Energy and Power Engineering

Vol. 4 No. 4 (2012) , Article ID: 20241 , 8 pages DOI:10.4236/epe.2012.44030

Experiences of the Electricity System Operator Incentive Scheme in Great Britain

1Roland Berger Strategy Consultants, São Paulo, Brazil

2Escola Politécnica, University of São Paulo, São Paulo, Brazil

Email: susteras@gmail.com, dorel.ramos@poli.usp.br

Received May 17, 2012; revised June 20, 2012; accepted July 4, 2012

Keywords: Power System; System Operation; Ancillary Services; Wholesale Electricity Market

ABSTRACT

National Grid is the electricity system operator in Great Britain and has an unique feature in so far as it is one of the world’s few for-profit system operators. In addition, the commercially orientation of the British market rules means that nearly every action taken by National Grid to operate the system has a cost associated to it. Based on those factors and in order to encourage National Grid to seek continuous improvements and drive for efficient and economic system operation, the regulator (Ofgem) offers an incentive scheme, whereby a target is agreed annually and any savings in relation to this target are shared between consumers and National Grid in the form of a profit. It is in National Grid’s best interest to have mechanisms to mitigate the impacts of volatility in the costs it faces as system operator so that it can implement cost saving actions without the risk of windfall losses (or gains) arising from sudden changes in uncontrollable drivers. The purpose of this paper is to share the experiences of National Grid in the operation of Great Britain’s electricity system, with a special interest on the mechanisms created to manage the associated costs in response to the incentive scheme. It does so by describing the market operation in Great Britain and the costs drivers impacting National Grid’s system operation and illustrating the steps recently taken by National Grid to propose volatility mitigation mechanisms. It concludes with the rationale and expected results from the latest proposals as consulted with the industry for introduction in the incentive scheme starting on 1 April 2011. It is worth noting that with this work, the authors wish to both share the experience with other system operators and regulators in the world, as well as give British market participants an insight on the inner workings of National Grid.

1. Disclaimers

The views expressed in this paper are of sole responsibility of the authors and do not reflect in any way those of Roland Berger Strategy Consultants.

The introduction part of this paper has been based on a text co-authored by one of the authors as published in the proceedings of CIDEL 2010.

2. Introduction

National Grid Electricity Transmission owns and operates the high voltage electricity system in England and Wales and is the National Electricity Transmission System Operator in Great Britain (England, Wales and Scotland) and the Offshore networks. Whilst the bulk of National Grid’s revenue is due to its function as owner of the transmission system, this paper focus solely on the costs and revenues related to its role as system operator.

The Great Britain electricity market presents some peculiarities in that National Grid is one of the few (if not the only) for-profit large system operator and, unlike most markets, National Grid is not responsible for fully dispatching the generators, but only for marginally balancing the system and resolving real rime congestions in the transmission system. Of the 330 TWh of electricity transferred across the grid in 2009, just 4% required the balancing intervention of National Grid: 5 TWh of “offers” to call on additional generation at times and 8 TWh of “bids” to pull back generation at times. This balancing activity is the focus of this paper and represents circa £900 m spend per year.

Most of the actions taken by National Grid take place through commercial relationships with generators and demand side parties. Such peculiarities lead the local regulator (Ofgem) to apply a set of incentive rules known as the Balancing Services Incentive Scheme (BSIS). This incentive scheme aims at encouraging innovation and ingenuity in the tools utilized by National Grid to balance and operate the system, above and beyond the requirements of its operating license, through the sharing of savings and overspends between the System Operator and the users [1].

Overview

The BSIS has been in place since the introduction of the New Electricity Trading Arrangements (NETA) in 2001. April 2005 saw the introduction of the British Electricity Trading and Transmission Arrangements (BETTA), which unified the electricity markets of Scotland with England and Wales. The costs to operate the system had then a significant change, mainly due to the need to manage the congested Anglo-Scottish interconnection.

Figure 1 illustrates the evolution of the costs which National Grid has been incentivised since the introduction of the incentive scheme.

