American Journal of Industrial and Business Management

Vol.4 No.2(2014), Article ID:43124,5 pages

DOI:10.4236/ajibm.2014.42016

The Allocation of Family Guanxi-Oriented Control Rights —Evidence from Family Listed Companies of Zhejiang China

School of Accounting, Zhejiang Gongshang University, Hangzhou, China.

Email: gulingyan@mail.zjgsu.edu.cn

Copyright (c) 2014 Lingyan Gu. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. In accordance of the Creative Commons Attribution License all Copyrights (c) 2014 are reserved for SCIRP and the owner of the intellectual property Lingyan Gu. All Copyright (c) 2014 are guarded by law and by SCIRP as a guardian.

Received August 20th, 2013; revised September 20th, 2013; accepted September 27th, 2013

KEYWORDS

Family Listed Company; Allocation of Control Right; Guanxi; Family Members; Zhejiang Province of China

ABSTRACT

Different from the market-oriented control mechanism in British and American, the guanxi-oriented control mechanism is a significant feature in Chinese family business. This paper proposes the concept of family guanxi- oriented control rights allocation for the first time. Based on the analysis about the influencing factors of the family guanxi-oriented control rights allocation, we use the sample companies coming from Zhejiang province of China to do further discussion. We find that 1) the actual controllers of Zhejiang family listed companies mainly have blood relationship; 2) parts of companies allocate the control rights between the family members who have more than three kinds of guanxi; 3) the controlling families prefer to control the board of the listed companies; 4) the intergenerational succession of control rights in Zhejiang family listed companies has been highlighted.

1. Introduction

Family-owned and managed firms play a vital role in the world economies. Family firms typically depict a complex, long-standing stakeholder structure that involves family members, top management, and a board of directors [1]. The owner-family’s members usually play multiple roles in managing and governing the firm [2]. Family members as managers often make the most important business decisions [3]. Therefore, family holds the final control rights.

However, family firms are often plagued by conflict. Relationship conflict, an interpersonal conflict that is laden with negative emotions like resentment and animosity, harms family firm performance [4].

In our daily life, the events about husband and wife feeling estranged, father and son into revenge, brother partition, occur frequently in family firms in recent years. The scramble for control rights between family members raises the worry and thinking about the effective control to the family firms. Furthermore, it also influences the allocation of family control rights.

In the current China, the corporate control market and the manager market are far from mature. Guanxi based on informal contracts plays an important role in the allocation of the control rights. The guanxi-oriented control mechanism operates universally in the allocation of family control rights. How to allocate the family control rights effectively is an issue worthy of further research by the field of theory and practice.

2. The Definition of the Guanxi-Oriented Control Rights Allocation

An outstanding feature of family listed companies is that the controlling family control the board and management through family members meanwhile control the shareholding of the listed companies. Lins did an empirical research about the companies’ ownership structure in the 22 emerging markets. The result is that companies in the 22 emerging markets, whose ownership is concentrated, are mostly controlled by family and the managerial positions are always occupied by the family members [5]. Chen & Nowland examined the family controlling companies’ monitoring mechanism of the board in Hong Kong, Taiwan, Singapore and Malaysia [6]. Hiller & McColgan tested the relationship between the CEO alternations with the company value in family controlled companies [7].

In the current China, the corporate control market and the manager market are far from mature. Different from the market-oriented control mechanism in British and American, the guanxi-oriented control mechanism is a significant feature in Chinese family business. When allocating the equity, arranging the board members and selecting the managers, the controlling family always prefers to choose people who have blood relationship, marriage relationship and quasi-family member relationship with them. The allocation of family control rights based on kinship is called family guanxi-oriented control rights allocation.

3. The Influencing Factors of the Guanxi-Oriented Control Rights Allocation in Family Business

The formation of guanxi-oriented control rights allocation in family business may be based on the factors as follows.

3.1. The Influence of Chinese Family Culture

The influence of family culture to Chinese people is incomparable of any other nationalities. The Chinese traditional culture started from the blood relationship, and family is the first and most important social organization to Chinese people [8].

Kinship is the core content of family culture. In traditional agricultural society, the family kinship is tied by blood, kept up by the order of the distinction between sexes, difference of humble and noble, and hierarchy of the old and young, connected by the marriage. As a result, a differential interpersonal relationship structure formed as the center of family. People pay attention to the kinship far more than any other social relationship. The concept of home and family deeply marked in Chinese people’s mind. The Chinese family culture not only supports a set of ethics rules for the family, but also generalizes to every aspect of social politics and economic life. Any group and organization, including enterprise and country, all can be regarded as the expansion of home.

