Theoretical Economics Letters

Vol.06 No.01(2016), Article ID:63341,11 pages

10.4236/tel.2016.61007

What Supported the Growth of China’s Air Transport Industry from 1955 to 2011?

Xingwu Zheng*, Yi Zhang, Wei Lu

College of Economics and Management, Civil Aviation University of China, Tianjin, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 3 January 2016; accepted 1 February 2016; published 4 February 2016

ABSTRACT

China’s civil aviation industry experienced an average annual growth rate of over 16% for traffic turnover during 1955-2011. It is important to identify the role of capital and labor inputs as well as total factor productivity (TFP) in China’s civil aviation industry during this period of time. First, the inputs of capital stock and labor as well as the output of traffic turnover in China’s air transport industry are measured. Next, the constrained E-G two-stage estimation of the CD production function is used to calculate the capital and labor elasticities and TFP, which provides the necessary basis for the estimation of the growth sources in China’s air transport industry from 1955 to 2011. The results show that the growth of China’s civil aviation industry has depended on the capital factor input and that TFP has played an increasingly important role. Furthermore, the results also indicate that private sources have been crucial for improving the TFP after the 2002 reform.

Keywords:

China’s Civil Aviation Industry, Growth Sources, TFP, Capital Stock, Labor

1. Introduction

In recent years, the air transport industry in China has received significant attention internationally due to its rapid growth rate over the past thirty years, even after the onset of the 2008 financial crisis. In 1950, the turnover of the air transport industry in China was 1.57 million tonne-kilometers (tkm), which increased to 57.32 billion tkm in 2011. The average annual growth rate of the turnover (tkm performed) of the air transport industry in China was 18.8% during this period, which was extraordinary relative to that of this industry elsewhere in the world; the global average annual growth rate was 9.0% during this time. The United States and France, which are developed countries, had average annual growth rates of 7.4% and 8.3%, respectively, in this sector. The corresponding value for

The “Big Boom”, namely, the rapid growth of the air transport industry in China, has generated interest in its growth sources. Many studies have focused on the “China Miracle” [1] of economic growth, most of which focused on the economic performance of China after 1978. The dominant view was that China’s rapid economic growth was mainly supported by the inputs of capital, labor, energy and raw materials, with some scholars concluding that the total factor productivity (TFP) contributed little [2] [3] , while others reported that the contribution of TFP to China’s economic growth increased gradually [4] [5] . Chow [6] noted that the accumulation of capital was the main source of economic growth in China, and Chow and Li [7] estimated that the contributions of capital, labor and TFP were 66.34%, 5.7% and 27.59%, respectively, during 1978-1998. Lin and Sun [8] summarized the current research works and concluded that from 1978 to the start of the 21st century, capital contributed the most to the economic growth in China, followed by TFP and then labor.

Were the growth sources of the air transport industry in China consistent with those of the macro economy? China began to import aircrafts from Western countries in 1970 to replace those made in the former Soviet Union, which might impact the growth sources in the air transport industry in China. After the open-door policy was adopted in 1978, the air transport industry in China experienced major reforms in 1980, 1987 and 20021. Did these institutional transitions change the pattern of growth sources in this industry? To answer these questions, this paper identifies the main sources that supported the rapid growth of the air transport industry. Any evolution of growth sources may have policy implications.

2. Literature Review

2.1. TFP Estimation of the Air Transport Industry

Although there have been no studies on the growth sources of the air transport industry, some studies had investigated the productivity of airlines and airports, which might provide useful information and references about relevant estimation approaches and data processing, including the calculation of capital and labor.

The pioneering work could be traced back to the estimation of TFP for US airlines by Caves et al. [9] [10] , who sought to analyze the effects of deregulation on efficiency. Windle [11] used the translog multilateral index procedure to compute TFP, adopting a weighted approach to form the multilateral output and input indices. The output was composed of scheduled revenue passenger-miles, non-scheduled revenue ton-miles, scheduled revenue ton-miles of mail, and scheduled revenue ton-miles of freight, and the revenue shares of these four separate components were used as the weights. The motivation behind this approach was that if the industry exhibited constant return to scale the prices of the outputs were proportional to their marginal costs. The input of labor contained three categories of employees: pilots and other cockpit personnel, cabin attendants and all other personnel. The weights used in the labor index were based on the compensation of each of these categories.

