Open Journal of Social Sciences

Vol.03 No.11(2015), Article ID:61332,7 pages

10.4236/jss.2015.311005

A Note on the Kou’s Continuity Correction Formula

Ting Liu1, Chang Feng2, Yanqiong Lu2, Bei Yao2

1School of Optical and Electronic Information, Huazhong University of Science and Technology, Wuhan, China

2School of Mathematic and Statistic, Huazhong University of Science and Technology, Wuhan, China

Received October 2015

ABSTRACT

This article introduces a hyper-exponential jump diffusion process based on the continuity correction for discrete barrier options under the standard B-S model, using measure transformation and stopping time theory to prove the correction, thus broadening the conditions of the continuity correction of Kou.

Keywords:

B-S Model, Discrete Barrier Options, Hyper-Exponential Jump Diffusion, Continuity Correction Formula

1. Introduction

In 2003, S. G. Kou [1] generalized a double exponential jump diffusion model into the pricing of continuity single barrier options. They analyzed the joint distribution of the final asset price by focusing on first passage time and combining it with the nonlinear renewal theory of the time series analysis. The Laplace transforms and the non-memory property of exponential distribution were also used during the analyzing process. In his article which was published in 1997, Kou [2]-[4] put forward a continuity correction of B-S model, which combined the pricing method of continuity barrier options with that of discrete barrier options. In 2013, D. Jun [5] generalized the continuity correction formula into the double barrier options in view of Kou’s report. Also in 2013, C. D. Fuh [6] introduced the double exponential jump diffusion model to the pricing of discrete single barrier options and look-back options. His article widened the conditions of the continuity correction formula of Kou and obtained a correction formula of discrete barrier options based on the double exponential jump diffusion process.

This article uses Kou’s theoretical derivation method for the first passage time and C. D. Fuh’s thought of proving the correction formula based on double exponential jump diffusion model for reference. In order to generalize the model into the pricing of both the discrete single and double barrier options on the basis of the hyper-exponential jump diffusion process, we combine the correction formula of discrete single barrier options raised by Kou with D. Jun’s correction of discrete double barrier options under the B-S model. Although formally, the correction formula in this article seems to be same as Kou’s and D. Jun’s, there are no restrictions of strike price K and barrier value H in the correction formula in this passage, which means that the scope of application of Kou’s and D. Jun’s correction are widened. Additionally, compared with the double exponential jump diffusion model of C. D. Fuh, the hyper-exponential jump diffusion model in this article is more general.

2. Pricing on Barrier Options

2.1. Continuity Correction Model

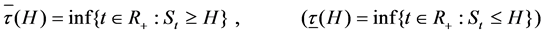

In 1997, Steven Kou put forward the concept of continuity correction in his paper, which combined the continuity barrier options with the discrete barrier options through the continuity correction formula. Denote the stopping time by , the definition goes as follows:

, the definition goes as follows:

(2.1)

(2.1)

or

(2.2)

(2.2)

Here H stands for the barrier level and  is the frequency of monitoring. Formula (2.1) and (2.2) represent the situation of continuously monitored and discretely monitored, respectively. Apparently, an up model has

is the frequency of monitoring. Formula (2.1) and (2.2) represent the situation of continuously monitored and discretely monitored, respectively. Apparently, an up model has  and a down model has

and a down model has . For convenience, we assume the risk-neutral interest rate r is a constant in this case. Because of the existence of jump, the “market” here is not a complete market, which means that the risk neutrality measure is not unique (more details can be found in Kou [7]). As a matter of convenience, we assume the risk neutrality measure Q just needs to meet the premise of rational expected equilibrium.

. For convenience, we assume the risk-neutral interest rate r is a constant in this case. Because of the existence of jump, the “market” here is not a complete market, which means that the risk neutrality measure is not unique (more details can be found in Kou [7]). As a matter of convenience, we assume the risk neutrality measure Q just needs to meet the premise of rational expected equilibrium.

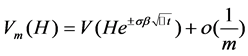

Kou has pointed out in his article that when m is large enough, which means , Formula (2.2) is weakly convergent to Formula (2.1). However, with the increasing of m, the convergence rate will become very slow and the error will also increase. To solve this problem, Kou implemented methods of time series analysis, which could provide limitations of K and H, and established correction formula as follow, based on the B-S model to fasten the convergence rate:

, Formula (2.2) is weakly convergent to Formula (2.1). However, with the increasing of m, the convergence rate will become very slow and the error will also increase. To solve this problem, Kou implemented methods of time series analysis, which could provide limitations of K and H, and established correction formula as follow, based on the B-S model to fasten the convergence rate:

(2.3)

(2.3)

If , “+” will be applied, if

, “+” will be applied, if , “−” will be applied.

, “−” will be applied.

Here,  , with

, with  standing for Riemann zeta function, which can be concretely written as

standing for Riemann zeta function, which can be concretely written as .This method of adjustment is called continuity correction.

