Modern Economy, 2011, 2, 279-286 doi:10.4236/me.2011.23031 Published Online July 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Duration Dependence in Bull and Bear Stock Markets Haigang Zhou, Steven E. Rigdon 1Department of Fin anc e, Clevela n d S t ate Universit y, Cleveland, USA 2Department of Mathem at i c s an d St at i st i cs , Southern Illinois University Edwardsville, Edwardsville, USA E-mail: H.zhou16@csuohio.edu Received January 20, 2011; revised March 15 , 20 1 1; accepted April 1, 2011 Abstract Testing duration in stock markets concerns the ability to predict the turning points of bull and bear cycles. The Weibull renewal process has been used in previous studies to analyze duration dependence in economic and financial cycles. A goodness-of-fit test, however, shows that this model does not fit data from U.S. stock market cycles. As a solution, this study fits the modulated power law process that relies on less restrictive assumptions. Moreover, it measures both the long term properties of bull and bear markets, such as the ten- dency of the cycles to become shorter (or longer), as well as the short term effects, such as duration depend- ence. The results give evidence of negative duration dependence in all samples of bull markets and evidence of positive duration dependence in complete, peacetime and post WWII samples of bear markets. There is no evidence of any structural change in duration dependence after WWII in either bull or bear markets. The re- sults show that bull and bear markets tend to get progressively shorter, but for bull markets this trend has accelerated since WWII whereas for bear markets this trend has decelerated since WWII. Goodness-of-fit tests suggest that the modulated power is a suitable model for U.S. stock market cycles. Keywords: Modulated Power Law Process, Business Cycles, Financial Cycles, Power Law Process, Weibull Distribution, Renew al Proc es s 1. Introduction The duration dependence of stock market cycles can help to pinpoint the peaks and troughs in these cycles. The predictability o f turning po ints and the relevan ce of dura- tion dependence analysis in financial markets has been studied in [1] and [2]. Unstructured statistical models have been used in modeling duration dependence in business cycles [3], REOIT cycles [1], and stock market cycles [2] and [4]. Previous studies have often used the Weibull renewal process to study duration dependence in business and financial cycles. For the Weibull renewal process, the probability of an event in a small interval depends only on the time since the previous event, and not on the pre- vious pattern of failures or the times since the process initially began. In particular, this model assumes that after the occurrence of an event, the system is always in exactly the same condition, precluding the possibility of a long term change in the system. Through goodness-of- fit tests, it was shown in [4] that U.S. business cycles do not fit the simple Weibull renewal process model. The nonhomogeneous Poisson process (NHPP) is ano- ther model that has been used to odel the occurrence of events in time. For an NHPP, the prob ability of an ev ent in a small interval is some function of time since the ini- tial startup of the system. An event and the subsequent restarting of the system, therefore, has no effect on the system performance. If the probab ility of an ev ent occur- ring in a small interval is constant across time, then the process is a homogeneous Poisson process where the times between events are independent and identically distributed exponential random variables. This special case is also a renewal process. Thus, for a renewal process, the system starts anew each time there is an event, whereas for the NHPP, the process picks up right where it left off. In the reliability context, the renewal process is described as a good-as- -new, or same-a s - new model, and the NHPP is described as a bad-as-old or same-as-old model. Therefore, a renewal process can model duration dependence but not any long term effects, such as the tendency of in- tervals to get longer or shorter. The NHPP, on the other hand, can model long term effects, but not duration de- pendence. We propose using the modulated power law process  H. G. ZHOU ET AL. 280 (MPLP) to model duration dependence for U.S. stock market cycles. This model, suggested by [5,6], and [7], is a compromise between a renewal process and an NHPP. With the MPLP, we are able to estimate long term effects, such as events becoming progressively more (or less) frequent, as well as short term effects, such as duration dependence. Our study is also related to the Frisch-Slutsky para- digm of cycles. Frisch [8] and Slutsky [9] state that there is no need to appeal to specific determinant causes of cycles. Many of the advances in theories of cyclical vo- latilities are in the field of business cycles and little theoretical work has been devoted to financial cycles. Although much of the following discussion on theories of cycles are from business cycles, we believe that the insight from the theories can also improve our under- standing of financial cycles, even without identifying the exact sources of shocks to the financial markets. Much progress has been made in understanding business cycles and even economists are not able to agree on the causes of cyclical volatility. The exact cau ses of cyclical volatil- ity are debated and identifying the sources of shocks to the financial markets is beyond the scope of this study. [10] provides a detailed review on the evolution of busi- ness cycle theories. References [11] and [12] provide a framework to identify shocks to the financial sectors. Frisch [8] and Slutsky [9] argued that many phenomena existed that could precipitate a real shock in the market’s equilibrium path. A large negative shock, although rare, would be sufficient to draw the average market activity away from the equilibrium level for a sufficiently long period of time to be considered a downswing. Slutsky argued that “clusters” of small negative shocks can also move the market away from its equilibrium. As we de- scribe in Section 2.2, the MPLP involves one parameter which can be thought of as the accumulated number of shocks. We fit the modulated power law process do data from bull and bear markets. We consider separately peacetime and war time data, as well as pre- and post-WWII data. We find evidence of negative duration dependence in all samples of bull markets and in pre-WWII bear markets, and evidence of positive duration dependence in com- plete, peacetime, and post-WWII samples of bear mar- kets. In regards to the long term effect, evidence shows that bull and bear markets tend to get progressively shorter, but for bull markets, this trend has accelerated since WWII, whereas for bear markets, this trend has decelerated since WWII. Section 2 describes the methodology used in the study as well as the sampling data. Section 3 presents descrip- tive statistics and empirical results, while Section 4 of- fers concluding remarks. 