Open Access Library Journal How to cite this paper: Obi, A.N. and Adeyemo, S.O. (2014) Evaluation of Capital Budgeting and Investment Decisions in Nigeria. Open Access Library Journal, 1: e141. http://dx.doi.org/10.4236/oalib.1101141 Evaluation of Capital Budgeting and Investment Decisions in Nigeria —A Study of Selected Industrial Firms in Imo State Adolphus Ngozika Obi1, Samuel Oluwaseun Adeyemo2 1Bursary Department, Federal Polytechnic, Nekede, Owerri, Nigeria 2Department of Mathematics and Statistics, Federal Polytechnic, Nekede, Owerri, Nigeria Email: sammy ad eye mo@ gma i l.co m Received 22 October 2014; revised 27 November 2014; accepted 16 December 2014 Copyright © 2014 by authors and OALib. This work is licensed under the Creative Commons Attribution International License (CC BY). http://creativ ecommon s.org/l icens es/by/4.0/ Abstract The study was primarily undertaken to evaluate the processes of capital budgeting and invest- ment decision in Nigeria. Particularly, it is an evaluation of the processes of capital budgeting and investment in capital assets in some manufacturing firms operating in Imo state. This study is aimed at evaluating the processes and procedures t hat Nigerian manufacturing firms adopt when budgeting for their long-term investments and the organizational structures that drive capital budgeting and investment decisions in the selected manufacturing firms as well as the impact of the economic environment on their ability to budget effectively. The study involved a survey of eight (8) out of the fourteen (14) active manufacturing firms in the state. A sample size of two hundred and forty (240) respondents was drawn from the selected firms, they were administered with structured questionnaire. The data collected were analyzed using tables, frequency, percen- tages, descriptive statistics, the t-test of population mean and the z-test of difference of means. The analysis revealed that: the firms budget for their capital investments using mainly the payback method of investment appraisal. The researcher therefore concluded that mangers tend to be overconfident in that they overestimate the precision of their information and their ability to con- trol risk; and though the sampled firms understand the obvious advantages of the net present value and the other sophisticated investment appraisal techniques over the payback method, they still adopt the later because of the nature of their economic environment, their size, lack of suffi- ciently qualified personnel, paucity of funds and their weak organizational structure. The re- searcher recommended that firms should hire risk-averse managers to make investment deci- sions on their behalf because the manager’s overconfidence serves to reduce the moral hazard that his risk aversion creates. Government at all levels in Nigeria should put in place a revolving fund to meet the long-term funding needs of the manufacturing sector which most of the banks are unwilling to provide at affordable interest rates. The present heavy tax burden on manufacturing firms by the Federal, States and Local governments should be discouraged.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 2 December 2014 | Volume 1 | Keywords Capital Budget, Business Risk, Discounted Cash Flow, Weighted Average Cost of Capital Subject Areas: Business Analysis, Business Finance and Investment 1. Introduction Capital budgeting is the process by which firms determine how to invest their capital. Included in this process are the decisions to invest in new project, reassess the amount of capital already invested in existing projects, allocate and ration capital across divisions and acquire other firms. In essence, the capital budgeting process de- fines the set and size of a firm’s real assets, which in turn generate the cash flows that ultimately determine its profitability, value and viability. In principle, a firm’s decision to invest in a new project should be made ac- cording to whether the project increases the wealth of its shareholders. Efficient allo cation of cap ital usually refer red to as capital budgeti ng is one of the most imp orta nt functions of financial management in mod ern times. This func tion involves the firm’s decision to commit its funds in long- term assets and other profitable activities. T he firm’s decision to invest fund s in long-ter m assets is of consider- able significance since they tend to influence its wealth, determine its size, set the pace and direction of its growth and affect its business risk, Pandey (1981) [1]. Capital budgeting addresses the question of how a com- pany decides to make investments in additional capacity or in ne w products and to replace worn-out fixed assets. Awomewe and Ogundele, (2008) [2], in their thesis “The importance of the payback method in capital budget- ing decision”, submitted to the school of management, Blekinge Institute of Technology, wrote: “the capital budgeting decision has been a very topical issue in the sustenance of a company. Several companies have lost their identity or liquidate d d ue to wrong capital b udget ing dec ision the y made at o ne par ticular ti me or the other. Based on these prevalent problems in industries and the effect of globalisation on industries, it is important to use effective method to analyze investment before decision is made. Capital budgeting is extremely important because the decision made involves the direction and opportunity for future growth of the organi s ati on.” Under conditions of global economy, the steady increase in the variety and scale of uncertainties, competitive interactions and risks prevail, and the difficulty to make reasonable investment decisions is growing. The effec- tive allocation of scarce resources can best be achieved with a sophisticated capital investment process. The process increases the probability of making rele vant investments b y ensuring that corpo rate strategy will be fol- lowed, that all i nvest ment opp ortunities will be considered appropriately and consistently, and that the counter- prod uctive p olitical aspect of informal d ec ision-making wil l be minimized. Because capital investment decisions rank among the most critical types of managerial decisions made in a fir m and can have majo r long-ter m implications, both positive and negative, for the success of a firm, managers must understand how capital investment decisions are made if they are to participate in improving corporate performance. Researches on capital budgeting and investment decisions in Nigeria have concentrated on the techniques used such as the payback period, net present value, internal rate of return, accounting rate of return, profitability index, etc. They established that Nigerian companies actually adopted one or more of these techniques but the outcomes have not been adequate. Capital budgeting is becoming increasingly more important as a kind of managerial tool in recent years. One important responsibility of a financial manager is to choose investmen ts with sat isfactory cash flows and rates of return. It therefore follows that a financial manager must be able to decide whether an investment is worth un- dertaking and be able to choose intelligently a mong two or more alter native s. T o d o t his, a pr ocedure called cap- ital budgeting is used to compare, evaluate and select the desired project or investment, Graham and Harvey (2001). Making correct capital budgeting and investment decision (e.g. whether to accept or reject a proposed project), ofte n requires recognising and correctly estimating the potentialities associated with projects. Inadequate evalu- ations and decision tools risk the possibility of applying scarce resources to areas which provide a return less than the cost of capita l, resulting i n a des truction of value, B righam (199 2) [3]. A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 3 December 2014 | Volume 1 | Most of the time, firms are attracted to any market opportunity or projects which will increase the owners’ equ i ty. However, due to limitations of the new projects and availability of funds, management needs to use cap- ital budgeting techniques to determine which projects will achieve the best return over an applicable period of time, Nasser (2010) [4]. He further summarised the procedures for capital budgeting as involving the accurate estimation of the p ro je ct cost, correc tly forecastin g its cash flo ws, evaluatin g the assoc iate d r isks, calculatin g the firm’s cost of cap ita l a nd using the se to determine the present and net present values of the project. A given Nigerian manufacturing firm operates in an environment where accurate and reliable data are inade- quate. The infrastructures needed to support its investments are weak and limited while its capacity to hire and retain sufficiently qualified personnel is hampered by lack of funds. This economic scenario poses a lot of chal- lenges to the ab ility of the firm to co rrectl y budget for its l ong-ter m exp e nditur e t hat d et er mines it s s urvi val a nd growth. It is for this reason that this study sets out to evaluate the process of capital budgeting and investment decisions in the selected Nige rian firms with a view to unveilin g the factors that drive the processes and making recommendations that will engender better r esults. 