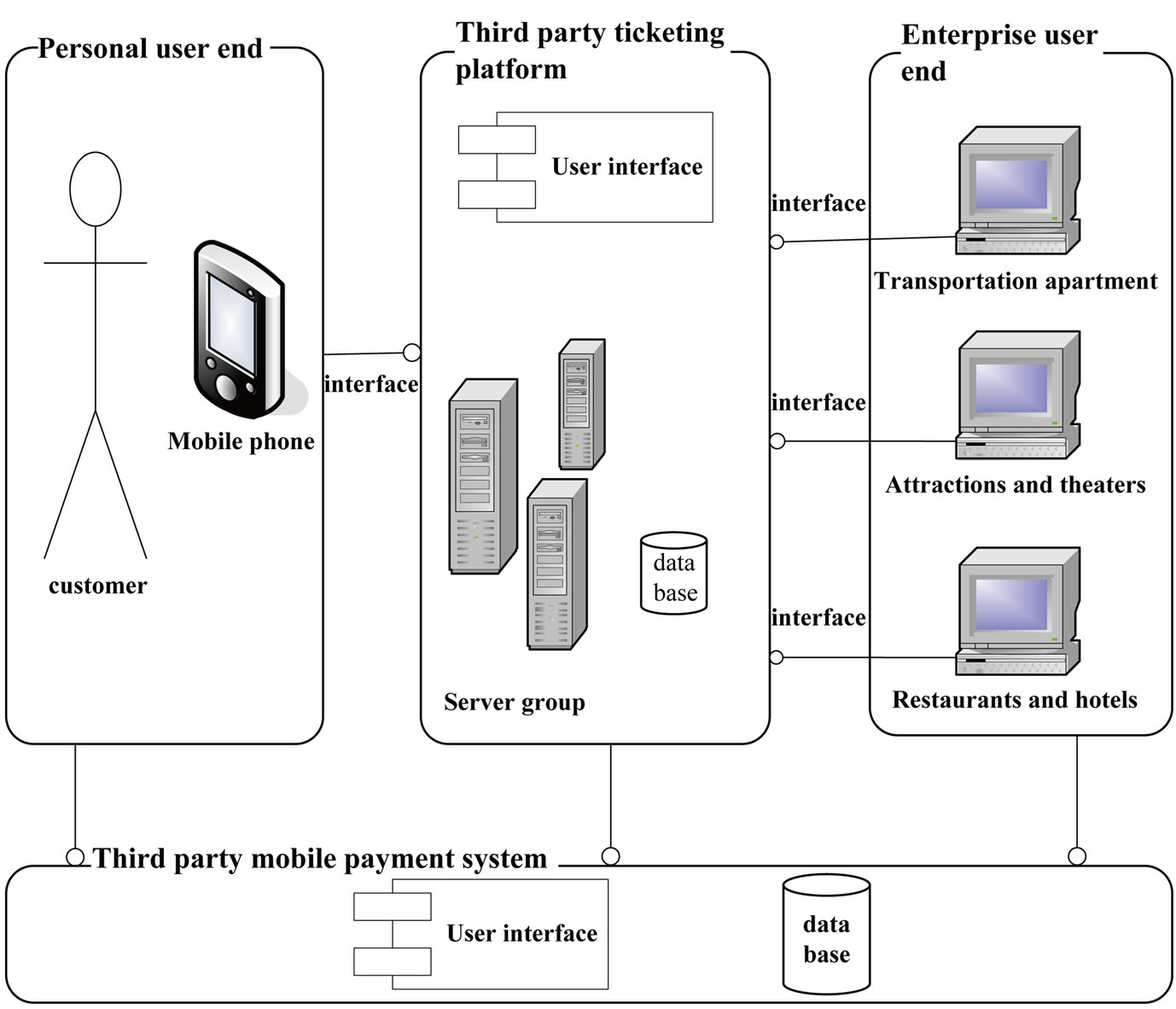

As is shown in Figure 1, Uniticket is composed of four major parts: universal third party mobile ticketing platform (Uniticket platform), payment platform, checking

Figure 1. General framework of Uniticket.

system and existing businesses’ ticketing systems. And the Uniticket platform is the very crucial part that provides interfaces for the other three and coordinates the operations of the whole system. And the components of Uniticket platform will be discussed in Section 3 [6].

2.2. The Flowchart for Customers to Function the System

The flowchart for customers to function the system is as follows:

• Enterprise users release and manage ticket information through their current management systems or the enterprise user end offered by the system.