2. Methodology and Data In this study, both the Weibull renewal process and the MPLP are used to examine the duration of bull and bear markets. The Weibull renewal process and its variations are widely used in the duration dependence literature. The Weibull renewal process assumes a linear relation- ship between the log of the intensity function (measured from the last event and restart of the system) and that of the durations. The MPLP is a generalization of both the Weibull renewal process and the NHPP with a power law intensity function. When we consider bull markets, we ignore the intervening bear markets and treat the intere- vent times as if they were back-to-back. Bear markets are treated similarly. 2.1. Weibull Renewal Process The Weibull renewal process assumes that the times be- tween events are independent random variables, each with the same Weibull distribution. The probability den- sity function (PDF) and the hazard function for the Wei- bull distribution are 1exp, 0, tt ft t and 1 ,0 1 ft t ht t Ft . Here 0 is a shape parameter and is a scale parameter. The hazard function is increasing when 1 , decreasing when 1 , and constant when 1 . 1 When , Weibull distribution reduces to the exponential distribution. the ) ) An increasing hazard function ( implies that the conditional probability of a turning point in the mar- ket cycle will thus increase as the duration of the cycle increases; this indicates positive duration dependence. On the other hand a decreasing hazard function 1 (1 implies that the conditio nal probability of a turning point will decrease as the duration of the cycle increases; this indicates negative duration dependence. We fit the Weibull renewal process to the bull and bear markets from 1885 to 2000. Goodness-of-fit tests reject the hypothesis of a Weibull renewal process for both the bull markets and the bear markets. Further details regarding the analysis of these data are found in Section 3.2. 2.2. The Modulated Power Law Process The MPLP was introduced by [5] and [6] as a compro- Copyright © 2011 SciRes. ME  H. G. ZHOU ET AL.281 mise between the Weibull renewal process and an NHPP with intensity function 1, t t 0,t (1) where time is measured from the initial startup of th e system. The NHPP with this parametric form of the in- tensity function is called the power law process in the reliability literature. As we mentioned in Section 1, the Weibull renewal process can be thought of as a same- -as-new model, whereas the NHPP is a same-as-old model because of the assumptions about what happens after an event and restart of the system. t The MPLP is then derived as follows. Suppose that shocks occur according to the power law process, the NHPP with intensity function given in (1). Suppose fur- ther that an event does not occur at every shock, but ra- ther after every shocks. For now we assume that is a positive integer. After the th shock, the shock counter is reset to zero, but time t is not reset to zero. This is what allows us to model the long term effects, such as the tendency of times between events to increase. For example, suppose that 2 and 5 t ; then we would observe that shocks occur more and more fre- quently as time advances, because the intensity function for the shocks is proportional to , an increasing function in . However, each time an event occurs, the shock counter would be reset, so we would have positive duration dependence. Thus, we would have positive du- ration dependence while the long term tendency is to have shorter durations. Larger values of 21 t t indicate stronger positive duration dependence, whereas larger values of indicate a long term tendency for shorter and shorter intervals between events. Since we consider the bull markets (and also the bear markets) as if they were back-to-back, we let i denote the time of the ith event, measured from the initial point of data collection. We define 0. The interevent times, 1iii T 0T TT , then represent the length of each bull (or bear) market. It can be shown (see, for example, [6,7]) that the ran- dom variables 1,1,2,, ii iTT , in are independent and identically distributed random vari- ables having a gamma distribution with PDF 1exp ,0. x fxx x From this result, we can determine the likelihood function for the i ’s, and then the likelihood function for the observed ’s. Note that the ’s are the event times measured from the initial startup of the system. The log likelihood function is then i Ti T 12 1 1 1 ,,,, ,lnln ln1 ln 1ln n n n i i n ii i t tt tnn nt tt (2). The maximum likelihood estimates can then be ob- tained by differentiating the log-likelihood function with respect to each parameter, setting the results equal to zero, and using a numerical method to approximate the solution. The description above relies on counting the number of shocks to the system, requiring that be a positive integer. However, the likelihood in (2) is a valid likeli- hood for all positive values of , not just for positive integers. The following example suggests how noninte- ger values can be allowed for . Suppose that local events occur at the rate t 5 . Each time a local event occurs, the probability that it is a shock to the system is 1/2. Suppose also, that shocks will cause a sys- tem event (end of bull/bear market). Since only about half of the local events will cause a shock, there will be on average 125 2.5 shocks