.This method of adjustment is called continuity correction.

According to the correction formula, we could find that the barrier-crossing probability will be lower after the adjustment of discretely monitored barrier. The amount of the adjustment is .

.

2.2. Hyper-Exponential Jump Diffusion Model

We assume that under the risk neutrality measure Q, the asset price  will obey the following hyper-expo- nential jump diffusion geometric Brownian motion model:

will obey the following hyper-expo- nential jump diffusion geometric Brownian motion model:

(2.4)

(2.4)

Here

rate, dividend rate and risk volatility, respectively.

Using Ito lemma and theories of calculation of stochastic partial differential equations, the solution of model (2.4) under continuously monitored situation is:

where

It’s obvious that, when we assume the discretely monitored time interval is

where

where

Now we try to find the relationship between this two joint distribution densities,

Let

For convenience, we use

Proposition 2.1. [8] For hyper-exponential jump diffusion model (2.4) and (2.5), when

where

2.3. Pricing on Discrete Single Barrier Options

In this section, based on the discrete model (2.8), firstly, we make an adjustment on the discrete model

where

The preparation has been done, however, two preparatory lemmas will be introduced before finally exhibit the main conclusion.

Lemma 2.2. For continuously monitored stopping time

Proof: Assume (2.14) is a true statement, in view of (2.12) and (2.13), when

From proposition 2.1, the equation above will be true if the following equation is proved:

where

In order to obtain Equation (2.15), here, we solve this problem by adjusting Kou’s method of the first passage time under the double exponential jump diffusion process. Noticing that

where L stands for the infinitesimal generator

Here,

As

where

Focusing on

is the local martingale and

more precisely,

and in view of (2.21)

If we integrate the three formulas above, for all

Now for convenience,

As

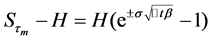

which obeys Taylor expansion of the first order and

When

Lemma 2.2 can be proved by substituting (2.24) and (2.16) into (2.15).

Lemma 2.3. For discrete barrier options with

where

Proof:

On the basis of proposition 2.1 in Kou [1] and Zhang [10],

When

Therefore,

Then lemma 2.3 can be proved by using corollary 3.3 in Kou [4].

Theorem 2.1. Let

where

The proof of the theorem can be derived directly from Lemma 2.2 and 2.3. What we need to illustrate is that although the conclusion here seems to be similar to Kou [2]’s, there are no restriction of

Cite this paper

Ting Liu,Chang Feng,Yanqiong Lu,Bei Yao, (2015) A Note on the Kou’s Continuity Correction Formula. Open Journal of Social Sciences,03,28-34. doi: 10.4236/jss.2015.311005

References

- 1. Kou, S.G. (2003) First Passage Times of a Jump Diffusion Process. Advances in Applied Probability, 35, 504-531. http://dx.doi.org/10.1239/aap/1051201658

- 2. Kou, S. (1997) A Continuity Correction for Discrete Barrier Options. Mathematical Finance, 7, 325-348. http://dx.doi.org/10.1111/1467-9965.00035

- 3. Broadie, M., Glasserman, P. and Kou, S.G. (1999) Connecting Discrete and Continuous Path-Dependent Options. Finance Stochastic, 3, 55-82. http://dx.doi.org/10.1007/s007800050052

- 4. Kou, S.G. (2003) On Pricing of Discrete Barrier Options. Statistic Sinica, 13, 955-964.

- 5. Jun, D. (2013) Continuity Correction for Discrete Barrier Options with Two Barriers. Journal of Computational and Applied Mathematics, 237, 520-528. http://dx.doi.org/10.1016/j.cam.2012.06.021

- 6. Fuh, C.D., Luo, S.F. and Yen, J.F. (2013) Pricing Discrete Path-Dependent Options under a Double Exponential Jump- Diffusion Model. Journal of Banking & Finance, 37, 2702-2713. http://dx.doi.org/10.1016/j.jbankfin.2013.03.023

- 7. Kou, S.G. (2002) A Jump-Diffusion Model for Option Pricing. Management Science, 48, 1086-1101. http://dx.doi.org/10.1287/mnsc.48.8.1086.166

- 8. Cai, N. (2009) On First Passage Times of a Hyper-Exponential Jump Diffusion Process. Operations Research Letters, 37, 127-134. http://dx.doi.org/10.1016/j.orl.2009.01.002

- 9. Thakoor, N., Tangman, D.Y. and Bhuruth, M. (2014) Efficient and High Accuracy Pricing of Barrier Options under the CEV Diffusion. Journal of Computational and Applied Mathematics, 259, 182-193. http://dx.doi.org/10.1016/j.cam.2013.05.009

- 10. Zhang, C.H. (1988) A Nonlinear Renewal Theory. Annals of Probability, 6, 93-824. http://dx.doi.org/10.1214/aop/1176991788