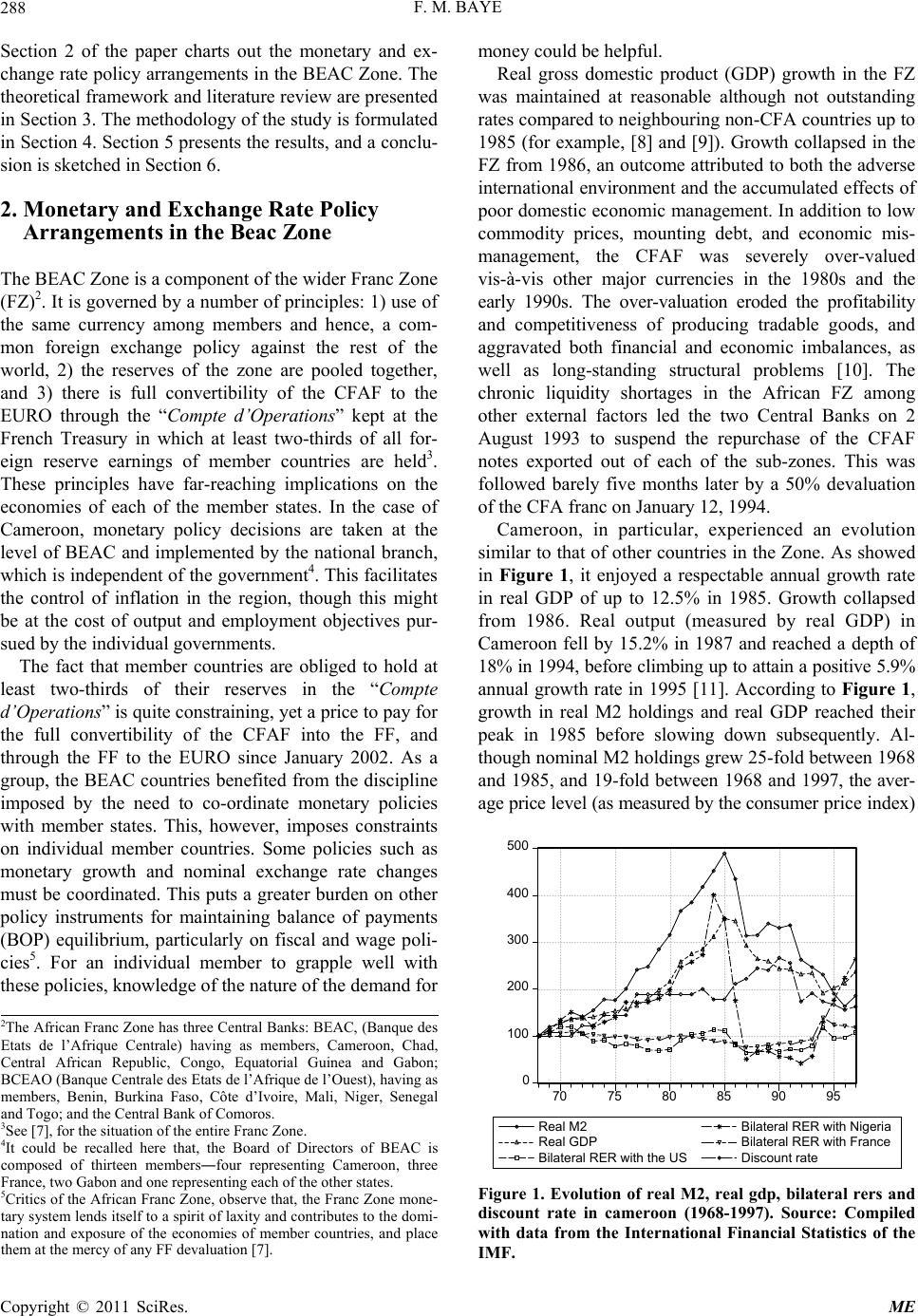

Modern Economy, 2011, 2, 287-300 doi:10.4236/me.2011.23032 Published Online July 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME The Role of Bilateral Real Exchange Rates in Demand for Real Money Balances in Cameroon Francis Menjo Baye Faculty of Economics and Management, University of Yaoundé, Yaoundé, Cameroon E-mail: bayemenjo@yahoo.com Received January 31, 2011; revised March 25, 2011; accepted April 10, 2011 Abstract This paper examines the demand for real M2 in Cameroon. After providing a sketch of the development in money demand theories, the paper specifies and estimates long- and short-run demand functions for real M2 using co-integration and error correction techniques. Some emphasis is echoed on the role of bilateral real exchange rates in the demand for real balances. The paper determines the speed that the market may take to eliminate exogenous shocks on real M2. Domestic real income, foreign interest rates, degree of credit restraint and bilateral real exchange rates (BRERs) appear to significantly influence the demand for real money balances in Cameroon. BRERs have both income and substitution effects on money demand and the ultimate effect depends on the dominance of one over the other. The magnitudes of the income elasticity of the demand for money suggest that wealth holders in CFA denominated assets consider money as a normal good. Some policy implications were derived from the analysis (JEL:E41). Keywords: Real M2, Real Exchange Rates, Co-integration, Cameroon 1. Introduction In the process of restructuring the production base of African economies from the 1980s, exchange rate re- forms and financial sector liberalization took centre- stage because it was believed they play crucial roles in the stabilization and adjustment process [1-4]. The Bank of Central African States (BEAC), to which Cam- eroon is a member, controls the evolution of the mone- tary base with a view to achieving a stable level of prices and enhancing output growth in member states. For an indi- vidual country in the monetary zone, the estimation of the demand for money on a long-run basis appears perti- nent, especially because monetary and exchange rate policies are coordinated among many independent coun- tries. Notwithstanding, an individual country can still manipulate its real exchange rate via other macroeco- nomic variables with implications for the demand for real M2 balances1. Intuition suggests that unlike the more developed countries were the speculative demand for money, which is negatively related to the interest rate, is preponderant since financial markets are well-developed; the demand for real M2 in Cameroon and perhaps the entire BEAC zone, typically comprises of the transaction (and precau- tionary) demand, which is proportional to real GDP. Em- pirically characterizing the demand for real M2 using Cameroon data will enable us to better appreciate this idea. Standard economic theory generally characterizes the demand for real money balances as resulting from changes in other ma croeconomic aggregates, which may be grouped into four categories [5,6]: 1) aggregates that measure the level of economic activity; 2) variables that measure the opportunity cost of holding money; 3) vari- ables that measure the rate of return to holding money; and 4) variables that measure the rate of currency depre- ciation, which closely tracks the opportunity cost of hold- ing domestic monetary assets relative to foreign assets. The main objective in this paper is to review and pro- vide an empirical basis for the characterization of the demand for real money balances using Cameroon data. The specific objectives are 1) to briefly review theories of money demand, 2) to specify and estimate long and short-run demand functions for money in Cameroon us- ing co-integration and error-correction techniques, 3) to determine the speed and duration that real M2 balances would take to adjust in response to a shock, and 4) to derive policy implications on the basis of the analysis. 1M2 is the main monetary aggregate in the BEAC zone.  F. M. BAYE 288 Section 2 of the paper charts out the monetary and ex- change rate policy arrangements in the BEAC Zone. The theoretical framework and literature review are presented in Section 3. The methodology of the study is formulated in Section 4. Section 5 presents the results, and a conclu- sion is sketched in Section 6. 2. Monetary and Exchange Rate Policy Arrangements in the Beac Zone The BEAC Zone is a component of the wider Franc Zone (FZ)2. It is governed by a number of principles: 1) use of the same currency among members and hence, a com- mon foreign exchange policy against the rest of the world, 2) the reserves of the zone are pooled together, and 3) there is full convertibility of the CFAF to the EURO through the “Compte d’Operations” kept at the French Treasury in which at least two-thirds of all for- eign reserve earnings of member countries are held3. These principles have far-reaching implications on the economies of each of the member states. In the case of Cameroon, monetary policy decisions are taken at the level of BEAC and implemented by the national branch, which is independent of the government4. This facilitates the control of inflation in the region, though this might be at the cost of output and employment objectives pur- sued by the individual governments. The fact that member countries are obliged to hold at least two-thirds of their reserves in the “Compte d’Operations” is quite constraining, yet a price to pay for the full convertibility of the CFAF into the FF, and through the FF to the EURO since January 2002. As a group, the BEAC countries benefited from the discipline imposed by the need to co-ordinate monetary policies with member states. This, however, imposes constraints on individual member countries. Some policies such as monetary growth and nominal exchange rate changes must be coordinated. This puts a greater burden on other policy instruments for maintaining balance of payments (BOP) equilibrium, particularly on fiscal and wage poli- cies5. For an individual member to grapple well with these policies, knowledge of the nature of the demand for money could be helpful. Real gross domestic product (GDP) growth in the FZ was maintained at reasonable although not outstanding rates compared to neighbouring non-CFA countries up to 1985 (for example, [8] and [9]). Growth collapsed in the FZ from 1986, an outcome attributed to both the adverse international environment and the accumulated effects of poor domestic economic management. In addition to low commodity prices, mounting debt, and economic mis- management, the CFAF was severely over-valued vis-à-vis other major currencies in the 1980s and the early 1990s. The over-valuation eroded the profitability and competitiveness of producing tradable goods, and aggravated both financial and economic imbalances, as well as long-standing structural problems [10]. The chronic liquidity shortages in the African FZ among other external factors led the two Central Banks on 2 August 1993 to suspend the repurchase of the CFAF notes exported out of each of the sub-zones. This was followed barely five months later by a 50% devaluation of the CFA franc on January 12, 1994. Cameroon, in particular, experienced an evolution similar to that of other countries in the Zone. As showed in Figure 1, it enjoyed a respectable annual growth rate in real GDP of up to 12.5% in 1985. Growth collapsed from 1986. Real output (measured by real GDP) in Cameroon fell by 15.2% in 1987 and reached a depth of 18% in 1994, before climbing up to attain a positive 5.9% annual growth rate in 1995 [11]. According to Figure 1, growth in real M2 holdings and real GDP reached their peak in 1985 before slowing down subsequently. Al- though nominal M2 holdings grew 25-fold between 1968 and 1985, and 19-fold between 1968 and 1997, the aver- age price level (as measured by the consumer price index) 0 100 200 300 400 500 70 75 80 85 90 95 Real M2 Real GDP Bilateral RER with the US Bilateral RER with Nigeria Bilateral RER with France Discount rate 2The African Franc Zone has three Central Banks: BEAC, (Banque des Etats de l’Afrique Centrale) having as members, Cameroon, Chad, Central African Republic, Congo, Equatorial Guinea and Gabon; BCEAO (Banque Centrale des Etats de l’Afrique de l’Ouest), having as members, Benin, Burkina Faso, Côte d’Ivoire, Mali, Niger, Senegal and Togo; and the Central Bank of Comoros. 