One of the main challenges in the operation of the incentive scheme is the observed volatility in the cost drivers, most of which are outside of the system operator’s control. Because BSIS has so far been based in setting a cost target prior to the start of the scheme, variations in costs caused by swings in uncontrollable drivers lead to potential windfall gains and losses, which counters any real incentive for National Grid to deliver innovations in system operation.

This work is organized as follows:

• Section 3 presents an introduction to the British Electricity Trading Arrangements (BETTA) and the role of National Grid as its system operator;

• Section 4 presents the main costs associated with National Grid’s system operation function and the contractual arrangements created to manage them;

• Section 5 explains the dynamics of the Balancing Services Incentive Scheme (BSIS);

• Section 6 details the negative effects of cost volatility on National Grid and the mechanisms created to try to mitigate them;

• Section 7 describes the innovations proposed for the incentive scheme with the expected benefits they shall bring.

3. Current Market Arrangements in Great Britain

In March 2001 the UK government introduced the New Electricity Trading Arrangements (NETA). According to Ofgem, “the former flawed and much-criticised arrangements under the Electricity Pool meant that wholesale prices failed to reflect falling costs and increased competition. NETA created a market where electricity is traded like any other commodity through bi-lateral contracts, where prices are agreed between the two contracting parties, or on power exchanges” [1].

These new arrangements meant that National Grid was no longer responsible for scheduling generation according

Figure 1. Past incentive scheme performance.

to its demand forecast; instead, National Grid became responsible for balancing the system in real time, with the market (generators and suppliers) informing the system operator of their own schedules ahead of real time (called the gate closure). In practice, only generators inform their scheduled position, with National Grid producing its own demand forecast.

Later, in April 2005 the final significant market change was put in place with the unification of the Scottish market with that of England and Wales, meaning that suppliers and generators in the whole of Great Britain would now be able to operate under a single market structure.

The information provided to National Grid by generators is called Physical Notification and it reflects the position each generating unit will take for each half-hour of the day, i.e. their self dispatched position for the supply of their power sale contracts. This information must be provided everyday at 11 o’clock in the morning for the next 24 hours and can be changed up to 1 hour ahead of real time (gate closure). Based on the information provided by generators and its own demand forecast, National Grid plans the operation of the system, considering its short term operating reserve requirements, primary and secondary frequency response requirements, potential congestions in the transmission system, etc.

The actual operation of the system is made by National Grid accepting bids (instructions for generators to reduce output) and offers (instructions for generators to increase output) in the Balancing Mechanism, performing over the counter (OTC) and exchange based trades and by using balancing services contracts (Figure 2).

These actions have cost associated to it, which are incurred by National Grid and later recovered from market participants via the Balancing Services Use of System (BSUoS) charges. These costs are subject to an incentive scheme, as described below.

4. Main Incentivised Cost Components

The costs to which National Grid is exposed in its role as

Figure 2. Bid and offer actions to balance market length.

system operator and is incentivised to minimize under the BSIS can be divided into two main groups: energy related and constraints.

4.1. Energy Related Costs

The Great Britain’s nominal operating frequency is 50 Hz. In order to maintain the frequency within the statutory limits of 49.5 to 50.5, National Grid has to balance generation with demand on a second by second basis.

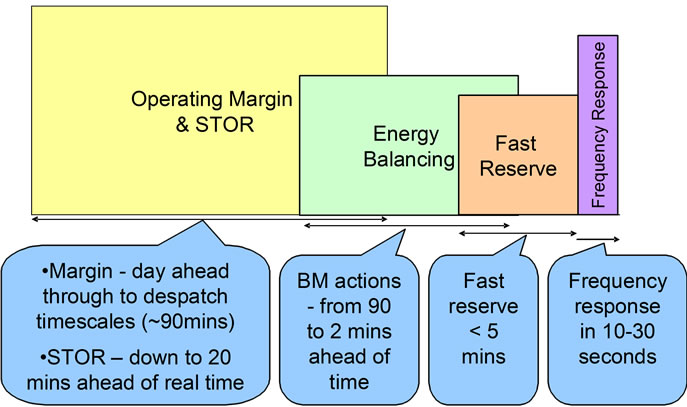

National Grid takes a number of different actions to ensure that the system frequency is maintained within the statutory and operational limits. The different actions are taken depending on the different timescales required for managing the system. Figure 3 shows the four main actions taken to respond to system frequency fluctuations; margin and Short Term Operating Reserve (STOR), energy balancing, fast reserve and frequency response.

