Journal of Applied Mathematics and Physics

Vol.04 No.07(2016), Article ID:68952,9 pages

10.4236/jamp.2016.47142

Rectangularisation Issues in Health Economics & Insurance: Measures and Mitigations

S. Jayaprakash1*, P. K. Dinakar2, Michael Ha3#, Zhengjun Jiang4, Uthit Siriwan5, Manning Li6, Chukwuemeka Okeagu3

1Nanobi Data and Analytics Private Ltd., Bangalore, India

2The Institute of Actuaries of India, Mumbai, India

3Xi’an Jiaotong-Liverpool University, Suzhou, China

4Bryant College, Beijing Institute of Technology, Zhuhai, China

5Faculty of Business, Charisma University, Turks and Caicos, UK

6Bank of Communications, Suzhou Branch, Suzhou, China

Received 4 May 2016; accepted 16 July 2016; published 19 July 2016

ABSTRACT

Aim: Actuaries are financial engineers who construct arrays of risk models combining mathematical techniques in order to carry out required actuarial calculations, such as reserve valuation and pricing. The main purpose is to identify some reliable models which price risk factors embedded in insurance products. Health insurance products which are very different in nature from life insurance products must be examined and priced carefully. This paper discusses predominantly two risks. Excess claims ratio and Rectangularisation risks. Background: The first author, Dr. S. Jayaprakash was responsible for Enterprise Risk Management with MetLife India. He was earlier associated with Life Insurance Corporation of India & Oracle Financial Services. Dr. P. K. Dinakar, the second author, qualified as Fellow of the Institute of Actuaries of India, was Chief Actuary of MetLife India Insurance. He was earlier associated with Life Insurance Corporation of India & Birla Sunlife. The third author, Dr. Michael Ha, FSA, MAAA, CFA, CPA (Australia), FRM, PRM, LLM, was Vice President of Strategic Business Initiatives Units at ING Life Insurance in its Taiwan operation. He started his actuarial career at MetLife, Canada. Earlier, the first and third authors worked on a research paper titled “Modeling Policyholder Behavior through Insurance Resonant Marts for Pricing Options and Guarantees” [1] which was presented at the 5th World Congress on Engineering and Technology. The seven authors decided to collaborate on the current research paper for health insurance design and financing purposes.

Keywords:

Claims Ratio, Valuation, De-Risk, Rectangularisation, Morbidity

1. Introduction

Health Care & Health Insurance poses major challenges across the globe. There is no ideal health care model or health Insurance plan that could solve the challenging issues. Health insurance has its own characteristics which are very different from those in the Life & General insurance. Life & General insurance losses which are tangible can be assessed and quantified explicitly. However, health insurance losses contain both tangible and intangible components with the latter being hidden and embedded implicitly. It requires a higher degree of cooperation and management by sector stakeholders.

Though the risk factors that exist in health insurance are various, the problems faced in the health insurance industry are common and numerous. In this paper, we discuss predominantly two risks. Excess claims ratio and rectangularisation risks. Based on the primary & secondary data, we analyze the issues faced and build theoretical models that could help individuals to determine an “Ideal Age for purchasing Health Insurance” similar to the idea of “Ideal age to plan for pension & annuity”.

2. Framework and Thought Process

The thought process can be itemized into the following 12 steps:

1) The life expectancy at birth has increased considerably over the years in many countries [2].

2) Although the increase in life expectancy can be advantageous for the life insurance industry, it could be a challenge for the health insurance industry to manage longevity risk. We live longer but not necessarily healthier [2].

3) Despite the increase in incident rates of various diseases and sicknesses, the average life span is lengthening due to health care advancement, medical technologies and healthier lifestyle [2].

4) Health care advancements care always comes with a premium cost to end users as a result of R&D budgets, spending, maintenance costs of corporatized medical hospital and industry etc.

5) As can be seen globally, it is beyond the reach of individual consumers to manage and financially support health care expenses from out-of-pocket. This translates into an increase in dependency on Group insurance which is based on pooled risk coverages. Group insurance often exists in organized plans provided by governments or sponsored by employers and professional associations [3].

