Journal of Financial Risk Management

Vol.05 No.03(2016), Article ID:70975,11 pages

10.4236/jfrm.2016.53018

The Impact of Margin Trading on Volatility of Stock Market: Evidence from SSE 50 Index

Muwei Chen

College of Economics, Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: August 2, 2016; Accepted: September 26, 2016; Published: September 29, 2016

ABSTRACT

No consensus has been reached on the impact of margin trading, including margin purchase and short sale, on market volatility. Margin purchase and short sale provide investors opportunities to be involved in financial market, so that this mechanism can increase market liquidity and efficiency. However, opponents argue that short sale may disrupt market. The data selected are SSE 50 index (Shanghai Security Exchange 50 Index) whose constituent shares are the most liquid and representative stocks in Shanghai Security. This paper analyzes SSE 50 Index covering a time period from Jan 4th, 2007 to October 16th, 2015. Moreover, time period is divided into three samples where market booms, corrects and drops. What’s more, this paper carries out Granger Causality Test, Impulse Response Analysis and Variance Decomposition Analysis, based on VAR model. To conclude, margin purchase and short sale ease volatility, but it depends when market is in different stage.

Keywords:

Margin Purchase, Short Sale, Volatility, VAR Model

1. Introduction

Margin trading is defined as margin purchase and short sale. That is, borrowing money from security companies with a certain percentage of cash deposit, leveraged investment, or short selling stocks which are believed to be overpriced. Margin trading plays an important role in securities trading, especially in fluctuating stock markets, where there are a variety of investment opportunities. However, the impact of margin purchase and short sale on market volatility still remains an open question. Many scholars make a research on the relationship between margin trading and market volatility, on developed market or emerging markets, only to come out with different opinions. Some state that margin trading makes stock markets volatile, some believe that margin trading well help stabilize the stock markets, and some hold a view that it depends. Galbraith (1955) mentions in The Great Crash 1929 that unlimited leverage causes crash, and Bogen & Krooss’s (1960) Pyramiding and De-pyramiding theory states that short sale could increase volatility. However, Miller (1977) argues that short sale constraints could cause price booming without limit. It is not until March 31st, 2010 that margin trading has been permitted in China and stocks in the list of margin purchase and short sale is renewing. According to Wind database, there have been a total number of 893 stocks in the list by October 31st, 2015, including 494 stocks exchanged in Shanghai Stock Exchange (SSE) and 399 in Shenzhen Stock Exchange (SZSE). Moreover, SSE owns a longer history than SZSE dose, and the capitalization of underlying stocks in SSE is much bigger than that of underlying stocks in SZSE. What’s more, the proportion of margin trading volume balance of underlying stocks in SSE is about 65 percent. Influenced by the 2008 financial crisis, Chinese stock market experienced a long-time dull, and then launched a rally in about July 2014. It peaked at its recent highest point as 5178.19 on June 15th, 2015 and then dropped during the “616” event and the “818” event. The paper employs margin trading data of SSE 50 index, which includes the most liquid and biggest-cap no more than fifty stocks in Shanghai Stock Exchange. SSE 50 index is one of the most representative indexes in Shanghai Stock Exchange. The time period selected is from January 4th, 2007 to October 16th, 2015, which well covers a time period when margin trading is forbidden, permitted and when the market experiences different phase. To study the relationship between margin trading and market volatility, this paper constructs VAR model, and Granger Causality Test, Impulse Response Analysis and Variance Decomposition Analysis are carried out, based on VAR model.

2. Literature Review

Many scholars make a research on the relationship between margin trading and market volatility, on developed markets or emerging markets. But interestingly, they come out with different opinions. Galbraith (1955) stated in his The Great Crash 1929 that the South Sea Bubble is largely attributed to speculation, in which unlimited leverage is used. The abuse of leverage led to large fluctuation in stock price, and eventually a crisis. After that, “Pyramiding and De-pyramiding” theory is proposed by Bogen & Krooss (1960) . Pyramiding effect exists when investors believe that share prices continue to rise, when stock prices are increasing. And upward price promotes margin purchase, inducing higher stock prices and further additional borrowing for further purchases. On the other hand, de-pyramiding occurs when the declining stock market passes on a negative signal, and decreasing stock prices induce brokers issue margin calls and force investors to sell shares, leading to lower price level and subsequent stock sales. Bernardo & Welch (2004) study the relationship between the outbreak of crisis and investors’ emotion and they believe that financial panic is easy to spread and margin could deteriorate the market. The constraint of short sale well benefits market stability. In other word, margin trading increases market volatility. Allen & Gale (1991) , Conrad et al. (1994) and Henry & McKenzie (2006) point out that margin trading can make stock market volatile because of information asymmetry and market inefficiency.