Good [12] employed both parameter and non-parameter methods to compute the TFP of the eight largest European airlines and the eight largest American airlines. Astochastic frontier model was used to compute the TFP in the parameter estimation, while date envelope analysis (DEA) was employed in the non-parameter estimation.

Charnes et al. [13] used the translog method to estimate the parametric frontier and then computed the TPF. Based on the approach of Charnes et al. [13] , Ceha and Ohta [14] incorporated the features of mutual competition of airlines. Färe and Sickles [15] measured the productivity of US airlines taking service quality into account. Traditionally, the price of service quality was required to compute the TFP in the presence of quality characteristics. Malmquist, a non-parameter approach, did not require price information. In this paper, circularity and punctuality were used to indicate service quality.

There have also been some similar studies on airports’ TFP. Parker [16] adopted two-stage DEA analysis to compute the technical efficiency before and after the privatization of BAA. Oum et al. [17] considered the revenues from non-aeronautical services as an output in addition to passenger traffic, cargo traffic and aircraft movements in the estimation of the TFP of 50 airports around the world. However, the estimation method was not revealed.

Yuen and Zhang [18] employed a two-stage approach to investigate the influence of competition and policy changes on Chinese airport productivity. They first calculated the productivity efficiency from 1995-2006 and then ran regressions to examine the factors affecting productivity efficiency. Chow and Fung [19] measured the productivity changes of 30 airports in Greater China during 2000 and 2006 by computing their Malmquist productivity indices using parametric output distance functions. However, in both of these studies, only capital inputs, such as terminals and runways, were considered due to the unavailability of labor inputs.

2.2. Growth Sources of China’s Economy

In contrast, there have been many studies on the growth sources of China’s economy due to the “China Miracle” [1] .

Li et al. [20] used the productivity measurement method developed by Jorgenson (1987) and estimated the Chinese economic growth sources with a translog production function. They concluded that the contributions of capital, labor and TFP to the economic growth were 75.07%, 19.47% and 5.46%, respectively, from 1953-1990. In their 1996 follow-up study, the contribution of capital, labor and TFP to the economic growth were 68.52%, 18.21% and 13.2%, respectively, from 1953-1995.

Chow [6] estimated the annual capital stock from 1952 to 1985 using official information on the “newly increased fixed assets through capital construction” of all state-owned enterprises and on circulating funds of state-owned enterprises “under the state budget”. He set up a production function for the aggregate economy to measure the economic losses due to the Great Leap Forward and the Cultural Revolution and the improvement in productivity in the 1980s after the economic reforms. Chow [6] also found that technological change was absent in the growth of the Chinese economy from 1952 to 1980, whereas capital accumulation played an important role during that period of time. Chow and Li [7] extended the early work of Chow [6] and estimated a Cobb-Douglas production function to account for China’s economic growth in terms of labor, capital and TFP using the outcome of Chow’s [6] study on the construction of the capital stock and official Chinese data. They concluded that the capital and labor coefficients for the sample period of 1952-1980 were 0.6353 and 0.3584, respectively, and that there were no technological advances during that period. However, the total factor productivity increased by approximately 2.6% per year from 1978 to 1998.

Wang and Yao [21] constructed a measure of China’s human capital stock for 1952-1999 and incorporated it into the Cobb-Douglas production function to measure the contributions of physical capital stock, labor and human capital to the economic growth. The growth of TFP contributed to 25.4% of the total output growth in 1978-1999, while the contribution of TFP growth was consistently negative for the pre-reform period, with physical capital accumulation accounting for 51% of economic growth and TFP growth accounting for only 0.2%.

Lin and Sun [8] defined the economic growth patterns as TFP enhancement, capital intensity, labor intensity and land intensity, which were quite different from the traditional division of economic growth patterns into intensive and extensive economic growth patterns, where the former referred to economic growth driven by TFP progress and the latter to factor accumulation. In practice, this division implied that the intensive economic growth pattern was better than the extensive one. Lin and Su insisted that it was impossible to identify which pattern out of the four was desirable or undesirable. They noted that the rational economic growth pattern was the one that could produce at the minimum cost regardless of whether economic growth was driven by factor accumulation or TFP enhancement.