3See [7], for the situation of the entire Franc Zone. 4It could be recalled here that, the Board of Directors of BEAC is composed of thirteen members―four representing Cameroon, three France, two Gabon and one representing each of the other states. 5Critics of the African Franc Zone, observe that, the Franc Zone mone- tary system lends itself to a spirit of laxity and contributes to the domi- nation and exposure of the economies of member countries, and place them at the mercy of any FF devaluation [7]. Figure 1. Evolution of real M2, real gdp, bilateral rers and discount rate in cameroon (1968-1997). Source: Compiled with data from the International Financial Statistics of the IMF. Copyright © 2011 SciRes. ME  F. M. BAYE289 also grew over the entire period (not reported in Figure 1). Once we divide nominal M2 by the price index to ob- tain an index of real money holdings, Figure 1 shows that real money balances grew only about 5-fold up to 1985 and 2-fold up to 1997 relative to 1968. Real GDP rose 3.5-fold by 1985 and 2.4-fold by 1997 relative to its level in 1968. Despite the observation that the opportu- nity cost of holding money (surrogated by the discount rate) doubled by 1985 relative to its value in 1968, the growth in real M2 remained superior to that of real GDP up to 1995. A priori, these observations appear to suggest that in Cameroon, M2 holdings may tend to respond more to GDP variations than to variations in the discount rate. The construction of a real M2 schedule will enable us to better understand this evolution. Bilateral real ex- change rates with the United States appear to move with real M2 and that with France tend to move in the oppo- site direction, especially from 1980s. These tendencies may become more apparent in the econometric analysis. 3. Conceptual Framework for Money Demand and Literature Review 3.1. Conceptual Framework for Money Demand In any economy, money plays at least four roles: 1) a medium of exchange to facilitate the payment of income and purchase of goods and services, 2) a unit of account - measure by which all prices are established, 3) a store of value - that alters the timing of spending decisions rela- tive to earning income, and 4) a source of deferred pay- ment. The two common measures of money as estab- lished by monetary authorities in many developing coun- tries are M1 and M2: M1 = Currency + Demand Deposits (checking ac- counts or current accounts) M2 = M1 + Time Deposits (simple interest-bearing savings accounts) The first measure is known as the narrow definition of money, which represents components that are readily accepted as payments for goods and services or to satisfy debts. The second measure is known as a broader defini- tion, which includes savings accounts that can easily be converted into currency or demand deposits. The mone- tary authorities in the BEAC zone use M2 as the basic monetary aggregate. We now turn to the classical money demand theories. 3.1.1. The Classical Money Demand Theories The classical economists insisted on Say’s law, which states that “supply creates its own demand” and relegated the role of money to the background. According to this classical persuasion, money acts as a numéraire―a commodity used in expressing prices and values, but whose own value is unaffected by this role. In this regard, money is “neutral” with no consequence for real eco- nomic magnitudes and its role, as a store of value, is perceived as limited under the classical assumption of perfect information and negligible transaction costs [12]. Early theories of the demand for money can be traced to the works of Mill, Walras, Jevons and Wicksell [13-16]. The concept of demand for money took formal shape through the quantity theory developed in the clas- sical equilibrium framework by two different but equi- valent expressions [17]. Irving Fisher of Yale University provided the famous equation of exchange―MsVt = PtT [18], where Ms represents quantity of money, Vt transac- tions velocity of circulation, Pt prices and T the volume of transactions―money is held simply to facilitate transactions and has no intrinsic value per se. An alternative theory―the so-called Cambridge ap- proach or cash balance approach, is primarily associated with the neo-classical economists such as Pigou and Marshall [19,20] among others associated with the Cam- bridge School. Their formulation is based on the simpli- fying assumption that for an individual, the level of wealth, the volume of transactions, and the level of in- come-over short periods―would on the average move in stable proportions to one another. They incorporated the money market equilibrium conditions while invoking the ceteris paribus clause to obtain the familiar quantity the- ory formulation―MV = Py, which relates the quantity of money to nominal income. In contrast with Fisher’s for- mulation, V is now the “income velocity of circulation” determined by technological and institutional factors and is assumed to be stable. Given that the real income y is at the full employment level and V being fixed, an increase in the quantity of money results in a proportional in- crease in P―that is, money is “neutral”―the familiar quantity theory exposition. The Cambridge formulation of the quantity theory provides a more satisfactory description of monetary equilibrium within the classical model [12]. It focuses on the public’s demand for money, notably, the demand for real money balances, as the important factor determining the equilibrium price level that is consistent with a given quantity of money. The emphasis the Cambridge formu- lation places on the demand for money is remarkable because it influences both the Keynesian and the Mone- tarist theories. 3.1.2. Keynesian Theory Keynes built upon the Cambridge approach to provide a more rigorous analysis of money demand, focussing on the motives for holding money [21,22]. Keynes postu- lated three motives for holding money: transactions, Copyright © 2011 SciRes. ME  F. M. BAYE 290 precautionary and speculative purposes. He also formally introduced the interest rate as another explanatory vari- able influencing the demand for real cash balances. In particular, 1) individuals will demand money to fi- nance their daily purchases of goods and services, which depends on the level of income; 2) individuals will de- mand money as a contingency against unforeseen expen- ditures, which also depends on the level of income; and 3) individuals will hold money as a store of wealth, the speculative motive6, which depends on the rate of inter- est. The speculative or asset motive for holding money arises because people dislike risk. Economic agents may be prepared to sacrifice a high average rate of return to obtain a portfolio with a low but more predictable rate of return. Hence, individuals choose their portfolios to bal- ance more certain but lower returns with higher but risk- ier ones [24]. Since people hold money now in order to spend it later, there is an obvious cost associated with holding money. The opportunity cost of holding money is the interest given up by holding money rather than financial assets7. The transaction motive for holding money reflects the fact that payments and receipts are not perfectly syn- chronized8. Since the demand for money is viewed as the demand for real money balances, a given amount of real money is required to undertake a given quantity of total transactions. Thus, when the price level doubles, in the absence of monetary illusion, we expect the demand for nominal money balances to double, leaving the de- mand for real money balances unaltered. 