3.2. The Influence of Chinese Guanxi Culture

In Chinese cultural contexts and real life, a distinctive character is guanxi [9]. Family blood relationship, kinship are the potential interpersonal rules in Chinese society. In the same family, family members have the same or close blood relationship, the same values and interest pursuits.

Compared with the west society, Chinese society is neither the society orientation nor the individual orientation, but guanxi orientation. In the interpersonal communication of Chinese people, the first thing to do is judging the type of guanxi. Guanxi which is influenced by the family culture becomes the key of complex social networks. In China, all the trust and commercial relations are established on the kinship or kin-based pure personal relationship [10].

3.3. The Influence of Trust Culture

Culture can be divided into low trust culture and high trust culture according to the level of trust between people [11]. The low trust culture exists in the society which pays more attention to the blood relations, such as China and France. The high trust culture is beyond the blood relations, such as America and Germany.

Compared with the western developed market economy, Chinese society lacks of trust. But the private trust is developed. The private trust is a differential structure. Different from the western common trust which is based on the confidence, Chinese family trust is based on loyalty [12].

3.4. The Influence of Kinship Altruism Psychological

Inclusive fitness, which is the fitness of alleles that have the same gene as themselves, is used to explain the altruistic behavior [13]. The behavior or the characteristics of the organisms are reserved because of their improvement of inclusive fitness. This process is called kin selection.

People prefer to help the kin than non-kin when they are in the situation of life and death, distribution of the property, or the corporative games.

The altruistic behavior facilitated by gene is sustained by the corresponding psychological foundation. For example, people feel subjectively that kin are more familiar. The purpose to help the kin is not for the happiness, but for the kin sincere consideration.

4. The Analysis about the Guanxi-Oriented Control Rights Allocation in Zhejiang Family Listed Companies

4.1. Sample and Date Collection

This paper selects family listed companies of Zhejiang China which are listing in Shanghai and Shenzhen stock exchanges before December 31, 2010 as samples. We screen and determine 142 samples by collecting the Zhejiang family listed companies’ annual or half annual report 2010, searching the guanxi between family members who are the final controlling shareholders of the family listed company by Baidu, Flush software and so on. We eliminate some family listed companies whose guanxi between the final controlling shareholders can’t be confirmed. Among the 142 samples, there are 35 family companies listing in main board of Shanghai stock exchange, 4 family companies listing in main board of Shenzhen stock exchange, 88 family companies listing in small and medium-sized enterprises board of Shenzhen stock exchange, and 15 listing in growth enterprises board of Shenzhen stock exchange.

