American Journal of Industrial and Business Management

Vol.04 No.12(2014), Article ID:52472,10 pages

10.4236/ajibm.2014.412081

A Behavioral Study of the Normative of the Listed Company Information Disclosure after IPO

Shuxin Cao, Jianqiong Wang

Southwest Jiaotong University of Economic and Management, Chengdu, China

Email: suxin_cao@163.com

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 14 October 2014; revised 25 November 2014; accepted 12 December 2014

ABSTRACT

This paper sets the corporations which occurs first information disclosure violation after IPO as a research object, using theoretical analysis and empirical analysis to study related issues of corporation information disclosure violations. This paper contacts this time length with causes of violated information disclosure and builds regression model. And there comes the result: the proportion of independent directors has positive correlation with the time length of corporation’s first violation after IPO; the proportion of managerial ownership has positive correlation with the time length of corporation’s first violation after IPO; the pressure of insurance license could shorten the time length of corporation’s first violation after IPO. This paper based on existed researches and analysis the feature of corporation violation types, adopts ordered logistic regression model to predict corporation violation types. Finally, this paper gives a series of recommendations based on the causes of corporations’ information disclosure.

Keywords:

Information Disclosure, Type of Violation, Time of Violation, Forecast

1. Introduction

Information disclosure system is an important part of the stock market system and is an important foundation for the healthy development of the securities market. Information disclosure of listed companies is a bridge between listed companies and investors and the public information. Information disclosure which is helpful for investors who hold value investment philosophy needs to be timely, true and normal, so that disclosure of such information can help investors to make the right investment decisions. But in recent years, the fact that the information disclosure of listed companies frequently appears irregularities has influenced the function of China’s securities market to optimize the allocation of resources, and to raise funds and so on. It has seriously undermined the normal order of the securities market and dampened the enthusiasm and confidence of the investors. The direct consequence of the violation of information disclosure of listed companies is brought further exacerbating the asymmetry of market information, so that market manipulation, speculation, insider trading and other illegal acts emerge, which harm the interests of investors. At the same time, it undermines the integrity of the market and hinders the smooth development of the economic growth. Therefore, the theoretical study on illegal information disclosure of listed companies is particularly important.

This paper will firstly give a theoretical study of the information disclosure of listed companies, then present situation of the information disclosure of listed companies will be analysed based on existing actual surveys, noted that the problems of the current information disclosure of listed companies. Only after grasping the factors that affect the information disclosure of listed companies illegal behaviors, can we further enhance the transparency of information disclosure of listed companies, in order to provide references for improving information disclosure system of listed companies.

Compared to previous studies, this paper has the following features and innovations: First, influencing factors on the quality of information disclosure frameworks were integrated. Drawing on the results of previous studies, it is necessary to deeply study corporate governance, corporate property rights system, internal controlling system and other aspects of the impact on the quality of information disclosure mechanism. Second, there has to establish the time measurement model and comprehensive measure system of a listed company after the IPO violate disclosure of information first time.

Other parts of this paper is organized as follows: The second part is the literature review, theoretical and empirical analysis literature review, the overview of the quality theory of information disclosure, first review of the related theories of information disclosure system of listed companies, and later defines the meaning of quality of information disclosure; the third part is the research designing and empirical analysis, establishing two models; one is time measure model for illegal information disclosure and the other one is prediction of the type of violation model; the fourth part is the conclusions and recommendations of this paper.