4.1.1. Operating Margin

The Operating Margin actions refer to the need to ensure there is enough synchronized generation to meet the reserve requirement, calculated so that the probability of demand not being met is only a total of one day in every 365 days. This operating margin is a balance between reducing the risk of demand disconnection and reducing the costs associated with operating margin actions.

Another component of Operating Margin is the downward regulation, actions taken by National Grid to exchange inflexible generation with flexible generation— this is achieved by desynchronising some of the units,

Figure 3. Actions taken in different time scales to manage system frequency.

allowing the output of other units to be increased above their minimum stable output.

4.1.2. Energy Balancing

Energy balance costs are those incurred by National Grid to correct for real time differences between generation supplied by the market and demand on the system.

The vast majority of energy related actions carried out by National Grid are in the form of bids and offers in the Balancing Mechanism (BM). For each settlement period, each generator submits prices at which National Grid can instruct them to vary their output during that period.

If the market is long (generation in excess of demand), National Grid instructs generation to decrease their output by accepting bid prices. Conversely, if the market is short (demand in excess of generation), National Grid instructs generating units to increase their output by accepting offer prices. For energy balancing purposes, these actions are performed in cost order and feed into the processes undertaken to calculate system imbalance prices.

System imbalance prices are the prices to which individual market participants will be exposed to in case their contractual position is different to their generation/consumption (since National Grid is not a market participant, it is not be exposed to imbalances, it only manages system imbalances). If a market participant is long, it will receive System Sell Price (SSP); if a market participant is short, it will pay System Buy Price (SBP). The mechanism to calculate SSP and SBP depend on the overall market position:

• If the system is overall long (i.e. National Grid took more bids than offers in a half hour), then SSP will be calculated as the average price of the lowest 500 MW of accepted bids, and SBP will reflect the power exchange price;

• If the system is overall short (i.e. National Grid took more offers than bids in a half hour), then SBP will be calculated as the average price of the highest 500 MW of accepted offers, and SSP will reflect the power exchange price.

The monthly settlement of all half-hourly imbalances is performed by Elexon, outside of the scope of National Grid’s role.

4.1.3. Fast Reserve

Fast Reserve is used to control frequency changes that might arise from sudden changes in generation or demand, such as incidents involving generation disconnection or rapid demand changes resulting from TV pickups (TV pickup is a typical phenomenon in the British system where sudden increases in demand are observed during commercial breaks or at the end of TV programs).

Fast Reserve delivers active power according to certain criteria through an increased output from generation or a reduction in consumption from demand sources, following receipt of an electronic despatch instruction from National Grid.

4.1.4. Frequency Response

National Grid must maintain the continuously changing system frequency within the statutory limits, as defined in the National Electricity Transmission System Security and Quality of Supply Standards (NETSSQSS) [2]. To assist with this, National Grid procures frequency response from units, which can be categorised as either dynamic response or non-dynamic response.

National Grid procures three different types of balancing services to assist with frequency control:

• Mandatory Frequency Response (MFR)

• Firm Frequency Response (FFR)

• Frequency Control by Demand Management (FCDM).

All generators bound by the requirements of the Grid Code [3] are required to have the capability to provide MFR. MFR is an automatic change in active power output in response to a system frequency change.

FCDM provides frequency response through the interruption of demand. The electricity demand is automatically interrupted when the system frequency falls to below a trigger threshold. The demand customers who provide the service are prepared for their demands to be interrupted for up to 30 minute duration. Historic statistical trends have shown that interruptions are likely to occur between approximately ten to thirty times per annum.