1.1. Statement of the Problem Capital investment decisions rank among the most critical types of managerial decisions made in a company and can have major long-term implications, both positive and negative. For the success of a company, managers must understand how capital investment decisions are made if they are to participate in improving corporate performance. The challenge faced by empiricists when testing for the presence and impact of managerial biases on capital budgeting and investment decisions is to develop a plausible measure of their biases. Although managerial over co nfid e nc e i s li ke l y to le a d firms t o ove ri n vest , si mp l y unc o ve ri ng inci d e nce s of o verinvest me nt to p ro ve or disprove any bahavioural theory of capital budgeting and investme nt decisions-ma king is genera lly i nsuff icien t. The reason is simple; many alternative theories revolving around asymmetric information or agency arguments can lead to the same predictions, Stein (2003) [5]. As such, in order to make a convincing case about behavioural influences on capital budgeting, researchers must associate some measure of overconfidence with firms’ eventual investment decisions and the outcome of these decisions. For a long time, such overconfidence were hard to find in finance, especially for agents making important decisions withi n corporations. As Stein (2003) [5] argue s, a mple evi denc e fr o m psyc holo gy s ho ws tha t ind ivi dual s te nd t o b e bia sed in the ir estimates of probabilities and that these biases affect their economic decisions. For the most part, however, the lack of direct overconfidence measures prevented empiricists from making a convincing case about the effects of this bias on capital budgeting decisions. The effects of overconfidence and optimism on capital budgeting poi nts to the tendenc y of ma nagers t o overestimate project cash flows. This leads to overinvestment, especially if firms do not adopt any control mechanisms aimed at trimming estimated cash flo ws. A natural instrument to counterbalance the inflated cash flows resulting from the behavioural biases of decision-makers is the discount rate that they use to calculate net present values. More specifically, the prescription of an inflated discount rate to calculate a project’s net present value should serve to reduce the effect of the manager’s bias on hi s ca s h flow estimates. In this circumstance, though the sampled firms budget for their capital expenditure using the recognised in- vestment appraisal methods, their investment decisions have not been as accurate as expected because the very economic factors t hat were u se d co uld no t be pr op erly contr o lled in an unc ert ain b usi ness enviro n ment i n whic h they operate. The outcomes of their investment decisions have led to huge losses, downsizing, declining capaci- ty utilization and in some cases, closure of operations. 1.2. Research Objectives The five (5) main objectives the researcher sets out to achieve through this study are as follows: 1) To identify the ex tent to which Nigeria n manu facturin g f ir ms apply capital budgeti ng pr ocesses in their de- cisions to acquire long-term assets. 2) To examine the processes and procedures followed in the firm’s decision to commit current funds into the acquisition o f long-term assets. 3) To enquire into the organizational structure in place in respect of making capital investment decisions for A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 4 December 2014 | Volume 1 | the firm. 4) To determine the investment appraisal method(s) that is most popular among Nigerian manufacturing firms. 5) T o exa mine the e xtent t o which t he economic environment affects the firm’s capital budgeting and invest- ment decisions. 1.3. Research Questions The researcher wishes to use this study to provide answers to the under listed five (5) questions. 1) To what extent does your firm apply capital budgeti ng in its decision s to acquire capital assets? 2) Does your firm follow any laid down rules in its decision to commit current funds into the acquisition of long-term a ssets? 3) Who take s the fi nal decision on wh ether or not the firm should acquire its long-term assets? 4) Whic h amo ng the rec o gniz ed inve st ment a pp raisa l t ech niq ues d oes your fir m co mmo nly u se wh en b udge t- ing for capital expenditure? 5) How has the economic environment affected the outcomes of your firm’s capital budgeting and investment decisions? 1.4. Research Hypothesis Based on the enormous challenges posed by capital budgeting and investment decisions on the profitability, sur- vival and growth of a gi ven f irm, t he hypothesis of this study is as fo l lo ws: Ho: The economic environment in which the firm operates does not significantly affect the outcome of its capital budgeting and investment decisions. Hi: The economic environment in which the firm operates significantly affects the outcome of its capital budgeti ng and investment decisions. 2. Literature Review The economists usually reserve the term investment for transactions that increase the magnitude of real aggre- gate wealth in the economy. This includes the purchase (or production) of new real durable assets such as facto- ries and machines, Parker (2010) [6]. Jiambalvo (2001) [7] in establishing the strong relationship between capi- tal b udgeting and invest ment decision wrote t hus: “investment decisio ns involving the acquisitio n of long-lived assets are often referred to as capital expenditure decisions because they require that capital (company funds) be expended to acquire additional resources. Investment decisions are also sometimes called capital budgeting de- cision”. Firms generally and manufacturing firms in particular are known to have adopted some of the investment ap- praisal methods in selecting projects that best meet their corporate objectives. Some of the investment appraisal methods to be discussed in this study include the payback period, net present value, internal rate of return, ac- counting rate of return, and the profitability index. Each of these methods involves some processes that could lead to sound investment decisions and it will be seen at the conclusion of this research how diligently Nigerian manufacturing firms process their investment decisions and the factors that impact on the process. Most academicians state that effective allocation can best be achieved with a sophisticated capital investment process. They assume that a sophisticated process increases the probability of making relevant investments by ensuring that corporate strategy will be followed, that all investment opportunities will be considered appro- priately and consistently, and that the counterproductive political aspect of informal decision-making will be minimized, Kersyte (2011) [8]. B ecause capital investment decisions rank among the most critical types of ma- nagerial decisions made in a firm and can have majo r long-term implications, both positive and negative, for the success of a firm, managers must understand how capital investment decisions are made if they are to par ticipate in improving corporate performance. Effective investment decision-making is essential to corporate survival and long-term success. These deci- sions help to mould firm’s future opportunitie s and develop competitive advantage b y influencing a mong other things, its technology, its processes, its working practices and its profitability. There are several important fea- tures for capital budgeting de cision-making to be effective, Adams e t al. (2004) [9]: A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 