iBusiness

Vol.2 No.2(2010), Article ID:1955,6 pages DOI:10.4236/ib.2010.22017

Using Analytical Hierarchy Process in Decision Analysis - The Case of Vietnam State Securities Commission

![]()

1Department of Business Management, National Sun Yat-Sen University, Kaohsiung, Taiwan, China; 2Department of Industrial

Engineering and Management, National Kaohsiung University of Applied Sciences, Kaohsiung, Taiwan, China.

Email: linhmc@hotmail.com

Received January 5th, 2010; revised February 25th, 2010; accepted April 3rd, 2010.

Keywords: Decision Analysis, Analytical Hierarchy Process, Benchmarking

ABSTRACT

This paper uses Saaty’s Analytical Hierarchy Process (AHP) to formulate the strategy framework for Vietnam’s State Securities Commission (SSC). In the first step, a questionnaire was designed to find Key Success Factors (KSFs) of the strategy of Taiwan Financial Supervisory Commission (FSC) by using the benchmarking technique. Criteria for questionnaire are carefully selected based on the Principles for securities market regulation set forth by the International Organization of Securities Commissions (IOSCO). The KSFs of FSC were then used to conduct a survey in the State Securities Commission of Vietnam (SSC). The data collected by AHP-structured pair wise comparisons were constructed into a computer-based program called Expert Choice. The result shows that top priority choice for SSC is to build up financial and operational capacity for securities firms, which in turn, will best support other alternatives. Another finding shows useful techniques in strategic management widely applicable in the business world can perfectly fit into the not-for-profit contexts in a way that it can help SSC reassessing and remodeling current flows of work in developing the nascent securities market to be the market that protect investors, insure fair, effective, transparent environment and reduce market systemic risk.

1. Introduction

The securities and derivatives markets are vital to the growth, development and strength of market economies. They support corporate initiatives, finance the exploitation of new ideas and facilitate the management of financial risk. Since retail investors are placing an increasing proportion of their money in mutual funds and other collective investments, securities markets have become central to individual wealth and retirement planning. Sound and effective regulation and market confidence are important for the integrity, growth and development of securities markets. Hence, it is important to develop suitable strategy for securities market regulation - a common task for many securities market regulators while still at nascent stage in Vietnam. Accordingly, the need to develop a well functioning securities market in Vietnam has been at government’s top agenda through recent years. However, since it is emerging and lack of synchronous market development policy, it has been foreseen a considerable task for the State Securities Commission of Vietnam (SSC) in using its scarce resources in working out the best strategies.

This study aims to analyze and design a formulation framework that used Analytical Hierarchy Process (AHP), one of the most common used methods in prioritizing the elementary issues in a complex problem. A questionnaire was designed to find Key Success Factors (KSFs) by benchmarking FSC’s strategies. Criteria for questionnaire are carefully selected based on the Principles for Securities Market Regulation set forth by the IOSCO. The achieved KSFs were then used to conduct a survey in SSC. The data collected by AHP-structured pair wise comparisons were constructed into a computerbased program capable of running AHP. The result shows that top priority choice for SSC is to build up financial and operational capacity for securities firms, which in turn, will best support other alternatives. In this research, the authors’ work has also shown that useful techniques in strategic management widely applicable in the business world can perfectly fit into the government or not-forprofit contexts. It has helped to create a strategy formulation model for the SSC to make better decisions.

2. Methodology

2.1 The AHP Approach

The AHP is a comprehensive framework, which is designed to cope with the intuitive, the rational, and the irrational when we make multi-objective, multi-criterion and multifactor decisions with and without certainty for any number of alternatives [1]. The AHP has been applied to many complex problems with various decision analyses, which enable decision-makers to derive ratio scale priorities or weights as opposed to arbitrarily assigning them [2]. Many others recognize a very important feature that AHP supports decision-makers by allowing them to structure complexity, to exercise judgment, and to incorporate both objective and subjective considerations in the decision process [3-5]. The AHP is also a novel decision analyzing approach that structures a problem using a hierarchy. It enables us to make effective decision on complex issues by simplifying and expediting human natural decision-making processes. Some other sees the AHP is the theory of measurement for dealing with quantifiable or tangible criteria that has found rich applications in decision theory, conflict resolution and in models of the brain [1,6,7]. To illustrate this process in an easy way, Bagchi and Rao [8] define that this hierarchy starts with a top level containing the ultimate objective of the problem. The sub-objectives, if any, constitute the next level, followed by the criterion variable affecting the higher-level objectives. The bottom level of the hierarchy contains the options or alternatives. Therefore, each hierarchical level can be seen as being made up of elements (or criterion variables) that in turn, are decomposed into sub-elements that make up the next level of the hierarchy.