Meanwhile, some state that the effect of margin trading on stock volatility depends. Jarrow (1980) questions the hypothesis of Miller (1977) and puts up with heterogeneous expectations, and he thinks that the stock may be overvalued or undervalued with short sale constraints but it depends on economic conditions. Kraus & Rubin (2003) also believe that the effect depends on economic environment, the change of information and some other exogenous variables. Saffi & Sigurdsson (2011) study on 26 countries and find that the return is positive skewed after margin trading is permitted but it has no significant influence on reducing the extreme loss.

However, a large number of people hold a view on the stabilization of margin trading on stock volatility. Miller (1977) theorizes that security prices are pulled up with long- term short sale forbidden, and then short sale can help the stock price keep a reasonable interval. Supposed that investors have heterogeneous beliefs or information about the value of securities, pessimistic investors would never enter the trading because they believe the price is overvalued. Positive investors would always believe that price is undervalued and they would like to bid so that some bad news is hidden with the upward price. Little by little, share prices deviate from its intrinsic value if short sale is forbidden. Supposed that margin trading is available, investors can borrow stocks from the market and then sell them, which is equivalent to the expanding supply of stock and share price would fall, fluctuating near its intrinsic value. Hong & Stein (2003) , Scheinkman & Xiong (2003) put forward theory about information asymmetric and heterogeneous agents. They believe that investment is limit if margin trading is forbidden and investors can not well deal with bad news in the market. They would care nothing but price and fundamental analysis makes no sense. Since the blind bid and put is the only way to gain returns, accumulated bubble would increase the possibility of financial risks and even market crash.

Margin purchase and short sale mechanism are relatively mature in most developed countries, while cautious in emerging countries. Only 31 percent of emerging countries allows margin trading while almost all developed countries do. According to previous literature, firstly, most of studies are about developed countries and there is no enough empirical study about emerging markets. Moreover, the data used is monthly data. However, capital market is developing and changing quickly. Emerging markets are more and more important in the process of economic globalization and it makes sense to study emerging markets with daily data. Secondly, studies on this topic focus on the relationship among margin purchase volume, short sale volume and proxy volatility but fail to consider market condition, especially when markets boom, in correction and drop. This paper studies margin trading in Chinese stock markets with a history of about 5 years. The data is collected daily. Moreover, the relationship among margin purchase volume, short sale volume and proxy volatility would be analyzed with different market condition. It is easy to cover a whole market cycle with a long enough time periods, and it makes sense to consider the relationship among the three while market is not even. Chinese stock market experiences a market crash in the middle of year 2015, the Shanghai Security Composite Index once peaks at almost 5178 and crashes. The volume of margin trading fluctuates dramatically. This paper would like to study Chinese stock markets and study SSE 50 Index, which is composed of the most big-cap and mature shares in Shanghai Security. The time period selected tends to cover almost the whole 8 years, from 2007 to 2015 while margin trading is first allowed on March 31st, 2010.

3. Data

3.1. Data Source

There are two stock exchanges in China mainland, one is Shanghai Stock Exchange (SSE), where mainly medium- and large-cap shares are traded, the other is Shenzhen Stock Exchange (SZSE), where mainly small-cap shares. It is recorded that the margin trading volume in SSE is far more than which in SZSE. Moreover, SSE 50 index is composed of no more than 50 medium- and large-cap stocks but well represents Shanghai Security. Following what Chen (2011) and Yu (2012) do, this paper studies SSE 50 index. Margin purchase and short sale is officially allowed on March 31st, 2010, however, only 90 stocks on the designed list at the very beginning. Afterwards, the number of stocks expands to 280, and seven exchange-traded-funds (ETF) are also added into the pilot scheme in December 2011. In order to make a comparison between market volatility pre- and host-margin trading list, the time period selected is from January 4th, 2007 to October 16th, 2015. And then the time period is divided into three periods by March 31st, 2010, when margin trading is first allowed in China, and June 15th, 2015, when Chinese stock markets peak at 5178. This paper collects daily data of SSE 50 Index (Shanghai Security Exchange 50 Index) constituent share price, the volume of margin purchase and the volume of short sale from January 4th, 2007 to October 16th, 2015. The database is Wind database. Wind database is built to collect and reprocess financial data by Shanghai Wind Information Co., Ltd. And it includes announcement and data about Chinese public companies, data about financial instruments like stocks, bonds and fund. Moreover, Wind database includes all Chinese macroeconomic data and part of the oversea economic data.