6) The recession of yesteryears is jolting even the stability of the group sponsored plans looking for a marked shift towards individual plans.

7) With the risks of lack in the portability of records (barring few countries) and asymmetric information, the moral hazards underlying in any of the individual products pose a great challenge for the stability and profitability of the individual plan portfolio without adequate controls.

8) With the traces of “Excessive Claims Ratio” exceeding even 100%, the attractiveness of the individual plans is doomed, albeit only such plans may bring continuity of cover in future and can create more bargaining power in the “Health Insurance Exchanges” [4] [5].

9) So, on one hand it is a challenge to manage the claims ratio and also the expectations of customers where claims are certain at some time points especially those providing life coverages. Certain subject to the continuity of the policy because though the life span has increased, the certainty of the treatment during the last years of an insured’s life is almost certain. This can be explained by the principles of Rectangularisation of Mortality curve & Compression of Morbidity.

10) Hence, an actuarial pricing for a health insurance policy may not turn sufficient as the incidence of the claim & the claim amount will be varying stochastically due to various factors, e.g. health care innovations, utilization rates of health care technology & treatment rates at a future point of time, epidemics, spread of awareness, lifestyle of the people, cultural changes etc. [6] [7].

11) Examining the above items, we can provide a calculator or a planner to individuals who want to buy health insurance coverages. Consumers can determine the ideal age at purchase based on various factors which could help to increase the penetration and lessen the claims burden at the “Rectangularisation Stage” and manage the “Costs associated with the “Morbidity Density” at this stage.

12) It is important to note that managing the “Compression of Morbidity factors” along with efficient claims ratio is not only an insurance problem but also involves socio-economics, health economics, political & legal factors.

3. Contributions

1) A modified approach towards claims ratio viz. improving the claims ratio not only by focusing on the numerator but also more on the denominator. This is based on a small sampling collected from primary data & secondary data that has implications on new product designs, marketing approach & technological approach (Both technological process and Predictive modeling).

2) Rectangularisation & Claims ratio are wider topics. In-depth discussions about these 2 topics will be presented in future research papers. In this paper, we present a theoretical model to look at the Rectangularisation of survival curve and compression of the morbidity factors based on some hypothetical scenarios. Our model also recommends for segmented product models that could help to overcome the cost impact at the final stages of life. It is based on various assumptions and the work involves more detailed modeling and application testing which will be discussed as a future scope of work.

3) In this paper, we also propose a small framework that could assist individuals to determine the “Ideal age to purchase Health Insurance”.

4. Risk Management

4.1. The Challenge of Claims

Claims, a factor which cannot be avoided, must be monitored and handled with caution by health insurers [8] [9]. Despite the growth of various pricing techniques, it is always a challenge to manage claims within the expected levels. In an Indian example, in 2002, the premium income generated was around Rs. 1000 crores (1 crore = 10 M), the claims payouts were Rs. 1600 crores approximately. After 6 years, in 2008, the premium income reached a level of Rs. 6000 crores but the claim payout was around Rs. 8000 crores. Indian Health Insurance provides almost 10% of the spending of in-patient hospitalization which is estimated around Rs. 70,000 crores whereas the whole health care spending is estimated around Rs. 200,000 crores per annum. So, if India touches the 20,000 crore mark in 2015, and then the claims will be around 30,000 crores.

Normally, when the health insurance industry plans to reduce claims ratio, it also wants to focus on the reduction of claims expenses, For example, the insurance industry tries various methods to reduce the cost of claims by examining “Medical Tourism” wherein destinations like Caribbean Islands (for Americas), Morocco (for Europe), Thailand & India (for Asia in specific and global in general) are promoted as attractive medical tourism destinations. Ventures are on to build infrastructure in those countries to attract patients. Various studies are available for savings in the cost of treatment based on the treatments available at Medical tourism destinations.

This paper mainly focuses on two approaches for the efficient management of claims ratio:

・ Focus towards the Denominator apart from Numerator.