2. Literature Review

2.1. Information Disclosure and Information Disclosure System Overview

Information disclosure of listed companies is listed companies and their appointed agency information on the process of information audit, preparation of collection, and information review and information bulletin of the companies. Since the stock market is a highly information-oriented market, so completely specification of information disclosure system helps investors to make more scientific decisions, in order to achieve rational allocation of resources, to improve the efficiency of the securities market at the same time. Through legal means, the information disclosure system can protect the position of information in the process of the securities markets. Its role is mainly reflected in the following aspects: first, to protect the interests of investors, which is the most fundamental role of the information disclosure system; Second, to promote self-development and self-restraint of listed companies is the direct role of information disclosure system; third, promote the development of the securities market, improve the effectiveness of the securities market. Yi Liu (2006) through the analysis found that under “Corporate Governance Guidelines” requirements, disclosure of corporate governance information to qualitative information in the form of reports with a little improvement, as in [1] . Since vulnerability of these standards, coupled with our long-standing low efficiency of the market, companies can find strategies to deal with these policies quickly so that these administrative requirements binding are not enough. Therefore, research on information disclosure of listed companies is imminent.

2.2. Overview of Factors Affecting the Quality of Information Disclosure

For each listed companies which violate, the reasons for illegal disclosure of information are different from each other because of their own particularities. Professor Shizhong Huang, in the paper named “Challenges and thinking of the quality of listed companies’ accounting information”, analyzes the reasons of the issues of accounting information disclosure of listed companies from the system of the current CPA corporate governance structure, the symmetry and defects of the costs and benefits of fraud, and from listed companies using asset restructuring and related transactions to manipulate accounting information and so on, as in [2] . Liguo Liu and Ying Du analyze the relationship between the characteristics of financial reporting fraud and the structures of ownership and the characteristics of the board of directors. The results show that: when higher the proportion of legal person shares of listed companies are, lower the proportion of outstanding shares are, higher the percentage of inside directors on the board, larger the scale of executive director and the board of supervisors, and the largest shareholder of listed companies is state-owned assets administration bureau, the company is more likely to occur financial reporting fraud, as in [3] . Chen and Jaggi, under empirical test of the levels of information disclosure of listed companies in Hong Kong Empirical, find family-controlling would be a negative impact on the level of information disclosure, as in [4] . Many as the above-mentioned study, but most studies are discussed separately from the different factors. But this paper will integrate the factors affect the quality of information disclosure. Drawing from the results of previous studies, deeply study the influencing mechanism from corporate governance, corporate property rights system, and internal controlling system and so on to the quality of information disclosure, which has some groundbreaking.

2.3. The Define of Violations of Information Disclosure of Listed Companies

Violations of information disclosure of listed companies, are the behaviors referred to in the process of information disclosure of listed companies violate relevant laws, regulations, authorized strength and provide false information or conceal or delay the disclosure of important facts. Those behaviors fundamentally affect the normal operation of the securities market, the efficient allocation of social resources, and the legitimate interests of investors.

Table 1 is the types and the contents included in the violation of information disclosure:

2.4. Factors Affecting the Length of Violation Time of Listed Companies after the IPO and Hypotheses

An excessive concentration of ownership will likely generate interest encroachment effect, that the controlling shareholders and management use insider information that is not publicly disclosed, together harm minority shareholders. Controlling shareholders have strong self-interest motives to conduct information disclosure violations that help conceal the fact that controlling shareholders harm minority shareholders. For dispersed ownership structure, violations of information disclosure often need to be achieved with coordination and efforts of all the key shareholders, which means feasibility of violations is relatively low. The first hypothesis follows:

H1: Ownership concentration has a negative correlation with the first time when violations information are disclosed after the IPO.

According to the nature of the ownership stake, there is no essential difference of information disclosure between the private and non-private listed companies. However, due to the different nature of the controlling shareholder, the targets and the decision-making of information disclosure may differ. So the first hypothesis follows:

Table 1. Descriptions and types of the violations of information disclosure.

H2: Compared with the time when non-private listed companies first disclose the violation after the IPO, private listed companies often do it in a shorter time.

According to the agency theory, equity incentives should be made so that management has the same goal as the stockholders. In China, with the establishment of the corporate governance structure, the equity incentive has gradually become an important way of incentives for managers. Typically, the higher the management holds, the more they conduct less likely violations. Thus the third hypothesis was put forward in this article:

H3: Management shares have a positive correlation with the length of time when the companies first disclose irregularities information after the IPO.