5 December 2014 | Volume 1 | • It is dynamic, not static. It explicitly recognises that the quality of information can be improved over time. Thus capital budgeting should be a sequential, multiple decision process that integrates the information needed to obtain cash flow estimates into the financial analysis of the cash flows. • It is linked to the strategy implementation in relation to the firm’s multiple stakeholders. Therefore, project proposals should be supported by relevant non-financial data and forecasts. • It recognises the o ptions i nher ent in value-enhancing capi tal bud geti ng. • It takes a cross-functional approach. The quality of estimates of expected cash flows and the uncertainty in cash flows are critical. Since the underlying information for these estimates come from many functions within the firm, those providing information must see themselves as strategic partners in th e process. • It views the firm’s compensation system as a centrepiece of capital budgeting. Unless the way in which managers and employees are rewarded is aligned with how capital is allocated, there will always be a possi- bility for poor decisions. • It stresses the importance of performance-based training. The people using capital budgeting must under- stand it, b uy into it and implement it c onsisten tly across the entire firm. Cross-functional training designed to enhance the performance of those involved is essential. The research of investment m a nageme nt l ite r at ur e sho ws t h a t t wo main a p pr o ac he s de fin i ng c ap it al bud ge t in g can be distinguished: the normative approach and the process approach. 2.1. The Normative Approach The normative approach represents the traditional theory on capital budgeting presenting rules on which basis the enterprise can make an investment decision. According to this approach, the emphasis is on the financial evaluation a nd selection o f the long -term investment in assets, and the development of advanced capital budget- ing techniques and their application in various situations are key issues, Madhani and Pankaj (2008) [10], An- gelou and Economides (2009) [11]. Although rigorous evaluation tools are important components of a sophisticated capital budgeting process, investment success depends on improving the entire process. Almost three decades ago, it was noted that too much emphasis was being placed on methods of ranking and selecting capital budgeting proposals. Focusing on the simple selection phase is myopic, and a more global approach is necessary to fully understand the capital budgeting process, Farragher et al. (1999) [12], Adler (2000) [13], Burns and Walker (2009) [14]. Therefore, from this point o f view the capital b udgeting process must be viewed in its entirety and the informational needs to suppor t e ffecti ve decisions must be built i nto the firm’s de c isio n support system. 2.2. The Process Approach The process approach to capital budgeting endorses broader perspectives, attempting to explain the way firms actually bring into effect their investment decisions, the way the investment opportunities are identified and analysed , the way the decisions are made, the way the returns on investments are evaluated, Ducai (2009) [15]. The models deriving from the process approach are mostly based on extensive case studies achieved in the en- terprises to identify the decisive stages related to the investment opportunity. Therefore the scientific literature on the subje c t te nds to be strongl y empirically oriented. Maccarrone (1996) [16] stated that capital budgetin g should be vie wed in the wider context o f strategic plan- ning and identified six fundamental phases in the capital budgeting process. At first, investment opportunities are identified, then, development and evaluation are performed by collecting relevant and detailed information for each alternative, and evaluating their profitability and global attractiveness. A screening of investment pro- pos als which have pa ss ed through the previous phase might be necessary because of financial or strategic factors. As a result, some projects might be cancelled or postponed to another planning period. Authorisation or project app roval and imple mentat ion/c ontrol a re the ne xt phase s. Final stage is the post -auditing, that enables the com- parison of the outcomes of each project with budget targets in order to assess forecast accuracy and identify er- ror patterns with a feedback effect on the whole decision process. Under po st-aud it and co ntrol, if a project does not appear to be developing as expected, the firm may want to abandon the project and reallocate its capital, Pr ueitt and Park (1997) [17]. Koch et al. (2009) [18] also listed six stages in the process as: identification, search, information acquisitio n, selection, financing and implementation/control. Whereas Burns and Walker (2009) [14] described the capital A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 6 December 2014 | Volume 1 | budgeting p rocess in ter ms of four p hases: identificatio n, develop ment, selection a nd control. T he identification phase comprises the overall process of project idea generation including sources and submission procedures and the incentives/reward system, if any. The development phase involves the initial screening process relying pri- marily upon cash flow estimation and early screening criteria. The selection phase includes the detailed project analysis that results in acceptance or rejection of the proj ect for f unding. F inall y, the control phase involves the evaluation of project performance for both control purposes and continuous improvement for future decisions. All four phases have common areas of interest including per- sonnel, procedures and metho ds involve d, a long with the rational e for each. As the literature review above described, various researchers have applied various labels, yet the main idea of the process sequence is almost the same and the stages/phases of the investment are, in substance, proposal initi- ation, proposal development, proposal management and project approval. An investment proposal is initiated in response to identification of a need or a problem. The development of the proposal includes estimation of the cost s and b e ne fi ts, a nd e val ua t io n o f al terna ti ve s. Pro p o sa l manage ment is t he g uid i ng of the i nve st ment p r o po s- al throu gh the orga nisation, cul mi nati ng in p rojec t approval. These stages have been found to occur in a botto m-top manner, with some iter ation be tween cont iguous sta g- es. Propo sals are initiated and d eveloped by the division sp ecialists thoug ht to be closest to the relevan t product market or operation and thus to have the best infor mation with which to identi fy needs and opportunities. Divi- sion managers conduct proposal management. The participation of senior management is indirect, consisting primarily of providing the organizational structure and strategic contexts for the investmen t decision. This generalised model, describing a complex multi-stage process, is the standard process model of capital investment or the Bower-Burgelman model, Maritan and Coen (2004) [19]. However, the capital budgeting process of investing in strategic projects that generate new capabilities is considerably different. Senior manag- ers are directly involved in the definition and impetus stages of these projects as well as indirectly involved thro ugh setting the structura l and s t rategic cont exts. 2.3. The Organisational Structure for Effective Capital Budgeting and Investment Decisions In Nigeria generally and Imo State in particular, studies have shown tha t only fe w firms can lay clai m to having a well-developed, efficient and practical capital-budgeting plan. Due to various economic constraints faced by the Nigerian firm, structuring for effective capital budgeting process is often overlooked, not given the desired attention or jettisoned altogether. How an organisation is structured plays key roles in directing its operations, hence very vital in its decision making process. The capital budgeting process involves some levels of actions and deci s i ons within the firm and only tho s e firms that are properly structur ed ge t them ri ght most of the t imes . A typical capital budgeting process involves four broad stages, Pandey (1981) [1]. • Project generation. • Project evaluation. • Project selection. • Project execution. These