4.2. Data Analysis and Results

4.2.1. The Analysis about the Guanxi between Family Actual Controllers

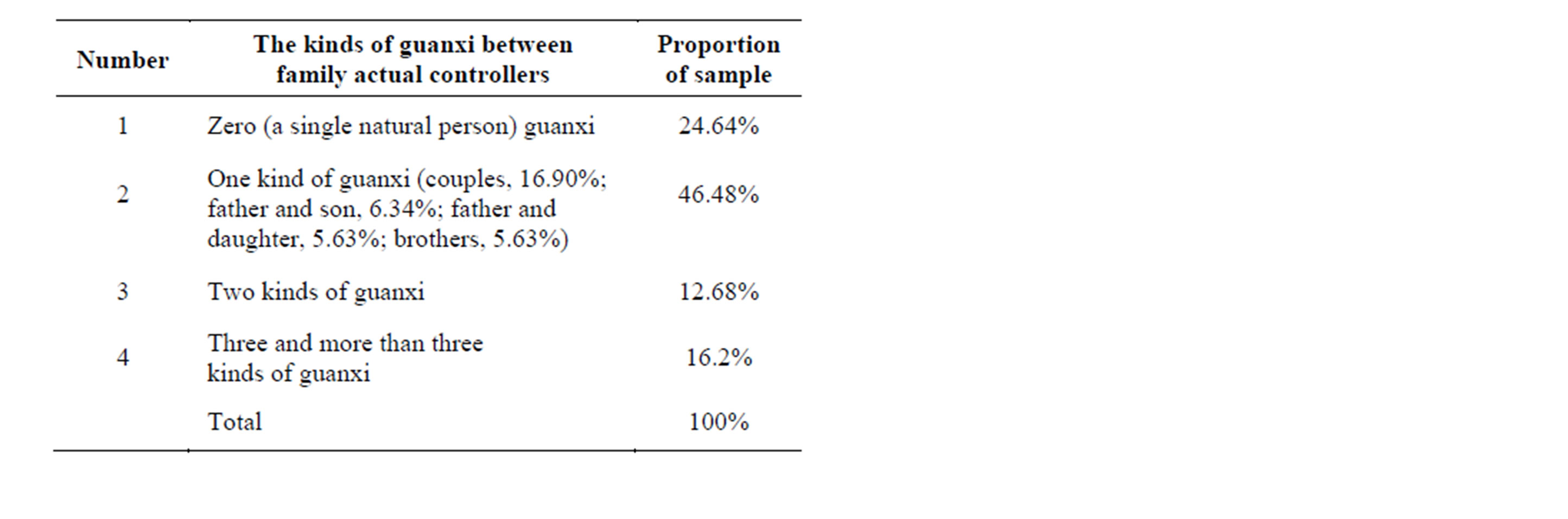

We analyze the guanxi between the family actual controllers through the annual or half annual reports, various announcements of the sample companies. The guanxi between family actual controllers are mainly including single nature person, couple, parents and children, brothers and sisters, cousins, father-in-law and son-in-law, husbands of sisters, nephew and uncle, nephew and aunty, sisters-in-law, brothers-in-law, classmates, friends and so on. The result of the guanxi between family actual controllers shows in Table 1.

In Table 1, about 24.64% of sample companies choose single family member as the actual controller of the family listed company who can be regarded as the “parent” of the whole family. Among the companies which are controlled by family members together, 46.48% of them allocate the actual control rights between the family members who have only one kind of guanxi, 12.68% of them allocate the actual control rights between the family members who have two kinds of guanxi and 16.2% of them allocate the actual control rights between the family members who have more than three kinds of guanxi.

In the sample companies whose actual controllers only have one guanxi, the top three guanxi between the family actual controllers are couples(16.90%), father and son (6.34%), father and daughter (5.63%), brothers (5.63%,

Table 1. Results of the guanxi between family actual controllers.

equal to the proportion of father and daughter).

Based on the analysis above, we can see that about 71.12% of the Zhejiang family listed companies allocate the actual control rights to one or two family members. Only 28.88% of them allocate the actual control rights to more than three family members. As we all known, the more the actual controller are, the guanxi between them will be more complex.

Then, we do further statistics about the guanxi between the family actual controllers of sample companies. In Addition to the sample companies which are controlled by a single natural person, there are 36.62% of the sample companies allocate the actual control rights between couples, 32.39% of them allocate the actual control rights between parents and children, and 30.99% of them allocate the actual control rights between brothers and sisters. Therefore, most family listed companies in Zhejiang prefer to allocate the control rights between the family members who have blood and marriage relationship.