Board size is a key factor affecting the efficiency of the board of supervisors that will also have an impact on information disclosure quality. According to the company law, the board should include 5 - 19 members. Yu Dongzhi and Chi Gguohua (2004) conclude that to a extent the board is crucial to suppress financial fraud, as in [5] . Thus based on the above reasons, this paper puts forward the fourth hypothesis:

H4: Board size has a negative correlation with the length of time when the companies first disclose irregularities information after the IPO.

In accordance with the design requirements of the independent directors system, independent directors are responsible for the false information disclosure. So independent directors will have the external pressure to identify the company’s information disclosure violations. The effectiveness of the board of directors is increasing function of the independent directors’ independence. And with the improvement of independent directors’ independence, they have a stronger willing to supervise the CEO. Thus this paper puts forward the fifth hypothesis:

H5: The proportion of independent directors has a positive correlation with the length of time when the companies first disclose irregularities information after the IPO.

For the allotment problem of listed companies China set up ROE threshold. Therefore, some do not meet the prescribed requirement but make up fictitious profit to keep the qualification of the listed company. Thus this paper puts forward the sixth hypothesis:

H6: With recent rights issue plan, listed companies likely disclose violation information in a shorter time after the IPO.

If listed companies encounter two consecutive years’ losses, they will be specially treated. And if listed companies encounter three consecutive years’ losses, they will be suspended. So those companies will profit through the means such as asset restructuring. Thus this paper puts forward the seventh hypothesis.

H7: Listed companies usually disclose violation information in a shorter time in order to keep the qualification of listed companies.

3. Research Design

3.1. Time Measure of the First Violation Information Disclosure of Listed Companies after IPO

1) The samples and data sources

In this article, through screening CCER2001-2010 listed company’s data, data of every company’s repeated violations is removed to get the data of first violation. Then on this basis, after the removal samples of f such as in violation of the law and other relevant provisions, only the 207 samples of illegal information disclosure are retained.

2) Variables design

The dependent variable: the length of time when listed companies first conduct illegal information disclosure.

The independent variables: Z index, the types of institutions holding shares (private companies or not), the proportion of management’s shares, board size, the proportion of independent directors, rights issue plans.

a) In this article Z index measures the ownership concentration. If the proportion of the company’s largest shareholder’s shares is significantly higher than that of other shareholders, so he has greater impact on company management and stock market performance. Z index is the ratio of the company’s largest shareholder with a stake of the second largest shareholder. The higher Z index is, the greater the difference between the first-largest shareholder and the second-largest shareholder is. Therefore Z index is a good index to measure the level of the listed company’s first-largest ability to control the company.

b) The types of institutions holding shares (private companies or not).

In this paper, the private listed company is defined as the actual controller of the company.

c) The proportion of management’s shares is the number of shares held by management in proportion to the total number of shares.

d) Board size is the number of directors.

e) The proportion of independent directors is the number of independent directors in proportion to the total number of directors. Independent directors are experts in general economic, legal and other aspects, who can effectively supervise the company’s management, improve the efficiency and accuracy of decision-making, identify and prevent information disclosure violations.

f) Rights issue plans

The CSRC require that listed companies should not carry out new ones within one accounting year after they carry out rights issue, which means there are no rights issue plans in 2 accounting years. In this paper, if a listed company has carried out rights issue, there are no rights issue plans within 2 accounting years.

g) If listed companies are in trouble caused by financial problems and so on, they are named as “ST”. Within 3 years, listed companies cannot improve the situation and thus are disqualified.

Therefore in this paper ST means that listed companies have the pressure to keep the qualification of listed companies.

3) The model design

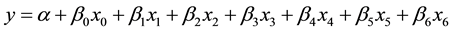

According to existing literature, previous analysis and hypothesis, this paper takes Z index, the types of institutions holding shares (private companies or not), the proportion of management’s shares, board size, the proportion of independent directors and rights issue plans into account.