4.1.5. Reactive Power

National Grid manages the voltage of the GB system, to meet Transmission Licence requirements for secure and stable power transmission and to ensure quality of supply to customers. Voltages are largely determined by the flows of reactive power on the system. National Grid ensures that reactive power is provided on a local basis to meet the constantly varying needs of the system so that there are sufficient reactive power reserves available to meet contingencies, such as generation plant losses and circuit trips.

To assist with controlling reactive power flows, in addition to the use of reactive compensation equipment, National Grid procures reactive power as a balancing service. It is obligatory for generators that are party to the Grid Code to have the capability to provide reactive power. These synchronous generators can be controlled to absorb or generate reactive power depending on the excitation. National Grid instructs these generators as to the level of reactive power that should be generated or absorbed to keep the system voltages within acceptable limit. Reactive power is procured via the reactive power market, the arrangements of which are defined in section 4 of the CUSC [4].

4.2. Constraints

A constraint occurs when the capacity of transmission links is exceeded so that not all of the required generation can be transmitted to other parts of the network, or an area of demand cannot be supplied with all of the required generation.

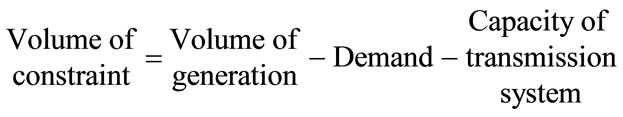

The volume of a constraint refers to the amount of generation that the transmission capacity is exceeded by i.e.:

A finite capability exists to transfer power in either direction across a boundary. Where constraints require that the transfer out of an area is reduced, by reducing generation or increasing local demand, these are termed “export” constraints. Circumstances where generation within the local group needs to be increased, or demand reduced, are termed “import” constraints. National Grid procures balancing services to manage system flows and alleviate constraints.

When any constraint is managed by limiting or increasing the output of a generator, costs are incurred. Other actions can be taken to alleviate constraints such as intertripping, forward trading or bilateral contracts to change or limit generator output.

Intertrip services are automatic control arrangements where generation may be reduced or disconnected following a system fault, avoiding the need to preemptively constrain generation output. Generators are paid an availability fee, an arming fee for the period during which the scheme is active and a tripping fee in case it is actually used. National Grid seeks to implement such arrangements whenever possible, as intertrips have proved to be a very cost efficient tool to manage system constraints.

Forward trading and bilateral contracts are normally used when there is an expectation that the prices achieved with such arrangements ahead of real time will be more attractive than those submitted by generators in real time in the balancing mechanism.

5. Incentivisation in Action

In a nutshell, the incentive scheme works as follows: the regulator (Ofgem) agrees with National Grid a budget to operate the system in the following year. If National Grid manages to operate the system at a lower then agreed cost, it is allowed to retain a share of any value created; however, should actual costs be greater than initially agreed, it must bear a share of such higher costs.

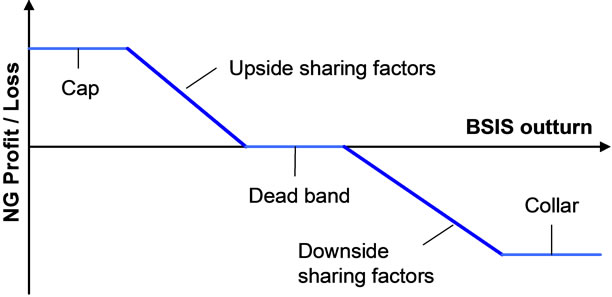

As Figure 4 illustrates, a cap is applied to the amount of profit National Grid can retain from the BSIS outturn and a collar is applied to the amount of loss that National Grid can be subject to. A “dead band” range is agreed, where there is no pain or gain share of the BSIS outturns for National Grid.

Figure 4. Illustration of the incentive scheme profit/loss.