• Personal users login the system and then do businesses such as inquiry and booking, and then submit the ticket information to the merchants.

• Personal users use the third party payment system as business agency and remit money to its account.

• The third party then tells the enterprises that the customer has paid, and then the merchant will send the number of the order to the personal user’s mobile phone. This number will be generated into 2-D barcode.

After receiving the successful payment information, the third party will remit money to the enterprise’s account, and this means the close of this deal.

And in this process, we must pay attention that if it is the first time for the user to use the system, then he must register to become a member. And after that, he can use the full functions of the system when he login the system with his username and password, otherwise, he can only achieve the inquiry function. And when the user registers, he must provide valid certificate that can show his real identification, so that the security of this system is improved.

3. The Components of Uniticket Platform

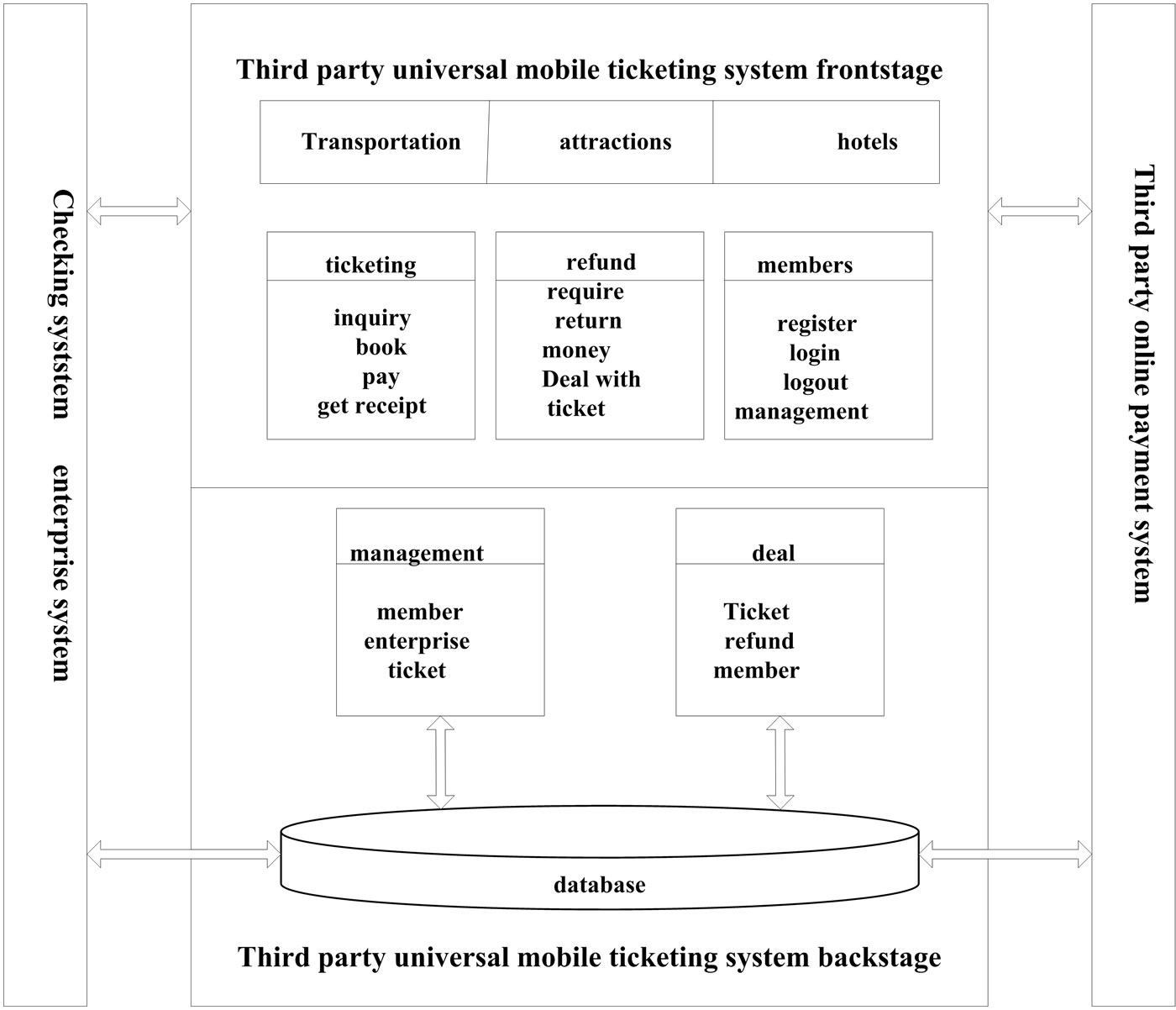

As is shown in Figure 2, the Uniticket platform is composed of ticket system, refund system, member management system and micro clients running on users’ phones and enterprises’ computers. And it also provides interfaces to existing businesses’ ticketing systems [7].