・ Managing the behaviors of the claims through Technology that could improve the Numerator.

4.2. Pattern of Diseases Vis-à-Vis Age

Due to the growth of complexities in life coupled with other sociological impacts by ways of malnutrition etc., there is no marked way to ignore any disease and benchmark it by stating the said disease will have its incidence only after a certain age. A quick analysis of claims records of a sample of 50,000 cases is shown in Figure 1.

This analysis is just an indicative and the purpose is to prove that there is no marked differentiation of diseases

Figure 1. Claims analysis of 50,000 cases.

vis-à-vis age. The peak counts can occur as early as the age of 24. This means that planning for health care expenses should be done early and health insurance coverages can start as early as in the 30’s. It is a myth to think that certain diseases and sicknesses, depending on individuals ’life styles, can occur only after their 40’s.

4.3. Shifting Focus towards Denominator

It is a known fact that Claims ratio = Claims Paid/Premiums received. In a way, the claims ratio can also be improved by increasing the premiums received in addition to improving the controls on the numerator.

Health Insurance in this matter is like a pension fund [10]. Unless, there is a regular inflow of new members to the pension fund and outflow, the stability of the pension fund becomes challenging [11]. Applying the same concept to health insurance, it is clearly understood that in no circumstance that all people fall sick at the same time. Only a certain percent of the insured population falls sick at particular time point which is analogous to a pension plan with a certain percent of retirees out of a plan of active participants. The stability of a health insurance funding system requires the growth and participation of younger members. Ideally, the health insurance premium collected should not exceed the medical and hospitalization expenses in agroup or country. In India, the estimated health care expenditure is close to Rs. 300,000 crore including expenses in Para medical, pharmaceutical expenses, etc. About one-third of the expenses attribute to hospitalization (mostly inpatient) related expenses. If hospitalization expenses could be covered by health insurance, then ideally health insurance premium would be close to Rs. 100,000 crore. However, it is only Rs. 6000 crores. Hence, a cluster-based approach can be tried for increasing the penetration levels in health.

Cluster-based product designs can be used as an approach to target the penetration. It can fine-tune the product designs by crediting different clusters with different preferential factors. In some countries, product designs are based on providing only tax benefits which may not yield anticipated results. A hierarchical cluster analysis was performed on a sample of around 200 people in India by one of the coauthors [12]. The factors that influence the purchase of the health insurance are listed below:

Cluster 1: Age, Sex, Work Experience, Marital Status and dependent children.

Cluster 2: Segment, Occupation and annual medical expenses.

Cluster 3: Sex and Adult Dependents.

Cluster 4: Monthly Income & Income Tax Assessment status.

Cluster 5: Location.

4.4. Need of Awareness Apart from Change in Product Designs

Even in more developed countries, e.g. the US, there are millions uninsured & underinsured. Health care reform, proposed by Obama, is a heated debate with various perspectives viz. Baucus Bill, COBRA benefits extension etc. At this juncture, this paper proposes to tweak the corporate health insurance models for increasing the penetration of health insurance in some other countries, e.g. India. Based on the lessons learnt, we can share our findings with an extension to other countries. Fundamentally, we can segregate the whole population into three segments as

1) People who are covered by Individual health insurance;

2) People who are covered by Group health insurance provided by employers; &

3) People who have no health insurance coverage.