Over the years, AHP has become one of the most widely used multiple criteria decision-making tools for researchers and decision makers. Many outstanding works have been published based on AHP in different fields such as planning, selecting best alternative, resource allocations, resolving conflict, optimization, etc., and numerical extensions of AHP [6-8]. The specialty of AHP is its flexibility to be integrated with different techniques like Linear Programming, Quality Function Deployment, Fuzzy Logic, etc. This enables the user to extract benefits from all the combined methods, and hence, achieve the desired goal in a better way [9].

2.2 Benchmarking for Strategy Choice

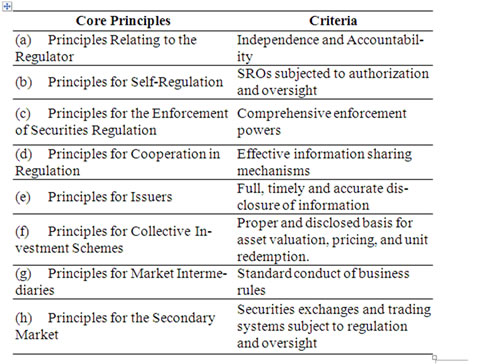

Using a benchmarking technique, the viability of various objectives and sub-objectives is evaluated for alternatives. In this paper, the benchmarking technique is based on the IOSCO’s principles for securities market regulation. The eight Core Principles are shown in the first column of Table 1. Each of these Core Principles has a number of criteria that are in the second column. Since it would be an enormous task to consider all the criteria, the only most significant criteria of each Core Principle are selected by the Questionnaire surveyed in FSC.

2.3 Strategy Formulation for SSC

The various steps in the application of AHP for securities market regulation strategy choice will now be based on the data obtained from surveys in the SSC and constructed into computer program.

2.3.1 SSC’s Mission and Values as Goals for Strategy Choice Model

Extensive discussion and consultation with SSC management board has been done and IOSCO’s objective requirements have been carefully considered. For any securities market regulator, it is necessary to achieve these goals in order to fulfill the task of securities market regulation. The α-level objectives are as follows:

1) Protection of Investors;

2) Fair, Efficient, and Transparent Market;

3) Reduction of Systemic Risk.

2.3.2 Alternative Strategies for SSC

The alternative strategies for SSC’s securities market regulation are:

1) Increase Securities Supply;

2) Increase Securities Demand;

3) Build up Financial and Operational Capacity for Securities Companies;

4) Strengthen Legal and Regulatory Framework;

5) Improve Market Infrastructure;

Table 1. The selected criteria corresponding to core principles are assigned to level β in the hierarchy

6) Develop Human Resource and Capacity.

The rationales of the Alternatives are as follows:

Rationale for Alternative 1 and 2: Inadequate securityies supplies and demands: supplies are qualitatively and quantitatively weak. There are not any securities issued by potentially large corporations like joint stock commercial banks, joint venture companies or general corporations but most are shares of privatized stated-own enterprises. Securities supplies are limited also due to the fact that depository shares which are qualified for trading accounts for only 40 percent of the listed stocks. On the other hand, bonds trading are so constrained even tradable volume is potentially large. In addition, listed companies are in good financial positions but most do not have adequate capitals. Government owned rate is high in most of the companies further making the tradable shares in the stock exchange low.

Rationale for Alternative 3: Limited intermediaries operations due to lack of professional and capable human resources of the securities companies. Most of securities companies exercise dealing and brokerage mainly. Other advanced services like underwriting and investment advisory are limited in few companies. The services provided for investors are not yet in superior quality and mainly in the two biggest cities of Hanoi and Ho Chi Minh City. This does not support attraction of investors in other cities and regions throughout the country. Low public confidence: inadequate accounting and auditing systems in place together with limited perception of information disclosure causes low degree of public confidence in the securities companies.