that cause a failure. The model just described is indistinguishable from a MPLP with rate t and 2.5 . Other fractional values can be similarly explained. In looking at another way of explaining fractional values of , [7] simulated a number of processes for various values of . They found that with large values of , the event times were evenly spaced, possibly with a long term effect of inter- event times getting shorter or longer. Thus for large , as the duration gets longer, we get closer to the next point in the spacing, which means that the conditional probability of a system event gets larger. For 1 , the events are very much clustered, with a few very short interevent times and a few very long interevent times. These are much more clustered than would be expected by a Poisson process. The existence of clustering sug- gests negative duration dependence, since as the duration increases, it becomes more likely that it is one of the very long interevent times. For a third way of consider- ing fractional valu es of , we consider special cases of the MPLP. When 1 , the MPLP with parameters and is a NHPP with intensity function t 1,t 0t. When , then the MPLP with parameters 1 and is a Weibull renewal process. Since noninteger values of are allowed in the Wei- bull distribution, it seems reasonable to allow noninteger values in a generalization of the Weibull renewal process. Copyright © 2011 SciRes. ME  H. G. ZHOU ET AL. Copyright © 2011 SciRes. ME 282 time samples. The results indicate that war does not have significant impact on the duration of stock markets. This differs from the results reported in [4] that the average length of the complete sample of expansions is lower than that of peace time expansions. We also observe that the average duration of bull markets is longer and the average duration of bear markets is shorter in the post-WWII subsample than in the pre-WWII subsample. Finally, if , then the MPLP reduces to the ho- mogeneous Poisson process with intensity function 1 1t . 2.3. Data Data from stock market cycles exist as far back as 1885. These data, taken from [13], are reproduced in Table 1. The bull and bear markets during wars are indicated in bold face. Figure 1 shows plots of durations for bull and bear markets both pre- and post-WWII. 3.2. Empirical Results from the Weibull Analysis Table 3 shows the maximum likelihood estimates of the parameters, along with confidence intervals. For bull markets, the MLE for is for the complete sample. Because the 95% confidence interval excludes 1, we conclude that there is evidence that the true value of ˆ1.836 exceeds 1. This indicates that positive duration de- pendence exists in cycles of bull markets. Similar results are obtained for the peace time, and pre- and post-WWII data (both bull and bear markets), supporting the exis- tence of positive duration dependence. This implies that the probability of a bull/bear market ending increases as the duration increases. These results differ from those 3. Empirical Findings 3.1. Descriptive Statistics Descriptive statistics of bull and bear markets, broken down into peacetime, pre-WWII, and post-WWII are reported in Table 2. The complete sample includes all observations, while the peacetime sample excludes war-time cycles. The average duration of bull markets is 28 months for the complete sample, and it is 27 months for the peacetime bull markets. The average duration of bear markets is 15 months for both complete and peace Table 1. U.S. bull and bear stock markets (1885 through 2000). Dates of peaks and troughs in the U.S. stock markets. Dura- tions (in months) are also shown. Data are obtained from [13]. Bold face indicates wartime bull and bear markets. Pre-WWII Post- WWII Trough Peak Bull Bear Trough Peak Bull Bear Jan-1885 May-1887 28 13 May-1946 21 Jun-1888 May-1890 23 7 Feb-1948 Jun-1948 4 12 Dec-1890 Aug-1892 20 31 Jun-1949 Jan-1953 43 9 Mar-1895 Sep-1895 6 11 Oct-1953 Jul-1956 33 17 Aug-1896 Apr-1899 32 17 Dec-1957 Jul-1959 19 15 Sep-1900 Sep-1902 24 13 Oct-1960 Dec-1961 14 6 Oct-1903 Sep-1606 35 14 Jun-1962 Jan-1966 43 9 Nov-1907 Dec-1909 25 7 Oct-1966 Dec-1968 26 18 Jul-1910 Sep-1912 26 27 Jun-1970 Jan-1973 31 23 Dec-1914 Nov-1916 23 13 Dec-1974 Sep-1976 21 18 Dec-1917 Jul-1919 19 25 Mar-1978 Dec-1980 33 19 Aug-1921 Mar-1923 19 7 Jul-1982 Jun-1983 11 11 Oct-1923 Sep-1929 71 33 May-1984 Aug-1987 39 3 Jun-1932 Feb-1934 20 13 Nov-1987 May-1990 30 5 Mar-1935 Feb-1937 23 14 Oct-1990 Jan-1994 39 5 Apr-1938 Oct-1938 6 42 Jun-1994 Aug-2000 74 Apr-1942 May-1946 49  H. G. ZHOU ET AL. Copyright © 2011 SciRes. ME 283 (a) (b) Figure 1. Dot plots for durations of bull and bear markets, measured in months. Multiple occurrences are indicated by stacking the dots. (a) Bull market; (b) Bear market. Table 2. Descriptive statisticsof bull and bear markets. The complete sample includes all bull and bear markets from January 1885 to August 2000, including separate statistics for peace time, pre-WWII and post-WWII. Complete Peace Time Pre-WWII Post-WWII Bull Markets Mean 28 27 26 31 Median 26 24 23 31 Std. Dev. 15.84 16.50 15.15 16.82 Skewness 1.21 1.54 1.68 0.91 Kurtosis 2.25 3.22 4.25 2.20 Bear Markets Mean 15 15 18 13 Median 13 14 18 18 Std. Dev. 9.01 8.07 10.47 6.45 Skewness 1.14 0.95 1.05 6.45 Kurtosis 1.36 –0.15 0.21 –1.37 reported in [2] who report the existence of duration de- pendence in post-WWII bear markets and in pre-war bull markets, but they found no evidence of duration de- pendence in pre-war bear markets and post-war bull markets. The Weibull renewal process implies that the process is renewed after every event. This precludes any long- term effects, such as the tendency for the intervals to become shorter or longer. We tested the adequacy of the Weibull distribution using goodness-of-fit statistics pro- Table 3. MLEs and confidence intervals. Maximum likeli- hood estimates and confidence intervals for the parameters of the Weibull renewal pr oce ss. 95% Confidence Interval for ˆ Lower Upper Bull Markets Complete 1.865 [1.512, 2.226 ] Peace time 1.699 [1.369, 2.108 ] Pre-WWII 1.900 [1.505, 2.398 ] Post-WWII 1.787 [1.306, 2.444 ] Bear Markets Complete 1.853 [1.547, 2.219 ] Peace time 1. 