Open Journal of Statistics

Vol.05 No.06(2015), Article ID:60395,18 pages

10.4236/ojs.2015.56056

Pricing American Options Using Transition Probabilities: A Dynamical Systems Approach

Rocio Elizondo1, Pablo Padilla2, Mogens Bladt3

1Directorate of Economic Studies, DGIE, Banco de México, Mexico City, Mexico

2Department of Mathematics and Mechanics, IIMAS, UNAM, Mexico City, Mexico

3Department of Probability and Statistics, IIMAS, UNAM, Mexico City, Mexico

Email: melizondo@banxico.org.mx, pablo@mym.iimas.unam.mx, bladt@sigma.iimas.unam.mx

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 30 July 2015; accepted 15 October 2015; published 20 October 2015

ABSTRACT

We give a new way to price American options by using Samuelson’s formula. We first obtain the option price corresponding to a European option at time t, weighing it by the probability that the underlying asset takes the value S at time t. We then use Samuelson’s formula with this factor which is given by the solution of the Fokker-Planck (Kolmogorov) equation for the transition probability density. The main advantage of this approach is that we can systematically introduce the effect of macroeconomic factors. If a macroeconomic framework is given by a dynamical system in the form of a set of ordinary differential equations we only have to solve a partial differential equation for the transition probability density. In this context, we verify, for the sake of consistency, that this formula coincides with the Black-Scholes model and compare several numerical implementations.

Keywords:

American Options, Fokker-Planck, Black-Scholes, Samuelson, Probability Density Function

1. Introduction

There are several methods for pricing European and American options [1] - [17] . We are interested in different ways to price American options that are flexible enough, so that they can be useful in nonstandard situations, or offer alternatives in standard settings.

Our main goal is to present a new way to price American options, which allows us to introduce the effect of macroeconomic factors that affect the financial market so we can introduce different dynamics for the under- laying asset and generalize more complex processes such as Levy processes.

This new formula does not pretend to improve on the existent methods in the context of the Black-Scholes model. We want to show that it is consistent with it. In fact it is equivalent to a previous one given by Carr, Jarrow and Minery [5] . The most interesting feature of this method is that it explicitly introduces the transition probability as a solution to a Fokker-Planck (Kolmogorov) equation. This allows us to consider more general situations when the underlaying asset does not follow a log-normal process.

We propose an extension of Samuelson’s formula for American type contingent claims, because one of the most interesting aspects of this formula is that it does not make explicit reference to the risk neutral distribution, but the physical or observed one (see Section 2 below).

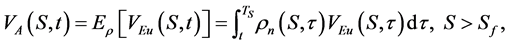

For the fixed underlaying asset value S we propose that the American option price is:

(1)

(1)

where for each time  of S,

of S,  is the normalized solution of the corresponding Fokker-Planck equa- tion (for the probability density function),

is the normalized solution of the corresponding Fokker-Planck equa- tion (for the probability density function),  is the solution of the Black-Scholes equation for the Euro- pean case,

is the solution of the Black-Scholes equation for the Euro- pean case,  is the free boundary and

is the free boundary and  corresponds to the expiration time at the free boundary, which de- pends on the location of the free boundary (for details see section 3).

corresponds to the expiration time at the free boundary, which de- pends on the location of the free boundary (for details see section 3).

For practical purposes, we present a theoretical example introducing the effect of macroeconomic factors in a derivative model, and for consistency, we prove that this formula satisfies the Black-Scholes inequality for American options in the log-normal case.

In what follows we define : The underlaying asset price at time t. E: Exercise price or maturity price. T: Exercise time or maturity time.

: The underlaying asset price at time t. E: Exercise price or maturity price. T: Exercise time or maturity time. : Time to early exercise (on the free boundary). t: Current time. r: Free risk interest rate.

: Time to early exercise (on the free boundary). t: Current time. r: Free risk interest rate. : Underlaying asset volatility.

: Underlaying asset volatility. : European option price.

: European option price. : European call option price.

: European call option price. : European put option price.

: European put option price. : American put option price.

: American put option price. : American call option price.

: American call option price. : American option price.

: American option price.

To value European type options there are explicit and standard formulas as Black-Scholes formula [14] , Samuelson formula [18] , an actuarial approach [2] , Merton’s theory of rational option pricing [9] , etc. However, to value an American options there are not closed formulas. Nowadays, there are several representations to approximate the value of American options. In general, there are not closed expressions except in special situations. In the case that a formula exists, it can be very complex. The best way to price American options in practice is to use numerical methods (explicit, implicit, finite differences, between others) although they can be complicated, too.