broad stages must be supported by the equivalent levels of organisational structure to ensure smooth and successful operations. Appleby (1981) in explaining the levels of organisatio n wrote “that small fir ms have a simple organisational structure. In this structure, ther e is spe c ia lisation of jobs, but it i s flexible. Often, jobs are made to fit the person available, example, if the sales manager has aptitude for figures, he may be placed in charge of Accounts with its obvious negative impact on the system. This is typical of manufacturing firms in Imo State as they are mainly of the small and medium size categories; they lack adequate resources needed to employ the relevant personnel. In this type of structure, rules are few and decisions are largely based on expe- rience. As the firm expands, more specialists and managers are required. At this level of organisation, duties are more specific and the qualities and qualifications needed by the personnel for each job are less personal but strictly based on q ualification, ability and c apacity of the individual. Detailed rules governing all aspects are formulated to guide mana gers in the running of their departments. A typical str ucture of the firm that g uides its opera tions includin g capital budget ing and inve stment activitie s is shown in Figure 1.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 7 December 2014 | Volume 1 | Figure 1. A typical organisational structure. Source: Appleby, R.C. (1981) [20]. Modern business adminis- tration, 3rd edition. • SHAREHOLDERS: They contrib ute their fund (capital) to establish the firm and do not take part in the d ay to day running of the business of the firm. • BOARD OF DIRECTORS: They establish the corporate objectives of the firm and make strategic corpo- rate decisions. • MANAGING DIRECTOR/CHIEF EXECUTIVE OFFICER (CEO): Operates business in order to ac- complish corporate objectives. • SENIOR MANAGERS/FUNCTIONAL HEADS: Co-ordinate activities to attain corporate objectives. • SENIOR ASSITANT MANAGER (Specialists): They assist senior managers and act as their deputies. They provide specialists’ inputs into t he o perations of their depa r tments/units. • SUPERVISORS, example, Foremen: They work to put Management’s plan into effective action, allocat- ing indi vi dual wor k and ensuri ng that they are accomplished. • WORKERS: The y carr y out the i nstruct ions of their supervisors and work to translate corporate plans into tangible result s. Generally speaking, for any firm to be effective, its structure must be adequate and duties at each level prop- erly specified, recognized and respected. However, the nature of operations of an organisation dictates the structure that will effectively drive it. For manufacturing firms, the functional approach has been widely rec- ommended, and the functional departments that are found under the control of the managing director/chief ex- ecutive officer are as shown in Figure 2. The structure which is typical of a manufacturing firm harmonises the activities of individual functions to- wards achieving the corporate strategic and tactical plans. They combine their know-how to effe ct i vel y d r ive the hierarchy of plans of the firm. The inadequacies of organisational structure in the sampled Nigerian firms ad- versely affected their overall performances. 2.4. Organisational Structure for the Finance Function Since capital bud geting and investment decision in a fir m is a maj or function of the finance department, it fol- lows that a well structured and properly staffed finance function holds the key to the realisation of this very corporate objective. Ross et al. (2001) [21] demonstrated a balanced finance department required in a good or- ganis ational s tructure (Figure 3). The essence of a well defined organisational structure for the finance department is to support the implemen- tation of capital expenditure and project control with particular reference to the financial pr ocedures that may be  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 8 December 2014 | Volume 1 | Figure 2 . Functional approach to organisational structure. Figure 3. Organisational structure for the finance department. Source: Ross et al. (2001) [21]. Fundamentals of corporate finance. adopted to ensure proper project author isation a nd eval uation; measure p rogress at a ll stages of completion and report to management information on projects as an aid to their successful completion or modification, Nor man Thornton (1978) [22]. 3. Research Methodology It is true that an empirical research work cannot be achieved by mere classroom work only. Some special me- thods are usually adopted in such a study to arrive at some conclusions at the end. Consequently, some special data gathering techniques which relate to the nature of the study (Capital Budgeting and Invest ment Decision in Nigeria with focus on some manufacturing firms in Imo State) have been adopted. 3.1. Research Design The survey research method has been adopted in this study. Anyanwu (2000) [23] defi ned t he sur vey metho d o f research as the investigation of the behavior, opinion or other manifestations of a group of people by questioning them. The survey may involve all or some of them and hence the associated concepts of population and sam- pling. 3.2. Sampling Design/Plan Data collection for the research work is made from two main sources, namely: • Primary sources, and • Secondary sources. A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 9 December 2014 | Volume 1 | Primary Sources: These are from questionnaires administered on the staff of the selected manufacturing firms located in Imo State. Questionnaire is therefore the major primary source of data for this research work. The researcher designed questions which were administered on the relevant staff o f the eight (8) manufacturing fir ms s ampled in the course of the study. The questions were structured so as to obtain direct answers from the respondents using simple words they could ea sily und er sta nd, he nc e the reasonably high participation (95%) achieved. The nature of this topic neces- sitated the use of questionnaire because in this part of the world corporate financial information are not easily disclosed to non staffers; in some instances, some of the employees are not privileged to have to have access. Those who responded did so because of the confidentiality associated with the use of questionnaire. Secondary Sources: These are from already existing materials which are relevant to the topic of the study. Data were mainly sourced from the review of available relevant documents and these included textbooks, jour- nals, s eminar s and work sho p pa pers, research work, among others. 3.3. Sampling Unit The population covered in this study comprises of thirty (30) staff from each of the eight sampled manufacturing firms, the repre sentation composed of the following: • Finance Section • Productive Section • Personnel Section • Marketing Section 3.4. Sampling Size The simple random sampling procedure was used to select the sample from the population in each of the eight firms. The sample was randomly selected and the breakdown of sample figures achieved is as stated below: • Finance Section 15 • Production Section 8 • Personnel Section 4 • Marketing Section 3 • Total respondents sampled in each firm 30 Therefore, the researcher sampled thirty (30) staff from each of the eight selected manufacturing firms, this gives a total sample size of two hundred and forty (240) staff used for this study. 3.5. Sampling Procedure The sampling procedure adopted for this study was a simple-random samplin g that is to say that a frame/map of the whole departments was made and replacement was avoided. The simple random sampling, a probability sampling method allows the samples to be selected with a known probability. In probability sampling, each element/per s on has a k nown (non-zero) chance of being considered. 3.6. Method of Data Analysis The methods that were adopted in analyzing the data collected from the questionnaire instrument are: • The percentages; • The descr iptive statistics • The t-test of population mean, a nd • The Z-test of difference of means. Computer application packages SPSS and MS Excel were used in the data analysis. 4. Analysis, Results/Findings, Discussions This section deals with the presentation of data collected from primary sources and analysis represented in tabu- lar form. It emphasizes on the presentation of data, graphical representation of the data and appro priate tests of hypotheses stated in chapter one.