Rationale for Alternative 4: Asynchronous securities market management: lack of comprehensive securities laws system revealed limitation and constraints in regulating and administering the securities market in Vietnam.

Rationale for Alternative 5: Ineffective structure of regulatory body and stock exchange operation model: current model of the exchange is under SSC. Depository, registration, settlement and clearing are operations of the exchange and not effectively managing and controlling the securities market in the long run. Above-mention systems are done manually or semi-automatically, thus it has caused low efficiencies in the supervisory function of the securities market.

Rationale for Alternative 6: A pool of technically trained and professionally competent human resource is perhaps the single most important requirement for the development of Vietnam capital market. The scope of human resource development in capital market is wide, ranging from market participants in both public and private sectors, from top policy makers and frontline regulators to intermediaries and investors. Thus, it is important for all stakeholders to collaborate in designing and delivering training programs with proper division of labor.

2.3.3 Details of Analysis Procedure of AHP

The AHP allows the decision maker to evaluate the criteria and their alternatives. The scale of importance must be set up prior to the questionnaire in order to enable correct evaluation of the criteria. In this research, the scale of 1 to 9 adopted is given earlier.

The designed questionnaire was delivered to key persons in SSC management with strict emphasis on relative importance of the pairwise judgments. These pairwise comparisons are made in accordance with the computer program format and corresponding the choice of SSC key personnel in relation to how they think the criteria’s importance taking part in selecting the strategy for securities market regulation in SSC.

The ten sets of pairwise comparisons questionnaire made from interviewing ten top management personnel were assembled into three groups, each of which having similar judgments. The represented pairwise comparison values were the average value of the group. The Participating Group 1 consists of three personnel at highest level of management level, the Participating Group 2 consists of three personnel from middle management level, and the Participating Group 3 consists of four personnel from lower management level. The then average values are entered into the computer program. The result was combined automatically by the program to produce the result of the strategy model.

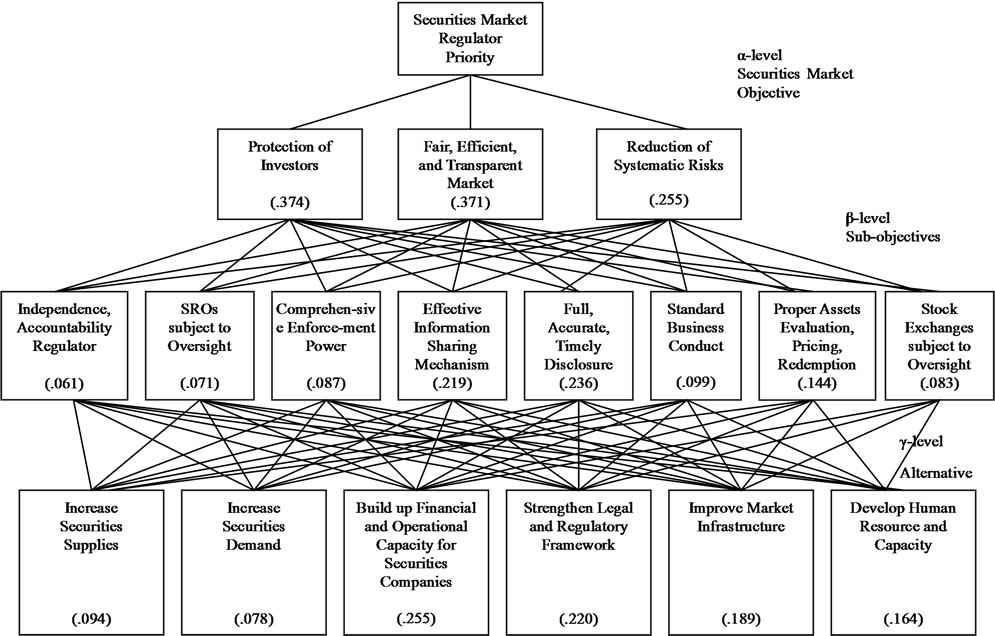

The Hierarchy Model for the strategy formulation is shown in Figure 1.