3.1.3. Post-Keynes Theories Following Keynes, a number of models were developed to provide alternative explanations to confirm the for- mulation relating real money balances with real income and interest rates. These models can be classified into three separate frameworks, namely: transactions, asset and consumer demand theories of money [12,17] Under the transactions theory of money demand fra- mework, the inventory-theoretic approach [25,26] and the precautionary demand for money [27] models were introduced. These models were derived from the me- dium-of-exchange function of money. The asset func- tion of money led to the asset or portfolio approach where major emphasis is placed on risk and expected returns on assets [28]. Alternatively, the consumer demand theory approach [29,30] considers the demand for money as a direct ex- tension of the traditional theory of demand for any dura- ble good. According to the Modern Monetarists view[31], which is essentially a mere sophisticated version of the Classical Quantity Theory, the demand for money is necessary only to finance transactions, and it is consid- ered as being related to a few key variables in a stable manner. They argue that the demand for money is no longer a function of solely the interest rate and income, but that the rate of return on a much wider spectrum of physical and financial assets would influence individu- als’ demand for money. Accordingly, individuals will act in such a way as to ensure that the rate of return at the margin is equal across the complete range of physical and financial assets that they could purchase. In this re- gard, money is seen as a substitute for all other assets and the demand for it is therefore a function of the rate of return on all these assets. Despite the different angles of the approaches to money demand, it has been observed that real income and the rate of interest or return constitute the main in- gredients in the analyses of both the neoclassical and variants of the neo Keynesian schools of thought [32]. The resulting implication of all the models is that the optimal stock of real money balances is positively related to real income and inversely related to the nominal rate of return or interest. Although the different theories con- sider similar key variables to explain the demand for money, what sets them apart is that they frequently differ in the specific role assigned to each. Notwithstanding, one consensus that emerges from the literature is that most empirical works are motivated by a blend of theo- ries [33]. 3.1.4. Derivation of the Basic Theoretical Model As intimated earlier, economic agents typically hold cash balances to allow for making transactions. The volume of these transactions tends to be proportional to the aggre- gate level of income. One approach to derive the func- tional form of money demand, as discussed above, is based on inventory control theory common in many models of management. In this approach, optimal cash balances are based on minimizing the total cost of hold- ing these cash balances. This total cost has as key com- ponents the cost of making transactions into or out of cash, and the increasing opportunity cost of holding lar- ger balances. This cost relationship can be expressed as follows: min CbYM Mi (1 ) 6Some authors consider the speculative demand for money as the rea eynisian invention [23]. 7Financial assets may take the form of bills, bonds, equities, and foreign currency. 8Hendry and Ericsson observe that the transaction-demand theory is based on the need for money to even out the differences between in- come and expenditure streams [24]. where b = the cost of making a single cash transaction (i.e., withdrawals from a checking or savings account or conversion into stocks and bonds), Y = Income, i = a market-determined interest rate or yield, M = the size of Copyright © 2011 SciRes. ME  F. M. BAYE291 Cash Balances. The ratio Y/M represents the number of transactions made per time period. A smaller amount held as cash balances results in a greater number of transactions being made per time period and thus an increase in the cost of holding these cash balances. With respect to the second component on the right-hand side of Equation (1), larger cash balances result in greater opportunity costs meas- ured in foregone interest income. Thus, a trade-off exists where economic agents may want to hold larger cash balances to minimize the transactions costs but may want to hold smaller balances to reduce the opportunity cost of holding these balances. The optimal value may be illustrated by taking the first order condition of (1) with respect to M: 1212 12 2 dd0; *CM MiMbYibYi (2) Equation (2) states that optimal cash balances M* are directly related to income Y and inversely related to the market rate of interest i. 3.2. Literature Review 3.2.1. Theoretical Review The demand for money in developing countries has a grey literature which is well articulated [23,34-38]. An important feature of money markets of developing coun- tries is what Myint called financial dualism [39], which implies the co-existence of heterogeneous interest rates in the organized and unorganized money markets. A variant of this view, which concerns the imperfect nature of financial markets in developing countries, has been well formulated [23]. Imperfection in the financial mar- kets reduces the efficiency of investment as it obstructs competition between borrowers and also increases trans- action costs9. Evidence concerning the unstable income velocity in developing countries suggests that the use of the quantity theory of money to explain the demand for money may not be suitable [23]. This view provoked an investiga- tion into the opportunity cost for holding money, and in many studies, the expected rate of inflation was observed as a major variable influencing the demand for money in developing countries [42-44]. The main argument for using the rate of inflation is that wealth holders in de- veloping countries can hold either real commodities (buildings, land, etc.) or money. Hence, the opportunity cost of money holding is given by the expected rate of inflation [29]. Some authors have argued that since asset holdings in developing countries is limited either to money or real goods and domestic interest rates may show little varia- tion over time as a result of government regulation, in- terest rates may not perform well in demand for money functions [45,46]. The foregoing arguments relegated the usefulness of interest rates in the money demand func- tions for developing countries to the background for the following reasons: 1) limited size of the organized finan- cial market; 2) the institutional pegging of interest rates; 3) limited array of financial assets, and 4) limited degree of substitution between money and financial as- sets in comparison with the economically developed countries [23]. In this context, it is perhaps possible to understand why some authors have regarded the demand for money as more a function of income and expected rate of infla- tion rather than the interest rate. It is also apparent why the transaction motive for holding money dominated other motives for money holding in earlier empirical investigations. Others have argued that in many developing countries, the interest rates in the rural money market may not be observed, although they will reflect the degree of credit restraint itself. With this, they consider that an appropri- ate estimate of credit restraint could be considered as a proxy variable for the interest rate in the money demand function. On the basis of these, it has been suggested that the long-run demand for money function could have as arguments: expected nominal GDP, expected index of the degree of credit restraint [38]10, and expected changes in the rate of inflation. To the extent that borrowing plays a role in financing economic activity