3.1. Ticketing System Based on B/S Architecture

Enterpriser users publish and manage ticket information by web sites. Individual users make the associated ticketing inquiries and reservations through the mobile phone wap network and complete online payment through mobile phones banking or other mobile payment methods. After the success of booking, individual users will get an order number. And then the order number will be delivered to personal user’s client to generate corresponding 2-D barcode image.

3.2. E-Ticket Management System Based on C/S Architecture

The client end of E-ticket management system runs on the individual’s mobile phone. And its functions include managing order number, communicating digital signature with the server and generate 2-D barcode image. Manage order number: capture order number from wap, classify and preserve order number, dispose overdue order number. And in order to ensure the security of e-tickets, must add digital signature when the client end transform order number into 2-D barcode image [8]. And the process of generating 2-D barcode image will be discussed in Section 4.2 since it adopted a security mechanism.

3.3. The Chosen of Mobile Payment Method

There are three kinds of mobile payment methods [9,10].

The first method is that the users pay the cost of mobile ticketing at the same time with paying their mobile bills. That is, the mobile network operators charge the bills and later pay the money to the merchants. But this approach is within very limited scope of businesses and can handle only a small sum of money due to the reason that the network operators are not financial institutions and hence cannot do banking business. So this method cannot be applied in mobile ticketing.

The second method is based on the banks. Usually, the users need to go to the mobile business hall with their identity certificate to get special SIM card, and then login the mobile website to recharge for the mobile wallet using credit card. But this method has disadvantages: A mobile phone can only be combined with one or a few banks, not convenient for users; different banks cannot interact with each other, limiting the promotion of mobile payment; every bank need to purchase their own equipment, a waste of resources.

And the third is what is adopted in Uniticket, called third party payment method. Third party payment refers to the kind of online payment mode that an independent body of a good reputation signs with the major banks, and then provides interfaces to bank payment system in order to accomplish payment. In third party payment, the customers choose what they need and then use third party payment platform to pay. Then the third party notifies the sellers that the payment is credited into account and asks for goods delivery. After the customers receiving the goods and making confirmation, the third party will give the money to the sellers’ account. So the third party plays the role as the connection between the sellers and the banks and the online supervisor. And it can coordinate all the processes of the transaction, charge for the ticket information release, operate and maintain the platform and collect users’ ticketing information. Thus it waives the

Figure 2. The design of Uniticket.

disadvantages of the former two methods.

The advantages of third party payment method are obvious and the success of third party payment tools such as Paypal and Zhifubao of Alibaba in China gives us great inspiration. And it becomes an inevitable trend for the domestic online payment industries to improve their businesses.

3.4. Check and Refund Ticket System Based on B/S Architecture

When checking the tickets, the first thing is to decode the 2-D barcode and then search the database to judge whether the e-ticket is valid. It will only pass through when it is valid. And when the customer wants to refund, he just need to login the system and require for refund. And after confirmation, the system will change the database, and the e-ticket will be listed invalid and the customer will get the money back from the third party, and then the third party will ask the money back from the customer. In this way, it will be much easier for the customers to refund.

4. What Guarantee the Security of Uniticket

Security is a key issue. So in this part, we will discuss the e-receipt and encryption algorithms and other techniques that used to ensure the security of Uniticket.

4.1. Dynamic 2-D Barcode as a Security E-Receipt

2-D barcode uses specific geometry to record data by a certain law of distribution of black and white graphic, read through image input device or electro-optical scanning device automatically so as to achieve automatic processing of information. It has some traits similar to barcode, but it can deliver information both horizontally and vertically thus can deliver large sum of information in a tiny area [11]. 2-D barcode has the features of large capacity, high-quality of decoding and strong security compared to barcode. Besides, the information carried can be restored even if it tears up or is contaminated, obviously superior to barcode [12].