All these studies focused on the productivities of micro entities (airlines or airports in the air transport industry) or the macro economic growth sources in

3. Inputs and Outputs Used in the Estimation

In this study, the factor inputs are the capital and labor used in air transport industry and the output is turnover (tkm). All the original data employed to compute those inputs and outputs for the estimation of the growth sources come from the 1983-2012 China Civil Aviation Statistical Yearbooks, which were published by the Civil Aviation Administration of China (CAAC). These yearbooks contain various data forChina’s air transport industry from 1950 to 2011.

3.1. Capital

The method used to measure capital input is vital to the computation of growth sources in the air transport industry. Currently, the various studies on the economic growth sources of China use different approaches to measuring capital input. Chow [6] , Chow and Li [7] and Wang and Yao [21] used the capital stock (in currency value) as capital input. Sun and Ren [22] adopted the concept of capital services proposed by the OECD [23] , which were the flow of productive services provided by an asset employed in production.

Concerning productivity studies of airlines and airports, Oum and Yu [24] computed the capital stock of the world’s major airlines based on the flight equipment and ground property and equipment (GPE), while Windle [11] treated flight equipment and GPE as independent inputs. Färe and Sickles [15] used the adjusted fleet size as flight capital, and Parker [16] measured the flow of capital services for BAA airports. When comparing the productivity performance of the world’s major airports, Oum and Yu [17] used direct physical capacity measures as a proxy for capital inputs, including number of runways, number of gates, and total terminal area size; purchased good and materials; and purchased services. Yuen and Zhang [18] considered two physical capital input measures: runway length and terminal size.

In our study, the growth sources of the air transport industry, including airlines, airports and other supporting and auxiliary sub-sectors, will be measured. Thus, it is difficult to compute the physical capital or flow of capital services from the various sub-sectors as the capital input. Instead, the capital stock of the air transport industry will be used as the capital input. The disadvantage of this approach is that some capital may be excessive and provide no productive services in the life cycle.

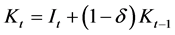

The capital stock used in our estimation will be limited to the scope of fixed capital except for inventory and working capital due to the easy computation of the currently available data. The perpetual inventory method will be employed to measure the capital stock of China’s air transport industry as follows:

(1)

(1)

where  is the fixed capital stock in year t,

is the fixed capital stock in year t,  is the fixed capital stock in the previous year,

is the fixed capital stock in the previous year,  is the newly increased assets in year t and

is the newly increased assets in year t and  is the depreciation rate of the fixed capital.

is the depreciation rate of the fixed capital.

The original and net values of fixed assets and the newly increased fixed assets of China’s air transport industry were available from the China Civil Aviation Statistical Yearbooks. However, the accounting concepts of the original value of fixed assets and the net value of fixed assets are not the appropriate connotation of capital input. Thus, the newly increased fixed assets will be used to compute the fixed capital stock.

3.1.1. Newly Increased Fixed Assets

The total annual newly increased fixed assets of China’s air transport industry are published in the China Civil Aviation Statistical Yearbooks and the China Civil Aviation Statistical Compilation (1949-2000). However, in recent years, the scope of this statistical indicator only includes the assets formatted by state investment. As all the enterprises in China’s air transport industry were state-owned before the reform and open-door policy, the China Civil Aviation Statistical Compilation (1949-2000) indicates that before 1983, all investments in infrastructure and technological improvement came from the state. Thus, the newly increased fixed assets in the statistics from 1949-1982 are considered as to be those of the whole industry. After 1982, the newly increased fixed assets in a given year are computed from the difference in this year’s original value of fixed assets and the previous year’s, which are listed as the value for the whole industry. It should be noted that the newly increased fixed assets in 1998 are negative using this computing approach. Therefore, the sum of the newly increased fixed assets in infrastructure, the newly increased fixed assets in technological improvements and investments in purchasing and renting aircrafts and other vehicles is used instead of the negative figure for 1998.