and there is some relationship between organized and unorganized markets11, however, the rate of interest can be used as an explanatory variable in de- mand for money functions in developing countries [47,48]. The recent financial liberalization and stabiliza- tion policies implemented within the framework of the SAPs in many developing countries turns to weaken the argument against the inclusion of the domestic rate of interest in the money demand function. It has equally been suggested that where there is doubt to the validity of including the domestic interest rate or, more generally, the appropriate choice of the opportunity cost variables, the issue could be resolved empirically [49]. The sources of opportunity cost variables consid- ered in the literature are internal or external in nature. Internal proxies include domestic interest rates and ex- pected inflation. The external proxies comprise expected real exchange rate variation, reflecting currency depre- ciation or substitution, and foreign interest rates reflect- 10Many ways to measure the degree of credit restraint have been sug- gested, namely, the discount rate of the Central Bank, the negative o the ratio of domestic credit to income, and the negative of the rate o domestic credit expansion. 11For an empirical estimation of these links, see [36]. 9A response to this state of affairs often gives rise to what is referred to as financial repression. For the effects of financial repression [40,41]. Copyright © 2011 SciRes. ME  F. M. BAYE 292 ing substitution between domestic and foreign financial assets. An increase in short-term foreign interest rates will, ceteris paribus, induce domestic residents to substitute foreign securities for domestic securities in their portfo- lios, reducing their money holdings in the process [50]. 3.2.2. Developments in Approaches to Money Demand Estimation The specification of money demand has spanned partial adjustment modeling, buffer stock modeling and now variants of co-integration and error correction modeling. Partial adjustment models (PAMs) in a log-log functional form was first applied to the demand for money by [51] and later popularized by [52]. The PAM introduced two concepts: 1) distinction between desired and actual money holdings, and 2) the schemes by which the actual money holdings adjust to the desired levels. This model fared well in 1960s and early 1970s, but failed in captur- ing the instability observed in the demand for money from 1973 data. As such, PAMs were shown to suffer from both specification problems and highly restrictive dynamics [33]. To address these short-comings, two so- lutions were proposed – modifying the theoretical under- pinnings and improving the dynamic structure. The PAM lost favor to buffer stock models (BSMs) in terms of the modification of the theoretical bases [53], and to error correction models (ECMs) in terms of improvements in the dynamic structure. It has, however, been shown that PAMs and BSMs are special cases of ECMs [54,55]. Proponents of the BSMs attributed the failings of the PAMs to their inability to explicitly capture the short-run impact of monetary shocks. Despite the appeal of BSMs in explicitly modeling money shocks and using more complex lag structures, they were equally accused of suffering from empirical shortcomings [56]. As criticism grew, the BSMs lost their appeal in favor of ECMs. In the context of ECMs, 1) the data characteristics are thoroughly examined before selecting the appropriate estimation techniques, 2) lag structures are selected based on data-generating processes of the economic variables and not on a priori based on economic theory or some naïve expectations, and 3) economic theory is allowed to specify the long-run equilibrium while the short-run dy- namics are defined from the data. Two widely used error correction techniques have been suggested [57-59]. The later approach provides an opportunity to evaluate the presence of multiple co-inte- grating vectors. The two variants of this approach―the vector error correction models (VECM) and structural time series models (STSM) are capable of jointly esti- mating the long- and short-run components of the de- mand for money [5]. In most cases, these modeling ap- proaches become parameter intensive in estimating the short-run autoregressive components, and most often than not, there is little guidance from economic theory on the appropriate lag structure to be selected. In this paper, we use the Engle and Granger two-stage method because it is simple to implement and all our variables are I (1). Moreover, the original Engle-Granger framework is a special case of multiple co-integrating vectors [57]. 3.2.3. Empirical Review Using annual data from 1948/49-1964/65 and in the case of India, income proved to be the most significant deter- minant of the demand for real cash balances, the interest rate being statistically insignificant [35]. It was con- cluded that the Indian money market was then compara- tively underdeveloped. This outcome supported the con- tention that the interest elasticity of the demand for money function would be more significant in countries with well developed money markets [34]. Simmons provides estimates of the demand for money functions drawing on the “general-to-specific” approach to modeling dynamic time series [49]. This approach is associated with David Hendry and his followers [24, 60-62]. A lot of effort in the context of developed coun- tries has recently been devoted to testing the stability of the demand for money functions [63,64]. Following the lead of Adams [65], Atta and Anyangah [66] present a more compre- hensive dynamic specifica- tion of the general-to-specific approach, and observe that 1) domestic interest rates serve principally as a measure of own rate of return on money, and 2) there is a margin of substitution between money and securities denomi- nated in foreign currencies in Botswana. Co-integration and error correction mecha- nisms have also been used to characterize the demand for money in a number of Afri- can countries [67]. Cameroon is one of the four countries included in the paper [67]. In the case of Cameroon, [67] finds three co-integrating relationships among real broad money, real GDP, infla- tion, interest rate and a measure of price variability. His error-correction mechanism passes the diagnostic tests and the error correction term has a nearly unit coefficient. Recent endeavors at esti- mating the demand for money functions are more meth- odological than theory or policy- oriented. Empirical lit- erature, which is policy oriented, on the demand for money in Cameroon is scarce. It is one of our goals to further reduce the extent of this scarcity. 4. Methodology of the Study 4.1. Econometric Model A more general version of modeling the demand for real money includes both real income, and the rate of interest Copyright © 2011 SciRes. ME  F. M. BAYE Copyright © 2011 SciRes. ME 293 [RERU, RERF, RERN] and all the variables are defined in Table 1. or the opportunity cost of money holdings as candidates on the right-hand side as in Equation (3) (also see Equa- tion 2). Following [50,68,69], we use the real exchange rate as a proxy for expected currency depreciation. Changes in the real exchange rate have two effects on the demand for domestic currency―an income effect and a substitu- tion effect. Assume that wealth holders evaluate their portfolio in terms of domestic currency. Exchange rate depreciation would increase the value of their foreign asset holdings expressed in terms of domestic currency and hence, be wealth enhancing. To maintain a fixed share of their wealth invested in domestic assets, they will repatriate part of their foreign assets to domestic assets, including domestic currency. Hence, exchange rate depreciation would increase the demand for domes- tic currency. , d MY R PP (3) where Md is desired money holding in nominal terms, P the general price level, Y the GDP or national income in nominal terms, and R a vector reflecting the opportunity cost of money holdings. In the present endeavours, we elect to specify a long-run money demand function and then its short-run counterpart. 