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 10 December 2014 | Volume 1 | The research was carried out to evaluate capital budgeting and investment decisions in Nigeria with particular reference to manufacturing firms in Imo state. Eight out of t he identi fied fo urteen firms we re surve yed. A sam- ple of 240 respondents was selected for this research. Prior to t he ma in sur vey, a pr eli min ary st ud y (p ilo t stud y) was conducted as reported in the dissertation proposal. 4.1. Analysis/Result s The records of the returned questionnaire are here under presented in a tabular format. Of the 240 questionnaire administered, 228, representing 95% were completed and returned. Tables 1-16 show the frequencies and percentages of the responses of the respondents with respect to the questions on the questionnaire. Table 1. Duration of service. Frequency Percent Valid P er cen t Cumulative Percent Valid LESS THAN 2 YEARS 20 8.8 8.8 8.8 2 - 4 YEARS 42 18.4 18.4 27.2 5 - 7 YEARS 55 24.1 24.1 51.3 8 - 10 YE ARS 51 22.4 22.4 73.7 MORE THAN 10 YEARS 60 26.4 26.4 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: Majority of the respondents have served their firms for more than five (5) years. Table 2. Section/department of respondent. Frequency Percent Valid P er cen t Cumulative Percent Valid Finance Section 115 50.4 50.4 50.4 Productive Section 60 26.3 26.3 76.8 Personn el Section 32 14.0 14.0 90.8 Marketing Section 21 9.2 9.2 100.0 Tota l 228 100 Interpretation: 50.4% of respondents are from the finance section, 26.3% of respondents are from the production section, 14% of respondents are from the personnel section and 9.2% of respondents are from the marketing section. Table 3. Does your firm apply capital budgeting process in making investment decisions? Frequency Percent Valid P er cen t Cumulative Percent Valid YES 172 75.4 75.4 75.4 NO 56 24.6 24.6 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 11 December 2014 | Volume 1 | Interpretation: 75.4% of respondents indicated that capital budgeting process is applied in making investment decisions in the manufacturing firms considered. Table 4. To what extent does your firm apply capital budgeting in its decisions to acquire capital assets? Frequency Percent Valid Percent Cumulativ e P ercent Valid To a Great Ext ent 91 39.9 39.9 39.9 To a Less Extent 15 6.6 6.6 46.5 In Very Few Cases 10 4.4 4.4 50.9 As Determined by the MD/CEO 107 46.9 46.9 97.8 Not Applicable 5 2.2 2.2 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: 39.9% of respondents indicated that capital budgeting process is applied in making investment decisions to a great extent and 46.9% indicated that capital budgeting process is applied in making investment decisions as deemed fit by the MD/CEO in the manufacturing firms considered. Table 5. Which one among the listed techniques does your firm commonly use when budgeting for capital expenditure? Frequency Percent Valid Percent Cumulativ e P ercent Valid Payback Period 90 39.5 39.5 39.5 Accounting Rate of R et u rn 40 17.5 17.5 57. 0 Inter nal Rate of Re t u rn 30 13.2 13.2 70.2 Net Presen t Va lue 46 20.2 20.2 90.4 Profitability Index 20 8.8 8.8 99.1 None of the Above 2 0.9 0.9 100.0 Tota l 228 100.0 Source: Sample survey, 2013. Interpretation: 39.5% of respondents indicated that payback period technique is employed by their firm when budgeting for capital expenditure. 17.5% use Accounting rate of return, 13.2% use internal rate of return, 20.2% use Net present value and 8.7% use Profitability Index in the man ufacturing firms c onsidered . Table 6. Which of the above mentioned methods do you recommend to your firm as the most appropriate in making in- vestment decision? Frequency Percent Valid Percent Cumulativ e P ercent Valid Payback Period 75 32.9 32.9 32.9 Accounting Rate of R et u rn 40 17.5 17.5 50. 4 Inter nal Rate of Return 36 15.8 15.8 66.2 Net Presen t Va lue 50 21.9 21.9 88.2 Profitability Index 27 11.9 11.9 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 12 December 2014 | Volume 1 | Interpretation: 32.9% of respondents indicated that they would recommend the payback period technique to their firm as the most appropriate technique when making investment decisions. 21.9% would recommend Net Present Value 17.5% would recommend Accounting Rate of Return, 15.8% favoured the Internal Rate of Return while 11.9% recommende d the Profitab ility Index. Table 7. Which of the under listed factors influences your firm in deciding to invest in long-term assets? Frequency Percent Valid P er cen t Cumulative Percent Valid Availability of Funds (on ly) 15 6.6 6.6 6.6 Overall Corpo rate Need ( O n ly) 20 8.8 8.8 15.4 Proprietor’ Need (O n l y) 50 21.9 21.9 37.3 Market Need ( O n l y) 10 4.4 4.4 41.7 Investment Climate ( O n l y) 10 4.4 4.4 46.1 All of the Above 123 53.9 53.9 100.0 Tota l 228 100 100 Source: Sample survey, 2013. Interpretation: 53.9% o f respondents indicated that all t he listed factors influenced their firm’s decisio n in long ter m invest- ment. 21.9% agreed that the need of the proprietor is the major factor. Table 8. Does your firm follow any laid down rules in its decision to commit current funds into the acquisition of long-term assets? Frequency Percent Valid P er cen t Cumulative Percent Valid YES 72 31.6 31.6 31.6 NO 48 21.1 21.1 52.6 NO IDEA 80 35.1 35.1 87.7 NEUTRAL 28 12.3 12.3 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: 35.1% of the respondents indicated that they have no idea if laid down rules are adhered to in the firm’s deci- sion to commit current funds into the acquisition of long term assets. 31.6% said yes, 21.0% said no while 12.3% are indifferent in the manufacturing firms considered. Table 9. Who takes the final decision on whether or not the firm should acquire its long-term asset s ? Frequency Percent Valid P er cen t Cumulative Percent Valid MD/CEO 138 60.5 60.5 60.5 Board of Directors 72 31.6 31.6 92.1 Management Committee 18 7.9 7.9 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 13 December 2014 | Volume 1 | Interpretation: 60.5% of respondents affirmed that the MD/CEO takes the final decision on whether or not the firm should acquire long term assets. 31.6% indicated that the decision is taken by the board of directors while 7.9% said that the management committee has a role to play i n such final de cision in the man ufact uri ng firms consider ed. Table 10. How do you describe the economic environment of Nigeria in general and Imo State in particular as it affects your firm’s operations? Frequency Percent Valid P er cen t Cumulative Percent Valid Harsh 98 43.0 43. 0 43.0 Discouraging 118 51.8 51.8 94.7 Encouraging 12 5.2 5.2 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: 51.8% of respondents affirmed that the economic environment is discouragin g to their firms operatio ns while 43% indicated that the economic environment is harsh to their firms operations in the manufacturing firms con- sidered. Table 11. The economic environment in which the firm operates does not significantly affect the outcome of its capital budgeting and investment decisions? Frequency Percent Valid P er cen t Cumulative Percent Valid Stron gly Agree 13 5.7 5.7 5.7 Agr e e 25 11.0 11.0 16.7 Disagree 73 32.0 32.0 48.7 Stron gly Disagree 117 51.3 51.3 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: 51.3% of respondents strongly disagreed that the economic environment in which the firm operates does not significantly affect the outcome of its capital budgeting and investment decision. 32.0% disagreed, 11.0% agre ed and 5.7% stro ngly agreed. Table 12. Do you agree that a good organizational structure plays positive role in your firm’s capital budgeting processes? Frequency Percent Valid P er cen t Cumulative Percent Valid Stron gly Agree 118 51.8 51.8 51.8 Agr e e 98 43.0 43.0 94.8 Disagree 7 3.1 3.1 97.9 Stron gly Disagree 5 2.1 2.1 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: 51.8% of respondents strongly agreed that a good organisational structure plays positive roles in firm’s capital budgeting processes. 43.0% agreed, 3.1% disagreed and 2.1% strongly disagreed.