993 [1.629, 2.437 ] Pre-WWII 1.908 [1.487, 2.448 ] Post-WWII 2.187 [1.660, 2.880 ] 95% Confidence Interval for ˆ Lower Upper Bull Markets Complete 32.30 [32.07, 32.54] Peace time 31.08 [30.82, 31.33] Pre-WWII 29.83 [29.53, 30.16] Post-WWII 35.22 [34.86, 35.58] Bear Markets Complete 17.44 [17.22, 17.67] Peace time 16.84 [16.60, 17.09] Pre-WWII 20.36 [20.06, 20.68] Post-WWII 14.40 [14.08, 14.73] posed by [14]. Table 4 shows the various goo dn ess-of -f it tests that we applied. The upper part of Table 4 reports the test results for bull markets, while the bottom part reports those for bear markets. For the complete sample, all three tests statistics reject the null hypothesis that the Weibull is the distribution for the interevent times. Both the Cramér-von Mises2 and Watson2 tests re- ject the null hypothesis at the 1% level, while the An- derson-Darlin 2 W U g test rejects at the 10% significance level. Similar results are reported for the peace time and pre-and post-war bull m a rkets. For bear markets, the Cramér-von Mises and Watson tests both reject the null hypothesis that the Weibull dis-  H. G. ZHOU ET AL. 284 tribution is adequate at the 1% significance level. TheAnderson-Darling statistics fail to reject the null hy- Table 4. Goodness-of-fit tests for the Weibull renewal proc- ess. Goodness-of-fit tests for the Weibull renewal process for bull markets (upper) and bear markets (lower), using the complete sample, peace time sample, and pre-WWII and post-WWII. All statistics are adjusted by multiplying by 10.2 n. The corresponding P-values are given in parentheses. Complete Peace Time Pre-WWII Post-WWII Bull Markets Cramer-von Mises 2 W5.74 (<0.01) 4.92 (<0.01) 3.21 (<0.01) 2.71 (<0.01) Watson 2 U5.73 (<0.01) 4.92 (<0.01) 3.21 (<0.01) 2.71 (<0.01) Anderson- Darling 2 0.638 (>0.1) 0.656 (>0.1) 0.957 (0.025) 0.366 (>0.25) Bear Markets Cramer-von Mises 2 W5.79 (<0.01) 4.74 (<0.01) 3.23 (<0.01) 2.63 (<0.01) Watson 2 U5.79 (<0.01) 4.74 (<0.01) 3.22 (<0.01) 2.63 (<0.01) Anderson- Darling 2 0. 291 (>0.25) 0.2392 (0.25) 0.727 (0.1) 0.427 (>0.25) pothesis at the 10% significance level for the complete, peace time and post-war samples. In summary, several goodness-of-fit tests show that the Weibull renewal process is not adequate for stu dying the duration dependence in bull and bear markets. As we discuss in the next section, the issue of goodness-of-fit testing is not whether the Weibull is better than some other distribution, such as the gamma, but rather, wheth- er a nonstationary model, such as the NPLP is better than a stationary model, such as the Weibull renewal process. 3.3. Empirical Results from the MPLP Analysis Next, we use the MPLP model to examine duration de- pendence in stock markets. The MPLP model allows long term effects, such as the interevent times to get shorter (or longer) in addition to short term effects like duration dependence. The MPLP contains three parame- ters: , a parameter that affects duration dependence; , a parameter that affects the tendency of the interevent times to get shorter or longer; and , a scale parameter. Table 5 reports maximum likelihood estimates of these three parameters; the upper part reports the results for bull markets, and the bottom part reports those for bear markets. The estimate of for the complete sample of bull markets is 0.914, indicating negative duration depend- ence in bull markets, i.e., the probability for a bull mar ket to end decreases as the duration of the bull market increases. The estimate for for the peace time data is Table 5. Point estimates and likelihood ratio tests for the MPLP parameters. Maximum likelihood estimates of , , and , results of likelihood ratio tests, and corre- sponding P-values for testing w hether the parameters equal 1. CompletePeace Time Pre-WWII Post-WWII Bull Markets ˆ -value for 0:1 H 0.914 4 10 0.931 4 10 0.9587 0.0334 0.7701 4 10 ˆ -value for 0:1H 3.2319 4 10 2.885 0.0003 3.4536 0.0010 3.9204 0.0049 P-value for 0:1H 0.0001 0.0018 0.0060 0.0049 ˆ 5.6811 6.8521 6.4177 2.3173 Bear Markets ˆ P-value for 0:1H 1.0654 4 10 1.0851 4 10 0.8793 0.0007 1.2414 4 10 ˆ P-value for 0:1H 3.1506 4 10 3.2843 4 10 3.8117 0.0021 3.6476 0.0012 P-value for 0:1H 0.0002 0.0005 0.0045 0.0039 ˆ 6.484 6.4239 2.6766 7.601 0.931 with similar im plications. Consider now the pre- and post-WWII data. The esti- mates of are for the pre-war sample, and for the post-war sample. Although the post-war estimate is lower than the pre-war estimate, both are statistically less than 1. Therefore, evidence of negative duration dependence exists both before and af- ter WWII. In summary, we find strong evidence of nega- tive duration dependence in the samples of bull markets, indicating that the likelihood for a bull market to end shortly decreases as the length of a bull market increases. ˆ0.95 87 ˆ01 0.77 The estimate of for the complete sample of bull markets is ˆ3.2319 , indicating that the long term effect is for the interevent times to become shorter. For peace time data, the estimate is , indicating that the interevent eimes tend to get shorter, but at a rate that is less than overall. The estimates of before and after WWII are, respectively, ˆ2.885 3.4536 ˆ and ˆ3.9204 , indicating that the interevent times tend to get shorter at a faster rate over the post-WWII period than over the pre-WW II perio d. Copyright © 2011 SciRes. ME  H. G. ZHOU ET AL.285 For the complete sample of bear markets, the estimate of is , indicating positive duration de- pendence in bear markets. Therefore the probability that a bear market ends increases with the length of the bear market. This result is the opposite of that observed for bull markets. There does seem to be a difference between duration dependence in pre-war and post-war bear mar- kets. For the pre-war data, the estimate is (negative duration dependence) and for the post-war data, the estimate is (positive duration depend- ence). Both are significantly different from 1. ˆ1.0654 ˆ ˆ0.8793 1.2414 The estimates of exceed 3 for all cases considered and all are significantly different from 1. These results are similar to those for bull markets and indicate that the cycles tend to become shorter over time. We also notice that is higher for the peace time sample than for the complete