4.1.1. Long-Run Demand for Money Drawing on the literature, we start by postulating a long-run desired demand for real money balances as a function of real income, a vector of opportunity costs for money holdings, and a vector of bilateral real exchange rates given by Equation (4). 01 ,2 ,3 ,, log log log log d t t ii it it MP YP OPCOST RER t (4) On the other hand, exchange rate movements may generate a currency substitution effects in which invest- tors’ expectation plays a crucial role. If wealth holders develop an expectation that the exchange rate is likely to deteriorate further following an initial depreciation, they will respond by raising the share of their foreign assets in their portfolios. In this context, currency depreciation where (OPCOST)i [DIR, CR, MMRG], (RER)i Table 1. Definition of variables. Variable Definition Md Desired stock of nominal cash balances (M2) P General price level captured by the consumer price index (1990 = 100) Y Nominal income represented by the GDP (OPCOST)i A vector of the opportunity costs for money holdings. DIR Domestic interest rate represented by the discount rate of the Central Bank (BEAC) The discount rate was used because of the absence of sufficient time series data on the lending and borrowing rates of interest. CR Degree of credit restraint captured by the ratio of GDP to domestic credit. Wong (1977) suggested a similar measure for the degree of credit restraint. MMRG Money market rate of interest in Germany. It is believed that part of the currency flight or speculation from the CFA countries was attributed to its full convertibility then, and the high interest rates in Germany before and after reunifica- tion in 1990 (RER)i A vector of bilateral real exchange rates. The bilateral real exchange rates were computed as: [nominal exchange rate with country i]*[(consumer price index of country i)/ (consumer price index of Cameroon)]. An increase in the index implies depreciation and a decrease an appreciation. The nominal exchange rate used is the period average, (line rf) in the International Financial Statistics12. RERU Bilateral real exchange rate with the Unites States. RERF Bilateral real exchange rate with France. RERN Bilateral real exchange rate with Nigeria. A stochastic disturbance term S ources: All data for this study were collected from several issues of the International Financial Statistics of the International Monetary Fund. 12Most of Cameroon’s exports are quoted in $US, and France and Nigeria are Cameroon’s major suppliers―France, by virtue of its economic and olitical affiliations and Nigeria by virtue of its neighborliness.  F. M. BAYE Copyright © 2011 SciRes. ME 294 means higher opportunity cost of holding domestic money, so currency substitution can be used to hedge against such risk. In this logic, exchange rate deprecia- tion would decrease the demand for domestic money. The actual effect of exchange rate depreciation is there- fore, an empirical issue because it depends on which of the effects dominates. An upward movement in foreign rates of interest en- hances the attractiveness of foreign assets, and acts as incentives to domestic residence to substitute foreign assets for domestic ones in their portfolios. This will reduce the demand for domestic money holdings. Since Equation (4) is expressed in log-linear func- tional form, the parameters j (j = 1, 2, 3) are elasticities of real cash balances with respect to the corresponding variables. Economic theory suggests that 1 0, i,2 0, and i,3 are to be determined empirically. The constant term o captures the effects of changing transactions costs and financial innovation over time. 4.1.2. Co-Integration and Error-Correction Mechanism to the Short-Run Model The general way of relating variables in the long-run demand for money function to capture short-run adjust- ments, in the context of time series data, is to specify a flexible dynamic distributed lag model, which includes an error-correction term from a co-integrating relation- ship as in Equation (5)13. 1 0 2 ,, 0 3 ,, 0 4 1 1 log log log log ˆ log n j tt j n ij itj j n ij it j j n j tt tj j MP kaYP bOPCOST cRER dMP v (5) where ˆt is the predicted residual term from a co-integrating relationship estimated from the long-run model (Equation (4)), is the coefficient of the er- ror-correction term, is the difference operator and vt is the usual white nose. This procedure, due to [57], is valid if, at least, a co-integrating relation exists among the variables14. When this happens, the variables are said to be co-integrated and error-correction terms exist to ac- count for short-run deviations from the long-run equilib- rium relationship implied by the co-integration. Data used in this paper is defined in Table 1 and sourced from several issues of the International Financial Statistics of the IMF. Data were collected for the period 1968-2000. For the long-run models, reviews adjusted the estimation sample to cover the period 1969-2000. For the short-run model, due to the admission of lags of up to order 4, the estimation sample was adjusted to 1974- 2000. 4.2. Estimation Procedures 4.2.1. Time Series Pre-Testing Procedure All the variables in the model were tested for unit roots by the Augmented Dickey-Fuller test to eliminate the possibility of spurious regressions and to verify whether they can be represented more appropriately as difference or trend stationary processes. However, as argued in [70,71], the mechanical transformation by differencing to induce stationarity eliminates, in many cases, the long- run information embodied in the original level form of the variables. The error-correction model (ECM) de- rived from the co-integrating equation by including the lagged error-correction term reintroduces, in a statistic- cally acceptable way, the long-run information lost through differencing. The error-correction term stands for the short-run adjustment to long-run equilibrium trends15. 4.2.2. Model Estimation Procedures We move from the estimation of a co-integrating long-run estimate of Equation (4) (defined when (Md/P)t = (M/P)t, because in the long-run variables are in their steady-state) to the short-run error-correction model (ECM) using the general-to-specific methodology16. We follow the two-step procedure for estimating co-inte- grated error-correction models as suggested by [57]. In step one, the co-integrating regression is estimated by ordinary least squares; and the residual series (if it turns out to be I(0)) is lagged and included among the ex- planatory variables in the second step to estimate the error-correction mechanism in addition to the short- run dynamic model. An important condition to ensure that the OLS estimation of the co-integrating regression is asymptotically optimal is that the errors should be non-correlated [73,74]. 13The single-equation error-correction model can be considered as a generalization of the conventional stock adjustment model widely used in the specification of the demand for money functions, and is consis- tent with optimizing behavior of economic agents in a dynamic envi- ronment as demonstrated by [55]. 14[57] pointed out that, even though individual time series may be non-stationary, linear combinations of them can be, because equilibriu forces tend to keep such series together in the long-run. 15This term also opens up an additional channel of Granger causality so far ignored by the standard causality tests [72], namely, the dynamic causality in the Granger (temporal) sense. This issue is, however, not explored in this paper. 16That is, Equation (5) as modified by the appropriate data generating rocesses.  