For example, if the upside sharing factor has been agreed at 25%, then for every £1 under the dead band threshold the BSIS outturn is, National Grid would be allowed to retain 25 p. Conversely if, for example, the downside sharing factor has been agreed at 30%, then for every £1 the BSIS outturns above the dead band threshold then National Grid will have to pay 30p towards BSUoS costs (the charge is transferred to Generators and Suppliers for balancing the system).

Prior to the commencement of each BSIS, the sharing factors and dead band are agreed between National Grid and Ofgem. The industry is consulted on the scheme design of each BSIS, via a consultation process led by National Grid [5]. All of the responses are carefully considered prior to the development and implementation of the final scheme.

The effect of the incentive scheme is that National Grid maintains a continuous tight watch on the costs of operating the system, making tactical decisions to optimize the system while minimizing cost on a minute-byminute basis. This is particularly true for the scheduling of plant and the scheduling of engineering works which could incur constraint costs.

6. Cost Volatility

The incentive scheme has traditionally followed a similar format year on year, with a total target cost and sharing factors agreed annually. One known issue with this approach is the extreme volatility of the total cost of factors outside National Grid’s control.

In recognition of the need to mitigate the risk of windfall gains and losses arising from swings in costs as a result of variations in uncontrollable cost drivers, an adjustment factor has been in place since the introduction of NETA, to allow for the correction of the costs target as market conditions changes in real time. The drivers covered by this adjustment are market imbalance (the difference between demand and contracted position) and power price. This adjustment factor is called Net Imbalance Adjuster (NIA).

6.1. NIA

The original idea behind the creation of NIA was that the most volatile aspect of the costs faced by the system operator is the cost to re-balance the system in real time (energy imbalance costs). Its initial formulation assumed that actions taken in real time would incur a premium on top of prevailing wholesale prices as, on theory, there is a limited pool of available options, with no time to schedule new generation or re-plan the system in bulk.

In practice, this premium is reflected as a multiplier of spot prices, which depends on the market direction. If the market is short, i.e. National Grid accepted more offers than bids, then the average price paid for those actions would be above the wholesale power price; if, on the other hand, the market is long, i.e. more bids accepted than offers, the price paid to National Grid (bids are in effect a sale of energy from the system operator to the generator, so that it can reduce its output to supply its contracted position) would be lower than the spot price.

The formulation, defined on National Grid’s transmission license, was for each half-hour calculated as:

NIA = 0.5 × Net Imbalance Volume

× Spot Price, if market long

NIA = 2.5 × Net Imbalance Volume

× Spot Price, if market short

The asymmetry between the premium in the bid and the offer prices is caused by the different competition levels for each market condition: when the market is short, only the few part loaded units in the system are capable of providing additional energy (or a whole new unit has to be synchronised into the system); when the market is long, in theory all units are capable of reducing their outputs (up to their minimum stable level).

The effect of NIA in the incentive scheme would be seen as National Grid being incentivised to act on the net costs of operating the system, i.e. the total costs faced by National Grid net of the allowance given through NIA to recognise the effects on energy imbalance of changes in market length and power price:

Incentivised Costs = Actual Costs – NIA

6.2. A New Formulation for NIA

Despite NIA’s intention to protect the incentive scheme from variations in those two drivers, in particular for the financial year 2008/2009 a spike in wholesale power prices saw BSIS reaching the loss collar in the early months of the scheme. That windfall loss led National Grid to study a better formulation for NIA in order to capture the effects of price variations in other cost components beyond Energy Imbalance.

In particular, it was felt that a new term should be introduced to recognize that even when the market is perfectly balanced, a number of actions are taken by National Grid, whose costs are heavily affected by wholesale power prices.