sample, indicating that wars slightly reduce the resilience of bear markets to external shocks. There is also a slight decrease in in the post-WWII sample than in the pre-WWII sample, indicating that the intere- vent times are getting shorter at a slower pace in the post-WWII period. Based on the Frisch-Slutsky para- digm, the lower indicates reduced resilience of bear markets to external shocks in the post-WWII period than in the pre-WWII perio d. ˆ ˆ ˆ Table 5 also gives the results of a number of hypothe- sis tests. We test whether or (or both simulta- neously) are equal to 1. For these parameters, the value of 1 is important; for , the value 1 is the bound- ary between negative and positive duration dependence, whereas for , the value 1 is the boundary be- tween the cycles tending to get shorter or longer across time. All of the hypothesis tests reject the null hypothesis of the parameter being 1. In summary, there is evidence of negative duration dependence in all bull markets. There is evid ence of pos- itive duration dependence in all bear markets except those before WWII. Thus, bull markets tend to become stronger and bear markets weaker as the cycle lengthens. In regards to the long-term effect, the results show that bull and bear markets tend to get progressively shorter, but for bull markets, this trend has accelerated since WWII, whereas for bear markets this trend has deceler- ated since WWII. Finally, since the lengths of bull and bear markets tend to get shorter over time, a stationary model such as the Weibull renewal process, or any re- newal process for that matter, is inadequate to model the cycle times. A nonstationary model such as the MPLP is needed. 4. Conclusions Possible models for the stochastic point process that go- verns financial cycles include the renewal process, the NHPP, and the MPLP. The MPLP is a generalization of both the renewal process and the NHPP in the sense that if 1 , then the MPLP reduces to the NHPP, and if 1 , then the MPLP reduces to the Weibull renewal process. If both 1 and , then the MPLP re- duces to the homogeneo us Poi sso n pr ocess. 1 Traditionally, the Weibull renewal process has been applied as a model for business and financial cycles. However, one of the assumptions implicitly made in the Weibull renewal analysis seems dubious. The Weibull renewal process also assumes that the underlying sto- chastic process does not change across time. In other words, a new market (i.e., a market that has just changed from bull to bear, or vice-versa) is the same now as any new market in the past. Considering that data come from such a long period (1885 to 2000), this assumption ap- pears unreasonable. A model is needed that can account for both duration dependence and log term trends for cycles to become shorter or longer. The MPLP, being a compromise between the renewal process and the NHPP, is such a model. Results of goodness-of-fit tests reject the Weibull process as a choice for modeling duration dependence of bull and bear markets. The MPLP overcomes the short- comings of the Weibull renewal process and is a more powerful model for dependence in financial cycles. The results indicate negative duration dependence in all samples for bull markets and positive duration de- pendence in complete, peace time, and post-WWII sam- ples of bear markets. There is no evidence of structural change after WWII in either bull or bear markets, with the exception that bear markets seem to have negative duration dependence before WWII and positive duration dependence after. Results also indicate that both bull and bear markets tend to get shorter over the long term, with some evidence that the rates are different in the post- WWII period and after excluding war time cycles. 5. Reference [1] J. E. Payne and T. W. Zuehlke, “Duration Dependence in Real Estate Investment Trusts,” Applied Financial Eco- nomics, Vol. 16, No. 5, 2006, pp. 413-423. doi:10.1080/09603100500391099 [2] S. J. Cochran and R. H. Defina, “Duration Dependence in the US Stock Market Cycle: A Parametric Approach,” Applied Financial Economics, Vol. 5, No. 5, 1995, pp. 27-37. doi:10.1080/758522757 [3] D. E. Sichel, “Business Cycle Duration Dependence: A Parametric Approach,” The Review of Economics and Statistics, Vol. 73, No. 2, 1991, pp. 254-260. doi:10.2307/2109515 [4] H. Zhou and S. E. Rigdon, “Duration Dependence in U.S. Copyright © 2011 SciRes. ME  H. G. ZHOU ET AL. Copyright © 2011 SciRes. ME 286 Business Cycles: An Analysis Using the Modulated Power Law Process,” Journal of Economics and Finance, Vol. 32, No. 1, 2008, pp. 25-34. doi:10.1007/s12197-007-9005-3 [5] M. Berman, “Inhomogeneous and Modulated Gamma Processes,” Biometrika, Vol. 68, No. 1, 1982, pp. 142- 152. [6] M. J. Lakey and S. E. Rigdon, “The Modulated Power Law Process,” Proceedings of the 45th Annual Quality Congress, Milwaukee, 20-22 May 1991, pp. 559-563. [7] S. E. Black and S. E. Rigdon, “Statistical Inference for a Modulated Power Law Process,” Journal of Quality Technology, Vol. 28, No. 1, 1996, pp. 81-90. [8] R. Frisch, “Propagation and Impulse Problems in Dy- namic Economics,” Economic Essays in Honor of Gustav Cassel, Allen and Unwin, London, 1933, pp. 171-173, 181-190, 197-203. [9] E. Slutsky, “The Summation of Random Causes as the Source of Cyclic Processes,” Econometrica, Vol. 5, No. 2, 1937, pp. 105-146. doi:10.2307/1907241 [10] S. Chatterjee, “From Cycles to Shocks: Progress in Busi- ness-Cycle Theory,” 2000. http://www.phil.frb.org/files/br/brma00sc.pdf [11] B. S. Bernanke, M. Gertler and S. Gilchrist, “The Finan- cial Accelerator in a Quantitative Business Cycle Frame- work,” Review of Economics and Statistics, Vol. 78, No. 1, 1996, pp. 1-15. [12] C. Nolan and C. Thoenissen, “Financial Shocks and the US Business Cycle,” Journal of Monetary Economics, Vol. 56, No. 4, 2009, pp. 596-604. doi:10.1016/j.jmoneco.2009.03.007 [13] A. R. Pagan and K. A. Sossounov, “A Simple Framework for Analysing Bull and Bear Markets,” Journal of Ap- plied Econometrics, Vol. 18, No. 1, 2003, pp. 23-46. doi:10.1002/jae.664 [14] M. A. Stephens, “Tests Based on EDF Statistics,” In: R. B. D’Agostino and M. A. Stephens, Eds., Goodness-of- -Fit Techniques, Marcel Dekker, New York, 1986, pp. 97-193.

