Applied Mathematics

Vol.4 No.8(2013), Article ID:35326,12 pages DOI:10.4236/am.2013.48153

Two-Sided First Exit Problem for Jump Diffusion Processes Having Jumps with a Mixture of Erlang Distribution*

School of Mathematical Sciences, Qufu Normal University, Qufu, China

Email: #wenyzhen@163.com, ccyin@mail.qfnu.edu.cn

Copyright © 2013 Yuzhen Wen, Chuancun Yin. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received May 29, 2013; revised June 29, 2013; accepted July 7, 2013

Keywords: First Exit Time; Two-Sided Jumps; Jump Diffusion Process; Overshoot

ABSTRACT

In this paper, we consider the two-sided first exit problem for jump diffusion processes having jumps with rational Laplace transforms. We investigate the probabilistic property of conditional memorylessness, and drive the joint distribution of the first exit time from an interval and the overshoot over the boundary at the exit time.

1. Introduction

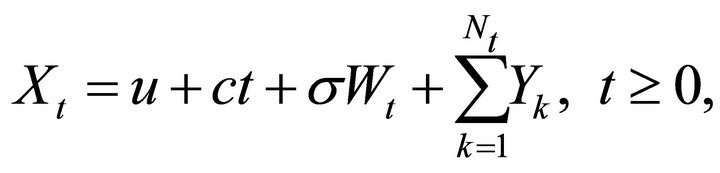

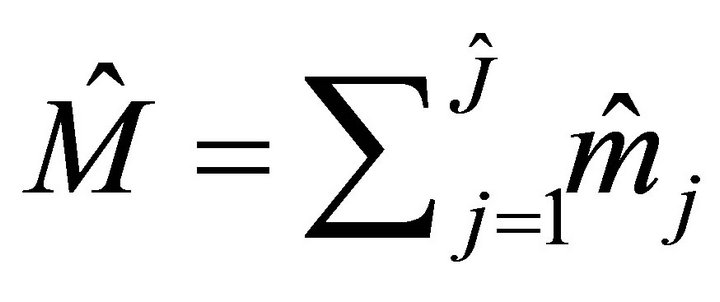

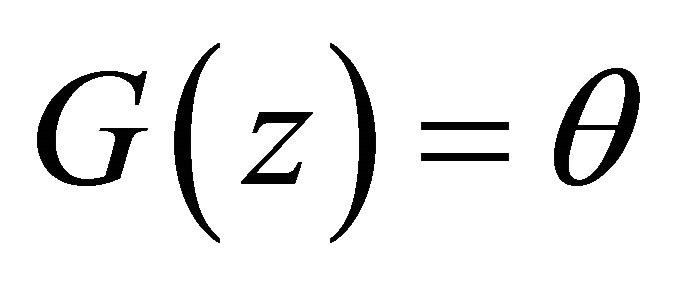

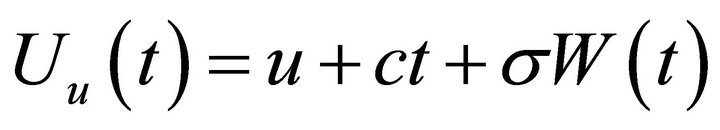

Consider the following jump diffusion process

(1.1)

(1.1)

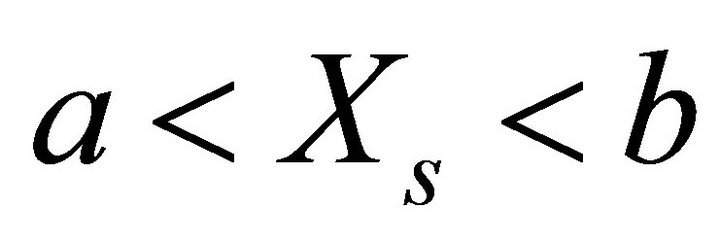

where the constant  is the starting point of

is the starting point of ,

,  and

and  represent the drift and the volatility of the diffusion part, respectively,

represent the drift and the volatility of the diffusion part, respectively,  is a standard Brownian motion with

is a standard Brownian motion with ,

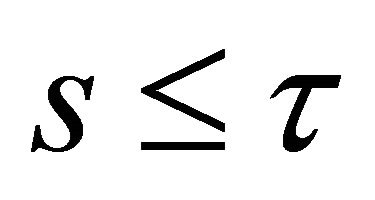

,  is a Poisson process with rate

is a Poisson process with rate , and the jumps sizes

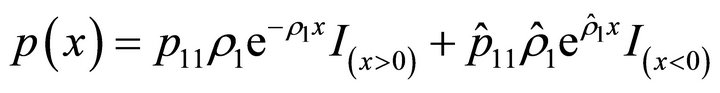

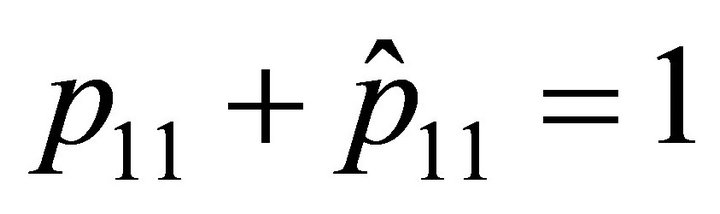

, and the jumps sizes  are assumed to be i.i.d. real valued random variables with common density

are assumed to be i.i.d. real valued random variables with common density . Moreover, it is assumed that the random processes

. Moreover, it is assumed that the random processes ,

,  and random variables

and random variables  are mutually independent. In this paper we are interested in the density

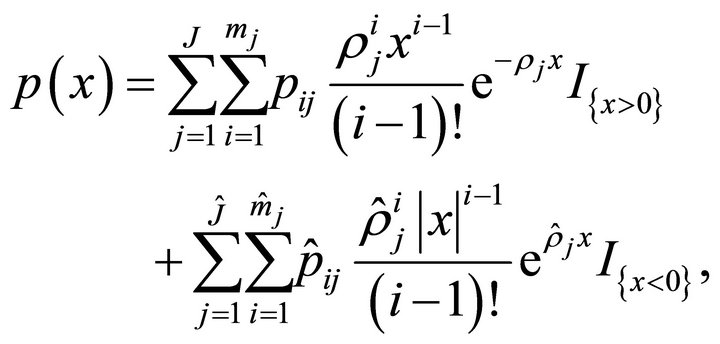

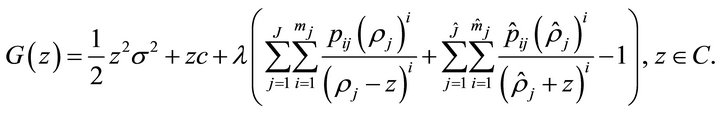

are mutually independent. In this paper we are interested in the density  of following type

of following type

(1.2)

(1.2)

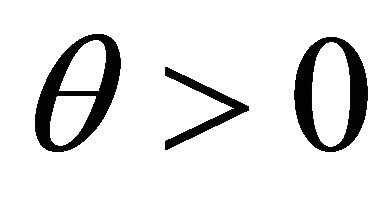

where ,

,  ,

,  ,

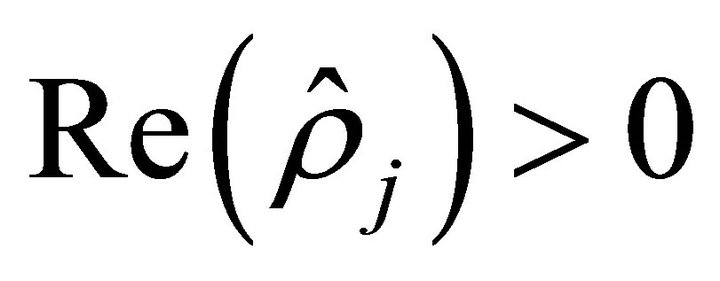

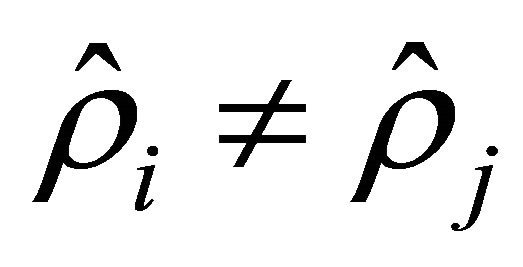

,  and that

and that ,

,  for all

for all . Moreover,

. Moreover,

Define  to be the first exit time of

to be the first exit time of  to two flat barriers

to two flat barriers  and

and

, i.e.

, i.e.

Recently, one-sided and two-sided first exit problems for processes with two-sided jumps have attracted a lot of attentions in applied probability (see [1-7]). For example, Perry and Stadje [1] studied two-sided first exit time for processes with two-sided exponential jumps; Kou and Wang [2] studied the one-sided first passage times for a jump diffusion process with exponential positive and negative jumps. Cai [3] investigated the first passage time of a hyper-exponential jump diffusion process. Cai et al. [4] discussed the first passage time to two barriers of a hyper-exponential jump diffusion process. Closed form expressions are obtained in Kadankova and Veraverbeke [5] for the integral transforms of the joint distribution of the first exit time from an interval and the value of the overshoot through boundaries at the exit time for the Poisson process with an exponential component. For some related works, see Perry et al. [8], Cai and Kou [9], Lewis and Mordecki [10] and the references therein.

Motivated by works mentioned above, the main objective of this paper is to study the first exit time of the process (1.1) with jump density (1.2) from an interval and the overshoot over the boundary at the exit time. In Section 2, we study the roots of the generalized Lundberg equation and conditional memory lessness. The main results of this paper are given in Section 3.

