Paper Menu >>

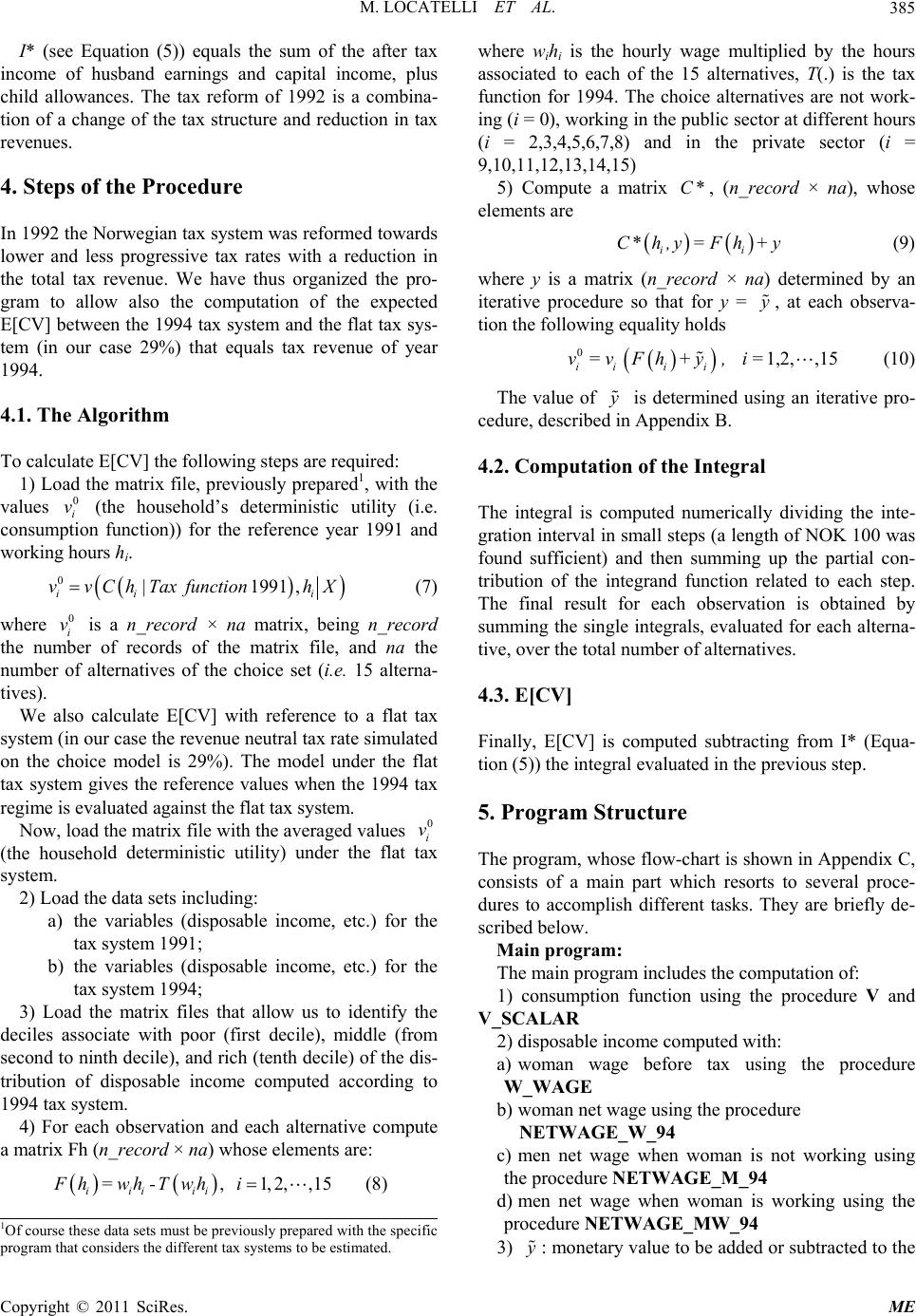

Journal Menu >>

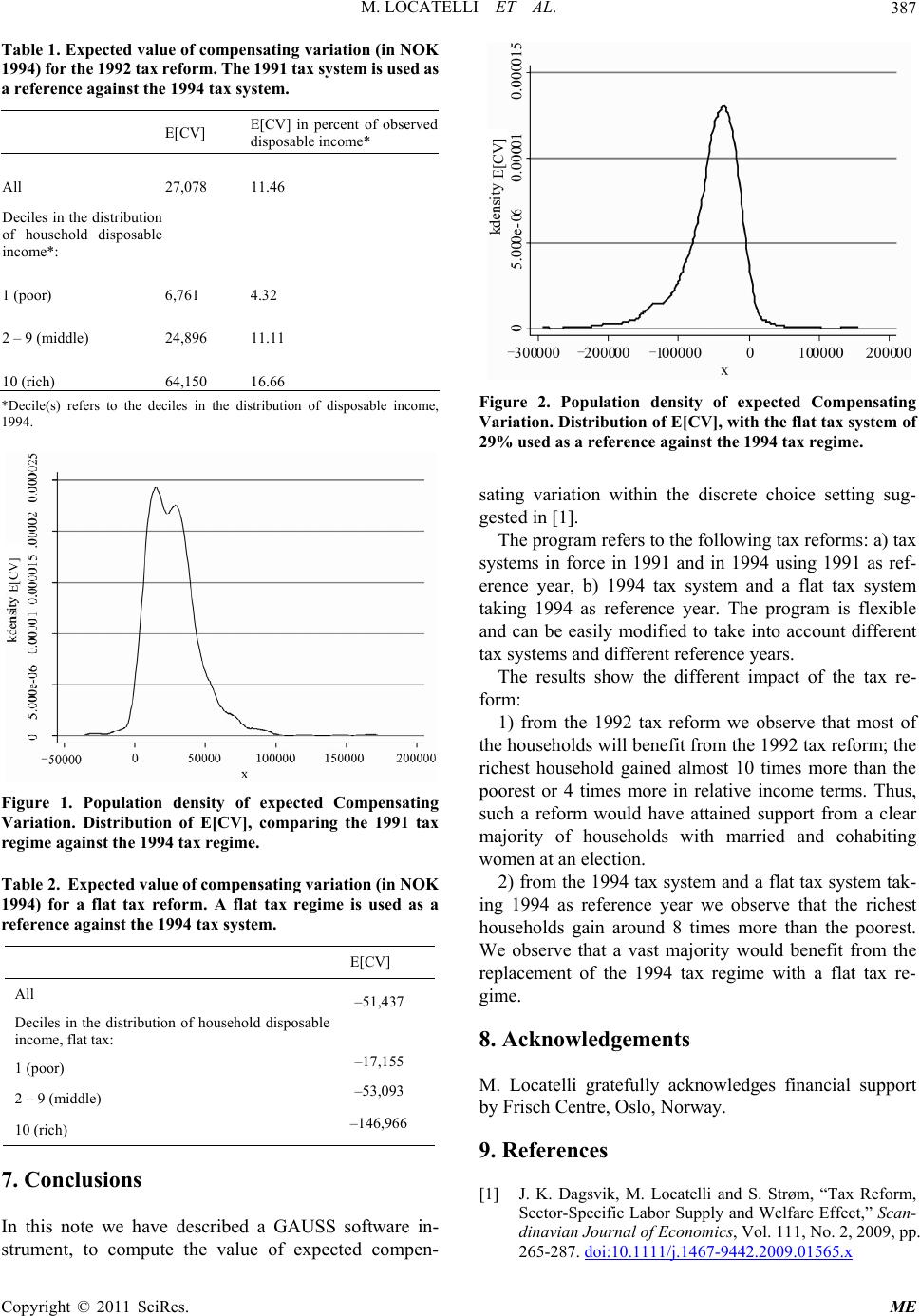

Modern Economy, 2011, 2, 383-389 doi:10.4236/me.2011.23041 Published Online July 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Computation of the Compensating Variation within a Random Utility Model Using GAUSS Software Marilena Locatelli, Steinar Strøm University of Turin and Child Centre, Turin, Italy, Frisch Centre, Oslo, Norway E-mail: marilena.locatelli@unito.it, steinar.strom@econ.uio.no Received February 23, 2011; revised April 10, 2011; accepted April 22, 2011 Abstract To evaluate a tax reform in terms of change in household welfare one possibility is to estimate the compen- sating variation using a suitable model to assess the change in the household utility. When a random utility model is used, the computation of compensating variation is not straightforward, particularly when utility is not linear in household income. It can be carried out using a methodology recently proposed in the literature. In this paper we describe a software instrument, implemented using GAUSS programming language for computing the compensating variation to evaluate the 1991 tax reform introduced in Norway. The program is flexible and adaptable to different tax systems and different reference years. JEL Classification: C63, B21 Keywords: Compensating Variation, Gauss Application, Tax System Evaluation 1. Introduction In 1992 the Norwegian tax system was reformed towards lower and less progressive tax rates, with a reduction in the total tax revenue. In the next following years the tax struc- ture was kept nearly unchanged. To evaluate a tax reform in terms of change in household welfare one possibility is to estimate the compensating variation (CV) using a suit- able model to assess the utility of the households. The theoretical framework and the empirical results of the evaluation of the above tax reform are reported in [1] in which there is also an extensive literature review on this subject. Novelty of the paper is the use of a random utility labor supply model, taking into accounting also sectoral choices (public and private), to assess the impact of tax reforms on household welfare. Some partial details on the algorithm implementation were first given in [2]. The computation of CV is not straightforward in a random utility model, in particular when utility is not linear in household income. A random utility function implies that the expenditure function is also random. Until recently, no analytic formulas have been available for calculating the distribution of CV. However, [3] have developed analytic formulas for this purpose, and we apply their methodology to calculate the distribution of CV and the mean and vari- ance of this distribution. What we thus do is to calculate the expected value of CV for each household and its distribution in the popula- tion. The purpose of this note is to describe the software in- strument, implemented using Gauss software package [4], to evaluate the above tax reform in terms of change in household welfare within a random utility model. The pro- gram is flexible and adaptable to different tax systems and different reference years. The paper is organized as follows. In the next Section, the data used in estimations are described. The model is explained in Section 3. In Section 4 we analyze the main steps of the procedure and in Section 5 the program struc- ture is outlined. The results are reported in Section 6. Sec- tion 7 draws some conclusions. The Table upon the estimation is reported in Appendix A. The interpolation method followed in the computation of CV is described in Appendix B. In Appendix C we re- port the GAUSS program flow. The complete program code can be downloaded [2]. 