F. M. BAYE295 5. Results 5.1. Results of the Unit Root Test All the variables in Table 2 present evidence of non-stationarity at levels. Rejection of the unit root hy- pothesis for the first difference of these variables sug- gests that we are dealing with integrated processes of the first order, that is, I(1) processes. Hence, the risk of using the original Engle-Granger formulation is minimal. 5.2. Co-Integrated Long-Run Estimates Table 3 presents the co-integrating long-run results that emanate from the implementation of the Engle-Granger first step OLS estimation. Two versions of Equation (2) are estimated, Model 1―the unrestricted version and Model 2―the restricted version. The unrestricted ver- sion includes all the variables postulated in Equation (4) and the restricted version excludes variables that behave perversely and/or are non-significant. The discussion that follows is centred on Model 2, which is preferred. The discount rate and the bilateral real exchange rate with Nigeria (RERN) do not qualify for inclusion in Model 2 as sanctioned by their signs and/or poor t-ratios. The fit of the regression is good as given by 2 R = 97%, and the residuals show no sign of serial correlation as indicated by the Breusch-Godfrey LM test statistic. Residuals of the co-integrating regression are stationary at their levels as shown by the ADF test statistic on the residuals. Thus, indicating that at least one co-integrating relation exists among the variables. All the explanatory variables included in Model 2 are significant, at least, at the 1 % level of committing a type I error. The long-run real money demand elasticities with re- Table 2. Unit root testing. Variable ADF level ADF first difference Order of integration log(M/P)t –2.0995 –3.4515** I(1) log(Y/P)t –2.4708 –3.2114** I(1) log(DIR)t –1.6584 –5.6331*** I(1) log(MMRG)t –2.4821 –4.8947*** I(1) log(CR)t –1.5735 –5.1777*** I(1) log(RERU)t –1.9602 –4.4999*** I(1) Log(RERF)t –1.4463 –5.2254*** I(1) Log(RERN)t –1.4387 –3.5694** I(1) Note: the ADF critical values of –3.6852 and –2.9705 indicate significance at the 1% (***), and 5% (**) levels, respectively. All the variables are as defined previously and are expressed in natural logarithms. spect to real income (Y/P), money market rate of interest in Germany (MMRG), credit restraint (CR), bilateral real exchange rate with the US (RERU), and bilateral real exchange rate with France (RERF) are 87%, –10%, –67%, 36%, and –51%, respectively, as reported in Ta- ble 3. As Table 3 shows, the opportunity cost of real money holdings as proxied by the degree of credit re- straint (CR) and the money market rate of interest in Germany have a negative and very highly significant effect on real money holdings. Real income registers a positive and very highly significant effect on real money balances. The indication here is that growth in real in- come would provoke an increase in the demand for real cash balances, and economic agents consider real money as a normal good. Table 3. Co-integrated long-run estimates.The Dependent Variable is real money balances (M/P)t. Long-run Variable Model 1 Model 2 log(Y/P)t 0.9548*** (7.0038) 0.8688*** (12.7489) log(DIR)t 0.0230 (0.1174) - DUM*log(MMRG)t –0.1379*** (–2.9390) –0.0973*** (–5.1771) log(CR)t –0.6656*** (–5.9486) –0.6712*** (–8.9019) log(RERU)t 0.3788*** (2.7387) 0.3565*** (2.9918) log(RERF)t –0.3451 (–1.4989) –0.5063*** (–3.3446) log(RERN)t –0.0679 (–0.9557) - Constant –0.2345 (–0.2017) 0.5836 (0.9426) R-squared 0.977 0.976 Adj. R-squared 0.969 0.971 SSR 0.1087 0.1135 F-statistic 127.67*** 187.40*** ADF ECT –4.8796*** –4.7311*** Breucsh-Godfrey LM Test 3.6831 (P > 0.2259) 3.0516 (P > 0.2174) RESET Test 1.1694 (P > 0.1585) 2.4180 (P > 0.1342) ARCH Test 1.2685 (P > 0.2703) 0.1030 (P > 0.7508) Sample (1968-2000) (1968-2000) Adjusted Sample (1969-2000) (1969-2000) Note: ***, ** and * indicate significance at the 1%, 5% and 10% levels, re- spectively. DUM is a dichotomous dummy variable, taking the value 1 from 1986 to track down the period of economic crisis and massive capital flight towards Germany, and 0 otherwise. Copyright © 2011 SciRes. ME  F. M. BAYE 296 The effects of the bilateral real exchange rate on real M2 are mixed. While depreciation in Cameroon’s bilat- eral real exchange rate with the United States (RERU) would enhance the demand for real M2 balances, that with France (RERF) would reduce the demand for real money balances in the long-run. This is an indication that as the degree of competitiveness in Cameroon enhances vis-à-vis the United States, the tendency would be for wealth holders who do business with the two countries to substitute CFAF holdings for the dollar as exports are encouraged. On the other hand, depreciation in Camer- oon’s bilateral real exchange rate with France (RERF) would encourage exports from Cameroon, which may favor an expansion in holdings denominated in French francs – thanks to the fixed convertibility between the CFAF and the FF in the period under study. Indeed, the CFAF and the FF (now EURO) can be considered inter- changeable with CFAF-denominated assets. In other words, the income effect of the BRER with the United States dominates the substitution effect and the opposite applies to BRER with France. The indication here is that economic agents would prefer portfolios with assets de- nominated in EURO if they expect a further devaluation of the CFA franc. 5.3. Dynamic Adjustment and Error-Correction Estimates The results presented in Table 4 submit valuable dy- namic elements to explain the short-run determinants of real M2 balances in Cameroon, following the Engle- Granger Error-Correction approach. Lags of up to order 4 of the first differences of the variables in Equation (5) were tested, and the non-significant ones omitted. The fit of the restricted Model is good (2 R=89 %). There is no evidence on the presence of serial correlation as indi- cated by the Breusch-Godfrey LM statistic and the per- formance of all the other diagnostic statistics reported in Table 4 responded favorably. A crucial parameter in the estimation of ECM is that associated with the error-correction term (ECT). As in- timated earlier, it measures the degree of adjustment of the actual real money balances with regard to its desired long-run equilibrium level. The error-correction term of –0.6982 is correctly signed17, and significant at the 1% level. This is an indication that about 70% of shocks on the demand for real M2 balances are corrected by the “feed-back” effect annually (Table 4). The error-co- rrection coefficient can be manipulated, in the context of the error-correction specification, to derive the corre- sponding adjustment speed in terms of the number Table 4. Dynamic Error-Correction Estimates in the Engle- Granger Sense. The Dependent Variable is the first differ- ence of the log of real money balances (log(M/P)t) Variable Short-run Coefficients ECTt-1 –0.6982*** (–4.2113) log(Y/P)t 0.7853*** (6.8590) DUM*log(MMRG)t-4 –0.0364* (–1.7720) log(CR)t –0.5034*** (–7.8329) log(RERU)t 0.2592*** (3.7426) log(M/P)t-1 0.1703** (2.1460) R-squared 0.9129 Adj. R-squared 0.8888 SSR 0.0362 Breusch-Godfrey LM Test 0.4515 (P > 0.6445) RESET Test 0.0002 (P > 0.9893) ARCH Test 1.0922 (P >0.3078) Sample (1968-2000) Adjusted Sample (1974-2000) Note: ***, ** and * indicate significance at the 1%, 5% and 10% levels, respecttively. ECT is the co-integrating error-correction term, and is the first difference operator. of time periods required to eliminate a given exogenous shock18. From our computations, in order to eliminate 95% of the effects of a shock on real M2 in Cameroon, it would take about 2.5 years. Our ECM suggests that the demand for real M2 in the short-run is determined by the first differences of real income; money market rate of interest in Germany, the degree of credit restraint, bilateral real exchange rate with the US, and the one-period-lagged dependent vari- able. The bilateral real exchange rate with France has a long-run effect on real M2 balances, but fails to exhibit any short-run effect. The indication here is that in the short-run the income effect may overshadow the substi- tution effect of BRERs. Short- and long-run elasticities of real money holdings (M/P) with respect to real income (79%; 87%), market rate of interest in Germany (–4%; –10%), degree of 18As explained by [102], adjustment periods can be computed as: (1 – a = (1 – )t, where t is the number of periods, is the error-correction coefficient and a = 0.95, if we want to estimate the approximate time eriod needed to dissi ate 95% of the effects of an exo enous shock. 