2. Preliminary Results

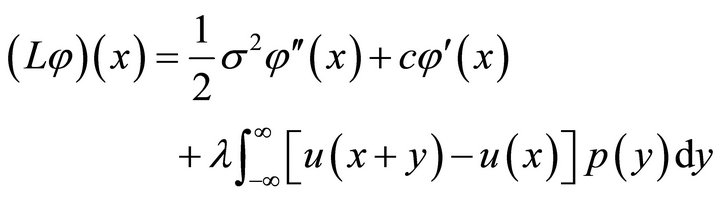

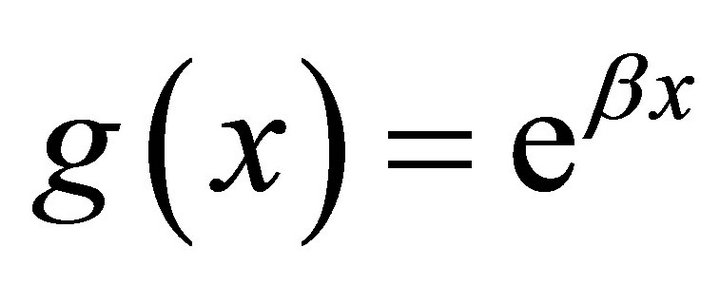

It is easy to see that the infinitesimal generator of  is given by

is given by

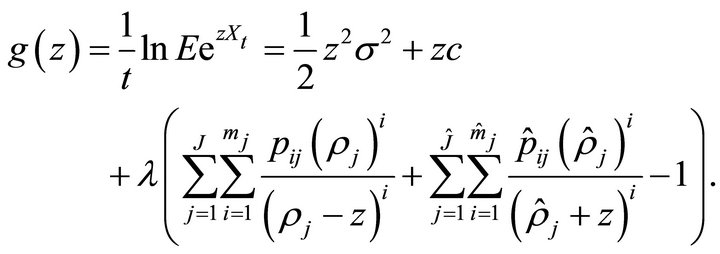

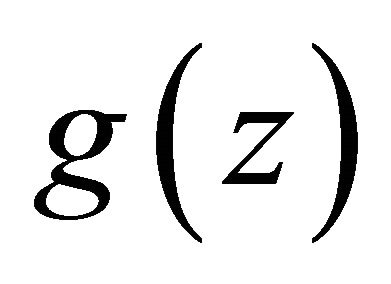

for any twice continuously differentiable function  and the Lévy exponent of

and the Lévy exponent of  is given by

is given by

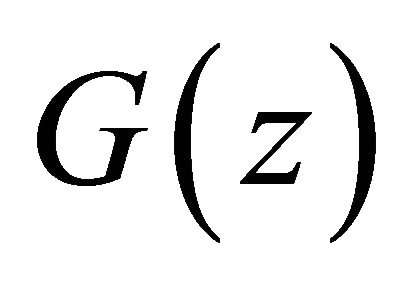

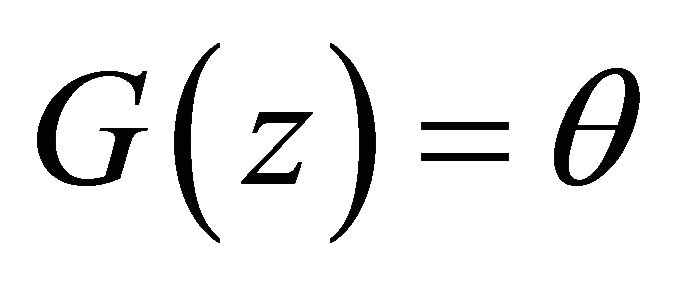

By analytic continuation, the function  can be extended to the complex plane except at finitely many poles. In the following, we consider the resulting extension

can be extended to the complex plane except at finitely many poles. In the following, we consider the resulting extension  of

of , i.e.,

, i.e.,

Let us denote  and

and .

.

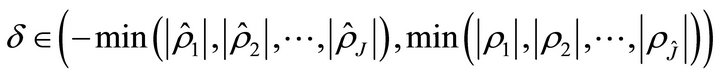

In [11], Kuznetsov has studied the roots of the equation . However, for this particular Lévy process

. However, for this particular Lévy process , we will give another simple proof for the roots of this equation.

, we will give another simple proof for the roots of this equation.

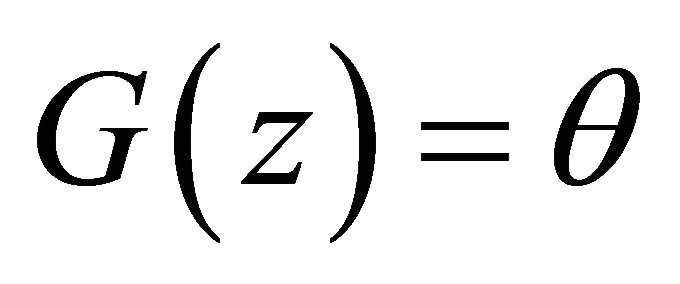

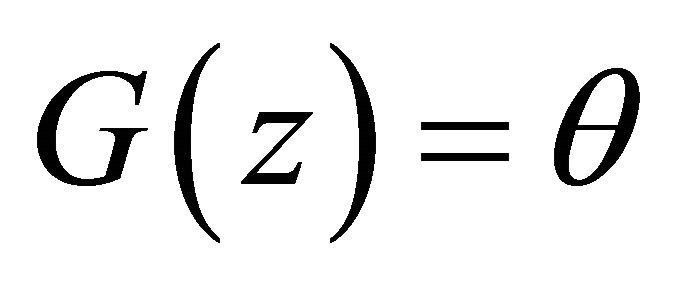

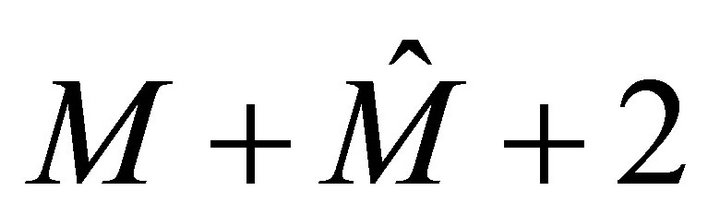

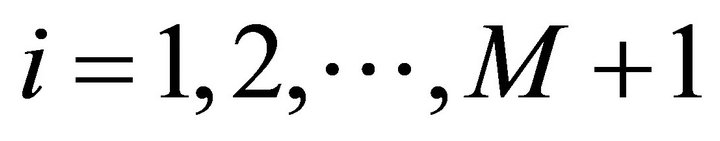

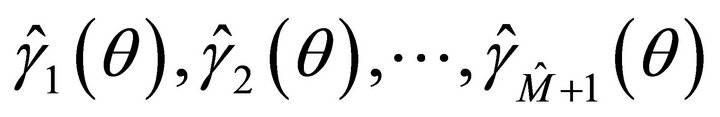

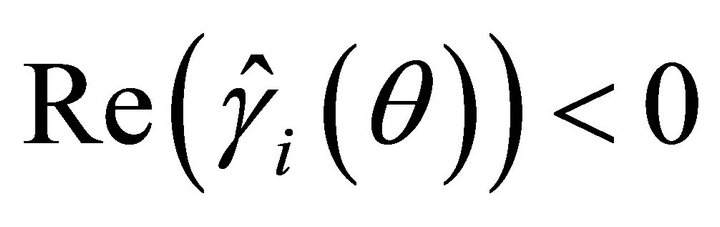

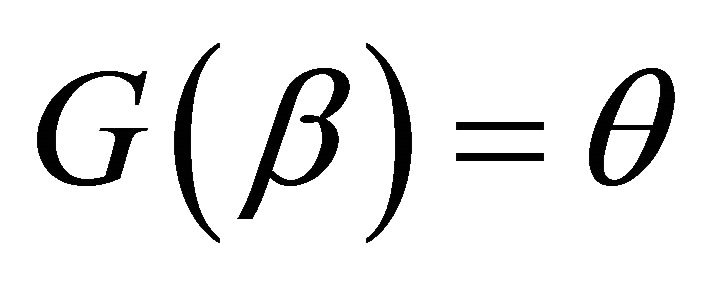

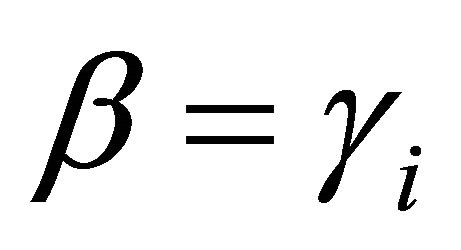

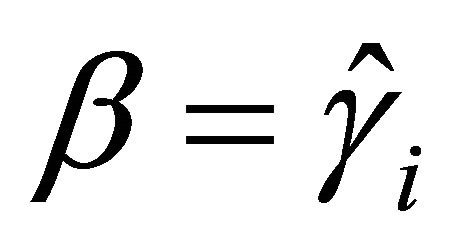

Lemma 2.1. For fix , the generalized CramérLundberg equation

, the generalized CramérLundberg equation

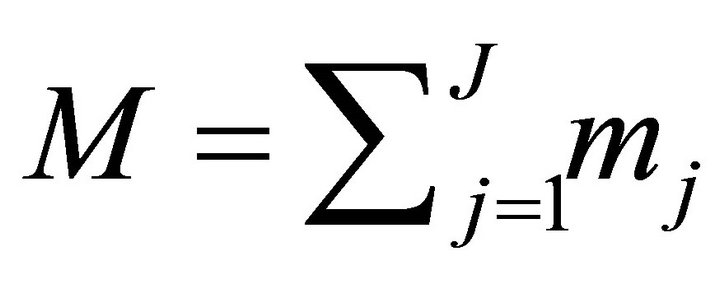

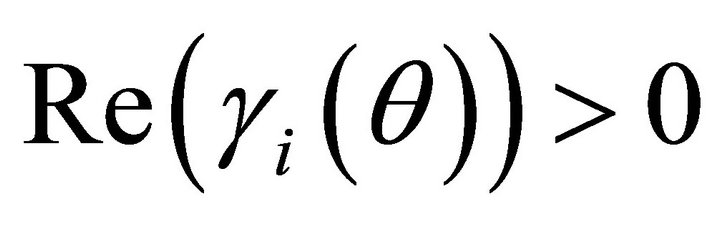

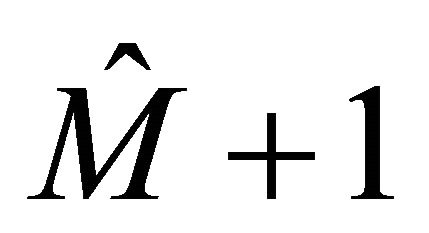

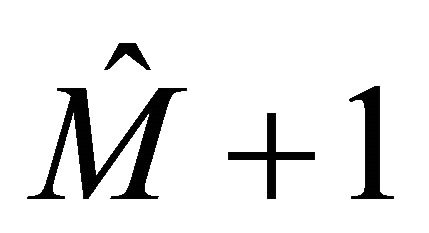

has  complex roots

complex roots  with

with  for

for  and

and  with

with  for

for .

.