2. The Data Data on the labor supply of married women in Norway used in this note consist of a merged sample from “Sur- vey of Income and Wealth, 1994”, Statistics Norway  M. LOCATELLI ET AL. 384 (1994) and “Level of Living Conditions, 1995”, Statistics Norway (1995). Data cover married couples as well as cohabiting couples with common children. The age of the spouses ranges from 25 to 64. None of the spouses are self-employed and none of them are on disability or other type of benefits. All taxes paid are observed and in the assessment of disposable income, all details of the tax system are accounted for. The size of the sample used in estimating the labor supply model is 810 (referred to as n_record in the pro- gram). 3. The Model To evaluate the tax reform of 1992 we calculate the change in household welfare. One way is to apply the measure of CV. The calculation of CV is not straight- forward in a random utility model when utility is not linear in household income. A random utility function implies that the expenditure function is also random. A general treatment of this issue was undertaken by [3] while in [1] the method was adapted to the change in household welfare with labor supply random utility model. What we do is to calculate the expected value of CV, E[CV], for each individual and thereafter the distribution of this value in the population from which we can derive mean, median etc. We will assume that the utility function has the struc- ture ,for 0,1,2,3,UC, h, z=vC,hzz (1) where C is the household disposable income, which equals the sum of the after-tax labor income of husband and wife plus the after tax capital income and public transfer like child allowances; h are hours of work. In details: 0 (not working), 315, 780, 1040, 1560, 1976, 2340, 2600 (both for public and private sector); v(.) is a deterministic function and ε(z) is a positive random taste shifter. The taste shifter accounts for unobserved indi- vidual characteristics and unobserved job-specific attrib- utes z. {ε(z)}, are independently distributed with c.d.f. exp(–x–1), x > 0. From Equation (1) we get the following implicit defi- nition of the CV when the tax regime of 1991 (prior to the tax reform) is compared to the tax regime of 1994 (after the tax reform): ,,Taxregime1991 ,, Taxregime1994 UCh z UC CVhz (2) In Equation (1) we have suppressed the subscript of the individual and we should also keep in mind that the choice of each individual is to choose to work or not, and given work, to choose sector and hours of work, given the job opportunity sets and the budget constraints under the different tax regimes and CV. In the calculation of the expected value of CV we take this choice structure into account. If an individual benefits from the tax re- form, the expected value of CV for this