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 14 December 2014 | Volume 1 | Table 13. There is a significant relationship between capital budgeting and the firm’s organisational structure. Frequency Percent Vali d Percent Cu mulative Percent Valid Stron gly Agree 104 45.6 45.6 45.6 Agr e e 85 37.3 37.3 82.9 Disagree 25 11.0 11.0 93.9 Stron gly Disagree 14 6.2 6.2 100.0 Tota l 228 100.0 100.0 Source: Sample survey, 2013. Interpretation: 45.6% of respondents strongly agreed that there is a significant relatio nship b et ween capital b udgeting and the firms’ organisational structure. 37.2% agreed, 11.0% disagreed and 6.2% strongly disagreed. 82.9% cumula- tively agr eed on t hi s . Table 14. The decision as to whether or not the firm should invest in long-term assets is no t the pr eserve of an y officer of the firm to make. Frequency Percent Valid P er cen t Cumulative Percent Valid Stron gly Agree 35 15.4 15.4 15.4 Agr e e 44 19.3 19.3 34.6 Disagree 84 36.8 36.8 71.5 Stron gly Disagree 65 28.5 28.5 100.0 Tota l 228 100.0 Source: Sample survey, 2013. Interpretation: 36.8% of respondents disagreed that the decision as to whether the firm should invest in long term assets or not is not the pr eserve of a ny o fficer o f the firm to make. 28.5% strongly disagreed, 15.4% strongly agreed and 19.3% agreed. 65.3% of the respondents cumulatively disagreed with this while 34.7% agreed. Table 15. Your firm’s employees are adequately qualified for the job they do as regards capital budgeting. Frequency Percent Valid P er cen t Cumulative Percent Valid Stron gly Agree 19 8.3 8.3 8.3 Agr e e 33 14.5 14.5 22.8 Disagree 75 32.9 32.9 55.7 Stron gly Disagree 101 44.3 44.3 100.0 Tota l 228 100.0 Source: Sample survey, 2013. Interpretation: 44.3% of respondents strongly disagreed that most staff employed in the firm are adequately qualified to han- dle budgeting. 8.3% strongly agreed to this. 77.2% of the respondents cumulatively disagreed with this. Table 16. What per centage could you quantify the economic environment of Nigeria in general and Imo state in particular as it affect s your firm’s operat ions descripti ve statistics. N Minimum Maximum Mean Std. Deviation Percentage 2 28 20 58 28.45 14.361 Source: Sample survey, 2013.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 15 December 2014 | Volume 1 | Interpretation: The responses were graded from 0% to 100% indicating what the economic environment is to the firm’s op- eration. 100% indicates a perfect encouraging situation and 0% indicates a perfect harsh condition. The mini- mum response was 20% and the maximum was 58%. The mean of all observations was 28.45% and the standard deviation was 14.361. 4.2. Test of Hypothesis on the Population Means Test Statistic is where; (sample mean) (sample standa rd deviation) Decision: We shall reject H0 if , otherwise, we do not reject H0. 28.45 5022.66 14.361 228 Z− == − Conclusion: Since the , we shall reject H0 and thus conclude that the average effect of economic en- vironment on firm’s operations less than 50% confirming that the economic situation is discouraging and not favourable to the firms’ ope rations. 4.3. Findings 1) T he research elicited more interest among the long-serving staff as 166 or 73% of the 228 that returned the questionnaire have served their firms for 5 years and above. 2) A little above 50 % of the respondents are staff of the finance sections of the firms sampled. 3) Over 75% of the firms surveyed apply capital budgeting process in making investment decision. 4) The extent to which capital budgeting is applied in the decision to acquire capital a ssets acr oss t he fir ms is largely determined by the Managing Director/Chief executive officer. 5) The payback period and Net present value appraisal techniques are more preferred by the firms. 6) Most of the staff sampled recommended payback period to their firms. 7) The Net present value also enjoys their recommendation. 8) All the listed factors: overall corporate interest, availability of funds, investment climate and market need influence the fir m’s decision to invest in long-ter m asset s, tho ugh the proprietor’s need seems to be the overrid- ing facto r . 9) The firms follow some laid down rules in their decision to commit current funds into the acquisition of long-term assets but many of their staff claimed ignorance of the existence of those rules. 10) Over 60% of those sampled said that the Managing Director/Chief Executive Officer takes the final deci- sion on whether or not the firm should acquire long-term assets. 11) The e conomic environment in which the firms o perate i s bot h harsh and disc ouraging to their operations. 12) More than 83% of the respondents disagreed with the assertion that the economic environment in which the firm opera te s does not significantl y af fect the outcome of its capital budgeting and investment de c isions. 13) Over 94% of the respondents agreed that a good organisational structure plays positive role in their firm’s capital budgeting processes. 14) 83% of respondents agreed that there is a significant relationship between capital budgeting and the firm’s organisatio nal s t ructure . 15) Majority of the respondents disagreed that the decision as to whether or not the firm should invest in long-term assets is not the preserve of any officer of the firm to make. A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 16 December 2014 | Volume 1 | 16) Only about 23% of the respondents agreed that employees of the firm are sufficie ntl y q ualified for the j ob they do as regards capital budgeting. 4.4. Discussion of Findings The responses to the research questions have been analyzed using simple percentage ratios. The analysis show that the r esponses and the results from t he test of hypotheses flow in the same dir e c tion. Most of the firms surveyed belong to the small and medium sized categories. Out of the listed 1 4 active man- ufacturing firms in Imo State, only two are public limited liability companies whose shares are quoted on the Niger ia n Stoc k Exc ha nge mar ket. The remaining 12 are private limited liability companies whose shares are not so quoted with all the attendant limitations in relation to access to their financial information, their ability to access funds, capacity to invest in long-term assets, etc. The firms are mainly managed by their owners who exercise absolute control over their operations, this ne- gates the principle of participatory management which is needed to drive effective capital budgeting process. This is aptly demonstrated in Table 4 where the result is that majority of the firms apply capital budgeting process as determined by the Managing Director/Chief Executive Officer. The operations of these firms do not necessarily lend themselves to proper internal governance as the wish of the owner-manager pre vails most of the time. This is a major drawback on effective capital budgeting process which entails a stage-by-stage approval process to be properly actualized. There were instances where the owner would buy an equipment at an exhibition he attended without consult- ing the production manager. The equipment when installed, may not fit into the production programme of the firm, the result is that the expected returns will not materialize and corporate objective not achieved. It is noticeable from the results in Table 5 and Table 6 that most of the firms prefer to use the payback me- thod which has a serious flaw. The Payback method ignores the time value of money, though it is easy to use and simple to calculate and understand. Small business owners rely on Payback period for their capital bud get- ing decisions because the principles underlying it are easily understood. The payback period shows the small business owner how long it will take him to payback his investment in the project. This concept is more mea- ningful to a small business owner like a typical Imo state based manufacturer than the other methods, particu- larly because of the liquidity of the firm, rather than the return on investment. Because cash flows in the distant future are inhere ntly risky, a shorter payback period implies that a project is less risky, Br igham, et al. (1992) [3]. He continued; the problems with the payback period are abundant. The payback method ignores those cash flows beyond the payback period, and ignores the time value of money. By ignoring these principles, the pay- bac k method doe s not maximise t he ret urn on investment of the f i rm. Because of the unpredictable investment climate in Nigeria, the sampled firms continue to prefer the quick recovery of their invested capital to future return on investment. The result is that these firms do not engage in long te r m plann