3.1.2. Deflator for Fixed Capital Formation and Economic Depreciation Rate

The official deflators for fixed capital formation in China have been published since 1990. Therefore, deflators for fixed capital formation before 1990 have to be calculated. Shan [25] establishes an approach to determine the deflators for fixed capital formation for that period of time, which are used in this study.

The determination of the economic depreciation rate is a key issue in the measurement of fixed capital. Here, we refer to the approach based on the life cycle of fixed capital used by Huang et al. [26] , Zhang et al. [27] and Shan [25] . Most of the annual statistics for the air transport industry in

Based on data availability, 1955 is chosen as the base year for the measurement of capital stock. The net value of fixed assets can be obtained, which is taken as the capital stock of the industry, considering the development stage of the macro economy and this industry in

The calculation results for capital stock from 1955 to 2011 for China’s air transport industry are listed in Table 1.

3.2. Labor

The difficulty in the measurement of labor in an industry is considering the relative qualities of various types of labor. Chow [6] and Chow and Li [7] directly used the labor force data in the Statistical Yearbook of China. Wang and Yao [21] constructed a time series of China’s stock of human capital as one component of the labor input, in addition to labor force. Young [3] also measured the human capital as the labor input. Yue and Ren [28] used the standards of gender, age, education and industry to classify labor and aggregated the different groups of labor using the translog function. Li et al. [29] measured the working time of the workforce as the flow of labor services.

Windle [11] computed the labor input as a multilateral index of three categories of employees (pilots, co-pilots and other cockpit personnel, cabin attendants, and all other personnel) with the compensation of each of these categories as the weights. Oum and Yu [24] , Oum et al. [17] and Parker [16] used the labor number as the labor input. Färe and Sickles [15] calculated the multilateral Tornqvist-Theil price and quantity indices for the labor input. Yuen and Zhang [18] did not consider labor input due to data unavailability.

Based on employee data in the China Civil Aviation Statistical Yearbooks, we may obtain the total number of employees and some breakdown numbers; thus, the total number of employees is divided into two groups: crew members (pilots, co-pilots and cabin attendants) and other personnel. After 2002, only the data for crew members could be obtained. The average ratio between crew members and other personnel from 1995-2001 is used to construct a time series for the other personnel from 2002 to 2011. Using the income of each group as the weight, the total number of employees is adjusted as the labor input to reflect the different role of different groups of employees in the production.

The adjusted labor input is contained in Table 1.

3.3. Output: Turnover (tkm)

Studies on the national economic growth sources always use GDP as the output. The added value of the air transport industry could be calculated based on the national input-output table, but it is difficult to measure the added value of the air transport industry in China, as its earliest national input-output tables were published in the 1970s and were not published annually.

In the studies of airline productivity, passenger and cargo traffic are commonly used as the output. Windle [11] constructed the multilateral output index composed of four separate components introduced in the literature review. Oum and Yu [24] and Good [12] applied passenger and cargo traffic as well as incidental services as the output. Ceha and Ohta [14] employed tkm performed as the output. Färe and Sickles [15] also adopted the traditional scheduled and non-scheduled traffic as the output while considering service quality.

Table 1. Inputs and outputs used for estimation.

aThe original number of employees is divided into crew and other personnel, and the labor input is then adjusted using their income shares as weights. bThe turnover is calculated using domestic and international turnover by the weight of revenue shares of each group.

For airport productivity, the passenger volume, cargo volume and aircraft movement are usually used as the outputs [18] . Oum et al. [17] employed a fourth output consisting of revenues from commercial or non-aeronautical services. Parker [16] considered the number of passengers and the amount of cargo and mail handled as outputs.

As we measure the growth sources of the whole industry, the outputs should be the final outputs of the whole industry as well. In the air transport industry, the final outputs are produced by airlines. Airports and other sub-sectors provide supporting or auxiliary services or intermediate services to airlines. Thus, the outputs of airlines will be considered as the final outputs of this industry. To simplify the measurement of output, the domestic and international turnovers of China’s air transport industry (expressed in tonne-kilometers, tkm) are used as the outputs in our analysis. Following the approach of Windle [11] , the adjusted overall turnover (tkm) is constructed using the revenue shares of these two types of turnover as weights (see Table 1). The motivation for using the weighted approach to adjust the output is that a tonne-kilometer contributes to the added value of this industry differently in each group.