The regression equation is

(1)

(1)

is the length of the first information disclosure violation time of listed companies after IPO.

is the length of the first information disclosure violation time of listed companies after IPO.  is

is  index.

index.  is private companies or not.

is private companies or not.  is the proportion of management’s shares.

is the proportion of management’s shares.  is the board size.

is the board size.  is the proportion of independent directors.

is the proportion of independent directors.  means that listed companies have rights issue plans or not.

means that listed companies have rights issue plans or not.  means that listed companies encounter special treatment (ST) or not.

means that listed companies encounter special treatment (ST) or not.

4) The empirical results and analysis

The article adopts the method of stepwise linear regression analysis. In light of the results, three possible models are put forward (Tables 2-4).

In Table 4, the R-square of the third group is obviously higher than that of others. Therefore its result is acceptable. Although the R-square is 0.22, it is reasonable when violation of information disclosure is caused by inner factor. In Table 4, Overall significance level of the third group is 0. In Table 3, the significance level of the proportion of independent directors is 0. The significance level of “ST or not” is 0.01. The significance level

Table 2. Overall significance of each regression combination.

Table 3. Parameters significance of each regression combination.

Table 4. Overall goodness of fit of each regression combination.

of the proportion of management’s shares is 0.02. They are obviously less than 0.05. So the results are rather reasonable.

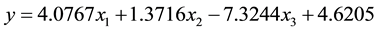

According to the result of Table 3, the model is:

(2)

(2)

is the length of the first information disclosure violation time of listed companies after the IPO.

is the length of the first information disclosure violation time of listed companies after the IPO.

Thus, it can be concluded that the proportion of independent directors and the proportion of management’s shares have a positive effect on the length of the first information disclosure violation time of listed companies after the IPO, and with the help of ST, listed companies spend less time conducting violation of information disclosure.

Listed companies after IPO spend more time conducting violation of information disclosure, which tell us that listed companies stick to regulations well. In China, listed companies after the IPO do not conduct instantly violation of information disclosure. But it is likely for listed companies to conduct violation of information disclosure within 3 - 9 years after the IPO. According to the formula (2), regulators and investors can infer that how much listed companies may spend conducting violation of information disclosure, so as to strengthen regulation and rationally invest.

3.2. The Prediction Model of Types of Violation Information Disclosure

1) The prediction model design

In this paper, the dependent variable is not a continuous variable, but an orderly classification variable. The types of violation information disclosure are defined as delay disclosure, key omissions, misrepresentations, inflated assets, and inflated profits. The ordered Logistic regression model is:

The probability prediction model is:

Regression coefficient

The model of prediction probability is

The

2) The predicted results analysis on the types of violations

In Table 5,

According to Table 8, the prediction model of types of violation information disclosure is

Table 5. Overall goodness of fit of the prediction model of types of violations.

Table 6. The result of pearson and deviance χ2 test.

Table 7. The pseudo coefficients of determination.

Table 8. The prediction result of the model.

The

4. Conclusions and Suggestions

4.1. Conclusions

Investor’s confidence in the capital market is the basis of the healthy development of securities market, the illegal information disclosure behavior of listed companies will have significant adverse impacts on the information system which is vital to the capital market. So the research contents in this article, the study of the characteristics and behavior pattern of the IPO companies’ violations during the first time information disclosure, have important theoretical and practical significance in the deep understanding of capital market information disclosure supervision system, and strengthening the transparency of the securities market.