4.2.2. The Descriptive Statistic Results of the Number of Actual Controllers and Guanxi

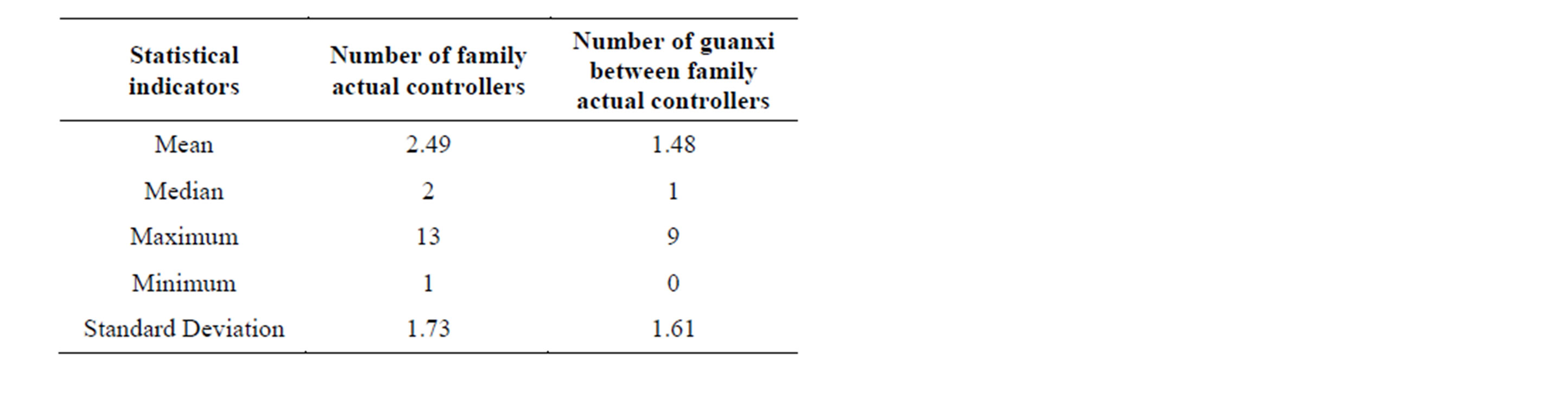

We use Eviews5.0 to analyze the number of the family actual controllers and the number of the guanxi between them. The results show in Table 2.

The sample companies choose more than two family members to control the family listed companies. Only one company chooses 13 family members to control the listed company together. Between the family actual controllers, there must be more than one kind of guanxi. The maximum one is allocating the control rights between the family members who have nine kinds of guanxi.

4.2.3. The Analysis about the Positions of the Actual Controllers in Family Listed Companies

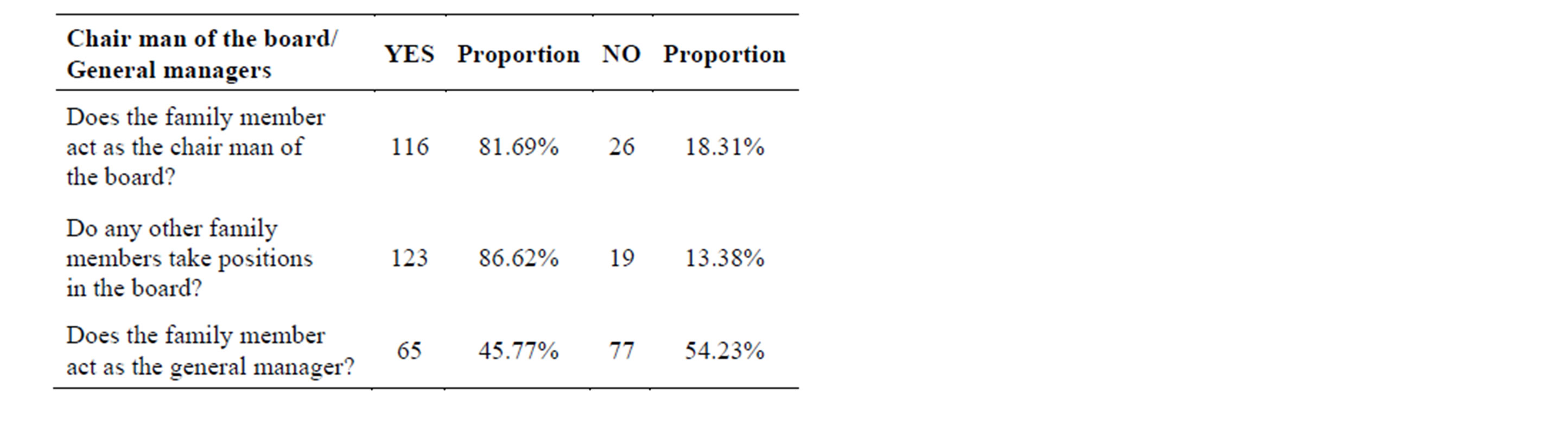

In most family listed companies, family members always control the key positions, especially the chair man of the board or the general manager. The result about the sample companies shows in Table 3.

According to Table 3, 81.69% of the sample companies allow the family member to act as the chair man of

Table 2. Descriptive statistic results of the number of family actual controllers and guanxi.

Table 3. The positions of family actual controllers.

the board, 86.62% of the controlling family prefers sending family members to work in the board. By contrast, the proportion of the sample where the family member acts as the general manager is 45.77%. In other words, 54.23% of controlling families prefer to select professional manager to act as the general manager of the listed companies. It is thus clear that Zhejiang family companies prefer to control the board than the managers.

In the further statistics, we find that there are 10 sample companies in which the family actual controllers don’t take any position in the board or managers. These 10 companies account for 7.04% of the whole sample. Meanwhile, they are all controlled by a single natural person.

5. Conclusions

Based the data analysis above, we find some interesting conclusions.