4. Estimation of the Production Elasticities of Input Factors

4.1. Determination of Estimation Approach

The essential issue in the measurement of the growth sources of the air transport industry is to compute the output elasticities of factors. Two different types of approaches to determine the output elasticities of different factors were identified in previous studies. Li [20] [29] used the factor income share as the output elasticity to compute the economic growth sources, while Chow [6] , Chow and Li [7] and Wang and Yao [21] applied econometric approaches to obtain the output elasticities of various factors. The econometric approaches assume that the output elasticities are constant; however, the output elasticities of different factors could change with time due to changes in their relative importance. The income share approach can treat the output elasticities in a dynamic way, but it assumes a perfect competitive market and constant returns to scale. In addition, it requires factor income data.

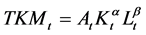

Due to the difficulty in measuring the income of the two inputs in our study and the imperfect competition of the air transport industry, econometric approaches will be used in this measurement of growth sources. As the production elasticities of the inputs and the TFP are needed to measure the growth sources of China’s air transport industry, the Cobb-Douglas production function is used. Thus, the basic CD production function for China’s air transport industry is as follows:

(2)

(2)

where  is the adjusted tonne-kilometers performed,

is the adjusted tonne-kilometers performed,  is the TPF,

is the TPF,  is the estimated capital stock and

is the estimated capital stock and  is the adjusted labor number of entire China’s air transport industry.

is the adjusted labor number of entire China’s air transport industry.

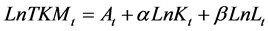

Taking the log of both sides of Equation (2), we obtain

(3)

(3)

where  is the output elasticity of the capital stock and

is the output elasticity of the capital stock and  is the output elasticity of labor. This model will be our basic model for the estimation.

is the output elasticity of labor. This model will be our basic model for the estimation.

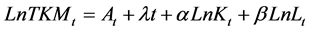

Technological advances usually cause the production function to change with time. The inputs and outputs in our model are all time series; thus, we will include a time trend variable into the model to explain the technological changes. Equation (3) will be

(4)

(4)

where t is the time trend. The technological change effect could be computed and is constant:

In the practical estimation, we will consider whether the time trend affects the input elasticities.

Based on Equation (4), utilizing the connotation of the Solow residual, the equation for the calculation of TFP growth could be obtained as follows:

where

4.2. Unit Root Test of the Input and Output Data

Before the starting of estimation of the Cobb-Douglas production function, the unit root test should be conducted to determine whether the variables of inputs and outputs are non-stationary due to the time series characteristic.

The ADF test approach is employed to test

4.3. E-G Two-Stage Estimation of the CD Production Function

In the first stage, the OLS is used to estimate the long-term equilibrium relationship among the variables using Equation (4). The initial result reveals a serial correlation by the DW test, after which the generalized difference method based on the Cochraqne-Orcutt procedure is applied to estimate Equation (4) to account for the serial correlation. In the second stage, the residual of the first regression is tested with the ADF approach, which shows that the residual is stationary. Therefore, there is cointegration among the variables. The results are shown in Table 2.

The sum of the coefficients of

Next, we will assume a constant return to scale in China’s air transport industry, which will restrict the sum of coefficients of capital and labor to 1.

4.4. Restricted E-G Two-Stage Estimation of the CD Production Function with Time Trend

We will now employ a restricted E-G two-stage estimation of the derivation of Equation (4):

The Newey-West HAC standard errors and covariance are used to address the serial correlation in the estimation. In the second stage, the ADF approach is applied to test the residual of the first regression, and the test shows that the residual is stationary at the 10% level. Therefore, there is a cointegration among the variables.

The results are shown in Table 3. The output elasticity of capital is 0.752, the output elasticity of labor is 0.248, and the regression shows that there is an average advance in technology of approximately 3.2% every year during this period of time.