3.2. Data Process

This paper firstly sum up trading volume balance of constituent shares in SSE 50 index, referred to as margin purchase volume,  for short.

for short.

,

,

where i is no. i constituent share, t is time.

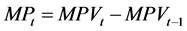

In order to smooth the data, this paper makes a difference of  and the difference is representative of margin purchase proxy,

and the difference is representative of margin purchase proxy,

.

.

And then, this paper does the same thing on short sale proxy.

,

,

where, SSt refers to short sale volume.

Return or yield is defined as Rt.

,

,

where ln(`) is logarithmic function and Pt is daily price of SSE 50 index.

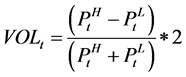

This paper makes an ARCH test on SSE 50 Index time series, only to find that no ARCH effect exists and GARCH model is not suitable to fit market volatility. This paper would follow what Yu (2012) does, computing market volatility with daily fluctuation range.

where,  is the highest daily price,

is the highest daily price,  is lowest daily price.

is lowest daily price.

Table 1 shows the statistical characteristics of yield, in overall sample, before margin trading is allowed and after that. It is easy to find that standard deviation and range are smaller after March 31st, 2010 than that before March 31st, 2010. Moreover, Levene homogeneity test of variance is significantly effective. From the above statistical analysis, market volatility is eased after margin trading is permitted. Is this result caused by margin trading? How and how much does margin trading affect market volatility? This paper would like to study the relationship among market volatility, margin purchase and short sale with VAR model, using Granger Causality Test, Impulse respond analysis and Variance decomposition analysis.

4. Empirical Result and Analysis

4.1. Stationary Test

Just before Granger Causality Test, this paper would make a stationary test on margin purchase proxy MP, short sale proxy SS and volatility proxy VOL. One of the popular stationary tests is Augmented Dickey-Fuller (ADF) test, Table 2 is the result of ADF test for MP, SS and VOL.

Table 1. Basic statistical analysis of SSE 50 index yield pre- and host-margin trading.

As can be seen from Table 2, the ADF test p value is near zero at 5% level. It is concluded that MP, SS and VOL is stationary over the period.

4.2. Granger Causality Test

Results of Granger Causality Test from Table 3 shows that during time period from March 31st, 2010 to October 16th, 2015, margin purchase does Granger cause market volatility while market volatility does cause margin purchase. There is a bidirectional induced relationship between margin purchase and market volatility. Short sale does not Granger cause market volatility, and market volatility does not Granger cause short sale at 5% level. We can make a conclusion that margin purchase does cause market volatility and market volatility influences short sale activity at the 10% level.

4.3. Impulse Response Function

Impulse Response Function is used to analyze the response of one party to another party more accurately, where impulse was first introduced by Sims (1980) and is to explore the dynamics of an error shock in the system on the future predicted economic variable.

In Figure 1, the red dotted line is what two times standard error shows. As can be seen from the response of VOL to VOL, a positive shock of market volatility by the size of one unit standard deviation has a impact on itself, but the impact begin to decline. This is in accordance with the general rules of the stock market fluctuations, that is, market volatility clustering effect does exist. Moreover, as can be seen from response of VOL to MP, when a positive shock is put on margin purchase, the stock market volatility is negative, with the maximum response in the fourth period which begins to weaken, and finally close to zero. Margin purchase stabilizes market volatility, and this effect will be more and more obvious in the first four periods, and then decreases.

Table 2. ADF test for MP, SS and VOL.

Table 3. Results of Granger Causality Tests (time period: 2010.03.31-2015.10.16).

Figure 1. Results of impulse response.

4.4. Variance Decomposition

The impulse response function is designed to describe how other variables response when a unit positive shock is put on one variable in the VAR system. And it is an absolute effect. However, variance decomposition can describe the contribution of each variable updates on other variable. And it is a relative effect scale description. Table 4 shows the intercept part of result of variance decomposition of VOL. As can be seen from Table 4, more than 92 percent is contributed to VOL itself, which well explains clustering effect. The contribution of margin purchase is more than short sale, about 7.07 percent and 0.27 percent respectively. Margin purchase volume is far more than short sale volume in Chinese stock markets and margin purchase plays an important role in the variance decomposition of VOL.