However, problems come out. Currently, 2-D barcode is mainly used to be identified passively with special facilities, such as those printed on a train ticket can be identified by special identifiers. While in 3G era, people are more likely to use mobile phones to get more information about various products, so they seek to identify 2-D barcode that contains the information of certain products actively with their own mobile phones. Thus 2-D barcode can be very complicated as it contains more information [13]. As a result, current identifying techniques and lower-level phones may be unable to satisfy the users’ needs. And another problem is the security of the 2-D barcode when it is used as an e-receipt cannot be guaranteed, because it can be easily taken a picture of by another person and thus used unlawful by the person.

In order to solve the capacity problem mentioned above, people are trying to create a new type of 2-D barcode such as colored barcode that use colors to contain additional information. But it leads to new problems: color distortion on some screens may cause the failure of identifying; and as a newly-born barcode, it has many different types without an official type, which hampers the application of it. Besides, it cannot solve the security problem mentioned above [14].

Since traditional 2-D barcode adopted an encryption technique, it can only be read by special tools which are facilitated with decryption algorithms. As a result, it ensures the privacy protection of the merchants and users and enhances the security. However, the security of the pictures themselves is usually ignored. For example, the 2-D barcode saved in a mobile phone can be easily taken a picture of and then be used by somebody else.

In order to solve all the problems mentioned, we created a new type of dynamic 2-D barcode that combine the advantages of traditional 2-D barcode and colored barcode. It is a tiny flash composed of several traditional 2-D barcodes that appear alternately, which cannot be taken picture of and can increase the capacity by several times without making it more complicated. In this way, we can use current coding and decoding algorithms [15] of 2-D barcode with just a little change. And since it is dynamically changing, it cannot be taken a picture of, thus ensure the security of the picture itself. Therefore, we apply this kind of 2-D barcode as an e-receipt to Uniticket.

4.2. MD5 Applied to the Database Management and Ticket Management

MD5 is a widely used encryption algorithm. It can transform a passage of message into a piece of 128 bit message-digest and can hardly be transformed back from message-digest back to the original message. So even if the message-digest is let out, the real message still remains unknown. So some sensitive data such as users’ passwords will be encrypted by MD5 and then be saved as message-digest in the database. Therefore, the next time the user check-in, the system will transform the newly input data into message-digest and then compare it with the one that saved in the database in order to judge whether the user is legal. In this case, even if the database manager will never know the user’s password, ensuring the security of such sensitive data.

In order to ensure the security of e-tickets, we must add digital signature when the client end transform order number into 2-D barcode image. The processes are as follows:

• The client end generates a string “S” (digital signature)randomly;

• Using MD5 to transform S into “M” and then send it to the server side;

• The server then save “M” in corresponding database;

• The client end will incorporate order number and “S”

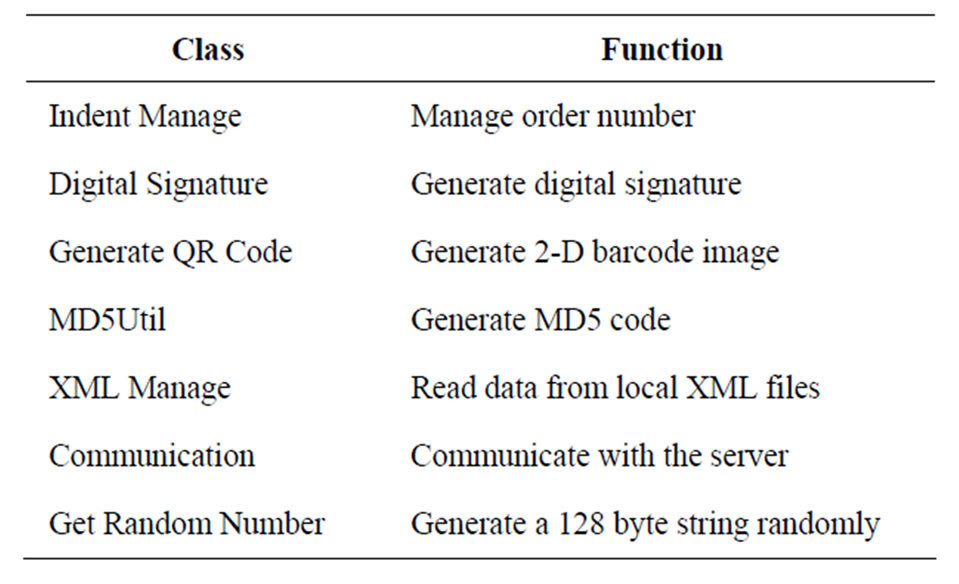

Generating 2-D barcode image: As noted above, the client end incorporates the order number and “S” into 2-D barcode image. When validate 2-D barcode, the validating system must first read out “S” from 2-D barcode image and then use MD5 to transform “S”, and compare the transformed value with “M” stored in database, only if they are the same will it be allowed to enter the next operating step. One-way nature of MD5 algorithm assures that “M” leakage will not lead to “S” leakage, thus ensuring the security of 2-D barcode. And the important classes designed is shown in Table 1.