ing, and as su ch ar e no t co ncerne d with lon g ra nge cap ita l bud get ing te ch niq ues. In Nige ria , th is is jus tified given the dear th of a dequa te and reliable financial data, lack of investible funds and such other envi- ronmental factors that imp act negatively on the busines s of t he firm, Akande (201 1) [24]. The more sophisticated investment appraisal techniques like the net present value, internal rate of return, profitability index, accounting rate of return, etc., are not as widely recommended as the payback period despite their ob vious advantages because they require the input of experts which the firms are unable to employ. Since it is the Managing Director/Chief Executive Officer that determines the choice of technique rather than the nat ure of op eration, as depicted in Table 7, the result i s that even if there are laid down rules guidi ng capital budgeting and inve stment decisions in the firms, majority of the employees do not key into it because the y are not usually carried along. If the employees do not take active part in the capital budgeting process as suggested in the results, they will not be motivated enough to ensure that expected results are achieved. The fiscal and economic challenges faced by Nigerian firms were listed by the Director General of the Manu- facturers’ Association of Nigeria (MAN), Akande, O. O. in the MAN’s 40th annual report and accounts (2011) [24] to include: weak infrastructure particularly in the area of power supply, inconsistency in fiscal, monetary and trade policies, multip lic ity of taxes /le vies, dear th o f long-term fund/high cost of fund, persistence congestion at the sea ports, etc. These economic challenges have serious negative effects on the firms’ capacity utilization as shown on Fig- ure 4.  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 17 December 2014 | Volume 1 | Source: 40th annual report and accounts 2011; Manufactu rers’ association of Nigeria. Figure 4 . Average capacity util ization of Nigerian manufacturing firms in 2010 and 2011. In support of his views, Akande pointed out that average electricity supplied to industrial consumers per day in hours dropped from 9.7 hours in 2010 to 6.7 hours in 2011. Again, average interest rate increased from 18.7% in 2010 to 22.03% in 2011. The combined effects of all the economic factors mentioned above are that forecasting which is the basis of capital budgeting becomes difficult and estimates used in making capital expenditure decision unrealistic. Assets acquired will not be fully utilised due to policy inconsistency of the government and persistent weak infrastruc- ture needed to drive capacity utilisation. This scenario makes capital investment very unpredictable and risky as depicted in the r esults shown on Table 10 and Table 11. An organisationa l struct ure de fines fu nctions, f unctio naries, their li mits of author ity and r elatio nships. I t is the people that make up an organisation, their individual and collective actions make the organisation wor k. Like all other oper ations of the fir m, cap ital budge ting a nd inves tment de cisions must b e drive n by t he input s of the re- levant personnel properly organized and working in a synergy, hence the positive relationship established be- tween capital budgeting and the firm’s organi s atio nal s t ructure (see Table 12 and Table 13). When an organisation is properly structured, important decisions like capital investment will not be the pre- serve of any officer but a result of a well coordinated effort of a group of well motivated employees working towards achieving a corporate objective. The result shown in Table 14 contradicts this collective approach to management through the instrumentality of an effective organisational structure. Over 65% of the respondents disagreed with the state ment that “the decision as to whether or not the firm should invest in lo ng-term asset s is not the preserve of an officer of the firm to make”. This is supported by another 77% who also disagreed that the firm’s employees are adequately qualified for the job they do as regards capital budgeting and investment deci- sion-making as shown on Table 15. These results support the already established fact that the capital investment decisions these firms make de- pend largely on the personal perception of the owner-manager and not necessary as dictated by the nature of the assi gnment o n hand. It is usuall y the o wner -manager t hat det ermines ho w much to invest, how to invest, where to invest and when to make the investment. The hiring of employees in most of these firms do not depend on qualification s and skills but on some other consider ations like relatio nship, tribe, r eadiness to accept lo w salary, among others. 5. Summary From the computations and analysis of data, the findings are summarized as follows: 1) Manufa cturing firms in Imo Sta te do budget for the ir capital investments. A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 18 December 2014 | Volume 1 | 2) The payback method is the most commonly applied by the firms. 3) The proprietor’s need is the most important factor in the decisio n of the firm to i nve st in long -term asse ts. 4) Some laid down rules are followed in the firms’ capital budgeting and investment decision process but such rules are not properly brought to the knowledge of the relevant the staff. 5) It is the managing director/chief executive officer that determines the nature and magnitude of the firm’s capital budgeting and investment decisions. 6) The Nigerian economic environment does not encourage the operations of t he fir m’s includ ing t heir cap ita l budgeti ng and investment decision processes. 7) A good organisational structure has a significant positive relationship with the firm’s ability to budget prop e rly for its capital investments. 8) Lack of sufficie ntly qualified personnel i n the employment of the fir ms impact nega tively on their choice and application of capital budgeting and investment appraisal techniques. 5.1. Conclusion Managers tend to be overconfident in that they overestimate the precision of their infor mation and their abilit y to control risk. Firm managers are especially prone to such a bias as their overconfidence leads them to decision- making roles and proves to be difficult to learn away in an economic environment with infrequent and imprecise feedback. In capital budgeting situations, overconfidence leads managers to overinvest. As the existing empirical litera- ture shows, overconfidence leads managers to invest free cash flows more rapidly, to start more new firms, in- vest in more novel projects and to stick with an unprofitable investment policy for too long. Learning, inflated hurdle rates and contractual incentives can reduce the investment distortions that result from managerial over- confidence but do not appear sufficient to eliminate them. The literature on the impact of managerial biases on capital budgeting is still relatively young. Most of the progress on directly linking proper measures of executive overconfide nce to their firm’s invest me nt polic y has been made in the last five to ten years . In t his a ut ho r’s v i e w, the fact that managerial traits seem to systematically and persistently correlate with the investment policies of firms remains a puzzle in need of more research. In addition to a deeper exploration of the interaction between contr actual ince ntive s, ove rconf idenc e and inves tment polic y, a p rod uctive direc tion is to study t he ent ire se t of tradeoffs that overconfidence brings to an organization. That is, the overaggressive investment policy that comes with managerial overconfidence could be the cost for larger benefits elsewhere in the firm. For example, recent work on the leadership role of overconfident agents seems to indicate that overconfidence is valuable for the in- terna l wor kin gs of the fir ms. I n the sa me ve in, o verc onfi dence can increase efficiency, the likelihood of survival and e co nomic growth. In this ligh t, the o ver al l net pr e sent value o f ove r co n fid enc e i n thei r fi r ms i s po ss ib l y p o s- itive, despite the capital b udgeting and investment decisions mistakes that they prompt. Though, the firms understand the obvious advantages of the net present value and other techniques over the payback method, the later is commonly applied by the firms sampled because of the nature of their economic environment, t heir small and medium size, lack of sufficiently qualified personnel and their weak organisational structure. In other words, they lack the very factors needed for effective capital budgeting and investment deci- sion process es. 5.2. Recommendations 1) Nigerian fir ms should hire risk-averse managers to make investment decisions on their behalf because the manager’s overconfidence serves to reduce the moral hazard that his risk aversion creates. The manager’s risk aversion makes his investment decisions overl y cautio us, but his overconfidence provides a naturally offsetting force b y making the manager think tha t his informatio n and skill allo w him to contro l risk better than he reall y can. Again, contractual incentives must come with a transfer of risk from the risk-neutral firm to the risk-averse manager, they are cheaper and more efficient if the manager can commit to an investment strategy that is as close to firs t-best as possible. This is precisely what overconfidence achieves; the biased manager naturally fol- lows an investment policy that is more in line with the shareholders’ objective, and so compensation arrange- ments can be more efficient. 