17The error-correction term has to remain negative for dynamic stability [101]. Copyright © 2011 SciRes. ME  F. M. BAYE297 credit restraint (–50%; –67%), RERU (26%; 36%), and RERF (0%; –51%), respectively, are given in Tables 3 and 4. The most responsive of the determinants of the demand for real M2 balances in the long-run appears to be real income, followed by the degree of credit restraint and Cameroon’s bilateral real exchange rate with the United States. 6. Conclusions An attempt has been made to provide an empirical basis for the characterization of the nature of demand for money in Cameroon. Specifically, the paper 1) undertook a brief excursion in the development of money demand theories, 2) specified and estimated demand functions for money in Cameroon using co-integration and er- ror-correction techniques, and 3) analyzed the speed that may be taken by the local money market to absorb ex- ogenous shocks on real M2 balances. Domestic real income, foreign interest rates, degree of credit restraint and bilateral real exchange rates were found to significantly influence the demand for real money balances in Cameroon during the period under study. Bilateral real exchange rates have both income and substitution effects on money demand and the ulti- mate effect depends on the dominance of one over the other. Domestic interest rates failed to manifest a sig- nificant effect. The magnitudes of the short- and long-run income elasticities of the demand for real M2 suggest that wealth holders in CFA-denominated assets consider money as a normal good. The error-correction specification suggested an ad- justment speed to long-run equilibrium of about 70 per cent per annum, which indicates that about 95% of the effects of any exogenous shock in real M2 balances in Cameroon would take, on the average, about 2.5 years to be eliminated. The following policy implications emanated from our results: by virtue of the rigidity of the nominal exchange rates facing the CFA, implementing policies that will dampen domestic prices, relative to those of trading partners, could , at least in part, ameliorate the ability of policy-makers to manipulate the demand for real M2; if the objective is to sustainably enhance the demand for real M2 balances, then narrowing the gap between growth in GDP and that of domestic credit to the economy, and vice versa, is worthwhile; there are benefits to be derived by monitoring money market developments in main partner countries with a view to supporting or countering potential tendencies as regards currency substitution or speculation via asset holdings, and policies geared towards influencing the demand-side of the money market should be designed at least with a medium term perspective. 7. References [1] B. B. Aghevli and P. J. Montiel, “Exchange Rate Policies in Developing Countries,” In: E.-M. Claassen, Ed., Ex- change Rate Policies in Developing and Post-Socialist Countries, International Center for Economic Growth, San Francisco, 1990. [2] S. Edwards, “Real Exchange Rate in Developing Coun- tries: Concepts and Measurements,” In: T. J. Grennes, Ed., International Financial Markets and Agricultural Trade, Westview Press, Boulder, 1990. [3] I. A. Elbadawi, “Real Over-Valuation, Terms of Trade Shock, and the Cost of Agriculture in Sub-saharan Af- rica,” Policy Research Working Papers, WP 5831, The World Bank, Washington, 1992. [4] P. Arrau and J. de Gregorio, “Financial Innovation and Money Demand: Application to Chile and Mexico,” Re- view of Economics and Statistics, Vol. 75, No. 3, 1993, pp. 524-530. doi:10.2307/2109469 [5] M. A. Cuevas, “Money Demand in Venezuela: Multiple Cycle Extraction in a Co-Integration Framework,” Working Paper, No. 2844, The World Bank, Washington, 2002. [6] M. Bahmani-Oskooee and R. C. Wing Ng, “Long-Run Demand for Money in Hong Kong: An Application of the ARDL Model,” International Journal of Business and Economics, Vol. 1, No. 2, 2002, pp. 147-155. [7] A. M’Bet and A. M. Niamkey, “European Economic In- tegration and the Franc Zone: The Future of the CFA France after 1996,” Research Paper 19, AERC, Nairobi, 1993. [8] World Bank “Adjustment in Africa: Reforms, Results and the Road Ahead,” A World Bank Policy Research Report, Washington, 1994. [9] M. F. Baye, “The CFA Franc Devaluation: Rationale, Consequences and Limitations for Cameroon,” University of Yaoundé II, (Manuscript), 1995. [10] S. Devarajan and L. E. Hinkle, “The CFA Franc Parity Change: An Opportunity to Restore Growth and Reduce Poverty,” The World Bank, Washington, 1994. [11] The International Monetary Fund, “International Finan- cial Statistics,” 1998. [12] S. S. Sriram, “Theory of Demand for Money: A Survey of Literature,” The Indian Economic Journal, Vol. 49, No. 1, 2001, pp. 103-115. [13] J. S. Mill, “Principles of Political Economy,” John W. Parker, London, 1848. [14] L. Walras, “Elements d’Economie Politique Pure,” F. Pichon, Paris, 1900. [15] W. S. Jevons, “Money and the Mechanism of Exchange,” D. Appleton, London, 1875. Copyright © 2011 SciRes. ME  F. M. BAYE 298 [16] K. Wicksell, “Lectures on Political Economy,” Transla- tion by E. Classen, London, 1906. [17] R. Katafono, “A Re-Examination of the Demand for Money in Fiji,” Working Paper 2001/03, Reserve Bank of Fiji, 2001. [18] I. Fisher, “The Purchasing Power of Money,” Macmillan, New York, 1911. [19] A. C. Pigou, “The Value of Money,” The Quarterly Jour- nal of Economics, Vol. 32, No. 1, 1917, pp. 38-65. doi:10.2307/1885078 [20] A. Marshall, “Money, Credit and Commerce,” Macmillan, London, 1923. [21] J. M. Keynes, “A Treatise on Money,” Macmillan, Lon- don, 1930. [22] J. M. Keynes, “The General Theory of Employment, In- terest, and Money,” Macmillan, London, 1936. [23] S. Ghatak, “Monetary Economics in Developing Coun- tries,” Macmillan, London, 1981. [24] D. F. Hendry and N. R. Ericsson, “An Econometric Analysis of UK Money Demand,” American Economic Review, Vol. 81, No. 1, 1991, pp. 8-38. [25] W. J. Baumol, “The Transactions Demand for Cash: An Inventory Theoretic Approach,” The Quarterly Journal of Economics, Vol. 66, No. 4, 1952, pp. 545-556. doi:10.2307/1882104 [26] J. Tobin, “The Interest-Elasticity of Transactions Demand for Cash,” The Review of Economics and Statistics, Vol. 38, No. 3, 1956, pp. 241-247. doi:10.2307/1925776 [27] K. Cuthbertson and D. Barlow, “Money Demand Analy- sis: An Outline,” In: M. P. Taylor, Ed., Money and Fi- nancial Markets, Basil Blackwell, Cambridge, 1991. [28] J. Tobin, ‘Liquidity Preference as Behavior Towards Risk,” The Review of Economic Studies, Vol. 25, No. 2, 1958, pp. 65-86. doi:10.2307/2296205 [29] M. Friedman, “The Quantity Theory of Money–A Re- statement,” In: M. Friedman, Ed., Studies in the Quantity Theory of Money, University of Chicago Press, Chicago, 1956. [30] W. A. Barnett, “Economic Monetary Aggregates: An Ap- plication of Index Number and Aggregation Theory,” Journal of Econometrics, Vol. 14, No. 1, 1980, pp. 11-48. doi:10.1016/0304-4076(80)90070-6 [31] M. Friedman, “Post-War Trends in monetary Theory and Policy,” National Banking Review, Vol. 3, No. 1, 1964, pp. 1-9. [32] D. E. W. Laidler, “The Demand for Money: Theories, Evidence and Problems,” 4th Edition, Harper Collins College Publishers, New York, 1993. [33] S. S. Sriram, “A Survey of Recent Empirical Money De- mand Studies,” IMF Staff Papers, Vol. 47, No. 3, 2001, pp. 279-311. [34] G. G. Kaufman and C. M. Latta, “The Demand for Money; Preliminary Evidence from Industrial Countries,” The Journal of Financial and Quantitative Analysis, Vol. 1, No. 3, 1966, pp. 75-89. doi:10.2307/233014 [35] D. Gujarati, “The Demand