3. Results

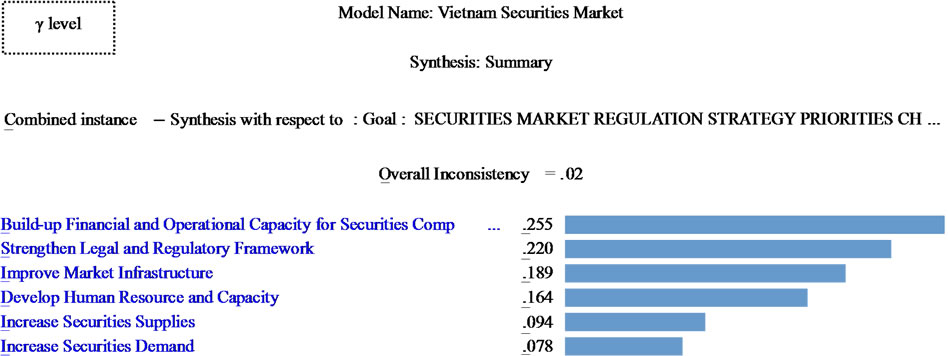

The decision-making methodology has been validated in the State Securities Commission of Vietnam. This was done by the structured pair wise comparison survey conducted directly with leadership of the SSC. The data then was fed into the model and the results were analyzed using AHP method incorporated in the computer program. The result shows that the top choice priority strategy for SSC is to build up financial and operational capacity for securities companies.

It is found out that the inconsistency ratio, which is a weighted average of the inconsistency ratios of Participating Group 1, Participating Group 2, Participating Group 3, and combined results are .05, .06, .05, and .02, respectively. This matches the requirement by AHP methodology in constructing strategy formulation model that requires inconsistency of less than 1. The inconsistency measure is useful for identifying possible errors in judgments as well as actual inconsistencies in the judgments themselves. Inconsistency measures the logical inconsistency of judgments. This has shown the capability and knowledge of top management at SSC in providing judgments and has contributed to the successfulness of this research.

Figure 1. The hierarchy model for the strategy formulation

The main objective of this study is to design, develop and formulate a strategy model for securities market regulation using the analytical hierarchy process has been realized. First, the study has shown that strategy formulation procedure in strategic management originally established and mainly applied in business world could be well employed to establish formulation models in public/government/not-for-profit organization context even in securities market industry, which has the most complex nature in the world. Secondly, a strategic decision making procedure for securities market regulators based on various studies of decision-making analysis has been created. In addition, KSFs of FSC in relation to securities market regulation strategy have been successfully established. The KSFs have been utilized as a benchmark to create a strategy formulation model for SSC. The strategy choice model has been validated in the SSC through AHP-structured questionnaire.

4. Discussion and Conclusions

It has been a demanding task of the State Securities Commission of Vietnam to increase the number of qualified listed stocks in the Stock Exchange. Everyday, both the regulator and market participants can easily see small number of listed companies that represent a far too small percentage of GDP. Everybody for sure thinks about how to increase such a small number in order to have a larger-size securities market, which will truly be an alternative channel of equity capital procurement in the economy, and consequently, will boost privatization process and contribute to economic development of Vietnam.

Currently, there are so many deficiencies in the regulatory environment and these create obstacles in increasing number of listed firms as well as developing the securities market. However, the authors view these deficiencies are normal since securities market in Vietnam has been around since 2000. Even though a majority of judges in the survey gave favorable scores toward regulatory framework strengthening but the result came at a different focus – the securities companies. The synthesis with respect to goal: Securities Market Regulation Strategy Priorities Choice is shown in Figure 2.

After implementing the model in SSC for two years period with strategy focus on development of securities companies, a number of policies favor the healthy operations of securities companies has resulted in an increase from 13 companies in 2004 to 56 companies in 2008 and to 104 companies as of December 31st, 2008. In turn, the market has developed to a stage no one could ever expect. In respond to the new incentives, number of listed shares in both exchanges has gone up to over 390 by end of

Figure 2. The synthesis with respect to goal: securities market regulation strategy priorities choice

2008 from around 50 in early 2005 (exclusive of nonlisted public firms); market capitalization increased from 3% in 2005 to over 46% of GDP by end of 2008 (exclusive of bond market).