In this article we analyze the causes of illegal information disclosure behavior of the IPO companies, and by empirical test, we find out that the violation behavior has lots to do with the ownership concentration and pressure of keeping the license. Most of the existing researches focus on the factors affecting the quality of information disclosure of listed companies, but few ones pay attention to the time span between IPO and the first time violation. In this paper the time span is considered into the cause of violation of information disclosure when the regression model is established, and the conclusion is drawn as follows: the proportion of independent directors is positive correlated with the time span between IPO and the first time violation; level of managerial share ownership is positive correlated with the time span; the pressure of keeping license will make the time span shorter. The orderly Logistic regression models are decided to be used after analyzing the listed companies’ violation types and characteristics and referring to existing research. Finally, a series of suggestions are put forward based on the causes of illegal information disclosure as analyzed in the paper.

4.2. Countermeasure and Suggestions

1) Give full play to the real-time monitoring function of stock exchange

The stock exchange is the site of centralized competitive securities trading, as well as the direct organizer and regulator of the securities market. As stipulated in the new securities law: the stock exchange of securities conducts real-time monitoring to securities trading and reports on abnormal transaction according to the requirement of State Council’s securities regulatory institution; The stock exchange shall supervise and urge the timely and accurate information disclosure activities of the listed companies and related duty officer in accordance with the law; Stock exchange may, when necessary, restrict the trade activities of the significant abnormal trading account and send message to the securities regulatory institution for the record.

The stock exchange should follow the principle of safety first, fully meet its obligation of servicing as well as supervision, and devote itself to upholding fair trading and keeping the standardization of information disclosure. In addition, there are two big securities exchange (Shanghai and Shenzhen stock exchange) in our country at present, which are similar to each other in function and market positioning and cannot coordinate each other’s operations, so we must strengthen the coordination of them.

2) Severely punish those who violate the law and discipline

a) Improve the current regulatory laws and regulations, increase the intensity of punishment

Because the securities market order in our country is in the phase of continuous improvement, the supervision laws and regulations needs to be changed so they can work in a unified and coordinated way and the principle of using harsh punishment to keep things manageable needs to be highlighted, punishment and responsibility investigation should be guaranteed when poor regulation happens. Severely punish those listed companies who violate the law and discipline of information disclosure, and the strict law enforcement need to be achieved, what’s more, the enforcement problems should be investigated too. So, the accounting law, securities law, and criminal law etc. should be modified to coordinate with each other as soon as possible, and the penalties of information disclosure violation in our securities market should be further strengthened.

b) Increase the penalties to prevent relapse

From the perspective of preventing relapse, public censure is too mild too preventing recidivism. There is as high as 40.1% of these companies received public censure the first time been punished again. Therefore, most of the punishment method is public censure. Despite the fact that the punishment should been chosen depending on the kind of violations, the mild punishment cannot offer deterrence of penalty if we judge from the correlation of the ratio of penalty again and public censure. Therefore, from the perspective of preventing relapse, increasing the intensity of punishment is an important way to increase the effectiveness of punishment.

c) Strengthening corporate governance and internal control construction, reduce the probability of been punished

In China’s capital market, the information disclosure is usually been used by listed companies to satisfy the needs of corporate governance. No matter the irregularity is due to the internal structure or the management, the illegal decision itself can reflect the defects in corporate governance and internal control construction. The Legislative branch and relevant government departments must strive hard to organize relevant departments and experts to investigate and survey, and build the effective corporate governance and internal control mechanism, establish an effective legal system, which are appropriate to the socialism economy with Chinese characteristics dominated by state-owned business. Therefore, the internal control regulations, CHP internal control process, and the corresponding legal responsibility should been specially formulated by our country which is the controlling shareholder, so as to perfect the internal control of the state holding listed companies.

3) To strengthen the daily supervision of information disclosure of listed companies

The requirements of the content and format of the information disclosure haven’t completely prevented the listed company information disclosure violations from happening, especially the rule of mandatory disclosure haven’t effectively played its role, without continuous supervision. The main reason for all this inefficiency happens is that the post-mortem supervision for information disclosure is not strict enough, and the punishment for disclosure delaying and major omission is not severe enough. Shi Meilun, the vice president of China Securities Regulatory Commission, on the regulation of listed company work symposium she pointed out that: the reason of why the problems arising from the information disclosure of listed companies can’t get treatment timely, is that the daily regulation is not in place and punishment for violation of laws is inadequate, so the urgent affairs at present is to solve the two problem above. Therefore, in quite a long time in the future, to strengthen the daily supervision of information disclosure of listed companies should be the focal point of the work of securities regulation.