The options are typically used for development of structural products, speculation strategies and hedging. Most of the options traded in the international markets are of American type.

For consistency, our objective is to prove analytically that (1) also coincides with standard approach in the literature as the Black-Scholes formula. We also compare its numerical implementation with the existent numerical methods such as: binomial trees, explicit and implicit partial differential equations methods.

In (1), we assume that we know a priori the location (or some approximation) of the free boundary. Existing methodologies both analytical and numerical can be used to approximate well the free boundary.

This article is structured in the following way. In the second section, we describe the Kolmogorov equations, which represents the transition probability density function in (1). In the third section, we present the formula to price the American options, as well as, some numerical examples and compare with others numerical methods. Finally, we give some conclusions and open problems.

2. Preliminaries

To understand the mechanism of our approach, we are going to describe the Kolmogorov backwards equation and Kolmogorov forward equation (Fokker-Planck equation). They are important tools for finding the pro- bability density function.

The Transition Probability Density Function

We derive an equation for the probability density function of a random variable defined by a stochastic differential equation (SDE). This density describes the temporal evolution of the state, x, of the phenomenon under study.

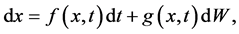

We introduce a general random variable x, which satisfies the SDE:

(2)

(2)

where f and g are any continuously differentiable functions of x and t, and W is the Wiener process or Brownian motion.

Then, the transition probability density function is denoted by

It is well know that p satisfies:

with the initial condition

where

Conversely, if we know the value

with final condition given by

For a detailed presentation of these subjects see [14] [19] - [22] .

3. Alternative Formula to Estimate American Options

We are going to evaluate an American option applying Samuelson’s formula ( [2] [18] ), using the transition probability density to generate the function corresponding to the physical measure as the solution of a Fokker- Planck type equation ( [19] [20] [23] - [25] ). For consistency, we are going to prove this new formula recovers the traditional Black-Scholes results in the log-normal case ( [10] [12] [14] [23] [26] - [28] ) for the price of an American put option. We are also going to compare this proposal with specific examples estimated with the tree methods (Cox, Ingersoll and Rubinstein) and the finite differences, explicit and implicit methods.

The main idea behind this formulation is that we can use the Fokker-Planck equation in more general or complex problems in order to incorporate the effect of macroeconomic factors to several models of financial derivatives and credit risk, where we do not know a priori the real distribution of the density and where the underlying asset does not follow a log-normal distribution.

3.1. A General Formula for Models Incorporating Macroeconomic Variables

The importance of considering macroeconomic factors in pricing standard or credit risk derivatives is that they considerably affect their value (see [29] ).

Our idea is to extend this model to the case where the parameters may depend directly on different macroeconomic factors or indices. In order to do this we generate the probability density function through the Fokker-Planck equation, which will allow us to systematically introduce the effect of macroeconomic factors on the option-pricing model.

We have a financial model that takes into account the effect of macroeconomic factors. Suppose we want to calculate the financial derivative value with underlying asset S, but the parameters

We consider that a macroeconomic environment is formed by n variables,

where

Now, we suppose that the underlying asset, in general, is governed by the stochastic differential equation:

In this case, the way to introduce the macroeconomic factors and time is through the return rate

On the other hand, we calculate the transition probability through the Fokker-Planck equation, but generalized to n variables2. In this case,

The advantage of using this equation lies in being able to represent concisely the dynamics of the system of equations by a single partial differential equation, via the transition probability function.

Finally, we can apply Samuelson formula or our formula to obtain the price of American or European options:

With

The Fokker-Planck equation can be used in credit risk and present net value problems (see [30] ), among many other cases where the transition probability follows more general processes, such as Lévy process.

We will consider the case of an American option on a single underlying asset following a log-normal process. Here

3.2. Alternative Formula for Pricing American Options

Introducing the alternative formula for estimating American options, we define the American option price with- out dividends in the following way. For a fixed S, we have:

with

where

Figure 1. Relationship between the times T and TS.

where

and

The consistency conditions are:

and

There is another alternative formula to estimate American options where the integration is with respect to time too (see [5] ).

Before proceeding with the details of our alternative formula it is necessary to define the location of the free boundary. We present the results we need in the following section.