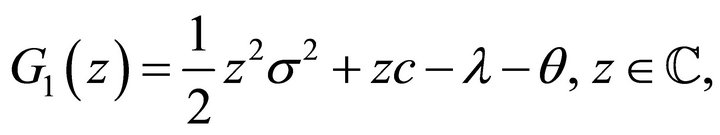

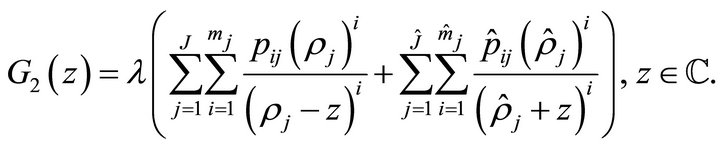

Proof. Let

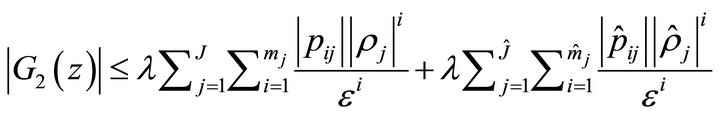

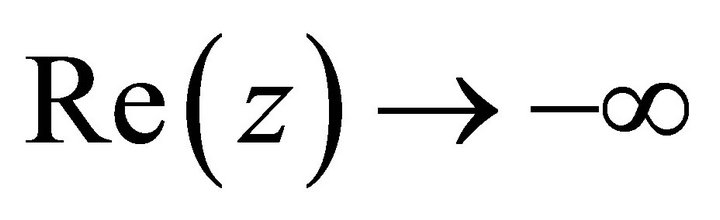

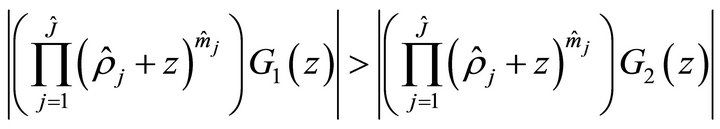

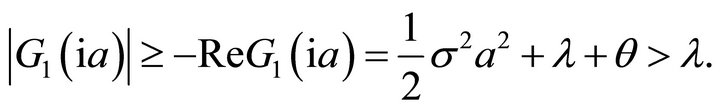

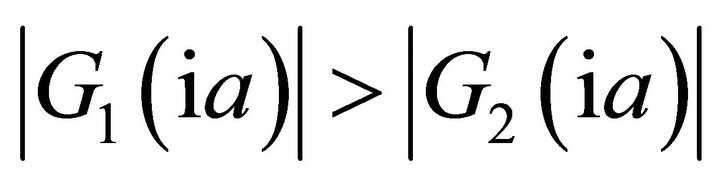

Firstly, we prove that for given ,

,  has

has  roots with negative real parts. Set

roots with negative real parts. Set

with

with where

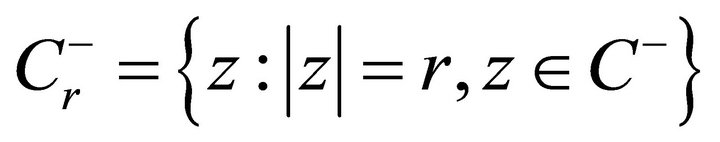

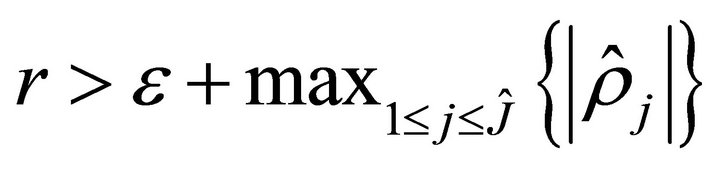

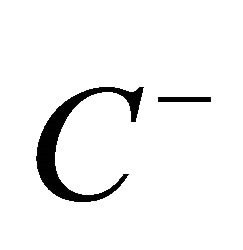

where  is an arbitrary positive constant. Applying Rouchés theorem on the semi-circle

is an arbitrary positive constant. Applying Rouchés theorem on the semi-circle , consisting of the imaginary axis running from

, consisting of the imaginary axis running from  to

to  and with radius

and with radius  running clockwise from

running clockwise from  to

to . We let

. We let  and denote by

and denote by  the limiting semi-circle. It is known that both

the limiting semi-circle. It is known that both  and

and  are analytic in

are analytic in . We want to show that

. We want to show that

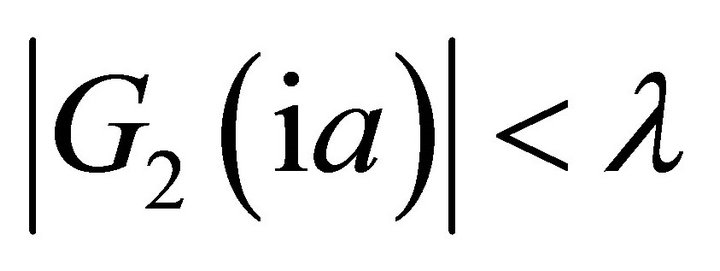

Notice that  for

for , and

, and

is bounded for

is bounded for . Hence, for

. Hence, for ,

,

on the boundary of the half circle in . For

. For , we have

, we have  (see Lewis and Mordecki [10]). On the other hand,

(see Lewis and Mordecki [10]). On the other hand,

Thus we have . Since

. Since

has

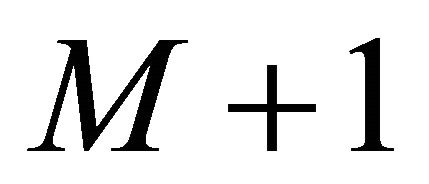

has  roots with negative real parts, so equation

roots with negative real parts, so equation  has

has  roots with negative real parts. Similarly, we can prove

roots with negative real parts. Similarly, we can prove  has

has  roots with positive real parts.

roots with positive real parts.

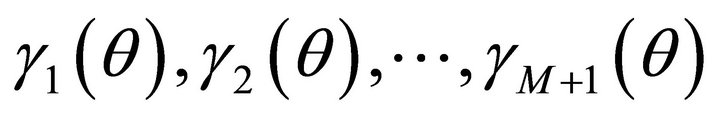

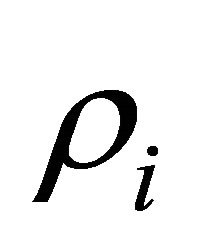

In the rest of this paper, we assume all the roots of equation  are distinct and denote

are distinct and denote  ,

,  for notational simplicity, and denote

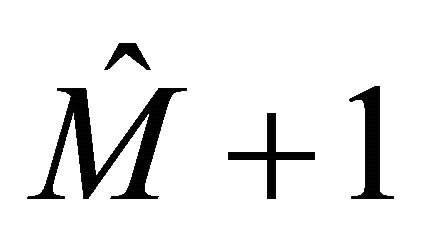

for notational simplicity, and denote  (or

(or  in the sequel) representing the expectation (or probability) when

in the sequel) representing the expectation (or probability) when  starts from

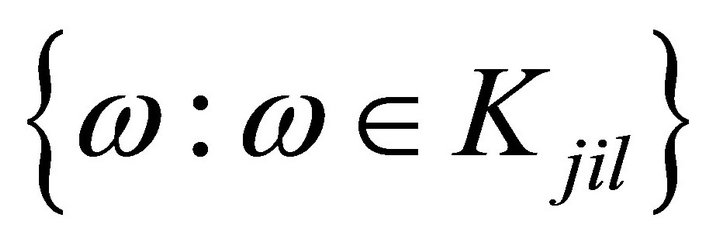

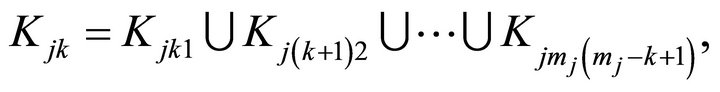

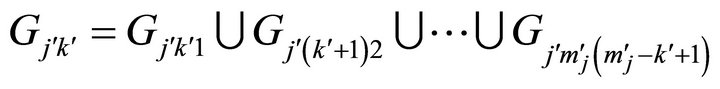

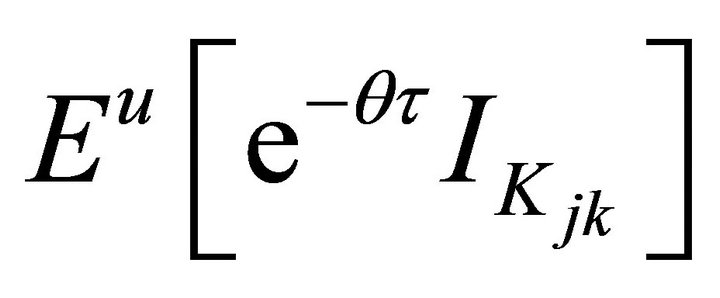

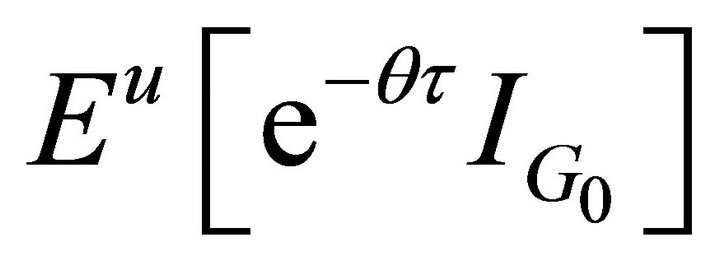

starts from . We denote a sequence of events

. We denote a sequence of events

,

,

= {

= { :

:  crosses

crosses  at time

at time  by the

by the  th phase of

th phase of  th positive jump whose parameter is

th positive jump whose parameter is  },

},

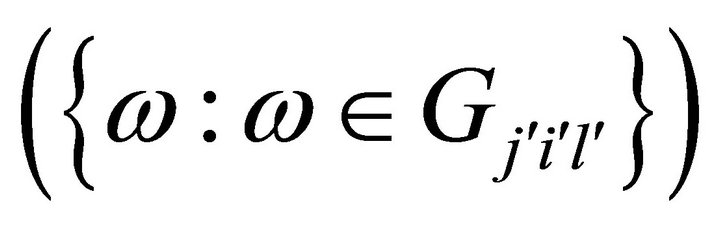

= {

= { :

:  crosses

crosses  at time

at time  by the

by the  th phase of

th phase of  th negative jump whose parameter is

th negative jump whose parameter is  }

}

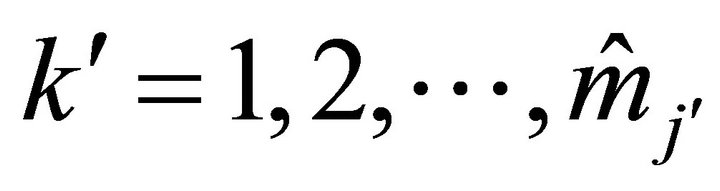

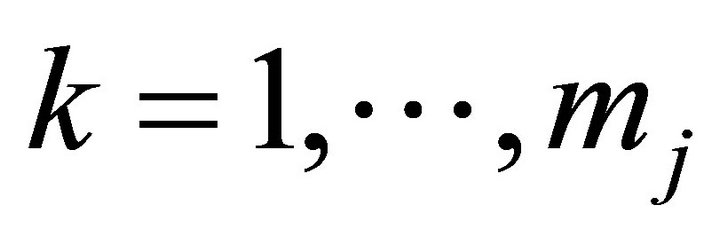

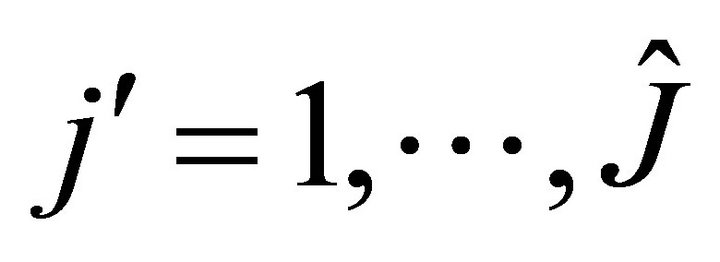

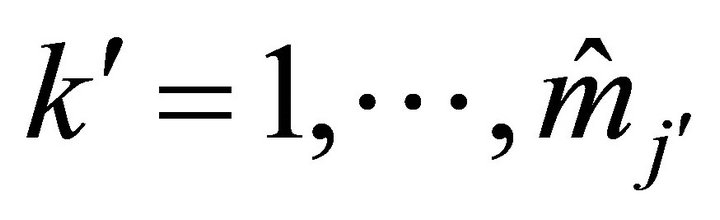

for ,

,  ,

,  ,

,  ,

,  and

and .