individual is positive, meaning that this amount has to be subtracted from household income under the 1994 tax regime in order to make the individual indifferent between the two tax regimes. To proceed with the calculation we need some nota- tion. Note first that the deterministic part of the utility function can be written , iii vvChhX (vi referred to as consumption function in the following), where i denotes the different job alternatives. In the examined case the choice alternatives (na) are 15: i = 1 the indi- vidual is not working, and denote hours of job in the public sector, while denote hours of job in the private sector. X is a vector of all exogenous characteristics. 2,3, ,8i 9, ,1i5 Now let 0Taxregime 1991 ii i v=vCh,hX (3) and let **,, ii vyvC hyhXi (4) where *, ii ChyFhy , iii ii F hwhTwh and T(.) is the tax function for 1994, wi is the wage rate. Let E[CV] be the expected value of the compensating variation, which can be calculated for each individual as follows [3]: 15 0 15 0* 0 1 ECV d * max , yi iii i iii iii i y Ivgb vgbvy gb (5) where, according to estimates given in [5] and reported in Appendix A, 4 6 11 13 1 4 4 1 foralliexceptfor4,6,11,13 exp(0.68) exp(1.58) exp(0.80) exp(1.06) 1 exp4.200.22; for2,3,,8 exp1.140.33;for9,10,,15. i i i gi g g g g b bXi bXi and is given by the following equation: i y 0* iii vvy (6) Copyright © 2011 SciRes. ME  M. LOCATELLI ET AL.385 I* (see Equation (5)) equals the sum of the after tax income of husband earnings and capital income, plus child allowances. The tax reform of 1992 is a combina- tion of a change of the tax structure and reduction in tax revenues. 4. Steps of the Procedure In 1992 the Norwegian tax system was reformed towards lower and less progressive tax rates with a reduction in the total tax revenue. We have thus organized the pro- gram to allow also the computation of the expected E[CV] between the 1994 tax system and the flat tax sys- tem (in our case 29%) that equals tax revenue of year 1994. 4.1. The Algorithm To calculate E[CV] the following steps are required: 1) Load the matrix file, previously prepared1, with the values (the household’s deterministic utility (i.e. consumption function)) for the reference year 1991 and working hours hi. 0 i v 0|1991 , ii i vv ChTax functionhX (7) where is a n_record × na matrix, being n_record the number of records of the matrix file, and na the number of alternatives of the choice set (i.e. 15 alterna- tives). 0 i v We also calculate E[CV] with reference to a flat tax system (in our case the revenue neutral tax rate simulated on the choice model is 29%). The model under the flat tax system gives the reference values when the 1994 tax regime is evaluated against the flat tax system. Now, load the matrix file with the averaged values (the household deterministic utility) under the flat tax system. 0 i v 2) Load the data sets including: a) the variables (disposable income, etc.) for the tax system 1991; b) the variables (disposable income, etc.) for the tax system 1994; 3) Load the matrix files that allow us to identify the deciles associate with poor (first decile), middle (from second to ninth decile), and rich (tenth decile) of the dis- tribution of disposable income computed according to 1994 tax system. 