Free Boundary

The problem of finding the American option value translates into finding a solution to a free boundary problem. The strategy for approaching the solution is to locate the free boundary,

So if

For a Call option (CA):

Put option (PA):

The curve

Figure 2. Region of solution of an American option.

The region outside the curve,

For a put option, a point outside the curve in the upper region is given by

This determines the region of solution for an American option.

We now define the price of an American option in terms of the price of a European option at each time t, where

Mathematically, for each t, the weight

calculating the the partial derivatives we have:

with boundary conditions:

The Fokker-Planck equation with respect to

Another condition of consistency but with respect to the parameter is

Remark 1 It is very important to keep in mind that the density

Remark 2 The Fokker-Planck equation with respect to

Let

This function satisfies the Fokker-Planck partial differential equation and the backwards Kolmogorov equation.

Remark 3 The normalization for the probability density function is given by:

with

Remark 4 Exercising an American call option before expiry is not optimal, because

According to this last remark, the interesting case to study is that of an American put option, hence from now on we will focus on this case. This is not valid anymore if we consider that the S can give dividends.

3.3. American Put Option Formula

Let

The probability density function

The consistency conditions of an American put option are:

This follows from Fatou’s lemma. Notice that

Moreover

This can be proved using the fact that the price of a put option near the free boundary

with

If we calculate the partial derivative with respect to S of the Equation (20) we get:

and consequently we have:

The next subsection shows, for consistency, that the alternative formula satisfies the Black-Scholes inequality.

3.4. Consistency of the Formula with the Black-Scholes Approach

The advantage of this new formula, provided we know the location of the free boundary, is that we only need to asses the value of the function

Remember that the Black-Scholes inequality for American options (see [14] ) is given by:

Let

Without loss of generality and to simplify the calculations, we write

Afterwards, we calculate the partial derivatives appearing in (16) and (23), and considering the value of

where

It is necessary to check that the left hand side of the inequality is less than or equal to zero, which we will do this next. It is straightforward to verify that all underlined terms are negative. We show that the positive terms, after an appropriate rescaling, are always of lower order than the negative ones. First we have to recall some important facts that will be useful in the proof. The term

which is negative for the European put option with a non-dividend-paying underlying asset and

This is always positive for a European call option with a non-dividend-paying asset (see [14] y [35] ). We show in Figure 3 the variation of delta of a call and put option with respect to the underlaying asset, as well as the variation of the delta with respect to maturaty time.

Hence it follows that:

Figure 3. Variation of D with respect to European options.

for a put option, and

for a call option.

Therefore, in the case of a put option, which is important for this analysis, we have

Lemma 1

Proof.

We proceed by contradiction.

For any

By continuity, the integral remains being positive for any arbitrary and small

Now, we analyze each term separately.

The difference

For the term

So

For

Although the term is greater than zero, we can make this smaller that the negative terms. This is explained with detail in remark 5.

Finally, we obtain

Which is in contradiction with (28).

We therefore have the Lemma 1

Moreover,

Remark 5 It is important to note that the time

Remark 6 For the positive terms of inequality (25), let m be an arbitrary large value such that

This is possible because the Fokker-Planck equation is linear and we can always rescale the solution. Also note that the valuation formula is linear with respect to

With that we have finally proved the claim that the new way to price American options given by (19) coincides with the standard one.

Analytical Comparison with Other Methodologies

Another way to see the consistency of our proposal is to verify that the formula of Carr, Jarrow and Myneni [5] and the binomial tree method are consistent with our formula 19.

1) Carr, Jarrow and Myneni Formula

Using their notation, in a region

and

Then starting from the previous theorem we have:

Here,

2) Binomial Tree Method

It is easy to check that the standard binomial tree method can be decomposed in two steps. First, we find the exercise (free) boundary and substitute the prices by the payoff. Second, we proceed exactly as in the European case restricted to this region. This is precisely the discrete analogue of expression (19).

3.5. Application of the Alternative Formula

For verifying the efficiency of the new formula to price American options it is necessary to analyze its behavior with specific examples. For that we consider several cases, in which we estimate the American option prices and we compare those with the prices obtained with other methods, such as: the tree method (Cox, Ingersoll and Rubinstein), the finite difference method (implicit and explicit) and Longstaff and Schwartz method. For consistency, we make all calculations for the log-normal case (Black-Scholes).

Before going into details about the numerical methods, we present the algorithm by which we calculate the prices of American put options.