.

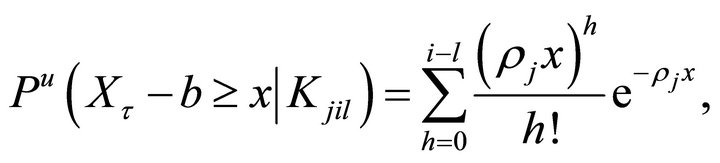

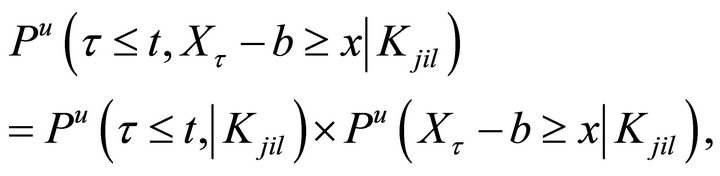

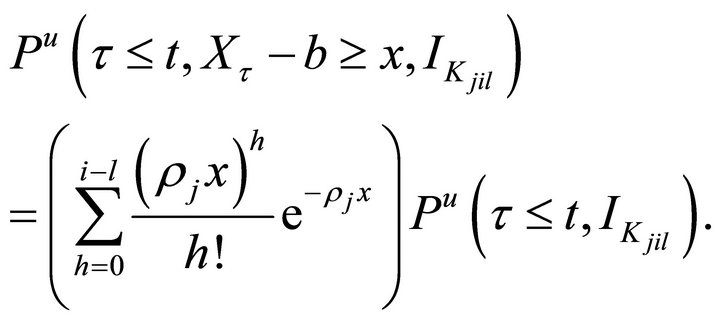

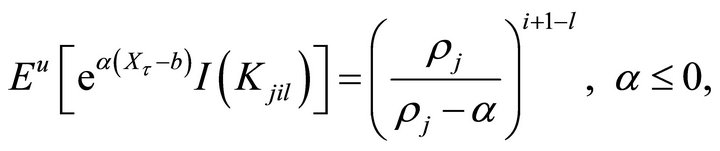

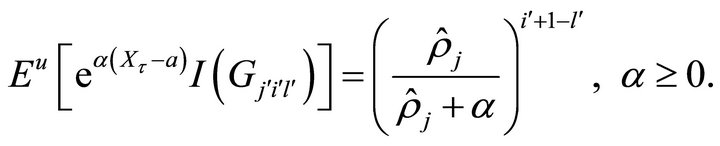

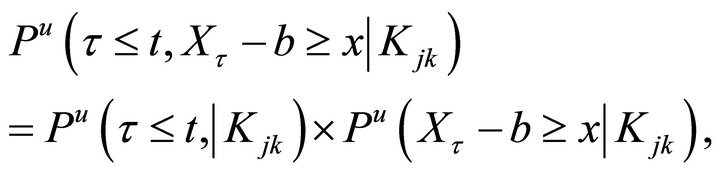

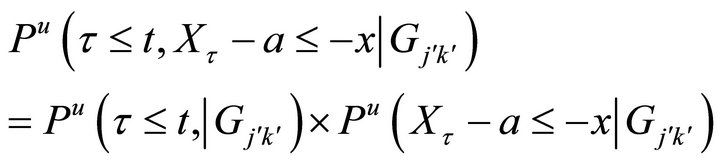

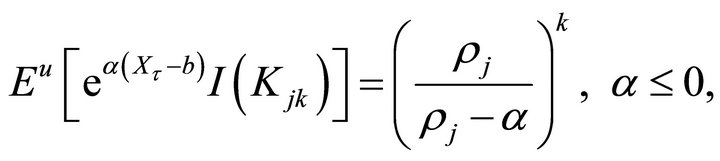

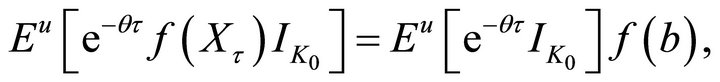

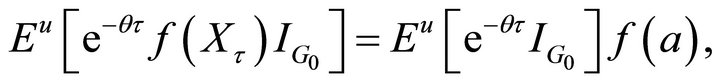

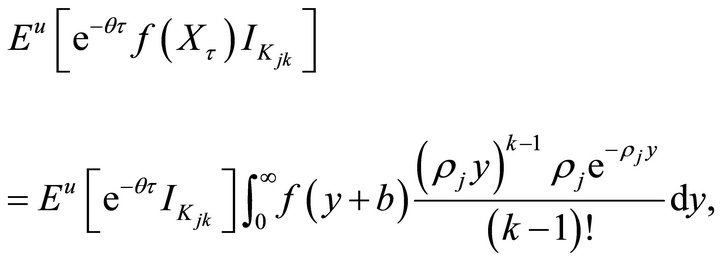

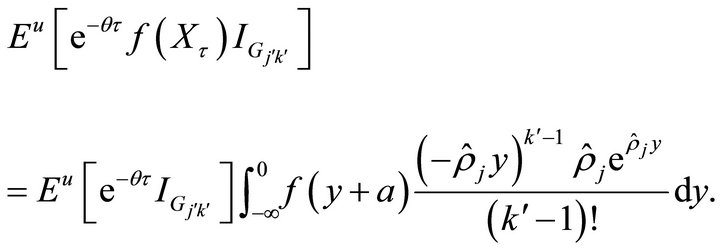

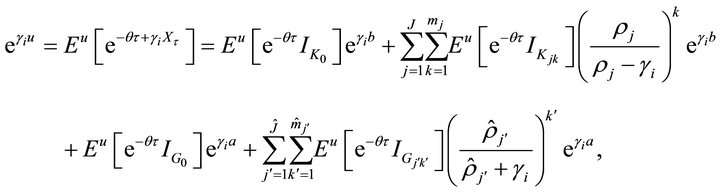

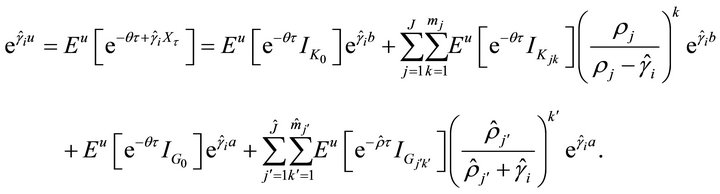

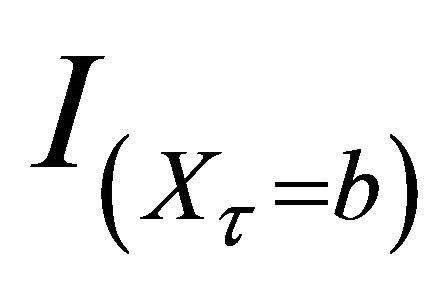

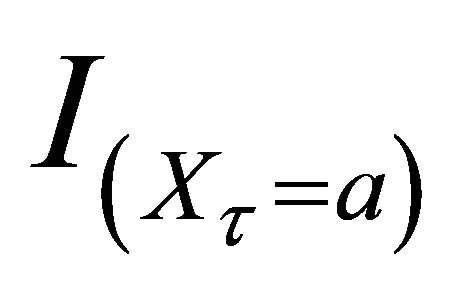

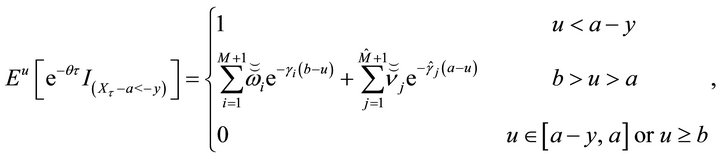

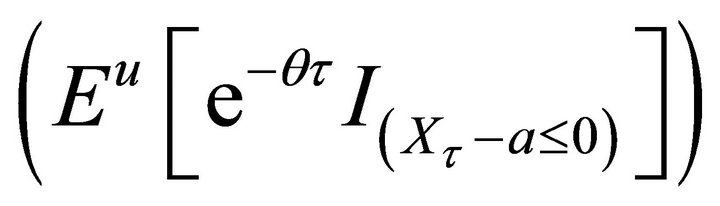

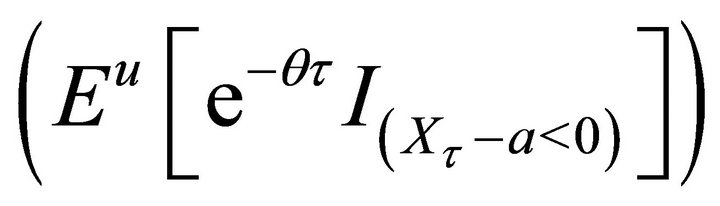

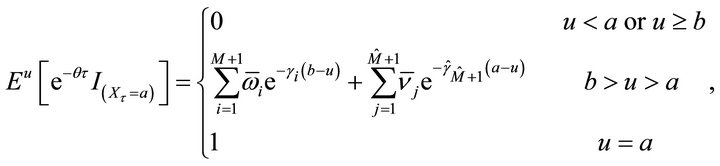

Theorem 2.2. For any , we have

, we have

(2.1)

(2.1)

(2.2)

(2.2)

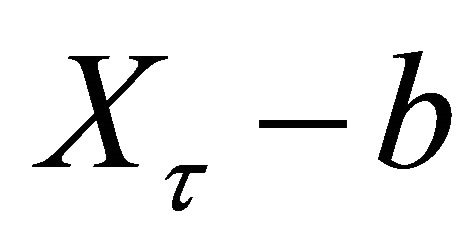

Furthermore, conditional on

, the stopping time

, the stopping time  is independent of the overshoot

is independent of the overshoot  (the undershoot

(the undershoot ). More precisely, for any

). More precisely, for any , we have

, we have

(2.3)