4) For each observation and each alternative compute a matrix Fh (n_record × na) whose elements are: , 1,2,,15 iii ii Fh = wh-Twhi (8) where wihi is the hourly wage multiplied by the hours associated to each of the 15 alternatives, T(.) is the tax function for 1994. The choice alternatives are not work- ing (i = 0), working in the public sector at different hours (i = 2,3,4,5,6,7,8) and in the private sector (i = 9,10,11,12,13,14,15) 5) Compute a matrix , (n_record × na), whose elements are C* ii C*h,y= Fh+ y (9) where y is a matrix (n_record × na) determined by an iterative procedure so that for y = y , at each observa- tion the following equality holds 01,2, ,15 iii i v=vFh+y, i= (10) The value of y is determined using an iterative pro- cedure, described in Appendix B. 4.2. Computation of the Integral The integral is computed numerically dividing the inte- gration interval in small steps (a length of NOK 100 was found sufficient) and then summing up the partial con- tribution of the integrand function related to each step. The final result for each observation is obtained by summing the single integrals, evaluated for each alterna- tive, over the total number of alternatives. 4.3. E[CV] Finally, E[CV] is computed subtracting from I* (Equa- tion (5)) the integral evaluated in the previous step. 5. Program Structure The program, whose flow-chart is shown in Appendix C, consists of a main part which resorts to several proce- dures to accomplish different tasks. They are briefly de- scribed below. Main program: The main program includes the computation of: 1) consumption function using the procedure V and V_SCALAR 2) disposable income computed with: a) woman wage before tax using the procedure W_WAGE b) woman net wage using the procedure NETWAGE_W_94 c) men net wage when woman is not working using the procedure NETWAGE_M_94 d) men net wage when woman is working using the procedure NETWAGE_MW_94 1Of course these data sets must be previously prepared with the specific p rogram that considers the different tax systems to be es t imated. 3) y : monetary value to be added or subtracted to the Copyright © 2011 SciRes. ME  M. LOCATELLI ET AL. 386 woman net wage of 1994 (Fh 94) for which the utility of 1994 equals that of 1991. It is evaluated resorting to the procedure INCR and the command lines listed in the main program for the refinement of the interval were the solution lies. 4) the integral using the procedure INTEGRAND. 5) E[CV] and E[CV] statistics for the total sample and for deciles of disposable income distribution (poor (first decile), middle (from second to ninth decile), and rich (tenth decile). Procedures (listed in alphabetic order): HALF: solution refinement through half interval search INCR: iterate until an interval is found with function values of different sign INTEGRAND: computation of the function to be in- tegrated and the integral (Equation (5)), for given y, ob- servation i, and alternative j INTERP: search a solution via linear interpolation NETWAGE_M_94: compute man net wage when woman is not working (1994 tax system). NETWAGE_MW_94: compute man net wage, when woman works (1994 tax system). NETWAGE_W_94: calculation of woman net wage (i.e. women working) using tax function 1994 V: computation of consumption function The procedure returns the matrix v (of dimension