4.5. Adding Dummy Variables

China’s air transport industry experienced several important institutional changes: in 1980, it broke away from the air force; in1987, airlines and airports became independent of the regulator (CAAC); and in 2002, the airlines were consolidated, and airports were localized. Therefore, we want to incorporate these changes in the estimation as dummy variables.

The estimation shows that only the 2002 institutional change is significant:

The result is shown in Table 4. The 2002 reform shifts the vertical intercept of the production function outward but does not change its slope. Part of the reason for the impact of the 2002 reform on the output is that it

Table 2. Basic estimation of CD production function.

Table 3. Restricted estimation of CD production function.

allowed private investment in the air transport industry.

We are surprised by the absence of the expected interaction of the 2002 reform and the elasticities of input factors. This phenomenon indicates that the 2002 reform leads to the investment of more resources in this industry and increases the output but does not change the relative efficiency of capital and labor.

Approximately 3.1% of technological progress per year occurred during 1955-2011. This result is larger than that reported by Chow and Li [7] for China’s macro economy (2.62%) during 1952-1998.

5. Calculation of the Growth Sources of China’s Air Transport Industry

Based on Table 1 and Table 4 as well as Equation (6), we can measure the contribution of capital and labor inputs as well as TPF to the growth of China’s air transport industry. The results are shown in Table 5.

Generally, from 1955-2011, the contributions of capital, labor and TFP to the growth of China’s air transport industry are 64.9%, 14.2% and 20.9%, respectively, indicating that the growth of China’s air transport industry is mainly supported by capital accumulation. This conclusion is in agreement with those of studies on the growth sources of China’s macro economy (Li et al. [20] ; Chow [6] ; Chow and Li [7] ; Wang et al. [5] ). Lin and Sun [8] report that this growth is promoted by capital intensity.

However, the contribution of TFP to the growth of China’s air transport is slightly different from that to the growth of China’s macro economy, with the former being larger than the latter. This difference could be explained by the fact that the development of this industry is driven by technology in China, justas in the rest of the world, and China’s air transport industry introduced advanced Western aircrafts into China years before the open-door policy was adopted, which will be discussed later.

From 1955-1965, the contribution of capital is nearly 90% and that of TFP is negative. The average negative annual TFP growth rate during this period reflects the shift to importing Western aircrafts and other equipment from the former

It is surprising that the TFP increased rapidly during 1971-1979 and that its contribution exceeds that of capital. Probing the history of China’s air transport, we find that

Table 4. Constrained estimation with dummy variables.

Table 5. Contribution of inputs to the growth of China’s air transport industry.

The rapid growth and substantial contribution of TFP was also observed in 2003-2011, corresponding to the first period in which the investment of private resources in the air transport industry has been allowed, which may explain part of this phenomenon. Another factor in this increase is the institutional change. After 2002, the regulator relaxed some restrictions on the market access of air transport, which includes the route access and slot distribution system. These changes may stimulate market competition and increase the TFP of all market participants, thereby increasing the TFP of the industry. This finding might also be attributed to a statistical issue, as the capital stock may be underestimated during this period of time. Before 2003, only state investment was allowed in this sector, which is reflected very well by the official statistics. However, after 2003, the official statistics might not include all private investment in this sector, as proven by the growth rate of capital stock, which decreased from 17.85% during 1993-2002 to 6.63% during 2003-2011.

The results of our analysis also have policy implications. First, the air transport industry is exhibiting capital intensity growth. State investment alone is insufficient to sustain long-term industry development. It is necessary to allow various sources of investment into this industry, as proven by the results of the 2002 reform in

6. Conclusions

We measure the inputs of capital stock and labor as well as the output of traffic turnover in China’s air transport industry and employ the constrained E-G two-stage estimation of the CD production function to calculate the growth sources in China’s air transport industry. We find that during 1955-2011, capital is the main factor supporting the growth of China’s air transport industry, while the role of TFP is gradually increasing. Although there are several important reforms, only the 2002 reform affects the production function which shows that the market-economy direction reform in air transport industry in China should be deepened further.