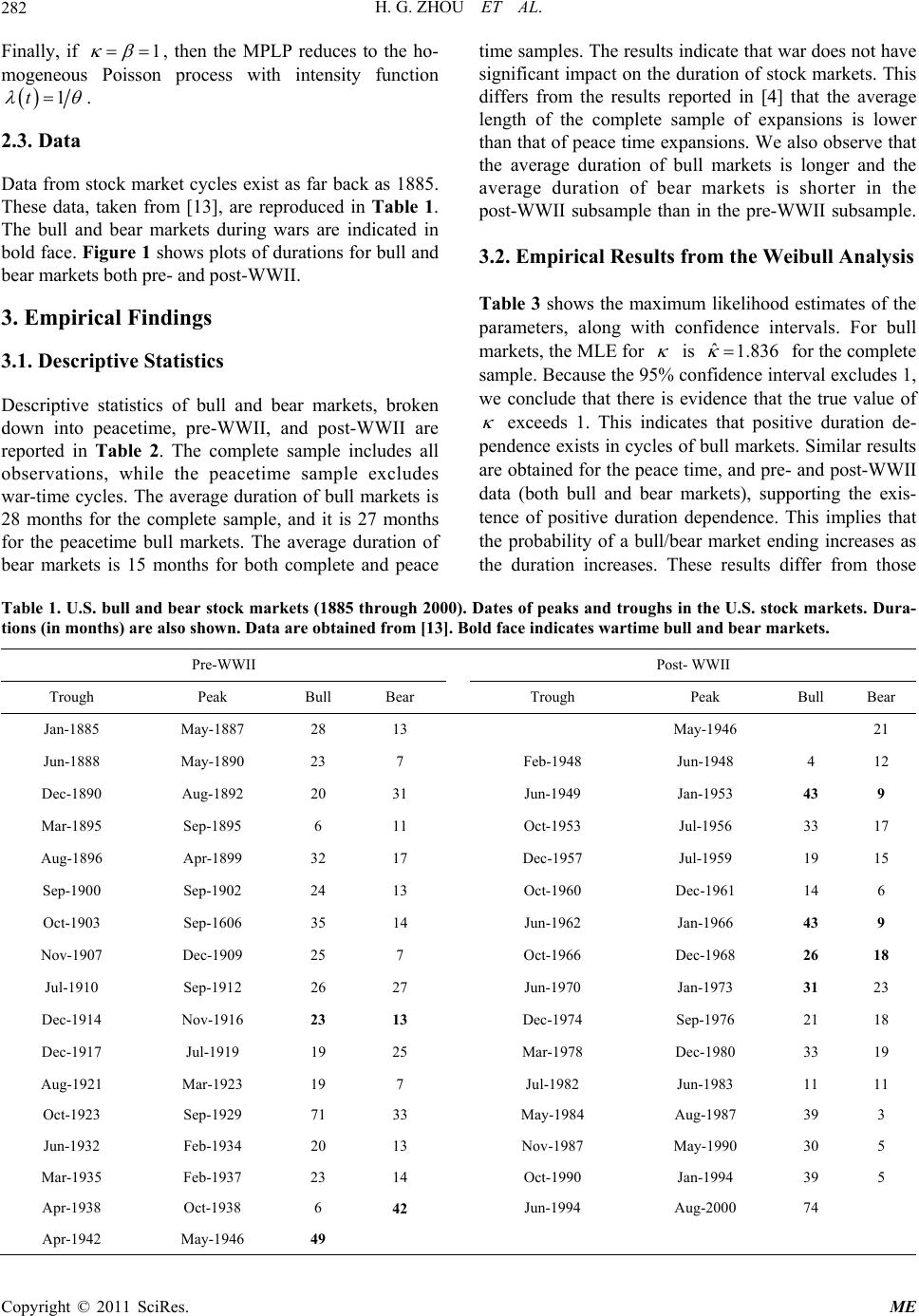