1) The actual controllers of Zhejiang family listed companies mainly have relationship by blood In Zhejiang family listed companies, the family control rights are always allocated to the family members who have relationship by blood. The family listed companies are almost controlled by parents and their children or brothers and sisters together. Besides the companies which are controlled by a single natural person, 84.11% of the rest companies are controlled by parents and their children or brothers and sisters 2) Parts of the Zhejiang family listed companies allocate the control rights between the family members who have several kinds of guanxi The proportion of the sample companies which allocate the control rights between more than 3 family members is 28.87%. It is far lower than the proportion of the companies which allocate the control rights between 1 or 2 family members. However, the more the family actual controllers are, the more possibility of the conflicts break out. In these sample companies, there are more than 3 kinds of guanxi between the actual family controllers. So, the family conflicts may occur more likely in these companies.

3) The controlling families prefer to control the board of the family listed companies Based on the analysis about the positions which are taken by the family actual controllers in the listed companies, we find that most controlling families control the board of the listed companies. The proportion is 86.62%. By contrast, the proportion of the family members participating in the operating management of the listed companies is 45.77%. It shows that Zhejiang family listed companies like to choose professional managers to act as general manager rather than the family members.

4) The intergenerational succession of control rights in Zhejiang family companies has highlighted In China, there is a tradition that fathers want their sons to follow their steps. Forty six of Zhejiang family listed companies are controlled by parents and their children together. Among the forty-six companies, there is no family member participating in the management in six sample companies; there are the parents participating in the management only in fourteen sample companies; there are the children participating in the management only in nine sample companies; there are the parents and their children both participating in the management in the rest seventeen companies. Although the number of the sample companies controlled by parents and their children is not so many, the proportion has reached 32.39%. It is more than one third of the sample companies. So, with the first founders quitting the management, the intergenerational succession of control rights will be more highlighted.

6. Acknowledgements

This paper is supported by the Humanities and Social Sciences Planning Foundation of Ministry of Education of China (11YJA630171).

REFERENCES

- M. Mustakallio, E. Autio and S. A. Zahra, “Relational and Contractual Governance in Family Firms: Effects on Strategic Decision Making,” Family Business Review, Vol.15, No. 3, 2002, pp. 205-222. http://dx.doi.org/10.1111/j.1741-6248.2002.00205.x

- R. Tagiuri and J. Davis, “Bivalent Attributes of the Family Firms,” Family Business Review, Vol. 9, No. 2, 1996, pp. 199-208.

- M. A. Gallo and J. Sveen, “Internationalizing the family business: Facilitating and restraining factors,” Family Business Review, Vol. 4, No. 2, 1991, pp. 181-190.

- K. Eddleston and F. W. Kellermanns, “Destructive and Productive Family Relationships: A Stewardship Theory Perspective,” Journal of Business Venturing, Vol. 22, No. 4, 2007, pp. 545-565. http://dx.doi.org/10.1016/j.jbusvent.2006.06.004

- K. Lins, “Equity Ownership and Firm Value in Emerging Markets,” Journal of Financial and Quantitative Analysis, Vol. 38, No. 1, 2003, pp. 139-184. http://dx.doi.org/10.2307/4126768

- E.-T. Chen and J. Nowland, “Optimal Board Monitoring in Family-Owned Companies: Evidence from Asia”, Corporate Governance, Vol. 18, No. 1, 2010, pp. 3-17. http://dx.doi.org/10.1111/j.1467-8683.2009.00778.x

- D. Hiller and P. McColgan, “Firm Performance and Managerial Succession in Family Managed Firms,” Journal of Business Finance and Accounting, Vol. 36, No. 3-4, 2009, pp. 461-484. http://dx.doi.org/10.1111/j.1468-5957.2009.02138.x

- X. T. Fei, “Rural China,” Shanghai SDX Joint Publishing Company, Shanghai, October 1985, p. 25.

- Guanfei Yang, “Guanxi Governance in Chinese Family Business and Its Evolution: Taking Zhejiang Yixing Group as a Case,” Social Sciences Academic Press, Beijing, October 2009, p. 22.

- Weber Max, “Confucianism and Taoism”, Beijing Business Press, Beijing, 1995, p.289.

- Fukuyama, “Trust—Social Morality and Prosperity Creation,” Far East Publisher, Beijing, 1998, p.113.

- X. C. Li and S. J. Zhang, “Family Business: Organization, Behavior and China Economy,” Shanghai People’s Publishing House, Shanghai, 2005, p. 332.

- W. D. Hamilton, “The Genetical Evolution of Social Behavior I, II,” Journal of Theoretical Biology, Vol. 7, No. 1, 1964, pp. 1-52.