4.5. Further Study

Totally speaking, margin trading stabilizes markets. However, markets are not stable, and they experience boom, correction and depression. How is it going when markets are in different phases. This paper divides the long time period into three phases. The correction phase is from Mar 31st 2010 to Jul 21st 2014, the boom phase from Jul 22nd 2014 to Jun 15th 2015, and the depression phase from Jun 16th 2015 to Oct 16th 2015. The number of trading day for these three sample is 1044, 220 and 80 respectively. This paper would make the same analysis including stationary test, Granger Causality Test, Impulse respond analysis and Variance decomposition analysis on these three samples as what this paper does above.

Stationary test shows that all the time series in these three samples is stationary and they can be used in VAR model. With the optimal lag order number from VAR model, this paper carries out Granger Causality Test and the result is as the following table shows.

As can be seen from Table 5, at 5% level, neither MP nor SS does Granger cause VOL when market is in correction. VOL does not Granger cause MP or SS either. VOL does Granger cause MP when market booms. When market is volatile booming, investors would like to margin purchase so as to magnify gains. What’s more, when the

Table 4. Result of variance decomposition of VOL (intercept part).

Table 5. Result of Granger Causality Test on VAR model (correction, boom and depression).

market is depressed, there is bidirectional causality relationship between margin purchase and market volatility and this paper would carry out Impulse response test and Variance decomposition analysis further. Moreover, VOL does Granger cause SS.

This paper carries out Impulse response test and Variance decomposition analysis on margin purchase proxy and market volatility proxy when market is in depression only to find that a unit of positive shock on margin purchase would affect market volatility negatively. The negative effect is maximal in the third period and then weakens, finally zero in the ninth period. When a unit of positive shock is put on market volatility, the response of margin purchase is negative too. Investors are conservative when market is depressed and volatile. Interestingly, when market price is falling, the contribution of margin purchase to variance of market volatility is 30.47%. Margin purchase significantly increases market volatility when Chinese market drops during the period from Jun 16th 2015 to Oct 16th 2015. Moreover, market volatility changes margin purchase when depression. Chinese government takes many measures to maintain market stability but fails. Market volatility and investors’ uncertainty about the future trend of the market lead to the shrinking of the size of margin purchase.

5. Conclusion

This paper studies the impact of margin trading, which includes margin purchase and short sale, on market volatility, based on SSE 50 index in Chinese stock market. With the basic statistical analysis, building VAR model and carrying out Granger Causality test, Impulse Response analysis and Variance Decomposition analysis, this paper finds that, totally speaking, margin trading stabilizes market volatility in the whole. And it can be confirmed by the basic statistical analysis and Impulse Response analysis, the finding of some other papers and the intent of policy makers in lots of countries. In China, margin purchase volume is much more than short sale volume, and margin purchase makes a bigger contribution to stabilization of market volatility than short sale does. However, whether the difference is caused by trading volume or not remains unknown.

Neither margin purchase nor short sale does Granger cause market volatility when market is in correction. Investors are pessimistic and they make little bid. What’s more, short sale makes nearly no difference due to its small trading volume.

When market booms, margin purchase does not Granger cause market volatility, and short sale does not either. However, market volatility does Granger cause margin purchase. When Chinese market booms during Jul. 22nd 2014 to Jun. 15th 2015, financial leverage matters. Financial leverage is used in the form of margin purchase, OTC financing and umbrella trust. Further study can be carried out with detailed data about the structure of financial leverage.

What’s more, when market depresses, investors do not practice arbitrage through short sale and disrupt the market, as what theory shows. Inversely, short sale deal size recorded shrinks and stays at about five to seven billion. When a unit of positive shock is put on margin purchase, the impact of market volatility is negative. Investors hold a pessimistic view about market when it depresses and they barely make a call. Sluggish investment sentiment would naturally not cause severe fluctuations in the market.

In above, margin trading, including margin purchase and short sale, stabilizes market volatility, just as what some policy makers expect. However, market itself influences investment sentiment and financial behavior, especially when market booms, corrects and depresses. What’s more, margin trading is young in China, compared to which in developed countries. Most Chinese investors are individual, to whom margin purchase and short sale are new. Moreover, a lot of financial leverage is not recorded and the exact impact of margin trading on market volatility is unknown.