Joint stock and equitized companies lacked interest to go public because they did not appreciate capital mobilization through securities market as compared with the traditional banking and government channels. In advanced market, intermediaries play a critical role in making market participants understand the tradeoffs by going public through consultancy and other services. In other words, with strong and active securities companies in place, good linkages between securities firms and customers will be established which market confidence will be built upon. As a result, more companies will be likely going public, and more trading accounts will be open. A good securities firm system will better contribute to solve the problem for both securities supplies and demand. Once a more effective securities market has been realized, both in size and scope, relevant government authorities will better support the course of regulating the market as discussed later. This is how the strategy formulation model constructed in this study gives out the prevailing choice of “Building up Financial and Operational Capacity for Securities Companies”.

For AHP methodology, strategic management should utilize the analytical hierarchy process approach based on scientific principles and human judgment that can address the complexity nature of the issues. A very critical stance is that in performing the survey at SSC and in constructing the model, the authors have observed that most SSC’s top management in making their pairwise comparisons with respect to different objectives in AHP structure emphasized much on the legal aspect. They argued that an incomplete legal framework could not support any activity in the market that could in turn help positively foster the securities market. However, truly from their point of views that the ever-important concept for securities market regulators is to protect investors’ rights and benefits, their consolidated decisions has turned out to be improving the quality of the market intermediaries – the securities firms as discussed earlier. By this way, the AHP approach using in strategy formulation could have helped SSC management to arrive at a priority choice in a more persuadable manner while well managing their scarce resources.

Through out this research, AHP appeared to have some limitation with regard to ambiguity in the selection of ratio in the inverse reciprocal matrix and in relation to determining consensus among a panel, each of which has selected a set of score in the pairwise comparisons. Given the case that all inconsistency ratios were over .1 or the model would have to use more than fifteen voters in a panel of decision makers, then it would be a massive task for the researcher in possible readjustment of the scores in pairwise comparisons. In such a situation, of course, the decision making finally would have incurred inaccuracy of priority weighting. Accordingly, it is desirable to further study of AHP to overcome its weakness. Once this task is accomplished, non-consensus among panels can be solved to help arriving at decisions that are more precise.

REFERENCES

- P. T. Harker and L. G. Vargas, “The Theory of Ratio Scale Estimation: Saaty’s Analytic Hierarchy Process,” Management Science, Vol. 33, No. 11, November 1987, pp. 1383-1403.

- T. L. Saaty, “Modeling Unstructured Decision Problems: A Theory of Analytical Hierarchy,” Proceedings of the First International Conference on Mathematical Modeling, University of Missouri-Rolla, Rolla, Vol. 1, 1997, pp. 59-77.

- E. H. Forman, “The Analytic Hierarchy Process as a Decision Support System,” Proceedings of the IEEE Computer Society, Salt Lake, 1983.

- T. L. Saaty, “Multicriteria Decision Making: The Analytic Hierarchy Process,” WS Publication, Pittsburgh, 1990.

- Y. Wind and T. L. Saaty, “Marketing Applications of the Analytic Hierarchy Process,” Management Science, Vol. 26, No. 7, 1980, pp. 641-658.

- L. G. Vargas, “An Overview of the Analytic Hierarchy Process and its Applications,” European Journal of Operational Research, Vol. 48, No. 11, 1990, pp. 2-8.

- F. Zahedi, “The Analytic Hierarchy Process: A Survey of Methods and its Applications,” Interfaces, Vol. 16, No. 4, 1986, pp. 96-108.

- P. Bagchi, R. P. Rao, “Decision Making in Mergers: An Application of the Analytic Hierarchy Process,” Managerial and Decision Economics, Vol. 13, No. 2, March - April 1992, pp. 91-99.

- O. S. Vaidya and S. Kumar, “Analytic Hierarchy Process: An Overview of Applications,” European Journal of Operational Research, Vol. 169, No. 1, 2006, pp. 1-29.