(2.3)

(2.4)

(2.4)

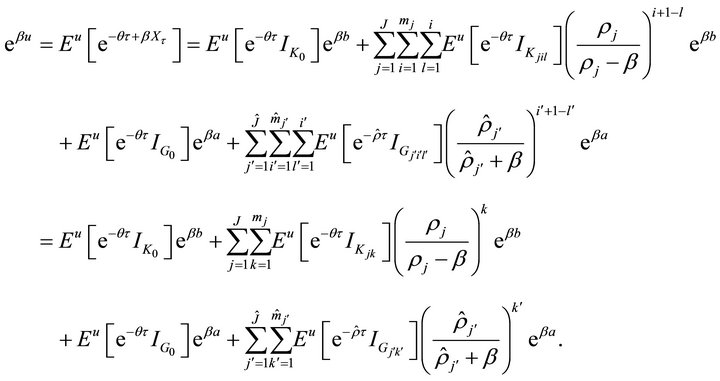

Proof. Firstly, we prove (2.1) and (2.3). It suffices to show

(2.5)

(2.5)

since (2.1) can be obtained by letting  in (2.5) and then dividing both sides of the resulting equation by

in (2.5) and then dividing both sides of the resulting equation by . It is known that an Erlang(n) random variable can be expressed as an independent sum of

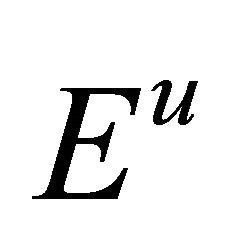

. It is known that an Erlang(n) random variable can be expressed as an independent sum of  exponential random variables with same parameters. Let

exponential random variables with same parameters. Let  the

the  independent exponentially distributed random variables with parameter

independent exponentially distributed random variables with parameter . Denote by

. Denote by  the arrival times of the Poisson process

the arrival times of the Poisson process , and let

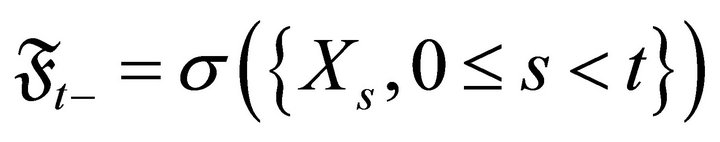

, and let  be the field generated by process

be the field generated by process ,

, . It follows that

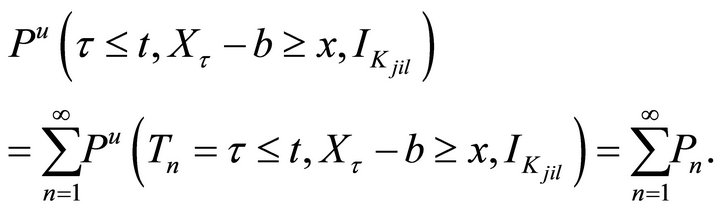

. It follows that

With , we have

, we have

Thus we have

(2.2) and (2.4) can be obtained similarly. This completes the proof.

The following results are immediate consequences of Theorem 2.2.

Corollary 2.3. For ,

,  ,

,  ,

,  ,

,  ,

,  , we have

, we have

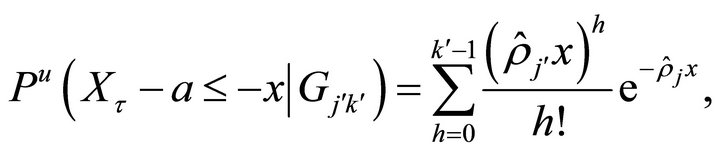

Corollary 2.4. For any , we have

, we have

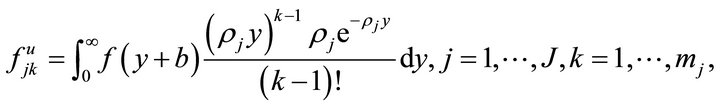

where

for ,

,  ,

,  ,

,  .

.

Corollary 2.5. For ,

,  ,

,  ,

,  , we have

, we have

Remark 2.6. When ,

,  , (2.1) and (2.3) reduce to Equations (8) and (9) of Cai [3], respectively.

, (2.1) and (2.3) reduce to Equations (8) and (9) of Cai [3], respectively.