This paper analyzes the relationship between margin trading and market volatility, especially when market is booming, in correction and dropping. However, the definition and division of these three different phases are subjective and there is no enough empirical study to support which day is exactly the cut-off point. What’s more, the data used are not that comprehensive, this paper studies Chinese stock market with the data of SSE 50 index and there may be some error. Last but not least, Chinese stock market is too much regulated by government, and the data recorded may not well reflect market behaviors. To have an overall comprehensive of the impact of margin trading on market volatility, further studies may focus on the resource and adequacy of the data used. Moreover, it is best to make a comparison of emerging markets and developed markets at the same time. What’s more, since behavior finance is well improved and developed nowadays, variables like investor psychology can be introduced into the VAR model.

Cite this paper

Chen, M. W. (2016). The Impact of Margin Trading on Volatility of Stock Market: Evidence from SSE 50 Index. Journal of Financial Risk Management, 5, 178-188. http://dx.doi.org/10.4236/jfrm.2016.53018

References

- 1. Allen, F., & Gale, D. (1991). Arbitrage, Short Sales, and Financial Innovation. Econometrica: Journal of the Econometric Society, 59, 1041-1068.

http://dx.doi.org/10.2307/2938173 [Paper reference 1] - 2. Bogen, J. I., & Krooss, H. E. (1960). Security Credit: Its Economic Role and Regulation. New Jersey, USA: Prentice-Hall. [Paper reference 2]

- 3. Bernardo, A. E., & Welch, I. (2004). Liquidity and Financial Market Runs. The Quarterly Journal of Economics, 119, 135-158.

http://dx.doi.org/10.1162/003355304772839542 [Paper reference 1] - 4. Conrad, J. S., Hameed, A., & Niden, C. (1994). Volume and Autocovariances in Short-Horizon Individual Security Returns. The Journal of Finance, 49, 1305-1329.

http://dx.doi.org/10.1111/j.1540-6261.1994.tb02455.x [Paper reference 1] - 5. Galbraith, J. K. (1955). The Great Crash 1929. Houghton: Mifflin Harcourt. [Paper reference 2]

- 6. Henry, ó. T., & McKenzie, M. (2006). The Impact of Short Selling on the Price-Volume Relationship: Evidence from Hong Kong. The Journal of Business, 79, 671-691.

http://dx.doi.org/10.1086/499135 [Paper reference 1] - 7. Hong, H., & Stein, J. C. (2003). Differences of Opinion, Short-Sales Constraints, and Market Crashes. Review of Financial Studies, 16, 487-525.

http://dx.doi.org/10.1093/rfs/hhg006 [Paper reference 1] - 8. Jarrow, R. (1980). Heterogeneous Expectations, Restrictions on Short Sales, and Equilibrium Asset Prices. The Journal of Finance, 35, 1105-1113.

http://dx.doi.org/10.1111/j.1540-6261.1980.tb02198.x [Paper reference 1] - 9. Kraus, A., & Rubin, A. (2003). The Effect of Short Sale Constraint Removal on Volatility in the Presence of Heterogeneous Beliefs. International Review of Finance, 4, 171-188.

http://dx.doi.org/10.1111/j.1468-2443.2005.00047.x [Paper reference 1] - 10. Miller, E. M. (1977). Risk, Uncertainty, and Divergence of Opinion. The Journal of Finance, 32, 1151-1168.

http://dx.doi.org/10.1111/j.1540-6261.1977.tb03317.x [Paper reference 3] - 11. Saffi, P. A., & Sigurdsson, K. (2011). Price Efficiency and Short Selling. Review of Financial Studies, 24, 821-852. [Paper reference 1]

- 12. Scheinkman, J. A., & Xiong, W. (2003). Overconfidence and Speculative Bubbles. Journal of political Economy, 111, 1183-1220.

http://dx.doi.org/10.1086/378531 [Paper reference 1] - 13. Sims, C. A. (1980). Macroeconomics and Reality. Econometrica: Journal of the Econometric Society, 48, 1-48.

http://dx.doi.org/10.2307/1912017 [Paper reference 1] - 14. Chen, W. (2011). An Empirical Research on the Impact of Taking Securities Margin Trading Pilot Project to China’s Stock Markets Volatility. Journal of Shanghai Finance University, No. 4, 42-50. [Paper reference 1]

- 15. Yu, X.-J. (2012). The Impact of Margin Purchasing and Short Selling on Liquidity and Volatility: Evidence from Shanghai Stock Market. Journal of South China University of Technology (Social Science Edition), No. 2, 1-7. [Paper reference 1]