However, this study has some limitations. First, the accuracy of the official data may affect the accuracy of our analysis, as demonstrated by the results for 2003-2011. The second limitation is the treatment of the capital input. We use the capital stock as the capital input but not the flow of capital service. Furthermore, the economic depreciation rate used in the calculation of capital stock, as the weighted average of the two depreciation rates, is not very accurate.

Cite this paper

XingwuZheng,YiZhang,WeiLu, (2016) What Supported the Growth of China’s Air Transport Industry from 1955 to 2011?. Theoretical Economics Letters,06,48-58. doi: 10.4236/tel.2016.61007

References

- 1. Lin, Y.F., Cai, F. and Li, Z. (1999) China’s Miracle: Development Strategy and Economic Reform (Revised). Shanghai Joint Publishing Company and Shanghai People’s Publishing Company, Shanghai, 137-177.

- 2. Krugman, P. (1994) The Myth of Asia Miracle. Foreign Affairs, 78, 62-78.

http://dx.doi.org/10.2307/20046929 - 3. Young, A. (2003) Gold into Base Metals: Productivity Growth in the People’s Republic of China during the Reform Period. Journal of Political Economy, 111, 1220-1261.

http://dx.doi.org/10.1086/378532 - 4. Jefferson, G., Rawski, T. and Zhang, Y. (2008) Productivity Growth and Convergence across China’s Industrial Economy. Journal of Chinese Economic and Business Studies, 6, 121-140.

http://dx.doi.org/10.1080/14765280802028237 - 5. Wang, X.L., Fan, G. and Liu, P. (2009) Transformation of Growth Pattern and Growth Sustainability in China. Economic Research, 1, 4-16.

- 6. Chow, G.C. (1993) Capital Formation and Economic Growth in China. Quarterly Journal of Economics, 3, 809-842.

http://dx.doi.org/10.2307/2118409 - 7. Chow, G.C. and Li, K.W. (2002) China’s Economic Growth: 1952-2010. Economic Development and Cultural Change, 51, 247-256.

http://dx.doi.org/10.1086/344158 - 8. Lin, Y.F. and Sun, J. (2007) On the Transformation of China’s Economic Growth Pattern. Management World, 11, 5-13.

- 9. Caves, D.W., Christensen, L.R. and Tretheway, M.W. (1981) U.S. Trunk Air Carriers, 1972-1977: A Multilateral Comparison of Total Factor Productivity. In: Cowing, T.G. and Stevenson, R.E., Eds., Productivity Measurement in Regulated Industries, Academic Press.

- 10. Caves, D.W., Christensen, L.R. and Tretheway, M.W. (1983) Productivity Performance of U.S. Trunk and Local Service Airlines in the Era of Deregulation. Economic Inquiry, 21, 312-324.

http://dx.doi.org/10.1111/j.1465-7295.1983.tb00634.x - 11. Windle, R.J. (1991) The World’s Airlines: A Cost and Productivity Comparison. Journal of Transport Economics and Policy, 35, 31-49.

- 12. Good, D.H., Roller, L.-H. and Sickles, R.C. (1995) Airline Efficiency Differences between Europe and the US: Implications for the Pace of EC Integration and Domestic Regulation. European Journal of Operational Research, 80, 508-518.

http://dx.doi.org/10.1016/0377-2217(94)00134-X - 13. Charnes, A., Gallegos, A. and Li, H.Y. (1996) Robustly Efficient Parametric Frontiers via Multiplicative DEA for Domestic and International Operations of the Latin American Airline Industry. European Journal of Operational Research, 88, 525-536.

http://dx.doi.org/10.1016/0377-2217(94)00216-9 - 14. Ceha, R. and Ohta, H. (2000) Productivity Change Model in the Airline Industry: A Parametric Approach. European Journal of Operational Research, 121, 641-655.

http://dx.doi.org/10.1016/S0377-2217(99)00058-2 - 15. Fare, R., Grosskopf, S. and Sickles, R.C. (2007) Productivity of US Airlines after Deregulation. Journal of Transport Economics and Policy, 41, 93-112.

- 16. Parker, D. (1999) The Performance of BAA before and after Privatization. Journal of Transport Economics and Policy, 33, 133-145.