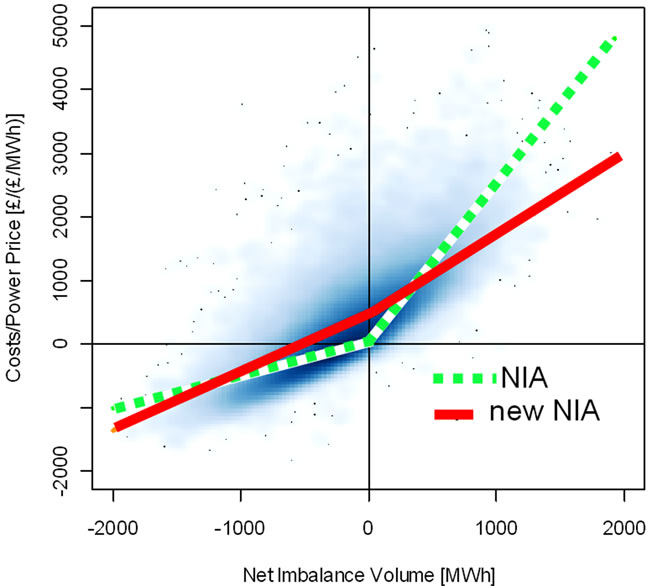

This is illustrated in Figure 5, where the ratio between half-hourly costs incurred and wholesale power price is plotted against different levels of Net Imbalance Volume along with the effect of the existing NIA formulation in the dashed green line. The area under the red ellipse is the one representing actions taken in a balanced market position.

After consultation with the industry [6], an offset coefficient has been introduced, with the new NIA formulation being given as NIA = (450 + 0.9 × Net Imbalance Volume) × Spot Price, if market long NIA = (450 + 1.25 × Net Imbalance Volume) × Spot Price, if market short The equivalent plot with the new NIA formulation is shown in Figure 6 below, where the orange dot-dashed line represents the effect of the introduction of this offset.

As can be noted in the formulation above and in Figure 6, the main (and only) change introduced by new NIA was that it had been designed to capture costs volatilities due to variations in wholesale power price when the market was close to a balanced position, which NIA had cleared failed to do.

Figure 5. Costs to power price ratio for different market length levels and the effect of NIA.

Figure 6. Costs to power price ratio for different market length levels and the effect of new NIA.

6.3. The Downfall of New NIA

Throughout the incentive schemes for the financial years 2009/2010 and 2010/2011, significant swings happened to the costs to system operation, this time to record low levels. Because the reduction in costs hasn’t been caused by changes in market length and could be only partially explained by changes in power prices, even the new NIA formulation failed to capture the observed cost oscillations. As a result, National Grid reached the profit cap for both years very early in their respective incentivisation periods.

It has become clear that other tools were necessary to minimise the effects of volatility in cost drivers in the incentive scheme, in order to minimise the risks of windfall gains and losses to the system operator.

The proposed method, as consulted with the industry for introduction on 1 April 2011, is described in the next section. While the proposals are National Grid’s, the judgements and opinions expressed are the sole responsibility of the authors.

7. Proposed Innovations in the Incentive Scheme

The main characteristic of the incentive scheme is the agreement prior to its commencement of a cost target, based on a forecast produced by National Grid. During the scheme, the objective becomes to beat this initial forecast, which is adjusted every half hour for changes in market length and power price through NIA.

As it happens, a number of the assumptions utilised to derive this initial forecast is also characterised by high volatility levels and low controllability by National Grid, such as overall system margin (i.e. the amount of generation available in the system in relation to peak demand), must run generation (i.e. Nuclear and Wind) availability, spot fuel prices, etc. Even though it would be expected that such parameters would eventually influence the two variables in NIA (market imbalance and power price), it is fair to admit that they have enough influence on their own to warrant their inclusion in some type of adjustment factor.

Unfortunately, the relationships between costs incurred in system operation and most drivers is non-linear in nature and there is a fair amount of cross influence, making the task of writing a set of clear cut equations a near impossible one. Instead, since the relationships are already modelled in the forecast tools, there could be a possibility of using those tools as “black box” adjustment factors. This is the first proposal for the new incentive scheme.

7.1. Ex-Post Inputs

The way to implement the proposition of using the forecast tools as adjusters is by feeding into them the actual parameters, as opposed to assumed values. This can be done in fixed intervals, for instance on a monthly basis, such that National Grid’s real performance is compared with the theoretical efficient one, as described in the models, and the profit or loss is calculated based on expost inputs.