3. Main Results

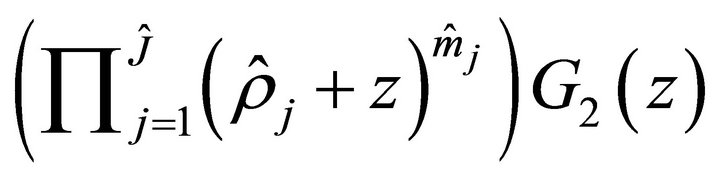

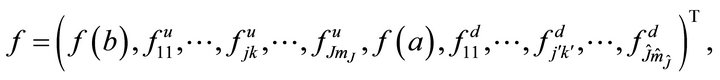

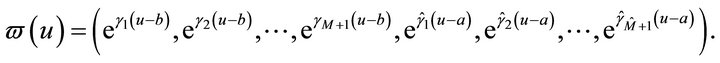

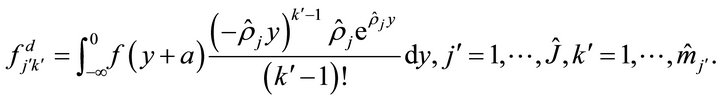

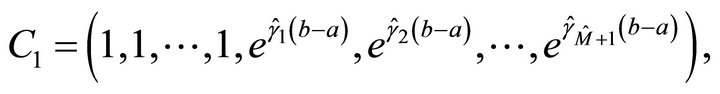

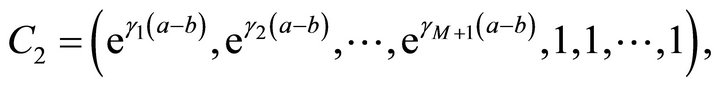

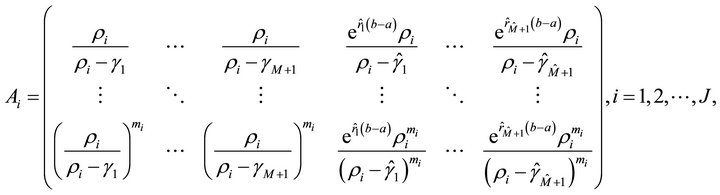

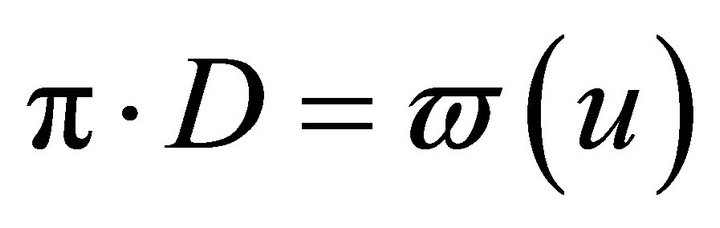

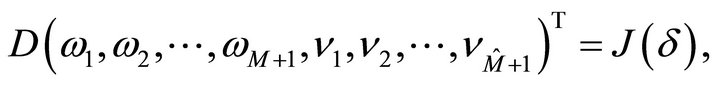

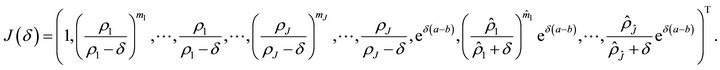

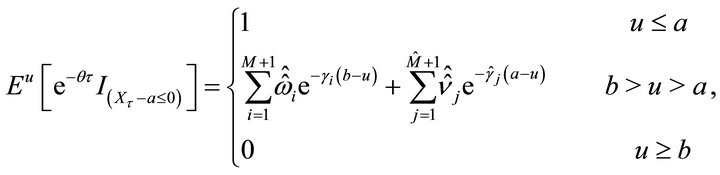

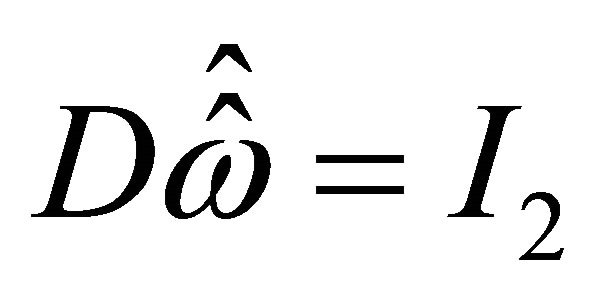

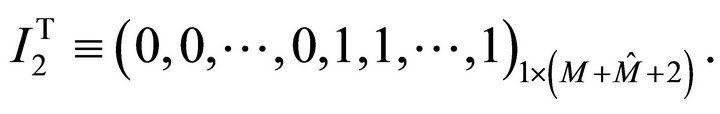

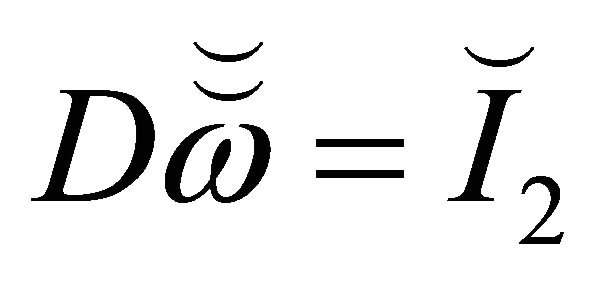

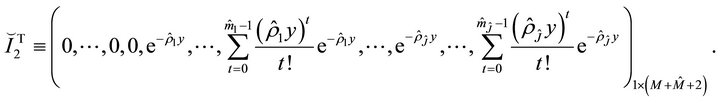

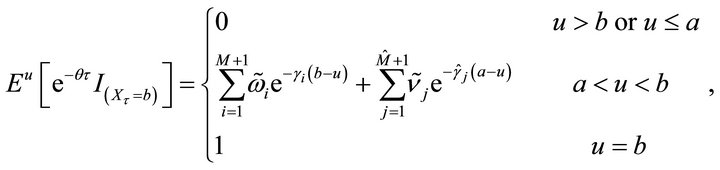

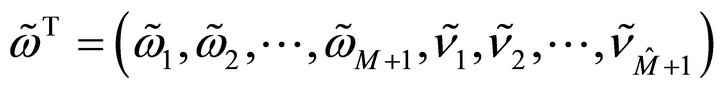

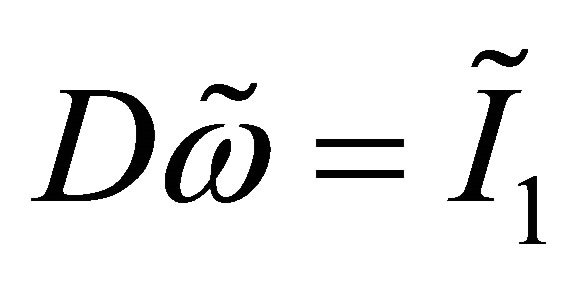

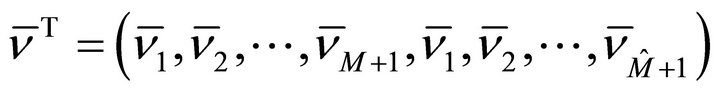

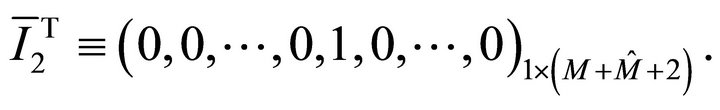

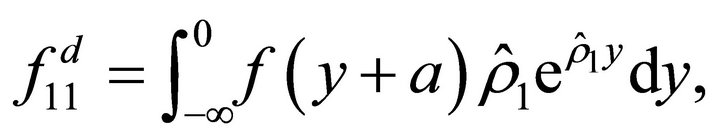

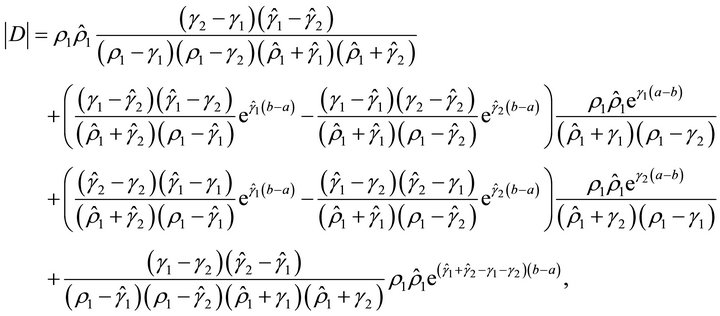

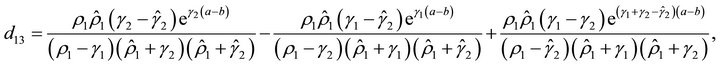

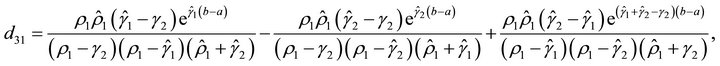

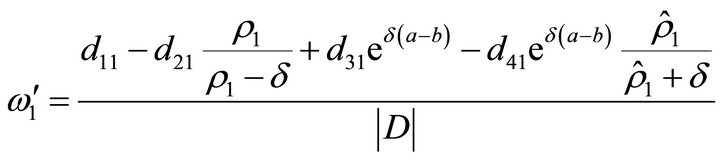

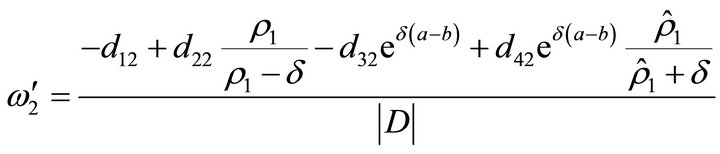

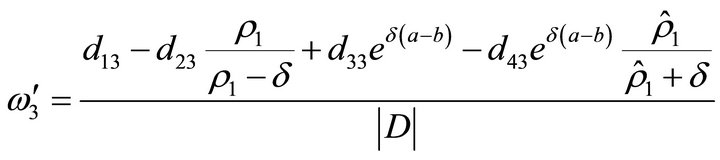

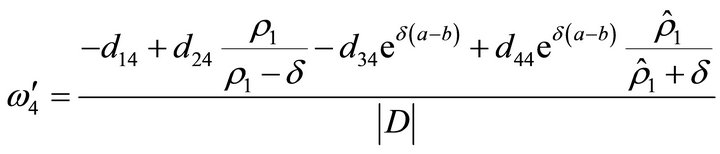

In this section, we study the distribution of the first exit problem to two barriers. We first define three vectors:

where

Let

Define a matrix  .

.

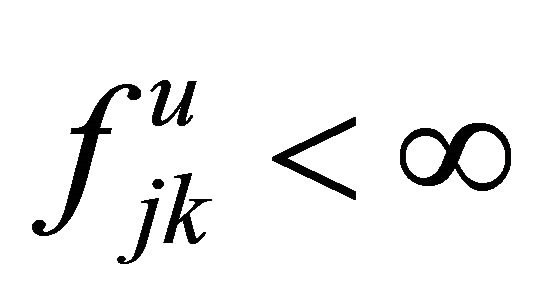

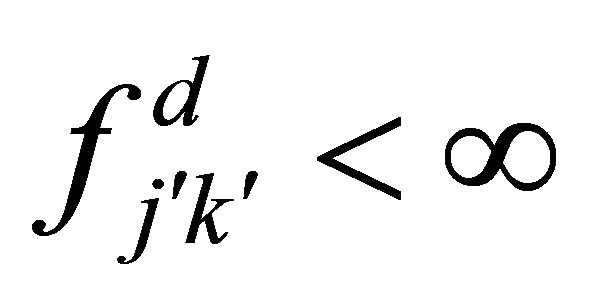

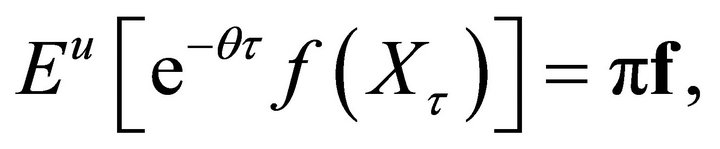

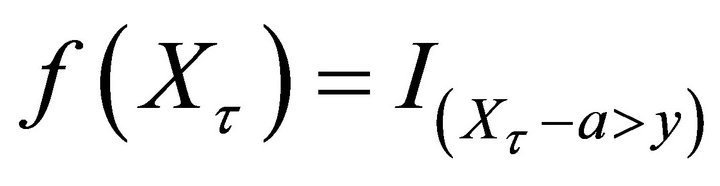

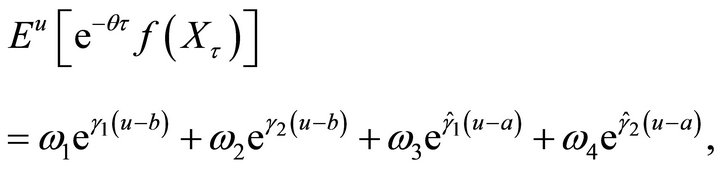

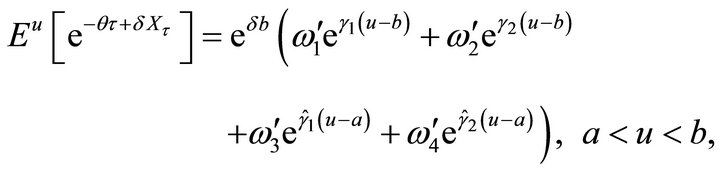

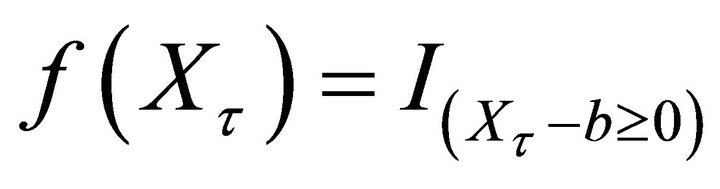

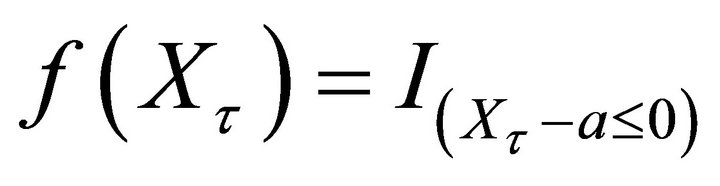

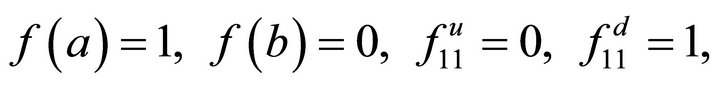

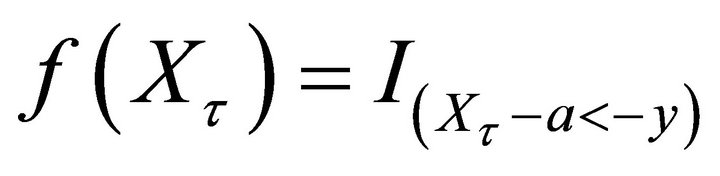

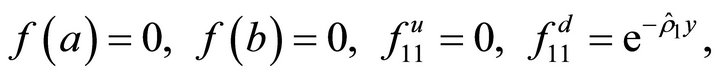

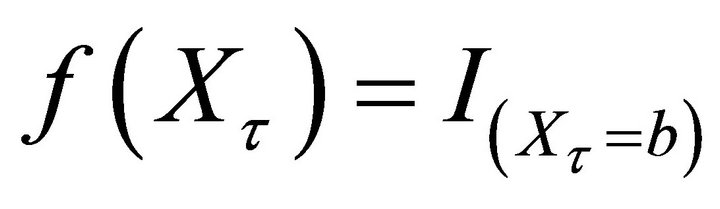

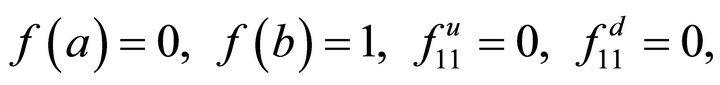

Theorem 3.1. Consider any nonnegative measurable function  such that

such that  and

and  for

for ,

,  ,

,  ,

, . For any

. For any  and

and , we have

, we have

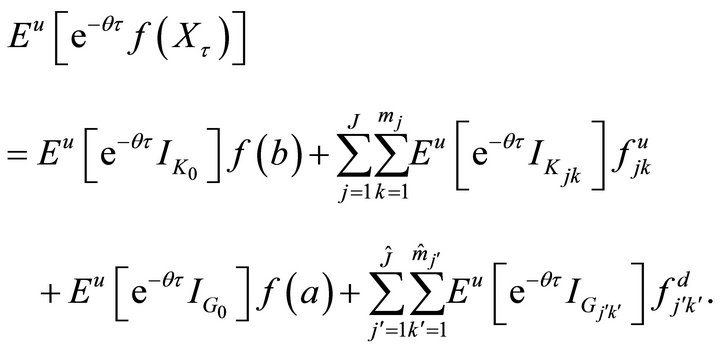

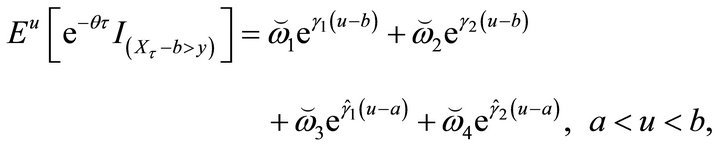

(3.1)