For an

1) In general, the probabilities are estimated using the solution of the partial differential equation (15) for various times before or equal to expiring. These probabilities for the log-normal case can be found also through the explicit solution (17).

2) Probabilities are normalized so that

3) Calculate the price of a European put option by the explicit Black-Scholes formula with underlaying asset S in different real times t8.

4) a) If a priori we know the free boundary,

b) If the free boundary is not known, we check whether the early exercise is optimal at each time step, i.e., takes the maximum between the solution of the Black-Scholes equation

5) Multiply the normalized probability,

6) Calculate the integral

The flow chart for the algorithm is given in Figure 4.

With this algorithm, we describe the numerical way to solve specific examples and we compare the results, evaluated with traditional methods and our approach.

To find the numerical solution of the Fokker-Planck PDE, use the Finite Element Modeling Laboratory package (FEMLAB Multiphysics in MATLAB), which is an advanced software package for modeling and simulating many physical process that can be described through PDE's.

For the particular case, where S follows a log-normal process, we can use the explicit solution (15) to determine the probabilities

The numerical approach is very close to the explicit probabilities. So we use both interchangeably. For practical purposes and only in this case, to verify that the new way to value American options (19) is consistent with the log-normal case (Black-Scholes), we use the closed formula (17), which was implemented in MAT- LAB.

Now, we show a concrete example according to the steps of the algorithm for pricing an American option with formula (19).

Let the asset price

Figure 4. Flow chart to find the price of an American put option given by the formula (19).

Table 1. Explicit and numerical comparison of the probabilities (r).

Table 2. American put option values.

Source: Own calculus using, as approach to the integral, the trapezoid method.

3.6. Comparison with Other Numerical Methods

In the following examples, we estimate the American put option values by the binomial method and the finite differences (implicit and explicit), we take the Bern Arne numerical implementation Ødegaard (see [33] ), and for other methods CRR (an American option price by Cox-Ross-Rubinstein tree method calculated using the finite differences for the Black-Scholes PDE)and FD (American option price by finite differences applying to the Black-Scholes PDE). The numerical implementations of these methods were made in MATLAB (see [34] ). The New a) for boundary know, and b) for boundary not know method corresponds to our methodology for evaluating an American put option with (19). For more details on these methods, see [14] [35] .

In Table 3, in each example all involved variables are changed in the model and we do not know

If in Example 3) we consider

Finally, in Table 4 we show the formula New a) and New b) when the time changes. We can see that when the boundary is known, the price does not change. However, whether the boundary is not known the price changes and it is bigger whether t goes up.

There are other more complex numerical methods to estimate american options, within them we mention some: [3] [4] [8] [11] [27] [36] - [41] .

4. Conclusions

In conclusion we can say the following:

Mathematically, we prove that this new proposal for pricing American options is consistent with the Black- Scholes approach (canonical problem).

One application of this formula could be seen in the analytical proof that an American call option is equal to a European call option, i.e., the early exercise of an American call option is not optimal and the probability

As an application of the new way of pricing American options, we show numerically several examples. This proposal gives adequate proxies in comparison with traditional methods, such as binomial trees (Binomial CRR) and finite differences (Explicit and Implicit).

The advantage of using this new formula is that in order to compute the price of any American option, we only need to approximate the value of the probability of staying in the requested state, provided we already know the location of the free boundary, as the value of a European put option is known explicitly, which makes it more flexible and easy to estimate.

Table 3. Comparison of an American put option.

Table 4. Comparison of an American put option.

Moreover, by obtaining the transition probabilities via the Kolmogorov equation, we have the advantage of being able to systematically incorporate the effect of macroeconomic factors, which would make the calculation of the option price more realistic.

Acknowledgements

The authors thank the Editor and the referee for their comments. The authors also appreciate the valuable comments and suggestions of Josué Cortés, Gonzalo Rangel, Patricia Saavedra, Alvaro Cartea, Gilberto Flores and the seminar participants in Banco de México. The views and conclusions presented in this paper are exclusively the responsibility of the authors and do not necessarily reflect those of Banco de México.