The main challenges for this approach are around reaching an agreement between National Grid, the industry and the regulator around the formulation of such models, the variables that should be moved to the ex-post approach, the governance process for controlling the appropriate use of the models and the triggers for review of model parameters.

New opportunities arise from the reduction of risks of windfall gains and losses, such as the extension of the incentivisation period and the sharpening of the incentive parameters, described below.

7.2. Longer Term Scheme

One of the main issues around the agreement of yearly targets for BSIS is the amount of time and resources required from National Grid, Ofgem and the industry as a whole to, respectively, produce forecasts and proposals; scrutinise the process; and analyze and respond to consultation processes. Increasing the interval between resetting of incentive schemes, therefore, reduces the burden for all interested parties, allowing a better use of their resources.

In addition, allowing longer periods for National Grid to reap the benefits of innovations should encourage the system operator to pursue investments in its systems and processes with longer payback period and, in theory, with higher societal returns.

7.3. Higher Sharing Factors and Caps/Collars

If the reduction of risks of windfall gains and losses allow more confidence for the setting of incentive schemes for longer periods, it should also allow for a sharper set of parameters, in particular the sharing factors, i.e. how much of the savings or over spending is divided between consumers and National Grid’s shareholders, and the caps and collars, i.e. the maximum potential amount to be gained or lost in the scheme.

These changes are aimed at both further encouragement to the system operator to introduce innovations in its systems and processes, but also as recognition to the increased effort required to achieve meaningful reductions, once the random effects of uncontrollable variables are removed from the equation.

8. Conclusions

This paper has presented an overview of the energy balancing service provided by National Grid in the UK power system. From this it can be seen that the incentive mechanism “BSIS Scheme” has led to the development of a comprehensive set of commercial and technical tools in order to balance and operate the system.

One concern around the effectiveness of the incentive scheme has been around the volatility of uncontrollable cost drivers, leading to swings in costs and windfall gains and losses. The creation of NIA and its improved formulation offered some protection, but were insufficient to guarantee an environment where changes in operational costs could be mostly associated with actions by National Grid.

An innovative approach of utilising the forecast tools as black box adjustment factors is being proposed and will be subject to consultation with and agreement by stakeholders. This should facilitate the introduction of longer incentivisation periods and sharper parameters.

REFERENCES

- OFGEM, “New Electricity Trading Arrangements (NETA)— One Year Review,” London, 2002. http://www.ofgem.gov.uk/Media/FactSheets/Documents1/1109-factsheet1102_24july.pdf

- National Grid, “National Electricity Transmission System Security and Quality of Supply Standard,” Version 2.0, London, 2009. http://www.nationalgrid.com/NR/rdonlyres/149DEAE1-46B0-4B20-BF9C-66BDCB805955/35218/NETSSQSS_GoActive_240609.pdf

- National Grid, “The Grid Code,” No. 4, London, 2009. http://www.nationalgrid.com/NR/rdonlyres/67374C36-1635-42E8-A2B8-B7B8B9AF2408/35187/Complete_I4GridCode.pdf

- National Grid, “The Connection and Use of System Code (CUSC),” London, 2012. http://www.nationalgrid.com/uk/Electricity/Codes/systemcode/contracts

- National Grid, “National Grid Electricity Transmission System Operator (SO) Incentives for 1 April 2010,” Version 1.0, 2009. http://www.nationalgrid.com/NR/rdonlyres/519DEB34-5CCE-40D6-9980-9DE23A41E666/38228/ElectricitySOIncentivesInitialProposalsConsultatio.pdf

- National Grid, “Consultation on the Development of an Incentive Target Indexation Methodology,” Wokingham, 2012. http://www.nationalgrid.com/NR/rdonlyres/E1C3C89D-1F71-467D-A052-C204B29C7F04/28024/Indexationconsultationdocument_posted.pdf