n_record × na) of the consumption function for a given matrix of disposable income disp (of dimension n_record × na), according to the following equation: 0.64 4 , , 2 11 0.53 23 0.64 4 , 0.53 1060000 1 exp 1.770.64 115.02 63.619.20 1 3640 1.27 0.970.53 1060000 1 0.12 0.64 11 3640 0.53 ij ij ii j ii ij j C v XX h XX C h where Ci,j = disposable income of record i and alternative j, passed as a parameter to the procedure. The other parameters are passed as global variables and have the following meanings: Xi1 is the logarithm of age of the woman, Xi2 is the number of children aged 0 - 6, and Xi3 is the number of children aged 7 - 17. V_SCALAR: computation of the value of consump- tion function v for a single value of disposable income, a given sample i and alternative j. This is the scalar version of procedure V. The procedure returns the value (scalar) of the consumption function v for a given disposable income disp, sample i and alternative j according to the equation reported for procedure V above. W_WAGE: Woman wage income before tax. 6. Results The expected CV obtained from the above procedure is reported in the following Table 1. From Ta ble 1, we observe that the mean household in the sample gained NOK 27078 from the 1992 tax reform. The richest household gained almost 10 times more than the poorest or 4 times more in relative income terms. The distribution of expected gain across households is given in Figure 1, and we observe that most of the households will benefit from the 1992 tax reform. Thus, such a reform would have attained support from a clear majority of households with married and cohabiting women at an election. 1 (11) We have also calculated the expected value of com- pensating variation of a flat tax reform. In the calcula- tions, the tax-revenue-neutral flat tax reform of 29% is used as a reference. Negative values mean that the nu- merical values have to be subtracted from household incomes under the flat tax regime in order to make the households indifferent in welfare terms between the 1994 regime and the flat tax regime. The expected CV is re- ported in the following Table 2. This Table then says that, on average, the households will gain NOK 51528 if there is a shift from the 1994 tax regime to a flat tax re- gime. The richest households gain around 8 times more than the poorest. Thus, in a distributional sense, the richest household benefited more from having the 1991 regime replaced with the 1994 tax regime than they would have in the case of a shift from the 1994 tax regime to a flat tax regime. In Figure 2, we show the population density of the individual mean CV. We observe that a vast ma- jority will benefit from the replacement of the 1994 tax regime with a flat tax regime. More details of the results are reported in [1]. Copyright © 2011 SciRes. ME  M. LOCATELLI ET AL.387 Table 1. Expected value of compensating variation (in NOK 1994) for the 1992 tax reform . T he 1991 ta x sys tem is us ed as a reference against the 1994 tax system. E[CV] E[CV] in percent of observed disposable income* All 27,078 11.46 Deciles in the distribution of household disposable income*: 1 (poor) 6,761 4.32 2 – 9 (middle) 24,896 11.11 10 (rich) 64,150 16.66 *Decile(s) refers to the deciles in the distribution of disposable income, 1994. E[CV] Figure 