2) Nigerian firms should also avoid mistakes when they decide to enter a new market. Firms systematically overrun their budget for new projects and overestimate their eventual market share with the effect, to properly  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 19 December 2014 | Volume 1 | take their competition into account when they assess their prospects for success in a new market. The tendency of individuals to overestimate their skills relative to those of their peers can be particularly detrimental when these individuals must compete with their peers. 3) Managers should learn from the outcomes of their investment decisions and appropriately adjust their be- liefs about their ab ility to pr ocess informatio n. If this were the case, managers’ expectations should become bet- ter calibrated over time and, as a result, they should make fewer investment mistakes. The feedback that manag- ers get about the ir investment decisions should be precise, qualitati ve and timely. 4) Government at all levels should put in place a revolving fund to meet the long-term funding needs of the manufacturing sector which most banks are unwilling to provide at affordable interest rates. This will encourage capital investments by these growing manufa cturi ng firms r esultin g to the corre sponding gr owth of the nationa l economy. 5) The p ower generat ion, tr ans missio n and distribution in sta llations i n the co untr y should b e made to functio n prop erly to enable the fir ms put their capita l assets into maximu m use. T his i s the perfe ct wa y of i ncreasi ng ca- pacity utilizatio n of Nigeria n fir ms whic h is presently o n the steady decline as repo rted by MAN. 6) The present heavy tax burden on manufacturing firms resulting from the continuous imposition of taxes and levies especially by the States and Local Governments should be discouraged. Tax administration in the country should be harmonised to avoid multiplicity and encourage long-term financial planning by Nigerian firms. 7) Proprietors of manufacturing fir ms in Imo State should encourage the full develop ment of the struc ture of their organisations with its attendant benefits which include: clear definition of functions, proper allocation of responsibilities to relevant officers, clear reporting lines and limits of authority which are the ingredients of ef- fective and efficient management. The staff must be made aware of the policies of the firm as their full under- standing thereof motivates them to put in their best towards achieving corporate objectives. 8) Firms in the manufacturing sector should engage sufficiently qualified personnel that are relevant in their drive for growth. The resort to the rule of the thumb approach to capital budgeting and investment decision process is no longer feasible in the face of the prevalent information revolution that has forced changes in the way firms operate. 5.3. Suggestion for Further Research The research was conducted in Imo State which is not one of the industrial states in Nigeria. Manufacturing firms opera ting in Imo State belong mainly to the small and medium size category. They lack of adequate funds needed for capital investment, recruitment and retention of sufficiently qualified personnel and their organisa- tional structures are not yet well developed. It wa s there fore, not ea sy to o btai n suc h resu lts t hat co uld ful ly de- scribe capital budgeting and investment decision processes in Nigerian manufacturing firms. As a result, I am suggesting that further research on the topic be carried out on manufacturing firms operating in any of the industrial states of Lagos, Rivers, Anambra, Kano or Kaduna so as to obtain a more representative result. References [1] Pandey, I.M. (1981) Financial Management. 2nd Revised Edition, Rashtravani Printers, New Delhi. [2] Awomewe, A.F. and Ogundele, O.O. (2008) The Importance of the Payback Method in Capital Budgeting Decision. Blekinge Institute of Technology, Blekinge. (Unpublished Work) [3] Bri gham, E.F. (1992) Management Theor y and Practice. 5th Ed ition, The Dryden Press, New York. [4] Wadee, N. (2010) Capital Budgeting: Theory and Application. New York Institute of Technology, Center for Entre- preneurial Studies, New York. [5] Stein, J.C. (2003) Agency, Information and Corporate Investment. In: Geo r ge, M., Constantinides, M.H. and Stultz, R.M., Eds., Handbook of the Economics of Finance, Else vie r North-Holland, Amste r d a m, 111-163. [6] Parker, J. (2010) Theories of Investment Expenditures. Economies 314 Course Book Chapter 15, 2. [7] Jiambalvo, J. (2001) Managerial Accounting. John Wiley & Sons, Inc., Hoboken. [8] Kersyte, A. (2011) Capital Budgeting Process: Theoretical Aspects. Kaunas University of Technology, Kaunas. [9] Ad ams , C., Bourne, M. and Neely, A. (2004) Measuring and Improving the Capital Planning Process. Measuring Business Excell ence, 8, 23-30. http://dx.doi.org/10.1108/13683040410539409  A. N. Obi, S. O. Adeyemo OALibJ | DOI:10.4236/oalib.1101141 20 December 2014 | Volume 1 | [10] Madhani, P.M. (2008) RO-Based Capital Budgeting: A Dynamic Approach in New Economy. ICFAI Journal of Ap- plied Finance, 14, 48-67. [11] Angelou, G.N. and Economides, A.A. (2009) A Compound Real Option and AHP Methodology for Evaluating ICT Business Alternatives. Telematics & Informatics, 26, 353-374. http://dx.doi.org/10.1016/j.tele.2008.02.004 [12] Farragher, E.J., Kleiman, R.T. and S ahu, A.P . (199 9) Cu rren t Capital Investment P ract ices. Engineering Economist, 44, 137-150. http://dx.doi.org/10.1080/00137919908967513 [13] Adl er, R.W. (2000) Strategic Investment Decision Appraisal Techniques: The Old and the New. Bu sin ess Horizo ns, 43, 15-22. [14] Burns, R.M. and Walker, J. (2009) Capital Budgeting Surveys: The Future Is Now. Journal of Applied Finance, 19, 78- 90. [15] Ducai, M.T. (2009) Aspects Regarding the Capital Budgeting. Review of Management & Economic Engineering, 8, 173-182. [16] Maccarone, P. (1996) Organizing th e C apital Budgetin g Process in Large Firms. Management Decision, 34, 43-56. http://dx.doi.org/10.1108/00251749610121489 [17] Prueitt, G.C. and Park, C.S. (1997) Phased Capacity Expansion—Using Continuous Distributions to Model Prior Be- liefs. Engineering Economist, 42, 91-110. http://dx.doi.org/10.1080/00137919708903172 [18] Koch, B.S., Mayper, A.G. and Wilner, N.A. (2009) The Interaction of Accountability and Post-Competition Audits on Capital Budgeting Decisions. Academy of Accounting and Financial Studies Journal, 13, 1-26. [19] Maritan, C.A. and Coen, C.A. (2011) Investing in Capabilities: The Dynamics of Resource Allocation. Organization Science, 22, 99-117. [20] Appleby, R.C. (1981) Modern Business Administration. 3rd Edition, Pitman Books Limited, London. [21] Ross, R., Westerfield, R.W., Jordan, B.D. and Firer, C. (2001) Fundamentals of Corporate Finance. Second South African Edition, Mc Gra w-Hill Book Company, Australia Pty Limited, USA. [22] Thornton, N. (1978) Management Accounting. William Heineman Ltd., London. [23] Anyanwu, A. (2000) Research Methodology in Business and Social Sciences. Canun Publishers Nigeria Limited, Owerri. [24] Akande, O.O. (2011) 40th Annual Report and Account 2011. Manufacturers’ Associ ation of Nigeria .

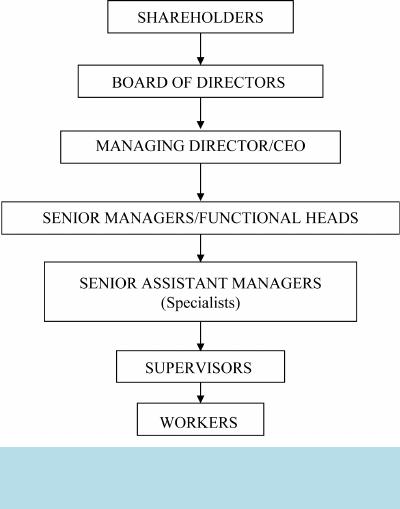

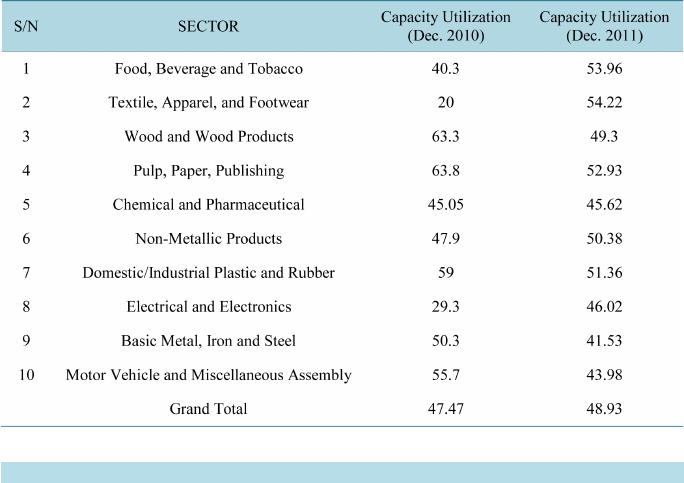

|