(3.1)

where  satisfies

satisfies

(3.2)

(3.2)

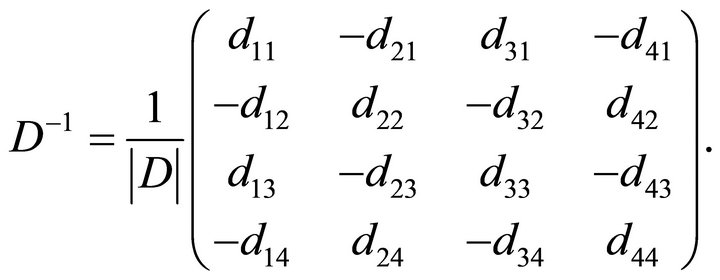

Moreover, when  is a non-singular matrix,

is a non-singular matrix,  is the unique solution of (3.2), i.e.,

is the unique solution of (3.2), i.e.,

(3.3)

(3.3)

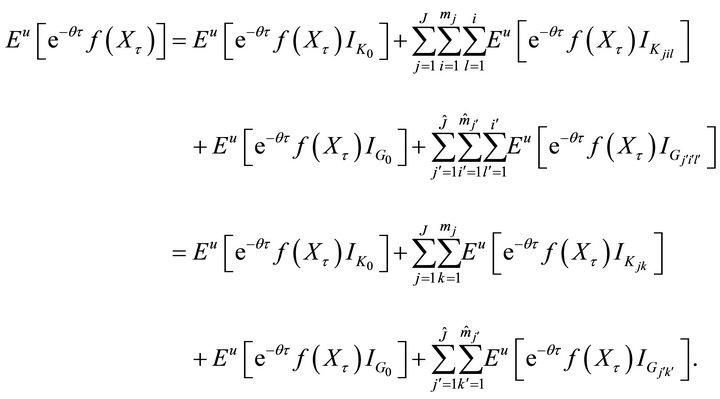

Proof. By the law of total probability, we have

It follows from Corollary 2.4, for ,

,  ,

,  ,

,  , we have

, we have

Combining these equations, we get

The expressions for ,

,  ,

,  and

and  can be determined as follows. Let

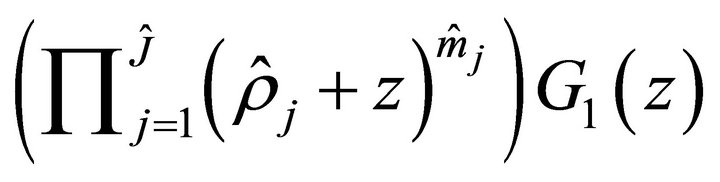

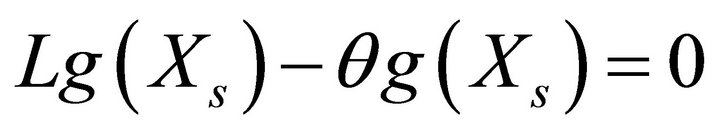

can be determined as follows. Let  denote the set of functions

denote the set of functions

such that  is twice continuously differentiable and bounded for

is twice continuously differentiable and bounded for  with

with  and

and  bounded for

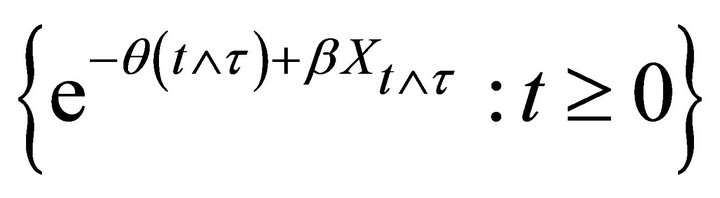

bounded for . By applying Itô formula to the process

. By applying Itô formula to the process , we have that for

, we have that for  and

and ,

,

where  is a martingale with

is a martingale with . Note that we have

. Note that we have  as

as .

.

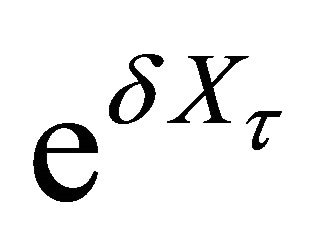

For any , we can easily obtain from the above equation that

, we can easily obtain from the above equation that

where the last term of the above equation is a mean-0 martingale. This implies that

(3.4)

(3.4)

By simple calculation, the function  with

with  and

and  satisfies

satisfies  for

for . It follows from (3.4) that the process

. It follows from (3.4) that the process

is a martingale. Then

is a martingale. Then

(3.5)

(3.5)

Setting  for

for  and

and  for

for  in (3.5), we have the following linear equations:

in (3.5), we have the following linear equations:

and

Then the vector  satisfies

satisfies  and we have (3.1). If

and we have (3.1). If  is non-singular, we have

is non-singular, we have  . This completes the proof.

. This completes the proof.

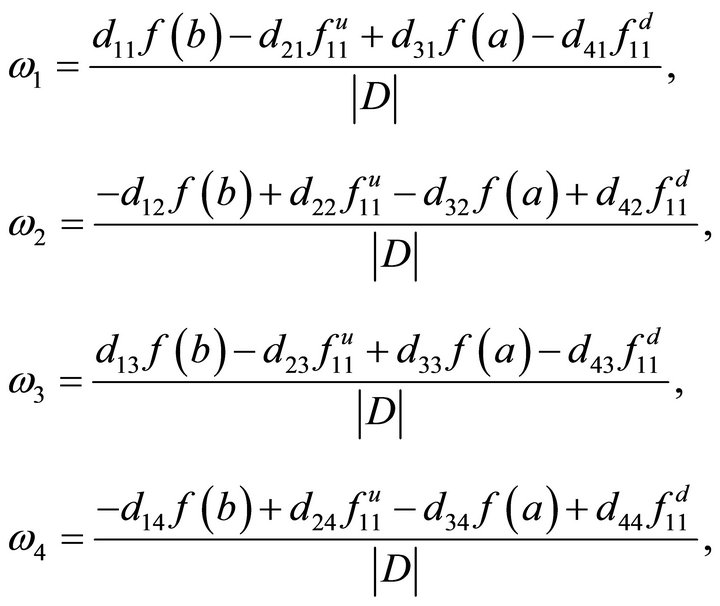

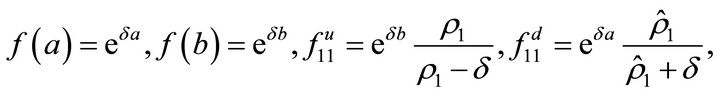

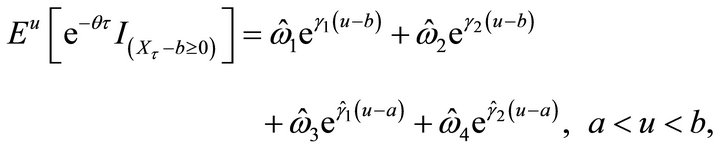

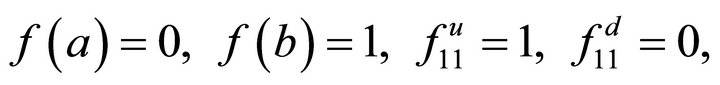

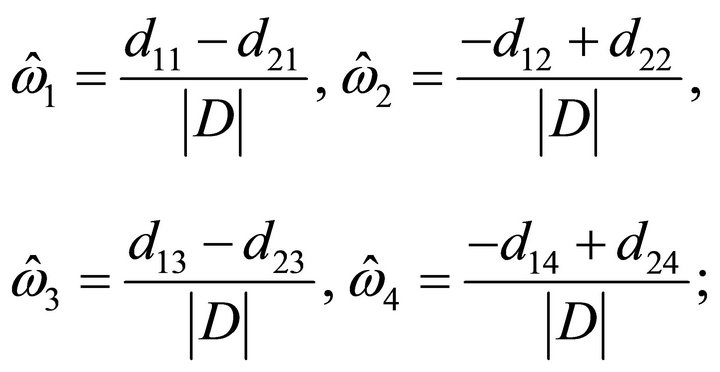

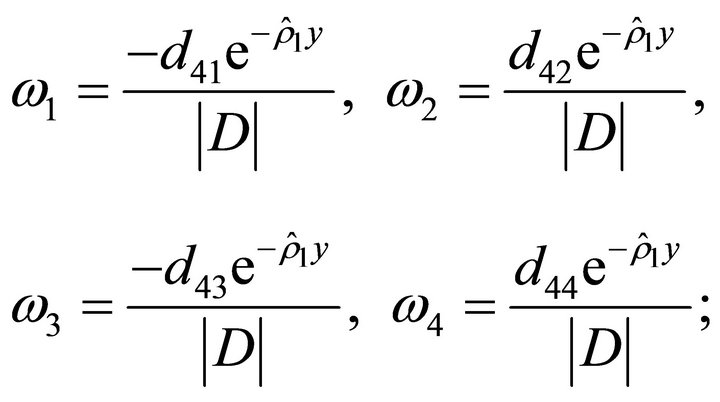

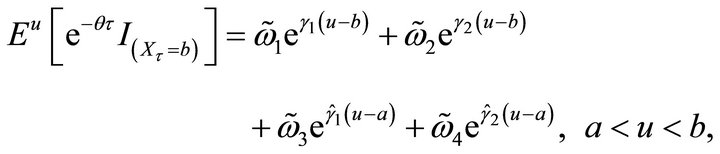

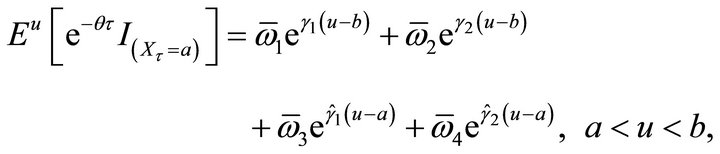

Corollary 3.2. For any

, we have

, we have

(3.6)

(3.6)

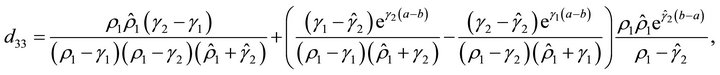

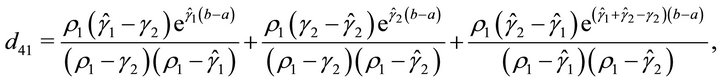

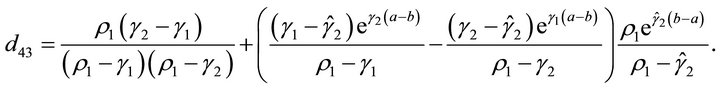

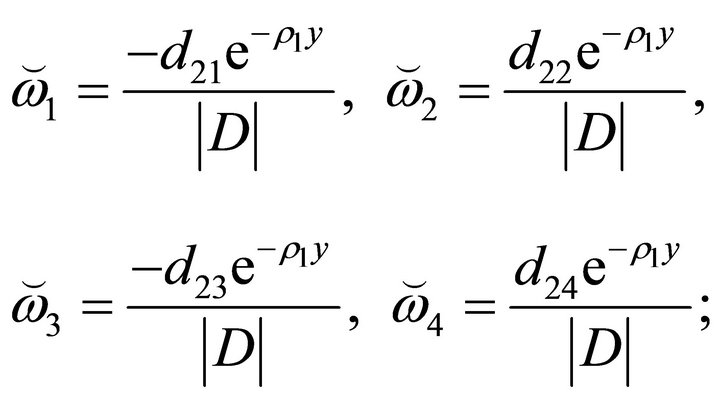

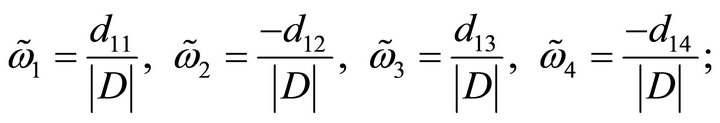

where

and

Remark 3.3. When ,

,  , (3.1) and (3.6) reduce to equation (6) and (15) of [4], respectively.