1. Population density of expected Compensating Variation. Distribution of E[CV], comparing the 1991 tax regime against the 1994 tax regime. Table 2. Exp ected valu e of co mpensating variation (in NOK 1994) for a flat tax reform. A flat tax regime is used as a reference against the 1994 tax system. E[CV] All –51,437 Deciles in the distribution of household disposable income, flat tax: 1 (poor) –17,155 2 – 9 (middle) –53,093 10 (rich) –146,966 7. Conclusions In this note we have described a GAUSS software in- strument, to compute the value of expected compen- E[CV] Figure 2. Population density of expected Compensating Variation. Distribution of E[CV], with the flat tax system of 29% used as a reference against the 1994 tax regime. sating variation within the discrete choice setting sug- gested in [1]. The program refers to the following tax reforms: a) tax systems in force in 1991 and in 1994 using 1991 as ref- erence year, b) 1994 tax system and a flat tax system taking 1994 as reference year. The program is flexible and can be easily modified to take into account different tax systems and different reference years. The results show the different impact of the tax re- form: 1) from the 1992 tax reform we observe that most of the households will benefit from the 1992 tax reform; the richest household gained almost 10 times more than the poorest or 4 times more in relative income terms. Thus, such a reform would have attained support from a clear majority of households with married and cohabiting women at an election. 2) from the 1994 tax system and a flat tax system tak- ing 1994 as reference year we observe that the richest households gain around 8 times more than the poorest. We observe that a vast majority would benefit from the replacement of the 1994 tax regime with a flat tax re- gime. 8. Acknowledgements M. Locatelli gratefully acknowledges financial support by Frisch Centre, Oslo, Norway. 9. References [1] J. K. Dagsvik, M. Locatelli and S. Strøm, “Tax Reform, Sector-Specific Labor Supply and Welfare Effect,” Scan- dinavian Journal of Economics, Vol. 111, No. 2, 2009, pp. 265-287. doi:10.1111/j.1467-9442.2009.01565.x Copyright © 2011 SciRes. ME  M. LOCATELLI ET AL. Copyright © 2011 SciRes. ME 388 [4] Aptech System, Inc., “GAUSS Software (Version 10),” Black Diamond, Ridgefield, 2009. [2] M. Locatelli and S. Strøm, “Computation of the Com- pensating Variation within a Random Utility Model Us- ing GAUSS Software,” Child Working Paper No. 02/2006. [5] J. K. Dagsvik and S. Strøm, “Sectoral Labor Supply, Choice Restrictions and Functional Form,” Journal of Applied Econometrics, Vol. 21, No. 6, 2005, pp. 803-826. doi:10.1002/jae.866 [3] J. K. Dagsvik and A. Karlstrøm, “Compensating Varia- tion and Hicksian Choice Probabilities in Random Utility Models That are Non-Linear in Income,” Review of Eco- nomic Studies, Vol. 72, No. 1, 2005, pp. 57-76. doi:10.1111/0034-6527.00324 [6] S. S. Kuo, “Computer Applications of Numerical Meth- ods,” Addison-Wesley, Boston, 1972. Appendix A Table A1. Estimation results for the parameters of the labor supply probabil i t i e s . Uniformly distributed offered hours with part-time and fulltime peaks Variables Parameters Estimate t-values Preferences: Consumption: Exponent α1 0.64 7.6 Scale 10–4 α2 1.77 4.2 