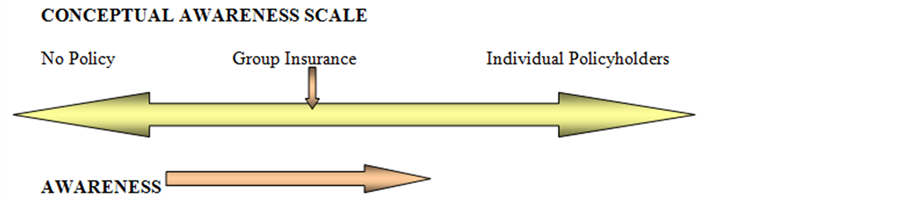

5. Conceptual Awareness Scale

5.1. Case of People Having Individual Health Insurance

From Diagram 1, we can see that individuals in this segment have the highest level of health insurance awareness. However, there are many individuals who have taken out health insurance policies do not understand the concept of health insurance, prevailing exclusions, for example. In India, the majority of people in this segment are under-insured and we notice there are people earning more than INR 300,000, have policies with only INR 50,000 sum insured. Agents fail to explain the same due to either poor knowledge or fear of losing business. Due to this, there are more lapsed policies in this segment, It is estimated as 10% - 15% of all health insurance lapsation annually. Agents and insurance companies fail to explain to the insured the consequence of lapsation of a health insurance policy.

Diagram 1. Concept awareness scale.

With the majority of health insurance policies being yearly-renewable, many policyholders who do not receive reminder notices on time, forget to renew their policies. If a life insurance policy is reinstated, a policyholder gets benefits without much difference prior to lapsation, By contrast, a health insurance policyholder loses many important benefits, e.g. exclusions and coverage for pre-existing diseases, upon the reinstatement of a lapsed policy.

Individual health insurance policyholders are supposed to have a higher level of awareness compared with those who are at the other end without health insurance coverage. Insurance companies are targeting this segment. It is a two-fold activity to win over the confidence of this segment. First, awareness should be created and second; the sale of the insurance policy must be executed. The activity seems to be a tough in the current scenario due to two reasons.

1) Insurance is still regarded only as a tax saving instrument with sizeable investment return. Health Insurance policies do not provide any investment return.

2) Some people view health problems philosophically rather than medically.

Under Group Insurance, insurance coverages are arranged for groups of buyers. Benefits are tailored for the needs of a group. Groups are based on employment or membership of societies, clubs, professions, etc. In India, most group insurance policies fall under the category of employment only. Benefits of Group insurance are numerous, like tax advantages for the employer, better bargaining and recruitment power, lower administrative expenses for the insurer, pooling of risk across different levels despite their insurability status, etc. In addition, some employers conduct medical test during the appointment, the quality of life is assumed to be good when compared with rest of the population.

However, most of the coverages and designs do not match with the characteristics of the group thus ending with more generous coverages, which indicates that there is still potential for up-selling insurance policies in this segment. The current scenario is such that many of the corporate employers are reducing the health insurance limit under the Group Health Covers and hence it is time for Insurance companies to focus more on up-selling opportunities among Corporate Health Insurance Policyholders so that the health premium income in the denominator is increased.

Let us consider that the Employer contribution to an insurance plan k, E(k) = A(k) + μP(k), which is expressed as a sum of A, a fixed contribution, which will vary across plans and the product of µ and P. P is the actual plan premium and µ is the Marginal subsidy. If we consider the marginal subsidy to include cross-subsidi- zation factor, the value of E(k) can’t be balanced which denotes the exorbitant claims ratio.

This paper analyses the expectations of the members of group health insurance plans, corporate policyholders, problems associated with such plans, tweaking the process and product features to enable interest among stakeholders, problems of moral hazard. The analysis of the primary data is given below which should give more input for the cross selling opportunities.

5.2. Primary Data Analysis

A pilot study was conducted among the employees of various organizations to understand the expectations of employees covered by group insurance policies. From 86 samples collected from employees covering software, government employees, Small Scale Industries (SSI), manufacturing sector, service sectors in Urban and Rural Areas adjoining the semi-urban areas. The important findings of the study and implications are listed in Figure 2.

・ 76.74% of the sample indicated that they incur medical expenses less than INR 500 per month, which indicates the quality of the health of them and their family members. Small groups from Small Scale Industries

Figure 2. Expectations of employees covered by group insurance.

and old employees of Government sector incur medical expenses more than INR 2000 per month (6.98%).

・ Surprisingly 44.19% of the sample does not have any insurance policies even towards their life. This indicates the failure of marketing programs to woo the segment for life and health.