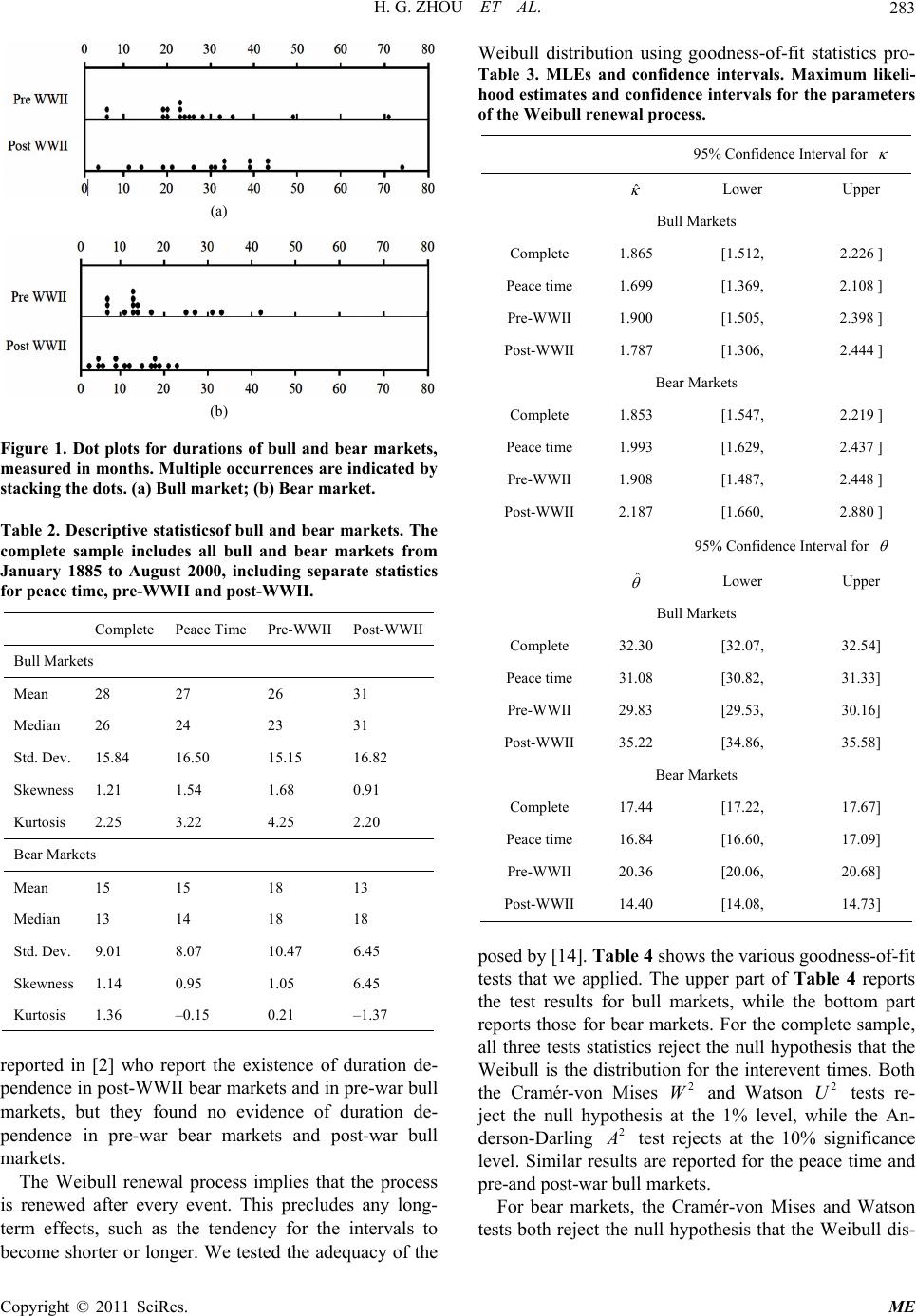

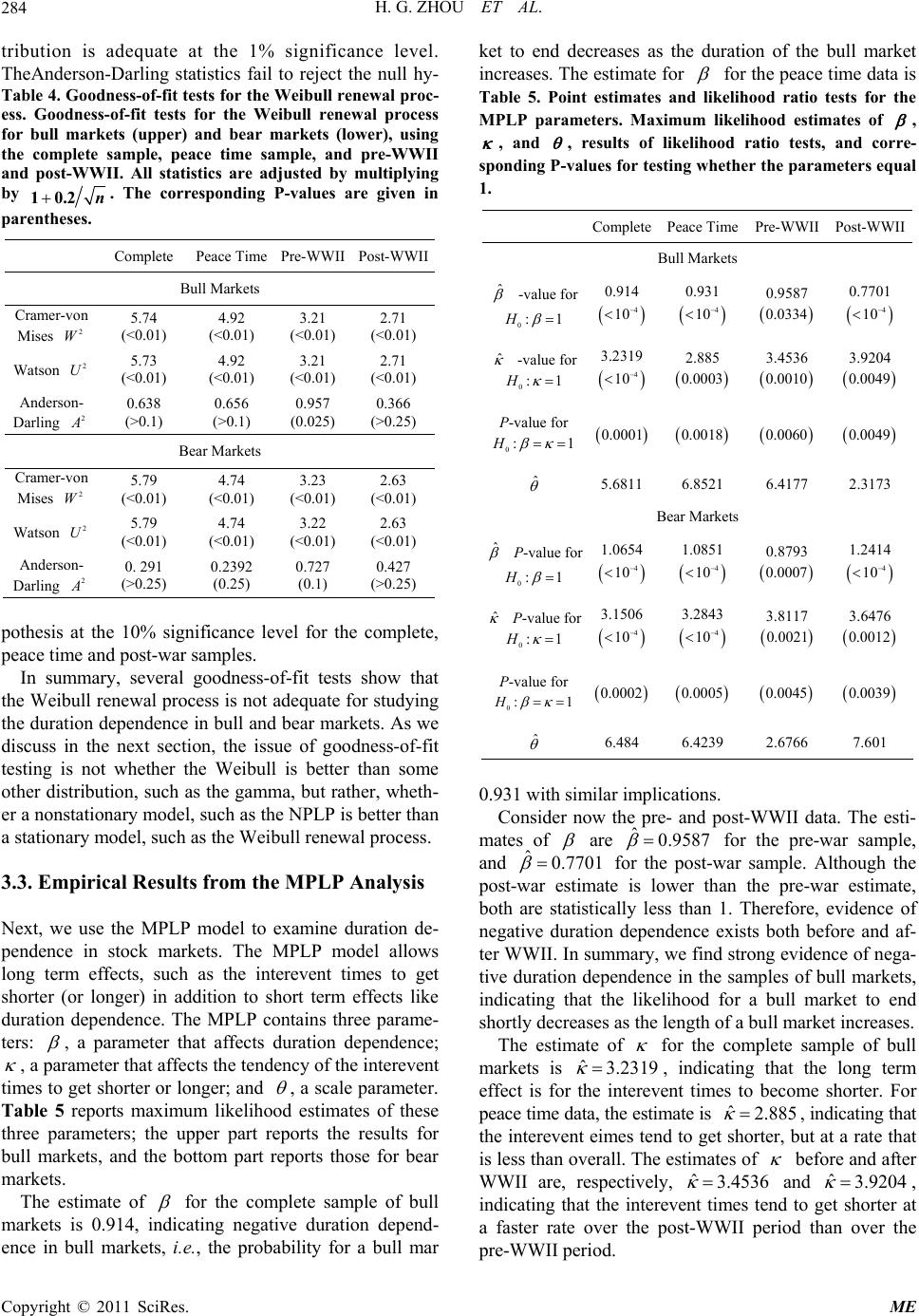