, (3.1) and (3.6) reduce to equation (6) and (15) of [4], respectively.

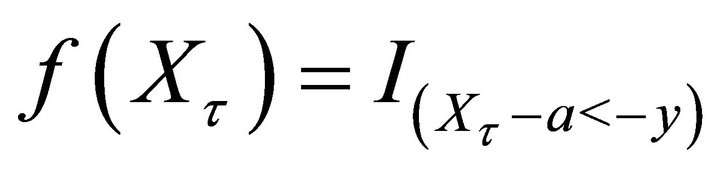

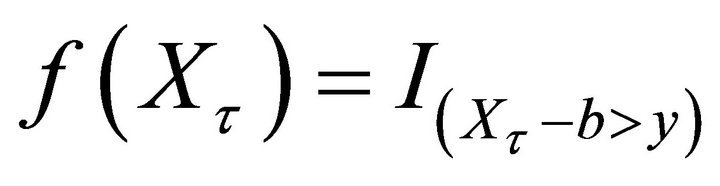

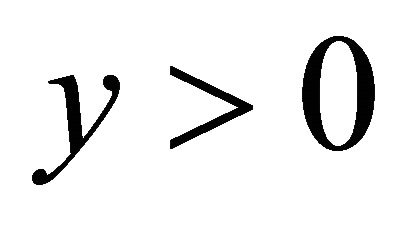

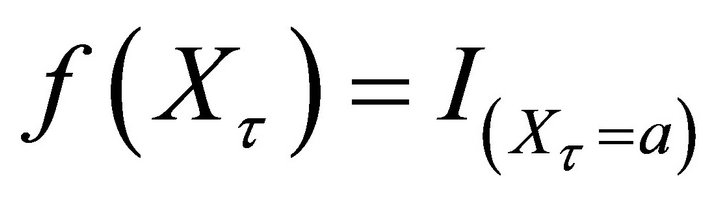

From Theorem 3.1, choosing  to be

to be ,

,

,

,  ,

,  ,

,  ,

,  and

and  respectively, we can obtain the following corollaries.

respectively, we can obtain the following corollaries.

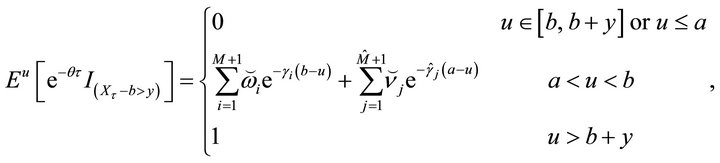

Corollary 3.4. 1) For any , we have

, we have

(3.7)

(3.7)

where

is determined by the linear system . Here

. Here

2) For any , we have

, we have

(3.8)

(3.8)

where

is determined by the linear system . Here

. Here

Corollary 3.5. 1) For  and any

and any ,

,  , we have

, we have

(3.9)

(3.9)

where

is determined by the linear system . Here

. Here

2) For  and any

and any ,

,  , we have

, we have

(3.10)

(3.10)

where

is determined by the linear system . Here

. Here

Note that the difference of

and

and

is exactly

is exactly

. Thus we obtain the following results.

. Thus we obtain the following results.

Corollary 3.6. 1) For , and for any

, and for any , we have

, we have

(3.11)

(3.11)

where

is determined by the linear system . Here

. Here

2) For  and any

and any ,

,  , we have

, we have

(3.12)

(3.12)

where

is determined by the linear system . Here

. Here

To end the paper, we give an example.

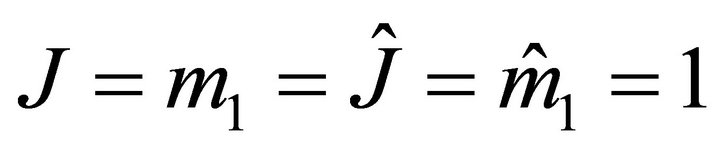

Example 3.7. When ,

,

and

and

, the equation

, the equation  has

has  real roots:

real roots: ,

,  ,

,  and

and

. Let

. Let

Denote  by

by

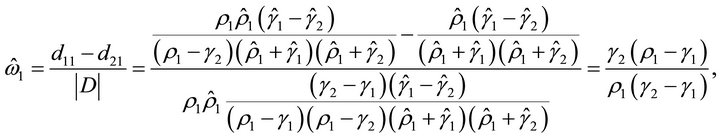

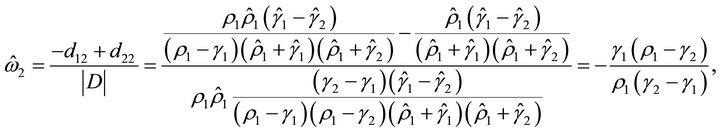

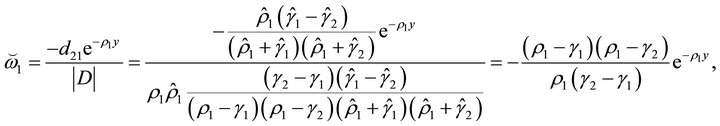

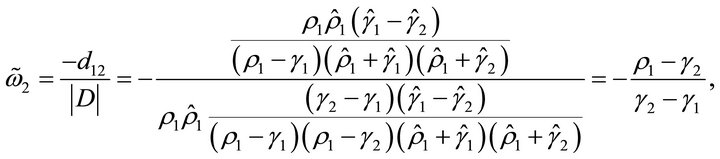

Then we have

where

We define  (

( ,

,  ,

, ) and

) and  (

( ,

,  ,

, ) as follows: let

) as follows: let  (

( ,

,  ,

, ) be obtained from

) be obtained from  (

( ,

,  ,

, ) by changing

) by changing  to

to  in

in  (

(

,

, ); let

); let  (

( ,

,  ,

, ) be obtained from

) be obtained from  (

( ,

,  ,

, ) by changing

) by changing  to

to  in

in  (

( ,

,  ,

, ).

).

• If , then we have

, then we have

where

•

• If , then we have

, then we have

where

•

• If , then we have

, then we have

where

•

• If ,

,  , then we have

, then we have

•

• If ,

,  , then we have

, then we have

where

•

• If , then we have

, then we have

where

•

• If , then we have

, then we have

where

When , we have

, we have

Therefore, we have

These results are all consistent with that of Theorem 3.1 of Kou and Wang [2] for the one-sided exit problem of the doubly exponential jump diffusion process.

REFERENCES

- D. Perry and W. Stadje, “Risk Analysis for a Stochastic Cash Management Model with Two Types of Customers,” Insurance: Mathematics and Economics, Vol. 26, No. 1, 2000, pp. 25-36. doi:10.1016/S0167-6687(99)00037-2

- S. G. Kou and H. Wang, “First Passage Times of a Jump Diffusion Process,” Advances in Applied Probability, Vol. 35, No. 2, 2003, pp. 504-531. doi:10.1239/aap/1051201658

- N. Cai, “On First Passage Times of a Hyper-Exponential Jump Diffusion Process,” Operations Research Letters, Vol. 37, No. 2, 2009, pp. 127-134. doi:10.1016/j.orl.2009.01.002

- N. Cai, N. Chen and X. W. Wan, “Pricing Double-Barrier Options under a Flexible Jump Diffusion Model,” Operations Research Letters, Vol. 37, No. 3, 2009, pp. 163-167. doi:10.1016/j.orl.2009.02.006

- T. Kadankova and N. Veraverbeke, “On Several TwoBondary Problems for a Particular Class of Lévy Processes,” Journal of Theoretical Probability, Vol. 20, No. 4, 2007, pp. 1073-1085. doi:10.1007/s10959-007-0088-8

- S. Fourati, “Explicit Solutions of the Exit Problem for a Class of Lévy Processes; Applications to the Pricing of Double-Barrier Options,” Stochastic Processes and their Applications, Vol. 122, No. 3, 2012, pp. 1034-1067. doi:10.1016/j.spa.2011.09.008

- M. Jacobsen, “The Time to Ruin for a Class of Markov Additive Risk Process with Two-Sided Jumps,” Advances in Applied Probability, Vol. 37, No. 4, 2005, pp. 963-992. doi:10.1239/aap/1134587749

- D. Perry, W. Stadje and S. Zacks, “Contributions to the Theory of First-Exit Times of Some Compound Processes in Queueing Theory,” Queueing Systems, Vol. 33, No. 4, 1999, pp. 369-379. doi:10.1023/A:1019140616021

- N. Cai and S. G. Kou, “Option Pricing under a Mixed-Exponential Jump Diffusion Model,” Management Science, Vol. 57, No. 11, 2011, pp. 2067-2081. doi:10.1287/mnsc.1110.1393

- A. L. Lewis and E. Mordecki, “Wiener-Hopf Factorization for Lévy Processes Having Positive Jumps with Rational Transforms,” Journal of Applied Probability, Vol. 45, No. 1, 2008, pp. 118-134. doi:10.1239/jap/1208358956

- A. Kuznetsov, “On the Distribution of Exponential Functionals for Lévy Processes with Jumps of Rational Transform,” Stochastic Processes and their Applications, Vol. 122, No. 2, 2012, pp. 654-663. doi:10.1016/j.spa.2011.09.007

NOTES

*This work was supported by the National Natural Science Foundation of China (No. 11171179) and Natural Science Foundation of Shandong Province (No. ZR2010AQ015).

#Corresponding author.