Cite this paper

Rocio Elizondo,Pablo Padilla,Mogens Bladt, (2015) Pricing American Options Using Transition Probabilities: A Dynamical Systems Approach. Open Journal of Statistics,05,525-542. doi: 10.4236/ojs.2015.56056

References

- 1. Bank, P. and Föllmer, H. (2002) American Options, Multi-Armed Bandits, and Optimal Consumption Plans: A Unifying View. Paris-Princeton Lectures on Mathematical Finance, 1814, 1-42.

http://dx.doi.org/10.1007/978-3-540-44859-4_1 - 2. Bladt, M. and Rydberg, T.H. (1998) An Actuarial Approach to Option Pricing under the Physical Measure and without Market Assumptions. Insurance: Mathematics and Economics, 22, 65-73.

http://dx.doi.org/10.1016/s0167-6687(98)00013-4 - 3. Bally, P., Pages, G. and Printems, J. (2005) A Quantization Tree Method for Pricing and Hedging Multidimensional American Options. Mathematical Finance, 15, 119-168.

http://dx.doi.org/10.1111/j.0960-1627.2005.00213.x - 4. Broadie, M. and Cao, M.H. (2008) Improved Lower and Upper Bound Algorithms for Pricing American Options by Simulations. Quantitative Finance, 8, 845-861.

http://dx.doi.org/10.1080/14697680701763086 - 5. Carr, P., Jarrow, R. and Myneni, R. (2006) Alternative Characterizations of American Put Options. Mathematical Finance, 2, 87-106.

http://dx.doi.org/10.1111/j.1467-9965.1992.tb00040.x - 6. Geske, R. and Johnson, H.E. (1984) The American Put Option Valued Analytically. The Journal of Finance, 39, 1511-1524.

http://dx.doi.org/10.1111/j.1540-6261.1984.tb04921.x - 7. Han, H.D. and Wu, X.N. (2004) A Fast Numerical Method for the Black-Scholes Equation of American Options. SIAM Journal on Numerical Analysis, 41, 2081-2095.

- 8. Ikonen, S. and Toivanen, J. (2008) Efficient Numerical Methods for Pricing American Options Under Stochastic Volatility. Numerical Methods for Partial Differential Equations, 24, 104-126.

http://dx.doi.org/10.1002/num.20239 - 9. Merton, R.C., Foreword by Samuelson, P.A. (1995) Continuous-Time Finance. Blackwell, Massachusetts.

- 10. Musiela, M. and Rutkowski, M. (1998) Martingale Methods in Financial Modelling. Springer-Verlag, Berlin.

- 11. Tangman, D.Y., Gopaul, A. and Bhuruth, M. (2008) A Fast High-Order Finite Difference Algotithm for Pricing American Options. Journal of Computational and Applied Mathematics, 222, 17-29.

http://dx.doi.org/10.1016/j.cam.2007.10.044 - 12. Jia, Q. (2009) Pricing American Options using Monte Carlo Methods. Department of Mathematics Uppsala University, U.U.D.M. Project Report.

http://www2.math.uu.se/research/pub/Jia1.pdf - 13. Uys, N. (2005) Optimal Stopping Problems and American Option. Master of Science Dissertation Submitted to the Faculty of Science, University of the Witwatersrand, Johannesburg.

- 14. Wilmott, P., Dewynne, J. and Howison, S. (1993) Option Pricing: Mathematical Models and Computation. Oxford Financial Press, Oxford.

- 15. Levendorskii, S. (2004) The American Put and European Options Near Expiry, Under Lévy Processes. Department of Mathematics, University of Leicester, Leicester, 1-30.

http://dx.doi.org/10.2139/ssrn.520062 - 16. Hyungsok, A. and Wilmott, P. On Trading American Options. OCIAM, Oxford University, Oxford.

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.38.7270&rep=rep1&type=pdf - 17. Luenberger, D.G. (1998) Investment Science. Oxford University Press, Oxford.

- 18. Méndez, R.E. (2007) Correlación Temporal en la Valuación de Derivados. Tesis de Maestra en Ciencias Matemáticas, UNAM, Mexico City.

- 19. Risken, H. (1989) The Fokker-Planck Equation: Methods of Solution and Applications. Springer-Verlag, Berlin.

http://dx.doi.org/10.1007/978-3-642-61544-3 - 20. Werner, H. and Lefever, R. (1984) Noise-Induced Transitions: Theory and Applications in Physics, Chemistry and Biology. Springer-Verlag, Berlin.

- 21. Carr, P. and Hirsa, A. (2002) Why Be Backward? Forward Equations for American Options. Morgan Stanley/Courant Institute, NYU, New York, 1-25.

- 22. Evans, L. (1998) Partial Differential Equations. American Mathematical Society, Providence.