for Money in India,” Journal of Development Studies, Vol. 5, No. 1, 1968, pp. 59-64 doi:10.1080/00220386808421282 [36] S. Ghatak, “Rural Money Markets in India,” Macmillan, India, Delhi, 1976. [37] S. Tomori, “The Demand for Money in the Nigerian Economy,” Nigerian Journal of Economic and Social Sciences, Vol. 14, No. 3, 1972, pp. 337-345. [38] C. H. Wong, “Demand for Money in Developing Coun- tries, Some Theoretical and Empirical Results,” Journal of Monetary Economics, Vol. 3, No. 1, 1977, pp. 59-86. doi:10.1016/0304-3932(77)90005-8 [39] H. Myint, “Economic Theory and the Underdeveloped Country,” Oxford University Press, New York, 1971. [40] R. I. McKinnon, “Money and Capital in Economic De- velopment,” The Brookings Institute, Washington, 1973. [41] E. S. Shaw, “Financial Deepening in Economic Devel- opment,” Oxford University Press, New York, 1973. [42] A. Hynes, “The Demand for Money and Monetary Ad- justment in Chile,” Review of Economic Studies, Vol. 34 No. 3, 1967, pp. 285-293. doi:10.2307/2296676 [43] J. V. Deaver, “The Chilean Inflation and the Demand for Money,” In: D. Meiselman, Ed., Variety of Monetary Ex- perience, University of Chicago Press, Chicago, 1970, pp. 9-67. [44] C. D. Campbell, “The Velocity of Money and the Rate of Inflation; Recent Experiences in South Korea and Bra- zil,” In: D. Meiselman, Ed., Variety of Monetary Experi- ence, University of Chicago Press, Chicago, 1970, pp. 341-386. [45] M. S. Khan, “Monetary Shocks and the Dynamics of Inflation,” IMF Staff Papers, Vol. 27, No. 2, 1980, pp. 250-284. doi:10.2307/3866713 [46] M. J. Driscoll and A. K. Lahiri, “Income Velocity of Money in Agricultural Developing Economies,” Review of Economics and Statistics, Vol. 65, No. 3, 1983, pp. 393-401. doi:10.2307/1924184 [47] J. O. Adekunle, “The Demand for Money: Evidence from Developed and Less Developed Economies,” IMF Staff Papers, Vol. 15, 1968, pp. 220-266. [48] Y. C. Parker, “The Variability of Velocity: An Interna- tional Comparison,” IMF Staff Papers, Vol. 17, No. 30, 1970, pp. 620-637. doi:10.2307/3866361 [49] R. Simmons, “An Error-Correction Approach to Demand for Money in Five African Developing Countries,” Jour- nal of Economic Studies, Vol. 19, No. 1, 1992, pp. 29-47. [50] S. Arango and M. I. Nadiri, “Demand for Money in Open Economies,” Journal of Monetary Economics, Vol. 7, No. 1, 1981, pp. 69-83. doi:10.1016/0304-3932(81)90052-0 [51] G. C. Chow, “On the Long-Run and Short-Run Demand for Money,” The Journal of Political Economy, Vol. 74, No. 2, 1966, pp. 111-131 doi:10.1086/259130 [52] S. M. Goldfeld, “The Demand for Money Revisited,” Brookings Papers on Economic Activity, Vol. 1973, No. 3, 1973, pp. 577-646. doi:10.2307/2534203 3 Copyright © 2011 SciRes. ME  F. M. BAYE Copyright © 2011 SciRes. ME 299 [53] D. E. W. Laidler, “The ‘Buffer Stock’ Notion in Monetary Economics,” The Economic Journal, Vol. 94, 1984, pp. 17-34. doi:10.2307/2232652 [54] D. F. Hendry, A. R. Pagan and J. D. Sargan, “Dynamic Specification, Chapter 18,” In: Z. Griliches and D. Mi- chael, Eds., Handbook of Econometrics, 2nd Edition, Vol. 1, Intriligator, New York, 1984, pp. 1023-1100. [55] S. Nickell, “Error Correction, Partial Adjustment and all that: An Expository Note,” Oxford Bulletin of Economics and Statistics, Vol. 47, No. 2, 1985, pp. 119-130. doi:10.1111/j.1468-0084.1985.mp47002002.x [56] R. Milbourne, “Disequilibrium Buffer Stock Models: A Survey,” Journal of Economic Surveys, Vol. 2, No. 3, 1988, pp. 187-208. doi:10.1111/j.1467-6419.1988.tb00044.x [57] R. Engle and C. W. J. Granger, “Co-integration and Er- ror-Correction: Representation, Estimation, and Testing,” Econometrica, Vol. 55, No. 2, 1987, pp. 251-276. doi:10.2307/1913236 [58] S. Johansen, “Statistical Analysis of Cointegration Vec- tors,” Journal of Economic Dynamics and Control, Vol. 12, No. 2-3, 1988, pp. 231-254. [59] S. Johansen, K. Juselius, “Maximum Likelihood Estima- tion and Inference on Cointegration―With Applications to the Demand for Money,” Oxford Bulletin of Econom- ics and Statistics, Vol. 52, No. 2, 1990, pp. 169-210. [60] D. F. Hendry, “Econometrics–Alchemy or Science,” Eco- nomica, Vol. 47, No. 188, 1980, pp. 387-406. doi:10.2307/2553385 [61] C. L. Gilbert, “Professor Hendry’s Econometric Method- ology,” Oxford Bulletin of Economics and Statistics, Vol. 48, No. 3, 1986, pp. 283-307. doi:10.1111/j.1468-0084.1986.mp48003007.x [62] A. Pagan, “Three Econometric Methodologies: A Critical Appraisal,” Journal of Economic Surveys, Vol. 1 No. 1-2, 1987, pp. 3-24. doi:10.1111/j.1467-6419.1987.tb00022.x [63] A. Beyer, “Modeling Money Demand in Germany,” Jour- nal of Applied Econometrics, Vol. 13, No. 1, 1998, pp. 57-76. doi:10.1002/(SICI)1099-1255(199801/02)13:1<57::AID- JAE457>3.0.CO;2-Z [64] E. Jondeau and N. Villermain-Lécolier, “La Stabilité de la Fonction de Demande de Monnaie aux Etats-Unis,” Revue Economique, No. 5, 1996, pp. 1121-1148. [65] C. Adam, “Recent Developments in Econometric Methods: An Application to the Demand for Money in Kenya,” AERC Special Paper No. 15, 1992. [66] J. K. Atta and J. Anyangah, “Dynamic Specification of the Money Demand in Botswana,” African Journal of Economic Policy, Vol. 4, No. 2, 1997, pp. 1-27. [67] D. Fielding, “Money Demand in Four African Countries,” Journal of Economic Studies, Vol. 21, No. 2, 1994, pp. 3-37. doi:10.1108/01443589410062968 [68] M. Bahmani-Oskooee and H. J. Rhee “Long-Run Elas- ticities of the Demend for Money in Korea: Evidence from Co-integration Analysis,” International Economic Journal, Vol. 8, No. 2, 1994, pp 1-11. [69] M. Bahmani-Oskooee and R. C. Wing Ng, “Long-run Demand for Money in Hong Kong: An Application of the ARDL Model,” International Journal of Business and Economics, Vol. 1, No. 2, 2002, pp. 147-155. [70] C. W. J. Granger, “Some Recent Developments in the Concept of Causality,” Journal of Econometrics, Vol. 39, No. 1-2, 1988, pp 199-211. doi:10.1016/0304-4076(88)90045-0 [71] A. M. M. Masih and R. Masih, “Empirical Test to Dis- cern the Dynamical Causality Chain in Macroeconomics Activity: New Evidence from Thailand and Malaysia Based on Multivariate Co-integrated VECM Approach,” Journal of Policy Modeling, Vol. 18, No. 5, 1996, pp. 531-560. doi:10.1016/0161-8938(95)00133-6 [72] E. Kouassi, B. Decaluwe, C. M. Kapombe and D. Co- lyer, “Temporal Causality and the Dynamic Interactions betweeen Terms of trade and Current Account Deficits in Co-integrated VAR Processes: Further Evidence from Ivorian Time Series,” Applied Economics, Vol. 31, No. 1, 1999, pp. 89-96. doi:10.1080/000368499324589 [73] P. C. B. Phillips and M. Loretan, “Estimating Long-Run Economic Equilibria,” Review of Economic Studies, Vol. 55, 1991, pp. 407-436. doi:10.2307/1913236 [74] I. A. Elbadawi and R. Soto, “Real Exchange Rates and Macroeconomic Adjustments in Sub-Saharan Africa and Other Developing Countries,” Journal of Africa Econo- mies, Vol. 6, No. 3S, 1997, pp. 74-120.  F. M. BAYE Copyright © 2011 SciRes. ME 300 Appendix: List of Acronyms BEAC: Banque des Etats de l’Afrique Centrale (Bank of Central African States) BRER: Bilateral Real Exchange Rate BSMs: Buffer Stock Models CFA: Currency of the members of the Franc Zone CR: Degree of Credit Restraint ECMs: Error Correction Models EURO: Currency of the European Union FF: French Franc FZ: Franc Zone GDP: Gross Domestic Product IFS: International Financial Statistics M1: Currency plus Demand Deposits M2: M1 plus Time Deposits MMRG: Money Market Rate of Interest in Germany PAMs: Partial Adjustment Models RER: Real Exchange Rate RERF: Bilateral Real Exchange Rate with France RERN: Bilateral Real Exchange Rate with Nigeria RERU: Bilateral Real Exchange Rate with the United States SAPs: Structural Adjustment Programmes STSMs: Structural Time Series Models US$: United States dollars VECMs: Vector Error Correction Models

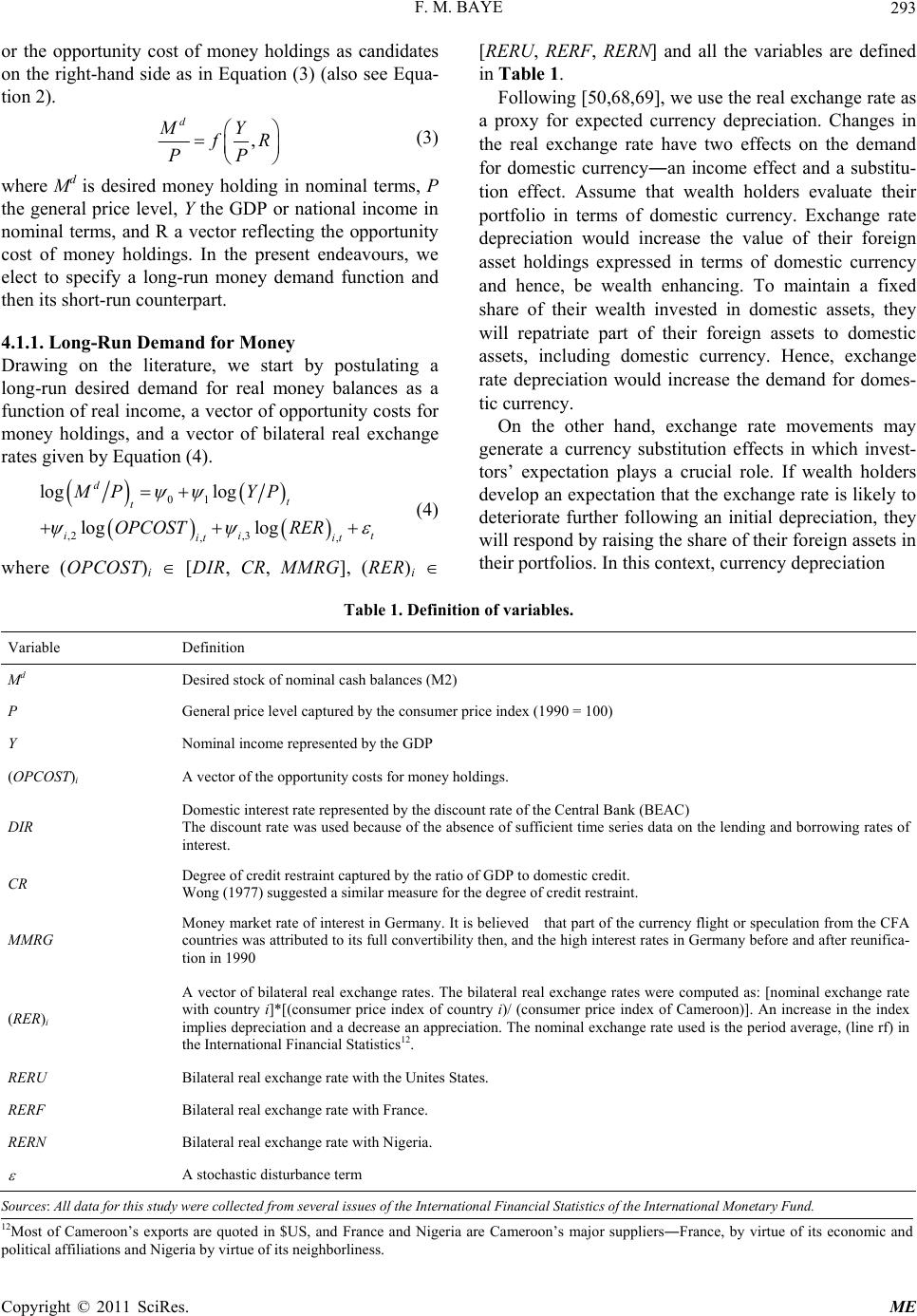

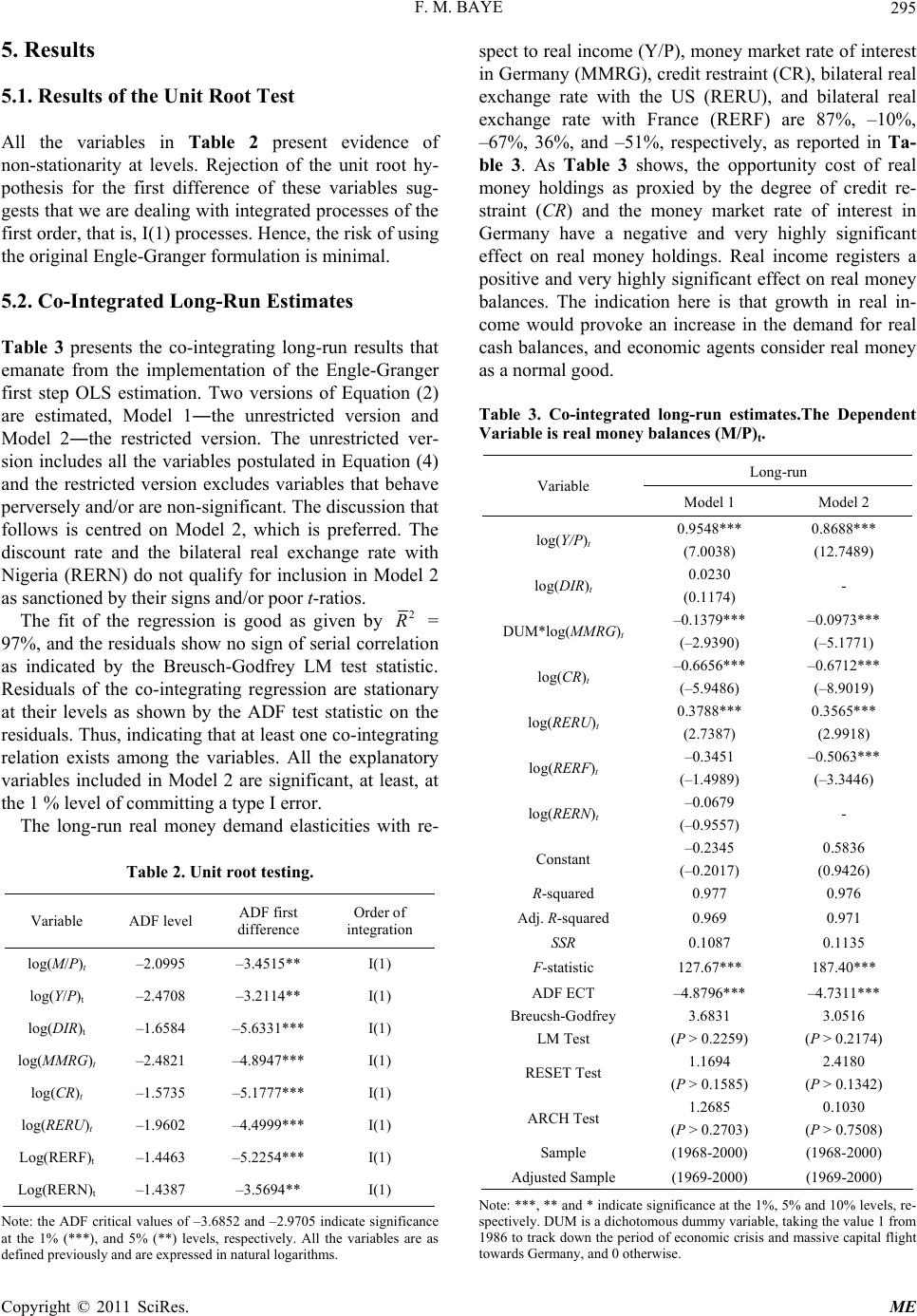

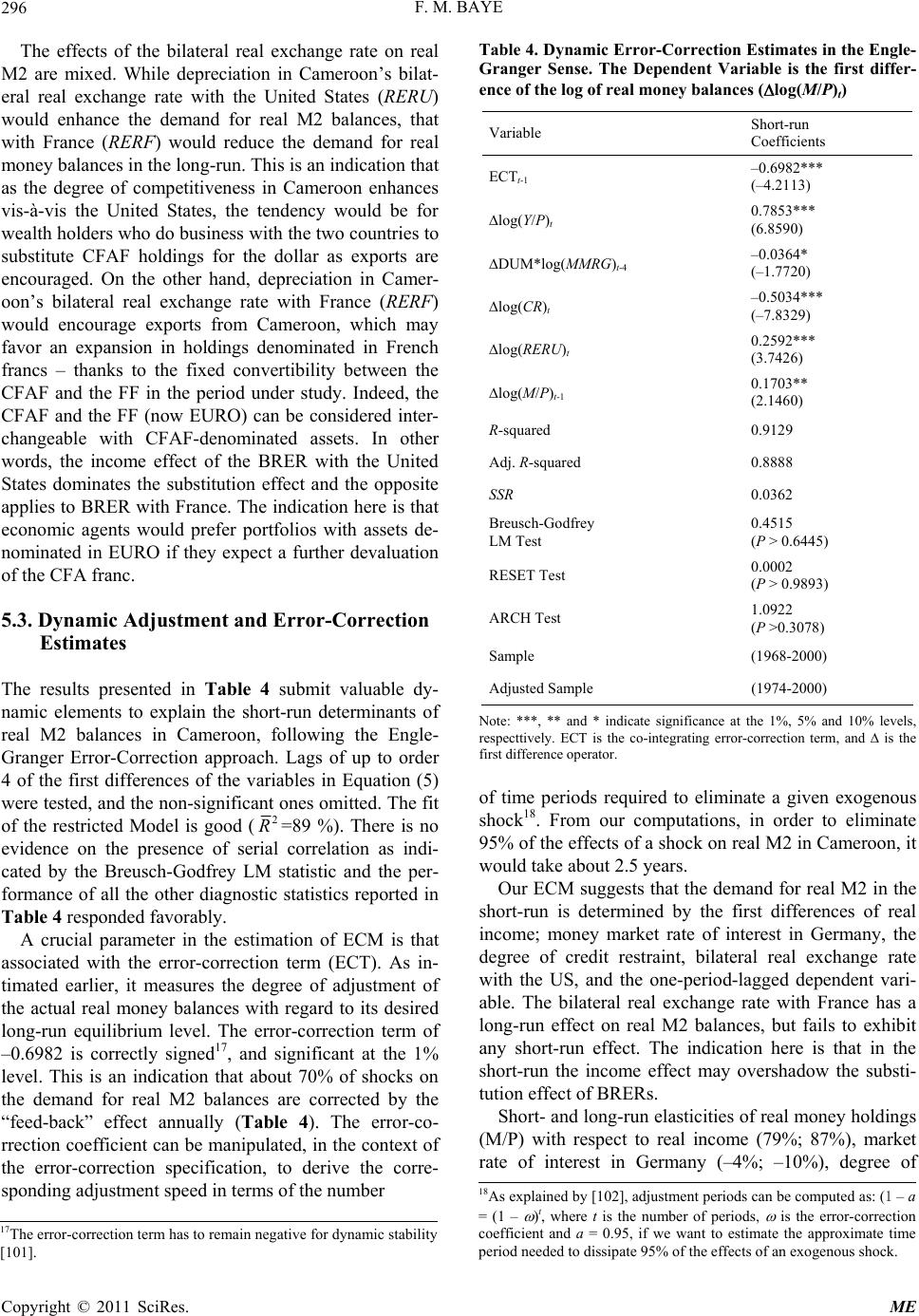

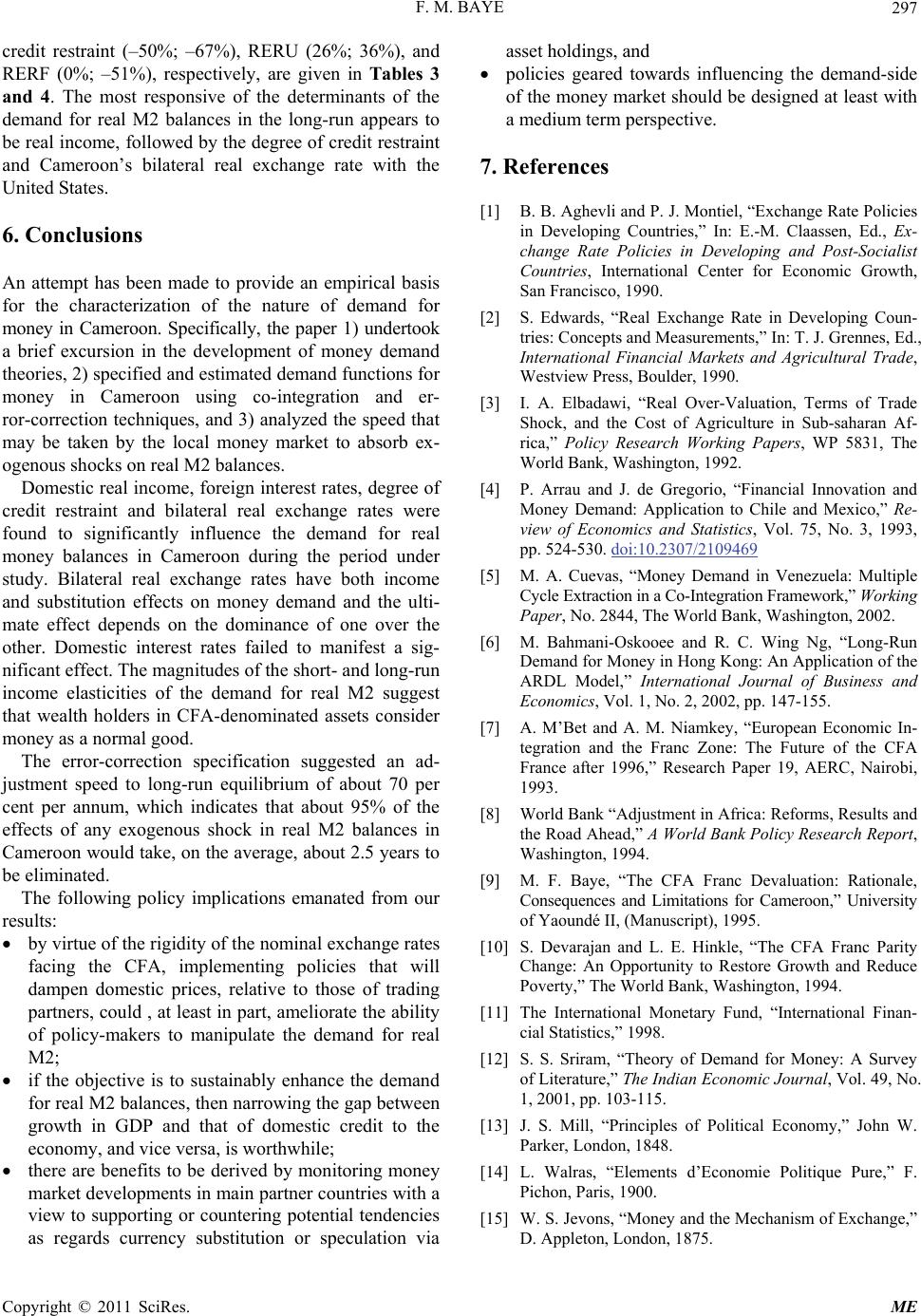

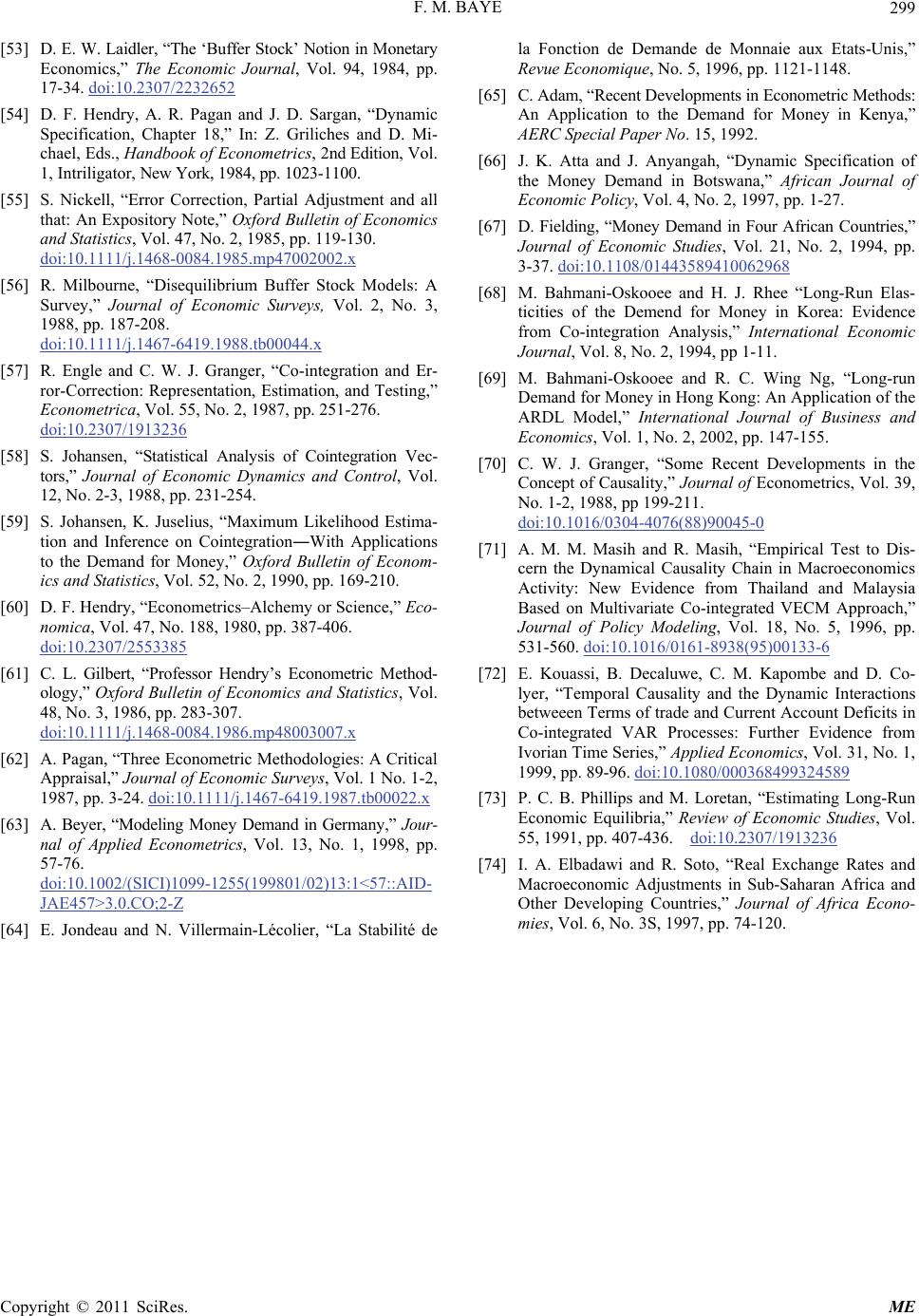

|