- 17. Oum, T.H., Yu, C.Y. and Fu, X.W. (2003) A Comparative Analysis of Productivity Performance of the World’s Major Airports: Summary Report of the ATRS Global Airport Benchmarking Research Report—2002. Journal of Air Transport Management, 9, 285-297.

http://dx.doi.org/10.1016/S0969-6997(03)00037-1 - 18. Yuen, A.C.-L. and Zhang, A.M. (2009) Effects of Competition and Policy Changes on Chinese Airport Productivity: An Empirical Investigation. Journal of Air Transport Management, 15, 166-174.

http://dx.doi.org/10.1016/j.jairtraman.2008.09.003 - 19. Chow, C.K.W. and Fung, M.K.Y. (2012) Estimating Indices of Airport Productivity in Greater China. Journal of Air Transport Management, 24, 12-17.

http://dx.doi.org/10.1016/j.jairtraman.2012.04.004 - 20. Li, J.W., Zheng, Y.J. and Yang, S.Z. (1992) Analysis on the Growth of China’s Economy. China Social Science, 1, 15-36.

- 21. Wang, Y. and Yao, Y.D. (2003) Sources of China’s Economic Growth 1952-1999: Incorporating Human Capital Accumulation. China Economic Review, 14, 32-52.

http://dx.doi.org/10.1016/S1043-951X(02)00084-6 - 22. Sun, L.L. and Ren, R.E. (2005) China’s Capital Input and TFP Estimation. World Economy, 12, 3-13.

- 23. OECD (2001) Measuring Productivity-Measurement of Aggregate and Industry-Level Productivity Growth. OECD, Paris.

- 24. Oum, T.H. and Yu, C.Y. (1995) A Productivity Comparison of the World’s Major Airlines. Journal of Air Transport Management, 2, 181-195.

http://dx.doi.org/10.1016/0969-6997(96)00007-5 - 25. Shan, H.J. (2008) The Re-Measurement of China’s Capital Stock: 1952-2006. Journal of Quantitative & Technical Economics, 10, 17-31.

- 26. Huang, Y.F. and Ren, R.E. (2002) A Comparison of TFP in the Manufacturing Sector between China and the United States. China Economic Quarterly, 2, 161-180.

- 27. Zhang, J., Wu, G.Y. and Zhang, J.P. (2004) The Estimation of China’s Provincial Capital Stock: 1952-2000. Economic Research Journal, 10, 35-44.

- 28. Yue, X.M. and Ren, R.E. (2008) Measuring the Labor Input of Chinese Economy: 1982. Economic Research Journal, 3, 16-28.

- 29. Li, J.W., Gong, F.H. and Ming, S.A. (1996) Productivity and the Growth of China’s Economy. Journal of Quantitative & Technical Economics, 12, 27-40.

- 30. Caves, D.W. (1962) Air Transport and Its Regulators: An Industry Study. Harvard University Press, Cambridge.

- 31. Levine, M.E. (1965) Is Regulation Necessary? California Air Transportation and National Regulatory Policy. Yale Law Journal, 74, 1416-1447.

http://dx.doi.org/10.2307/794731 - 32. Caves, D.W., Christensen, L.R. and Tretheway, M.W. (1984) Economies of Density versus Economies of Scale: Why Trunk and Local Service Airline Costs Differ. Rand Journal of Economics, 15, 471-489.

http://dx.doi.org/10.2307/2555519 - 33. Gillen, D.W., Oum, T.H. and Tretheway, M.W. (1985) Airline Cost and Performance: Implication for Public and Industry Policies. Centre for Transportation Studies of University of British Columbia, Vancouver.

- 34. Creel, M. and Farell, M. (2001) Economies of Scale in the US Airlines Industry after Deregulation: A Fourier Series Approximation. Transportation Research E, 37, 321-336.

http://dx.doi.org/10.1016/S1366-5545(00)00025-9

NOTES

*Corresponding author.

1In 1980, air transport was separated from the air force, and in 1987, airlines and airports became independent of the regulator (CAAC). In 2002, the central-government-owned airlines consolidated into the Big Three, and control of all airports except Beijing Capital Airport and airports in Tibet were transferred to local governments.