- 23. Lyuu, L. (2000) Financial Engineering and Computation: Principles, Mathematics and Algorithms. Cambridge University Press, New York.

- 24. Pontryagin, L., Andronov, A. and Vitt, A. (1989) Appendix: On the Statistical Treatment of Dynamical Systems. Springer-Verlag, New York, 329-348.

- 25. Zhang, W.-B. (1991) Synergetic Economics: Time and Change in Nonlinear Economics. Springer-Verlag, Berlin.

- 26. Llenera-Garcés, F. (2000) Una Nota Sobre Valoración de Opciones Americanas y Arbitraje. Investigaciones Económicas, XXIV, 207-218.

- 27. Mikosch, T. (1999) Elementary Stochastic Calculus with Finance in View. World Scientific Publishing, Singapore.

- 28. Steele, J.M. (2001) Stochastic Calculus and Financial Applications. Springer-Verlag, New York.

http://dx.doi.org/10.1007/978-1-4684-9305-4 - 29. Padilla, P. and Bladt, M. (2001) Nonlinear Financial Models: Finite Markov Modulation and Its Limits. In: Avellaneda, M., Ed., Quantitative Analysis in Financial Markets, Collected Papers of the New York University Mathematical Finance Seminar, Vol. III, World Scientific Publishing, Singapore, 159-171.

- 30. Elizondo, R. (2009) Incorporación de Factores Macroeconómicos en los Modelos de Valuación de Productos Derivados. Thesis de Doctorado en Ciencias, IIMAS, UNAM, Mexico City.

- 31. Elizondo, R. and Padilla, P. (2008) An Analytical Approach to Merton’s Rational Option Pricing Theory. Analysis and Application, 6, 169-182.

http://dx.doi.org/10.1142/s0219530508001110 - 32. Jarrow, R.A. (1998) Preferences, Continuity and the Arbitrage Pricing Theory. The Review of Financial Studies, 1, 159-172.

http://dx.doi.org/10.1093/rfs/1.2.159 - 33. Odegaard, B.A. (2007) Financial Numerical Recipes in C++.

http://www1.uis.no/ansatt/odegaard/gcc_prog/recipes/recipes.pdf - 34. Numerical Implementation Website.

http://www.mathworks.com/matlabcentral/fileexchange/loadFile.do?objectIdB - 35. Hull, J. (2000) Options, Futures, and Other Derivatives. Prentice Hall, Upper Saddle River.

- 36. Broadie, M. and Detemple, J. (1996) American Option Valuation: New Bounds, Approximations and a Comparison of Existing Methods. The Review of Financial Studies, 9, 1211-1250.

http://dx.doi.org/10.1093/rfs/9.4.1211 - 37. Chesney, M. and Jeanblanc, M. (2003) Pricing American Currency Options in a Jump Diffusion Model. 1-19.

- 38. Christ Churh College (2004) Nonlinear Black Scholes Modelling: FDM vs FEM. A Thesis Submitted in Partial Fulfilment of the Requirements for the MSc in Mathematical Finance, Oxford University, Oxford.

- 39. Leung, L.T. and Po-Shing, W.S. (2002) Valuation of American Options via Basis Functions. Department of Statistics, Stanford University, Technical Report No. 2002-28, 1-29.

- 40. Longstaff, F. and Schwartz, E. (2001) Valuing American Options by Simulation: A Simple Least-Squares Approach. This Paper Is Posted at the Scholarship Repository, University of California, Oakland.

http://repositories.edlib.org/anderson/fin/1-01 - 41. Matache, A.M., Nitsche, P.A. and Schwab, C. (2003) Wavelet Galerkin Pricing of American Options on Lévy Driven Assets. Research Report No. 2003-06, Zürich, 1-26.

NOTES

1If the system depends on one macroeconomic factor such that

2If

with

3Note that when we say that TS is the time to expiration, we mean the time corresponding to the free boundary, i.e., for each S there is a time TS on the free boundary.

4Since the origin is contained in the interior of the early exercise region.

5In general, the Fokker-Planck equation does not have explicit solutions.

6If

7We only have to observe that the Black-Scholes equation is backwards. Then, in order to make the consistent calculations, we have to take the backwards Kolmogorov equation for

8A priori we do not know the location of the free boundary, which implies that the value of expiration time at the boundary TS is unknown, then for numerical calculations instead we take the expiry time T.

9The time is annual, namely, 5 months is equivalent to