・ 34.88% of the sample does not know the details of the group insurance coverages although they are covered by group insurance. There are instances among this (34.88%), around 7% have incurred some medical expenses in the past but have not claimed.

Premium affordability is a critical factor for purchase of additional coverage for majority of the people (82.35%). There are certain instances where Group Health Insurance policies are offered at the lowest rates due to pressure from competition, without the proper actuarial calculation of fair premiums. Sometimes this has forced the insurer to withdraw its coverage in the mid of the year due to exponential claims ratio in a particular account leading to multipronged negative effects over employers and employees. Recently, regulations were modified to control this.

In the equation for Group Health Insurance, E(k) = A(k) + μP(k), if we consider the marginal subsidy to include cross-subsidisation factor, which is experienced in India now, the value of E(k) can’t be balanced which denotes the exorbitant claims ratio. Hence we have to think about a scenario, which can increase the value of the left-hand-side of the equation by including more contribution from employees. Hence if we consider a scenario where employees make more contribution than employers to combat the situation of under-insurance coverage, it will require the designing of new plans to optimize financial inputs. The equation, with employees’ contribution will become, E(k) + Ee(k) = A(k) + μP(k), where E is the Employers’ contribution and Eeis the Employees’ contribution.

The above equation has to be dealt with carefully in the Indian environment as inclusion of Employees contribution to lessen the pressure arising from under-insurance coverage may overturn. For example, if the demand responsiveness increases, it may induce price reductions and hence increases adverse selections. On the other hand, more generous plans disproportionately attract the sickest employees. The presence of Moral Hazard can increase claims ratio and there are instances where TPAs have settled claims of INR 20,000 for dysentery, claimed by members of Group Health Insurance.

5.3. Scope for New Strategies

From the above analysis and discussions, it can be inferred that Strategies of insurance companies should be cluster-specific and based on identified clusters, similar occupation groups, etc. This can be taken as a miniature model for analysis.

From the conceptual awareness scale shown in Diagram 1, it can be inferred that Group Insurance exhibits the characteristics of both aware & unaware segments. Hence, Group Insurance (corporate) segment can be taken in the first phase as an experimental measure among selected groups.

・ For the purpose of illustration, we use an example in Diagram 2 to identify four groups of corporate insurance, A, B, C & D. Most insurance companies perform analyses of groups separately and do not collate the data of various groups or pool individual records exhibiting similar characteristics of a group of a cluster. However, in this method, let us assume that Group A and Group C are exhibiting similar characteristics and a list of 1 lakh (1 lakh = 100,000) individual policyholder characteristics exhibit the same characteristics of the cluster. The same should be pooled and the aggregated data can be studied. Employers can also share employees’ medical records which are collected during entry and annual medical examinations. This will enable insurers to perform better medical underwriting of the group.

・ The same can be correlated with available data of individual insurance policyholders.

・ Mapping & gap analysis using data warehouse between group and individual insurance can be performed to understand the behavior of individual insurance.

6. Technology Controlling Claims Ratio

Health Insurance involves complex underwriting rules and based on the claims pattern, the rules are modified often and also implemented immediately. Data warehousing and Data Mining & Predictive modeling techniques can help insurance companies to reveal the hidden secret in the data related to need for change in underwriting rules and claims procedures. BPM (Business Process Management) components in software application can help to implement any relevant changes immediately. Solutions are being developed taking into consideration claims leakage management.

6.1. Relationship between Claims Ratio & Rectangularisation

Rectangularisation is an effect over the mortality curve wherein there is an exponential change in the pattern of the curve beyond a certain age that makes the curve look like a rectangle. Hence, rectangularisation is more linked to the sudden increase in the death rate beyond a particular age. From health insurance perspective, such deaths are associated with the health care expenses and hence there is certainly a sudden increase in the health care expenses around the terminal period of an individual [13].