4.3. Other Adoptions that Ensure the Security

Payment is a great concern of both the sellers and the buyers. As is discussed in 3.3, the third party payment method adopted in Uniticket hides the information of users’ credit cards from public and therefore cut down the chance of the information being stolen.

And the combination of B/S and C/S architecture, discussed in Section 3, achieves not only the distribution of the system but also the load balance. Therefore, it improves the stability and security of the database.

5. A Case Study of the System

As is discussed in Section 1, Uniticket has overcome some weaknesses of exiting ticketing systems, bringing great convenience to the users and achieving win-win situation. And it uses dynamic 2-D barcode, which is proposed for the first time ever, as e-receipt, which concentrates on not only the security of the information hidden in the barcode but also the security of the picture itself. Also, the architecture of Uniticket is smart because it com-

Table 1. Client terminal system program classes description.

bines C/S and B/S wisely. It runs the encryption and decryption and some other functions that require great resources on the client end (C/S), and ticketing, check-in and refund functions which need to access large sum of data from the database use B/S architecture. Therefore, the operation of Uniticket may seem just as normal as other ticketing systems but it greatly improves the efficiency and the security.

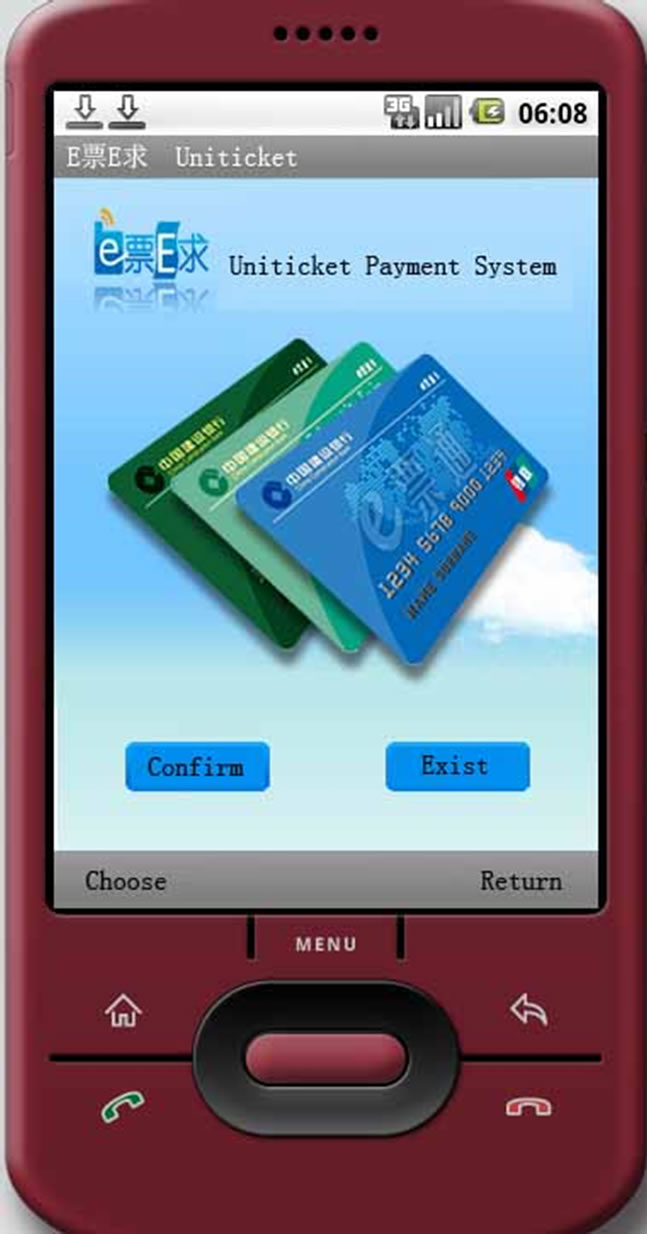

The user end is shown in the following figures, taking the process of film ticketing as an example.