Subsistence level C0 in NOK per year 60 000 Leisure: Exponent α3 –0.53 –2.1 Constant α4 115.02 3.2 Log age α5 –63.61 –3.2 (log age)2 α6 9.20 3.3 # children 0 - 6 α7 1.27 4.0 # children 7 - 17 α8 0.97 4.1 Consumption and Leisure, interaction α9 –0.12 –2.7 Subsistence level of leisure in hours per year 5120 The parameters b1 and b2; j1 j2 log =+ j bffS Constant, public sector (sector 1) f11 –4.20 –4.7 Constant, private sector (sector 2) f21 1.14 1.0 Education, public sector (sector 1) f12 0.22 2.9 Education, private sector (sector 2) f22 –0.34 –3.3 Opportunity density of Offered hours, gk2(h), k = 1,2 Full-time peak, public sector (sector 1)* 11 log Full 0 g hgh 1.58 11.8 Full-time peak, private sector (sector 2) 22 log Full 0 g hgh 1.06 7.4 Part-time peak, public Sector 11 log Part 0 g hgh 0.68 4.4 Part-time peak, private Sector 22 log Part 0 g hgh 0.80 5.2 # observations 810 Log likelihood –1760.9  M. LOCATELLI ET AL. Copyright © 2011 SciRes. ME 389 Appendix B based both on an absolute and relative tolerance. Considering the last interval x, x where the solution To determine the value y we must solve the following equation (for each record and each alternative) v0 = v(Fh94 + ). y That means that we must find the zero of the function f x defined as: 0, with 94 f xvvxxFh y 4 , where y is a generic amount of income to be added to the 1994 woman net wage . Calling x* the value for which , e have 0fx *9 y xFh To determine the value of x* the following steps are done: 1) iterate until an interval is found where the solution lies, using procedure INCR; 2) refine the interval iterating until an approximate solution is found. For the very first iterations (NITER ≤ 5), the new value is searched using linear interpolation (see Figure 1), implemented by the procedure INTERP. Then (NITER > 5) the solution is refined using a half-interval search method, implemented by the proce- dure HALF. Fore more details on these methods see, for example, Ch. 6 of [6]. The exit test is performed only after the solution has been refined using HALF (i.e. only if NITER > 5) and is x 1 x 2 f(x 1 ) f(x 2 ) Solution x app Figure 1. The linear interpolation method: 1 = app x x 121 12 f xx x f xfx . 1 2 is sought, the function value m f x at the mean value 12 0.5 m x xx is computed. Furtermore the relative error on x, rel_err = h 211 x xx,valuated. The solu- tion is accepted is e if m f x ≤ abs_tol or rel_err ≤ rel_tol. A satisfactory trade-off between speed and accuracy has been found assumbs_tol = 10 and rel_tol = 1e-8. Th * ing a en the procedure exits assuming x = xm . Appendix C: the GAUSS Program Flow Load Set dy 0 =100 Compute Fh94 (disposable income, year 1994) Call: w_wage, netwage_W_94, netwage_m_94, netwage_mW_94 Initial values: Call V: computation of consumption function where y 0 is the male disposable income for 1994 Give an increment to y 0 to find an interval where fx 1 and fx 2 have different signs: Call: INCR Refine the solution and call it x* Call: INTERP, HALF , and V_scalar is the solution found. Set Compute the integral Call: INTEGRAND Compute E[CV] statistics END N O YES YES Are tolerance limits satisfied? N O YES N O 10 1 f xVV(x) 0 Fh94 2 xy 1 Fh 9 4x 20 2 f xVV(x) 1 0 f x? Fh 94x 12 0 f xfx ? 00 0 y ydy Fh 94yx* x E[CV] Integral * I 00 00 0 ( V_91 or V29)VV V |