The increase in the health care expense contributes to the increase in the claims ratio. In an ideal scenario, if an individual who has health insurance coverage, continues to renew his policy, the extra health and medical expenses incurred during his terminal period will be covered within the income. Duetomarket competition, companies are forced to offer health coverages to individuals with pre-existing diseases and sicknesses provided that these individuals have continuous renewals for 4 - 5 years. In a high inflationary environment and with increasing treatment costs, it is not sustainable to provide comprehensive self-sufficient health insurance coverages to individuals who have paid premium continuously for only a limited number of years. Some countries are offering financial solutions to customers through “Life Insurance Trading” to provide expenses to the health care

Diagram 2. Data pooling.

to bridge the gap. Supplementary policies in the form of critical illness coverages and allowance policies are also becoming popular. In order to provide sufficient coverages to meet medical expenses beyond the lexis point, it requires a continuity of premium payments for a higher number of years due to the presence of moral hazard. Moral hazard is dishonesty or character defects in an individual that increases the chance and size of a loss, such as faking accidents or inflating claims amounts [13].

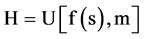

Basically, moral hazard can be defined as the tendency of an insured to maximize his utility function, U, when severity in sickness, s, occurs. Here, s is distributed with density function f(s). If m is denoted for the actual medical expense paid by the insured, we can define, H, as the health-care cost to an insurance company.

There are two ways for a customer to alleviate moral hazard.

1) By providing more evidence & interest towards primary health care.

2) By reserving claims on individual basis for later years.

Both 1) & 2) have link to each other, if an insured regularly undergoes primary health care checkups, there are chances that the “Incidence of Rectangularisation” is shifted over a few years may be 2 - 3 years.

6.2. De-Risking Rectangularisation

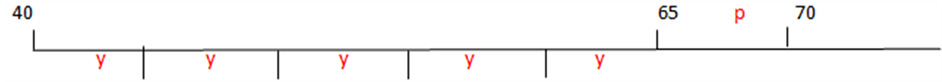

Assuming an individual having no health insurance becomes sick at the age of 65 and dies at the age of 69, the total expenses associated with medical treatments and health care in these final 5 years are P. Ignoring interests, P is the sum of five annual expenses X1, X2, X3, X4 & X5 for Age 65, Age 66, Age 67, Age 68 and Age 69 respectively.

Without health insurance, this individual would settle his medical bill, P, using his savings, borrowings and other regular income. Let us consider “y” as his savings, “Q” as his borrowings and “R” as his other income.In the absence of health insurance coverage, P may or may not be equal to the sum of y, Q and R. P<>∑(y + Q + R).

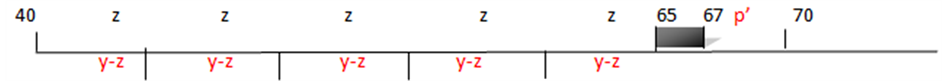

In another situation, assuming the same individual took out a health insurance policy at Age 40 with a sum insured, P, and paid an annual level premium of z. Some health insurance policies even offer regular primary health checks and studies have proved that primary health care delays the incidence of tertiary diseases and increases the survivability of the people. His annual savings were reduced by an amount, z, to (y − z). Due to the primary health care benefits provided by the policy, the incidence of the diseases is assumed to happen at the age of 67 instead of 65. The reduction in medical expenses which is shown in bold is equivalent to P ? P’.

Ideally, with regular health checks, P’ should not be great than P. Although the model is based on a zero interest rate environment and assumptions only, it gives an idea for non-actuaries or non-finance professionals to determine the purchase time of a health insurance policy. We will elaborate more on this suggested model in future research work.

6.3. Ideal Product Design

Due to different morbidity rates in different demographic regions, there is no single health care plan suitable for individuals and insurance companies. For example, even the factor of cross-subsidization is difficult to assess between the people in Tripura, a NE Indian state and the residents in Kerala, a SW state. Hence, research on the existing disease patterns, mortality rates, morbidity rates, consumer behavior at hospitals, hospital behavior towards patients are factors required in the design and pricing of packaged health insurance plans [14].