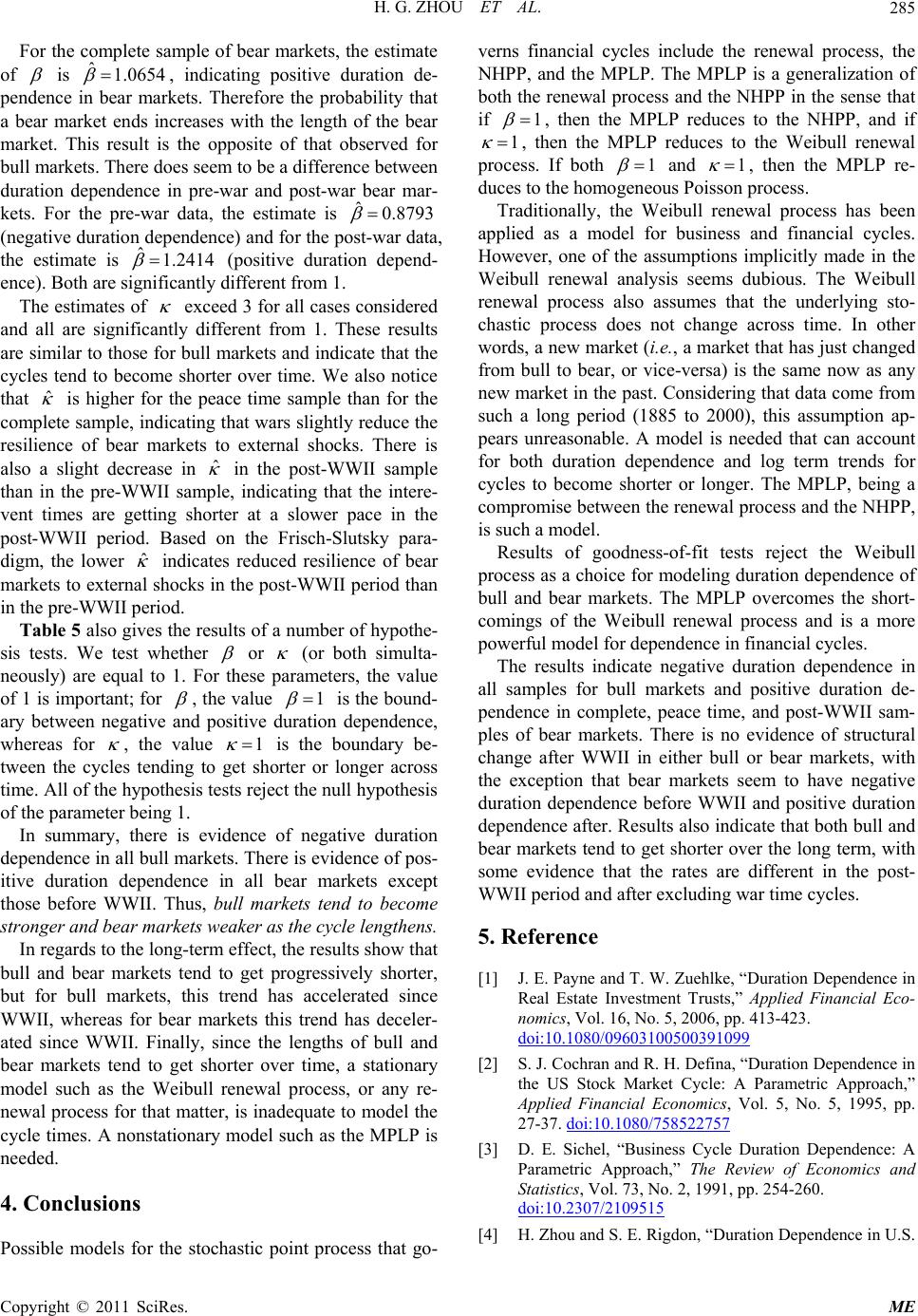

|