As is shown in this set of figures, Figure 3 is what Uniticket looks like in the mobile phone, and after clicking on the icon then comes Figure 4, on which we can see all kinds of tickets and related value-added services. And when choosing the movie icon, we can follow Figures 5 and 6 to choose the desired films. And Figure 7 is the payment page. Last but not least, Figure 8 shows the dynamic 2-D barcode as a security e-receipt, but of course it cannot be dynamic in this paper.

6. Conclusions

As the mobile commerce develops, the requirements of both the customers and the enterprises are changing rapidly. And a third party universal mobile ticketing system is needed to better satisfy the needs. Uniticket comes out just in time. It brings convenience to the customers, saves

Figure 3. The icon of Uniticket.

Figure 4. The main page.

Figure 5. Search desired films.

Figure 6. The list of the films.

Figure 7. The payment page.

Figure 8. E-receipt of dynamic 2-D barcode.

expenses for the sellers, and coordinates the cooperation of other participants of this ticketing system including third party universal ticketing platform provider and financial bodies. Besides, it uses a new dynamic 2-D barcode which has much larger capacity and can guarantee the security when it is served as an e-receipt. As a consequence, Uniticket shows a broad future.

REFERENCES

- O. Kaellstroem, “Business Solutions for Mobile ECommerce,” Ericsson Review, Vol. 77, No. 2, 2000, pp. 80-92.

- J. H. Wu and S. C. Wang, “What Drives Mobile Commerce? An Empirical Evaluation of the Revised Technology Acceptance Model,” Information & Management, Vol. 42, No. 6, 2005, pp. 719-729.

- M. M. Fu, “E-Ticket and Mobile E-Ticket,” Journal of Civil Aviation Flight University of China, Vol. 20, No. 2, 2009, pp. 52-55.

- B. Chipangura, A. Terzoli, H. Muyingi and G. S. V. R. K. Rao, “Design, Development and Deployment of a Mobile E-Commerce Application for Rural South Africa—A Case Study,” Proceedings of the 8th International Conference on Advanced Communication Technology, South Korea, Vol. 3, 20-22 February 2006, pp. 1479- 1484.

- J. Qaddour, “WAP and Push Technology Integrated into Mobile Commerce Applications,” Proceedings of IEEE International Conference on Computer System and Applications, 2006, pp. 779-785. doi:10.1109/AICCSA.2006.205178

- Y. Zhao, Y. C. Wang and M. H. Qu, “Development and Research of B/S and C/S Based Management Information System of Vehicle Equipment,” Journal of Shanxi University of Technology (Natural Science Edition), Vol. 22, No. 4, 2006, pp. 69-72.

- L. Gong and C. Zhou, “Development and Research of Mobile Termination Application Based on Android,” Computer and Modernization, Vol. 8, No. 26, 2008, pp. 85-88.

- H. J. Yi and M. G. She, “MD5 Arithmetic and Digital Signature,” Computer & Digital Engineering, Vol. 34, No. 5, 2006.

- G. Me, “Payment Security in Mobile Environment,” International Conference on Computer Systems and Applications, Tunis, 14-18 July 2003, p. 34.

- P. Lin, H.-Y. Chen, Y. G. Fang, J.-Y. Jeng and F.-S. Lu, “A Secure Mobile Electronic Payment Architecture Platform for Wireless Mobile Networks,” IEEE Transactions on Wireless Communications, Vol. 7, No. 7, 2008, pp. 2705-2713. doi:10.1109/TWC.2008.070111

- L. Peng, “Research on the Handset Two-Dimensional Code Service,” Telecommunications Science, Vol. 22, No. 12, 2006, pp. 36-39.

- Q. H. Cheng, “The Feasibility Analysis on Replacing One-Dimensional ISBN Bar Code with Two-Dimensional ISBN Bar Code,” Sci-Tech Information Development & Economy, Vol. 18, No. 26, 2008, pp. 71-73.

- Y. Liu and M. Y. Liu, “Research on Data Encoding of Two-Dimensional QR Code Barcode,” Journal of Beijing Institute of Technology, Vol. 25, No. 4, 2005, pp. 352- 355.

- D. Y. Zhang, “Technology Standard and Application of Two-Dimensional Bar Code,” Information Technology & Standardization, Vol. 10, 2007, pp. 18-22.

- W. H. Lv, “Coding and Discernable of 2D Bar Code,” Modern Electronic Technique, Vol. 7, 2002, pp. 62-65.

NOTES

*This work were supported by National Natural Science Foundation of China (No. 60762005 and 61062009), the Natural Science Foundation of Jiangxi Province for Youth (No.2009GQS0070) and National Innovation Experiment Program for University Students of China (No. 091040322).