4) Use reasonable and effective incentive mechanism to make voluntary disclosure more

The greater the frequency of disclosing and the shorter the time lag between disclosure activities, the higher the quality of the disclosing information. But at present there is no kind of effective incentive mechanism to encourage listed companies to shorten disclosure time lag or disclose information more often. Without benefit drive, even those companies which can provide information of high quality may take appropriate strategy to delay disclosure time. So effective incentive system should be set up to encourage active information disclosure, and both the mandatory disclosure and the proactive disclosure should be considered into the information disclosure system. What’s more, the timeliness, sufficiency, and the breadth of information disclosure should be strengthened, so as to change the traditional one-time disclosure into dynamic and successional information disclosure. Only in this way the information disclosure behavior can be guided and the quality of information can be improved. Take an example, exception clause can be made for active disclosure behavior of listed companies, some special protection can be taken for voluntary earnings forecasts disclosure, so the voluntary information disclosure of listed companies who want to fight for a better quality of information disclosure level is encouraged and in the end, the quality of the listed company disclosing information and the overall quality are improved.

5) Improve the consciousness and the quality of the information disclosure relevant personnel by publicity and education etc.

The quality of disclosing information and how actively the disclosing activities all depends on the quality and personal choice of relevant personnel, so the fundamental method is to improve the consciousness and quality of employees.

a) Improve the integrity awareness and occupational qualities of the listed companies management, so as to improve the authenticity of the information disclosure. As the core of the management of listed companies, the management layer decides the information disclosure behavior. It is necessary to train and educate the management layer, to let them understand that the high quality of information they disclosing can help them attract investors, communicate with potential investors and investors better, set up the enterprise image, strengthen self-supervision, and also have important implications for the long-term development of the enterprise.

b) Strengthen the certified public accountant education of professional ethics, to keep the audit independent and strengthen supervision function of the audit of listed companies. Certified public accountants is equivalent to the guarantor of the quality of information disclosed by the listed company, therefore certified public accountants should not take advantage of the information users’ trust in their profession, to obtain other interests.

c) Establish a regular report system for person in the know and supervise them, to prevent information leakage and insider trading. But at present the monitoring technology in China is imperfect, the accuracy and effectiveness of market monitoring is not high enough, so there is still a long way to crack down the insider trading activities, which requires person in the know to improve the professional ethics and quality, so as to avoid unfair losses of the general retail investors.

d) Enrich the finance and economics knowledge of staff of media like journalists, editors. Encourage the media to recruit some finance and economics professionals to help it improve the financial knowledge of existing workers. As a bridge between listed companies and information users, the media shall perform their duties of supervising the securities market, keep the independence and professional quality, convey practical and realistic information to the information users, and shouldn’t collaborate with the listed company to misled investors and damage the interests of investors.

References

- Liu, Y. (2006) Research of Information Disclosure for Corporate Governance. Hunan University, Changsha.

- Huang, S.Z. (2001) Challenges to the Quality of Accounting Information of Listed Companies. Accounting Research, 10, 6-11.

- Liu, L.G. and Du, Y. (2003) An Empirical Research on the Relationship between Corporate Governance and the Quality of Accounting Information. Accounting Research, 2, 28-36.

- Chen and Jaggi (2000) Association between Independent Non-Executive Directors, Family Control and Financial Disclosures in Hong Kong. Journal of Accounting and Public Policy, 19, 285-426.

- Yu, D.Z. and Chi, G.H. (2004) Number of Directors, Board Stability and Performance: Theory and Experience. Economic Research Journal, 4, 70-79.