To reduce the severity of “Morbidity Density Burden”, new health insurance plans can be designed to meet the needs of various sub-groups in a population. There should be a base health insurance plan, bH, which provides coverages of primary health care and medical needs with proper deductibles. A well-designed primary health care system reduces the severity of Morbidity Density Burden. Similarly, a secondary medical care treatment plan, sH, could be provided to cater for the expenses associated with secondary medical care and treatment needs. A tertiary medical care plan, tH, could be added, if required. Ideally, the proper combination of these medical plans, depending on the needs of the individuals, helps to reduce the financial impact at the “rectangularisation stage”.

7. Conclusion

Various surveys across the globe indicate that although people are aware of the high costs associated with medical care and hospital treatments, they postpone the purchase of health insurance based on the assumptions that they will live long and they can take out health insurance policies later or older when they are likely to fall sick. This becomes a major challenge as this mentality induces adverse selection and moral hazard; increases the burden at rectangularisation stage and claims ratio. This paper introduces a way of identifying rectangularisation. Framework to calculate an optimal age at which an individual should purchase a health insurance policy can induce the consciousness, e.g. buying annuity products and various methods to reduce claims ratio using technological & processing methods, will be presented in future.

Acknowledgements

The authors would like to thank Xi’an Jiaotong-Liverpool University for supporting and sponsoring the publication of this paper.

Cite this paper

S. Jayaprakash,P. K. Dinakar,Michael Ha,Zhengjun Jiang,Uthit Siriwan,Manning Li,Chukwuemeka Okeagu, (2016) Rectangularisation Issues in Health Economics & Insurance: Measures and Mitigations. Journal of Applied Mathematics and Physics,04,1327-1335. doi: 10.4236/jamp.2016.47142

References

- 1. Jayaprakash, S. and Ha, M. (2015) Modeling Policyholder Behavior through Insurance Resonant Marts for Pricing Options and Guarantees. World Journal of Engineering and Technology, 3, 227-233. http://dx.doi.org/10.4236/wjet.2015.33C033

- 2. Ha, M., Rezaee, Z., Lo, D. and Zheng, L. (2015) Can a Postponed Retirement Solve the Financial Problem. Journal of Social Economics, 2, 89-93.

- 3. Bluhm, W.F. (1992) Group Insurance. ACTEX Publications, Winsted, Connecticut.

- 4. Black, K. and Skipper, H. (1987) Life Insurance. 11th Edition, Prentice-Hall, Upper Saddle Riv-er.

- 5. Rejda, G.E. (1991) Social Insurance & Economic Security. 4th Edition, Prentice-Hall, Upper Saddle River.

- 6. Gerber, H.U. (1997) Life Insurance Mathematics. 3rd Edition, Springer-Verlag, Berlin. http://dx.doi.org/10.1007/978-3-662-03460-6

- 7. Trowbridge, C.L. (1989) Fundamental Concepts of Actuarial Science. Revised Edition, Actuarial Education and Research Fund.

- 8. Rejda, G.E. (2011) Principles of Risk Management and Insurance. 11th Edition, Pearson.

- 9. Vaughan, E.J. and Vaughan, T. (2008) Fundamentals of Risk and Insurance. 10th Edition, John Wiley, Hobo-ken.

- 10. Anderson, A.W. (1990) Pension Mathematics for Actuaries. 2nd Edition, The Windsor Press Inc.

- 11. Berin, B.N. (1989) The Fundamentals of Pension Mathematics.

- 12. Jayaprakash, S. and Ganesan, S. (2004) Health Insurance in India—Turning the Turning. Geneva Association, Health & Ageing Newsletter.

- 13. Ha, M. (2014) Lecture Notes for MTH305: Financial Risk Man-agement. Xi’an Jiaotong-Liverpool University, Suzhou.

- 14. Jayaprakash, S. and Ganesan, S. (2005) Tweaking Corporate Health Insurance Models. First World Insurance & Risk Congress.

NOTES

*In memory of my father, Mr. Sugavanam Jegadeesan, who will be dearly missed.

#In memory of my aunt, Lucia Diana, who peacefully passed away on the 30th of April, 2016. She will be dearly missed.